What About 401 To Roth Ira Conversions

A 401 is an excellent way to save for retirement through tax deductions today and tax-deferred growth until you start making withdrawals in retirement. However, with tax rates at historical lows today, many people want to take advantage of the current tax rules and convert their traditional 401 into a Roth IRA to have tax-free growth and withdrawals in the future.

While tax-free income is appealing, you will have to pay taxes on the amount you convert, and converting your 401 to a Roth IRA requires extra steps.

Save Money During A Roth Conversion

This is where things can get tricky. If you plan to convert your traditional IRA into a Roth IRA to take advantage of tax-free growth, you can avoid immediate tax consequences by first rolling over any pre-tax contributions over to your 401. Youll want to consult a tax professional when converting a traditional IRA to a Roth option.

Decide Where You Want The Money To Go

If youre making a rollover from your old 401 account to your current one, you know exactly where your money is going. If youre rolling it over to an IRA, however, youll have to set up an IRA at a bank or brokerage if you havent already done so.

Bankrate has reviewed the best places to roll over your 401, including brokerage options for those who want to do it themselves and robo-advisor options for those who want a professional to design a portfolio for them.

Bankrate has comprehensive brokerage reviews that can help you compare key areas at each provider. Youll find information on minimum balance requirements, investment offerings, customer service options and ratings in multiple categories.

If you already have an IRA, you may be able to consolidate your 401 into this IRA, or you can create a new IRA for the money.

Recommended Reading: How To Get Your Money Out Of 401k

Why Choose Irar For Your Self

The answer is clear and simple!

Your account will be serviced by an experienced team of Certified IRA Services Professionals with expertise in self-directed IRAs. Our knowledge and experience in self-directed IRA rules, regulations, and recent trends, will assist you in making smart educated decisions.

Youll also be able to save over 50% compared to fees charged by other industry providers. We believe in maintaining lower fees because were committed to helping you build long-lasting retirement wealth.

At IRAR we see many cases in which IRA owners transfer their existing self-directed IRA to IRAR because theyve grown unhappy with their current provider account fees were too high, poor service, or the provider has gone out of business or changed in management.

Regardless of the reason, we want to help.

Maximize Your Tax Brackets By Converting A Portion At A Time

Most people’s incomes allow them to make more money before being taxed at a higher income bracket. You can take advantage of this capacity for additional income by converting a portion of your income at a time. If your income is $20,000 less than the current tax bracket ceiling, you can convert $20,000 to a Roth IRA without paying a higher percentage in taxes. It is best to consult with a CPA or tax preparer in the 4th quarter of the year to discuss this opportunity and calculate how much you can reasonably convert.

Don’t Miss: How Should I Roll Over My 401k

You Might Want A Roth Account

If your 401 plan doesnt provide a Roth 401 option, you might choose to roll your retirement savings into a Roth IRA. Advantages of a 401-to-Roth IRA rollover include:

Avoiding Roth IRA income restrictions. Even if your annual income is above the thresholds for Roth IRA contributions, youre still allowed to roll your 401 savings into a Roth IRA. This move is commonly referred to as a backdoor Roth IRA conversion, and it can grant you the benefits of tax-free withdrawals in retirement.

No required minimum distributions . With a 401or even a traditional IRAyoure subject to RMDs, or the mandated annual withdrawals from your retirement savings once you reach age 72. Roth IRAs are free of RMDs, providing you with more control over your retirement savings.

Tax-free withdrawals in retirement. When you roll over a traditional 401 into a Roth IRA, youll probably end up paying some taxes on the amount youre converting. But these taxes may be less than what youd pay if you took regular withdrawals from a traditional 401 in retirement.

Access to additional death benefits. Because there are no lifetime distribution requirements, you can pass down your Roth IRA to your heirsalthough beneficiaries need to draw down the account within 10 years.

Henderson cautions that you must be aware of the immediate tax consequences when you roll your money from a 401 to a Roth account.

How To Decide Which Rollover Is Right For You

When you leave an employer, youll have to decide if you want to leave your 401 in place, roll it over into an IRA, or roll it over into a new 401.

First, consider the fees that each plan charges. If you find that the fees at your previous company are higher than what youd pay at your new company or in an IRA, then it makes sense to roll your balance over. Moving the money to an IRA can be an effective way to save on fees some online brokerages offer 0% expense ratios on index funds.

Recommended Reading: Where To Invest 401k Now

My Experience Rolling Over To Vanguard

Like many, I have been with several employers since I finished school and started in the workforce. And because I have always been pretty good about contributing to my retirement accounts, at one point I had a Roth IRA, two 401ks, a 457b and my own individual stock account. Trying to manage so many accounts was daunting, so I ended up doing what a lot of us do ignoring them and just letting things sit. While this isnt terrible it goes against the idea of rebalancing and diversifying your portfolio. So, after reading my brothers blog for the last year, I was finally motivated to try to consolidate the accounts so I could take a more active role in managing my portfolio.

I chose Vanguard basically because I had heard a lot of good things about their no/low load funds and good performance. I started by calling the number on their Personal Investors website, quickly got through to a live person and explained that I wanted to rollover my IRA from a former employer to Vanguard. I was transferred to a concierge transfer specialist who then walked me through the process of creating an account online, which took about 5 minutes. He also verified that I wanted to do a rollover IRA and asked what type of investments I wanted to place the money in once it reached Vanguard. I opted for a money market holding fund until I could do more research on their offerings.

Advantages Of A 401 Rollover To An Ira

The main advantage of a 401 rollover to an IRA can be summed up in one word: control.

The control factor with an IRA can be broken down as follows:

Recommended Reading: When Can I Rollover 401k To Ira

Transferring A 401 Plan And Ira To A Canadian Rrsp

Investment Insight

If youve been living and working in the United States, youd have likely accumulated retirement savings while employed. Now that youve returned to Canada, youre probably considering transferring the retirement savings you accumulated abroad to a Canadian registered retirement savings plan ¹ but are concerned about the tax implications and the logistics associated with such a transfer.

Set Up Your New Account

If you don’t already have a rollover IRA, you’ll need to open onethis way, you can move money from your former employer’s plan into this account. If there are both pre-tax and post-tax contributions in your 401, you might need to open a Roth IRA too.* Which IRA should you consider for your rollover?

Also Check: Can I Move My 401k To A Different Company

What Is A Rollover Ira

A rollover IRA is an individual retirement account often used by those who have changed jobs or retired. A rollover IRA allows individuals to move their employer-sponsored retirement accounts without incurring tax penalties and remain invested tax-deferred. Consolidating multiple employer-sponsored retirement accounts can make it easier to monitor your retirement savings.

*Note: If you have an existing rollover or traditional IRA at Prudential, you can roll your assets into that account.

Can You Transfer A 401 To An Ira While Youre Still Employed

Home » IRA » Can You Transfer a 401 to an IRA While Youre Still Employed?

Thousands of Americans wonder the same thing: Can I transfer my 401 to an IRA if Im still with my current employer? Yes, theres a good chance you can.

While most people think about transferring their 401 after they leave a job, its actually something you might be able to do while youre still in that joband doing so could offer some attractive asset options. Learn when it makes sense to roll some of your 401 into an IRA while still employed, along with the advantages.

Don’t Miss: How Do I Take Money Out Of My Voya 401k

Ira Rollovers Are Big Business

Although it would be nice to roll over my 401 to Vanguard, they dont offer anything in terms of rollover bonuses. Companies like Fidelity offer up to $600 just for rolling over your 401. Their funds might not be as inexpensive as Vanguard but theyre not that far off.

One thing to watch out for though is that some of these companies charge large fees to close IRAs. I still have $200 left in a TD Ameritrade Roth IRA because I refuse to pay $150 to close my account. I dont know if I would recommend rolling over to one of these companies but the bonuses definitely make it tempting.

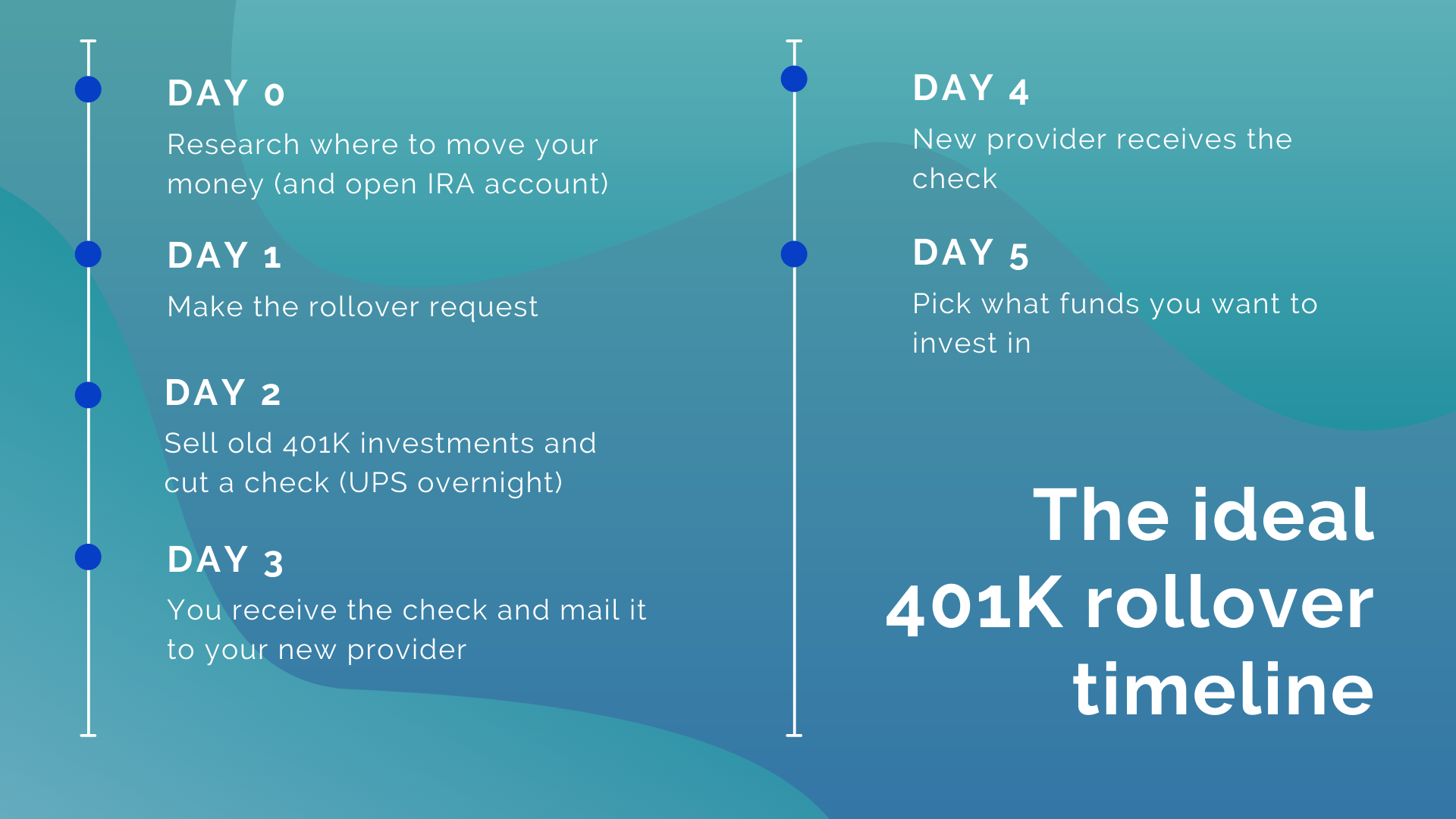

Begin The Rollover Process

Youll have to fill out paperwork to conduct your rollover and it may require some back-and-forth conversations with your providers. You have several options to actually move the money from the old provider to the new one, but your best option is a direct rollover.

In a direct rollover, the funds are sent straight from your 401 into your new account without you touching the funds. Its important that you specify a direct rollover so that you dont have the check made payable to you. You could trigger a mandatory 20 percent withholding for taxes, and the IRS charges a 10 percent bonus penalty on withdrawals made before age 59 1/2.

Don’t Miss: What Happens To 401k When You Die

Traditional Ira Vs Roth Ira

Lets say that after evaluating the advantages and disadvantages of doing a 401 rollover to an IRA, you decide to move forward with the rollover.

Now you have a second choice: traditional IRA or Roth IRA.

Lets look at both.

Traditional IRA

The traditional IRA has all the advantages and disadvantages weve discussed so far.

The main advantage to doing a 401 rollover to a traditional IRA is that there are no tax consequences as a result of the rollover.

Youll move the old 401 to your traditional IRA, report it on your tax return as a full rollover, and there will be no ordinary income tax due, and no 10% early withdrawal penalty.

Youll be able to keep the money in the traditional IRA, building up tax-deferred investment income.

After age 59 ½ you can begin taking withdrawals from the plan.

As you do, the amount of the withdrawals will be subject to ordinary income.

If you take withdrawals before reaching 59 ½, youll not only have to pay ordinary income tax, but also the 10% early withdrawal penalty .

Beginning at age 70 ½ youll be required to begin taking RMDs, based on your life expectancy, which will be calculated for each age a withdrawal is required.

Roth IRA

If you do a rollover of a 401 to a Roth IRA, youll experience financial pain at the time of the rollover, but youll gain many benefits in the future.

Thats because a rollover from a 401 to a Roth IRA creates a tax liability.

Lets say youre in a combined federal and state marginal income tax rate of 30%.

How Long Do You Have To Roll Over A 401

If a distribution is made directly to you from your retirement plan, you have 60 days from the date you receive a retirement plan distribution to roll it over into another plan or an IRA, according to the IRS.

But if you have more than $5,000 in a 401 at your previous employer and youre not rolling it over to your new employers plan or to an IRA there generally isnt a time limit on making this decision.

Read Also: Can A Small Business Owner Have A 401k

What Type Of Ira Should I Open

During the process of opening your new account, you may get asked which type of IRA youd like to open. You might see the following options: Rollover IRA, Traditional IRA, or Roth IRA. Heres how to pick the right one:

- If you had a Traditional 401 pick a Rollover IRA or, if thats not available, Traditional IRA or, if thats not available, just IRA. The only exception would be if youre considering a Roth conversion, but this is an advanced tax planning strategy that most people dont need to worry about.

- If you had a Roth 401 pick a Roth IRA. Youll need to match the Roth 401 to a Roth IRA for tax reasons.

- If your 401 has mixed assets youll need to open two IRAs, one Roth and one Traditional to for their respective assets.

Also Check: How Do I Use My 401k To Start A Business

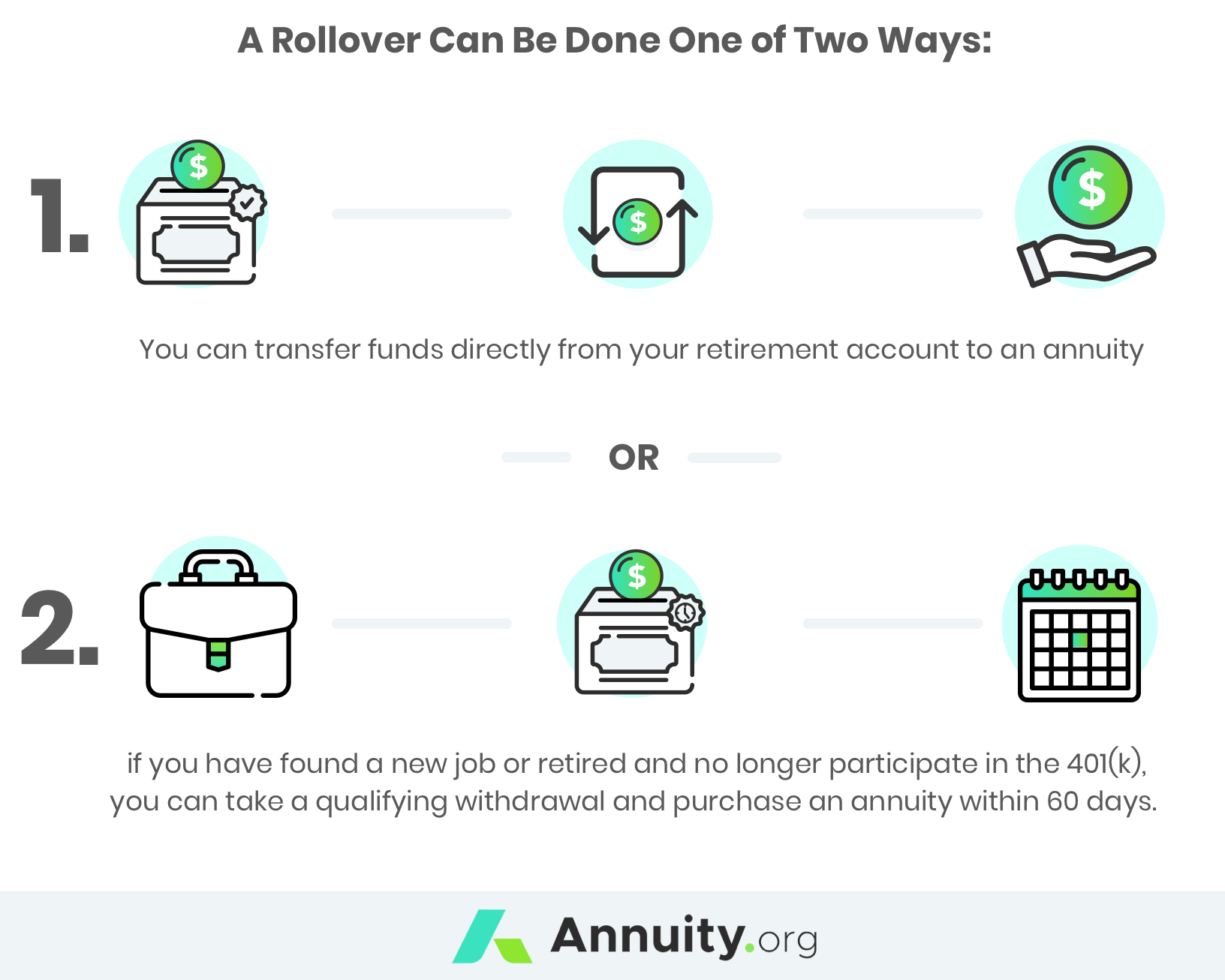

To Ira Rollover Methods

The rules regarding retirement account distributions can seem complicated, discouraging some account holders from rolling over their 401s to IRAs. Fortunately, special regulations apply in this situation and if you follow IRA rollover rules, there is no risk to the tax-deferred status of your contributions.

There are multiple ways to complete a rollover without incurring taxes and penalties. The first option is a direct rollover, which takes place when your plan administrator makes your distribution payment directly to your new retirement account. The plan administrator withholds no taxes and sends the check to the IRA custodian, made payable to the new retirement account.

Suppose, for example, that Stacie has $100,000 in a 401 that she wants to roll over to a new retirement account. If the money is sent directly to Stacie, she will receive $80,000, since 20% of the plan funds will be withheld. To avoid any tax penalties, Stacie will have to send the full $100,000 to the receiving account. If she cant come up with the cash, the missing $20,000 will be taxable since the money was never transferred to the new plan.

Also Check: How To Find Out If You Have Unclaimed 401k Money

What Are Your Choices For A Rollover

In general, once you leave a job you have three choices for how to deal with your employer-sponsored retirement plan:

- Leave it with your old employers 401 plan: This approach requires the least amount of work, but may require you to have a minimum amount if you plan to maintain the account there.

- Roll it over into your new employers 401 plan: This approach will require you to file some paperwork, but youll have all your 401 money in one place. This choice can make sense if you like your new employers plan.

- Roll it over into an IRA: This move will require you to file some paperwork, but then youll have the complete freedom to invest the money as you see fit. If you liked the investment options you held in a previous plan, you may still be able to access those via an IRA.

, thats another option for a rollover. But this option is not typical for most individuals.)

If you roll over your 401 into an IRA, youll also want to consider the kind of rollover you need.

- With a Roth 401, youll likely be more interested in a Roth IRA, so that you can maintain the substantial advantages of that plan.

- If you have a traditional 401, then youll probably opt for a traditional IRA.