Sales And Capital Gains Tax Rates

Tax rates dont only apply to earned income and corporate profits. Tax rates can also apply on other occasions when taxes are imposed, including sales tax on goods and services, real property tax, short-term capital gains tax, and long-term capital gains tax. When a consumer purchases certain goods and services from a retailer, a sales tax is applied to the sales price of the commodity at the point of sale. Since sales tax is governed by individual state governments, the sales tax rate will vary from state to state. For example, the state sales tax rate in Georgia is 4%, while the tax rate in California is 6%, as of 2019.

Since additional income gained from investments is categorized as earnings, the government also applies tax rates on capital gains and dividends. When the value of an investment rises and the security is sold for a profit, the tax rate that the investor pays depends on how long s/he held the asset. The tax rate on the capital gain of a short-term investment is equal to the investors ordinary income tax. So, an individual who falls into the 24% marginal tax bracket will pay 24% on his or her short-term capital gains.

You May Like: Can I Roll A 401k Into A Roth Ira

Expand Your Investment Options

A 401k is a common retirement investment program. Many employers offer this program for their employees, and becoming part of the 401k program is a standard benefit that new employees sign up for on day one. But 401k investments dont offer the high return potential some other retirement accounts do. Thats why converting from a 401k to a Roth IRA is a popular choice.

Switching over to a Roth IRA allows you more investment options than staying in a 401k account. The Roth IRA also gives you, the account holder, greater control over your investment than what you have if you remain with your 401k.

Can I Contribute To A Traditional Or Roth Ira If I’m Covered By A Retirement Plan At Work

Yes, you can contribute to a traditional and/or Roth IRA even if you participate in an employer-sponsored retirement plan . See the discussion of IRA Contribution Limits. If you or your spouse is covered by an employer-sponsored retirement plan and your income exceeds certain levels, you may not be able to deduct your entire contribution. See the discussion of IRA deduction limits.

Also Check: Can I Transfer Money From 401k To Ira

Is My Ira Contribution Deductible On My Tax Return

If neither you nor your spouse is covered by a retirement plan at work, your deduction is allowed in full.

For contributions to a traditional IRA, the amount you can deduct may be limited if you or your spouse is covered by a retirement plan at work and your income exceeds certain levels.

Roth IRA contributions aren’t deductible.

Watch Out For The Five

The IRS requires any conversion to have occurred at least five years before you access the money.

If you have not kept assets in your Roth IRA for five or more years, you may be charged taxes and/or penalties on withdrawals, says Keihn. If you think youre going to need to withdraw the assets in less than five years from opening a Roth IRA, you may want to reconsider a conversion or have a conversation with a CPA to see if its still the best path for you.

Don’t Miss: How To Calculate Rate Of Return On 401k

How To Reduce The Tax Hit

If you contributed more than the maximum deductible amount to your 401, you have some post-tax money in there. You may be able to avoid some immediate taxes by allocating the after-tax funds in your retirement plan to a Roth IRA and the pretax funds to a traditional IRA.

Alternatively, you can choose to split up your retirement money into two accounts: a traditional IRA and a Roth IRA. That will reduce the immediate tax impact.

This is going to take some number crunching. You should see a competent tax professional to determine exactly how the alternatives will affect your tax bill for the year.

The Build Back Better billpassed by the U.S. House of Representatives and currently being considered by the U.S. Senateincludes provisions that would eliminate or reduce the use of Roth conversions for wealthy taxpayers in a few ways.

If passed in its current form, starting in January 2022, employees with 401 plans that allow after-tax contributions up to $58,000 would no longer be able to convert those to Roth IRA accounts. Further limitations would go into effect in 2029 and 2032, including preventing contributions to IRAs for high-income taxpayers with aggregate retirement account balances over $10 million and banning Roth conversions from pretax retirement accounts for high-income taxpayers.

Ask Your 401 Plan For A Direct Rollover Or Remember The 60

These two words “direct rollover” are important: They mean the 401 plan cuts a check directly to your new IRA account, not to you personally.

Here are the basic instructions:

Contact your former employers plan administrator, complete a few forms, and ask it to send a check or wire for your account balance to your new account provider.

The new account provider gives you instructions for how the check or wire should be made out, what information to include and where it should be sent. You can opt for an indirect 401 rollover instead, which essentially means you withdraw the money and give it to the IRA provider yourself, but that can create tax complexities. We generally recommend a direct rollover.

If you do an indirect rollover, the plan administrator may withhold 20% from your check to pay taxes on your distribution. To get that money back, you must deposit into your IRA the complete account balance including whatever was withheld for taxes within 60 days of the date you received the distribution. .)

For example, say your total 401 account balance was $20,000 and your former employer sends you a check for $16,000 . Assuming youre not planning to go the Roth route, you’d need to come up with $4,000 so that you can deposit the full $20,000 into your IRA.

At tax time, the IRS will see you rolled over the entire retirement account and will refund you the amount that was withheld in taxes.

Don’t Miss: How To Transfer 401k From Vanguard To Fidelity

Use A Roth Ira Before Retirement For Other Purposes

The ability to tap money in a Roth IRA without penalty before age 59 1/2 allows for flexibility to use the Roth IRA for other purposes. In essence, this account can act as an emergency fund and could be used to pay off significant unexpected medical bills or cover the cost of a child’s education.

But it’s best to only tap into these funds if it’s absolutely necessary. And if you must withdraw any money from a Roth IRA before retirement, you should limit it to contributions and avoid taking out any earnings. If you withdraw the earnings, then you could face taxes and penalties.

Proposed Roth Ira Conversion Rules For High Earners

If you are looking for tax-advantaged savings vehicles, you might be weighing up the 529 plan vs Roth IRA. With Roth IRA, they offer a retirement account with many advantages for employees. Before taking advantage of a Roth IRA, you should know that Roth IRA conversion rules can change from year to year.

The bill will eliminate the backdoor Roth conversion from 2022, which is considered a roundabout way to contribute to a Roth IRA by high-income individuals. Roth IRA conversion rules would impose a new requirement on the rich whose balances are at least $10 million across any defined contribution retirement accounts like IRAs or 401s to make withdrawals.

The IRS expanded the Roth IRA income limits in 2022, allowing you to earn more money while still benefiting from the tax-free Roth account or the tax-deferred traditional IRA. However, Roth conversion rules 2022 would stop you from taking advantage of Roth IRA conversion.

Any individual taxpayers earning above $400,000 per year, and married couples earning more than $450,000 a year, could not contribute to their savings. They also would be required to withdraw 50 percent of any amount above the $10 million thresholds. Lets take an example. If you had $20 million in an IRA and 401 at the end of 2030, you would have to take out $5 million under Roth IRA conversion rules.

Recommended Reading: What Happens To Your 401k If You Leave Your Job

Taxpayers Can Now Take Tax Free Jump From 401k To Roth Ira

Moving your retirement money around just got easier. In a conciliatory move for taxpayers, the IRS has issued new rules that allow you to minimize your tax liability when you move 401 funds into a Roth IRA or into another qualified employer plan. The situation arises when you have a retirement account through your employer that includes both pre-tax and after-tax funds. When you leave the company and want to move your money, allocating these retirement funds to new plans becomes tricky.

The new allocation rules take effect beginning in 2015, but taxpayers can choose to apply them to distributions beginning on September 18, 2014, the date the new rules were released by the IRS.

Under the old rules, you would have to pro-rate distributions and rollovers separately between pre-tax and after-tax amounts according to a set formula. This resulted in payment of tax on a pro rata share of pre-tax funds. The new rules allow you to do the allocations yourself within certain limits. You now can choose to move pre-tax money into a traditional IRA and after-tax money into a Roth IRA. If you moved pre-tax amounts into a Roth IRA, you would have to pay tax on the rollover because Roths can only be funded with after-tax money. Now you can direct pre-tax dollars to one account and after-tax dollars to another to avoid tax liability.

Lets look at an example.

Smart Planning

Disadvantages Of An Ira Rollover

A rollover is not for everyone. A few cons to rolling over your accounts include:

- . You may have credit and bankruptcy protections by leaving funds in a 401k as protection from creditors vary by state under IRA rules.

- Loan options are not available. The funds may be less accessible. You may be able to get a loan from an employer-sponsored 401k account, but never from an IRA.

- Minimum distribution requirements. You can generally withdraw funds without a 10% early withdrawal penalty from a 401k if you leave your employer at age 55 or older. With an IRA you generally have to wait until you are age 59 1/2 to withdraw funds in order to avoid a 10% early withdrawal penalty. The Internal Revenue Service offers more information on tax scenarios as well as a rollover chart.

- More fees. You may be responsible for higher account fees as compared to a 401k which has access to lower-cost institutional investment funds because of group buying power.

- Tax rules on withdrawals. You may be eligible for favorable tax treatment on withdrawals if your 401K is invested in company stock.

Neither State Farm nor its agents provide tax or legal advice.

Recommended Reading: How Do You Find Out About Your 401k

Should I Convert My Current 401 Into A Roth 401

If you already have a traditional 401 at your current job and the company just introduced a Roth 401 option, converting that 401 into a Roth might sound like a good idea. But is a conversion your best option? It depends on your situation.

The main drawback of converting a traditional 401 into a Roth 401 is the tax bill that comes with making the switch. Youre going to have to pay taxes on that money because it hasnt been taxed yet.

Lets say you have $100,000 in your traditional, pretax 401 and you want to convert the account into a Roth, after-tax 401. If youre in the 22% tax bracket, that means youd be paying $22,000 in taxes. Thats a lot of cash!

If you convert your 401 into a Roth 401, you need to have the cash on hand to cover the tax billno exceptions. Do not use money from the investment itself to pay the taxes. If you do, youll lose a lot more than $22,000. Youll also miss out on years of compound interest, which is typically about 10%. So after 30 years, a $100,000 account could grow to be $436,000 more than an account with a $78,000 starting point because of compound interest. Try our compound interest calculator that will do the calculations for you!

But before you do anything, make sure you talk with an investing professional. They can help you understand the tax impact of a 401 conversion and weigh the pros and cons of each option.

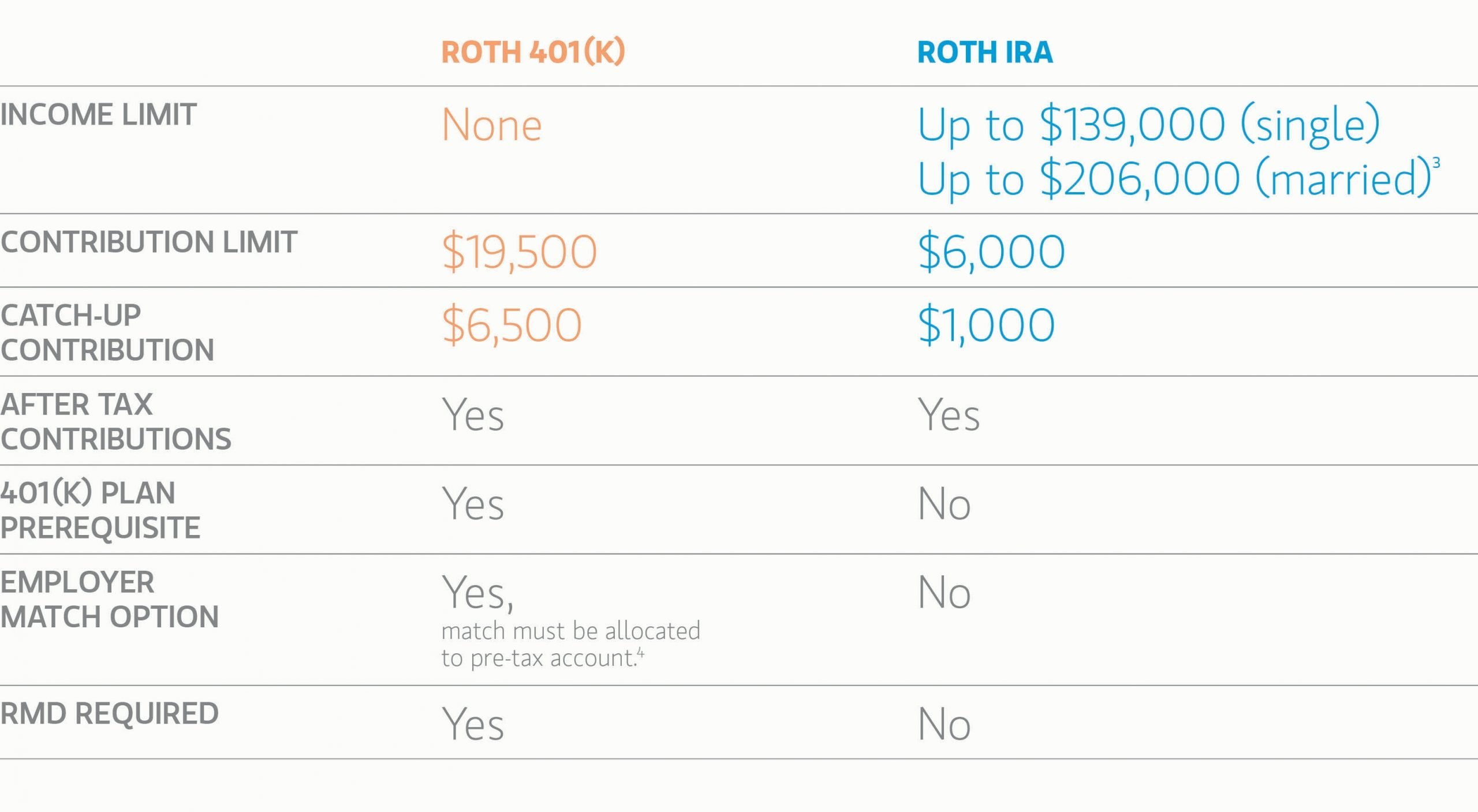

Roth 401s As An Alternative

A Roth 401 combines the employer-sponsored nature of the traditional 401 with the tax structure of the Roth IRA. If your employer offers this type of plan, youll contribute after-tax money to your account and you wont owe taxes when you start receiving distributions. If your employer offers a match, though, that money is in a traditional 401 plan. So if you choose to convert it, you will owe taxes on it the year you do so.

If youre looking to do a rollover from a Roth 401 to a Roth IRA , the process is quite simple. All youll have to do is follow the same steps as if you were rolling over a traditional 401 to a traditional IRA. The tax structure is staying the same. If youre looking to convert your Roth 401 into a traditional IRA, youre out of luck. Unfortunately, this isnt possible, since you cant un-pay taxes on the money in your Roth 401.

Don’t Miss: How To Withdraw Funds From 401k

How To Convert Traditional 401 To Roth Ira

You can convert your 401 account into a Roth IRA through the following steps:

The first step would be to set up a Roth IRA if you dont have one already. You can open a Roth IRA with a brokerage firm.

The next step is to transfer all your 401 funds into a traditional IRA.

Finally, you can convert your traditional IRA to Roth IRA.

Direct rollover: You can request your employer or plan administrator initiate a direct rollover, commonly referred to as a trustee-to-trustee transfer. Once you complete the necessary documentation, your retirement plan administrator directly transfers the proceeds of your account to the designated IRA.

Indirect rollover: Instead of going for a trustee-to-trustee rollover, you can ask your plan administrator to issue you a check for the balance amount of your retirement account. You can then deposit this check into your IRA within 60 days of receiving it.

Any delay beyond 60 days will make you liable for withdrawal taxes and a 10% penalty if you are under 59 ½ years of age.

Rollover 401 to Roth IRA Tax Consequences__:__ The amount of money lying in your traditional IRA account at the time of conversion is considered your contribution, and you must pay taxes on it. You should include this amount in your taxable income for the year in which the conversion takes place.

You Pay Taxes Now Instead Of Later

Roths turn traditional IRA and 401 rules on their head. Rather than getting a tax break for money when it goes into the account and paying tax on all distributions, with a Roth, you save after-tax dollars and get tax-free withdrawals in retirement.

By accepting the up-front tax breaks for traditional IRA accounts, you accept the IRS as your partner in retirement. If you’re in the 24% tax bracket in retirement, for example, 24% of all your traditional IRA withdrawalsincluding your contributions and their earningswill effectively belong to the IRS. With a Roth, 100% of all withdrawals in retirement are yours.

The Roth strategy of paying taxes sooner rather than later will pay off particularly well if you’re in a higher tax bracket when you withdraw the money than when you passed up the tax break offered by the traditional account. If you’re in a lower tax bracket, though, the Roth advantage will be undermined.

Also Check: How Do I Start My Own 401k

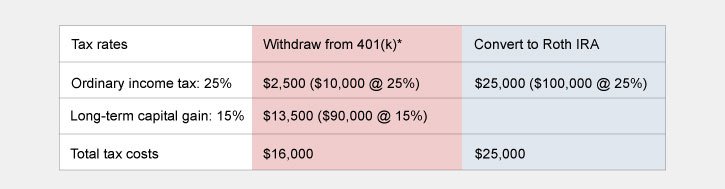

Paying Taxes On Your 401 To Roth Ira Conversion

Roth retirement accounts are funded with after-tax dollars, while traditional 401s are funded with pre-tax dollars, so you must pay taxes on your 401 to Roth IRA conversions. In most cases, the funds you’re converting count toward your taxable income, but you must complete your conversion by Dec. 31 if you want it to go on this year’s tax bill.

The effect on your tax bill depends on how much you’re converting and how much other taxable income you’ve earned during the year. If you’re not careful, your 401 to Roth IRA conversion could push you into a higher tax bracket, meaning you’ll lose a higher percentage of your income to the government. You can avoid this by staying mindful of your tax bracket throughout the year and striving to keep your total taxable income, including conversions, under your bracket’s upper limit.

You may not owe taxes on the full amount of your 401 to Roth IRA conversion if you’ve made nondeductible 401 contributions in the past. But that’s where things get a little hairy. Nondeductible 401 contributions are funds you contribute to a traditional 401 but don’t get an immediate tax break for. You pay taxes on your contributions, but earnings grow tax deferred until you withdraw them.

Where Should You Transfer Your 401

You have several options on what to do with your 401 savings after retirement or when you change jobs. For example, you can:

The right choice depends on your needs, and thats a choice everybody needs to make after evaluating all of the options.

Want help finding the right place for your retirement savings? Thats exactly what I do. As a fee-only fidicuary advisor, I can provide advice whether you prefer to pay a flat fee or youd like me to handle investment management for you, and I dont earn any commissions. To help with that decision, learn more about me or take a look at the Pricing page to see if it makes sense to talk. Theres no obligation to chat.

Important:The different rules that apply to 401 and IRA accounts are confusing. Discuss any transfers with a professional advisor before you make any decisions. This article is not tax advice, and you need to verify details with a CPA and your employers plan administrator. Likewise, only an attorney authorized to work in your state can provide guidance on legal matters. Approach Financial, Inc. does not provide tax or legal services. This information might not be applicable to your situation, it may be out of date, and it may contain errors and omissions.

Don’t Miss: What Is The Max Percentage For 401k