I Cant Imagine A Better Financial Service

I have been a very happy Fidelity customer for 35 years. I tried the big brokerage companies that offer personal service. What did I find out? They grew rich and I barely broke even, even in booming markets. Fidelity gives me the tools and the information I need to make the best financial decisions. My money has grown exponentially so that I can withdraw funds to pay big bills and still see huge gains to my portfolio. It isnt rocket science. Research the highest yielding funds over the long and short term at the risk level you are comfortable with. Fidelitys research is sooo darn easy that I can find and print off the research in minutes. I rebalance my funds, drop the dogs, invest in some new winners. It really is that easy. Need money transferred to your bank account? Click, click, you are done. Fees are extremely low too. Need help? Call the 800 number and their very knowledgeable Representatives will assist you quickly and cheerfully. Now I am the one making the money, not my broker. I have taught all of my children to invest with Fidelity and they are light years ahead of their peers financially.

How To Open A Fidelity Brokeragelink Account

After talking to a Fidelity representative to make sure you fully understand all the details, you can open a Fidelity BrokerageLink account by completing the online application or by calling and asking to have a BrokerageLink Acknowledgement Form mailed to you.

- Online: Log in to your account on NetBenefits, then click the Quick Links drop-down next to your preferred plan. Select BrokerageLink to go to the BrokerageLink section under Investments. Review the information carefully, then click Open an Account and follow the steps. To open an account for multiple plans, select all the plans for which you would like to open a BrokerageLink account.

- Your representative can either walk you through the process of opening your account online, or send a Fidelity BrokerageLink Acknowledgement Form to your home address. Complete the BrokerageLink Acknowledgement Form and promptly return it to Fidelity, following the directions listed on the form. Please allow plenty of time for the mailing and processing of your BrokerageLink Acknowledgement Form.

When Do Mutual Funds Update Their Prices

A mutual fund‘s price, or its net asset value , is determined once a day after the stock markets close at 4 p.m. Eastern Standard Time in the U.S. While there is no specific deadline when a mutual fund must update and submit its NAVs to regulatory organizations and the media, they typically determine their NAVs between 4 p.m. and 6 p.m. EST.

Recommended Reading: How To Withdraw 401k From Old Job

Contribution Limits For 401 403 And Most 457 Plans

| 2021 | ||

| Employee pre-tax and Roth contributions1 | $19,500 | |

| Employee after-tax contributions and any company contributions2 | $38,500 | |

| Maximum annual contributions allowed3 | $58,000 | |

| Additional employee pre-tax and Roth contributions1 | $6,500 | |

| Maximum annual contributions allowed3 | $64,500 | $67,500 |

1. If you have contributed to more than one qualified retirement plan during the calendar year, it is your responsibility to ensure that you have not exceeded these limits.

2. Company contributions include any employer matching, profit-sharing, and non-elective contributions.

3. Amount typically not to exceed the lesser 100% of your compensation or this number. Your employer’s retirement plan might limit the compensation to something less than 100% please refer to your plan’s Summary Plan Description or plan document for other applicable limits.

The annual compensation limit is $305,000. You can make contributions up to the IRS contribution limits noted above up to $305,000.

What Fees Are Displayed In The Fees Column Of The What Drove Your Change In Balance Table

The fees column generally only includes maintenance and servicing related account fees including, for example: advisory fees, bank charges and brokerage account fees. Certain ongoing, asset-based fees, such as mutual fund management and annuity separate account fees, that are reflected in the performance calculation are not displayed in the fees column.

Recommended Reading: Why Rollover Old 401k To Ira

What Do The Current And Change Columns Display

The Current and Change columns show account balance activity for your accounts.

- CurrentRepresents the most current information for that balance field. Some fields display realtime values, while others are updated intraday or overnight. For additional balance update information, click on the Understanding Your Balances link at the top of the Balances Page.

- ChangeRepresents the difference between the Current value and the previous days closing value. If the value in the Current column has moved in your favor compared to the previous days value, the value in the Change column will displayed in green with an arrow pointing up. If the value in the Current column has moved against you compared to the previous days value, the value in the Change column will be displayed in red with an arrow pointing down. If there is no Change in a balance field that updates realtime or intraday, the value in the Current column will be represented as $0.00. Two hyphens “” in the Change column indicate a balance that does not update intraday or realtime throughout the day

Important: Select Your Funds And Name Your Beneficiary

If you enrolled in the Basic Retirement Plan, SRA or 457 plans, the investment funds and beneficiary designations for your accounts are a default unless you specifically made changes. You may change these at any time by contacting TIAA or Fidelity Investments. Note that any changes you make must be done for each account for which you have enrolled.

Read Also: When Can You Get Your 401k

The Average 401 Balance By Age

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

A record number of 401 holders at Fidelity Investments hit millionaire status in 2018. Not one of them? Youre in very good company: A seven-figure 401 balance is the exception, not the rule.

In fact, the average 401 balance at Fidelity which holds 16.2 million 401 accounts and is consistently ranked as the largest defined contribution record-keeper was $103,700 as of March 2019.

If that still seems high, consider that averages tend to be skewed by outliers, and in this case, that number is being propped up by those rare millionaires. The median, which represents the middle balance between the highs and lows, is just $24,500.

No matter which number is closer to your reality and certainly for some, both will feel out of reach its important to remember that numbers like this are akin to train wrecks: They will tempt you to gawk, but they wont likely offer you much actionable information.

Paul Mccartney Marketing Campaign

Fidelity has experimented with marketing techniques directed to the baby boomer demographic, releasing Never Stop Doing What You Love, a compilation of songs by Paul McCartney. McCartney became the firm’s spokesman in 2005 in a campaign entitled “This Is Paul”. On the day of the disc’s release, company employees were treated to a special recorded message by Paul himself informing them that “Fidelity and have a lot in common” and urging them to “never stop doing what you love”.

Also Check: What Is The Best 401k Match

Smart Retirement Planning Avoids Leaving Money On The Table

A third retirement planning mistake retirement savings millionaires sidestep is not taking full advantage of a company match. “Save at least enough of your pay to qualify for the maximum company match,” Badeau said. “That match is like a pay raise. Don’t leave free money on the table.”

The fourth often-shared retirement planning mistakes millionaires avoid is playing it too safe with investments. Many retirement savings millionaires understand some asset classes dramatically outperform other asset classes over time. Small-cap stocks averaged an annual return of 11.8% from 1926 through Jan. 31, 2020, according to Morningstar Direct. Large-cap stocks grew at a 10.2% pace.

In contrast, cash-equivalent 30-day Treasury bills dawdled along at a pokey 3.3% pace. Long-term corporate bonds managed to grow little more than 6% a year.

“401 millionaires hold a much higher percentage of equities than non-millionaires do,” Badeau said. “They understand that some assets tend to make their accounts grow faster.”

While Fidelity 401 millionaires have 74.4% of their money at work in stocks and stock mutual funds on average, the typical Fidelity baby boomer 401 saver has just 67.6% in stocks and stock funds.

Sysco 401 Plan Enhancement

When you need to take a loan or withdrawal from your 401 plan, it can take days or even weeks to access your funds due to waiting periods. In an effort to support our associates impacted by coronavirus, weâve partnered with Fidelity to make Electronic Funds Transfer and eCertified Hardships available, so you can access your funds quickly.

Electronic Funds Transfer â Starting today, we have eliminated the 10-day waiting period for EFTs. Now, when a participant enters their banking information in NetBenefits, they no longer have a 10-day waiting period to receive funds. EFTs are immediately available for any loans or withdrawals that are $50,000 or less. In addition to eliminating wait times, this will also reduce cost to the participant.

eCertified Hardships â If you need to make a hardship withdrawal, you may be able to initiate a withdrawal in as little at 48 hours through eCertification. You can speak with a representative or initiate a qualifying hardship withdrawal anytime on NetBenefits.

To learn more about accessing your retirement funds for coronavirus-related relief, call Fidelity at 1-800-635-4015 or visit the Fidelity website. Review the rest of the content on this page to learn more about the Sysco 401 Plan.

Recommended Reading: Where Do I Go To Withdraw My 401k

Why Are Some Of The Fields On This Page Highlighted In Yellow

Fields highlighted in yellow indicate securities priced real-time throughout the day. The total of these changes, Today’s Change, displays beneath the Change $ column.

Those fields not highlighted in yellow indicate securities priced less frequently. These include:

- Mutual funds

- Fixed income securities

The total of these changes, Change in Securities Not Priced Today, displays beneath Today’s Change.

Do You Need $1 Million To Retire

Should you be worried if you haven’t amassed a $1 million balance in your 401 or IRA or are not on track to reach a retirement account balance of that size?

Perhaps only if your annual salary is comparable to the millionaires’.

“Not everyone needs $1 million at retirement,” Badeau said. “You do if you want to retire to an expensive location and live in a big house. But most people can adjust their lifestyle if they haven’t saved $1 million.”

Follow Paul Katzeff on Twitter at for tips about personal finance and mutual funds that outperform the market.

YOU MIGHT ALSO LIKE:

Read Also: Do I Have A 401k Out There

Is It A Good Idea To Borrow From Your 401

Using a 401 loan for elective expenses like entertainment or gifts isn’t a healthy habit. In most cases, it would be better to leave your retirement savings fully invested and find another source of cash.

On the flip side of what’s been discussed so far, borrowing from your 401 might be beneficial long-termand could even help your overall finances. For example, using a 401 loan to pay off high-interest debt, like credit cards, could reduce the amount you pay in interest to lenders. What’s more, 401 loans don’t require a credit check, and they don’t show up as debt on your credit report.

Another potentially positive way to use a 401 loan is to fund major home improvement projects that raise the value of your property enough to offset the fact that you are paying the loan back with after-tax money, as well as any foregone retirement savings.

If you decide a 401 loan is right for you, here are some helpful tips:

- Pay it off on time and in full

- Avoid borrowing more than you need or too many times

- Continue saving for retirement

It might be tempting to reduce or pause your contributions while you’re paying off your loan, but keeping up with your regular contributions is essential to keeping your retirement strategy on track.

Long-term impact of taking $15,000 from a $38,000 account balance

Assumptions: See footnote 2.

What Are Purged And Hidden Accounts Are They Included In Applicable Account Groups And Related Returns

Purged accounts are accounts that have been removed due to two years of inactivity and a balance of zero. Hidden accounts are accounts which customers have decided not to display on Fidelity.com. Purged and hidden accounts, however, will be removed from all account groupings when the returns are refreshed the following month.

Surrendered and terminated annuity contracts will no longer be available on Fidelity.com and will therefore no longer show a personal rate of return. Deferred annuity contracts that have been annuitized will no longer display an account level PRR but the historical annuity returns will still be included in the aggregate rate of return calculation.

Note: For contracts that annuitized prior to January 31, 2012 no historical data will be available.

You May Like: Can The Irs Take My 401k If I Owe Taxes

Why Is Personal Rate Of Return Not Available For My Income Annuity

When you purchase an income annuity contract, your assets are received by the insurance company in exchange for a guarantee that the insurance company will pay you a lifetime income. Your contract now represents an income guaranteed for your lifetime, not a specific asset amount, and so there is no basis from which a Personal Rate of Return can be calculated.

Fidelity Funds Are Renowned For Their Managers’ Stock

Fidelity celebrates good stock picking. The firm holds a contest every year for its portfolio managers: They get 60 seconds to pitch one idea, and the best pitch wins a dinner for four. The best performer after 12 months also wins dinner.

Maybe that’s why many of the best Fidelity funds stand up so well in our annual review of the most widely held 401 funds.

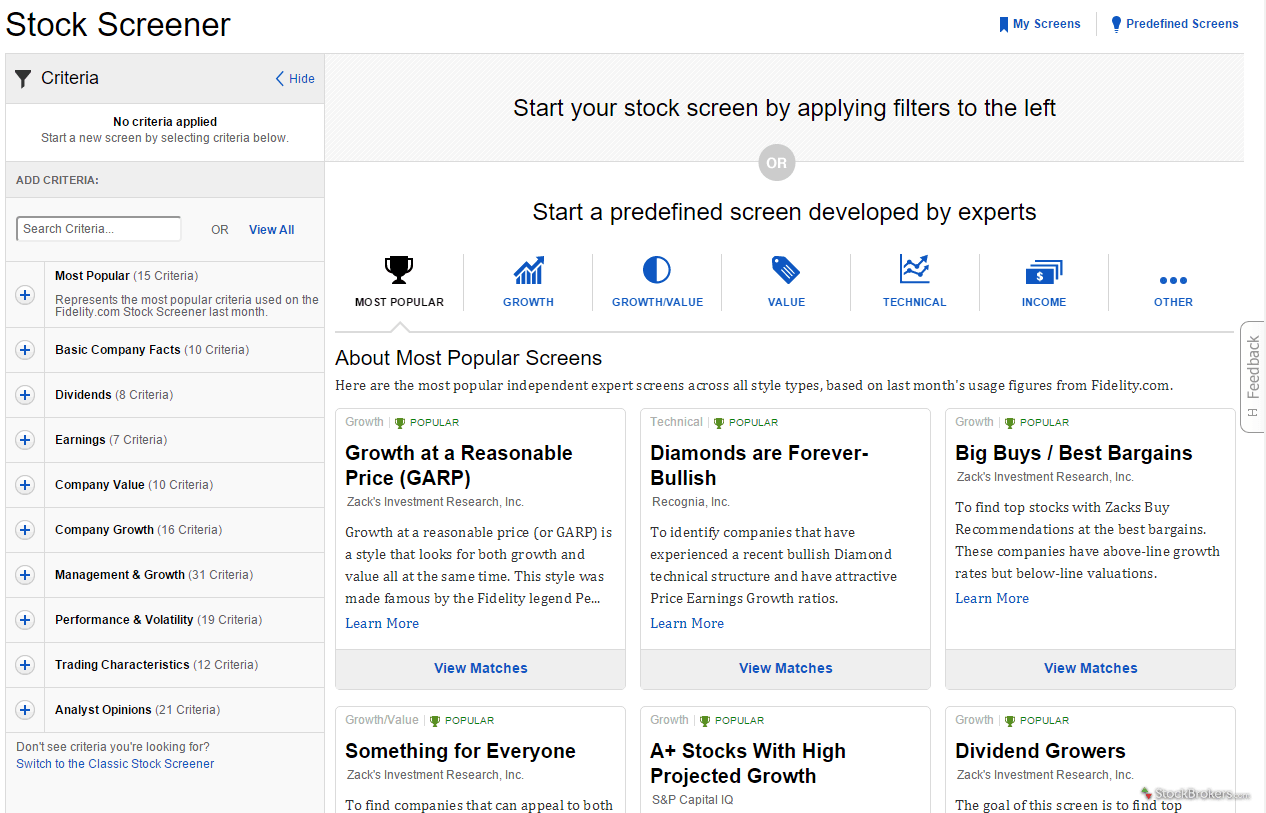

Here, we zero in on Fidelity products that rank among the 100 most popular funds held in 401 plans, and rate the actively managed funds Buy, Hold or Sell. A total of 22 Fidelity funds made the list, but seven are index funds, which we don’t examine closely because the decision to buy shares in one generally hinges on whether you seek exposure to a certain part of the market.

Actively managed funds are different, however. That’s why we look at the seven actively managed Fidelity funds in the top-100 401 list. We also review seven Fidelity Freedom target-date funds as a group as they all rank among the most popular 401 funds. And we took a look at Fidelity Freedom Index 2030 it has landed on the top-100 roster for the first time, and while it’s index-based, active decisions are made on asset allocation.

Let’s look at some of the best Fidelity funds for your 401 plan. We’ll determine which ones stand up to scrutiny, and which ones, if any, you should avoid.

- Rank among the top 401 funds: #59

- Best for: Investors who want an all-in-one, stock-and-bond portfolio

Recommended Reading: Can Anyone Have A 401k

How Does My Stock Plan Service Activity Affect My Personal Rate Of Return

Your performance impact will differ based on transaction type. Please refer to the table below for details on how SPS transactions are included in performance reporting.

| SPS Transaction | |

| Closing price on date the shares are deposited | |

| Stock Swaps | Fair Market Value |

Please note that performance in the Brokerage account for Stock Plan transactions begins measurement at the time of purchase, exercise or vesting.

Significance of SPS activity on performance will depend on the size of the SPS activity as compared to the remainder of the account or portfolio – the larger the amount of other assets, the smaller the impact and vice-versa.

Refer to customer statement for change in investment value and additional details on SPS transaction activity.

Note: Prior to April 14, 2014, Restricted Stock Awards and Restricted Stock Units were included as follows:

| SPS Transaction | Performance Start Date |

| Restricted Stock Awards |

Nav Update Cutoff Times

For investors, it’s important to understand the difference between the NAV update time and the trade cutoff time. Most mutual funds have self-imposed NAV updating deadlines, which are closely tied to the cut-off times for NAV publications in newspapers and other publications. This is typically around 6 p.m. EST.

The trade cutoff time, however, is the time by which all buy and sell orders for a mutual fund must be processed. These orders are executed using the NAV of the trade date. For example, if a mutual fund’s trade cutoff time is 2:00 p.m. EST, then trade orders must be processed before then to be filled at that business day’s NAV. If an order comes in after the trade cutoff time, it will be filled using the next business day’s NAV.

Recommended Reading: What Are The Different 401k Plans