Stay In The Existing Plan

Most companies will allow you to keep your retirement savings in their plans after you leave. Your money will continue growing tax deferred. However, if you have less than $5,000 in your account, your money may be automatically cashed out and sent to you.

As you progress through your career it is likely that you will have multiple employers. According to a Bureau of Labor Statistics 2019 study, the average worker who was born between 1957 and 1963 held an average of 12.3 jobs during their career. If you choose to leave your 401 at each employer that you leave, by the end of your career you may have several accounts that you need to keep track of. Multiple 401s may also lead to certain plans not being aligned with your risk tolerance as you move closer to retirement.

How Long Do You Have To Move Your 401 After Leaving A Job

If you leave your job, you have the right to move your 401 money to another 401 or IRA. Knowing how long you have to move your 401 after leaving a job can help plan your retirement savings better.

When switching jobs or quitting to start a business, it is easy to get lost in the excitement. As you plan your next move, you should remember your 401 plan where youâve been accumulating your retirement savings. By knowing what happens to your 401 and how long it takes to move your 401 after leaving a job, you can plan what to do with your retirement savings.

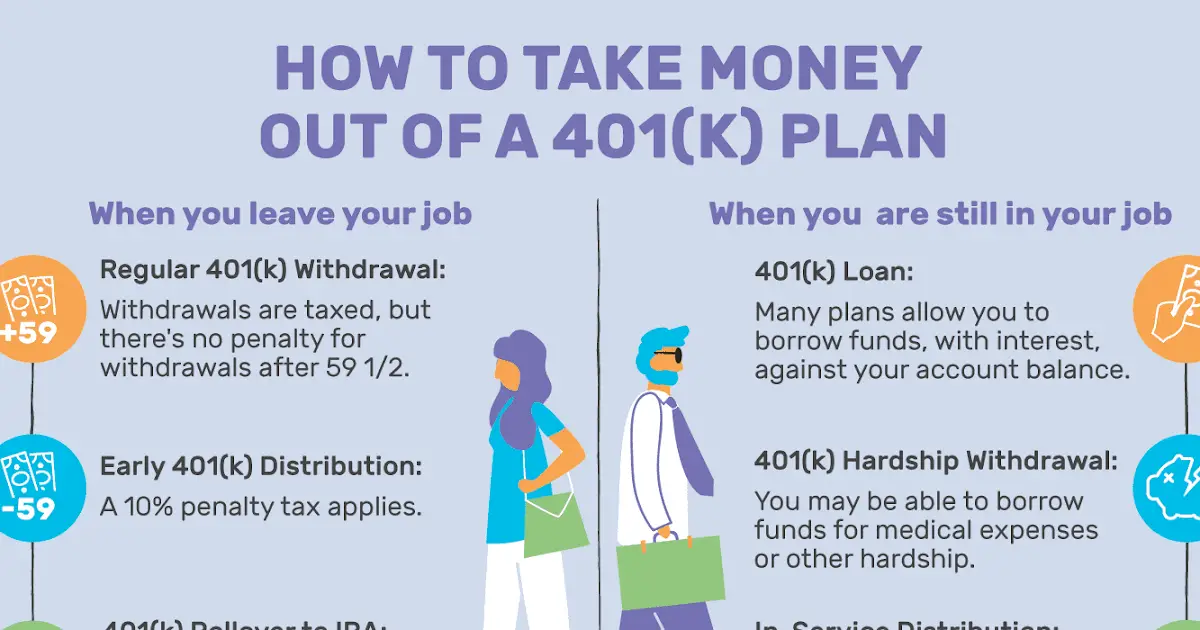

Generally, 401 plans are tied to employers, and once you leave your job, you will no longer contribute to the plan. However, the amount you contributed to your account is still your money, and you can choose what to do with it. How long you have to move your 401 depends on how much asset you have in the account: you have 60 days from the date of leaving your employer to move the 401 money into a preferred retirement plan if your 401 balance is below $5000. For large balances over $5000, you can leave the funds in your old 401 plan for as long as you want.

Just Because You Can Cash Out Your 401 Doesnt Mean You Should

Technically, yes: After youve left your employer, you can ask your plan administrator for a cash withdrawal from your old 401. Theyll close your account and mail you a check.

But you should rarelyif everdo this until youre at least 59 ½ years old!

Let me say this again: As tempting as it may be to cash out an old 401, its a poor financial decision. Thats because, in the eyes of the IRS, cashing out your 401 before you are 59 ½ is considered an early withdrawal and is subject to a 10% penalty on top of regular income taxes. Oh, yes, thats another thing: Since the 401 is funded with pre-tax money, you also have to pay taxes on it when you cash out.

In most cases, your plan administrator will mail you a check for 70% of your 401 balance. Thats your balance minus 10% for the withdrawal penalty and 20% to cover federal income taxes .

Its financially prudent to save for retirement and leave that money invested. But paying the 10% early withdrawal penalty is just dumb money its equivalent to taking money youve earned and tossing it out the window.

Read Also: How To Take A Loan From 401k

When Changing Jobs Is This Your Best Option

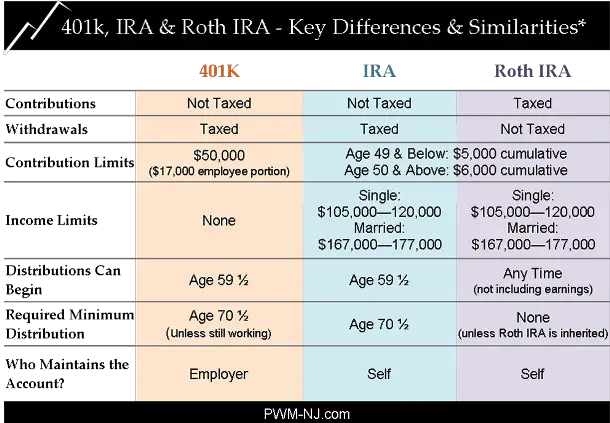

When an employee leaves a job due to retirement or termination, the question about whether to roll over a 401 or other employer-sponsored plan quickly follows. A 401 plan can be left with the original plan sponsor, rolled over into a traditional or Roth IRA, distributed as a lump-sum cash payment, or transferred to the new employers 401 plan.

Each option for an old 401 has advantages and disadvantages, and there is not a single selection that works best for all employees. However, if an employee is considering the option of transferring an old 401 plan into a new employer’s 401, certain steps are necessary.

Youll Halt Compound Interest In Its Tracks

Compound interest is another way of saying interest on interest it results in exponential account growth over time. By cashing out your 401 early, youll be giving up somewhere around 30% of your balance to taxes and penalties. This will substantially reduce your asset base and limit the degree to which your account can grow via compound interest into the future.

Read Also: How To Roll Your 401k From Previous Employer

How To Withdraw From A 401 At Age 55

Under the right circumstances, you can withdraw from a 401 at age 55 . If you retire, quit or get fired between age 55 and 59, you can withdraw without penalty from your 401. See IRS Publication 575

The tax doesnt apply to distributions that are: From a qualified retirement plan after your separation from service in or after the year you reached age 55

What is separation from service? Heres how the IRS defines it:

To meet the requirements for the first exception in the list above, you must have separated from service in or after the year in which you reach age 55 . You cant separate from service before that year, wait until you are age 55 , and take a distribution.

If you leave your job before age 55 you cant take a distribution without paying the 10% penalty. If you wait until after you turn 55 you can take a distribution without paying the 10% penalty.

See page 34 of the publication.

There are several important points to know about the Rule of 55.

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Recently enacted legislation made a number of changes to the rules regarding defined contribution, defined benefit, and/or individual retirement plans and 529 plans. Information herein may refer to or be based on certain rules in effect prior to this legislation and current rules may differ. As always, before making any decisions about your retirement planning or withdrawals, you should consult with your personal tax advisor.

The change in the RMD age requirement from 70½ to 72 only applies to individuals who turn 70½ on or after January 1, 2020. Please speak with your tax advisor regarding the impact of this change on future RMDs.

A qualified distribution from a Roth IRA is tax-free and penalty-free, provided the 5-year aging requirement has been satisfied and one of the following conditions is met: age 59½ or older, disability, qualified first-time home purchase, or death.

Be sure to consider all your available options and the applicable fees and features of each before moving your retirement assets.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Recommended Reading: What Happens To Your 401k When You Leave A Company

How To Locate A 401 From A Previous Job

If youre trying to locate an old 401 plan from a previous job, youre not alone. Not by a long shot. Roughly $850 million in plan assets owned by 33,000 employees are orphaned each year, held by a financial institution without an employer to oversee the plan . Thats a lot of money being left on the tableroughly two percent of all 401 plan assets.

The good news is that the Department of Labor has established rules for protecting money put into a 401, so the money isnt necessarily lostjust waiting for someone to claim it. However, that doesnt mean your old 401 account will always be easy to track down. It may take some digging, but there are a variety of ways you can find it.

This Is What Happens To Your 401 When You Quit

When you quit your job, you have five options for your 401:

If youre considering quitting or transitioning jobs, you may be wondering what to do with your 401. Each of the options above has benefits and drawbacks, and you should carefully consider whats best for you.

Before you decide what to do with your 401, make sure you dont have a loan on your 401. 401 loans are appealing because they dont affect your debt-to-income ratio however, if you cant repay it by the tax due date after leaving your job, youll be taxed on the balance and charged an early withdrawal fee. Some companies offer special options here, so you should always check with your 401 administrator and plan documents.

Youll also want to keep in mind the fact that some account types only allow one rollover per year so if youre changing jobs frequently, this is something to be aware of. Refer to this chart from the IRS to learn more about account rollovers.

With this in mind, you have the following options for your 401 when quitting your job:

Also Check: How Can You Take Out Your 401k

How To Cash Out A 401 From Your Old Job

By David Carlson

Every day thousands of employees switch jobs from one company to another. One thing that needs to be taken care of in this process is the employee’s 401k. There are a few options available to the employee including cashing out their 401k and transferring the funds to a rollover IRA.

Are you trying to find out how to cash out your 401k from old jobs? You’re in luck. We’ve got some advice for you in this post on how to go about cashing out your 401k, as well as an alternative option to cashing out that may save you more money.

Leave The 401 In The Care Of Your Former Employer

If your 401 balance is low say $5,000 or less most plans will allow you to keep the money where it is after you leave. By default, you may be able to manage the money without making changes, but your investment choices will be limited. If the money is under $1,000, the company may cut you a check to force the money out. If the money is between $1,000 and $5,000, they will likely help you set up an IRA if they are forcing you out.

You May Like: What Happens To My 401k After I Quit

Options For Cashing Out A 401 After Leaving A Job

The amount in your 401 account, including your contribution, your employers contribution, and any earnings on your investments, belongs to you and can supplement your retirement fund. The huge amount of money accumulated in your 401 account may tempt you to cash out your plan, but its in your best interest not to do so.

Leaving your account with your old employer may not a good idea. There are chances that you may forget the account after some time. You can, instead rollover to your new employer or even set up an IRA to roll 401 funds into.

Rolling over your 401 to an IRA gives you the flexibility to invest your funds the way you want. However, in some states like California, your creditors have easier access to your IRA funds than the money kept in a 401 account. If you see any potential claim or lawsuit against you, you may want to let your funds lie in a 401 account rather than transferring into an IRA.

Alternatively, if you are eligible for the 401 plan of your new employer, you may want to roll over your old 401 to your new account. No matter where you invest, always consider minimizing the risk by diversifying your portfolio. You may never want to invest a large portion of your savings in a single company, no matter how much you trust it.

You Have Less Than $1000 In Your 401

If you have less than $1000 in your 401, you may request to get a lump sum payment via check. Still, if you leave the funds behind without giving any instructions to the employer, the plan administrator may force cash-out in order to close the account.

Usually, active 401 accounts incur costs to maintain, and your employer may be unwilling to bear the cost since you will no longer contribute to the plan. The employer will send you a check within 3 to 10 days of leaving the job. Once the payment is made, you have 60 days to deposit the funds into an IRA to avoid paying taxes. If you donât deposit the funds into an IRA, the payment will be considered an early withdrawal and you will pay an income tax and early withdrawal penalty.

Read Also: How To Open A Solo 401k

What Is A 401

A 401 is a retirement savings plan offered by employers that allows workers to defer a portion of their paycheck into a long-term investment account. Some employers match a portion of contributions, while others just provide the 401 accounts themselves. By investing your money, you let it grow through the power of compound interest. A 401 is just a handful of tax-advantaged retirement savings vehicles available. Other options include an IRA for self-managed retirement savings, a 403 for public school employees and tax-exempt organizations, a 457 for state and local government employees and some non-profit employees, and a TSP for federal government employees.

How To Cash Out A 401 From A Former Employer

Cashing out a 401k from a former employer is not a difficult task. In most cases, you contact the plan administrator for the appropriate paper work, fill it out, send it to the financial institution that manages the 401k, and wait for the check to come in the mail or for the electronic transfer.

Tips

-

In order to cash out a 401 from a former employer, you will likely have to contact the plan administrator at your former place of employment and request access to the paperwork needed to withdraw your funds.

Also Check: How To Transfer Your 401k To Another Company

The Rule Of 55 For Early Withdrawals From 401s

Here are a few things to keep in mind when considering retiring between age 55 and 59 1/2 and using the Rule of 55 to take early distributions:

If all that looks good to you, thats the simpler and less risky of the two methods to get your money sooner.

The pros of using the Rule of 55

The cons of using the Rule of 55

How Long Does It Take To Cash Out Your 401 After Leaving A Job

If you opt to cash out your 401, youll need to contact your 401 plan provider and have them send you the money either electronically or via paper check. This process can take anywhere from a few days to a few weeks. In either case, you should have the money within a reasonable amount of time after requesting it.

Don’t Miss: How To Get The Money From Your 401k

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

I Still Have A 401k From My Last Job What Do I Do About That

As you move ahead from job to job, dont make the mistake of leaving a trail of old savings accounts behind you. Put your hard-earned savings to work for you by looking at all the options. If youve left a job and a 401k, here are the options available to you for those funds.

- Leave your balance

- Rollover to new 401 plan.

- Rollover to an IRA.

- Cash out your 401.

Recommended Reading: Can I Keep My 401k With My Old Employer