See What Our Clients Have To Say:

– Client, 14 years

– Client, 20 years

– Client, 14 years

– Client, 20 years

– Client, 14 years

– Client, 20 years

– Client, 14 years

– Client, 20 years

– Client, 14 years

– Client, 20 years

– Client, 14 years

– Client, 20 years

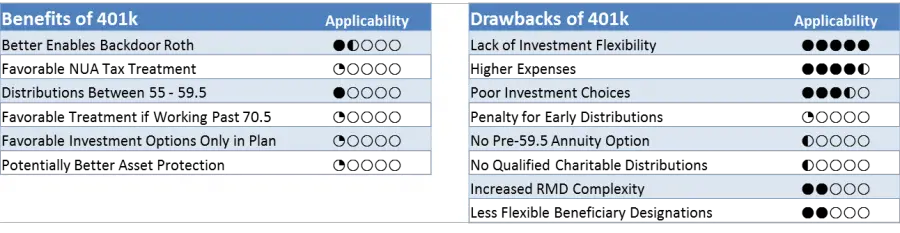

*Consider all available options, which include remaining with your current retirement plan, rolling over into a new employer’s plan or IRA, or cashing out the account value. When deciding between an employer-sponsored plan and IRA, there may be important differences to consider – such as range of investment options, fees and expenses, availability of services, and distribution rules . Depending on your plan’s investment options, in some cases, the investment management fees associated with your plan’s investment options may be lower than similar investment options offered outside the plan.

1Morningstar gives its best ratings of 5 or 4 stars to the top 32.5% of all funds based on their risk-adjusted returns. The Overall Morningstar Rating is derived from a weighted average of the performance figures associated with a funds 3-, 5-, and 10-year Morningstar Rating metrics. As of 7/31/21, 69 of 154 of our Investor Class funds received an overall rating of 5 or 4 stars.

3Generally, as long as you’ve held the account at least 5 years and you’re age 59½ or older.

We All Pay For Retirement Tax Breaks That Mostly The Wealthy Use

Woman hand putting a coin into a piggy bank.

getty

Saving for retirement is brutally hard, no matter what some say to layer a populist patina over the subject.

If you have a hard time saving for retirement, its not a surprise. The reason for many millions isnt lack of diligence, which is a euphemism for the willingness to grind oneself into the ground for the money necessary to live. As if, by eschewing every cup of coffee out and being sure to return each and every bottle and can for deposit, you too will live comfortably in your old age.

The reason is a lack of financial resources. A living wage means much more than $15 an hour, especially when the business world took the concept of the 401which was supposed to be for additional savings atop a defined benefits pension planand IRA, turning them into an excuse to wipe away pensions for most people. The share of families with active participation in retirement plans that had a defined benefit plan fell from 40 percent in 1992 to 17 percent in 2016, according to the Tax Policy Center. Given that defined benefit plans are the most common for government employees, the percentage of people in private industry with access to traditional pensions is likely much lower.

According to the Bureau of Labor Statistics, only 67% of private industry workers had access to any retirement plans in 2020. This is one area where union membership or higher income seem to pay off in terms of pension benefits, as this BLS chart shows.

Are There Limits On The Quantity I Can Roll Over Into My Roth Ira

No, there are not any limits on the full quantity youll be able to roll out of your different retirement account right into a Roth IRA. Nevertheless, it could be useful to unfold out your rollovers over a number of tax years relying in your tax state of affairs and marginal tax bracket.

To distinction, in the event you have been to contribute straight into your Roth IRA, the annual contribution limit as of 2021 is $6,000 per yr .

Recommended Reading: Can You Set Up Your Own 401k

Taking Advantage Of What A Roth Ira Does

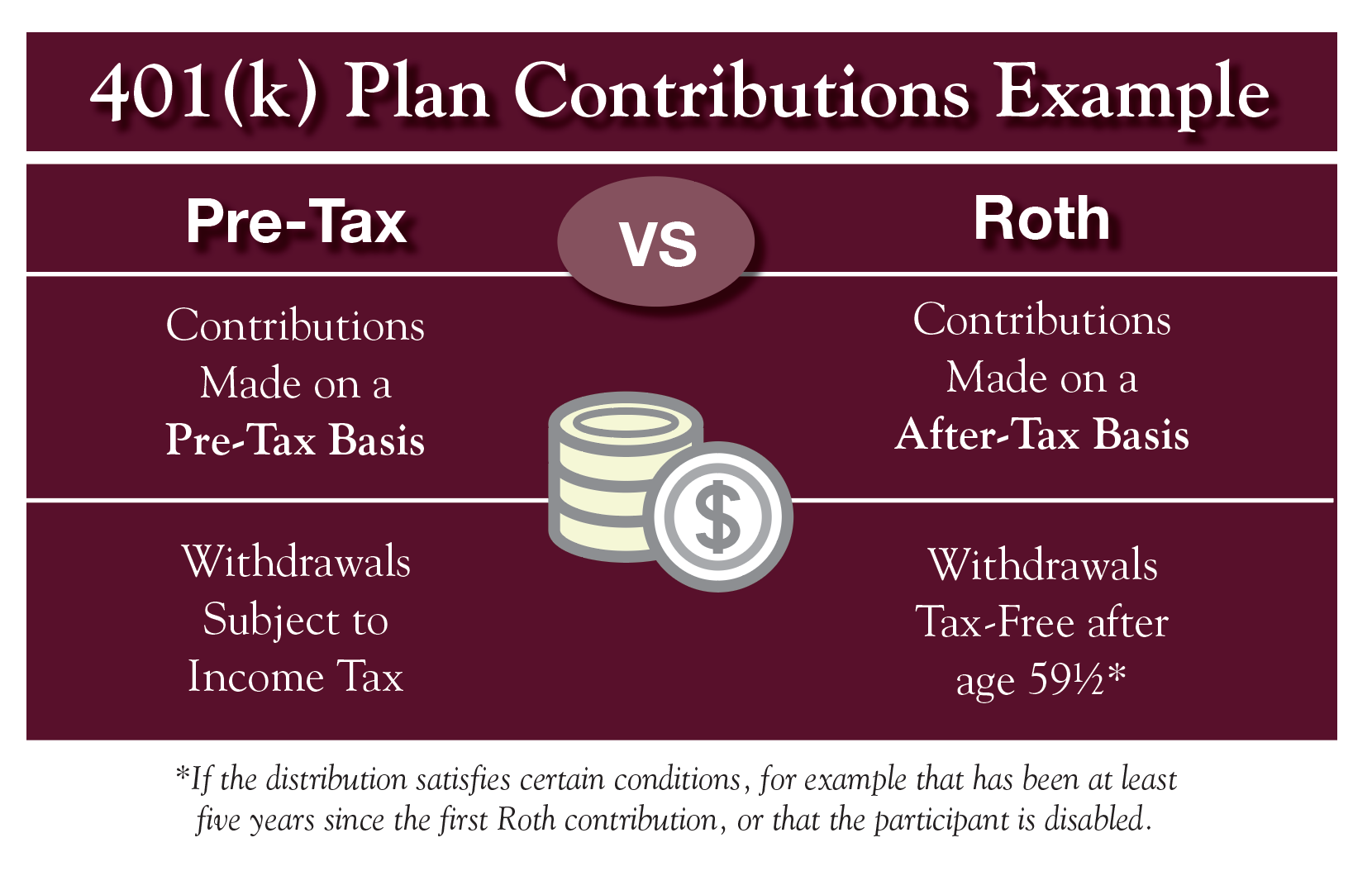

At a basic level, when you execute a Roth conversion, youre moving from the benefits of having a Traditional IRA to the benefits of having a Roth IRAwhich means that youre opting to pay taxes now rather than during retirement. Generally, with a Roth IRA, as long as you have had the account for more than five years and are over 59½ , you wont have to pay any taxes when you withdraw money at retirement.

If you expect that your tax rate will be the same or higher than your current rate when you plan to withdraw money, paying taxes on that money now could mean a better after-tax return overall.

But why convert from Traditional? Well, there are a few key limitations to Traditional IRAs that might drive IRA holders to consider a Roth conversion. Heres one.

Keeping The Current 401 Plan

If your former employer allows you to keep your funds in its 401 after you leave, this may be a good option, but only in certain situations. The primary one is if your new employer doesn’t offer a 401 or offers one that’s less substantially less advantageous. For example, if the old plan has investment options you cant get in a new plan.

Additional advantages to keeping your 401 with your former employer include:

- Maintaining performance:If your 401 plan account has done well for you, substantially outperforming the markets over time, then stick with a winner. The funds are obviously doing something right.

- Special tax advantages: If you leave your job in or after the year you reach age 55 and think you’ll start withdrawing funds before turning 59½ the withdrawals will be penalty-free.

- Legal protection: In case of bankruptcy or lawsuits, 401s are subject to protection from creditors by federal law. IRAs are less well-shielded it depends on state laws.

The Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 does protect up to $1.25 million in traditional or Roth IRA assets against bankruptcy. But protection against other types of judgments varies.

If you are going to be self-employed, you might want to stick to the old plan, too. It’s certainly the path of least resistance. But bear in mind, your investment options with the 401 are more limited than in an IRA, cumbersome as it might be to set one up.

Recommended Reading: When Can You Start Drawing From Your 401k

Will I Pay Taxes When Rolling Over A Former Employer

Generally, there are no tax implications if you move your savings directly from your employer-sponsored plan into an IRA of the same tax type to a Roth IRA).

If you choose to convert some or all of your pretax retirement plan savings directly to a Roth IRA, the conversion would be subject to ordinary income tax.

You Can Still Recharacterize Annual Roth Ira Contributions

Prior to 2018, the IRS allowed you to reverse converting a traditional IRA to a Roth IRA, which is called recharacterization. But that process is now prohibited by the Tax Cuts and Jobs Act of 2017.

However, you can still recharacterize all or part of an annual contribution, plus earnings. You might do this if you make a contribution to a Roth IRA then later discover that you earn too much to be eligible for the contribution, for instance. You can recharacterize that contribution to a traditional IRA since those accounts have no income limits. Contributions can also be recharacherized from a traditional IRA to a Roth IRA.

The change would need to be completed by the tax-filing deadline of that year. The recharacterization is nontaxable but you will need to include it when filing your taxes.

Recommended Reading: How To Lower 401k Contribution Fidelity

Keep The Money In Your Old 401 Plan

Deciding what to do with an old 401 can be stressful, so its alright to keep your old account while you weigh your options. Many plans allow former employees to keep their 401s after they have left the company. Most investors dont typically choose to keep assets in an old 401 on purpose it often happens when investors dont understand their rollover options. Before deciding to keep your 401, make sure you are happy with the investment options and plan fees.

You Want To Increase Your Tax Diversification

Contributions to traditional IRAs are tax-advantaged, meaning you wont pay taxes on your invested funds until you begin taking withdrawals at retirement. Roth IRAs, on the other hand, are taxed up front but offer tax-free withdrawals after age 59 ½. If youre unsure how your tax and income situation might pan out in the future, having both types of accounts a traditional IRA and a Roth IRA is a smart move in terms of diversifying your future tax exposure.

Don’t Miss: Where To Check 401k Balance

Determine If A Roth Ira Rollover Is Right For You

Ultimately you have to determine whether rollover to a Roth IRA is the best decision for your retirement planning. You can speak with a company representative or independent financial advisor to decide to proceed with the conversion process. If converting to a Roth IRA is the best decision for your retirement, take care to follow the conversion rules and avoid possible penalties.

Use A Roth Ira Before Retirement For Other Purposes

The ability to tap money in a Roth IRA without penalty before age 59 1/2 allows for flexibility to use the Roth IRA for other purposes. In essence, this account can act as an emergency fund and could be used to pay off significant unexpected medical bills or cover the cost of a child’s education.

But it’s best to only tap into these funds if it’s absolutely necessary. And if you must withdraw any money from a Roth IRA before retirement, you should limit it to contributions and avoid taking out any earnings. If you withdraw the earnings, then you could face taxes and penalties.

Also Check: Do You Get Your 401k When You Quit

What To Consider When Choosing A Broker

If youre planning to roll over your 401 into an IRA, youll likely be most concerned with a broker that can do the following things best. Most brokers do offer an IRA, but some popular ones do not, but the brokers below all offer IRAs. We also considered the following factors when selecting the top places for your 401 rollover.

- Price: Trading commissions for stocks and ETFs have fallen to $0 at most online brokers, and thats great for investors. But there are other costs, too, perhaps most notably account fees, such as fees for transferring out of your account.

- No-transaction-fee mutual funds: The brokers in the list below offer thousands of mutual funds without a transaction fee. If youre rolling over your 401 and you like the mutual funds you have already, these brokers may allow you to buy and sell the same one without a fee.

- Investing strategy: While a 401 may limit your investing options to a pre-selected group of mutual funds, an IRA gives you the ability to invest in almost anything trading in the market. So we considered how each broker might fit an investors needs.

Cons Of Rolling Your Roth 401 Funds Into A Roth Ira

When it comes to Roth IRAs, the most important thing to keep in mind is the five-year rule. The clock starts ticking when you make your first contribution into your Roth IRA, not when you open the account. So even if youve had a Roth IRA for more than five years, you may still have to hold off withdrawals if it took you a few years to start contributing. Any Roth 401 contributions youve made dont make any difference in relation to this timeline.

If you need the money and dont plan to change jobs any time soon, remember that you may be able to get a Roth 401 loan from your plan administrator. To clarify, you could borrow up to $50,000 or 50% of your vested account balance, whichever is less, though the loan must be repaid within five years or immediately upon leaving your employers service to avoid it being treated as a taxable distribution. Roth IRAs dont offer this kind of flexibility, so a rollover would eliminate this option.

You should consider the investment options and fees of a Roth IRA before definitively deciding on a rollover. It may be that your Roth 401 program offers a better selection of possible investments or charges fewer fees than a Roth IRA would.

Read Also: How Much Can I Take From 401k For Home Purchase

How To Transfer Retirement Funds To A Roth Ira: Convert Your 401 To A Roth Ira

This article was co-authored by wikiHow staff writer, Eric McClure. Eric McClure is an editing fellow at wikiHow where he has been editing, researching, and creating content since 2019. A former educator and poet, his work has appeared in Carcinogenic Poetry, Shot Glass Journal, Prairie Margins, and The Rusty Nail. His digital chapbook, The Internet, was also published in TL DR Magazine. He was the winner of the Paul Carroll award for outstanding achievement in creative writing in 2014, and he was a featured reader at the Poetry Foundations Open Door Reading Series in 2015. Eric holds a BA in English from the University of Illinois at Chicago, and an MEd in secondary education from DePaul University.There are 22 references cited in this article, which can be found at the bottom of the page.Learn more…

If youre looking to grow your retirement savings tax-free, a Roth IRA is like a dream come true. However, if youve got multiple retirement accounts or youre trying to figure out what youre allowed to do here without causing yourself problems, it may be hard to find the info you need. While the transferring part is easy enough, understanding the impact after that happens can be tricky. Luckily, weve got you covered with everything you need to know about consolidating, transferring, and rolling over your funds into a Roth IRA while minimizing your upfront costs.

Account Consolidation: Streamlining Your Retirement Savings

Multiple retirement accounts may mean multiple investment decisions, statements, fees, emails, and more. Consolidating retirement accounts can make it easier to manage your retirement savings.

This document is intended to be educational in nature and is not intended to be taken as a recommendation.

Investment and insurance products are:

- Not insured by the Federal Deposit Insurance Corporation or any federal government agency.

- Not a deposit, obligation of, or guaranteed by any Bank or Banking affiliate.

- May lose value, including possible loss of the principal amount invested.

The subject matter in this communication is educational only and provided with the understanding that Principal® is not rendering legal, accounting, or tax advice. You should consult with appropriate counsel or other advisors on all matters pertaining to legal, tax, or accounting obligations and requirements.

Financial professionals are sales representatives for the member of Principal Financial Group®. They do not represent, offer, or compare products and services of other financial services organizations.

Insurance and plan administrative services provided through Principal Life Insurance Co. Securities offered through Principal Securities, Inc., 800-547-7754,member SIPC. Principal Life and Principal Securities are members of Principal Financial Group® , Des Moines, IA 50392.

You May Like: Should You Roll Your 401k Into An Ira

K Conversion Tax Consequences

Retirement accounts like 401k plans are typically funded with pretax money a Roth IRA is an after-tax account. Thus, youll likely face tax consequences on your 401k conversion to a Roth. Youll have to report the transaction on your taxes, and the IRS will consider all of the pretax income you convert to your Roth to be fully taxable at ordinary income tax rates, which can amount to a significant hit if you have a large 401k fund.

For example, if the amount of your rollover pushes you into the highest tax bracket, youll owe 37 percent on the transfer, just in federal taxes. And if you live in a high-tax state, such as California, you might face as much as 13.3 percent in additional state tax, pushing your total tax burden to over 50 percent of the amount of your 401k rollover.

Also See: How to Use Your IRA as a Last-Minute Tax Deduction

How To Reduce The Tax Hit

Now, if you contributed more than the maximum deductible amount to your 401, you’ve got some post-tax money in there. You may be able to avoid some immediate taxes by allocating the after-tax funds in your retirement plan to a Roth IRA and the pre-tax funds to a traditional IRA.

Alternatively, you can choose to split up your retirement money into two accounts, one a traditional IRA and the other a Roth IRA. That will reduce the immediate tax impact.

This is going to take some numbers-crunching. You should see a competent tax accountant or tax attorney to determine exactly how the alternatives will affect your tax bill for the year.

However, consider the long-term benefit: When you retire and withdraw the money from the Roth IRA, you will not owe taxes. There is another reason to think long term, which is the five-year rule explained later.

Recommended Reading: How Much To Withdraw From 401k

Tips For Managing Your Retirement Accounts

- Taking care of your retirement plans on your own is harder than it might seem. Luckily, finding the right financial advisor that fits your needs doesnt have to be hard. SmartAssets free tool matches you with financial advisors in your area in 5 minutes. If youre ready to be matched with local advisors that will help you achieve your financial goals, get started now.

- Check your 401 contributions each year to make sure youre taking full advantage of your employers plan when it comes to matching contributions. Run the numbers through our 401 calculator annually to make sure youre contributing enough to reach your target retirement savings goal.

Reasons You May Want To Roll Over Now

- Diversification. Investment options in your 401 can be limited and are selected by the plan sponsor. Rolling your funds over into an IRA can often broaden your choice of investments. More choices can mean more diversification in your retirement portfolio and the opportunity to invest in a wider range of asset classes including individual stocks and bonds, managed accounts, REITs and annuities.

- Beneficiary flexibility. With some IRAs, you may be able to name multiple and contingent beneficiaries or name a trust as the beneficiary. Other IRAs may allow you to impose restrictions on beneficiaries. These options aren’t usually available with 401s. But, keep in mind, not all IRA custodians have the same rules about beneficiaries so be sure to check carefully.

- Ownership control. You are the owner and have access rights with an IRA. The assets in your IRA are also not subject to blackout periods. With a 401 plan, the qualified plan trustee owns the assets and assets may be subject to blackout periods in which account access is limited.

- Distribution options. If your IRA is set up as a Roth IRA, there is not a set age when the owner is required to take minimum distributions. With 401 plans and traditional IRAs, the owner will have to take required minimum distributions by April 1 of the year after they turn age 72.

Also Check: Can I Take 401k Money To Buy A House