Maximize Employer 401 Match Calculator

Contribution percentages that are too low or too high may not take full advantage of employer matches. If the percentage is too high, contributions may reach the IRS limit before the end of the year. As a result, employers will not match for the rest of the year. This calculation can show the contribution percentage window in order to take full advantage of the employers matching contributions.

Spoiler Alert: Its Probably More Than You Think

Among Americans who contribute to a 401 or similar retirement plan, the most common contribution amount is just enough to take advantage of the employer match. For example, if an employer is willing to match its employees’ contributions dollar for dollar up to 5% of salary, the average worker will contribute 5% of their salary to take advantage.

While this is certainly a good start, you’re allowed to contribute a lot more to your 401 than your employer is likely willing to match. Here’s how much you could end up with if you decide to max out your 401 contributions in 2018, and every year after that.

Planning For Retirement : How Much Should You Put In A 401

A 401 pension plan is made available through your employer. As an employee, you can contribute a certain amount of money every year, and that money is tax-free until you withdraw it after retirement.

Investing a portion of your earnings into a 401 should be at the top of your list of financial priorities, especially if your company will match your contributions. The earlier you start, the better your chances of saving up a nest egg for a comfortable retirement.

But how much should you contribute to your 401 per paycheck? The answer can significantly impact your monthly budget.

Keep reading to learn what you should look out for.

Read Also: What Happens To My 401k If I Retire Early

First Place To Look: Iras

Contributing to an IRA in addition to your 401 is one option. Whether you contribute to a Roth IRA or traditional IRA, your money will grow tax-free until you retire just as it does in your 401k. Once you start making withdrawals, you’ll pay income taxes on the money you withdraw from your traditional IRA or 401k, but not on withdrawals from your Roth IRA. However, a Roth doesn’t give you a tax deduction or tax savings in the year in which you make the contribution unlike a traditional IRA or 401.

How To Max Out 401 Contributions

Having a maxed out 401 can help you feel more secure about your retirement future. If youre interested in maxing out your plan:

- Examine your monthly expenses and how much those represent, as a percentage of your total income

- Look at how much of your pay youre currently contributing to your 401 and how much more you would need to contribute to reach the limit

- Go back to your budget and ask yourself if upping your contribution is possible.

- If yes, contact your 401 plan administrator and request an increase in your contribution rate

- If no, take a closer look at your spending for areas you can reduce

Pro tip: If you cant immediately contribute the maximum amount to your 401, you might also consider increasing your contributions by 1% each year until you reach the annual limit.

Also Check: How To Claim 401k Money

What Is The Maximum 401k Contribution Amount

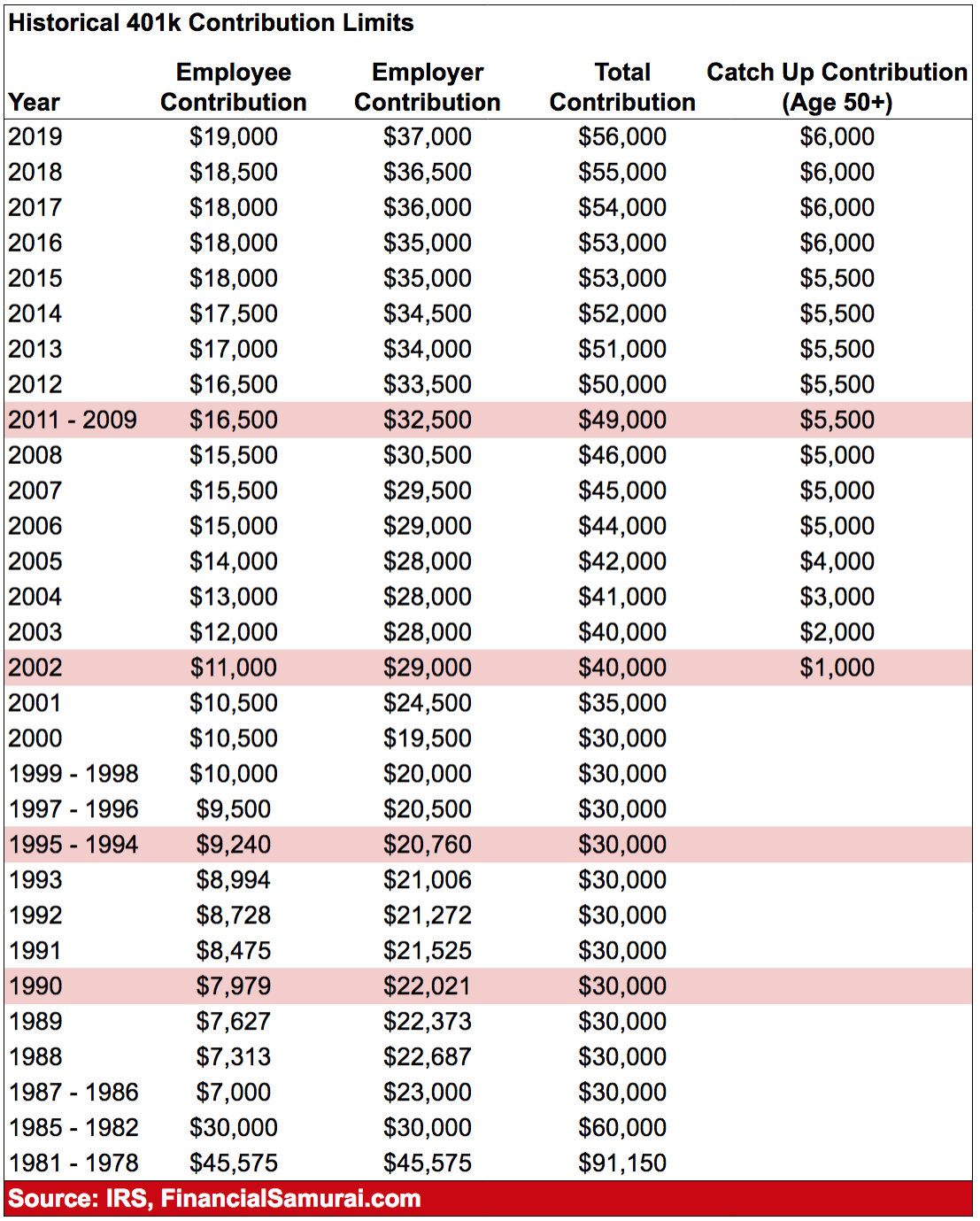

Starting in 2020 , you can contribute up to $19,500 each year to your 401k if you are under 50. If you are over the age of 50, you may be able to make catch-up contributions. This provision lets you invest up to an additional $6,500 in your 401k .

PRO TIP: You need to be behind in your 401k contributions to make catchup contributions.

When compared to a Roth IRA, where you can only contribute up to $6,000/year, this is an amazing opportunity especially since your pre-tax money is being compounded over time.

How To Use The Contribution Calculator

This calculator is designed to show you how you could potentially increase the value of your retirement plan account by increasing the amount that you contribute from each paycheck. The Growth Chart and Estimated Future Account Totals box will update each time you select the Calculate or Recalculate button.

Pre-filled amountsBased on our records, the following information may be pre-filled:

Salary

- Pay period. If the information is not available, the default pay period is weekly.

Contribution

- Your contribution rate. Note that we will use 8% as a default value if your contribution rate is not available or if your contribution is a dollar amount rather than a percentage.

Investment

Also Check: Should I Get A 401k

Read Also: Does Employer Match Count Towards 401k Limit

How To Max Out A 401k

For 2021, the 401k contribution limit is $19,500 in salary deferrals. Individuals over the age of 50 can contribute an additional $6,500 in catch-up contributions.

Yet, most people dont know how to max out a 401k. According to a Vanguard study , only 12% of plan participants managed to max out their 401k in 2019. Here are some strategies on how to max out your 401.

Opportunity To Get Any Stimulus Checks You May Have Missed

If you were eligible to receive stimulus money in 2020 and 2021 , and you didn’t receive all of it, don’t worry. You can claim the missing amount as a Recovery Rebate Credit on your taxes that you file this spring, which will reduce the taxes you owe by the amount you’re still missing from your stimulus payment. This means that you’ll essentially receive your payment as part of your tax refund .

The IRS addresses most questions you may have about this on their Recovery Rebate Credit page.

Read Also: How Do I Find My 401k Plan

Irs Announces 401 Limit Increases To $20500

IR-2021-216, November 4, 2021

WASHINGTON The Internal Revenue Service announced today that the amount individuals can contribute to their 401 plans in 2022 has increased to $20,500, up from $19,500 for 2021 and 2020. The IRS today also issued technical guidance regarding all of the costofliving adjustments affecting dollar limitations for pension plans and other retirement-related items for tax year 2022 in Notice 2021-61 PDF, posted today on IRS.gov.

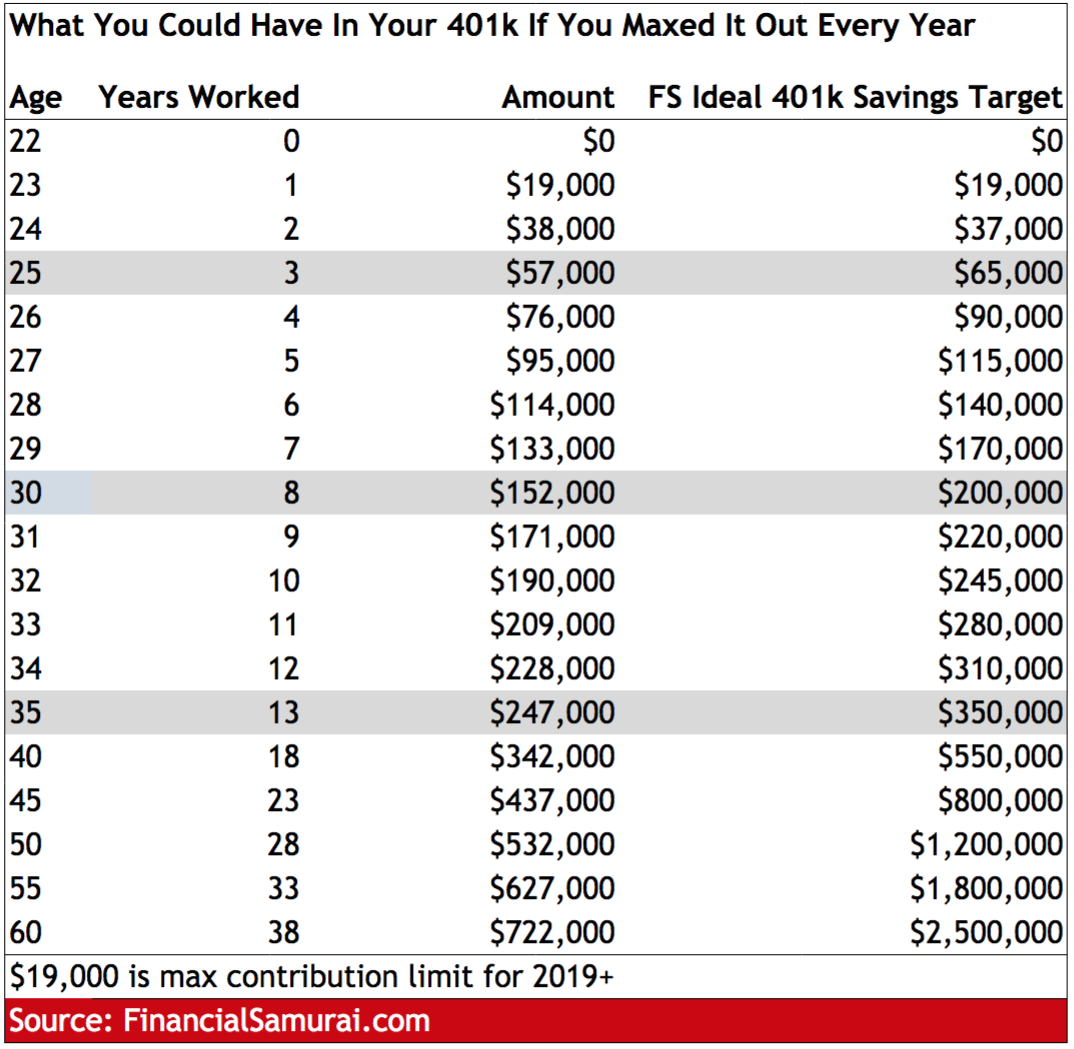

What If You Always Maxed Out Your 401k

Whats the surest way to become a millionaire? I can tell you right now max out your 401k contribution every year. It will take a while, but I guarantee you will get there. This is the easiest way to build wealth. The problem is you have to start investing young and most of us didnt know that when we were 22. We all spent too much money and didnt invest enough in our 20s. Even I didnt want to contribute to my 401k when I started working in 1996. To that young guy, retirement was 40+ years away. Why should I put so much money aside? I wanted to go out, have fun, replace my junky old car, and buy nicer clothes. Fortunately, my dad convinced me to start contributing to my 401k and saved me from a huge mistake. The compounding effect of investing early is absolutely amazing. Its too bad so many young people dont understand this concept and put off investing until later.

Recommended Reading: Should I Get A 401k

Tips For Contributing To Your 401

- If youre struggling to get started or stay on track, consider working with a financial advisor. Our financial advisor matching tool can help you find a professional to work with. First, you answer some simple questions. Then, the tool links you up to three local advisors. You can then view their profiles and set up interviews before deciding to work with one.

- If you switch jobs, you can no longer contribute to a previous employers 401 plan. You dont want to lose the hard work you did to save that money, so you should look to make a direct 401 rollover to your new employers plan.

- A traditional IRA and a 401 offer similar tax benefits. You might wonder whether one is a better option for you. Heres an article to help you think about an IRA vs. a 401.

- You should always avoid early withdrawals from your 401. Not only will you have to pay the income tax, youll have to a pay 10% penalty. There are a couple of ways you could avoid that big penalty though. If you really think you need to withdraw money early, heres more information on 401 withdrawals.

Phathom Pharmaceuticals Announces New Data At Acg 2021 Annual Scientific Meeting

For people who have to consider what they can afford to contribute, the best advice is to regularly check up on their 401 status. Every quarter or so consider how much you are dedicating to your retirement account, compare it to the cap and check to see if you can budget for a little bit more. As you get older, work harder to increase those contributions, and perhaps even consider signing up for an automatic increase plan if your employer offers one.

The standard advice is to try and contribute between 15% to 20% of each paycheck to your retirement account. For many people, this is an enormous amount of money, but it is possible. The median American makes approximately $59,000. This means finding of $9,000 in the budget . It wont be easy, which is why you should make it an active part of your budgeting process. If you treat your 401 like a fire-and-forget, it will be easy to miss opportunities to put more money in.

Also Check: How To Know If I Have 401k

Read Also: Can 401k Be Transferred To Another Company

What Is A 401

A 401 is a retirement plan offered by some employers. These plans allow you to contribute directly from your paycheck, so theyre an easy and effective way to save and invest for retirement. There are two main types of 401s:

-

A traditional 401: This is the most common type of 401. Your contributions are made pre-tax, and they and your investment earnings grow tax-deferred. Youll be taxed on distributions in retirement.

-

A Roth 401: About half of employers who offer a 401 offer this variation. Your contributions are made after taxes, but distributions in retirement are not taxed as income. That means your investment earnings grow federally tax-free.

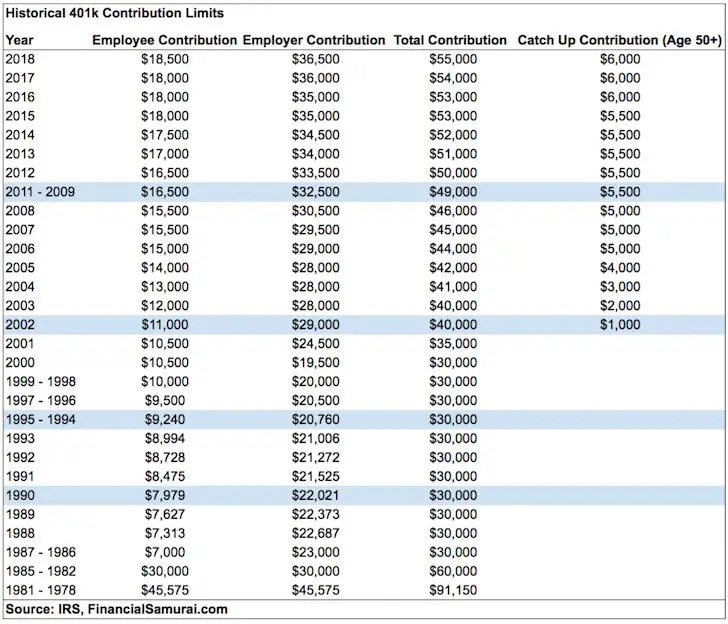

Contribution Limits For 2021

Contributing to your 401 is a great way to prepare for retirement, allowing for tax-deferred growth and, in some cases, employer matching contributions. If you really want to boost your savings, you might even contribute the maximum to the account. For 2021, the 401 annual contribution limit will remain unchanged from 2020 at $19,500. For employees over 50, there are also catch-up contributions. The limits for these will also remain unchanged from 2020 at $6,500. Note that the IRS also has rules surrounding 401 employer matching. Many taxpayers work with a financial advisor to maximize their retirement strategy. Lets take a look at the contribution limits and rules for 2021.

Also Check: Does Borrowing From 401k Affect Credit Score

Do 401 Contribution Limits Include The Employer Match

Employees are allowed to contribute a maximum of $19,500 to their 401 in 2020, or $26,000 if youre over 50 years of age. The good news is employer contributions do not count towards the $19,500 limit. Instead, employer matching contributions are subject to the lesser known $57,000 limit on all contributions made to a 401 account .

Your 401 can receive no more than $57,000 in contributions in a single year, whether those contributions are made by you or by your employer. That limit is three times the contribution limit for employees, so your employer would need to offer a 200% 401 employer match on all contributions you make for you to reach the limit.

The $57,000 limit mostly affects small business owners and the self-employed who pay themselves and make retirement contributions as both the employee and the employer. Most people who work for regular companies will never have to worry about the $57,000 overall limit.

Also Check: Should I Rollover My 401k When I Retire

What Is A 401k

A 401k is a powerful type of retirement account that many companies offer to their employees as a perk. With each pay period, you put a portion of your paycheck into the account. It happens automatically so you dont have to do anything special and there are a ton of benefits.

A 401k is called a retirement account because it gives you huge tax advantages if you dont touch your money until you reach the minimum retirement age of 59 1/2 years. While you will have to pay a penalty if you touch your 401k savings before you reach retirement age, the benefits far outweigh the risk.

Here is a snapshot of the benefits of having a 401k:

Recommended Reading: Who Can Open A Solo 401k

Contribute Up To The Employer Match

You have enough saved up to cover your expenses. You emergency fund is there in case you need it. Now youre starting to think about 401 contributions. Where do you you start?

The first thing you should figure out is if you have an employer matching program with your 401. With an employer match, your employer will match your 401 contributions up to a certain percentage of your gross salary. Say your employer offers 100% match on the first 5% you contribute. That means if you contribute 5% of your gross salary to your 401, your employer will contribute an amount equal to 5% of your gross salary. The total contribution to your 401 would then equal 10% of your gross salary.

An employer match allows you to increase your contribution, and you should always take advantage of matching programs. Unfortunately, many people pass up free money by not contributing up to their employer match.

Building Up An Adequate Emergency Fund

Roger Whitney, host of the podcast Retirement Answer Man, says that its important to build up an emergency fund before you start maxing out your retirement fund. Think of an emergency fund as the financial airbag of your life, he said.

Having an emergency fund can give you financial options when anything unexpected comes up and help you keep your long-term assets for the long term. If you dont have an emergency fund, you may be forced to deplete your resources if you face a job loss or a financial emergency.

How much should you save? Caswell suggests saving three to six months of expenses in a safe and liquid bank account, such as a high-yield savings account.

Don’t Miss: Can You Roll A 401k Into An Existing Roth Ira

Take Advantage Of Catch

Catch-up contributions allow investors over age 50 to increase their retirement savingswhich is especially helpful if theyre behind in reaching their retirement goals. Individuals over age 50 can contribute an additional $6,500 for a total of $26,000 for the year. Putting all of that money toward retirement savings can help you truly max out your 401.

As you draw closer to retirement, catch-up contributions can make a difference, especially as you start to calculate when you can retire. Whether you have been saving your entire career or just started, this benefit is available to everyone who qualifies.

And of course, this extra contribution will lower taxable income even more than regular contributions. Although using catch-up contributions may not push everyone to a lower tax bracket, it will certainly minimize the tax burden during the next filing season.

You Should Max Out 401 Contributions Right Not So Fast

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

Just because you can do something doesnt mean you should. Like entering a hot dog eating contest, getting a tattoo on your face or even deciding to max out 401 contributions.

The last one may seem incongruous after all, numerous studies show Americans feel they arent saving enough for retirement. And if youve read any personal finance advice, you probably believe the best bet is to save, save, save.

The maximum 401 contribution is $19,500 in 2021 and $20,500 for 2022 . But depending on your financial situation, putting that much into an employer-sponsored retirement account each year may not make sense. Rather, you may want to fund other accounts first. Here are three things to consider before you max out 401 contributions.

Read Also: How Much Does 401k Cost Per Month

What About The Market

This gets down to the question of lump sum investing versus dollar cost averaging. You can get a more complete discussion of my views on this topic in Podcast 71 which is completely dedicated to the topic. But lets summarize it here.

Under ideal circumstances, lump sum buying works well if you can buy into the market at the point of the year when stocks are the cheapest. The problem is that we cant know when thats going to be. The market goes up in the long term, so in theory at least, the earlier that you get into the market the better. And of course, you want to take advantage of both tax deferral and of compounding of investment returns, too.

Over the long-term, it will probably be to your advantage to front-load funding. Lump sum investing tends to outperform dollar cost averaging, at least in many years.

In 2013 for example, front loading would have worked well because the market ultimately rose 32% for the year. But had you done it in the 2008 2009 time frame, it would have been a disaster because the market fell from the beginning of each year.

I think the bigger question in regard to front-loading is how much does it really matter? And I think the answer to that question is, probably not much. I tend to max out my 401k early, but not to the extreme. One year, I maxed out my 401k in about nine months.

Do you have different thoughts on maxing out your 401 early?