Can My Employer Match My Designated Roth Contributions Must My Employer Allocate The Matching Contributions To A Designated Roth Account

Yes, your employer can make matching contributions on your designated Roth contributions. However, your employer can only allocate your designated Roth contributions to your designated Roth account. Your employer must allocate any contributions to match designated Roth contributions into a pre-tax account, just like matching contributions on traditional, pre-tax elective contributions.

What Is A 5

The 5-taxable-year period of participation begins on the first day of your taxable year for which you first made designated Roth contributions to the plan. It ends when five consecutive taxable years have passed. If you make a direct rollover from a designated Roth account under another plan, the 5-taxable-year period for the recipient plan begins on the first day of the taxable year that you made designated Roth contributions to the other plan, if earlier.

If you are a re-employed veteran making designated Roth contributions, they are treated as made in the taxable year of qualified military service that you designate as the year to which the contributions relate.

Certain contributions do not start the 5-taxable-year period of participation. For example, a year in which the only contributions consist of excess deferrals will not start the 5-taxable-year period of participation. Further, excess contributions that are distributed to prevent an ADP failure also do not begin the 5-taxable-year period of participation.

You Can Still Recharacterize Annual Roth Ira Contributions

Prior to 2018, the IRS allowed you to reverse converting a traditional IRA to a Roth IRA, which is called recharacterization. But that process is now prohibited by the Tax Cuts and Jobs Act of 2017.

However, you can still recharacterize all or part of an annual contribution, plus earnings. You might do this if you make a contribution to a Roth IRA then later discover that you earn too much to be eligible for the contribution, for instance. You can recharacterize that contribution to a traditional IRA since those accounts have no income limits. Contributions can also be recharacherized from a traditional IRA to a Roth IRA.

The change would need to be completed by the tax-filing deadline of that year. The recharacterization is nontaxable but you will need to include it when filing your taxes.

Don’t Miss: How To Borrow Against 401k Fidelity

Should You Convert Your Traditional 401 Into A Roth 401

7 Minute Read | September 27, 2021

Over the past few years, you might have received an email from your companys human resources department introducing a new retirement savings plan option: the Roth 401.

More and more companiesespecially large onesare adding Roth options to their 401 plans. In fact, seven out of 10 employers now offer this option to their employees.1 If the Roth 401 is on the table at your workplace, thats great news for you!

But if you now have a Roth 401 option, youre probably wondering what to do with your existing 401. Is converting an existing 401 to a Roth the way to go? Or should you just leave it alone?

There are some things to keep in mind before you make this decision, so lets dive in.

Signs It Makes Sense To Roll Your 401 Into A Roth Ira

If youre thinking of rolling your 401 into a Roth IRA instead of a traditional IRA, you have plenty of reasons to do so. Not only do Roth IRAs let you invest your dollars in the same investments as traditional IRAs, but they offer additional perks that can help you save money down the line. Here are four signs that a Roth IRA might actually be your best bet.

Also Check: How Do I Find Previous 401k Accounts

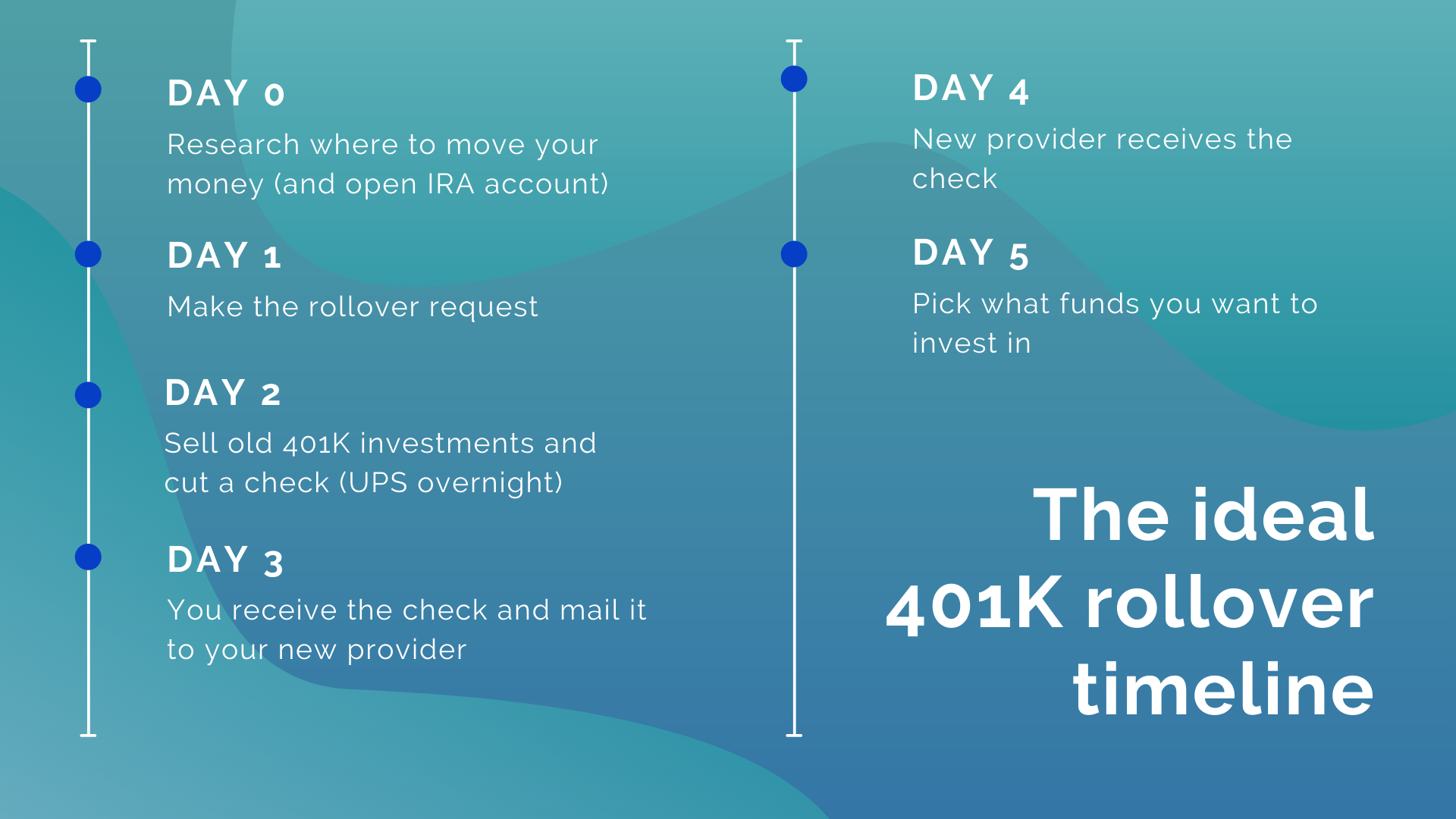

How To Roll Over A 401 To An Ira In 4 Steps

If you decide to do a 401 rollover to an IRA, typically the money from an old 401 must go into the new IRA account within 60 days. There are four steps to do a 401 rollover into an IRA.

Choose which type of IRA account to open

Open your new IRA account

Ask your 401 plan for a direct rollover or remember the 60-day rule

Choose your investments

Should I Roll Over My Traditional Ira Funds Into A Roth Ira

Whether you should roll funds from your current retirement account into a Roth depends entirely on your tax situation. If you are in a lower tax bracket this year than you plan to be during retirement, a rollover may make sense. For example, if you had been furloughed or laid off due to the coronavirus pandemic, that year might be a good year to consider transferring some of your retirement funds into a Roth IRA.

On the other hand, if you expect to be in a lower tax bracket during retirement, it is wise to keep your funds where they are currently. This becomes harder to plan as tax laws change and tax brackets are updated.

Don’t Miss: Can You Transfer 403b To 401k

How To Enter 1099r And Not Get Taxed

This is a rollover from my ex-employer’s 401k to a Roth IRA. They mailed the checks to me and I deposited them to a Roth IRA. I was told that this is a not taxable event, but the 1099R box 2a taxable has same amount as box 1. Box 2b has Total Distribution. Box 7 has G. IRA/SEP/SIMPLE is not checked. In TurboTax, if I answer no to Roth, I don’t get taxed. Do I need to get the Payer to correct box 2a to zero ? Is it ok to answer no to Roth? How do I get this done correctly to reflect this as a non-taxable rollover from 401k to Roth IRA?

Two: Convert Your Traditional Ira To A Roth Ira

No doubt, there are significant advantages to moving your 401 money to a Roth IRA. But, as noted earlier, it will be a taxable event. You will owe taxes not only on your contributions and your companys contributions if it has a matching program, but also on your earnings, which include capital gains and dividends. This bump in income could boost you to a much higher income bracket so that you are paying more tax than if you left the money in a traditional IRA and paid taxes as you made withdrawals in retirement.

Because the taxation of your money is changing, the switch from a traditional IRA to a Roth is called a conversion rather than a rollover. More importantly, it is a permanent process. So you should make sure this is what you really want to do before you do it.

Also Check: How To Close Your 401k Early

Rolling Over A 401 To A Roth Ira: Should You Convert To A Roth

What are your 401 rollover options? You may consider rolling over an old 401 to a Roth IRA, which is properly described as a Roth conversion. Converting your old 401 or 403 to a Roth IRA is worth considering. A Roth IRA offers unique benefits unavailable in other types of retirement accounts: no RMDs, tax-deferred growth and tax-free withdrawals. But a 401 to Roth IRA conversion doesnt make sense in every situation. For high-earners, it may not make sense to pay tax on your retirement savings now.

What Percentage Of Income Should Go To 401k And Roth Ira

Numerous financial planning studies show that the appropriate portion of retirement savings is between 15% and 20% of total income. These contributions can be made in the 401 scheme, 401 line received from employer, IRA, Roth IRA, and / or tax authorities.

What percent of your income should you invest into ROTH IRAs and pre tax retirement?

Investors say you should aim to give at least 15% of your income before you pay your taxes. But being careful about which types of accounts to invest in, and when, can be frustrating.

How much can a 30 year old contribute to a Roth IRA?

The IRS, from 2021, is the maximum amount you can give to a traditional IRA or Roth IRA for six dollars. In other words, the $ 500 a month you can donate within a year. If you are 50 years or older, the IRS allows you to pay up to $ 5,000 a year .

Recommended Reading: Is There A Limit For 401k Contributions

How To Roll Over Your 401 Plan To A Roth Ira

Rolling over your 401 plan to a Roth IRA is a taxable event. Youll have to pay income tax on your contributions, your employer-match contributions and all earnings. Depending on the size of your account, this could push you into a much higher tax bracket, so you shouldnt proceed before youve done the math. You may also want to consult a financial advisor to make sure this move is the right one for you. In the meantime, heres what you need to know about the two-step process of rolling over your 401 first to a traditional IRA and then converting the traditional IRA into a Roth IRA.

Can You Lose All Your Money In An Ira

The most likely way to lose all your money in your IRA is to have the entire portion of your account invested in a single stock or bond investment, and the investment becomes less valuable to the exit company. You can prevent permanent-loss of IRA status like this by modifying your account.

Is the IRA safe? When it comes to safety and security, IRAs are as safe as you are, and even if some security has secured your retirement accounts, it is up to you to invest your IRA money wisely.

Also Check: How Do You Take Money From Your 401k

What If I Have Employer Stock In My Employer

You can choose to roll company stock into an IRA or a taxable brokerage account. If you decide to roll the stock to an IRA, its full value will be taxed as income at your regular rate if you move the stock to a taxable brokerage account, you might be able to save money by paying capital gains taxes on the difference between the stocks value and the price you paid for it. There are tax benefits to each, so consult your tax advisor and ask about the net unrealized appreciation strategy.

Can I Take A Loan From My Designated Roth Account

Yes, if the plan permits, you can identify from which account in your 401, 403 or governmental 457 plan you wish to draw your loan, including from your designated Roth account. However, you must combine any loans you take from your designated Roth account with any other outstanding loans from that plan and any other plan maintained by the employer to determine the maximum amount you are permitted to borrow. The repayment schedule for your loan from your designated Roth account must separately satisfy the amortization and quarterly payment requirements.

Also Check: What Happens To My 401k When I Leave My Job

Can I Contribute More To The Ira After My Rollover

Yes, but the amount of your contribution can’t exceed the amount of income you earned that year .

You’re also subject to annual Roth IRA limits . And those limits are reducedand gradually phase outas your modified adjusted gross income increases. Also, there are no age limits on Roth IRA contributions.

Please note: There may be special tax considerations when you combine rollover assets with new contributions in one account, otherwise known as commingling.

Yes. Effective for 2020, there is no age limit to open the IRA or contribute to it. For 2019 contributions and earlier, no contributions were allowed for years you were age 70½ or older.

Also, the amount of your contribution can’t exceed the amount of income you earned that year . In addition, you’re subject to annual traditional IRA limits .

Please note: There may be special tax considerations when you combine rollover assets with new contributions in one account, otherwise known as commingling.

You Want To Increase Your Tax Diversification

Contributions to traditional IRAs are tax-advantaged, meaning you wont pay taxes on your invested funds until you begin taking withdrawals at retirement. Roth IRAs, on the other hand, are taxed up front but offer tax-free withdrawals after age 59 ½. If youre unsure how your tax and income situation might pan out in the future, having both types of accounts a traditional IRA and a Roth IRA is a smart move in terms of diversifying your future tax exposure.

You May Like: Which 401k Investment Option Is Best

Should You Convert To A Roth Ira Now

Once youve decided a Roth IRA is your best retirement choice, the decision to convert comes down to your current years tax bill. Thats because when you move money from a pre-tax retirement account, such as a traditional IRA or 401, to a Roth, you have to pay taxes on that income. Another issue is that the Build Back Better bill, currently before the Senate, could limit or ban some types of conversions.

-

Roth IRAs deliver huge tax advantages, including tax-free growth and tax-free withdrawals in retirement.

-

You can withdraw contributions at any time, for any reason, tax-free.

-

Unlike traditional IRAs and 401, a Roth doesnt have required minimum distributions.

-

You pay tax on the conversionand it could be substantial.

-

You may not benefit if your tax rate is lower in the future.

-

You must wait five years to take tax-free withdrawals from the Roth after a rollover, even if youre already age 59½.

It makes sense: If you had put that money into a Roth originally, you would have paid taxes on it for the year when you contributed.

A Roth IRA rollover is most beneficial when:

Roth Iras And Income Requirements

There is another key distinction between the two accounts. Anyone can contribute to a traditional IRA, but the IRS imposes an income cap on eligibility for a Roth IRA. Fundamentally, the IRS does not want high-earners benefiting from these tax-advantaged accounts.

The income caps are adjusted annually to keep up with inflation. In 2021, the phase-out range for a full annual contribution for single filers is from $125,000 to $140,000 for a Roth IRA. For married couples filing jointly, the phase-out begins at $198,000 in annual gross income, with an overall limit of $208,000.

And that is why, if you have a high income, you have another reason to roll over your 401 to a Roth IRA. Roth income limitations do not apply to this type of conversion. Anyone with any income is allowed to fund a Roth IRA via a rolloverâin fact, it is one of the only ways.

401 funds are not the only company retirement plan assets eligible for rollover. The 403 and 457 plans for public-sector and nonprofit employees may also be converted into Roth IRAs.

Investors may choose to divide their investment dollars across traditional and Roth IRA accounts, as long as their income is below the Roth limits. However, the maximum allowable amount remains the same. That is, it may not exceed a total of $6,000 split among the accounts.

Read Also: How To Locate Lost 401k

Taxpayers Can Now Take Tax Free Jump From 401k To Roth Ira

Moving your retirement money around just got easier. In a conciliatory move for taxpayers, the IRS has issued new rules that allow you to minimize your tax liability when you move 401 funds into a Roth IRA or into another qualified employer plan. The situation arises when you have a retirement account through your employer that includes both pre-tax and after-tax funds. When you leave the company and want to move your money, allocating these retirement funds to new plans becomes tricky.

The new allocation rules take effect beginning in 2015, but taxpayers can choose to apply them to distributions beginning on September 18, 2014, the date the new rules were released by the IRS.

Under the old rules, you would have to pro-rate distributions and rollovers separately between pre-tax and after-tax amounts according to a set formula. This resulted in payment of tax on a pro rata share of pre-tax funds. The new rules allow you to do the allocations yourself within certain limits. You now can choose to move pre-tax money into a traditional IRA and after-tax money into a Roth IRA. If you moved pre-tax amounts into a Roth IRA, you would have to pay tax on the rollover because Roths can only be funded with after-tax money. Now you can direct pre-tax dollars to one account and after-tax dollars to another to avoid tax liability.

Lets look at an example.

Smart Planning

Your Company May Offer A Roth Option

Many companies have added a Roth option to their 401 plans. After-tax money goes into the Roth, so you won’t see the immediate tax savings you get from contributing pretax money to a traditional plan. But your money will grow tax-free. account.)

For 2021, you can stash up to $19,500 a year, plus an extra $6,500 a year if you’re 50 or older, into a Roth 401. Contributions must be made by December 31 to count for the current tax year, and the limit applies to the total of your traditional and Roth 401 contributions. A Roth 401 is a good option if your earnings are too high to contribute to a Roth IRA.

Read Also: How To Set Up A 401k Plan

Distributions From Your Rolled

Although it is typically not advisable to tap retirement funds before you leave the workforce, in tight times, the undesirable option may become the only option. If you must withdraw money from your Roth at the time of the rollover, or soon after that, be aware that the timing rules for such withdrawals differ from those of traditional IRAs and 401s. Some of these requirements may also apply to Roths that are rolled over when you are at or close to retirement age.

Specifically, to make distributions from these accounts without incurring any taxes or penalties, the distribution must be qualified, which requires that it meets what is known as the five-year rule. Also applied to inherited retirement accounts, this rule requires that funds had remained intact in the account for a five-year period to avoid or at least minimize taxes and penalties.