What Is The Average 401 Match

The National Association of Plan Advisors states that in 2021, the average employer 401 match was 4.6%, according to data from Fidelity, which helps more than 40 million people invest their own life savings. This hasnt changed much in a decade, as statistics from the U.S. Bureau of Labor Statistics noted in 2011 that the median plan matches up to 5% of earnings.

In 2020, it was also reported that employees contributed approximately 8.8% to their 401 plans while employers contributed a match of around 4.6%. Its safe to say that theres no set-in-stone number for what an employer match should be, but if your company offers a match between 3% and 5%, thats a thumbs up for your retirement savings.

Again, since not all companies offer a match to their employees, finding a job that has one as part of its benefits package is a pretty big deal. After all, a 401 match is essentially free money and its money that could make a huge difference in your ending balance when you are close to retirement.

Average 401k Balance At Age 65+ $471915 Median $138436

The most common age to retire in the U.S. is 62, so its not surprising to see the average and median 401k balance figures start to decline after age 65. Once you reach age 65, there are still several considerations for your retirement, even if you are no longer working and accumulating wealth. Some of these include making decisions about Medicare, creating a plan around withdrawing money from your retirement accounts, and evaluating any additional insurance needs.

Start Earning More For A Better Financial Future

The answer to How much should I have in my 401k? is an important one but its not the only way to ensure your financial future.

We are going to let you in on a little secret. It is one that has helped thousands of people live their Rich Life:

Theres a limit to how much you can save, but theres no limit to how much money you can earn.

Bonus:

Many people dont understand this and because of that, theyre content with contributing very little to their retirement accounts. When they actually retire, theyre surprised when their nest egg is a lot smaller than they thought and they have to get a job as a Walmart greeter to pay for their condo.

If you realize that your earning potential is LIMITLESS, you can truly get started working toward living a Rich Life today.

We recommend three ways to start earning more money:

1. Negotiate a salary raise. 99% of people are content with not asking for a salary raise. So if you are willing to negotiate, that puts you in the 1% and showcases to your boss that youre a Top Performer willing to work hard for more money.

2. Start a side hustle. One of my favorite money-making tactics is starting your own side hustle. We all have skills. Why not leverage those skills to start earning more money in your free time?

We want to help you get started on one of these tactics today: Starting a side hustle.

Thats why we want to offer you my Ultimate Guide to Making Money.

Stuff like:

UGH.

Read Also: Should I Transfer 401k From Previous Employer

Working With Your Financial And Tax Professionals

A 401 plan can become the cornerstone of a personal retirement savings program, providing the foundation for future financial security. Consult your financial and tax professionals to help you determine how your employer’s 401 and other savings and investment plans could help make your financial future more secure.

Important NoteEquitable believes that education is a key step toward addressing your financial goals, and we’ve designed this material to serve simply as an informational and educational resource. Accordingly, this article does not offer or constitute investment advice and makes no direct or indirect recommendation of any particular product or of the appropriateness of any particular investment-related option. Your needs, goals and circumstances are unique, and they require the individualized attention of your financial professional. But for now, take some time just to learn more.

Please be advised that this material is not intended as legal or tax advice. Accordingly, any tax information provided in this material is not intended or written to be used, and cannot be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer. The tax information was written to support the promotion or marketing of the transactions or matter addressed and you should seek advice based on your particular circumstances from an independent advisor.

What’s the next step for you?

A financial professional can help you decide. Let’s talk.

How Much Should I Invest In A Roth 401

We recommend investing 15% of your income into retirement savings. If you have a Roth 401 at work with good mutual fund options, you can invest your entire 15% there. Lets say you make $60,000 a year. That means you would invest $750 a month in your Roth account. See? Investing for the future is easier than you thought!

You May Like: How Can I Get Access To My 401k

Take Note Older Savers

If you start saving later in life, especially when you’re in your 50s, you may need to increase your contribution amount to make up for lost time.

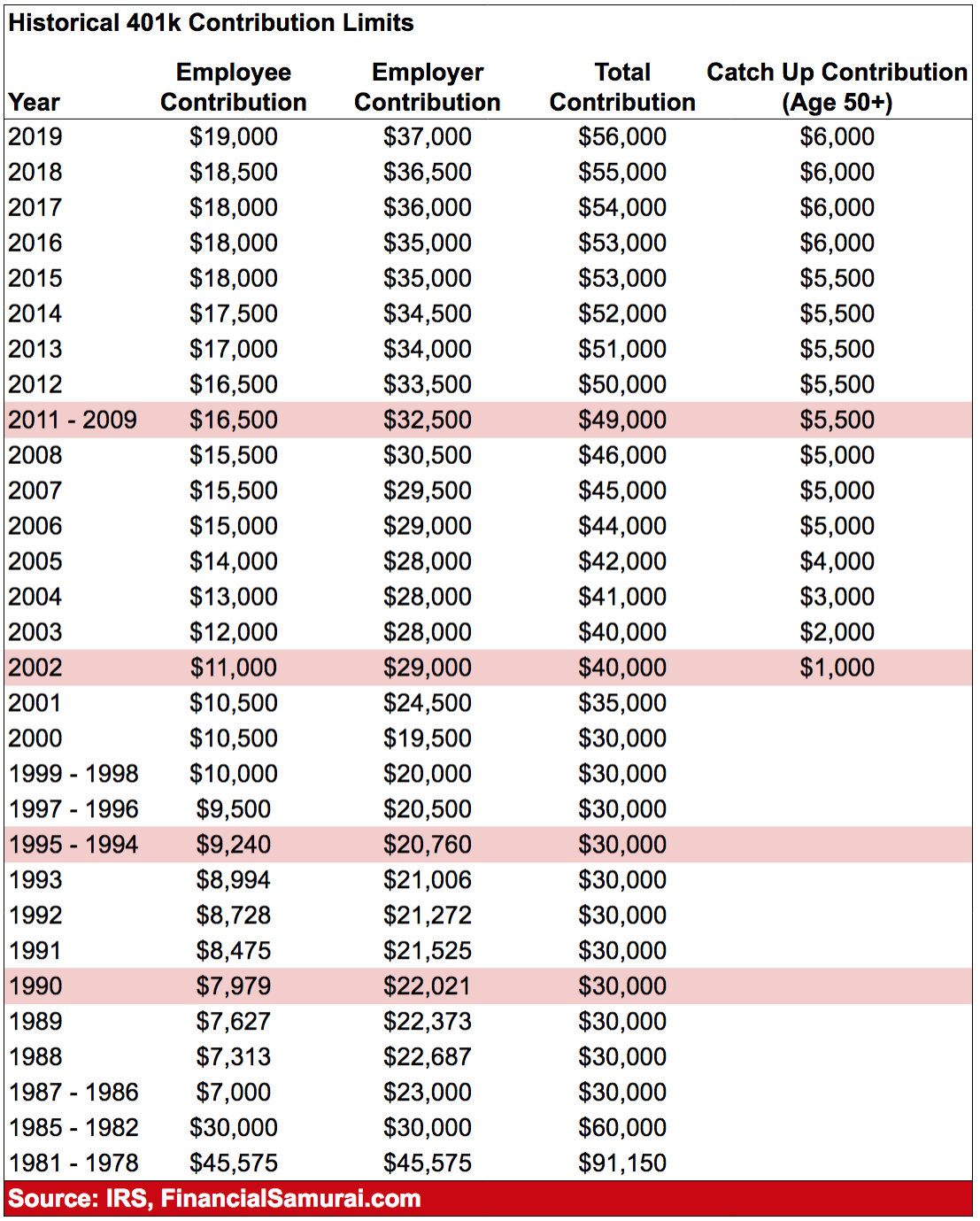

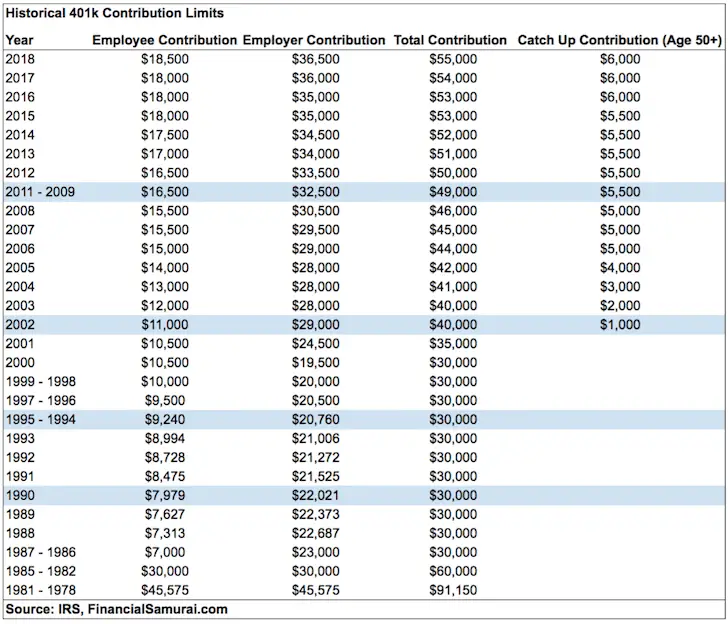

Luckily, late savers are generally in their peak earning years. And, from age 50, they have a greater opportunity to save. As noted above, the 2021-2022 limit on catch-up contributions is $6,500 for individuals who are age 50 or older on any day of that calendar year.

If you turn 50 on or before Dec. 31, 2021, for example, you can contribute an additional $6,500 above the $19,500 401 contribution limit for the year for a total of $26,000 including catch-ups.

“As far as an ‘ideal’ contribution is concerned, that depends on many variables,” says Dave Rowan, a financial advisor with Rowan Financial in Bethlehem, PA. Perhaps the biggest is your age. If you begin saving in your 20s, then 10% is generally sufficient to fund a decent retirement. However, if you’re in your 50s and just getting started, you’ll likely need to save more than that.”

The amount your employer matches does not count toward your annual maximum contribution.

How Often Should I Contribute To An Ira

Make it consistent. The other key is to make consistent contributions â even better to automate the process altogether . For one, this ensures youâre making saving a habit. But thereâs an additional benefit, known as dollar-cost-averaging.

It works like this: If you want to max out your IRA, you could invest $6,000 all at once, or you could invest $500 each month. Investing in increments is one way to dull the psychological impact of market volatility because you arenât watching a large sum of money potentially decline in value out of the gate. Dollar-cost averaging may also help you arrive at a better average price for your portfolio investments.

If you have the funds and can stomach a little volatility, a Northwestern Mutual analysis shows investing a lump sum all at once tends to outperform dollar-cost averaging over the long run. Regardless, itâs beneficial to develop a consistent investment strategy that works for you and makes it easier to participate in markets for the long term.

Read Also: What Age Can I Start Withdrawing From My 401k

How Much Does Bjc Match 401k

As of today, there is a maximum of one BJC matched per match. Contributions of 4% or higher pre-tax amount can be deducted by 75% of the employee. In this plan, you contribute to your retirement account at a rate after tax that works out to after-tax income. The Target Date funds, which automatically adjust your investments as you get older, are among the investments available.

What If You Can’t Meet Your Employer Match

If you aren’t yet in a position to contribute enough to meet your employer’s match, and thus not enough to reach the desired 15% savings rate, aim to boost your retirement contributions by 1% to 2% each year. If you opt in to do so, some companies will automatically raise your contribution rate annually, so it’s worth making sure you are signed up for what is called an “auto-escalation” feature.

Ivory Johnson, a CFP and founder of Delancey Wealth Management, recommends increasing your contribution rate as you get pay raises until you max out the limit. There is a limit to how much you can contribute annually to your 401. In 2021, the standard annual contribution limit is $19,500 for 401 plans. And those over age 50 can use catch-up contributions to add an extra $6,500 in their 401 account. Employer contributions don’t count towards those specific limits.

Lynch reminds retirement savers to be strategic with the magic number they would like to contribute to their 401 before automatically trying to max it out, however.

“Situations can arise where you may need to prioritize your cash savings in your emergency fund or save for a different reason, such as for a down payment on property or a vehicle,” she adds. “$19,500 isn’t a small chunk of change.”

Keep in mind that although you don’t pay income taxes on the money you set aside in a 401, you’ll have to pay taxes later on when you eventually withdraw the funds in your nonworking years.

Also Check: Who Can Open A Solo 401k

You Are Leaving The Wells Fargo Website

You are leaving wellsfargo.com and entering a website that Wells Fargo does not control. Wells Fargo has provided this link for your convenience, but does not endorse and is not responsible for the content, links, privacy policy, or security policy of this website.

Retirement may seem a long way off and far removed from your day-to-day concerns. And yet, this is actually the best time to start planning and saving that is, when you still have time to accumulate the money youll need.

Here are some common mistakes that throw people off course in their retirement planning. Knowing these pitfalls should help you steer clear and save more.

What Percentage Of Companies Match 401k Contributions

The 401 match for all employers fluctuated between 3% and close to 5% for the past decade, as confirmed by data from sources, such as the U.S. Labor Department. They are the Bureau of Labor Statistics and Fidelity International. In addition to 87% of employers setting aside retirement plan contributions according to Fidelitys 2020 Facts & Insights report.

Also Check: Can I Keep My 401k With My Old Employer

Dont Beat Yourself Up If You Cant Save That Much Money In Your 401 By 30

There are a couple of good reasons some twentysomethings dont start putting away for retirement immediately:

- Youre in grad school

- Youre battling big debts

If youre a student, its unlikely youll have extra money to tuck away for retirement. And thats okay, because your education will hopefully increase your lifelong earning potential.

If youve got high-interest credit card debt, your top priority should be to pay that down. Debt interest rates could crush even the best retirement account returns, so its best to use extra funds to dispatch credit card balances quickly.

The one exception? If your employer matches 401 contributions. In this case, contribute the maximum percentage your employer will match, then increase retirement savings after your debt is gone.

What Are Roth 401 Contribution Limits

For 2022, the 401 contribution limit is $20,500. This contribution limit applies to your 401 contributions, whether theyre in a Roth or traditional 401. That means if youre contributing to both, the combined total of your contributions cant exceed that amount.6 And in case you were wondering, your employers contributions do not count toward the limit.

If youre 50 or above, the contribution limit increases to $26,000.7

You May Like: How To See How Much Is In My 401k

Is 4 Percent 401k Match Good

The maximum possible match remains a median of 3 percent of pay.Most employers require workers to save between 4 and 6 percent of their pay to get the maximum possible match. Immediate eligibility to participate. Only about half of companies offer new employees immediate eligibility for the 401 plan.

What Is Employee Match 401k

Employer matching of your 401 contributions means that your employer contributes a certain amount to your retirement savings plan based on the amount of your annual contribution.Occasionally, employers may elect to match employee contributions up to a certain dollar amount, regardless of employee compensation.

Recommended Reading: How To Find Out 401k Balance

Think Of Medical Needs Later In Life

Annette Hammortree, CLTC, RICP, and Owner of Hammortree Financial Services

When taking a look at your employers retirement plan, I suggest that you start by contributing 15 percent of your income. The 401 specifically should be for at least the full matching contributions offered by your employer. The next step depends on your goals and objectives.

Once you have committed to matching the 401 contribution, the next step would be to utilize a Health Savings Account, since you can tap into this for medical needs during retirement, as well as starting a Roth IRA. The Roth is important since it provides another bucket to generate income during retirement. The power is in the rate of savings not the rate of return.

I also recommend taking a bucketing approach for different savings objectives, short , intermediate , long term and retirement.

How To Calculate Employer Match 401k

For example, your employer may pay $0.50 for every $1 you contribute up to 6% of your salary. So if you make $50,000 per year, 6% of your salary is $3,000. If you contribute that much to your 401, your employer contributes half the amount $1,500 of free money as a match.

Contents

Don’t Miss: Can I Roll My Roth 401k Into A Roth Ira

What Percent Of Your Salary Should Go Toward Retirement

How much money you need to live financially comfortable during retirement varies widely depending on the individual. There are plenty of proposals on how much retirement savings you should have. Meanwhile, many of the free online calculators will show little agreement with one another. And while its difficult to forecast exactly what youll need during retirement there are benchmarks to aim for.

The ideal savings rate varies by expert or study because making plans for the future depends on many unknown variables, such as not knowing how long youll be working, how well your investments will do, or how long you will live, among other factors.

Could You Increase Your 401 Contribution

How often you can adjust your 401 or 403 contribution is generally determined by your employer and your retirement planit may be once a year or as often as youd like.

If youre able, reducing non-essentials or allocating new income could allow you to bump up the amount youre saving.

A 1% increase only makes a small difference in your paycheckbut may make a big difference down the road. Consider the example below for a $35,000 annual income:1

| Additional contribution |

|---|

1 This example is for illustrative purposes only. It assumes $35,000 in annual income, 3.5% annual wage growth, 30 years to retirement, 7% annual rate of return and a 25% tax bracket. Estimated monthly retirement income calculations assume a 4.5% annual withdrawal in retirement. The assumed rate of return is hypothetical and does not guarantee any future returns nor represent the return of any particular investment option. Reduced take-home pay is accurate for the initial year and would change based on participants annual pay. Estimated savings amounts shown do not reflect the impact of taxes on pre-tax distributions. Individual taxpayer circumstances may vary.

2 Contributions are limited to the lesser of the annual plan or the IRS limit as indexed annually.

3 Some plans may not allow catch-up contributions to the plan.

This document is intended to be educational in nature and is not intended to be taken as a recommendation.

Also Check: Can You Contribute To 401k After Leaving Job

Take Advantage Of Employer Matching

At a minimum, you should contribute enough to your 401 that you’re taking full advantage of your employer’s matching program.

For example, if your employer is willing to match all of your contributions up to 4% of your salary, then you should do everything you can to contribute at least that amount. Not doing so is the same thing as agreeing to a salary reduction you’re simply refusing part of the compensation you’re entitled to.

An important factor to consider is that many employers dole out the 401 match based on your contribution for each pay period. So if you temporarily halt contributions to your 401 for a few months to handle an emergency, you might not be able to get those salary matches back by contributing extra in the last few pay periods.

Likewise, if you defer a big chunk of your paycheck early in the year and max out the contribution limit, you might forgo matching contributions later in the year. Talk to your HR department to see what the policy is.

Employer matching is the way many people turn relatively small amounts of their salary into a large retirement nest egg. Let’s say you make $60,000 and your employer matches up to 4% of your salary. That means you’re contributing $2,400, but $4,800 is going into your account.

Over a 35-year career, assuming 2% annual salary increases, you could end up with a 401 balance of $900,000, assuming 7% average annual returns . With good market performance, you could even get to $1 million or more.