With No Requirement To Withdraw Funds This Can Act As Your Longevity Insurance

One of the unique benefits of a Roth IRA is what it doesnt have: a requirement to begin taking money out at a certain age. With other tax-deferred options like a traditional IRA or a 401, account holders must begin taking money out by age 72.

Think about your family history. Is one of your grandparents still alive at age 90? While the average American has a life expectancy of approximately 77 years today, keep in mind that advances in medicine can increase that typical time frame. A Roth IRA gives you a pool of money that you can hold off on dipping into until you think the time is right. No matter what age you are now, the much older version of yourself will be thankful for those maximum contributions.

Can I Contribute To A Traditional Or Roth Ira If I’m Covered By A Retirement Plan At Work

Yes, you can contribute to a traditional and/or Roth IRA even if you participate in an employer-sponsored retirement plan . See the discussion of IRA Contribution Limits. If you or your spouse is covered by an employer-sponsored retirement plan and your income exceeds certain levels, you may not be able to deduct your entire contribution. See the discussion of IRA deduction limits.

Which Account Is Better

Neither type of account is better than the other. Instead, a 401 and an IRA present you with two different investment options with their own benefits and drawbacks. Your financial goals, your income and the quality of investments offered by either account will influence which account you prioritize and how much you contribute to each.

Recommended Reading: How To Buy Individual Stocks In 401k

What Is The 401 Maximum

The maximum anyone can contribute to a 401 account for 2020 is $19,500 for most savers. This limit applies to 401 plans and similar 403 and 457 plans. Those 50 and older can save an additional $6,500 per year, which is called a catch up contribution.

For investors under 30, the $19,500 maximum means you can save an average of $1,625 per month. If you are able to save and invest that much, youre well ahead of the typical American in saving for retirement.

401 accounts are great for pre-tax contributions. This means you dont pay any income taxes the year of your contribution. Instead, you pay taxes on withdrawals in the future, presumably at a lower tax rate than you pay today.

However, 401 plan accounts are notorious for high fees and few investment options. If you have old 401 accounts with past employers, its often a wise idea to roll over your balance to a Rollover IRA. But as long as you have the job, contributing to a 401 is still usually a good idea even with the typical fees.

What Is The Biggest Advantage Of A Roth Ira

Roth IRAs offer several key benefits, including tax-free growth, tax-free withdrawals in retirement, and no minimum distribution required, but they also have their drawbacks. One major drawback: Roth IRA contributions are made on an after-tax basis, meaning there is no tax deduction in the year of contribution.

Are there any tax advantages to a Roth IRA?

There are many advantages to keeping your money in a Roth IRA. Roth IRAs offer tax-free growth on both contributions and income earned over the years. If you play by the rules, you will not pay taxes when you take the money.

What is the main advantage of a Roth IRA?

A Roth IRA is a retirement savings account that allows your money to grow tax-free. You fund Roth with after-tax dollars, meaning youve paid taxes on the money you put in. In return for no upfront tax deductions, your money grows and grows tax free, and when you withdraw in retirement, you pay no taxes.

Also Check: How To Lower 401k Contribution Fidelity

What Should You Do After Maxing Out Roth Ira

- If youve exhausted your Roth IRA contributions, you can still save for retirement through 401s, SEP, SIMPLE IRAs, or health savings accountsas long as youre eligible.

- Even before you deposit money into a Roth IRA, be sure youve fully loaded your 401 to receive the maximum workplace match.

- Investment-only annuities are free of the exorbitant fees associated with traditional annuities.

Tips For A Financially Successful Retirement

- Managing your investments and retirement accounts isnt easy. Circumstances may even require you to change your current strategy. If you need help, a financial advisor can guide you through the financial field and introduce you to new savings tactics. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- Each state follows unique retirement tax laws. Keeping them in mind during your retirement planning process is vital for any worker. Educate yourself to maximize your savings value and reduce your overall tax burden.

Read Also: Who Can Open A Solo 401k

Your Employer Doesnt Offer A 401 Or Youre Self

Employer-sponsored 401 plans are called the backbone of retirement savings for two reasons:

But what if you dont have access to a 401 through your employer? In that case, your next best option is likely a tax-advantaged IRA. In 2022, you can contribute up to $6,000 to a traditional IRA .

If youre self-employed, you can also consider another type of IRA, called a Simplified Employee Pension or SEP IRA. These plans allow small business owners to set aside much more for retirement than a regular traditional IRA will allow.

Whether youre saving in a regular traditional IRA, a Roth IRA, or a SEP IRA, the tax savings can put you miles ahead of where you would be if you only put money in a taxable account, says Hayden Adams, CPA, CFP® and director of tax and financial planning at the Schwab Center for Financial Research.

Tax On Excess Ira Contributions

An excess IRA contribution occurs if you:

- Contribute more than the contribution limit.

- Make a regular IRA contribution for 2019, or earlier, to a traditional IRA at age 70½ or older.

- Make an improper rollover contribution to an IRA.

Excess contributions are taxed at 6% per year for each year the excess amounts remain in the IRA. The tax can’t be more than 6% of the combined value of all your IRAs as of the end of the tax year.

To avoid the 6% tax on excess contributions, you must withdraw:

- the excess contributions from your IRA by the due date of your individual income tax return and

- any income earned on the excess contribution.

See Publication 590-A for certain conditions that may allow you to avoid including withdrawals of excess contributions in your gross income.

You May Like: Can I Transfer 401k To Ira

How Much Will I Save If I Max Out My 401k

- If a 25-year-old invests $19,500 per year, their account will increase to $4.48 million by the time they reach 70.

- If a 30-year-old invests $19,500 per year, their account will increase to $3.24 million by the time they reach 70.

- If a 35-year-old invests $19,500 per year, their account will increase to $2.32 million by the time they reach 70.

- If a 40-year-old invests $19,500 per year, their account will increase to $1.63 million by the time they reach 70.

- If a 45-year-old invests $19,500 per year, their account will increase to $1.13 million by the time they reach 70.

Because of the power of compound interest, time is on your side when youre young, as the data illustrate. The sooner you start investing your money, the less youll have to save each month to meet your retirement target of $1 million, for example.

Youd have to save roughly $1,625 every month, or nearly $750 per paycheck if you get paid every other week, to max out your 401 in 2020. . Calculate what proportion of your salary this translates to and begin contributing that amount.

Thats a significant amount of money to save, and it may not be feasible for everyone. If youre only comfortable putting aside 1% of your income, its preferable to start small and progressively raise your contributions rather than not begin at all. Auto-increase, a useful option provided by your firm, allows you to set the percentage increase.

What Does It Mean To Max Out 401

Before we answer the main question, lets discuss what maxing out a 401 means. The IRS imposes limits on what employees can defer out of their paycheck into a 401 account. The employer may also match, or do a flat-contribution, into the 401 account. The maximum amount the employee is allowed to defer in 2022 is $20,500 for people under age 50 and $27,000 for those age 50 and older. Employer contributions into the employee 401 do not count against this limit. There is an overall 401 limit of $61,000 into a 401 for 2022, so if your employer happens to put a huge contribution into your 401, that may limit your ability to max out at $20,500, but the majority of employers wont be putting that major of a contribution, so we will use $20,500 as the maximum in this blog.

As we have discussed in other blogs, many employers are allowing employees to have access to a Roth 401 and a traditional 401, meaning you can choose which tax treatment you want for your money. You may be able to choose both types of tax treatment for your 401 contribution, but the $20,500 for under age 50 is for all employee contributions combined. So you could put some money into the traditional 401 and some into Roth, as long as the combined total doesnt exceed the IRS maximum of $20,500 . Remember, all employer contributions are traditional.

So with that background, lets talk about the main question: should you max out that $20,500 employee contribution? To answer that, I will ask you some questions.

Also Check: Can You Open A Personal 401k

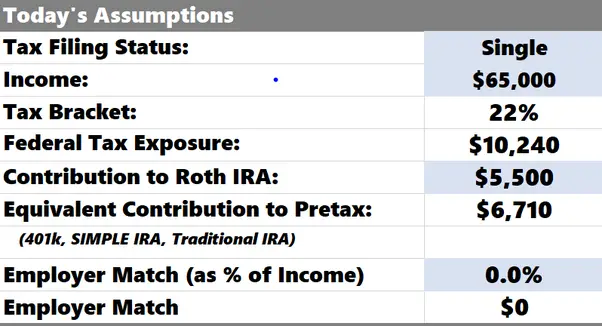

Can You Max Out Both 401k And Ira

The contribution limits for 401 plans and IRA contributions do not overlap. As a result, as long as you match the varied eligibility conditions, you can contribute fully to both types of plans in the same year. For example, if youre 50 or older, you can put up to $23,000 in your 401 and $6,500 in your IRA in 2013. The restrictions are lower if you are under 50: $17,500 for 401 plans and $5,500 for IRAs. If you have numerous 401s, however, the cap is cumulative for all of them. The same is true of IRAs. You wont be able to contribute to your conventional IRA if you use your whole contribution limit in your Roth IRA.

Can I Contribute $5000 To Both A Roth And Traditional Ira

You can contribute to both a regular and a Roth IRA as long as your total contribution does not exceed the IRS restrictions for any given year and you meet certain additional qualifying criteria.

For both 2021 and 2022, the IRS limit is $6,000 for both regular and Roth IRAs combined. A catch-up clause permits you to put in an additional $1,000 if youre 50 or older, for a total of $7,000.

You May Like: How Do I Cash Out My Fidelity 401k

Is 45 Too Late To Start Saving For Retirement

Okay, now you understand what we mean when we say its not too late. Assume youre 40 years old, earn $55,000 per year, and have no retirement savings. We recommend putting aside 15% of your gross salary for retirement, which translates to $688 per month in your 401 and IRA. If you did that for 25 years, you may be worth $1 million by the time youre 65. Youd be a millionaire, thats right!

Put Money Into Taxable Investments

Lots of people think that they cant invest in mutual funds if they participate in their companys retirement plan. Thats not true. You can open a taxable account with an investment management company or brokerage firm. Youre investing after tax dollars, so youre not getting any sort of break with the IRS. Thats why its not the first and best option. But its better than putting your money under the mattress!

What are the advantages of taxable investments? Good question. Heres the answer:

The disadvantage of a taxable account is, well, the taxes. Youll pay the IRS on the growth of those investments, because the government is, well, the government. Uncle Sam wants his share.

In addition to investing in the stock market, some people choose to invest in real estate. This is an option, but only if you have cash to pay for it. Dont ever go into debt to invest! Also, make sure you have an emergency fund specifically for your real estate so you can cash flow any taxes, repairs or other emergencies.

Read Also: Can I Have 2 401k Plans

The Benefits Of Having A 401k And An Ira

Your 401k can serve as the backbone of your retirement plan. After all, its easy to save because your contributions are automatically taken out of your paycheck and your employer hopefully matches some or all of your contributions. However, having just a 401k might not be enough to help you reach your retirement goals.

Thats where having an IRA to contribute to in addition to your 401k comes in with an assist. An IRA gives you another way to save, plus it provides you with more investment choices. The two combined make your retirement plan that much stronger.

How Do I Invest After Maxing Out Retirement Accounts

Yes, even if you have a 401 plan at work, you may be allowed to contribute to a regular or Roth IRA . You can put aside $6,000 every year . If you choose a traditional IRA, you may be able to deduct the entire amount of your contributions if you or your spouse worked for a company that offered a retirement plan. If thats the case, and you still want to contribute to an IRA, a Roth IRA is a better option.

Don’t Miss: How To Do 401k Rollover

What If You Contribute Too Much

If you discover that you contributed more to your IRA than you’re allowed, you’ll want to withdraw the amount of your overcontributionand fast. Failure to do so in a timely way could leave you liable for a 6% excise tax every year on the amount that exceeds the limit.

The penalty is waived if you withdraw the money before you file your taxes for the year in which the contribution was made. You also need to calculate what your excess contributions earned while they were in the IRA and withdraw that amount from the account, as well.

The investment gain must also be included in your gross income for the year and taxed accordingly. What’s more, if you are under 59½, you’ll owe a 10% early withdrawal penalty on that amount.

What Is A Recharacterization Of A Contribution To A Traditional Or Roth Ira

A recharacterization allows you to treat a regular contribution made to a Roth IRA or to a traditional IRA as having been made to the other type of IRA. A regular contribution is the annual contribution you’re allowed to make to a traditional or Roth IRA: up to $6,000 for 2020-2021, $7,000 if you’re 50 or older . It does not include a conversion or any other rollover.

Recommended Reading: Can I Transfer Roth 401k To Roth Ira

How Do I Recharacterize A Regular Ira Contribution

To recharacterize a regular IRA contribution, you tell the trustee of the financial institution holding your IRA to transfer the amount of the contribution plus earnings to a different type of IRA in a trustee-to-trustee transfer or to a different type of IRA with the same trustee. If this is done by the due date for filing your tax return , you can treat the contribution as made to the second IRA for that year .

Open A Health Savings Account

An HSA is a type of savings account that works with your health insurance. It allows you to save money for medical, dental, and vision expenses tax-free.

You can open an HSA if you have whatâs called a high deductible health plan . An HDHP has a deductible of whatâs called a minimum annual value .

The MAV is what you have to pay out-of-pocket for your health care each year before your insurance kicks in. In other words, itâs what you have to pay before the HDHP coverage comes into play.

You can save money tax-free. You donât have to worry about the IRS taking what youâve saved if something happens whatâs in your account is yours for good.

Recommended Reading: Can You Withdraw Your 401k When You Leave A Company