Leave The Money Where It Is

Assuming your current employer allows it not all do you may decide to leave your 401 right where it is.

If the plan has top-notch, low-cost investment options, this might not be a bad choice.

Know that when leaving money behind in a 401, there may be restrictions on whether you can take a loan against that account or on the size of any pre-retirement withdrawals you might make so check the rules of the plan before making your final decision.

The decision to stay with your current plan, however, might not be yours to make if your balance is below $5,000. A majority of workplace plans will require that you transfer the balance elsewhere or cash it out, according to the most recent survey of workplace retirement plans by the Plan Sponsor Council of America.

If your balance is over $5,000 but your current plan doesn’t have great, low-cost investments, you might be better off transferring the money to another tax-advantaged retirement account .

The same is true if you already have several other existing retirement accounts at old employers.

“A really bad outcome is to have lots of little accounts scattered around. It’s easy to forget about them. It doesn’t let you appreciate how much you’ve really saved. And the odds of screwing something up gets higher,” said Anne Lester, the former head of retirement solutions at JP Morgan Asset Management who founded the Aspen Leadership Forum on Retirement Savings in partnership with AARP.

Roll It Over To Your New Employer

If youve switched jobs, see if your new employer offers a 401, when you are eligible to participate, and if it allows rollovers. Many employers require new employees to put in a certain number of days of service before they can enroll in a retirement savings plan. Make sure that your new 401 account is active and ready to receive contributions before you roll over your old account.

Once you are enrolled in a plan with your new employer, its simple to roll over your old 401. You can elect to have the administrator of the old plan deposit the balance of your account directly into the new plan by simply filling out some paperwork. This is called a direct transfer, made from custodian to custodian, and it saves you any risk of owing taxes or missing a deadline.

Alternatively, you can elect to have the balance of your old account distributed to you in the form of a check, which is called an indirect rollover. You must deposit the funds into your new 401 within 60 days to avoid paying income tax on the entire balance and an additional 10% penalty for early withdrawal if youre younger than age 59½. A major drawback of an indirect rollover is that your old employer is required to withhold 20% of it for federal income tax purposesand possibly state taxes as well.

Cashing Out A : What A 401 Early Withdrawal Really Costs

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

Contributing to a 401 can be a Hotel California kind of experience: Its easy to get your money in, but its hard to get your money out. That is, unless youre at least 59½ years old thats when the door swings wide open for a 401 withdrawal. But try cashing out a 401 with an early withdrawal before that magical age and you could pay a steep price if you dont proceed with caution.

You May Like: How To Find Old 401k Plans

How To Cash Out A 401 From A Former Employer

Cashing out a 401k from a former employer is not a difficult task. In most cases, you contact the plan administrator for the appropriate paper work, fill it out, send it to the financial institution that manages the 401k, and wait for the check to come in the mail or for the electronic transfer.

Tips

-

In order to cash out a 401 from a former employer, you will likely have to contact the plan administrator at your former place of employment and request access to the paperwork needed to withdraw your funds.

You May Like: Can You Roll A Traditional 401k Into A Roth Ira

Disadvantages Of Closing Your 401k

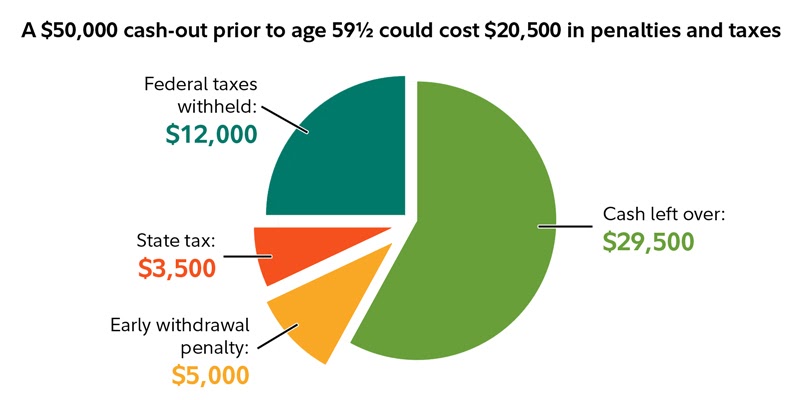

Whether you should cash out your 401k before turning 59 ½ is another story. The biggest disadvantage is the penalty the IRS applies on early withdrawals.

First, you must pay an immediate 10% penalty on the amount withdrawn. Later, you must include the amount withdrawn as income when you file taxes. Even further down the road, there is severe damage on the long-term earning potential of your 401k account.

So, lets say at age 40, you have $50,000 in your 401k and decide you want to cash out $25,000 of it. For starters, the 10% early withdrawal penalty of $2,500 means you only get $22,500.

Later, the $25,000 is added to your taxable income for that year. If you were single and making $75,000, you would be in the 22% tax bracket. Add $25,000 to that and now youre being taxed on $100,000 income, which means youre in the 24% tax bracket. That means youre paying an extra $6,000 in taxes.

So, youre net for early withdrawal is just $16,500. In other words, it cost you $8,500 to withdraw $25,000.

Beyond that, you reduced the earning potential of your 401k account by $25,000. Measured over 25 years, the cost to your bottom line would be around $100,000. That is an even bigger disadvantage.

Read Also: Where To Put My 401k

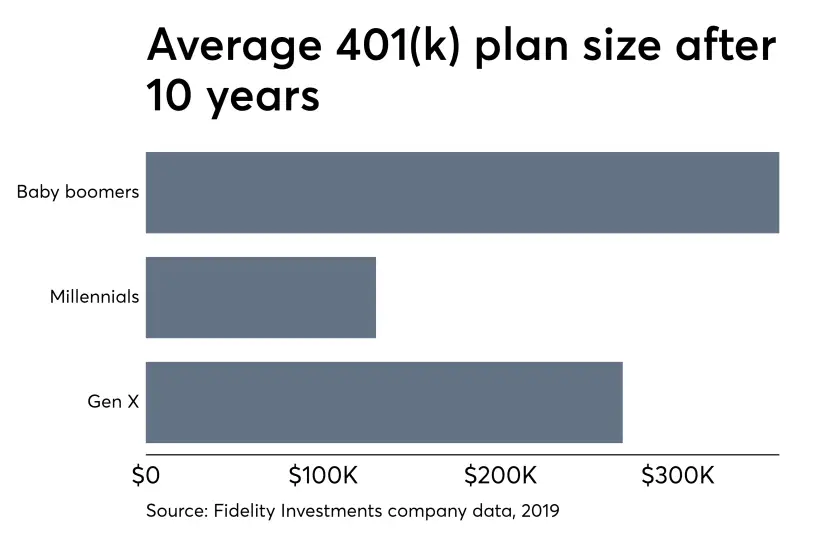

Fidelity Funds Are Renowned For Their Managers Stock

Fidelity celebrates good stock picking. The firm holds a contest every year for its portfolio managers: They get 60 seconds to pitch one idea, and the best pitch wins a dinner for four. The best performer after 12 months also wins dinner.

Maybe thats why many of the best Fidelity funds stand up so well in our annual review of the most widely held 401 funds.

Here, we zero in on Fidelity products that rank among the 100 most popular funds held in 401 plans, and rate the actively managed funds Buy, Hold or Sell. A total of 22 Fidelity funds made the list, but seven are index funds, which we dont examine closely because the decision to buy shares in one generally hinges on whether you seek exposure to a certain part of the market.

Actively managed funds are different, however. Thats why we look at the seven actively managed Fidelity funds in the top-100 401 list. We also review seven Fidelity Freedom target-date funds as a group as they all rank among the most popular 401 funds. And we took a look at Fidelity Freedom Index 2030 it has landed on the top-100 roster for the first time, and while its index-based, active decisions are made on asset allocation.

This story is meant to help savers make good choices among the funds available in their 401 plan. It is written with that perspective in mind. Look for our reviews of other big fund firms in the 401 world, which currently include Vanguard, and will soon include American Funds and T. Rowe Price.

What Happens To My Tiaa

If you die before your retirement income begins, the current full value of your account balances in all investment funds will be payable to your beneficiary under any of the payment options elected by the beneficiary and allowed by the record keeper (subject to the federal income tax laws described in more detail below

You May Like: Should I Do A Roth Ira Or 401k

Changing Employers And A 401 K

A change of company might mean you change your 401 k too. Try to find out how long that company can hold your 401k after you leave. We encourage you to discuss this matter with your new employer. It’s important that you take your old 401 k into consideration when you look for a new place of work. You may also want to choose your new employer based on the kind of retirement plan is on offer.

You Have Options But Some May Be Better Than Others

After you leave your job, there are several options for your 401. You may be able to leave your account where it is. Alternatively, you may roll over the money from the old 401 into either your new employers plan or an individual retirement account . You can also take out some or all of the money, but there can be serious tax consequences.

Make sure to understand the particulars of the options available to you before deciding which route to take.

Read Also: How To Start Withdrawing From 401k

Periodic Distributions From 401

Instead of cashing out the entire 401, you may choose to receive regular distributions of income from your 401. Usually, you can choose to receive monthly or quarterly distributions, especially if inflation increases your living expenses. If the 401 is your main source of income, you should budget properly so that the distributions are enough to meet your expenses.

For example, if you have accumulated $1 million in retirement savings, you can choose to receive $3,330 every month, which amounts to approximately $40,000 annually. You can adjust the amount once a year or every few months if your 401 plan allows it. This option allows the remaining savings to continue growing over time as you take periodic distributions.

Making A Fidelity 401k Withdrawal

Your 401k is your money, and making a withdrawal is as simple as contacting Fidelity to let them know you want it. The easiest way is to simply visit Fidelitys website and request a check there. However, you can also reach out via phone if you prefer: Call 800-343-3543 with any questions about the process.

From there, you can download the appropriate withdrawal request form and then mail it to the address listed on the form. Fidelity will have your check for you in five to seven business days after receiving your request. There are no fees for requesting a check, but if you liquidate any holdings, there could be commissions or mutual fund fees associated with that.

Borrowing From Your 401k: What You Need to Know

Don’t Miss: How To Calculate Your 401k Contribution

Why Does Slavic401k Reimburse All Revenue Paid By The Funds

Also Check: How To Open A Solo 401k

What Is A 401 K

If you’re a member of the US workforce, you probably have a rough idea of what a 401 k account is. Many employers offers a 401 k. A 401 k is an account that part of your pay/income goes towards. A financial institution uses this money to invest. Once the investment is profitable, you get a share of the returns.

An 401 k account is subject to different taxes than a regular savings account. You can keep the money in such an account for years without paying taxes on it. The amount of time that the funds sit in your account isn’t important, though. It’s actually expected that the funds stay in your 401 k account until you reach retirement age.

Read Also: How To Pull Money Out Of My 401k

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

Early Money: Take Advantage Of The Age 55 Rule

If you retireor lose your jobwhen you are age 55 but not yet 59½, you can avoid the 10% early withdrawal penalty for taking money out of your 401. However, this only applies to the 401 from the employer you just left. Money that is still in an earlier employers plan is not eligible for this exceptionnor is money in an individual retirement account .

If your account is between $1,000 and $5,000, your company is required to roll the funds into an IRA if it forces you out of the plan.

Don’t Miss: Can I Convert My 401k To A Roth Ira

What Are The Pros And Cons Of Withdrawal Vs A 401 Loan

A withdrawal is a permanent hit to your retirement savings. By pulling out money early, youll miss out on the long-term growth that a larger sum of money in your 401 would have yielded.

Though you wont have to pay the money back, you will have to pay the income taxes due, along with a 10% penalty if the money does not meet the IRS rules for a hardship or an exception.

A loan against your 401 has to be paid back. If it is paid back in a timely manner, you at least wont lose much of that long-term growth in your retirement account.

Financial Hardship Withdrawal Process

- If you are married, your spouse must sign in the presence of a notary public.

- Mail completed forms and copies of your supporting documentation directly to Fidelity at the address on the form. Do not mail your Fidelity forms to Vanderbilt Human Resources.

Note: The Office of Benefits Administration no longer handles hardship distribution or loan request forms. Mail these forms directly to Fidelity to the address on the form.

Don’t Miss: How To Save For Retirement Without A 401k

Early Withdrawals: The 401 Age 55 Rule

If you retireor lose your jobwhen you are age 55 but not yet 59½, you can avoid the 10% early withdrawal penalty for taking money out of your 401. However, this only applies to the 401 from the employer that you just left. Money that is still in an earlier employers plan is not eligible for this exceptionnor is money in an IRA.

Nashville: How Do I Invest for Retirement?

More People Than Ever Are Investing 401 Savings In Bitcoin

Here are seven reasons why.

Before you can take advantage of these rollover benefits, there are specific details you need to know, and three steps you must take.

Dont Miss: Can You Use 401k To Buy Investment Property

Also Check: How Does 401k Retirement Work

How Much Money Can I Put Into My 401 Account

The maximum pre-tax contribution dollar amount is set by law and adjusted for inflation annually. The current pre-tax contribution limit is $18,000. If you are age 50 or older you may also make an additional catch-up contribution of $6,000 per year. In addition, there are special non-discrimination rules that apply to the plan. If you earn more than $120,000 a year, or own more than 5 percent of the company, contribution caps may apply for you.

The Hardship Withdrawal Option

A hardship withdrawal can be taken without a penalty. For example, taking out money to help with economic hardship, pay college tuition, or fund a down payment for a first home are all withdrawals that are not subject to penalties, though you still will have to pay income tax at your regular tax rate. You may also withdraw up to $5,000 without penalty to deal with a birth or adoption under the terms of the SECURE Act of 2019.

A hardship withdrawal from a participants elective deferral account can only be made if the distribution meets two conditions.

- Its due to an immediate and heavy financial need.

- Its limited to the amount necessary to satisfy that financial need.

In some cases, if you left your employer in or after the year in which you turned 55, you may not be subject to the 10% early withdrawal penalty.

Once you have determined your eligibility and the type of withdrawal, you will need to fill out the necessary paperwork and provide the requested documents. The paperwork and documents will vary depending on your employer and the reason for the withdrawal, but once all the paperwork has been submitted, you will receive a check for the requested fundsone hopes without having to pay the 10% penalty.

Also Check: Is Fidelity Good For 401k