Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Recently enacted legislation made a number of changes to the rules regarding defined contribution, defined benefit, and/or individual retirement plans and 529 plans. Information herein may refer to or be based on certain rules in effect prior to this legislation and current rules may differ. As always, before making any decisions about your retirement planning or withdrawals, you should consult with your personal tax advisor.

The change in the RMD age requirement from 70½ to 72 only applies to individuals who turn 70½ on or after January 1, 2020. Please speak with your tax advisor regarding the impact of this change on future RMDs.

A qualified distribution from a Roth IRA is tax-free and penalty-free, provided the 5-year aging requirement has been satisfied and one of the following conditions is met: age 59½ or older, disability, qualified first-time home purchase, or death.

Be sure to consider all your available options and the applicable fees and features of each before moving your retirement assets.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Is There A Service Out There Than Can Handle This Process For Me

Yes thats where Capitalize comes in!

Weve made it our mission to make this process easier for everyone. If you choose to do a 401-to-IRA rollover, we can handle the entire process for you. Most of the process can be done online and our rollover experts will guide you through any of the manual parts.

Its 100% free to you .

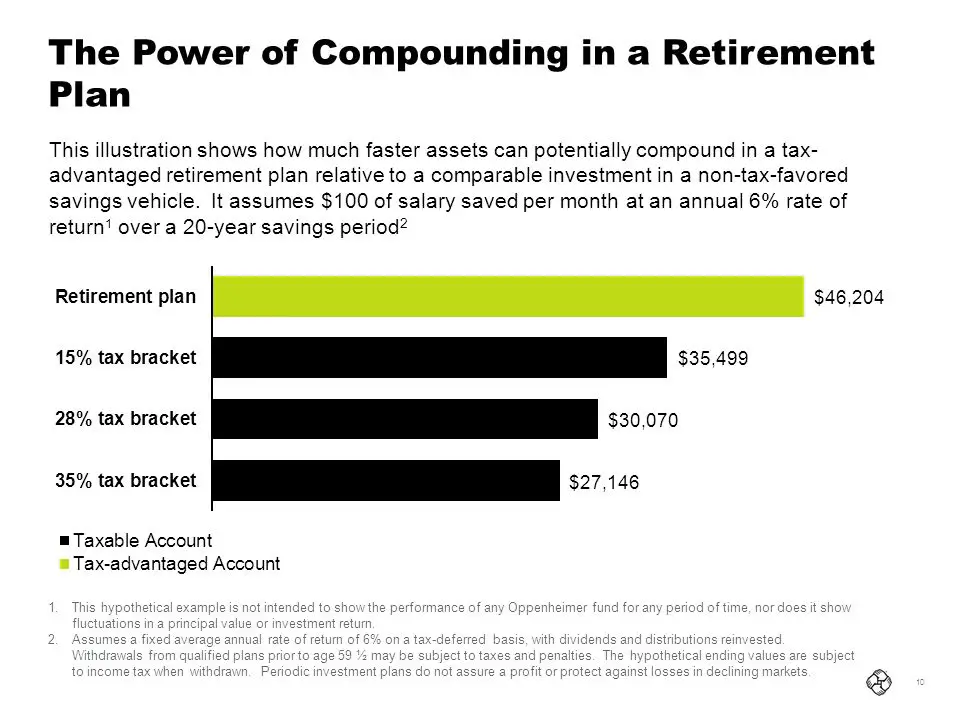

Compound Interest Only Works If You Leave The Money Alone

We talk a lot at Money Under 30 about compound interest. Its what makes a comfortable retirement possible for most of us. When you cash out your 401 early, youre not just subtracting that balance from your eventual retirement fund. Rather, youre deducting your balance, plus any interest your balance will earn over the next few decades, plus the interest the interest would earn! Taking a few hundred bucks now could cost you thousands down the road. Not to mention that you immediately lose almost 30% of your balance to taxes and fees.

It might feel like a small windfall now, but over the long term, youre taking yourself to the cleaners.

Most retirement funds are set up to allow your money to grow with few interruptions: Hence why the money you put into a 401 isnt taxed, why the interest you earn while your money is in the 401 isnt taxed, and why its relatively hard to remove money from your account until youre close to retirement age.

While we know its tempting to take that small pot of cash, we urge you to resist. And once youve gotten a new job, you should roll your old 401 into your new employers plan. Thatll take away the temptation entirely.

Read Also: Can I Roll A 401k Into An Existing Ira

Roll Over The Money To An Ira

You can roll over the funds to an IRA with a bank or brokerage firm. This IRA can be used every time you need to roll over a 401 without having to open a new account each time. The money will continue growing tax deferred and will be available for you in retirement. Some 401s allow for a post-tax Roth contribution. If your former contributions were going into the Roth, you can roll the money into a Roth IRA.

IRAs offer you more investment choices than 401s as you can invest in anything from stocks, bonds, mutual funds and more. There are many online platforms that enable investors to buy and sell investments on their own. But if this sounds like it is outside your comfort level, you can find a financial adviser who will help you manage your investments while planning for retirement.

You Have Less Than $1000 In Your 401

If you have less than $1000 in your 401, you may request to get a lump sum payment via check. Still, if you leave the funds behind without giving any instructions to the employer, the plan administrator may force cash-out in order to close the account.

Usually, active 401 accounts incur costs to maintain, and your employer may be unwilling to bear the cost since you will no longer contribute to the plan. The employer will send you a check within 3 to 10 days of leaving the job. Once the payment is made, you have 60 days to deposit the funds into an IRA to avoid paying taxes. If you donât deposit the funds into an IRA, the payment will be considered an early withdrawal and you will pay an income tax and early withdrawal penalty.

Read Also: Can I Move Money From 401k To Roth Ira

Do You Get Your 401 If You Quit

Be aware of the following rules regarding your old 401 account:

-

If your 401 has a total investment of more than $5,000, your employer may allow you to leave the account with them even after you quit the job.

-

If your account has a balance of less than $1,000, your employer may force you out and pay the amount left in your account with a check.

-

If the total investment amount in your old 401 is between $1,000 and $5,000 and your employer wants to force you out, they must transfer the amount to your IRA.

How Long Do I Have To Deposit The Check

You should deposit the check you get right away. Even if the check is made out to your IRA provider , you should try to do it within 60 days of receiving it.

Get a prepaid envelope sent directly to your door with a tracking number! Start a rollover with Capitalize and well send you a prepaid priority mail envelope with detailed instructions to make sure your rollover is transferred successfully. Get started

Don’t Miss: How To Search For Unclaimed 401k

Alternatives To Cashing Out

If you want to make a more conservative decision, you can leave your money in your 401 k when you change to a different company or employer. Cashing out your 401 k isn’t a requirement, after all. If you’re happy with your old employer’s 401 k, we recommend that you leave the money where it is. You can withdraw it once you retire. This is also a great way to avoid paying excessive income tax.

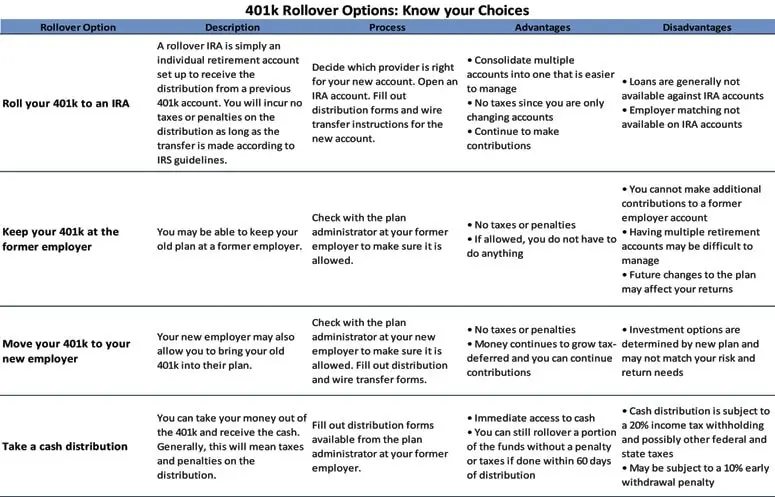

You can also stretch out the time that you withdraw money from your 401 k. The funds don’t have to come out in a lump payment. A plan participant leaving an employer typically has four options , each choice offering advantages and disadvantages. You can leave the money in the former employers plan, if permitted Roll over the assets to your new employer plan if one is available and rollovers are permitted Roll over the funds to an IRA or cash out the account value. The more time between your payments, the easier it is to avoid paying extra tax on the money. This is because funds from your 401 k are considered part of your taxable estate.

Balance Less Than $1000

If you have less than $1,000 in your 401, your employer could give you a lump-sum check for the amount.

If you didnât intend to receive your funds in this manner, youâll have 60 days from the date you terminated your 401 to roll the funds over to your current 401 or an IRA. Otherwise, the IRS will hit you with a 10% early withdrawal penalty tax for the amount.

Read Also: How To Check 401k Balance Adp

Plan Your Retirement With Your 401 K

If you havent already, its crucial that you start to plan your retirement as soon as possible. Financial security is a vital part of having a healthy and happy retirement. The aim of having a 401 k in the first place is that it gives you freedom from work and acts as a nest egg. You might be working hard now, but you want to be able to truly enjoy your golden years. Having the proper retirement plans in place is the easiest way to ensure this. If you start planning to retire well before the time comes, you should be in a very strong position financially.

Take the time to come up with plans for your retirement while you still have a job. These plans dont have to be concrete. All you have to do is get an idea of how your retirement may look financially. Then you can plan distributions from your 401 k, as well as any investments you may want to investigate.

Read Also: How To Transfer 401k From Fidelity To Vanguard

Search Form 5500 Directory

All employers that provide 401 plans to their employees are required to fill out a 5500 form every year with the DOL. Websites like FreeERISA* allow users to search by company name to locate the correct Form 5500. Another option is to search the DOLs 5500 database. Both simple searches will provide you with additional contact information.

For further assistance in finding lost 401 plans, the U.S. Department of Labor has an Abandoned Plan Search, which helps participants and others find out whether a particular plan is in the process of beingor already has beenterminated. The name of the Qualified Termination Administrator responsible for the termination will be listed as well, giving you a good idea of who to contact .

But beware: some companies, even legitimate ones, can acquire your information about unclaimed retirement accounts and offer to assist you with your search, often with a percentage fee for their services.

When it comes to planning and saving for retirement, its vital to have all your assets accounted for. Locating an old 401 plan is like finding cash in the pocket of an old pair of jeans. Its money you forgot you had but are happy you found. So if you know youve contributed funds to a 401 account but cant figure out where those funds are, the resources listed above may help you find past retirement accounts that may have been lost along your employment journey.

You May Like: What Are The Best 401k Funds To Invest In

Choice : Transfer To Your New Employers 401 Plan

Provided your current employers 401 accepts the transfer of assets from a pre-existing 401, you may want to consider moving these assets to your new plan.

The primary benefits to transferring are the convenience of consolidating your assets, retaining their strong creditor protections, and keeping them accessible via the plans loan feature.

If the new plan has a competitive investment menu, many individuals prefer to transfer their account and make a full break with their former employer.

Making A Hardship Withdrawal

Don’t Miss: Can You Use Your 401k To Start A Business

Rollover The Money Into Your New Employers 401k Plan

If your new employer offers a 401k plan with low costs and a wide variety of investment options, this might be a viable option to consider. However, we generally recommend that people rollover their 401k plans into an IRA as they are usually lower cost and have more investment options, but more on that later.

If you are interested in rolling the money over into your new employers 401k, meet with the HR department or retirement plan custodian to find out more about your new companys plan, including whether you will be allowed to participate as soon as youre hired or will have to work for a certain number of days before youre eligible.

To accomplish this rollover, you will instruct the administrator of your former employers 401k to transfer your assets directly into your new employers plan once your account has been established. Alternatively, you can instruct the former employers 401k administrator to send you a check but you must deposit the funds into your new account within 60 days to avoid paying income taxes and a potential penalty on distribution.

Traditional Rollover Sep And Simple Iras

If you are considering a withdrawal from one of these types of IRAs before age 59½, it will be considered an early distribution by the IRS.

In many cases, youll have to pay federal and state taxes. There may also be a 10% penalty unless you are using the money for exceptions such as a first-time home purchase, birth or adoption expense , qualified education expense, death or disability, health insurance , and some medical expenses. A 25% penalty may apply if you take a distribution within the first 2 years of opening a SIMPLE IRA.

If any of these situations apply to you, then you may need to fill out specific IRS forms. Always consult your tax advisor about your specific situation.

Don’t Miss: What Are Terms Of Withdrawal 401k

You Have Options But Some May Be Better Than Others

After you leave your job, there are several options for your 401. You may be able to leave your account where it is. Alternatively, you may roll over the money from the old 401 into either your new employers plan or an individual retirement account . You can also take out some or all of the money, but there can be serious tax consequences.

Make sure to understand the particulars of the options available to you before deciding which route to take.

Just Because You Can Cash Out Your 401 Doesnt Mean You Should

Technically, yes: After youve left your employer, you can ask your plan administrator for a cash withdrawal from your old 401. Theyll close your account and mail you a check.

But you should rarelyif everdo this until youre at least 59 ½ years old!

Let me say this again: As tempting as it may be to cash out an old 401, its a poor financial decision. Thats because, in the eyes of the IRS, cashing out your 401 before you are 59 ½ is considered an early withdrawal and is subject to a 10% penalty on top of regular income taxes. Oh, yes, thats another thing: Since the 401 is funded with pre-tax money, you also have to pay taxes on it when you cash out.

In most cases, your plan administrator will mail you a check for 70% of your 401 balance. Thats your balance minus 10% for the withdrawal penalty and 20% to cover federal income taxes .

Its financially prudent to save for retirement and leave that money invested. But paying the 10% early withdrawal penalty is just dumb money its equivalent to taking money youve earned and tossing it out the window.

Read Also: Can I Roll My Wife’s 401k Into My Ira

Your 401 K And Income Tax

You may be wondering if your 401 k is subject to income tax. Once you’ve withdrawn the money from the 401 k, you need to pay tax on it. It is considered part of your taxable estate. This is why you must check the terms of your 401 k before you get any money from it. Terms like these should be clearly outlined in the plan. Withdrawing funds without understanding the implications of doing so is one common mistake that people make when changing employers in the USA. It’s important to consider the other options you have.

If you’re changing employers, you still have plenty of time to build up passive capital via investment and your 401 k. You’re unlikely to get much out of rushing into a decision that you aren’t completely ready for. Roll all of the funds out of your 401 k at once, and you might end up drowning in taxes.

How Long Can A Company Hold Your 401 After You Leave

When you change jobs, it might be unclear how long a company can hold your 401 after you leave. Learn more about your 401 waiting period.

When you leave your job, your employer can choose to hold or disburse your 401 money depending on your age and the amount of retirement savings you have accumulated. How long a company can hold your 401 depends on how much asset you have in the account: the company can hold for as long as you want unless you decide to rollover to a new plan or take a cash out. However, you must have at least $5000 in your 401 if you want the company to continue managing your plan. For amounts below $5000, the employer can hold the funds for up to 60 days, after which the funds will be automatically rolled over to a new retirement account or cashed out.

If you have accumulated a large amount of savings above $5000, your employer can hold the 401 for as long as you want. However, this may be different for small amounts, which the employer can cash out and send in a lump sum, or rollover your 401 into an Individual Retirement Account .

You May Like: How To Withdraw Money From Your Fidelity 401k