What Are The Contribution Levels And Limits Of A Solo Roth 401

The savings inside of a Solo Roth 401 are made up of both employee and employer contributions. In this case, the employer is the employee. That is the definition of self-employed. When contributing to a Solo 401 as the employee, you are allowed up to $19,500 or 100% of compensation for tax year 2020 .1

Employers with Solo 401 plans or Solo Roth 401 plans can make a profit-sharing contribution of up to 25% of eligible compensation, capped at a total of $57,000 for both employer and employee contributions in 2020. Over age 50 catch-up contributions are in excess of the $19,500 and $57,000 caps.

Heres one place where the tax distinction between the Solo 401 and Solo Roth 401 comes into play. In a Solo 401, the only option is tax-deductible, or pre-tax, savings. By contrast, the Solo Roth 401 offers two options. The doctor mentioned above could opt for traditional, tax-deductible savings or exercise the Roth featurepay taxes today and not be concerned with paying taxes in the future, possibly at a higher rate. Roth savings are often referred to as post-tax savings with tax-free growth and tax-free withdrawals. While its nice to have both options, he would probably be wise to take the Roth route due to the restrictions on the employer contribution described below. This would also allow him to diversify his retirement savings from a tax perspective.

Selecting A Brokerage Firm For Your Solo 401k

When selecting a brokerage firm for your solo 401k, you want to select the firm that offers the most options.

If you’re okay with a prototype plan, you can use our Solo 401k Brokerage Comparison to see which major firms offer the options you’re looking for.

If you’re using a custom solo 401k plan, you need to take your solo 401k documents to the brokerage of your choice and they will open a custodial account on your 401k’s behalf. Some firms offer this service, and others don’t. For example, Fidelity and Charles Schwab are two brokerage firms that allow for customers to use third-party 401k plans with their brokerage services.

However, when using a third party plan, it adds to the complexity of using a solo 401k. For instance, as a custodial account, the firm will not keep track of your trades and investments – that’s your responsibility. If you need to fill out tax forms, such as a 1099-R, these firms will not help you. You either have to do it yourself, or pay someone to do it for you.

We decided to go with ETrade for our Solo 401k because they had the most robust free plan.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

You May Like: How To Find Old 401k Contributions

Can I Contribute To A Roth Ira If I Am Self

Self -employed investors can use a Roth IRA to help fund part of their retirement. The only eligibility requirement to contribute to a Roth IRA is that you and / or your spouse have earned such salary income (vs.

How much can you contribute to an IRA if you are self-employed?

Contribute as much as 25% of your net income from self -employment , up to $ 61,000 for 2022 .

Can a self-employed person contribute to a SEP and a Roth IRA?

You can use self -employment income to fund SEP IRAs. If you maximize both, you can continue and open a Roth IRA for as long as you qualify. And if you make too much money to open a Roth IRA, keep in mind that SEP IRA contributions reduce your taxable income.

What Are The Contribution Levels And Limits Of A Solo 401

To take full advantage of contributions to a Solo 401 plan you must understand your limits as an employee and employer, as well as contributions allowed on behalf of a spouse if applicable.

When contributing as the employee, you are allowed up to $19,500 or 100% of compensation in salary deferrals for tax years 2020 and 2021. If you are over 50, an additional $6,500 catch-up contribution is allowed for tax years 2020 and 2021. This is the type of contribution that can be made as pre-tax/tax-deferred or Roth deferral or a combination of both. Additionally, as the employer, you can make a profit-sharing contribution up to 25% of your compensation from the business up to $57,000 for tax year 2020 and $58,000 for tax year 2021. When adding the employee and employer contributions together for the year the maximum 2020 Solo 401 contribution limit is $57,000 and the maximum 2021 solo 401 contribution is $58,000. If you are age 50 and older and make catch-up contributions, the limit is increased by these catch-ups to be $63,500 for 2020 and $64,500 for 2021.

Compensation from your business can be a bit tricky. This is calculated as your business net profit minus half of your self-employment tax and the employer plan contributions you made for yourself plan). The limit on compensation that can be factored into your tax year contribution is $285,000 for 2020 and $290,000 for 2021.

Don’t Miss: What Percentage Of 401k Is Required Minimum Distribution

Administering A Solo 401 Plan

Once your Solo 401 plan exceeds $250,000 in assets at the end of the year, the IRS requires you file an annual Form 5500 EZ. Or if you ever terminate the plan, you must also file a Form 5500 EZ.

Unlike Traditional 401 plans, there are no compliance testing requirements to ensure Solo 401 plans do not favor highly compensated employees and are non-discriminatory, as long as you have no employees participating in the plan.

These plans can be called Self-Directed 401, Individual 401, Individual Roth 401, Self-Employed 401, Personal 401 or One-Participant 401 depending upon the vendor offering the plan services.

How A Roth 401 Works

Like Roth IRAs, Roth 401s are funded with after-tax dollars. You don’t get any tax benefit for the money you put into the Roth 401, but when you begin to take distributions from the account, that money will be tax-free, as long as you meet certain conditions, such as holding the account for at least five years and being 59½ or older.

Traditional 401s, on the other hand, are funded with pretax dollars, providing you with an upfront tax break. But any distributions from the account will be taxed as ordinary income.

This basic difference can make the Roth 401 a good choice if you expect to be in a higher tax bracket when you retire than when you opened the account. That could be the case, for example, if you’re relatively early in your career or if tax rates shoot up substantially in the future.

Also Check: Who Does Amazon Use For 401k

Age 50 And Over Catch Up Contribution Question:

The short answers is no.

- The maximum amount of voluntary after-tax contributions that you can make to a solo 401k plan for 2021 is $58,000 even if you are 50 or older .

- Assuming that you are 50 or older, you have not already made employee contributions to another 401k plan and that you have sufficient self-employment income, you can make an additional $6,500 catch up contribution for 2021. This would be made as either a pre-tax or Roth employee contribution and would also not be counted in determining the amount of voluntary after-tax contributions that you can make.

Deadline To Set Up And Fund

- For taxable years 2020 and beyond, individual 401 plans may be set up by tax filing deadlines plus extensions. Note: It can take 30 or more days to establish a plan.

- Salary deferral portion of the contribution must be deducted from a paycheck prior to year end, with some exceptions for certain business structures.

- Business owner contribution may be made up through the business tax filing due date plus extensions.

You May Like: How To View My 401k Account

Solo 401 Contribution Deadline

Note that the solo 401 contribution deadline is the extended due date of your individual tax return or your business tax return . Specifically, here are the solo 401 contribution deadlines for specific tax situations:

- Deadline for solo proprietor who has not extended Form 1040: April 15

- Deadline for solo proprietor who has extended Form 1040: October 15

- Deadline for S corporation owner who has not extended Form 1120S: March 15

- Deadline for S corporation owner who has extended Form 1120S: September 15

- Deadline for C corporation owner who has not extended Form 1120: October 15

So if youre making solo 401 contributions, be sure to keep in mind the deadlines above.

The Mega Backdoor Roth Ira Conversion

To do this, a solo 401 must allow after-tax contributions and in-service distributions of after-tax contributions, and the client would need to be able to afford to contribute the after-tax contributions, Berger notes.

The Latest

The money in the solo 401 that fits those specifications then can be rolled into a Roth IRA.

The example Berger provides is someone with a 401 with her company and a separate sole proprietorship that is not related to her company.

Her side company is very profitable one year, so she is able to contribute $58,000 to the solo plan. To take advantage of the mega backdoor Roth, she takes a distribution of her solo plan after-tax account and converts that to a Roth IRA. Again, Berger says, a mega backdoor Roth must be done with after-tax contributions.

One point Berger makes about solo 401 plans is theyre not subject to a lot of rules that govern regular 401 plans. Theyre not subject to ERISA and they arent subject to IRS rules that apply to 401 plans like non-discrimination rules.

Recommended Reading: How To Roll Over 401k To Ira Vanguard

Total Contribution Limit Question:

In short, no because that would exceed the overall limit. The overall contribution limit to a solo 401k for 2021 is $58,000 per year or $65,500 for those 50 or older in 2021. Therefore, if you contribute $58,000 as voluntary after-tax contribution, you would only have the $6,500 catch-up limit left which can be contributed to the Roth solo 401k since the rules do not allow for treating the catch-up as a voluntary after-tax solo 401k contribution.

The Schwab 401k Plan Document

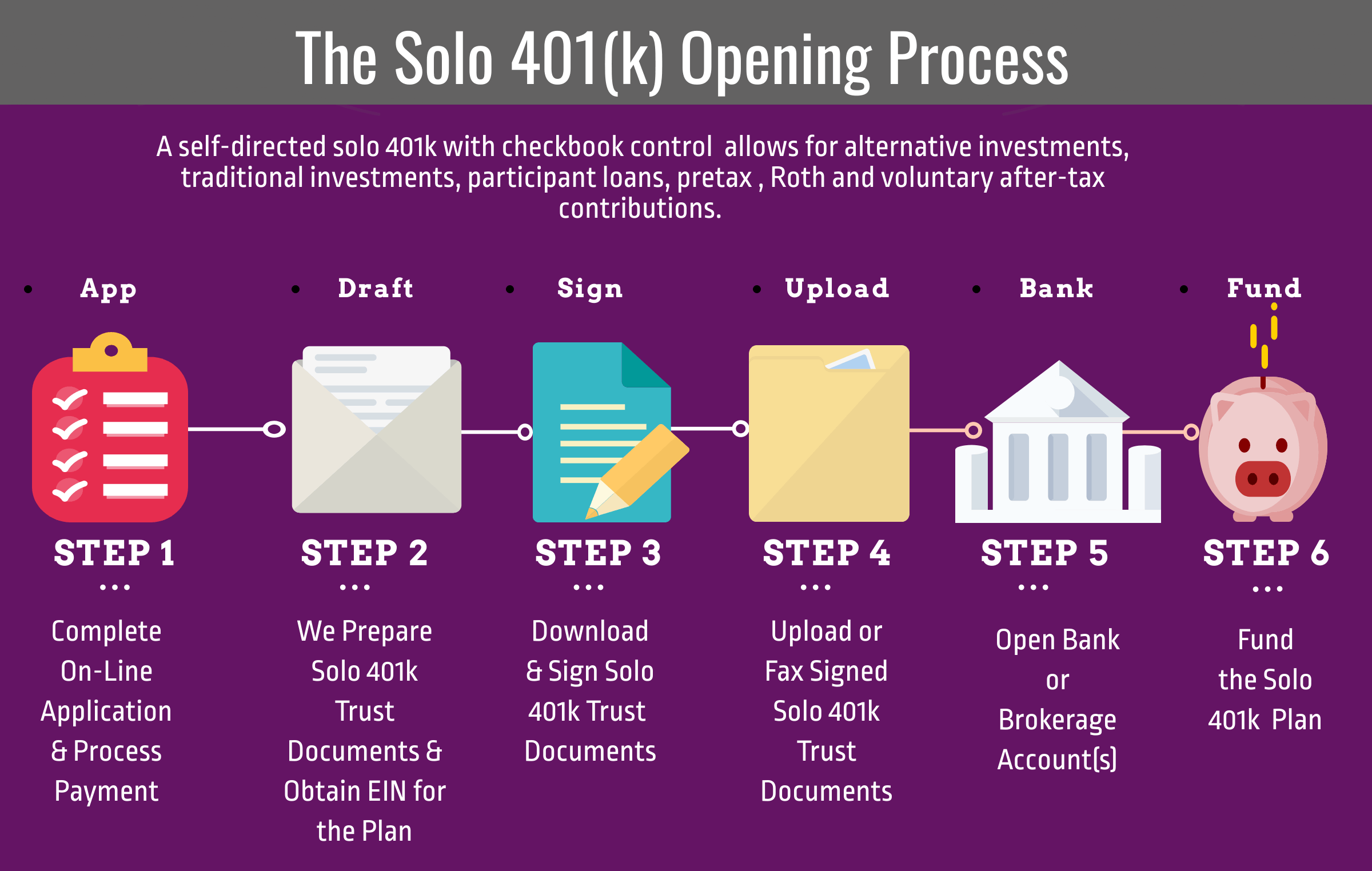

Starting a Solo 401K with Charles Schwab is simple with the following steps:

- Apply for your EIN, Employer Identification Number. You apply for the number with the IRS. The process is completely online and only takes a few minutes.

- Complete the Schwab required paperwork including the plan document, adoption agreement, and account application.

- Send all original copies to Schwab, but make sure to keep a copy for yourself.

- Make sure all parties complete the Elective Deferral Agreement. This determines how much you agree to have withheld from your earnings.

Charles Schwab requires you to send your money in via check. On the check, you must include your company name and a list of the amount to be deposited in each account with the corresponding account number.

You must make all contributions for the year by the tax filing date, which is normally April 15th. If you need an extension you can apply for it and use the dates accordingly.

You May Like: How Much Does A Solo 401k Cost

Can I Take A Loan From My Solo 401

Yes, you can take a loan from your solo 401, up to 50% of the account value and no greater than $50,000.

So if you have a $60,000 balance in your solo 401, the maximum you could borrow is $30,000.

If you have a $100,000 balance in your solo 401, the maximum you could borrow is $50,000.

And because the loan can be no greater than $50,000, even if you have a $1,000,000 balance in your solo 401, the maximum you could borrow is $50,000.

This loan must be paid back within five years, with interest.

What Are The Tax Benefits Of A Solo 401

Solo 401s share the same tax benefits as their traditional 401 counterparts.

You can elect to contribute pre-tax earnings to your Solo 401 and pay taxes when you distribute your funds during retirement. In turn, youâll lower your immediate income tax obligation.

Or, you can choose to contribute after-tax earnings into a Roth Solo 401, then your distributions during retirement would be tax-free.

Additionally, any matching contributions you make as your employer are tax-deductible for your business, lowering its tax obligation as well.

Recommended Reading: What To Invest My 401k In

How Do They Work For Small Business

The largest difference with the Solo 401K is the fact that you are the employer and the employee. Both contributions come from you one is your earnings and the other is your share of profit-sharing. As the employee you are able to contribute up to $19,500 toward your retirement account. If you earn less than that per year, you may contribute up to 100% of your earnings, but $19,500 is the maximum.

As the employer you may contribute the lesser of $57,000 or 25% of your earned income minus ½ your self-employment tax. If you are over 50 years old, you may also contribute an extra $6,500 for catch-up contributions, helping you get even further with your retirement savings.

Who Can Contribute To A Solo 401

Business owners and their spouses can contribute to a solo 401 plan.

Solo 401 Rules for Spouse: Its important that each individual have their own, separate account. So while ABC Company could have a solo 401 plan called ABC Company Solo 401 Trust, Spouse A will have an account say at a bank or brokerage firm in the name of ABC Company Solo 401 Trust solely for his or her benefit, while Spouse B will have an account in the name of ABC Company Solo 401 Trust solely for his or her benefit.

Don’t Miss: How Does 401k Retirement Work

Contribution Limits For Self

You must make a special computation to figure the maximum amount of elective deferrals and nonelective contributions you can make for yourself. When figuring the contribution, compensation is your earned income, which is defined as net earnings from self-employment after deducting both:

- one-half of your self-employment tax, and

- contributions for yourself.

Use the rate table or worksheets in Chapter 5 of IRS Publication 560, Retirement Plans for Small Business, for figuring your allowable contribution rate and tax deduction for your 401 plan contributions. See also Calculating Your Own Retirement Plan Contribution.

Solo 401 Contribution Limits

The total solo 401 contribution limit is up to $58,000 in 2021 and $61,000 in 2022. There is a catch-up contribution of an extra $6,500 for those 50 or older.

To understand solo 401 contribution rules, you want to think of yourself as two people: an employer and an employee . Within that overall $58,000 contribution limit in 2021 and $61,000 in 2022, your contributions are subject to additional limits in each role:

-

As the employee, you can contribute up to $19,500 in 2021 and $20,500 in 2022, or 100% of compensation, whichever is less. Those 50 or older get to contribute an additional $6,500 here.

-

As the employer, you can make an additional profit-sharing contribution of up to 25% of your compensation or net self-employment income, which is your net profit less half your self-employment tax and the plan contributions you made for yourself. The limit on compensation that can be used to factor your contribution is $290,000 in 2021 and $305,000 in 2022.

Keep in mind that if youre side-gigging, employee 401 limits apply by person, rather than by plan. That means if youre also participating in a 401 at your day job, the limit applies to contributions across all plans, not each individual plan.

You May Like: Should I Invest In 401k Or Roth Ira

How To Set Up 401k With Employer

How to set up a 401k for a small business

Contents

What Is The Maximum Contribution To A Solo 401k

Contribution limits to a Solo 401k are very high. For 2021, the max is $58,000 and $64,500 if you are 50 years old or older. This is up from $57,000 and $63,500 in 2020. This limit is per participant. So if your spouse is earning money from your small business that means they can also contribute up to the same amount into the Solo 401k. If you are both 50 years old or older, this means that combined contributions could be up to $129,000 per year!

Solo 401k contributions are much higher than all other retirement plans. Traditional and Roth IRA limits are just $6,000. The catch up contribution is $1,000 more if you are 50 years old or older. The IRS typically increases contribution limits every couple years as a cost of living increase to keep up with inflation. Therefore, its a fair bet to expect contribution limits to continue going up over time.

You May Like: How To Withdraw From Merrill Lynch 401k