When Can You Withdraw Your Money From A 401k

One of the golden rules of personal finance is do not touch your 401k.

If you withdraw money from your 401k account before the age of 59 ½, you will have to pay a 10% early withdrawal penalty . Since these funds come from your pre-tax salary, you will also have to pay income tax on the amount that you cash out.

For example, lets say you fall in the 24% tax bracket and wish to withdraw say $5,000 from your 401k. You will have to pay a total of $1,700 in penalties and taxes. So, always think twice before withdrawing money from your retirement plan.

If you are switching jobs, it would be wise to let your investments rollover to an IRA rather than cashing it out before you leave.

History Of The Internal Revenue Code

In 1919, a committee of the U.S. House of Representatives began a project to re-codify the U.S. Statutes. The completed version was published in 1926. Title 26, the Internal Revenue Code, was originally compiled in 1939. Congress has the authority to rewrite the tax code and add items to it every year. For example, in 2017, Congress passed the Tax Cut and Jobs Act, which brought about major reforms of the tax code affecting both individuals and businesses.

The Internal Revenue Service, founded in 1862, governs the codes in Title 26. Based in Washington, D.C., the IRS is also responsible for collecting taxes. The IRS is granted the right to issue fines and punishments for violations of the Internal Revenue Code.

Your Marginal Tax Bracket

Your tax savings become more significant when you’re in a higher .

Your marginal tax rate is the rate you’ll pay on your highest dollar of income.

Your tax brackets as a single taxpayer as of the 2021 tax year would be:

- 10% on income from $0 to $9,950

- 12% on income from $9,951 to $40,525

- 22% on income from $40,526 to $86,375

- 24% on income from $86,376 to $164,925

- 32% on income from $164,926 to $209,425

- 35% on income from $209,426 to $523,600

- 37% on income over $523,600

Your marginal tax rate would therefore be 22% in 2021 if you earn $80,000, because your top dollar falls within this parameter.

Tax brackets cover different spans of income if you’re married and filing a joint return or if you qualify as head of household because you’re single, have a dependent, and meet other rules.

You should keep making pre-tax contributions to a 401 plan if you enjoy getting those tax savings because you’re in a high tax bracket, and expect to be in a lower marginal tax bracket during your retirement years. You might prefer making contributions to a Roth 401 if you expect to be in a higher tax bracket when you retire, or if you prefer the idea of tax-free growth of earnings.

You May Like: How To Invest My 401k In Stocks

Roll Your 401 Balance Into Ira

Another possibility is for you to roll the balance over into an IRA. When moving the money, make sure you initiate a trustee-to-trustee transfer rather than withdrawing the funds and then depositing them into a new IRA. Many IRA custodians allow you to open a new account and designate it as a rollover IRA so you dont have to worry about contribution limits or taxes. When rolling your 401 balance into an IRA, make sure you place traditional 401 funds in a traditional IRA, and Roth funds in a Roth IRA.

Talk With A Financial Advisor

Still have questions about your 401 and what a 401 loan would mean for your financial future? The best thing you can do is talk to a qualified financial advisor you can trust.

Our SmartVestor program can connect you with a financial advisor you can turn to for sound advice. That way, you dont have to make these huge financial decisions on your own.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.

Don’t Miss: How To Open 401k Solo

There Are Fees You Pay For Your 401

Unfortunately, 401 plans come with fees but many savers dont realize this. According to TDAmeritrades January 2018 Investor Pulse Survey, 37% of Americans dont know that they pay any 401 fees, 22% dont know if their plan has fees, and 14% dont know how to determine the fees. Typically larger plans will have lower fees but the number of enrollees and the plans provider can also affect the cost. Typically, fees will range from 0.5% to 2% of the plan assets.

Pay attention to each fund’s expense ratio, which is a measure of a fund’s operating expenses expressed as an annual percentage. The lower the expense ratio, the less youll pay to invest. A total expense ratio of 1% or less is reasonable. Look at your 401 plan’s website to find a fund’s expense ratio.

The good news is that your plan may give you access to lower-cost institutional shares, which are cheaper than different share classes of the same investment bought through an IRA. The average equity mutual fund expense ratio for stock funds in 401s was 0.50% in 2020, according to the Investment Company Institute. One way to cut costs: Look to see whether your plan offers index funds, which tend to be cheaper than actively managed funds.

Look For Creative Ways To Save

Before you even think about raiding your 401, you should take a good, hard look at your budget. The truth is there might be hundredsor even thousandsof dollars worth of savings hiding right there in plain sight. You just have to know where to look!

Here are some things you can do today to save some money and free up cash:

- Cancel automatic subscriptions and memberships.

- Pause contributions to your 401.

- Pack your own lunches .

- Check your insurance rates and shop around.

Don’t Miss: Should You Borrow From 401k To Pay Off Debt

When Is The Money Yours

Some types of matching employer contributions are subject to a vesting schedule. The money is there in your account, but you’ll only get to keep a portion of what the company put in for you if you leave your job before you’re 100% vested. You always get to keep any of the money that you personally put into the plan.

Whats Happening In The Job Market

Americans are leaving their jobs in droves. The COVID-19 pandemic disrupted our lives and forced us to look inward and figure out what we really want as far as our careers are concerned. In 2021, millions of Americans quit their jobs and more are considering a better position in 2022.

A 2021 survey from Bankrate says people are looking at flexible work arrangements, higher pay and job security in their careers. More than half of the workers surveyed said they are willing to leave their jobs to find something better.

Some people who were close to retirement age are choosing to retire earlier than they had planned. Are you among those ready to leave your job?

According to research from Goldman Sachs, nearly 70% of the five million people who have stopped working during the pandemic are older than age 55. About a million of those people were of typical retirement age and 1.5 million were considered early retirees.

I like to use the statement that if youre quitting your job and youre not going back to work and youre 60 years old, youre facing 30 years of unemployment, said James Gallagher, president of Waterstone Financial in Fort Myers, Florida. Saving a little bit at a time turns into something really big. If you wait, you are never going to be able to retire.

But not all people are leaving the workforce entirely.

Recommended Reading: What Happens When You Roll Over 401k To Ira

What Is A 401k Match

Employers who offer a 401K often include a 401K match where they match a portion of your contributions. Each employer differs, but you may expect an average of a 3 5 percent match.

Lets say, for example, you make $75,000 per year and your employer offers a 5 percent match. They will match contributions of up to $3,750 or 5 percent of $75,000. They only match what you contribute, though. If you dont put anything into your 401K, you miss out on the match.

In addition to the percentage match, each employer differs in how much of your contribution theyll match. Most employers offer either a 100 percent or 50 percent match. Using the $3,750 example, youd receive $3,750 or $1,875 respectively.

How To Open And Manage A 401

If your company offers a 401, be sure to actually enroll in it or you wont have an account. The exact procedure for opening a 401 varies from company to company. If you work in an office, youll likely have an HR representative who can provide you with instructions or other resources to help you set up your account. Otherwise, you can always ask your supervisor or colleagues if you dont know how to get the ball rolling.

It might be worth consulting with a financial advisor if you have questions about how a 401 fits into your overall retirement plans. SmartAssets free matching tool can pair you with advisors in your area.

There are four main options you have to manage your 401 when you leave your company. You can either withdraw the money directly from your account, roll it over into an IRA, move it to your new company or keep it with your old company.

Immediately withdrawing your money from your account is the option you should avoid at all costs. This is because those funds then factor into your taxable income, heavily increasing your tax burden for the year. In addition, if youre younger than 59.5 years old, the IRS will slap you with a 10% income tax penalty. Your best bets are to either leave your 401 with your old employer, take it with you to your new job or roll it over into a shiny, new IRA.

Recommended Reading: How Do You Borrow From 401k

You End Up Paying Taxes On Your Loan Repaymentstwice

Normally, contributing to your 401 comes with some great tax benefits. If you have a traditional 401, for example, your contributions are tax-deferredwhich means youll pay less in taxes now . A Roth 401 is the opposite: You pay taxes on the money you put in now so you can enjoy tax-free growth and withdrawals later.

Your 401 loan repayments, on the other hand, get no special tax treatment. In fact, youll be taxed not once, but twice on those payments. First, the loan repayments are made with after-tax dollars . And then youll pay taxes on that money again when you make withdrawals in retirement.

Whats worse than getting taxed by Uncle Sam? Getting taxed twice by Uncle Sam.

How Much Should You Contribute To Your 401k

If you can, stuff as much money as you can into your 401k. Aim to hit the maximum contribution every year. The more money you can defer from taxes the better.

If you are just starting out, the first thing to do is make sure you at least get your employers match. For example, If your employer matches the first 5% of the money you contribute, it would be stupid not to contribute 5% of your salary.

Why? Because it is free money. You are leaving money on the table by not taking this contribution.

Aim to contribute at least 10% of your income in your 401K and 10% of your income in a Roth IRA.

Also Check: How Long Will My 401k Last

How Does A 401 Loan Work

If you want to borrow money from your 401, youll need to apply for a 401 loan through your plan sponsor. Once your loan gets approved, youll sign a loan agreement that includes the following:

- The principal

- The term of the loan

- The interest rate and other fees

- Any other terms that may apply

If you have an employer-sponsored retirement planlike a 401, 403 or 457 planyou can usually borrow up to 50% of your account balance, but no more than $50,000.2

When you apply for a 401 loan, you can decide how long the loans term will be, but it cant be more than five yearsthats the longest repayment period the government allows. But do you really want to be in debt for five years?

Most plans will let you set up automatic repayments through payroll deductions, which means youll be seeing less money in your paycheck until the loan is paid off. Those paymentswhich include the principal and the interestwill keep going right into your 401 until the principal is paid off. And keep in mind that some companies wont allow you to put any additional money into your 401 while you are repaying the loan.

Ready for some bad news? Your loan repayments will be taxed not once, but twice. Unlike traditional 401 contributions, which are tax-deferred, you wont get a tax break for your loan repayments. Instead, that money gets taxed before it goes into your 401 and then youll pay taxes again when you take the money out in retirement.

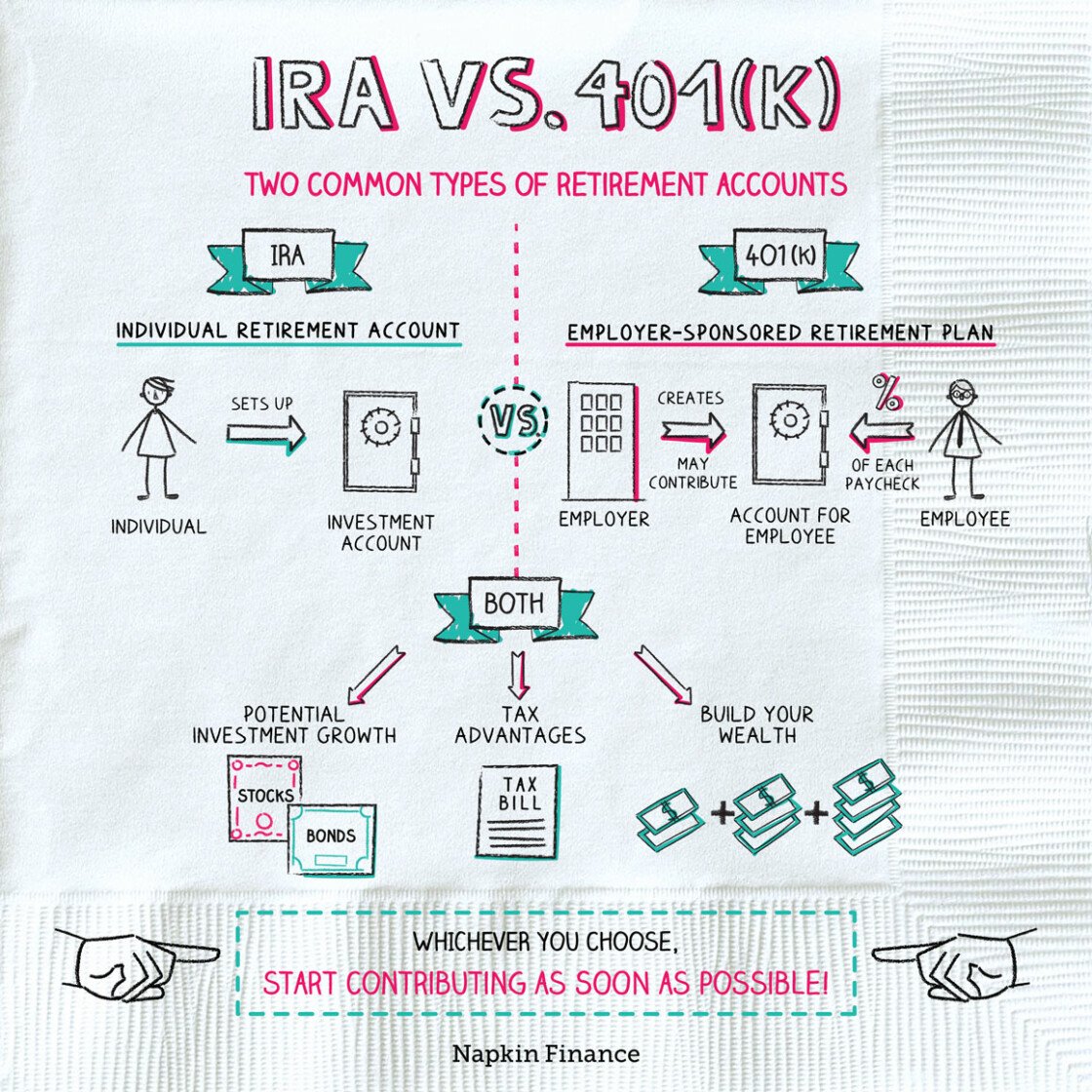

What Is A 401k

A 401k is an employer-sponsored retirement account. It allows an employee to dedicate a percentage of their pre-tax salary to a retirement account. These funds are invested in a range of vehicles like stocks, bonds, mutual funds, and cash. Oh, and if you’re curious where the name 401k comes from? It comes directly from the section of the tax code that established this type of plan specifically subsection 401k.

Don’t Miss: Where To Find My 401k

Getting Started With A 401

When saving for your retirement, employers may need some guidance, such as deciding between a Simple IRA vs 401 plan. For employees, the enrollment process may vary within different organizations, and different companies may also have different waiting periods for new hires before they are eligible to participate.

Eligible employees are required to receive a summary plan document which provides information about their plan and its available options. If they’re not sure how much to save each paycheck, provide them resources such as a 401 calculator to help them estimate both expected contributions and account earnings over time.

What Is 401k Vesting And How Does It Work

401k vesting, also known as your vested balance, is the amount of money in your retirement savings account that you are allowed to take with you in case you decide to leave your current job.

It also signifies your maximum borrowing limit if you want to take a 401k loan.

The way vesting works is quite simple and straightforward, though it tends to throw people off track.

The money you put into your 401k account is always 100% yours. However, in order to claim the contributions made by your employer, you must be fully, or at least partially, vested. Depending on your companys rules and regulations, becoming fully vested in your account can take anywhere between three to six years.

There are two main types of vesting schedules followed in most organizations:

- Cliff Vesting: As per this schedule, you cannot claim your employers contribution unless you have for them for at least three years. After that, you have full ownership of all the money in your 401k account.

- Graded Vesting: Under this schedule, you get to become fully vested after six years of service in the same place. Each year, your ownership grows by 20%. So, for instance, if you leave after working for only one year, you can only claim 20% of what your employer contributed over that time period.

If you wish to change jobs, dont forget to check your vested account balance first. Based on your plan, staying a little longer can add a handsome amount of money to your 401k savings.

Recommended Reading: Should I Invest My 401k

Convert To An Ira And Keep Contributing

You cannot contribute to a 401 after you leave your job, so if you want to continue adding money to your retirement funds, youll need to roll over your account into an IRA. Previously, you could contribute to a Roth IRA indefinitely but could not contribute to a traditional IRA after age 70½. However, under the new Setting Every Community Up for Retirement Enhancement Act, you can now contribute to a traditional IRA for as long as you like.

Keep in mind that you can only contribute earned income, not gross income, to either type of IRA, so this strategy will only work if you have not retired completely and still earn taxable compensation, such as wages, salaries, commissions, tips, bonuses, or net income from self-employment, as the IRS puts it. You cant contribute money earned from either investments or your Social Security check, though certain types of alimony payments may qualify.

To execute a rollover of your 401, you can ask your plan administrator to distribute your savings directly to a new or existing IRA. Alternatively, you can elect to take the distribution yourself. However, in this case, you must deposit the funds into your IRA within 60 days to avoid paying taxes on the income.

Traditional 401 accounts can be rolled over into either a traditional IRA or a Roth IRA, whereas designated Roth 401 accounts must be rolled over into a Roth IRA.

Tax Benefits Of A 401k Catch

Contributions to a traditional 401k directly reduce the savers taxable income .

Since catch-up contributions are extra savings on top of regular contributions, you can get an even bigger tax deduction in the current year.

For example, consider a 55 year old with a $100,000 pre-tax salary who contributes the maximum annual limit to their 401k in 2022, plus $2,000 in catch-up contributions. Their taxable income would drop to $77,500. As a single filer, that brings their top tax rate from 24% to 22% for the year. When you add in other deductions, such as the standard deduction, taxable income is reduced even further.

Making extra pre-tax contributions to a 401k means that your full dollar has the opportunity to grow in the market and compound. You wont pay income taxes until you withdraw the money later.

Read Also: How Do I Take Money Out Of My Voya 401k