How Does The Amazon Mega Backdoor Roth Work

The Mega Backdoor Roth is a powerful employee benefit within your 401 that allows Amazon employees to convert your after-tax dollars into a Roth 401 for tax-free growth and tax-free access in retirement.

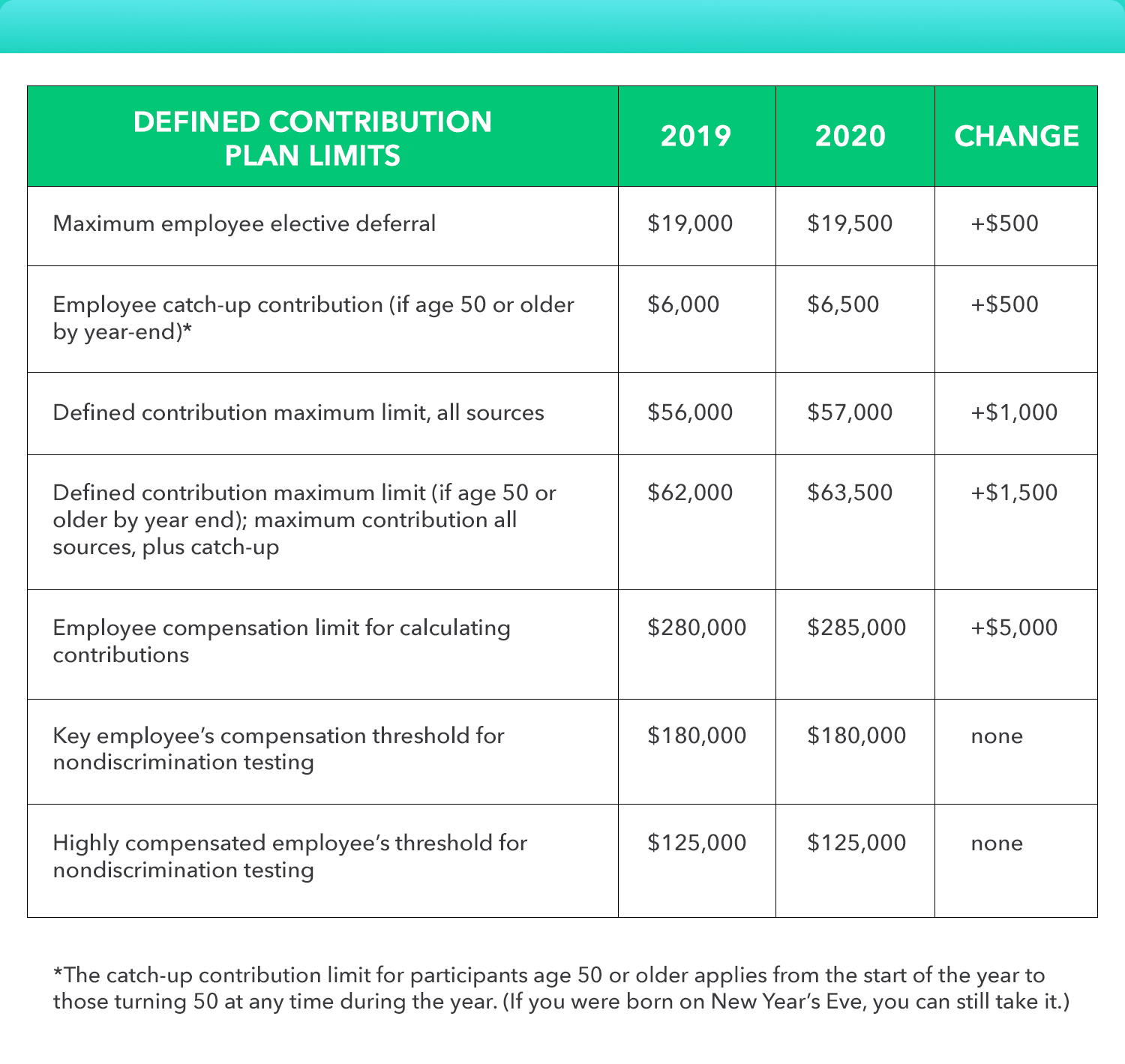

There was an exciting update to the Amazon 401 provision announced in early 2022. Now employees can save ~$37,000 into the Mega Backdoor Roth portion of their 401.

Prior to the announcement, Amazonians were limited to contributing only 10% of their base salary, above and beyond their standard 401 contribution. Now Amazon employees will be able to contribute up to the Federal 401 limit towards the after-tax portion of their 401, which can then immediately be converted to Roth.

This is an incredible benefit that can be better understood through a hypothetical example of an Amazon employee who is under 50, earning a base salary of $160,000 per year. As mentioned, in this scenario you can max out your regular 401 with a contribution of $20,500. Amazon will match 50% of your 401 contribution, up to 4% of salary, which in this example is $3,200 .

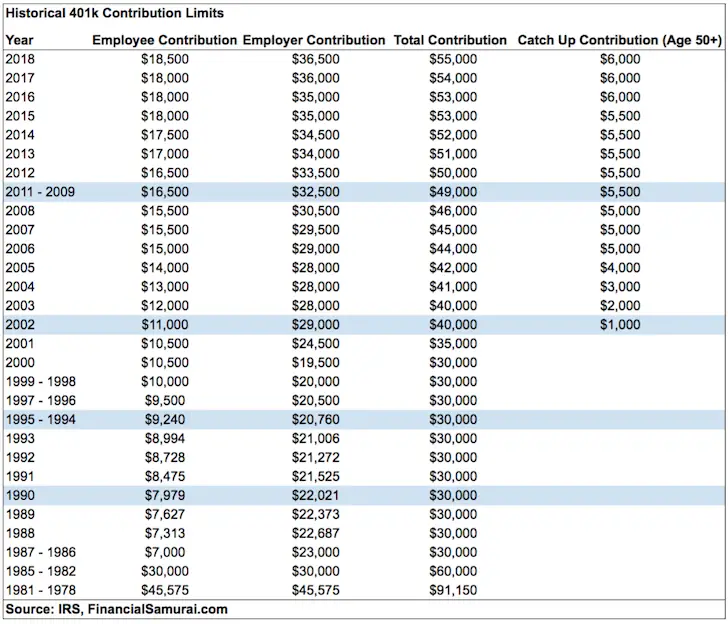

Typically, employees are limited in terms of how much that they can save into retirement accounts. Each year, if youre under 50, you can set aside $20,500 into a 401, and another $6,000 into either a Roth or traditional IRA if youre over 50, you can save an additional $6,500 into your 401. Many people do not realize that the Federal limit for total 401 contributions is $61,000 and $67,500 .

The Bottom Line: Save If You Can

Do your homework and shop around for all of your available options for saving for retirement. When evaluating whether or not to contribute to your employer-sponsored 401, use your level of income, target annual expense ratio, and desired list of investment funds. The sooner that you start saving for retirement, the closer youll be to your nest eggs target.

If you want to set up or switch to a 401 that’s great for employees and employers, let your company know about .

Extra Benefits For Lower

The federal government offers another benefit to lower-income people. Called the Saver’s Tax Credit, it can raise your refund or reduce the taxes owed by offsetting a percentage of the first $2,000 that you contribute to your 401, IRA, or similar tax-advantaged retirement plan.

This offset is in addition to the usual tax benefits of these plans. The size of the percentage depends on the taxpayer’s adjusted gross income for the year and tax-filing status. The income limits to qualify for the minimum percentage offset under the Saver’s Tax Credit are as follows:

- For single taxpayers , the income limit is $33,000 in 2021 and $34,000 in 2022.

- For married couples filing jointly, it’s $66,000 in 2021 and $68,000 in 2022.

- For heads of household, it maxes out at $49,500 in 2021 and $51,000 in 2022.

Also Check: How Do I Add Money To My 401k

What Happens If You Leave Your Job

Dont worry. You dont lose your 401 savings if you leave your current employer. You typically have a few different options available to you. First, you can leave it in the company plan, if they allow it. You wont be able to continue making contributions or any changes to your allocations. But you can access it when youre ready to retire.

Average 401k Balance At Age 45

When you hit your 50s, you become eligible to make larger contributions towards retirement accounts. These are called catch-up contributions. Make sure that you take advantage of them! Catch-up contributions are $6,500 in 2021. So if you contribute the annual limit of $19,500 plus your catch-up contribution of $6,500, thats a total of $26,000 tax-deferred dollars you could be saving towards your retirement.

Read Also: What Is The Max Percentage For 401k

What Kinds Of Mutual Funds Should I Choose For My Roth 401

Diversifying your portfolio is key to maintaining a healthy amount of risk in your retirement savings. Thats why it’s important to balance your investment among four types of mutual funds: growth and income, growth, aggressive growth, and international funds.

If one type of fund isnt performing as well, the other ones can help your portfolio stay balanced. Not sure which funds to select based on your Roth 401 options? Sit down with an investment professional who can help you understand the different types of funds, so you can choose the right mix.

How Much Should You Contribute To Your 401 Rule Of Thumb

As a rule of thumb, experts advise that you to save between 10% and 20% of your gross salary toward retirement. That could be in a 401 or in another kind of retirement account. No matter where you save it, you want to save as much for retirement as you can while still living comfortably.

Its important to say that this is just a general rule. The actual amount you should save depends on your individual situation. For example, if you are 50 years old and dont have any retirement savings, you should save more than 20% of your gross annual salary. If youre 30 years old and already have $100,000 in retirement savings, you could probably decrease your contributions for a bit in order to pay off a mortgage or loan. Its difficult to create a one-size-fits-all plan, because everyone is in a different place with his or her finances.

Saving 10% to 20% of your salary every year might sound like a lot. Luckily, you dont have to do it all at once. You can spread your contributions out throughout the year and you can contribute more or less some years. You also dont have to save all that money through your 401. Lets take a step back and talk about other factors you should consider when you think about how much to contribute to your 401.

You May Like: Does Vanguard Have 401k Plans

What Happens If You Contribute Too Much To Your 401

If your 401 contributions exceed the limits above, you may end up being taxed twice on your excess contributions: once as part of your taxable income for the year that you contribute and a second time when you withdraw from your plan. Earnings still grow tax-deferred until you withdraw them.

If you realize you contributed too much to your 401, notify your HR department or payroll department and plan administrator right away. During a normal year, you have until your tax filing deadlineusually April 15to fix the problem and get the money paid back to you.

Excess deferrals to a 401 plan will have to be withdrawn and returned to you. Your human resources or payroll department will have to adjust your W-2 to include the excess deferrals as part of your taxable income. If the excess deferrals had any earnings, you will receive another tax form that you must file the following tax year.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Don’t Miss: How Do I Access My 401k Account

Avoid Choosing Funds With High Fees

It costs money to run a 401 plan. The fees generally come out of your investment returns. Consider the following example posted by the Department of Labor.

Say you start with a 401 balance of $25,000 that generates a 7% average annual return over the next 35 years. If you pay 0.5% in annual fees and expenses, your account will grow to $227,000. However, increase the fees and expenses to 1.5%, and you’ll end up with only $163,000effectively handing over an additional $64,000 to pay administrators and investment companies.

You can’t avoid all of the fees and costs associated with your 401 plan. They are determined by the deal your employer made with the financial services company that manages the plan. The Department of Labor has rules that require workers to be given information on fees and charges to make informed investment decisions.

The business of running your 401 generates two sets of billsplan expenses, which you cannot avoid, and fund fees, which hinge on the investments you choose. The former pays for the administrative work of tending to the retirement plan itself, including keeping track of contributions and participants. The latter includes everything from trading commissions to paying portfolio managers’ salaries to pull the levers and make decisions.

How Much Should I Have Saved So I Can Retire Early

The general rule of thumb for whatever age you plan on retiring is to have 80% of your pre-retirement income replaced. Create a careful budget of your expected total expenses per year in retirement and multiply that by how many years you wish to be in retirement. Suppose you plan on retiring around 40 or shortly after. In that case, you need to consider things like waiting to qualify for Medicare or Social Security benefits when considering how much your expenses will be.

Read Also: What Is Max Amount To Contribute To 401k

Is It Worth Having A 401 Plan

Generally speaking, 401 plans are a great way for employees to save for retirement. They make it easy to save because the money is automatically deducted. They have tax advantages for the saver. And, some employers match the contributions made by the employees.

All else being equal, employees have more to gain from participating in a 401 plan if their employer offers a contribution match.

Make Sure You Contribute At Least This Much

Deciding how much to save in your 401 shouldn’t take an advanced degree in mathematics.

At a minimum, you should contribute as much as your employer will match to your 401. If you’re able to put away even more for retirement, you can contribute up to $19,500, or $26,000 if you’re older than 50, in 2021 .

There are a few other considerations to take into account before plowing all that money into your 401, but here’s all you need to know.

You May Like: How To Withdraw My 401k Money

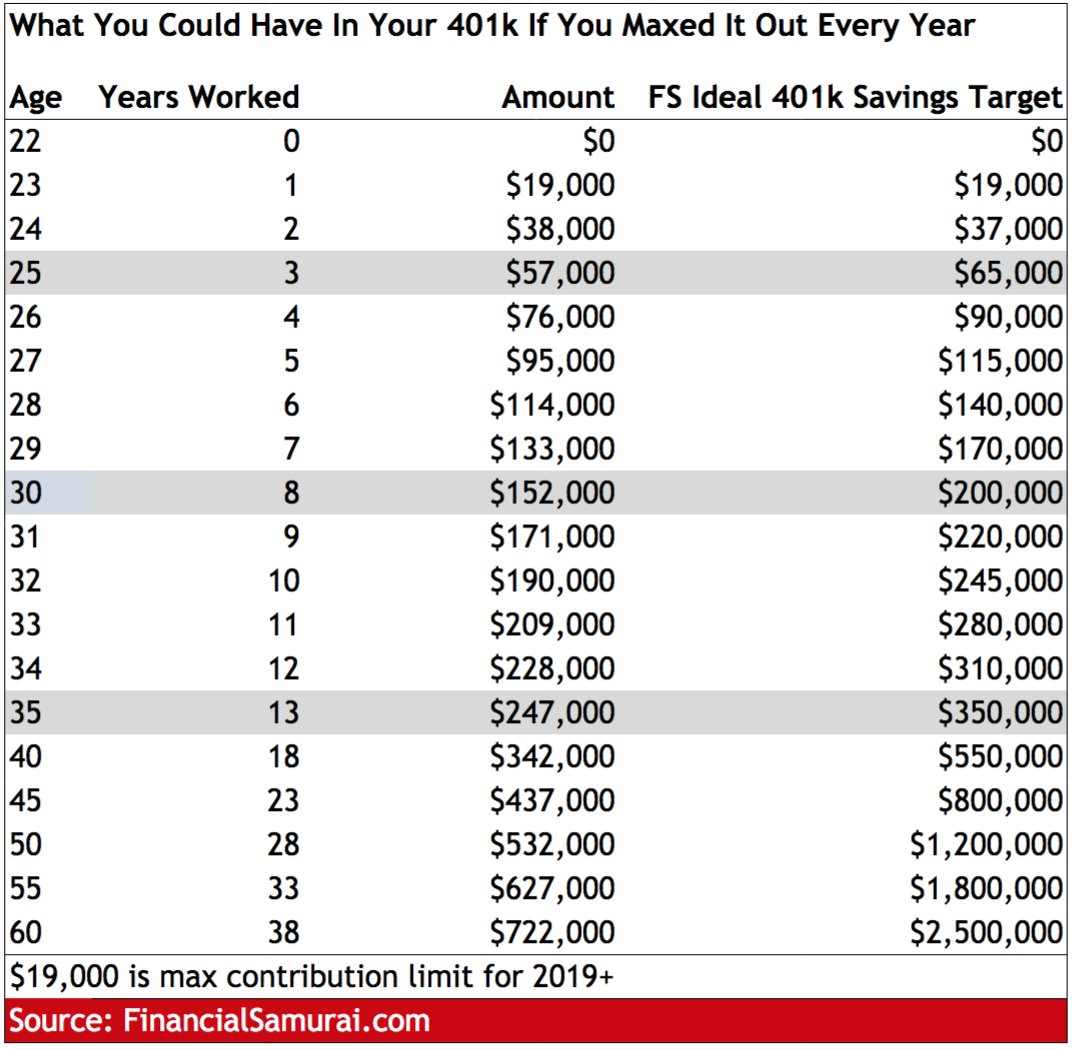

K Savings Potential By Age

The following chart depicts 401k savings potential by age, based on several assumptions. So this is how much you could have saved. These numbers can seem high to many people, especially if you are older and started your retirement savings when the contribution limit was much lower. It can still be used as a guide for your target total retirement savings amounts, including your IRA, Roth IRA, and after-tax savings. While its designed for one person, it can also be used as a guide for a married couple if one spouse decides to no longer work.

The assumptions we used for this chart include:

| AGE | |

|---|---|

| $827,000.00 | $6,610,084.46 |

*Generally, financial planners say the expected rate of return for a 401k is between 8% and 10%.

So, how do you stack up? Are you on the high end? The low end? Do you think these numbers are realistic?

Required Distributions For Some Former Employees

A 401 plan may have a provision in its plan documents to close the account of former employees who have low account balances. Almost 90% of 401 plans have such a provision. As of March 2005, a 401 plan may require the closing of a former employee’s account if and only if the former employee’s account has less than $1,000 of vested assets.

When a former employee’s account is closed, the former employee can either roll over the funds to an individual retirement account, roll over the funds to another 401 plan, or receive a cash distribution, less required income taxes and possibly a penalty for a cash withdrawal before the age of 59+1â2.

Recommended Reading: What Time Does Fidelity Update 401k Accounts

When Is An Ira A Better Option

An IRA and a 401 are both retirement saving vehicles and the two share commonalities. But there are a few important differences that make IRAs the better choice in some situations.

A 401 is only available through your employer. If you work at a company that doesnt offer a 401, you cant get one. People in work situations where the employer does not offer 401 accounts can still get retirement savings accounts with tax benefits thats where the IRAs come in.

IRAs are another type of retirement savings account. Unlike a 401, an IRA is not tied to your employer. You can sign up for an IRA at online brokerage like E*Trade, Vanguard, or Fidelity and open an account.

Another reason why someone might choose an IRA is for the investment options. IRAs are generally known to have a wider selection of investment opportunities than what youll find with a 401. But keep in mind that the contribution limits with an IRA account is much lower than the limits with a 401.

Contributions In Excess Of 2021 Limits

Evaluating your estimated contributions for the year ahead and analyzing your contributions at the end of a calendar year can be very important. If you find that you have contributions in excess of the 2020 limits, the IRS requires notification by March 1 and excess deferrals should be returned to you by April 15.

You May Like: Should I Transfer 401k To Roth Ira

A Beginner’s Guide To Understanding 401k Plans

The word 401k is synonymous with retirement, but how many of us actually know all the rules around 401k accounts? We’ll walk you through all the finer details, but we also know you’re busy, so we’ve also whipped up this handy table of contents for you, too. Feel free to self-serve some of the most frequently asked questions about 401k plans, or binge it all, top to bottom.

Now, onto the good stuff:

Rrsp Contributions & Pension Adjustments

If you pay into an employer plan such as a pension, that might impact your limit. Your Notice of Assessment from the CRA will show you how your pension adjustment affects your RRSP contribution limit.

Here are some of the ways your employer plan can impact your RRSP limits:

- Pension adjustments and your RRSP contribution limit: If you belong to a pension plan through your employer or union, the amount you can contribute to your RRSP is decreased.

- If you have a defined benefit plan, the CRA will estimate the value of the benefit you earned over the course of the prior year.

- If you have a defined contribution or deferred profit sharing plan, the adjustment is the total amount you and your employer contributed during the prior year.

Your Notice of Assessment from the CRA will show you how your pension adjustment affects your RRSP contribution limit.

Recommended Reading: How To Calculate Your 401k Contribution

What Are Annuities

An annuity is simply a contract between you and an insurance company. The insurer promises you periodic payments for a certain period in exchange for your money. Or, in some cases, until a specified event occurs, such as the annuity owners death, aka the annuitant.

Depending on your current situation, you can receive these payments in a series of monthly, quarterly, or annual installments for life. Or, you could receive one lump sum. In addition, you can grow your nest egg tax-deferred and guarantee a reliable income stream when you retire by investing in tax-deferred accounts sold by insurance companies.

Moreover, you decide when youll benign receiving these payments.

With an immediate annuity, monthly payments begin immediately following a lump sum payment usually in the range of $100,000 or more. Payments on a deferred annuity generally start after the contract is signed so that you can make smaller contributions throughout years or even decades. This type of annuity is actually similar to your 401 contributions.

What Is A 401

In a 401, qualified employees of an employer can invest and save for the future, which like annuities, is tax-deferred. However, a 401 is not available to everyone. 401s are only available if the company you work for offers them.

In short, a 401 plan is tied to an employer, while an annuity is not.

But, what happens if you switch jobs? Of course, you could leave the annuity in place. But, it may be better for you to roll the money over from the old 401 into the 401 of your new employer or into an IRA.

The decision to contribute to your 401 and how much you will contribute each paycheck is entirely up to you within the parameters of the plan and IRS contribution limits. Employers may also contribute to the plan, but its entirely up to them.

401 contributions are deducted before taxes, so you lower your income tax bill by contributing to one. In addition, the money you contribute will not be taxed until you withdraw it from the plan, just like with annuities.

Also Check: Is Roth Ira Better Than 401k

What Is The Average 401 Match

Saving for retirement comes with its struggles. However, you may already know the rates that retirement guides recommend to you. For example, save 15% of your income per year. Or have such-and-such percentage saved by age 35. But maximizing your 401 savings takes a little more than contributing as you can. One opportunity waiting for many workers is 401 matching. Through this employer-sponsored program, you can take advantage of funds already owed to you. Here is the average 401 match for companies around the nation and how to make the most of it.

A financial advisor can help you plan for the future, including saving for retirement. Find a local advisor today.