Should I Invest In The 401k Or Roth Ira

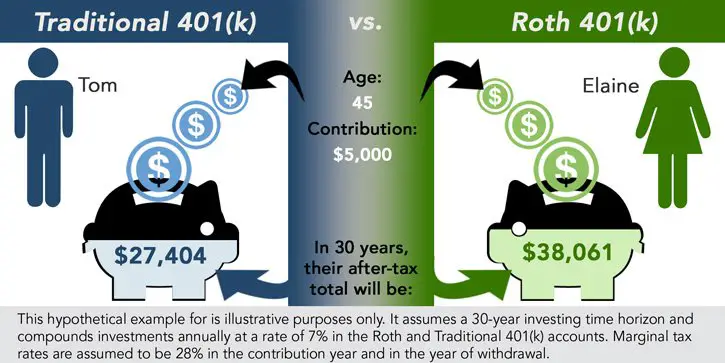

Ideally, you should contribute the maximum to both the 401k and Roth IRA. However, most new investors dont have that much income. To max out both accounts, youd need to save $25,000. Thats a lot of money. If you cant save that much, then do this.

First, contribute to the 401k up to the employer matching. This is the best investment you can make because your investment will double right away. If youre not contributing this much, youre giving up free money. Lets calculate and see where to invest after that. Ill use an excel spreadsheet to do this.

Here are some assumptions.

- The investor is in the 22% tax bracket. He can invest $6,000 in Roth IRA or $7,690 pretax in 401k.

- 8% annual gain.

- The investor starts at 22, retires at 60, and lives until 86.

- The withdrawal rate is 7% at 60. I made the money run out at 86.

- After retirement, the investor will have a lower effective tax rate due to not having a job. I assume the investor will pay 12% tax. This is a big assumption, but it should be valid. Most retirees make less money after they retire and pay less tax.

Here is the graph of the 401 vs Roth IRA.

As we expected, the 401 portfolio grows much more than the Roth IRA. Thats because you dont have to pay tax initially and can invest more. The 401k grows to $1,829,768 by the time were 60 years old. The Roth IRA grows to $1,427,647. Thats a big difference.

What Happens If I Take A Distribution From My Designated Roth Account Before The End Of The 5

If you take a distribution from your designated Roth account before the end of the 5-taxable-year period, it is a nonqualified distribution. You must include the earnings portion of the nonqualified distribution in gross income. However, the basis portion of the nonqualified distribution is not included in gross income. The basis portion of the distribution is determined by multiplying the amount of the nonqualified distribution by the ratio of designated Roth contributions to the total designated Roth account balance. For example, if a nonqualified distribution of $5,000 is made from your designated Roth account when the account consists of $9,400 of designated Roth contributions and $600 of earnings, the distribution consists of $4,700 of designated Roth contributions and $300 of earnings .

See Q& As regarding Rollovers of Designated Roth Contributions, for additional rules for rolling over both qualified and nonqualified distributions from designated Roth accounts.

Also Check: How Can I Find All Of My 401k Accounts

The Option To Convert To A Roth

An IRA rollover opens up the possibility of switching to a Roth account. s, a Roth IRA is the preferred rollover option.) With Roth IRAs, you pay taxes on the money you contribute when you contribute it, but there is no tax due when you withdraw money, which is the opposite of a traditional IRA. Nor do you have to take required minimum distributions at age 72 or ever from a Roth IRA.

If you believe that you will be in a higher tax bracket or that tax rates will be generally higher when you start needing your IRA money, switching to a Rothand taking the tax hit nowmight be in your best interest.

The Build Back Better infrastructure billpassed by the House of Representatives and currently under consideration by the Senateincludes provisions that would eliminate or reduce the use of Roth conversions for wealthy taxpayers in two ways, starting January 2022: Employees with 401 plans that allow after-tax contributions of up to $58,000 would no longer be able to convert those to tax-free Roth accounts. Backdoor Roth contributions from traditional IRAs, as described below, would also be banned. Further limitations would go into effect in 2029 and 2032, including preventing contributions to IRAs for high-income taxpayers with aggregate retirement account balances over $10 million and banning Roth conversions for high-income taxpayers.

But this can be tricky, so if a serious amount of money is involved, its probably best to consult with a financial advisor to weigh your options.

You May Like: How To Transfer 401k From Adp To Fidelity

Should I Invest In 401k Or Roth Ira

Many new investors wonder if they should invest in the 401k or Roth IRA. Both of these are tax-advantaged retirement accounts, but there are differences. Ideally, you should contribute the maximum to both your 401k and Roth IRA. Thats what we do. However, its a lot of money when youre starting out. Some people cant contribute that much. Which one should you invest in if you cant contribute the maximum to both accounts? First, well quickly go over the 401k and Roth IRA. Then well see which one we should invest in first.

You Pay Taxes Now Instead Of Later

Roths turn traditional IRA and 401 rules on their head. Rather than getting a tax break for money when it goes into the account and paying tax on all distributions, with a Roth, you save after-tax dollars and get tax-free withdrawals in retirement.

By accepting the up-front tax breaks for traditional IRA accounts, you accept the IRS as your partner in retirement. If you’re in the 24% tax bracket in retirement, for example, 24% of all your traditional IRA withdrawalsincluding your contributions and their earningswill effectively belong to the IRS. With a Roth, 100% of all withdrawals in retirement are yours.

The Roth strategy of paying taxes sooner rather than later will pay off particularly well if you’re in a higher tax bracket when you withdraw the money than when you passed up the tax break offered by the traditional account. If you’re in a lower tax bracket, though, the Roth advantage will be undermined.

Recommended Reading: How Do I Find Out My 401k Balance

Eligibility And Contribution Limits

There are no modified adjusted gross income limits for saving to a 401, so you can make use of this type of account, no matter how much or how little money you earn. You might not be able to save the full amount allowed each year to a Roth IRA, or you may not be able to contribute at all if you earn above certain MAGI limits.

The amount of your contribution also depends on your income tax filing status.

| 2022 Roth IRA Income Limits | ||

|---|---|---|

| If Your Filing Status Is: | And Your MAGI Is: | |

| $10,000 | Zero | |

| Single, head of household, or married filing separately, and you didnât live with your spouse at any time during the year | < $129,000 | Up to the limit |

| Single, head of household, or married filing separately, and you didnât live with your spouse at any time during the year | $129,000 but < $144,000 | A reduced amount |

| Single, head of household, or married filing separately, and you didnât live with your spouse at any time during the year | $144,000 | Zero |

The IRA contribution limit for 2021 is $6,000. Itâs $7,000 if youâre 50 or older. These limits will remain the same in 2022. Subtract from your MAGI one of three amounts to figure out the amount of your permitted reduced contribution in 2022:

- $204,000 if youâre married and filing a joint return or are a qualifying widow or widower

- $0 if youâre married and filing a separate return, and you lived with your spouse at any time during the year

- $129,000 if you have any other filing status

Read Also: Can You Use Money From 401k To Buy A House

Disadvantages Of A Roth Ira

Just like a 401, a Roth IRA has its downsides:

- Contribution limit. You can only invest up to $6,000 in a Roth IRA each year or $7,000 if youre age 50 or older.3 Thats a lot less than the 401 contribution limit.

- Income limits. If youre single or the head of a household, your modified adjusted gross income has to be less than $125,000 to contribute the full amount to a Roth IRA. If youre married and file your taxes jointly with your spouse, your MAGI must be less than $198,000. If your income is above these limits, the amount you can invest is reduced. And if you make $140,000 or more as a single individual or $208,000 or more as a married couple filing jointly, youre not eligible for a Roth IRA.4 However, the traditional IRA would still be an option.

Read Also: How To Invest My 401k In Stocks

Max Out Both To Boost Your Nest Egg

Kirsten Rohrs Schmitt is an accomplished professional editor, writer, proofreader, and fact-checker. She has expertise in finance, investing, real estate, and world history. Throughout her career, she has written and edited content for numerous consumer magazines and websites, crafted resumes and social media content for business owners, and created collateral for academia and nonprofits. Kirsten is also the founder and director of Your Best Edit find her on LinkedIn and Facebook.

What Is An Ira

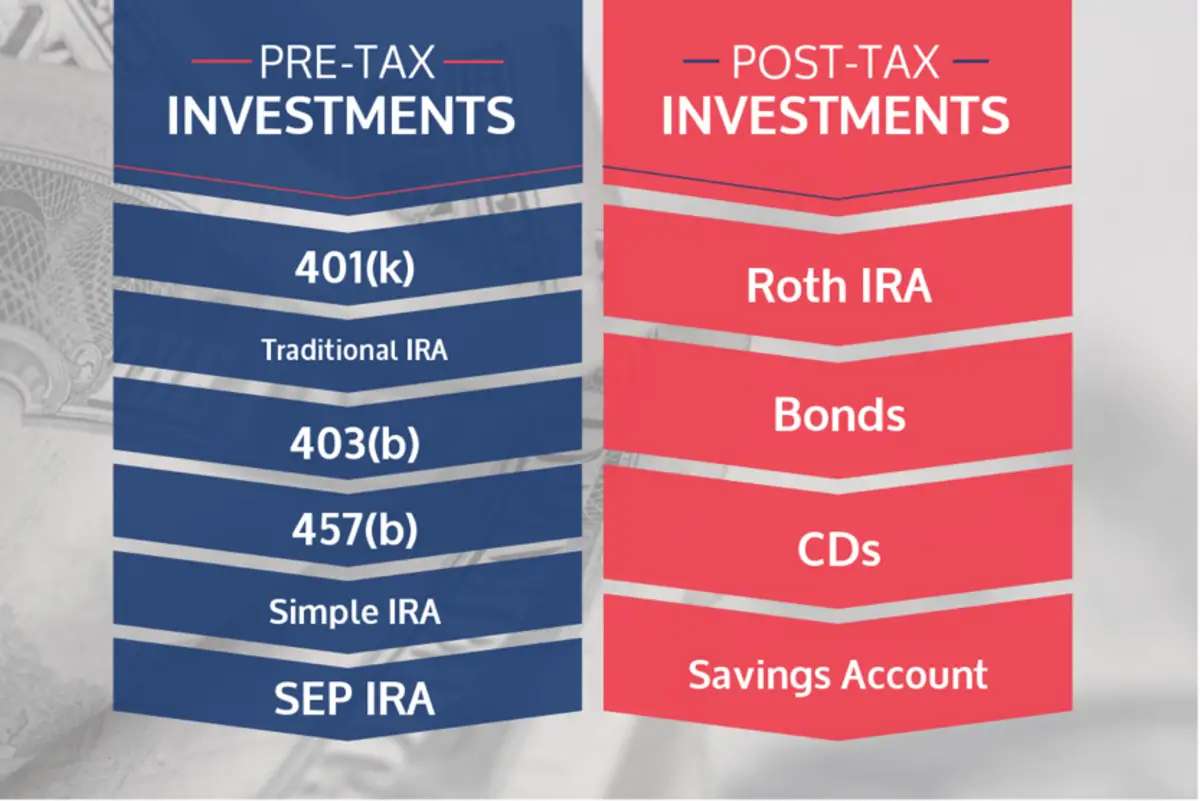

An IRA is another way to save and invest for your retirement, but it’s something you can do on your own instead through an employer. You would open an IRA for yourself at a bank, credit union, investment firm, broker or through a mutual fund provider. The different types of IRAs are as follows.

- Traditional: You can save pretax earnings and, as long as you qualify, those contributions will reduce your taxable income. So if your salary is $40,000 and you save $5,000, your taxable income will be $35,000. Your contributions are instead taxable only when you begin to withdraw the funds.

- Roth: With this IRA, you contribute after-tax earnings. Your contributions and the money they make are not treated as income when they’re withdrawn, so will not be subject to income tax.

- Spousal: You can open a separate traditional or Roth IRA so a working spouse can make contributions in the name of a non-working spouse. This way, both partners will have their own retirement account to tap into when the need arises.

- Rollover: When you switch employers, you can transfer the money in a 401 plan to a rollover IRA. While you may be able to remain with your employer’s plan, the rollover IRA can reduce fees and provide you with greater control over your investments.

Smaller companies that don’t offer 401 plans have special IRAs available to them:

Recommended Reading: How To Rollover Ira To 401k

Saving For Retirement In A Roth Ira

If you meet the income requirements for contributions, there are two compelling reasons to use a Roth IRA for retirement savings.

You Can Still Recharacterize Annual Roth Ira Contributions

Prior to 2018, the IRS allowed you to reverse converting a traditional IRA to a Roth IRA, which is called recharacterization. But that process is now prohibited by the Tax Cuts and Jobs Act of 2017.

However, you can still recharacterize all or part of an annual contribution, plus earnings. You might do this if you make a contribution to a Roth IRA then later discover that you earn too much to be eligible for the contribution, for instance. You can recharacterize that contribution to a traditional IRA since those accounts have no income limits. Contributions can also be recharacherized from a traditional IRA to a Roth IRA.

The change would need to be completed by the tax-filing deadline of that year. The recharacterization is nontaxable but you will need to include it when filing your taxes.

Read Also: Can You Withdraw From Fidelity 401k

Short Of Cash Be Cautious

It may be tempting to pull money out of your 401 to cover a financial gap. Or, when you are considering rolling money over from a 401 to an IRA, you may wish to roll over only a portion of your retirement savings and take the rest in cash. But do you know the true cost? Use our 401 Early Withdrawal Costs Calculator first.

Investment and Insurance Products are:

- Not Insured by the FDIC or Any Federal Government Agency

- Not a Deposit or Other Obligation of, or Guaranteed by, the Bank or Any Bank Affiliate

- Subject to Investment Risks, Including Possible Loss of the Principal Amount Invested

Investment products and services are offered through Wells Fargo Advisors. Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC and Wells Fargo Advisors Financial Network, LLC, Members SIPC, separate registered broker-dealers and non-bank affiliates of Wells Fargo & Company.

WellsTrade® and Intuitive Investor® accounts are offered through WFCS.

Retirement Professionals are registered representatives of and offer brokerage products through Wells Fargo Clearing Services, LLC . Discussions with Retirement Professionals may lead to a referral to affiliates including Wells Fargo Bank, N.A. WFCS and its associates may receive a financial or other benefit for this referral. Wells Fargo Bank, N.A. is a banking affiliate of Wells Fargo & Company.

Can You Lose All Your Money In Ira

The most likely way to lose all of the money in your IRA is by having the entire balance of your account invested in one individual stock or bond investment, and that investment becoming worthless by that company going out of business. You can prevent a total-loss IRA scenario such as this by diversifying your account.

Also Check: Can I Borrow Against 401k

What You Need To Know When Deciding Between Roth And Traditional

- Roth and traditional retirement accounts are taxed differently.

- Which account you choose should be based on your current and future marginal tax rates.

- Choosing the right account can help you avoid paying excess taxes.

When youre working and saving for retirement, you typically have a choice between traditional and Roth retirement accounts, including IRAs and 401s. But how do you choose which account to open? Taxes are a primary factor to consider, says Roger Young, CFP®, a senior financial planner with T. Rowe Price. You dont want to pay more in taxes than necessary, so choose carefully.

The tax treatment of Roth and traditional accounts varies considerably. Thats because the way you put money into these accounts and how you take it out later is very different:

- Traditional retirement accounts are generally funded with money on a pretax basis, meaning it comes straight out of your paycheck before you pay any taxes on it. This reduces your taxable income and essentially gives you a tax break for the same year. However, that tax break comes with strings attached. When it’s time to start taking money out of those accounts, youre going to have to pay taxes on every dollar you withdraw.

- Roth accounts, on the other hand, are funded with money that youve already paid taxes on. So contributing to a Roth doesnt reduce your taxes today. However, qualified distributions are tax-free.

Consider Your Current and Future Tax Rates

Roth or Traditional?

Having Trouble Deciding?

If Your Employer Offers A 401 Match

1. Contribute enough to earn the full match. Check your employee benefits handbook. If you see that your employer matches any portion of the money you contribute to the company 401 plan, do not bypass this opportunity to collect your free money.

A company matching program is one of the biggest benefits of a 401. It means that your employer contributes money to your account based on the amount of money you save, up to a limit. A common arrangement is for an employer to match a portion of the amount you save up to the first 6% of your earnings.

Even if a 401 has limited investment choices or higher-than-average fees, carve out enough money from your paycheck to get the full company match, as its effectively a guaranteed return on those dollars. Also note that employer contributions dont count toward the 401 annual contribution limit.

2. Next, contribute as much as youre allowed to an IRA. Depending on which type of IRA you choose Roth or traditional you can get your tax break now or down the road when you start withdrawing funds for retirement.

-

A traditional IRA is ideal for those who favor an immediate tax break. Contributions may be deductible that means your taxable income for the year will be reduced by the amount of your contribution. But, if you’re also covered by a 401, your deduction may be reduced or eliminated based on income. If you has a workplace retirement plan, check out the IRA limits.

Also Check: How To Put Money In 401k

Are Roth Iras High Risk

Risk lovers, rejoice. Choosing an investment for your Roth IRA is a great opportunity to put your intrepid tendencies to good use. Since the whole point of a Roth IRA fund is to keep it in an account until you retire, you may want to put at least some of that money into a high-risk, long-term investment.

Should you be aggressive with your Roth IRA?

Having an aggressive investment in your Roth IRA maximizes tax-free growth. And if you dont need the money in retirement, you can pass Roth over to your heirs, who can also take tax-free withdrawals.

Can a Roth IRA fail?

The five-year rule applies in three situations: if you withdraw your account earnings, if you convert a traditional IRA to a Roth, and if the beneficiary inherits a Roth IRA. Failure to follow the five-year rule can result in the payment of income tax on income withdrawals and a 10% penalty as well.