Borrowing Money From My 401k

It may seem like an easy way to get out of debt to borrow from your retirement accounts for DIY debt consolidation, but you can only borrow $50,000 or half the vested balance in your account, if its less than $50,000. You wont face a tax penalty for doing so, like you would with an out-right withdrawal, but youll still have to pay the money back.

And unlike a home equity loan where payments can be drawn out over a 10-to-30-year period, most 401k loans need to be paid back on a shorter time table like five years. This can take a huge chunk out of your paycheck, causing you even further financial distress. Borrowing money from your 401k also limits the ability of your invested dollars to grow.

Paying off some of your debt with a 401k loan could help improve your debt-to-income ratio, a calculation lenders make to determine how much debt you can handle. If youre almost able to qualify for a consolidation or home equity loan, but your DTI ratio is too high, a small loan from your retirement account, amortized over 5 years at a low interest rate may make the difference.

At What Age Can You Withdraw From 401k

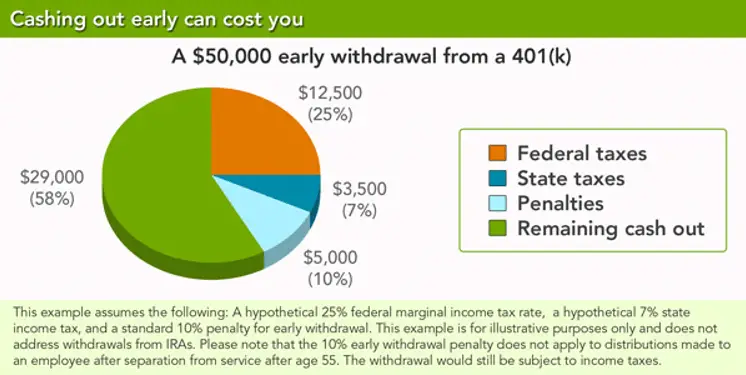

You can withdraw your money at any age, but if most people do so before age 55 , then theyâll have to pay a penalty on their withdrawal. There are also other exceptions to the age 50 rule including those with total and permanent disability and medical expenses exceeding 7.5% of your adjusted gross income. You can also make withdrawals without penalty because of an IRS levy plan, qualifying disaster distributions and your status as active duty military or a qualified reservist.

Traditional Approach: Withdrawals From One Account At A Time

To help get a clearer picture of how this could work, lets take a look at a hypothetical example: Joe is 62 and single. He has $200,000 in taxable accounts, $250,000 in traditional 401 accounts and IRAs, and $50,000 in a Roth IRA. He receives $25,000 per year in Social Security and has a total after-tax income need of $60,000 per year. Lets assume a 5% annual return.

If Joe takes a traditional approach, withdrawing from one account at a time, starting with taxable, then traditional and finally Roth, his savings will last slightly more than 22 years and he will pay an estimated $69,000 in taxes throughout his retirement.

Withdrawing from one account at a time can produce a tax bump midway in retirement

Note that with the traditional approach, Joe hits an abrupt tax bump in year 8 where he pays over $5,000 in taxes for 11 years while paying nothing for the first 7 years and nothing when he starts to withdraw from his Roth account.

In this scenario, a proportional withdrawal strategy in retirement cuts taxes by almost 40%

Read Also: How To Take Out 401k Money For House

You May Like: How Can I Get My 401k Without Penalty

How Holtzmans Tax Team Can Help

Like other tax legislation, the CARES Act includes many intricacies that can complicate taking advantage of early 401k withdrawals. Holtzmans team of accounting and tax advisors can help you determine whether you qualify for a hardship withdrawal and identify other opportunities to minimize your taxes. Contact our Tax Services team to learn how this important piece of legislation can benefit you.

See If You Qualify For An Exception To The 10% Tax Penalty

Generally, the IRS will waive it if any of these situations apply to you:

-

You choose to receive substantially equal periodic payments. Basically, you agree to take a series of equal payments from your account. They begin after you stop working, continue for life and generally have to stay the same for at least five years or until you hit 59½ . A lot of rules apply to this option, so be sure to check with a qualified financial advisor first.

-

You leave your job. This works only if it happens in the year you turn 55 or later .

-

You have to divvy up a 401 in a divorce. If the courts qualified domestic relations order in your divorce requires cashing out a 401 to split with your ex, the withdrawal to do that might be penalty-free.

Other exceptions might get you out of the 10% penalty if you’re cashing out a 401 or making a 401 early withdrawal:

-

You become or are disabled.

-

You rolled the account over to another retirement plan .

-

Payments were made to your beneficiary or estate after you died.

-

You gave birth to a child or adopted a child during the year .

-

The money paid an IRS levy.

-

You were a victim of a disaster for which the IRS granted relief.

-

You overcontributed or were auto-enrolled in a 401 and want out .

-

You were a military reservist called to active duty.

Don’t Miss: When To Withdraw From 401k

What You Need To Know Before Taking A Hardship Withdrawal From Your 401

One of the top rules of retirement planning hasnt changedtaking money out of a qualified retirement savings account before you reach full retirement age could be a costly mistake. Withdrawals, such as hardship distributions, could affect the funds available to you when you are set to retire. Experts warn that a 401 hardship withdrawal should be your absolute last resort and should only be used when you have used or explored all other options.

K Withdrawal Rules: How To Avoid Penalties

401k plans, IRAs and other tax-advantaged retirement savings accounts are common ways to save for retirement, and millions of Americans pour money into them every year. Its generally wise to avoid withdrawing money from your 401k, as there are often hefty penalties and taxes to consider for early withdrawals.

Sometimes, however, unplanned circumstances force people to withdraw funds from their 401k early. So if you find yourself in a place where you need to tap your retirement funds early, here are some rules to be aware of and some options to consider.

Don’t Miss: Can I Use My 401k To Buy Stocks

Making The Numbers Add Up

Put simply, to cash out all or part of a 401 retirement fund without being subject to penalties, you must reach the age of 59½, pass away, become disabled, or undergo some sort of financial hardship . Whatever the circumstance though, if you choose to withdraw funds early, you should prepare yourself for the possibility of funds becoming subject to income tax, and early distributions being subjected to additional fees or penalties. Be aware as well: Any funds in a 401 plan are protected in the event of bankruptcy, and creditors cannot seize them. Once removed, your money will no longer receive these protections, which may expose you to hidden expenses at a later date.

Exceptions To The Penalty

The IRS permits withdrawals without a penalty for certain specific uses. These include a down payment on a first home, qualified educational expenses, and medical bills, among other costs.

As with the hardship withdrawal, you will still owe the income taxes on that money, but you won’t owe a penalty.

Read Also: Where Can I Cash A 401k Check

Can You Be Denied A Hardship Withdrawal

Most 401 plans provide loans to participants who are facing financial hardship or have an immediate emergency need such as medical expenses or college education. If the reason for the 401 loan is a luxury expense that does not meet the financial hardship criteria, the loan application could be denied.

Who Qualifies To Take A Cares Act 401k Withdrawal

To qualify for the tax penalty exemption:

- The account owner, their spouse, or dependent must have been diagnosed with COVID-19 by a CDC-approved test, or

- The account owner must have experienced adverse financial consequences as a result of COVID-19-related conditions. For example, adverse financial consequences might include a delayed start date for a job, a rescinded job offer, quarantine, lay off, job furlough, reduction in pay or hours, a reduction in self-employment income, the closing of a business, an inability to work due to lack of child care, or other factors.

The IRS explains those qualifications in more detail in Notice 2020-50, Guidance for Coronavirus-Related Distributions and Loans from Retirement Plans Under the CARES Act.

Don’t Miss: How To Find A Deceased Person’s 401k

Ways To Withdraw Your 401

There are several ways to go about withdrawing your money in retirement.

- Rollover your funds: Instead of keeping your money in a 401, you can roll it over into a new account to keep it growing in retirement with more investment options.

- Take regular distributions: You can contact the financial institution managing your 401 and set up periodic payments to give you a fixed stream of income, much like a paycheck. You can also opt to take the distribution as you need them, as long as you take out the minimum required amount.

- Purchase an annuity: You can also purchase an annuity to ensure a fixed stream of payments.

- Take a lump sum: This is often not recommended by financial experts, but you have the ability to take out the money all at once.

Which option you pick will depend on your financial situation and goals in retirement. A financial planner can help you develop a plan that fits your needs.

Keeping Your Money In A 401

You are not required to take distributions from your account as soon as you retire. While you cannot continue to contribute to a 401 held by a previous employer, your plan administrator is required to maintain your plan if you have more than $5,000 invested. Anything less than $5,000 will trigger a lump-sum distribution, but most people nearing retirement will have more substantial savings accrued.

If you have no need for your savings immediately after retirement, then theres no reason not to let your savings continue to earn investment income. As long as you do not take any distributions from your 401, you are not subject to any taxation.

If your account has $1,000 to $5,000, your company is required to roll over the funds into an IRA if it forces you out of the planunless you opt to receive a lump-sum payment or roll over the funds into an IRA of your choice.

Recommended Reading: How Do I Take Out My 401k

Better Options For Emergency Cash Than An Early 401 Withdrawal

We know it can be a struggle when suddenly you need emergency cash for medical expenses, student loans, or crushing consumer debt. The extreme impact of coronavirus on public health and the economy has only compounded some of the more routine challenges of consumer cash flow.

We get it. The money squeeze can be quick and traumatic, especially in a more volatile economy.

Thats why information about an early 401 withdrawal is among the most frequently searched items on principal.com. Understandably so, in a world keen on saddling us with debt.

But the sad reality is that if you do it, you could be missing out on crucial long-term growth, says Stanley Poorman, an advice and planning manager for Principal® Advised Services who helps clients on household money matters.

In short, he says, Youre harming your ability to reach retirement. More on that in a minute. First, lets cover your alternatives.

How Much Tax Do I Pay On 401k Withdrawal

When you make an early withdrawal from a 401 account, youâll have to pay the normal taxes on that income. If you are working, that additional taxable income can put you in a higher tax bracket than you would have been if you had withdrawn the funds after retirement, which would have defeated much of the advantage of using the 401 in the first place.

Also Check: What Happens With 401k When You Quit

When You Leave A Job

When you leave a job, you generally have the option to:

- Leave your 401 with your current employer

- Roll over the funds to an IRA

- Roll over the funds to your new employer’s 401.

If you choose any of those options, you will not owe taxes or a 10% penalty. You can also take this money as a distribution, but this will trigger early withdrawal penalties if you are under 59 1/2 .

Tips For Retirement Savings

- Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- Prefer to take a DIY approach to investing and retirement planning? You can start by using this retirement calculator to see if youre on pace for a comfortable retirement. If youd like to invest more to grow that nest egg, check out one of these brokerages where you can open an IRA. You might also use a robo-advisor, which generates an investment plan for you for less than youd pay a traditional advisor.

- If youre over the age of 50, take advantage of catch-up contributions. Catch-up contributions are a great way to boost your savings. Use SmartAssets retirement calculator to ensure youre saving enough to retire comfortably.

Recommended Reading: Can I Withdraw From My 401k To Buy A House

Request A Hardship Withdrawal

In certain circumstances you may qualify for whats known as a hardship withdrawal and avoid paying the 10% early distribution tax. While the IRS defines a hardship as an immediate and heavy financial need, your 401 plan will ultimately decide whether you are eligible for a hardship withdrawal and not all plans will offer one. According to the IRS, you may qualify for a hardship withdrawal to pay for the following:

- Medical care for yourself, your spouse, dependents or a beneficiary

- Costs directly related to the purchase of your principal residence

- Tuition, related educational fees and room and board expenses for the next 12 months of postsecondary education for you, your spouse, children, dependents or beneficiary

- Payments necessary to prevent eviction from your principal residence or foreclosure on the mortgage on that home

- Funeral expenses for you, your spouse, children or dependents

- Some expenses to repair damage to your primary residence

Although a hardship withdrawal is exempt from the 10% penalty, income tax is owed on these distributions. The amount withdrawn from a 401 is also limited to what is necessary to satisfy the need. In other words, if you have $5,000 in medical bills to pay, you may not withdraw $30,000 from your 401 and use the difference to buy a boat. You might also be required to prove that you cannot reasonably obtain the funds from another source.

Can You Withdraw Money From 401k At Any Time

Key Points. While its possible to withdraw money from your 401k account before you reach retirement, there may be tax and penalty consequences to doing so. Before withdrawing money from your 401k account early, you should consider other options. For many people, a better alternative is to take out a 401k loan instead.

Don’t Miss: How Much Can You Put Into A Solo 401k

Can I Draw 401k From A Bank

Taking a withdrawal from your traditional 401 should be your very last resort as any distributions prior to age 59 ½ will be taxed as income by the IRS, plus a 10 percent early withdrawal penalty to the IRS. This penalty was put into place to discourage people from dipping into their retirement accounts early.

What Are The Penalties For Withdrawing From My 401 Before Age 59

Unless you fall into one of the special exemption categories, you will pay a penalty of 10% of the amount of funds you withdraw. This can get quite pricey and really cut into your retirement savings. If you must make a withdrawal before reaching retirement age, then make sure you check the list of exemptions to the penalty. If you can qualify under one of the exemptions, then you will not be forced to pay this extra penalty.

Read Also: Can I Roll A Roth Ira Into A 401k

Debt Relief Without Closing My 401k

Before borrowing money from your retirement account, consider other options like nonprofit credit counseling or a home equity loan. You may be able to access a nonprofit debt management plan where your payments are consolidated, without having to take out a new loan. A credit counselor can review your income and expenses and see if you qualify for debt consolidation without taking out a new loan.

8 MINUTE READ

Withdrawal Taxes And Early Distributions

You might find yourself in a situation where you need the money in your 401 before you reach 59 1/2 years of age. The account is designed to be part of your retirement plan, but circumstances come up where you cant avoid dipping into the money for other reasons. Down payments, emergency medical bills and education costs are a few examples of expenses some people pay with 401 funds.

If this is the case for you, expect to pay a 10% penalty fee. This is on top of the income tax youll pay for withdrawing the funds. Remember, even if its paying for an emergency, its still counted for tax purposes as income. Youll want to run the numbers, adding the tax and penalty tax, to see if it makes sense to pull money out early. Its also important to factor in the opportunity cost of pulling your investments out of the market.

In some cases, there is an exception to the 10% additional tax. The IRS lists the circumstances where the tax doesnt apply. Losing your job at 55, or starting a SOSEPP plan are two examples. Youll still be on the hook for income taxes, of course.

Given the tax hit and opportunity cost of early withdrawals, its not ideal solution. Before you commit to a penalized withdrawal, consider if borrowing the money from your 401 might be a better solution.

You May Like: Can I Move Money From 401k To Ira