The Benefits Of Rolling Over Your 401 When You Leave A Job

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

Whenever you change jobs, you have several options with your 401 plan account. You can cash it out, leave it where it is, transfer it into your new employer’s 401 plan , or roll it over into an individual retirement account .

Forget about cashing it outtaxes and other penalties are likely to be staggering. For most people, rolling over a 401or the 403 cousin, for those in the public or nonprofit sectorinto an IRA is the best choice. Below are seven reasons why. Keep in mind these reasons assume that you are not on the verge of retirement or at an age when you must start taking required minimum distributions from a plan.

Keeping The Current 401 Plan

If your former employer allows you to keep your funds in its 401 after you leave, this may be a good option, but only in certain situations. The primary one is if your new employer doesn’t offer a 401 or offers one that’s less substantially less advantageous. For example, if the old plan has investment options you cant get in a new plan.

Additional advantages to keeping your 401 with your former employer include:

- Maintaining performance:If your 401 plan account has done well for you, substantially outperforming the markets over time, then stick with a winner. The funds are obviously doing something right.

- Special tax advantages: If you leave your job in or after the year you reach age 55 and think you’ll start withdrawing funds before turning 59½ the withdrawals will be penalty-free.

- Legal protection: In case of bankruptcy or lawsuits, 401s are subject to protection from creditors by federal law. IRAs are less well-shielded it depends on state laws.

The Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 does protect up to $1.25 million in traditional or Roth IRA assets against bankruptcy. But protection against other types of judgments varies.

If you are going to be self-employed, you might want to stick to the old plan, too. It’s certainly the path of least resistance. But bear in mind, your investment options with the 401 are more limited than in an IRA, cumbersome as it might be to set one up.

How Do I Avoid Tax On Ira Withdrawals

Contents

Heres how to minimize 401 and IRA withdrawal taxes in retirement:

- Avoid the early payout penalty.

- Roll over your 401 with no tax withholding.

- Remember the required minimum distributions.

- Avoid two distributions in the same year.

- Start recordings before you have to.

- Donate your IRA distribution to charity.

Can I Withdraw Money From My IRA Without Paying Taxes? Once you reach age 59½ you can withdraw money without a 10% penalty from any type of IRA. If its a Roth IRA and youve had a Roth for five years or more, you dont owe income tax on the withdrawal. If not, you will. Once you reach age 72, you must take a distribution from a traditional IRA.

Read Also: When Can I Rollover 401k To Ira

Can I Move My 401k To An Ira Without Penalty

Can you roll a 401 into an IRA without a penalty? You can transfer money from a 401 to an IRA without penalty, but you must deposit your 401 funds within 60 days. However, there will be tax consequences if you transfer money from a traditional 401 to a Roth IRA.

How do I transfer my 401k without penalty? Heres how to avoid 401 fees and penalties:

- Avoid the 401 early withdrawal penalty.

- Shop around for low cost funds.

- Read your 401 fee disclosure statement.

- Dont quit a job until youve signed up for the 401 plan.

- Transfer your 401 directly to a new account.

- Compare 401 loans to other borrowing options.

How To Transfer A Traditional Ira Into A 401

If youve weighed the choices and decided youd like to combine retirement plan balances inside your 401 and your 401 plan provider is ready and willing to take those IRA assets there are steps you need to take to do it right.

First, know that you cant roll a Roth IRA into a 401 not even into a Roth 401. Were specifically talking about pretax money in a traditional IRA here.

As with a 401 rollover, the easiest way to roll a traditional IRA into a 401 is to request a direct transfer, which moves the money from your IRA into your 401 without it ever touching your hands. Contact your 401 plan administrator for instructions on how to do this following its guidance will allow you to avoid taxes and penalties.

About the author:Arielle O’Shea is a NerdWallet authority on retirement and investing, with appearances on the “Today” Show, “NBC Nightly News” and other national media. Read more

Don’t Miss: What Is The Best Fund To Invest In 401k

How To Start A 401 To Ira Rollover

Doing a 401 rollover to IRA isnt terribly difficult. Once youve figured out exactly which IRA you want to use, set one up with that company. You can do this online, just like youd start any other financial account.

Next, get in touch with the financial company managing your 401. Ask if they have any special rollover requirements, and assuming youve met all of them, have a check for your assets mailed to the company you opened an IRA with. That company will then deposit it in your account. Youve officially completed your rollover!

Will I Pay Taxes When Rolling Over A Former Employer

Generally, there are no tax implications if you move your savings directly from your employer-sponsored plan into an IRA of the same tax type to a Roth IRA).

If you choose to convert some or all of your pretax retirement plan savings directly to a Roth IRA, the conversion would be subject to ordinary income tax.

Don’t Miss: Can You Withdraw Your 401k When You Leave A Company

Can I Keep The Same Funds I Have In My Retirement Plan

This depends on your plan. First, you’ll want to reach out to your provider to determine if moving the assets over “in-kind” or “as is” could be an option for you.

If it is an option, then you’ll want to contact us at 877-662-7447 . One of our rollover specialists can help determine if we can hold your current investments here at Vanguard.

If it isn’t an option, don’t worrywe can still help you choose new investments once your assets have arrived here at Vanguard.

How Do I Rollover My 401k To Gold Without Penalty

A 401k to gold rollover comes without penalties. Setting up a self-directed IRA with a Precious Metals broker-dealer as the Trustee is the simplest approach to convert all or portion of your current 401 to Gold. Then, from your current 401, you request a Trustee-to-Trustee transfer to the self-directed account.

Don’t Miss: Can I Manage My Own 401k

Account Consolidation: Streamlining Your Retirement Savings

Multiple retirement accounts may mean multiple investment decisions, statements, fees, emails, and more. Consolidating retirement accounts can make it easier to manage your retirement savings.

This document is intended to be educational in nature and is not intended to be taken as a recommendation.

Investment and insurance products are:

- Not insured by the Federal Deposit Insurance Corporation or any federal government agency.

- Not a deposit, obligation of, or guaranteed by any Bank or Banking affiliate.

- May lose value, including possible loss of the principal amount invested.

The subject matter in this communication is educational only and provided with the understanding that Principal® is not rendering legal, accounting, or tax advice. You should consult with appropriate counsel or other advisors on all matters pertaining to legal, tax, or accounting obligations and requirements.

Financial professionals are sales representatives for the member of Principal Financial Group®. They do not represent, offer, or compare products and services of other financial services organizations.

Insurance and plan administrative services provided through Principal Life Insurance Co. Securities offered through Principal Securities, Inc., 800-547-7754,member SIPC. Principal Life and Principal Securities are members of Principal Financial Group® , Des Moines, IA 50392.

Rolling Your Annuity Into A 401

Can you roll your annuity over into your 401? It depends.

First, your annuity would need to already be an IRA annuity. And second, your 401 plan would have to allow you to roll money from other tax-deferred retirement plans into it.

You should check with the person in charge of your employers plan. You should also check with your annuity provider and review the contract to make sure youre able to take the funds from the annuity.

Also Check: How To Find Out Where Your 401k Is

What Are The Advantages Of Rolling Over A 401 To An Ira

Doing a 401 rollover to an IRA offers perks that can include more diverse investment selections than a typical 401 plan, perhaps cheaper investments and lower account fees. It’s also a way to keep your retirement funds organized and ensure you have easy access to them. And while some 401 plans pass account management fees along to the employees, many IRAs charge no account fees.

In summary, it’s a good way to save money, stay organized and make your money work harder.

Rollovers Of Retirement Plan And Ira Distributions

Information on this page may be affected by coronavirus relief for retirement plans and IRAs.

Most pre-retirement payments you receive from a retirement plan or IRA can be rolled over by depositing the payment in another retirement plan or IRA within 60 days. You can also have your financial institution or plan directly transfer the payment to another plan or IRA.

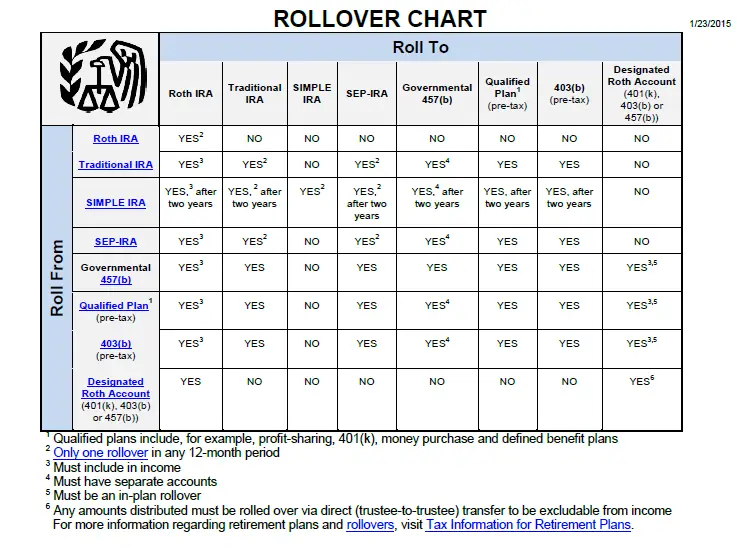

The Rollover Chart PDF summarizes allowable rollover transactions.

Read Also: Can I Move Money From 401k To Ira

How Long Does An Indirect 401 Rollover Take

401 plan administrators may force an indirect rollover if you have less than $1000 in your account. You may also choose an indirect rollover if you want to use the funds as short-term credit, and deposit the funds into the IRA account before the 60-day deadline expires. When you request the funds, the 401 plan administrator will liquidate any non-cash assets in your account, and send you a check.

The 60-day rule applies to indirect rollovers, and it requires you to deposit the funds into an IRA within 60 days of funds transfer from the 401 plan. Funds deposited within the 60 days do not attract income tax or early withdrawal penalty. However, if you miss the deadline, the IRS treats the money as an early withdrawal and subjects it to income taxes at your tax bracket rate and a 10% early withdrawal penalty.

For example, if the 401 plan administrator sent you a check for $40,000, you must deposit the funds within 60 days. Assuming that you deposit the funds on the 61st day since the date of receipt, you will be required to include the distribution in your annual taxable income for the year, and pay taxes on the distribution. IRS will also charge you a 10% penalty, equivalent to $4,000 if you are below age 59 ½.

Take Advantage Of An Investment Option In The 401

Conversely, there may be an investment option available in your 401 that is not available in your IRA account. You may want to leave a portion of the funds in your 401 to take advantage of that opportunity. Remember, diversifying your portfolio is extremely important when it comes to investing and if you have access to something special inside your 401, its worth keeping some money there to take advantage of the investment opportunity.

Don’t Miss: Can I Borrow Against My Fidelity 401k

Dont Roll Over Employer Stock

There is one big exception to all of this. If you hold your company stock in your 401, it may make sense not to roll over this portion of the account. The reason is net unrealized appreciation , which is the difference between the value of the stock when it went into your account and its value when you take the distribution.

Youre only taxed on the NUA when you take a distribution of the stock and opt not to defer the NUA. By paying tax on the NUA now, it becomes your tax basis in the stock, so when you sell itimmediately or in the futureyour taxable gain is the increase over this amount.

Any increase in value over the NUA becomes a capital gain. You can even sell the stock immediately and get capital gains treatment.

In contrast, if you roll over the stock to a traditional IRA, you wont pay tax on the NUA now, but all of the stocks value to date, plus appreciation, will be treated as ordinary income when distributions are taken.

Can I Roll Over My Retirement Plan Assets Into A Roth Ira

If you have a Roth 401 or 403, you can roll over your money into a Roth IRA, tax-free.

If you have a traditional 401 or 403, you can roll over your money into a Roth IRA. However, this would be considered a “Roth conversion,” so you’d have to report the money as income at tax time and pay ordinary income tax on it.

Recommended Reading: How Do I Get A Loan From My 401k

What Is Better Than A 401k

Some alternatives to retirement savers include IRAs and qualified investment accounts. IRAs, such as 401s, provide tax benefits for retirement savers. If you qualify for the Roth option, consider your current and future tax situation to choose between a traditional IRA and a Roth.

Is it better to have a 401k or IRA or both? âIf given the option to invest in either one, a key benefit of a 401 is that most employers will offer an employer match on employee contributions. If you have the income that will allow you to spend $19,500 on your 401 and $6,000 on your IRA, then you absolutely must invest in both.

Option : Leaving Money In Your Former Employer’s 401 Plan

Leaving money in your current 401 may be an option, depending on the terms of your plan. Many factors including the option to add money and your investment choices depend on the terms of your plan, but typically:

- Ability to add money: Once you leave your employer, you generally won’t be able to add money to your plan.

- Investment choices: 401 plans typically have a more limited number of investment options compared to an IRA but may include investments you can’t get through an IRA.

- Available services: Some plans may offer educational materials, planning tools, telephone help lines and workshops. Your plan may or may not provide access to a financial advisor.

- Fees and expenses: 401 fees and expenses often include administrative fees, investment-related expenses and distribution fees. These fees and expenses may be lower than the fees and expenses of an IRA.

- Penalty-free distributions: Generally, you can take money from your plan without tax penalties at age 55, if you leave your employer in the calendar year you turn 55 or older.

- Required minimum distributions: Generally, you must take minimum distributions from your former employer’s plan beginning at age 72.

Contact your plan administrator to learn more about the terms of your plan, including its fees.

Read Also: How Does A 401k Retirement Plan Work

Roll Over Your Money To A New 401 Plan If This Option Is Available

If you’re starting a new job, moving your retirement savings to your new employer’s plan could be an option. A new 401 plan may offer benefits similar to those in your former employer’s plan. Depending on your circumstances, if you roll over your money from your old 401 to a new one, you’ll be able to keep your retirement savings all in one place. Doing this can make sense if you prefer your new plan’s features, costs, and investment options.

-

- Any earnings accrue tax-deferred.1

- You may be able to borrow against the new 401 account if plan loans are available.

- Under federal law, assets in a 401 are typically protected from claims by creditors.

- You may have access to investment choices, loans, distribution options, and other services and features in your new 401 that are not available in your former employer’s 401 or an IRA.

- The new 401 may have lower administrative and/or investment fees and expenses than your former employer’s 401 or an IRA.

- Required minimum distributions may be delayed beyond age 72 if you’re still working.

When You Don’t Roll Over

Cashing out your account is a simple but costly option. You can ask your plan administrator for a checkbut your employer will withhold 20 percent of your account balance to prepay the tax youll owe. Plus, the IRS will consider your payout an early distribution, meaning you could owe the 10 percent early withdrawal penalty on top of combined federal, state and local taxes. That could total more than 50 percent of your account value.

Think TwiceThe repercussions of taking money out now could be enormous: If you took $10,000 out of your 401 instead of rolling it over into an account earning 8 percent tax-deferred earnings, your retirement fund could end up more than $100,000 short after 30 years.

If your former employers plan has provided strong returns with reasonable fees, you might consider leaving your account behind. You dont give up the right to move your account to your new 401 or an IRA at any time. While your money remains in your former employers 401 plan, you wont be able to make additional contributions to the account, and you may not be able to take a loan from the plan. In addition, some employers might charge higher fees if youre not an active employee.

Further, you might not qualify to stay in your old 401 account: Your employer has the option of cashing out your account if the balance is less than $1,000 though it must provide for the automatic rolling over of your assets out of the plan and into an IRA if your plan balance is more than$1,000.

Read Also: How Does A Solo 401k Plan Work