A Couple Of Things To Remember

You own the money you contribute to your 401 so if you change employers, you can roll it over into your new employers 401 or another qualifying retirement plan account.

Keep in mind that your 401 plan operates on the assumption that you are saving for retirement so once youve put dollars in, there are penalties if you decide to take them out before you reach retirement age.

To withdraw the money means you also miss out on the advantage of time and its effect on compound interest.

Saving early and increasing your contributions as you go can help set yourself up for a secure retirement.

Like what youre reading?

Get articles like this delivered directly to your inbox.

After Establishing The Plan

Once your portfolio is in place, monitor its performance. Keep in mind that various sectors of the stock market do not always move in lockstep. For example, if your portfolio contains both large-cap and small-cap stocks, it is very likely that the small-cap portion of the portfolio will grow more quickly than the large-cap portion. If this occurs, it may be time to rebalance your portfolio by selling some of your small-cap holdings and reinvesting the proceeds in large-cap stocks.

While it may seem counter-intuitive to sell the best-performing asset in your portfolio and replace it with an asset that has not performed as well, keep in mind that your goal is to maintain your chosen asset allocation. When one portion of your portfolio grows more rapidly than another, your asset allocation is skewed toward the best performing asset. If nothing about your financial goals has changed, rebalancing to maintain your desired asset allocation is a sound investment strategy.

And keep your hands off it. Borrowing against 401 assets can be tempting if times get tight. However, doing this effectively nullifies the tax benefits of investing in a defined-benefit plan since you’ll have to repay the loan in after-tax dollars. On top of that, you will be assessed interest and possibly fees on the loan

How Much Do You Need And At What Risk

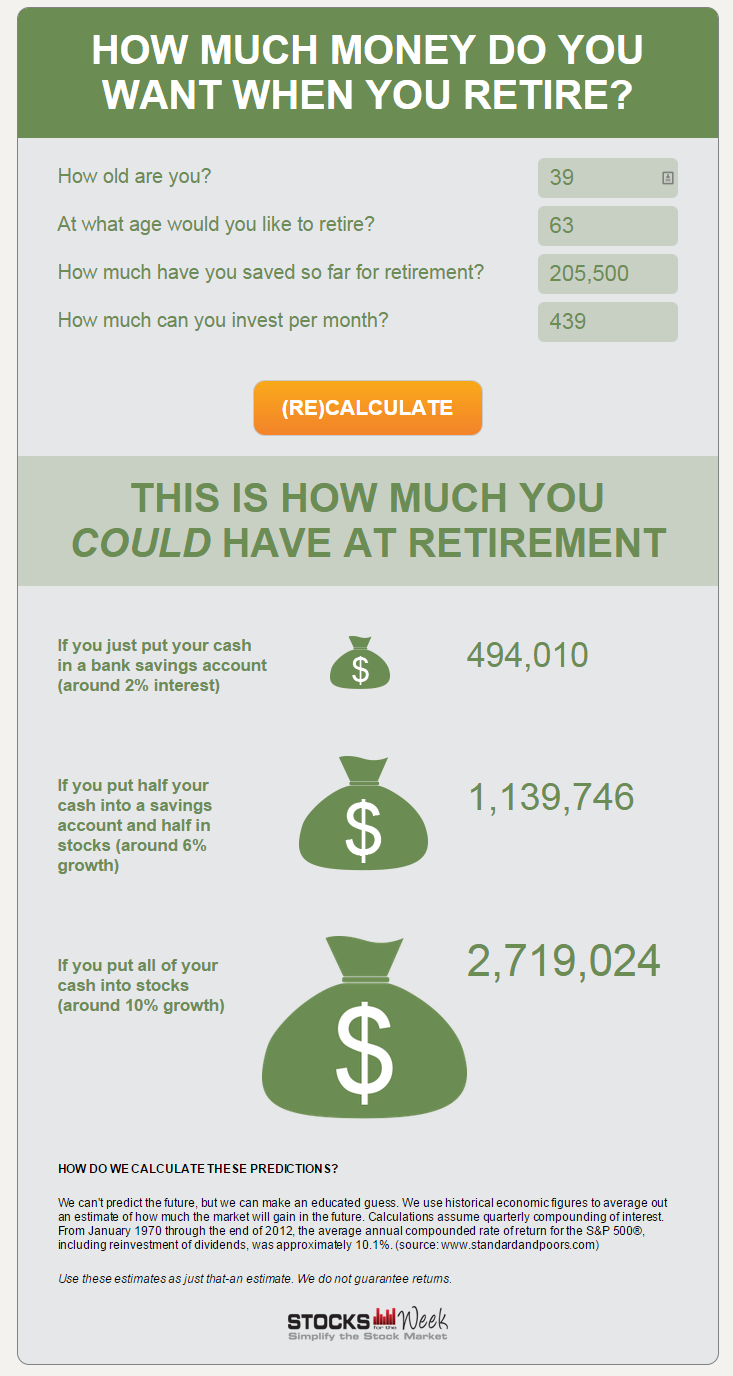

A better start to retirement planning begins with an estimate of how much you will need in retirement. You dont have to be accurate down to the penny but should try to estimate your living expenses to the nearest $50,000 or so. Take your current expenses, deducting those that you wont have in retirement like education and retirement savings, and then add in new expenses for things like travel. The Department of Labor Consumer Expenditure survey can help you see how much people spend on average according to their age.

Any retirement calculator will show you the return needed on your investments to meet your future spending needs given things like age, annual savings and current investments. Your next step is to do a reality check on this number.

If you need a return of more than 10% annually on your investments to meet your retirement goals, you may need to rethink your savings rate or your goals. Aiming for such a high annual rate will force you into riskier investments and may cause you to panic-sell when the markets tumble. A return of between 4% and 6% for a blended portfolio of different assets is a more realistic goal.

Your own tolerance for risk will also play a part in your 401k investing plan. Theres nothing wrong with being a conservative investor, preferring stability to the possibility of higher returns. The biggest mistake you could make is chasing returns to the point that market volatility makes you nervous and leads you to commit bad investing behaviors.

Don’t Miss: Can You Roll Over 403b To 401k

Why Convert Traditional Ira To Roth

A Roth conversion is when you convert the money you have in a traditional IRA into a Roth IRA. This is sometimes referred to as a Roth Backdoor IRA because you are not investing in Roth, you are converting money. Conversion allows you to bypass both income and premium restrictions. This is the back door method of making money with Roth.

Why You Dont Have To Be Afraid Of A Stock Market Crash

As I mentioned earlier, a stock market crash can be a golden opportunity to buy great companies at great prices and make incredible returns.

Even Warren Buffett has said its best to look at market fluctuations as your friend rather than your enemy.

You can do this both in your 401k, or self-directed retirement account, and in a money market account. Keep in mind, you wont be able to buy individual stocks when theyre on sale in your 401k, but you can still take advantage of the low prices and buy when others are running in fear.

Here are a few more tips to help you navigate a stock market crash:

Read Also: What Are Terms Of Withdrawal 401k

How To Protect Your 401k From A Stock Market Crash

Are you riding your retirement on the success of the stock market? If so, its understandable that youre worried about what a crash could mean for your 401k.

If thats you and youre wondering how to protect your 401kfrom a stock market crash, Ive got good news for you:

You dont have to worry.

The stock market is volatile, but you can minimize that risk with the right investing strategy.

If you invest your money the right way, you can not only protect your retirement but also experience even greater returns so your retirement can be even sweeter. Ill show you how to take advantage of stock market volatility, which includes a stock market crash, so you can profit from the fluctuations instead of watching your portfolio take a plunge.

Are you with me?

What Is A Crypto Ira

A Crypto IRA is an Independent Retirement Account, as described above, that primarily invests in cryptocurrency instead of traditional sectors such as equity-bond mutual funds. While investors are limited to traditional investment products tied to cryptocurrencies such as single-asset trusts or digital asset basket funds, there are a handful already available to investors with likely more on the way. This allows average investors the opportunity to make long-term investments in cryptocurrencies through safe, accredited institutions. Gone are the days of the wild west when cryptocurrency investors had to wire funds to non-accredited entities overseas to hopefully buy Bitcoin and not have their funds frozen, lost, or stolen.

In a span of only a few years, the nascent crypto space is now not only tradable on major investing platforms but also includable in traditional retirement accounts. As crypto continues to mature and gain adoption by institutions, investors large and small gain new opportunities to invest in this new and burgeoning space making huge waves in finance, banking, and investing. In addition to greater accessibility and institutional-grade custody, investors are now able to legally and compliantly include crypto in tax-advantaged accounts, providing validation and outsized gains with less or no tax liability.

You May Like: How To Transfer My 401k To My Bank Account

How To Handle 401 Investments

A 401 plan can be a great way to help save for retirement. And while it can be a relatively low-effort way to invest, there are also a lot of moving parts to consider. You may want to consider whether the plan has automatic features, your companys policies, the applicable administrative and management fees, and which allocations might be right for you. It may be wise to consult with a financial advisor to help stay on track for your financial goals.

There are several steps you can take to manage your 401 plan to help meet your retirement goals. Start by understanding your companys matching formula, if applicable, and the potential impact that could have on your savings. Also consider whether your 401 plan has a vesting schedule, which could impact your account balance if you leave your job before a certain period. Finally, consider automating your retirement savings plan and choosing asset allocations that meet your needs.

Reasons To Contribute To A 401

Please fill out all required fields

Email addresses provided will be used only to let the recipient know who sent the web content. The information will not be used for any other purpose by Securian Financial.

Thank you for sharing

Your message has been sent.

If youre employed with a company that offers a 401 plan and you are not participating, reconsider! Consistently contributing to a 401 throughout your working years can help create a secure retirement.

Its not as difficult as you think: Lets say youre starting now at age 25 and your annual salary is $50,000. If you contribute ten percent of your earnings consistently, receive a three percent raise each year and earn an eight percent rate of return on your investment, you could have more than $2 million in your 401 by the time you retire at 65!1

Depending on your employers tax status, your plan may be called 403 or 457. Both are similar to a 401 in how they benefit you.

There are other financial tools available you can use to prepare for retirement, but 401s offer many advantages that other savings and investment vehicles dont. Here are three of them.

1. 401 contributions are before tax money

The amount you choose to contribute to your 401 is deducted from your paycheck before taxes are taken out. As a result, youre paying taxes on a smaller portion of your salary and your overall tax rate may be lower.

2. When you finally pay taxes on your 401, it may be at a lower rate

Recommended Reading: Which 401k Investment Option Is Best

What Are The Benefits Of A 401k

Contributions to a 401k reduces your taxable income by the amount you contribute. Additionally, your investments grow tax-deferred, compounding your earnings over time. However, because most 401ks are traditional, as opposed to Roth accounts, they are not permanent tax shelters and you will need to pay taxes on your investments eventually, typically when you begin receiving distributions during retirement.

Extra Benefits For Lower

The federal government offers another benefit to lower-income people. Called the Saver’s Tax Credit, it can raise your refund or reduce the taxes owed by offsetting a percentage of the first $2,000 that you contribute to your 401, IRA, or similar tax-advantaged retirement plan.

This offset is in addition to the usual tax benefits of these plans. The size of the percentage depends on the taxpayer’s adjusted gross income for the year and tax-filing status. The income limits to qualify for the minimum percentage offset under the Saver’s Tax Credit are as follows:

- For single taxpayers , the income limit is $33,000 in 2021 and $34,000 in 2022.

- For married couples filing jointly, it’s $66,000 in 2021 and $68,000 in 2022.

- For heads of household, it maxes out at $49,500 in 2021 and $51,000 in 2022.

Recommended Reading: How To Borrow From Your 401k

Age : The 7x Recommendation

This is also the time to make a push toward paying off debt to enter retirement owing the minimum amount possible. Live within your means and pay off bills, especially high-interest credit card debt. If you don’t, those monthly payments will eat into your retirement savings later on. Doing so will also increase your credit score and lower your credit utilization rate, which will make it easier to refinance your home at a lower interest rate.

How Much Should I Contribute To My 401

The general rule of thumb is to aim to invest 15% of your gross income into your 401, including your employer match. But the exact target for you depends on your life stage, investing goals, and the aggressiveness of your portfolio. You also may want to combine a 401 with other retirement investment accounts such as a Roth 401 for tax strategy. Talk to an advisor to discuss the right investment plan for you.

Also Check: Can I Buy 401k Myself

Why You Should Invest In A Roth Ira

Once you’ve invested enough money to get the game going, you should consider investing in a Roth IRA if you qualify. Rota IRAs are beneficial because you can withdraw this money tax-free upon retirement. This allows you to diversify your future tax liabilities by having a tax-free and tax-free retirement fund.

How Aggressive Should Your 401 Be

How aggressively you need to invest depends on many factors, but here are some of the most important for determining how to invest:

- Future needs. If you need a lot of money for retirement or want to live an opulent lifestyle, you should invest more aggressively. If your needs are lower, you can afford to be less aggressive.

- Ability to save. If you have a strong ability to save money, then you can afford to take less risk and still meet your financial goals. If you cant save as much, then youll need to be more aggressive with your investments to reach your goals.

- Time horizon. The more time until you need the money, the less aggressively you need to invest. If you have decades until retirement even just a full decade you have a lot of time to ride out the markets fluctuations and take advantage of the compounding power of stocks.

- Risk tolerance. If you have low tolerance for risk, you may not want to be so aggressive, but that means youll need to save more or give yourself more time before retirement to accumulate the level of money that you need.

Those are some of the key factors to consider when determining how aggressively to invest. But many financial advisors would say that investors with decades until retirement could reasonably invest 100 percent of their 401 into diversified stock funds. Others with less than a decade until they need the money may consider becoming more conservative over time.

You May Like: Where To Find My 401k

When Should I Contribute To My Self

So long as you have revenue, you can start contributing the employee portion up to the maximum immediately. Contribute the maximum to your self-employed 401k during the same calendar year. Its up to you whether youd like to contribute in bi-weekly, monthly, quarterly, bi-annually, or random lump sum increments.

For the employer profit sharing portion of your self-employed 401k contribution, you should probably wait until after you do your taxes to figure out your profit and loss. You can always conservatively guesstimate your employer profit sharing contribution if you dont feel the need to be exact.

Just remember the money you do contribute to your self-employed 401k cant be touched until age 59.5. You dont have to contribute the maximum if your liquidity needs are high.

Annuities And Health Savings Accounts

There are other tax-advantaged ways to save after you have maxed out an IRA and 401 account. One option is to consider buying and investing in annuities.

There are many advantages and disadvantages with annuitiesthey can carry high sales loads, typically have high expenses, and sponsors have continually transferred more risk to the investor. All of that said, money in an annuity can accumulate without year-to-year taxation, and it is a worthwhile option if protecting even more retirement savings from the taxman is essential.

Another option, if you have a high-deductible health plan , is to save in a Health Savings Account , a tax-advantaged vehicle you can use if you have this type of health insurance.

Many investorsparticularly higher-income families that can afford to pay the deductibles and young employees in good healthfind these accounts helpful in saving additional retirement funds.

You May Like: How To Search For Unclaimed 401k

How To Stop 401k Contributions And Put Money In Savings

People in a difficult financial situation often consider stopping contributions to their 401 retirement plans either permanently or temporarily. Many financial advisers warn not to stop contributions to your 401 unless your company has stopped matching your contributions or you are close to retirement age. However some employees are temporarily stopping their 401 contributions to put money into savings instead. The process is fairly simple and can be done through the human resources department at your place of employment.

Review Employer Matching Rules

An employer match occurs when a company contributes to your 401 after you put your own money into your account. Companies may match 100% of your contributions up to 4% or your salary or use another system, such as contributing 50% of up to 6% of your salary. Vanguard data, however, shows the median 401 match is 4% of a worker’s salary.

Because requirements can differ, you need to know your individual company’s rules for matching contributions. If you don’t already know how this process works, find out as soon as you can in 2022. That way, you’ll have all year to claim as much of the free money available to you from your employer as possible and you’ll know exactly what you need to do in order to do that.

You May Like: How To Calculate Employer Contribution To 401k

What You Can Do If Your Portfolio Is Too Aggressive

Investors who find their portfolio is too aggressive have potential fixes for this issue that range from simple one-time moves to an overhaul of your financial plan with a financial advisor.

The first step is to take down the risk in your portfolio by moving some exposure in stock funds into bond funds or even cash, depending on when you need the money.

One good path is to find an asset allocation between stocks, bonds and cash that meets your needs and temperament. A more aggressive allocation might have 70 percent or more in stocks, while a more conservative one might have that much in bonds. Then stick with this allocation and rebalance it when it moves too far away from your target allocation.

This means that often a market correction is a good time to shift more to stocks, not less, says Carver. The key is sticking with a target allocation which eliminates the need to make decisions based on market behavior or predictions.

If youre managing the portfolio yourself, Johnson recommends starting the risk reduction perhaps as much as five years before youll want to access the portfolio. That doesnt mean you need to go all cash and bonds, but rather gradually move the portfolio toward lower total risk.

Another good option is to meet with your own advisor and your companys 401 advisor each January, says Paul Miller, managing partner at accountancy Miller & Co. in the New York City area.