Roth Conversion: Things To Be Aware Of

Roth IRAs have a 5-year aging rule which requires you to wait 5 years after your first Roth IRA contribution before you can withdraw earnings tax-free in retirement or qualify for an exception to the 10% penalty.

There’s also a 5-year waiting period for conversions money). In this case, if you are under the age of 59½, you’ll need to wait 5 years before you can withdraw that money without incurring a 10% penalty. Note that this only applies to taxable money that was converted it does not apply to any balances that were not taxable when converted.

Another important fact to understandthere’s no way to undo a Roth conversion.

Before the Tax Cuts and Jobs Act was enacted in December 2017, you could undo a Roth conversion. That option is no longer available.

Finally, investors should be aware that taxes are not the only factor when it comes to rolling funds from a 401 plan to an IRA, of any type. There may be considerations related to fees, investment choices, creditor protection, RMDs, and other factors that need to be weighed in deciding whether a rollover is appropriate for you. Consider consulting a financial advisor before making any decisions.

Complete The Rollover Before Earnings Accrue

You want to roll over your money as soon as possible because you want to minimize the likelihood your funds see any investment returns as these will be taxed in the conversion.

If your after-tax contributions do end up generating investment growth, the IRS allows you to split up the funds, rolling the after-tax contributions into a Roth IRA and the investment earnings into a traditional IRA.

Can I Transfer My Roth 401 To A Roth Ira

Generally, once you leave the employer, you can transfer your Roth 401 into a Roth IRA. You will need to be careful not to inadvertently move any pre-tax money thats in your 401 into a Roth IRA because this would trigger a taxable event. If you wanted to avoid any additional tax, but you decide to move all of the money out of the 401 is the best decision, you would need to move traditional money into a traditional IRA. Then the Roth money would go into a Roth IRA to keep the same tax treatment in place.

You May Like: How Much Is The Maximum Contribution To 401k

Should You Convert To A Roth 401

If your company allows conversions to a Roth 401, youll want to consider two factors before making a decision:

Why Might You Consider An In

When you have a 401, you dont have maximum control over the types of assets you can hold, such as mutual funds, stocks, and bonds. You typically have a limited menu of options.

Through an in-service rollover, transferring some or all of your 401 funds to a personal IRA can open up more options for your assets. For instance, you might be able to put money into alternative assets like precious metals . A bonus is that you usually can keep contributing to your employers 401 after youve moved funds to an IRA.

Furthermore, an in-service rollover enables your personal financial advisor to provide more hands-on help since at least some of your assets are in an IRA that you control and not in an employer-sponsored 401 that could come with strings attached.

Plus, some 401 plans have annual fees with their options that are way above average. If youre stuck in one of those, you can minimize your costs by rolling your 401 money into an IRA with a lower-cost fund company, explains Rick Salmeron, a certified financial planner.

On top of that, you might be permitted to make tax-free withdrawals from an IRA that you wouldnt be able to make from a 401.

With your funds in an IRA, you are the account owner and have more control over your assets, free from the restrictions your employer-sponsored plan can impose, Salmeron adds.

Also Check: Can Anyone Have A 401k

Don’t Miss: How To Find A Deceased Person’s 401k

Can You Roll An Ira Into A 401

posted on

If you have multiple retirement accounts, you can often move money between them without tax consequences, and you might want to combine accounts for several reasons. The most common move is to roll from your 401 to an IRA, but its also possible to do the opposite: You can roll a pretax IRA into a 401.

There are pros and cons to everything, and that includes moving an IRA into your 401 or 403b. You might like the investment choices better, or your employers retirement plan might have less expensive investments. Simplifying is another reason to transfer IRAs to a 401: Clean up those old accounts instead of spending mental energy and time to keep track of multiple accounts.

How To Roll Over Your 401 To A Roth Ira

Rolling over your 401 plan to a Roth IRA is a taxable event. Youll have to pay income tax on your contributions, your employer-match contributions and all earnings. Depending on the size of your account, this could push you into a much higher tax bracket, so you shouldnt proceed before youve done the math. You may also want to consult a financial advisor to make sure this move is the right one for you.

You May Like: How To Cancel 401k Plan

Rollover To Ira: How To Do It In 4 Steps

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

A 401 rollover is a transfer of money from an old 401 to an individual retirement account or another 401. You’d most likely need to do a rollover when you leave a new job to start a new one, and if you’re in this situation, you likely have a few options, such as rolling your old 401 into your new workplace 401, or cashing it out.

This article focuses on rolling a 401 over to an IRA, which is a great way to consolidate your retirement accounts and keep an eye on your investments.

Who Can Do A Roth Ira Conversion

Regardless of income or marital status, anyone can convert their qualifying IRA holdings to a Roth IRA. Prior to 2010, account owners may only convert if their modified adjusted gross income was less than $100,000.

Despite its benefits, Roth may not be the best choice for every investor. Before deciding whether conversion is correct for you, you should think about three essential factors: taxes, time, and costs. The Roth IRA FAQs from Fidelity can help you balance these issues and obtain answers to any queries you might have. If you have any questions about your personal situation, talk to your tax counselor.

Its also worth noting that if you have to make a required minimum distribution in the year you convert to a Roth IRA, you must do it first.

Read Also: How Much Can One Contribute To 401k

Can You Buy An Ira At A Bank

2. Choosing where to open your IRA. You can open an IRA at most banks, credit unions and other financial institutions. However, IRAs are also available through online brokers, mutual fund providers and other investment companies such as Vanguard and Fidelity.

What banks offer IRA accounts?

As noted above, IRAs are offered by many institutions, from national banks like Citi and Chase to investment firms like Fidelity and Charles Schwab. In addition, a new generation of online investment platforms, such as Betterment and Wealthfront, cater to those who want a hands-on experience to save for retirement.

Can I get an IRA at a bank?

You can open an IRA at most banks and credit unions, as well as through online brokers and investment firms. If you already make automatic contributions to a 401 account through your employer, you might wonder if you also need an IRA.

Dont Miss: Can I Buy Individual Stocks In My 401k

What Are The Benefits Of A Roth Ira

A major benefit of a Roth individual retirement account is that, unlike traditional IRAs, withdrawals are tax free when you reach age 59½. You can also withdraw any contributions, but not earnings, at any time regardless of your age.

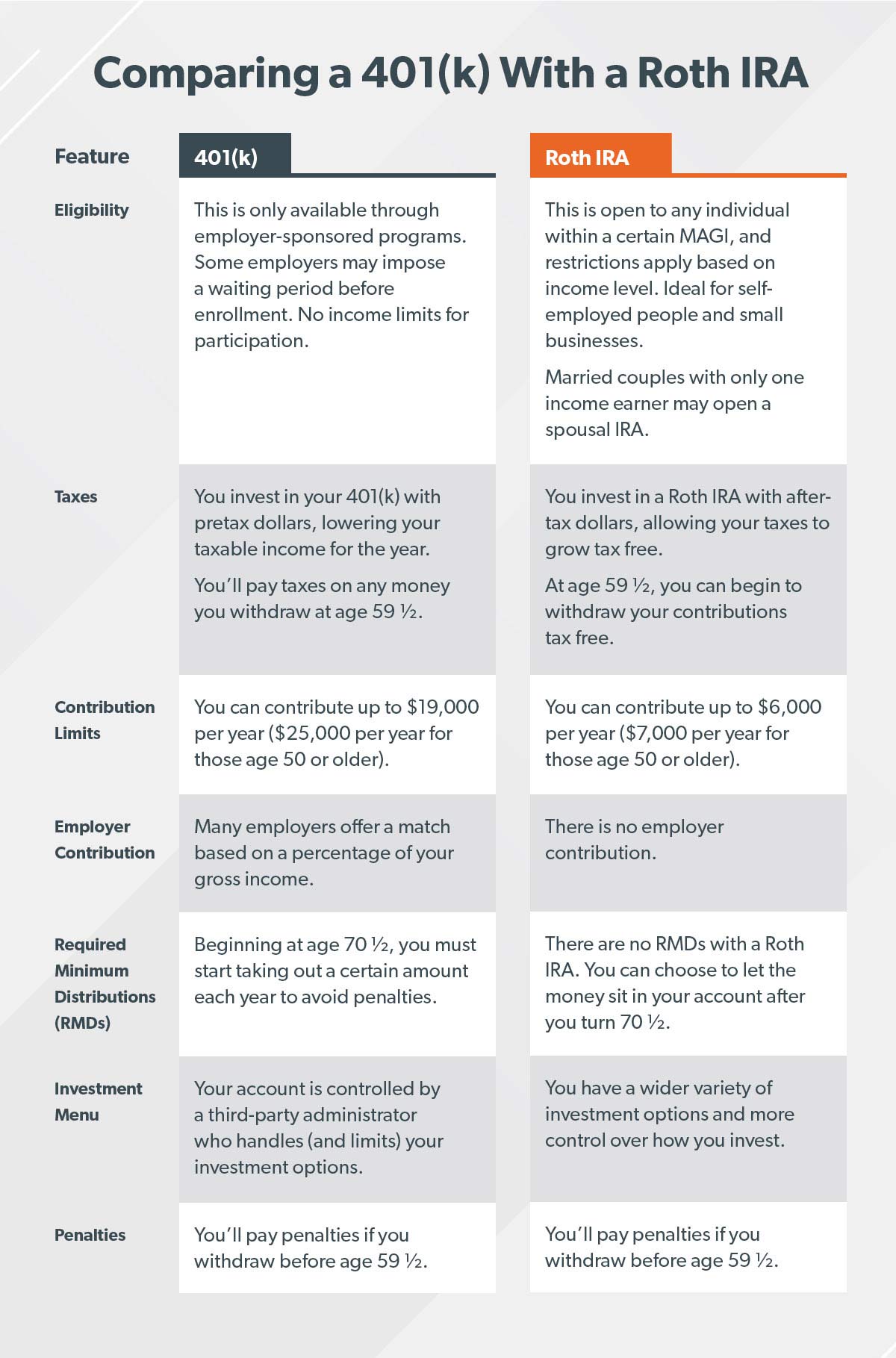

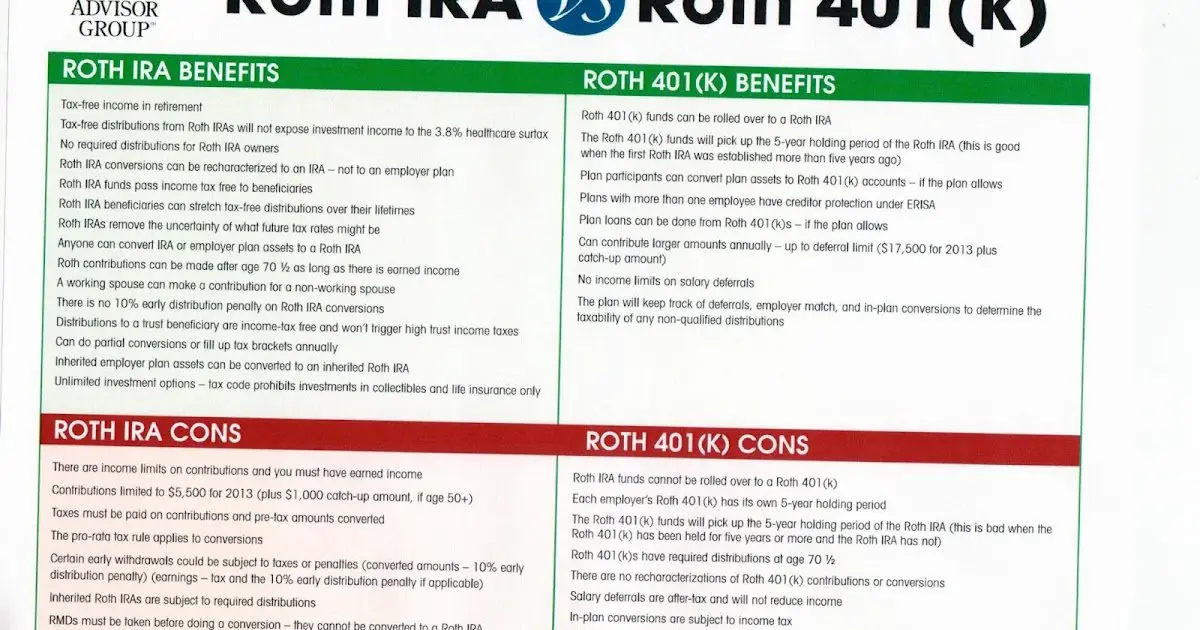

In addition, IRAs typically offer a much wider variety of investment options than most 401 plans. Also, with a Roth IRA, you dont have to take required minimum distributions when you reach age 72.

Don’t Miss: How To Transfer 401k To Another 401 K

Advantages Of Payroll Deduction Iras

Once your employer has established a relationship with your desired payroll deduction IRA provider, youll need to sign a document authorizing your company to transfer money from each paycheck into your IRA. To determine a contribution amount, consider retirement saving guidelines like putting away 15% of your paycheck for retirement. If you cant afford that amount now, you can start smallerlike $100 each month. Just make sure you arent contributing more than $6,000 a year .

Video advice: 401k VS Roth IRA

There Are Roth Ira Contribution Limits

To be able to contribute to a Roth, you must have earned income. You are also limited to stashing up to $6,000 in a Roth IRA and an extra $1,000 if you’re 50 or older for 2021. Those amounts are staying the same for 2022. You can contribute to both Roth and traditional IRAs, but the total cannot exceed this annual limit.

But higher-income taxpayers are barred from contributing to a Roth IRA. For 2021, the ability to contribute to a Roth phases out if your adjusted gross income is between $198,000 and $208,000 for joint filers and between $125,000 and $140,000 for single filers. For 2022, your ability to contribute will phase out between $204,000 and $214,000 for joint filers and $$129,000 and $144,000 for single filers.

You can make a 2021 Roth IRA contribution as late as April 18, 2022.

Recommended Reading: What Is Max Amount You Can Put In 401k

How Much Are Vanguard Fees For Roth Ira

Cost is just one of many factors that affect profitability. The company also does not charge an inactivity fee for all IRAs. However, Vanguard charges a $20 annual service fee for regular accounts with balances less than $50,000. There are also annual Go fees: $25 for the SINGLE IRA, $15 for the 403 plans, $20 for the single 401/Roth 401 plans, and $20 for the 529 plan .

Question 8 Of : How Do I Avoid Taxes On A Roth Ira Conversion

Read Also: How To Find Out If Deceased Had 401k

Roth 401 Vs Traditional 401 For High

What do you do after youve maxed out your traditional 401? If your employer offers a Roth 401 then you could consider using it to set aside some post-tax retirement savings. Unlike Roth IRAs, both 401s and Roth 401s dont have income phase-out limits. So if you dont qualify for a Roth IRA because your income is above IRS income limits you can make after taxes contributions to a Roth 401.

Who Should Consider A Mega Backdoor Roth

Before you get too excited about the ability to go above and beyond the typical $6,000-$7,000 per year Roth IRA contribution limits, its important to understand that a mega backdoor Roth strategy is only suited to certain investors.

Brent Weiss, CFP, co-founder of Facet Wealth, outlines the following scenarios when a mega backdoor Roth might make sense for you:

You have already maxed out your traditional 401 contributions.

You are ineligible for direct Roth IRA contributions because your income is too high.

You would like to contribute more money than the annual IRA limits.

Youve already taken care of other key financial goals, like paying down debt, saving for college or saving for shorter-term objectives.

You have sufficient extra income or money to contribute on an after-tax basis.

Your companys 401 plan allows for both after-tax contributions and in-service withdrawals to a Roth IRA or transfers to the Roth 401 portion of the plan.

Its important to not adversely affect other areas of your financial life when deciding to contribute after-tax dollars, says Weiss.

Recommended Reading: How To Protect Your 401k In A Divorce

Converting A 401 To A Roth Ira

You can also convert traditional 401 balances to a Roth IRA. Generally, you’ll only be able to transfer a 401 to a Roth IRA once you’ve left the company that provided the 401 or once you reach the age of 59½, which is the age most plans allow for in-service withdrawals. That’s not always the case, however, so check the rules of your employer’s 401 plan.

Another option that may be available to you: an in-plan Roth conversion. If your employer offers a Roth 401 option, you may be able to convert your existing pre-tax and after-tax balances to a Roth account within the plan. Some employers even offer an auto-convert feature inside their plan. You can set it up so that any after-tax contributions are automatically converted to a Roth 401 at regular intervals.

Taxes on a 401 to Roth IRA conversion depend on the type of contributions involved:

Pre-tax contributions onlyIf your 401 account is composed entirely of pre-tax money , then you’ll be subject to current-year income tax on the entire amount converted to a Roth IRA.

After-tax contributions onlyIf the contributions made to your 401 account were made entirely in after-tax dollars, you can roll them directly into a Roth IRA, as long as any tax-deferred earnings associated with them are also distributed from your employer-sponsored plan at the same time to another eligible retirement plan.

Read Viewpoints on Fidelity.com: Rolling after-tax money in a 401 to a Roth IRA

You Want To Increase Your Tax Diversification

Contributions to traditional IRAs are tax-advantaged, meaning you wont pay taxes on your invested funds until you begin taking withdrawals at retirement. Roth IRAs, on the other hand, are taxed up front but offer tax-free withdrawals after age 59 ½. If youre unsure how your tax and income situation might pan out in the future, having both types of accounts a traditional IRA and a Roth IRA is a smart move in terms of diversifying your future tax exposure.

Read Also: How To Get My 401k From A Previous Employer

What Should I Do If I Have To Choose Between A Roth 401 Or A Roth Ira

If your finances put you in a position where you have to choose between a Roth 401 and a Roth IRA:

A Roth 401k might be better for you if: Your employer plan allows Roth contributions and you want to put away more than $6,000 of Roth money towards retirement each year. In addition, if your income puts you over the Roth IRA contribution limits, this allows you to still contribute Roth money towards retirement.

A Roth IRA might be better for you if: You qualify for Roth IRA contributions and you want the flexibility that comes with a Roth IRA account . If you already get your employer match and can still put funds towards retirement, maxing out your Roth IRA each year is a great idea.

Another consideration is the type of investments available to you. With a Roth 401, your investments are limited to the ones available in your 401 plan. It can be great, or it can be sub-par. With a Roth IRA, you have control over the funds you can invest in. But a powerful tool can be a double-edged sword, and its best to consult a financial planner when making investment decisions.