How To Figure Out Your 401k Expenses

Also, I ran across a nice 401K expense calculator in Money magazine this month that I thought I would share.

Step 1: Tally Administrative Costs

- Go to your plans summary annual report. Find the basic financial statement section.

- Subtract benefits paid from total plan expenses.

- Divide that number by the total value of the plan.

- This number is your plans administrative cost.

Step 2: Calculate Investment Fees

- Multiply your fund expense ratio by your balance in the fund.

- Divide those total fees by your total balance.

- This number is your investment expense.

- *If you have only one fund , your investment expense ration is the ratio on this one fund.

Step 3: Add Administrative and Investment Fees

So what are your thoughts about 401K fees and the rating system provided by BrightScope? Let me hear from you in the comments below

How Do I Log In To My Fidelity Account

You can get to the homepage by clicking on the Fidelity logo in the top left. Here you will be asked to enter the username and password you created. If this is the first time you are logging into your account online, you will need to click on the Register for online access button which is also in the top right hand corner of the homepage.

Investing In You And Your Future

After one year of service American will provide you with an employer contribution to your 401 account. The amount contributed will depend on your workgroup.

Team members with prior service or who transfer to American from one of its wholly owned subsidiaries will have their prior service at the subsidiary credited towards the one-year eligibility requirement and toward the service requirement for vesting full ownership of your 401 account balance.

American will contribute 16% of your eligible compensation to your 401 account up to the IRS limits. Participation is automatic, and you will be eligible for this nonelective company contribution* after completing one year of service.

If you do not have an investment election on file, your nonelective company contributions will be made to the Target Date Fund closest to the year you will turn age 65.

You are always 100% vested in your contributions, the nonelective company contributions and any associated earnings.

*A nonelective company contribution is a contribution to your 401 account that the company makes regardless of whether you are making your own contributions.

Flight Attendants receive a nonelective company contribution*, plus you are eligible to receive matching company contributions based on your eligible compensation. You become eligible to receive the following employer contributions after completing one year of service:

TWU-designated team members

IAM-designated team members

Also Check: How To Find My 401k Money

How Do I Find Out My 401 Fees

401 fees are listed in different places, depending on whos charging them.

-

401 provider fees: The fees charged by your companys 401 plan administrator will be listed by the administrator directlyusually on their website or in the informational material given to you when you first enroll in the plan. Like we mentioned, these fees are sometimes covered by your employer, or you might have to pay them yourself.

-

Front-end and back-end loads: You can see a specific funds front-end and back-end loads in its prospectus, which is available on the SECs website as well as on services like Morningstar. Prospectuses are always available to you before, during, and after you hold shares in the fund. No-load funds” are funds that charge neither a front-end nor a back-end load, but some still charge a 12b-1 fee .

-

Operating expenses: 12b-1 fees, investment management fees, and miscellaneous other annual fees are all gathered into one figure: the 401 expense ratio. This figure is expressed as a percentage of the average AUM. For example, if youve invested $10,000 in a fund with a 5% expense ratio, youll pay $500 a year in fees. In most cases, the annual gross expense ratio for 401 is the same amount as the net expense ratio. However, if there are waivers and reimbursements affecting the gross expenses, the gross expense ratio for a 401 plan may be higher.

Why Are 401k Fees So Hard To Find

Simply put, 401K administrators make it hard to find fees. And before you think Im picking on 401Ks, it applies to Roth IRA and Traditional IRA fees as well. When you first go searching for your 401K plan fees, it can be pretty frustrating. Its not like your 401K administrator or employer sends you a bill at the end of the year that says heres how much you owe us for managing your retirement. Wouldnt it be nice if they treated us this way? But they dont. My opinion is that this setup is a result of the transition from employer-controlled pension funds to employee-directed 401K plans.

Back when there were no 401K plans, there were pension funds. Employers controlled everything with regard to your retirement assets. When the 401K was created, investment companies stepped up to fill the gap as administrators. They, along with the company, set the rules about how to report information to you. Unfortunately, this meant making expenses an afterthought in their communications with employees. And as long as they werent asking, the employers and administrators werent talking about the expenses.

Also Check: Is Fidelity A 401k Plan Administrator

Estimate Your Plan Costs

Start by examining your 401 account statement, which is available online or mailed to you on at least a quarterly basis. You will also receive a participant fee disclosure notice at least annually that provides the total expenses of your plan. These documents will show your funds expense ratios as well as your plans administrative fees, Herman says.

Its also important to check for any red flags that may indicate that your costs are higher than they should be. For example, some funds charge an additional layer of expense called 12b-1 feesthese are partially used for marketing costs and typically run 0.25 percent a year. That information may be lumped in with the expense ratio, making it hard to spot. But you can find it broken out in the funds prospectus, as well as in the annual report, along with any commissions to buy and sell the fund.

What to do: Once you know your 401 plans all-in costs, see how they stack up compared with plans of similar size. As a guideline, very large plansthose offered by Fortune 500 companies, for exampletypically charge rock-bottom fees that average 0.5 percent or less, says Bob Morrison, a fee-only certified financial planner with Downing Street Wealth Management in Denver.

By contrast, plans run by small businesses, which lack economies of scale, may cost 1.5 percent to 2 percent. You may be able to find specific cost comparisons for your companys plan at BrightScope.

How Do I Complete The Account Transfer Form

Open your new account online and follow the step-by-step tutorial.- To transfer to an existing TD Ameritrade account, print the Account Transfer Form and follow the instructions below:

Guidelines and What to Expect When TransferringBe sure to read through all this information before you begin completing the form. Contact us if you have any questions.

Information about your TD Ameritrade Account Write the name/title of the account as it appears on your TD Ameritrade account. If you do not already know the number of the TD Ameritrade account into which you are transferring, leave the account number section blank.- You must complete the Social Security Number or Tax ID Number section because your transfer cannot be processed without this information.

Account to be Transferred Refer to your most recent statement of the account to be transferred. Be sure to provide us with all the requested information.

Transfer Instructions

You May Like: How Does Taking Money Out Of 401k Work

Also Check: Where To Check 401k Balance

Use A Brokerage Window

If your plan offers a brokerage window, which is the ability to trade offerings of a brokerage house such as TD Ameritrade, Schwab or Fidelity through your 401, you likely have access to virtually unlimited investment options including low-cost, exchange traded funds . And your 401 plan’s brokerage window may even offer dozens of ETFs that can be bought with no trading commissions, depending on the sponsor. portfolios via a brokerage window for our clients. We absolutely love them.)

You don’t have to be a math whiz to see that over time, the compounding effect of asset-based revenue sharing can unnecessarily put your retirement portfolio in critical condition. If you have a 401 balance of $50,000 or more, act now before more of your hard-earned money bleeds out.

Ron is the founder and CEO of ONE Retirement, an independent advisory firm focused on managing clients’ retirement assets.

Contributing To Your Mit 401 Account

You contribute to your 401 account through deductions from your MIT paycheck. You can contribute pre-tax dollars, Roth post-tax dollars, or a combination of both. You may change your contribution preferences any time through Fidelity NetBenefits.

Your contributions are sent to Fidelity Investments at the end of each pay period. You may contribute as little as 1% and as much as 95% of your salary after amounts for Social Security and Medicare taxes and health and dental insurance have been subtracted. You may start, stop, or change your deferral or investment elections at any time.

Federal law limits the amount of your pay each year that may be recognized for determining your allowable contribution. In 2021, MIT can consider only the first $290,000 of pay for calculating your allowable contributions. This means that if your annual compensation exceeds $290,000, MIT Payroll will take 401 deductions from your pay until your pay for the year reaches $290,000, or one of the other 401 program limits has been reached .

Contribution limits

What MIT contributes to your 401 Plan

- MIT matches your 401 contributions dollar-for-dollar up to the first 5% of your MIT pay .

- MIT only contributes a match during months in which you have made a contribution

- The MIT match is provided pre-tax, and therefore is fully taxable when you withdraw your matching contributions from the plan, along with associated investment earnings.

When contributions are invested in your 401 account

Read Also: What Employees Can Be Excluded From A 401k Plan

Benefits Of The Mit 401 Plan

When you enroll in and contribute to your 401 account, you are 100% vested that is you fully own your contributions, MITs matching contributions, and all interest earned on the investments you choose through the Plan.

In addition, you receive tax benefits when you contribute to your MIT Supplemental 401 account. You can choose when you receive your tax benefits right away, with pre-tax contributions, or later on, with Roth post-tax contributions.

Save on a pre-tax basis and receive tax benefits now

- Your 401 contributions are deducted from your paycheck before taxes are applied, reducing your current taxable income and therefore your taxes.

- In retirement, you will pay federal and state income taxes on any amount you withdraw from the plan.

Save on a post-tax basis and receive tax benefits later

- Your 401 contributions are taken out of your paycheck after federal and state income taxes have been applied, so they will not reduce your current taxable income or your taxes.

- In retirement, you will pay no taxes on any amount you withdraw as long as you take the distribution after age 59½ and at least 5 years after the first Roth contribution was made.

What Are Your Choices For A Rollover

In general, once you leave a job you have three choices for how to deal with your employer-sponsored retirement plan:

- Leave it with your old employers 401 plan: This approach requires the least amount of work, but may require you to have a minimum amount if you plan to maintain the account there.

- Roll it over into your new employers 401 plan: This approach will require you to file some paperwork, but youll have all your 401 money in one place. This choice can make sense if you like your new employers plan.

- Roll it over into an IRA: This move will require you to file some paperwork, but then youll have the complete freedom to invest the money as you see fit. If you liked the investment options you held in a previous plan, you may still be able to access those via an IRA.

, thats another option for a rollover. But this option is not typical for most individuals.)

If you roll over your 401 into an IRA, youll also want to consider the kind of rollover you need.

- With a Roth 401, youll likely be more interested in a Roth IRA, so that you can maintain the substantial advantages of that plan.

- If you have a traditional 401, then youll probably opt for a traditional IRA.

Don’t Miss: How To Open A 401k Self Employed

What To Do With A Lost Retirement Account When You Find It

Once youve found a lost retirement account, what you do with it depends on what type of plan it is and where its located.

Old 401k balances can be rolled into your current employers plan or rolled into an IRA in a trustee-to-trustee transfer. You can also request a payout of the plan balance, but if you are under the age of 59.5, the payout will be subject to income taxes and a 10% penalty for early withdrawal.

If you find an old pension through the PBGC, youll have to go through a process to verify your identity. Once the PBGC has established that you are owed the benefits, you can apply for them at any time once youve reached retirement age.

Its not uncommon for former employees to leave funds in a former employers retirement plan, believing theyll get around to dealing with it later. Years pass by, and maybe youve forgotten about a few old accounts. Even if they didnt amount to much at the time, a few hundred dollars here and there combined with some market growth over the years just might add up to a nice addition to your retirement savings. Its worth a look!

Also Check: How Do I Transfer My 401k To A Roth Ira

What If Your Companys 401k Is Not Yet Rated By Brightscope

The company I work for has not been rated by BrightScope just yet. Mike assured me that they are getting to it. But he also pointed out that I can help. You can actually submit data to BrightScope. Click on the Provide Us with Data link and youre taken to a page where you can upload specific plan documents. This will help BrightScope provide a rating for your company faster.

You can still find out your 401K plan fees by completing a Personal 401K Fee Report. Its free to complete and will shed some light on the expenses of the funds in your 401K.

Also Check: How Do I Start A Solo 401k

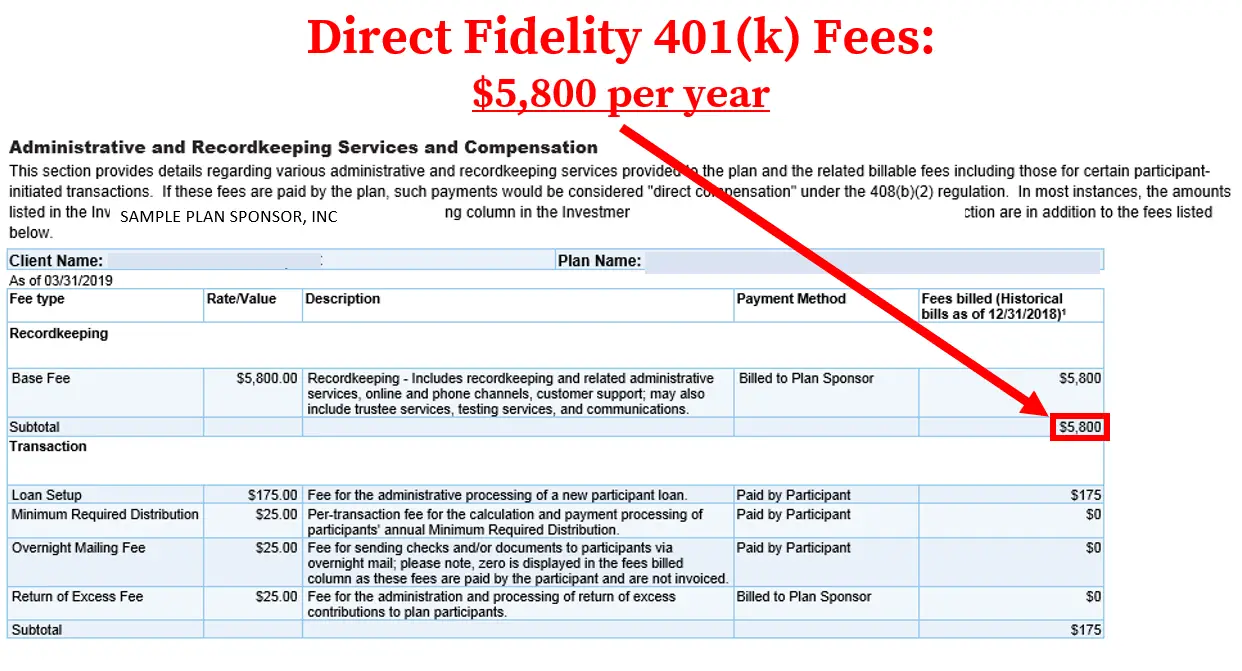

Dont Let Your Fidelity 401 Fees Get Out Of Hand

Even if yours are below average now, Fidelitys revenue sharing can cause them to very quickly become excessive as assets grow. For this reason, its crucial that you compare your plans fees on a regular basis.

Too much trouble? Weve got a solution.

Simply switch to a 401 provider that charges fees based on headcount not assets – to the extent possible. Such a fee structure will make it easier for you to keep your 401 fees in check as your plan grows. You just might save some money while youre at it.

About Eric Droblyen

Eric Droblyen began his career as an ERISA compliance specialist with Charles Schwab in the mid-1990s. His keen grasp on 401k plan administration and compliance matters has made Eric a sought after speaker. He has delivered presentations at a number of events, including the American Society of Pension Professionals and Actuaries Annual Conference. As President and CEO of Employee Fiduciary, Eric is responsible for all aspects of the companys operations and service delivery.

- Connect with Eric Droblyen

Be Prepared To Print Scan And Mail Things

Oh, and possibly get them notarized as well.

TIAA-CREF allowed me to sign and scan the necessary documents, and send them back via their messaging service.

Vanguard, and the retirement plan for Ohio public employees, did not. Vanguard required a signature and that I mail the form back to them. The public employees fund, on the other hand, required that I sign and get the document notarized before either mailing or faxing it back to them.

Why is this all required? Because of the Retirement Equity Act of 1984!

That law, signed by Americas Handsome and Senile Grandpa, Ronald Reagan, was passed to keep people from screwing over their spouses. Thus, to roll over your 401, start taking withdrawals, or change beneficiaries, you have to get your spouses signature. And if youre not married, youve got to swear to your singleness in writing.

The particulars of proving that you are acting with the approval of your spouse vary from plan to plan. Some might simply require a signature others require notarization. If youre not married, some nice plan administrators might allow you to just swear to that by checking a box.

If you dont have a scanner at home , then there are several iPhone or smartphone apps that will do. .

All of this is crazy annoying, and counter to our expectation that transactions be smooth and seamless. But theres often a lot of money on the line in these transactions, and those plans dont want to be responsible for money being moved when it shouldnt be.

You May Like: How To Claim 401k From Previous Employer