When A Problem Occurs

The vast majority of 401 plans operate fairly, efficiently and in a manner that satisfies everyone involved. But problems can arise. The Department of Labor lists signs that might alert you to potential problems with your plan including:

- consistently late or irregular account statements

- late or irregular investment of your contributions

- inaccurate account balance

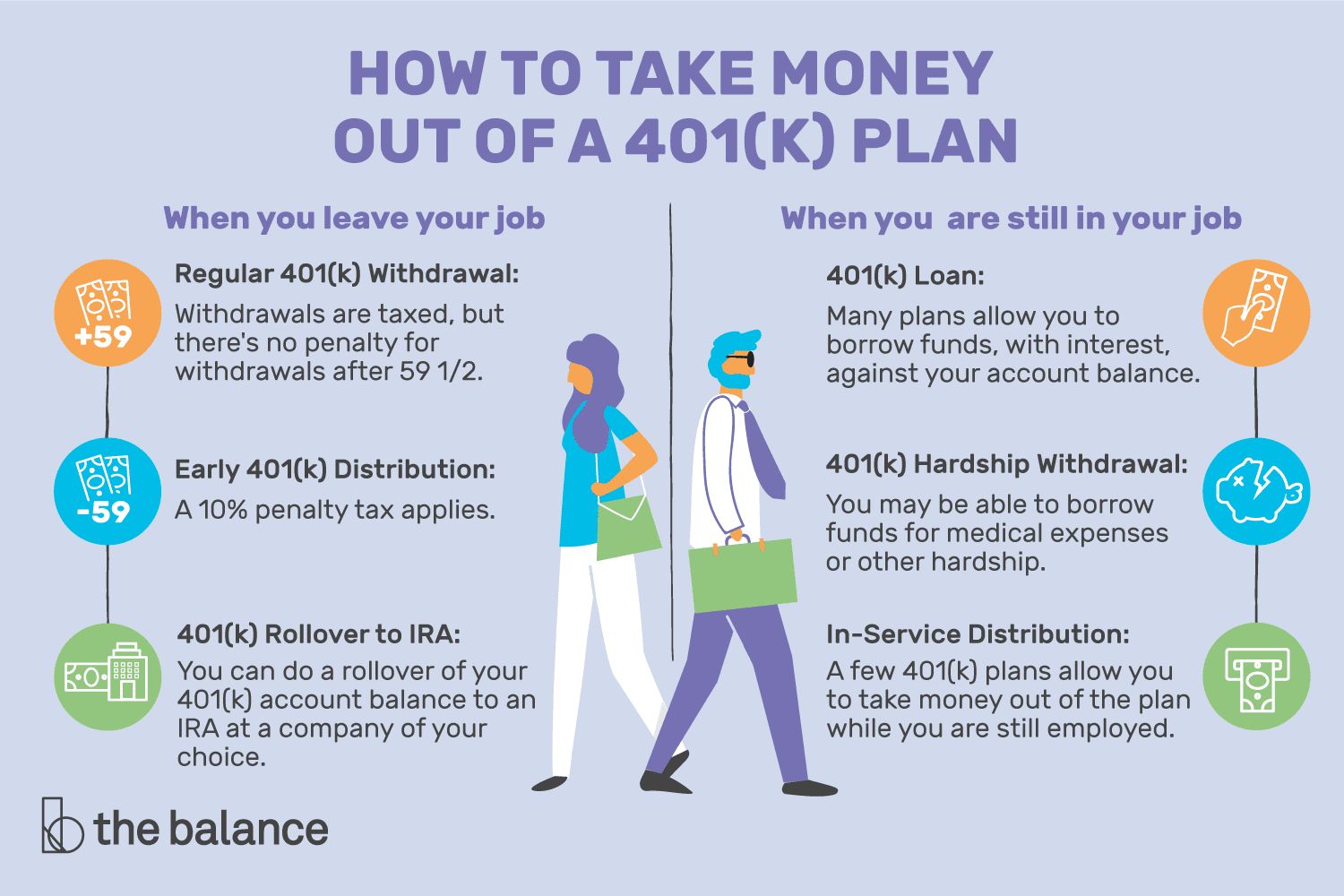

Can I Borrow From My 401k To Buy A House

Youre allowed to take out a loan from your 401k or IRA. You will be borrowing money from yourself and then paying yourself back with interest.

The 401k loan will be required to be paid back, usually automatically deducted from your paychecks. It has a tax advantage over a typical early withdrawal from your 401k without paying it back.

When you withdraw early, you will be charged a 10% tax penalty. If you get a loan and promise to repay the amount, you will not be charged a penalty tax.

As with any loan, interest accumulates on the amount borrowed. However, since it is your money, the interest is paid back to yourself, added to your 401k balance, and not paid to a lender.

You will need to talk to your plan administrator about a hardship withdrawal to purchase a home.

How much can I borrow?

- $50,000, OR

- 50% of your 401 account balance

- If the account balance is less than $10,000, you can borrow up to $10,000 up to your account balance

Tips On 401 Withdrawals

- Talk with a financial advisor about your needs and how you can best meet them. SmartAssets financial advisor matching tool makes it easy to quickly connect with professional advisors in your local area. If youre ready, get started now.

- If youre considering withdrawing money from your 401 early, think about a personal loan instead. SmartAsset has a personal loan calculator to help you figure out payment methods.

Read Also: Can I Borrow Against 401k

Why Did Gethuman Write How Do I Withdraw My Retirement Or 401k Money From My Merrill Lynch Account

After thousands of Merrill Lynch customers came to GetHuman in search of an answer to this problem , we decided it was time to publish instructions. So we put together How Do I Withdraw My Retirement or 401k Money from My Merrill Lynch Account? to try to help. It takes time to get through these steps according to other users, including time spent working through each step and contacting Merrill Lynch if necessary. Best of luck and please let us know if you successfully resolve your issue with guidance from this page.

Eligibility For A Hardship Withdrawal

The Internal Revenue Service ‘s immediate and heavy financial need stipulation for a hardship withdrawal applies not only to the employee’s situation. Such a withdrawal can also be made to accommodate the need of a spouse, dependent, or beneficiary.

Immediate and heavy expenses include the following:

- Certain medical expenses

- Home-buying expenses for a principal residence

- Up to 12 months worth of tuition and fees

- Expenses to prevent being foreclosed on or evicted

- Burial or funeral expenses

- Certain expenses to repair casualty losses to a principal residence

You wont qualify for a hardship withdrawal if you have other assets that you could draw on to meet the need or insurance that will cover the need. However, you needn’t necessarily have taken a loan from your plan before you can file for a hardship withdrawal. That requirement was eliminated in the reforms, which were part of the Bipartisan Budget Act passed in 2018.

The $2-trillion coronavirus emergency stimulus bill signed into law on March 27, 2020, allows those affected by the coronavirus situation a hardship distribution to $100,000 without the 10% penalty those younger than 59½ normally owe account owners have three years to pay the tax owed on withdrawals, instead of owing it in the current year.

Don’t Miss: How Much Can You Save In 401k Per Year

Dividing Your 401 Assets

If you divorce, your former spouse may be entitled to some of the assets in your 401 account or to a portion of the actual account. That depends on where you live, as the laws governing marital property differ from state to state.

In community property states, you and your former spouse generally divide the value of your accounts equally. In the other states, assets are typically divided equitably rather than equally. That means that the division of your assets might not necessarily be a 50/50 split. In some cases, the partner who has the larger income will receive a larger share.

For your former spouse to get a share of your 401, his or her attorney will ask the court to issue a Qualified Domestic Relations Order . It instructs your plan administrator to create two subaccounts, one that you control and the other that your former spouse controls. In effect, that makes you both participants in the plan. Though your spouse cant make additional contributions, he or she may be able to change the way the assets are allocated.

Your plan administrator has 18 months to rule on the validity of the QDRO, and your spouses attorney may ask that you not be allowed to borrow from your plan, withdraw the assets or roll them into an IRA before that ruling is final. Once the division is final, your former spouse may choose to take the money in cash, roll it into an IRA or leave the assets in the plan.

When A 401 Loan Makes Sense

When you mustfind the cash for a serious short-term liquidity need, a loan from your 401 plan probably is one of the first places you should look. Let’s define short-term as being roughly a year or less. Let’s define “serious liquidity need” as a serious one-time demand for funds or a lump-sum cash payment.

Kathryn B. Hauer, MBA, CFP®, a financial planner with Wilson David Investment Advisors and author of Financial Advice for Blue Collar America put it this way: “Lets face it, in the real world, sometimes people need money. Borrowing from your 401 can be financially smarter than taking out a cripplingly high-interest title loan, pawn, or payday loanor even a more reasonable personal loan. It will cost you less in the long run.”

Why is your 401 an attractive source for short-term loans? Because it can be the quickest, simplest, lowest-cost way to get the cash you need. Receiving a loan from your 401 is not a taxable event unless the loan limits and repayment rules are violated, and it has no impact on your .

Assuming you pay back a short-term loan on schedule, it usually will have little effect on your retirement savings progress. In fact, in some cases, it can even have a positive impact. Let’s dig a little deeper to explain why.

Read Also: How Do I Use My 401k To Start A Business

Other Options For Getting 401 Money

If you’re at least 59½, you’re permitted to withdraw funds from your 401 without penalty, whether you’re suffering from hardship or not. And account-holders of any age may, if their employer permits it, have the ability to loan money from a 401.

Most advisors do not recommend borrowing from your 401 either, in large part because such loans also threaten the nest egg you’ve accumulated for your retirement. But a loan might be worth considering in lieu of a withdrawal if you believe there’s a chance you’ll be able to repay the loan in a timely way s, that means within five years).

Loans are generally permitted for the lesser of half your 401 balance or $50,000 and must be repaid with interest, although both the principal and interest payments are made to your own retirement account. It is also worth noting that the CARES Act raises the borrowing limit from $50,000 to $100,000. If you should default on the payments, the loan converts to a withdrawal, with most of the same consequences as if it had originated as one.

401 loans must be repaid with interest in order to avoid penalties.

About two-thirds of 401s also permit non-hardship in-service withdrawals. This option, however, does not immediately provide funds for a pressing need. Rather, the withdrawal is allowed in order to transfer funds to another investment option.

Disadvantages Of Closing Your 401k

Whether you should cash out your 401k before turning 59 ½ is another story. The biggest disadvantage is the penalty the IRS applies on early withdrawals.

First, you must pay an immediate 10% penalty on the amount withdrawn. Later, you must include the amount withdrawn as income when you file taxes. Even further down the road, there is severe damage on the long-term earning potential of your 401k account.

So, lets say at age 40, you have $50,000 in your 401k and decide you want to cash out $25,000 of it. For starters, the 10% early withdrawal penalty of $2,500 means you only get $22,500.

Later, the $25,000 is added to your taxable income for that year. If you were single and making $75,000, you would be in the 22% tax bracket. Add $25,000 to that and now youre being taxed on $100,000 income, which means youre in the 24% tax bracket. That means youre paying an extra $6,000 in taxes.

So, youre net for early withdrawal is just $16,500. In other words, it cost you $8,500 to withdraw $25,000.

Beyond that, you reduced the earning potential of your 401k account by $25,000. Measured over 25 years, the cost to your bottom line would be around $100,000. That is an even bigger disadvantage.

Also Check: Should I Roll Over 401k To Ira

What Happens If I Have A 401 Loan But Later Lose Or Quit My Job

If you leave the company and have a loan against your 401, there are some new rules you should be aware of.

The 2018 Tax Reform law extended the repayment period for your 401 loan until the due date of your tax return, including extensions. If you were affected by COVID-19, the 2020 CARES Act provides that you may be able to delay payments due from March 27, 2020 to December 31, 2020 for up to one year.

If you don’t repay the loan, the remaining amount will be treated as a taxable distribution and reported on a 1099-R. If you are also under age 59 1/2, you’ll pay a 10% penalty for an early distribution. If you were affected by COVID-19, the penalty for early distribution may be waived.

A plan may provide that if a loan is not repaid, your account balance can be reduced or offset by the unpaid portion of the loan. However, you can rollover the offset amount to an eligible retirement plan. You have until the due date of your tax return, including extensions, to rollover the offset amount.

When you enter your 1099-R, we’ll calculate any additional taxes or penalties on your outstanding 401 loan balance.

Related Information:

Provide The Withdrawal Amount

Indicate how much you want to withdraw from your retirement account in the third section of the form. You are not held to any minimum or maximum withdrawal amounts unless you have a traditional IRA and are age 70 1/2 or older. In these cases the IRS requires you to withdraw a minimum amount from your accounts each year. The required minimum distribution amount varies depending on your age and how much you have in your retirement accounts. If you do not take the distribution, you will incur an additional 50 percent tax on the amount you should have taken. Merrill Lynch provides a required minimum distribution calculator, as well as an automatic required minimum distribution service to help customers determine how much they must take out. Roth IRA holders do not have to meet this requirement.

Don’t Miss: How To Take My Money Out Of 401k

Borrowing From My 401k Is It Allowed And If So How Do I Do It

Where my dad works he can. borrow from his 401k when he needs money for something I don’t know who is provider is but will walmart let me do that with Merrill Lynch? Yes I know the potential repercussions on my taxes as well as I would have to pay it back automatically with each paycheck but my dad needs a vehicle for work and he’s currently driving a 2003 Dodge Durango and either the wheel bearings or the joints are going and he almost didn’t make it home the other day. He likes to do his own auto work but he’s in his 60s and he really can’t crawl under a vehicle like he used to when he was younger. I want to either some or all of it to either make a portion of the payments for a new or used SUV at a dealer or something that’s used that’s within a few years. We have one new car for my stepmom but both of them have stated they can’t afford another car payment at this time. Since they are letting me live with them I want to help them out. I give my stepmom money each month towards food etc but a car is a necessary thing for his job. I asked a lady from HR and she said the associates in critical need trust fund can only be used for myself. Any ideas?

Low And No Down Payment Mortgages

Instead of getting a loan for your down payment, you can look into some of the government-backed loans that offer low and no down payment mortgages.

FHA Loans FHA home loans require a low 3.5% down payment, making them a prevalent option. With a down payment this low, you may not need to use your retirement account to afford the down payment.

VA Loans If youre a Veteran, you could qualify for a VA home loan with no down payment. This is one of the greatest benefits offered to Vets in our Country. Not only do VA loans provide 100% financing, but no mortgage insurance is required.

USDA Loans The U.S. Department of Agriculture guarantees USDA loans for low-to-median income families in the countrys rural areas. TDA finances 100% of the purchase price for eligible borrowers.

Conventional 97 Loan This type of conventional loan was created by Fannie Mae to compete with the low down payment government-backed loans. As the name suggests, a conventional 97 loan offers a 3% down payment, allowing you to finance 97% of the purchase price.

Home Possible / HomeReady Loans Fannie Mae and Freddie Mac created the Home Possible and HomeReady loan programs for first-time homebuyers who meet the income limits, have a 620 credit score and a 3% down payment. Your income must be below 100% of the area median income to be eligible.

Read Also: How To Rollover My Fidelity 401k

When Can You Lose The Rights Over Your 401

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

Kirsten Rohrs Schmitt is an accomplished professional editor, writer, proofreader, and fact-checker. She has expertise in finance, investing, real estate, and world history. Throughout her career, she has written and edited content for numerous consumer magazines and websites, crafted resumes and social media content for business owners, and created collateral for academia and nonprofits. Kirsten is also the founder and director of Your Best Edit find her on LinkedIn and Facebook.

Most individuals that have 401 plans know the basics, your employer withholds pretax dollars from your paycheck and deposits the money into an account where you can invest it. You get to decide what percentage of your paycheck goes toward your 401, and your employer might make matching contributions. The money grows tax-deferred until retirement when youre required to withdraw a certain amount every year and pay taxes on it.

People generally dont know as much about 401 rights, howeverespecially for rare situations. Two of those situations include leaving the company and borrowing from your account.

Take An Early Withdrawal

Perhaps youre met with an unplanned expense or an investment opportunity outside of your retirement plan. Whatever the reason for needing the money, withdrawing from your 401 before age 59½ is an option, but consider it a last resort. Thats because early withdrawals incur a 10% penalty on top of normal income taxes.

While an early withdrawal will cost you an extra 10%, it will also diminish your 401s future returns. Consider the consequences of a 30-year-old withdrawing just $5,000 from his 401. Had the money been left in the account, it alone would have been worth over $33,000 by the time he turns 60. By withdrawing it early, the investor would forfeit the compound interest the money would accumulate in the years that follow.

You May Like: How To Check My Walmart 401k

Debt Relief Without Closing My 401k

Before borrowing money from your retirement account, consider other options like nonprofit credit counseling or a home equity loan. You may be able to access a nonprofit debt management plan where your payments are consolidated, without having to take out a new loan. A credit counselor can review your income and expenses and see if you qualify for debt consolidation without taking out a new loan.

8 MINUTE READ

What Happens If I Stop Contributing To My 401k

If you are considering stopping contributions to a 401k, you would be better served to merely suspend those contributions. A short-term suspension will slow the performance of your retirement fund, but it wont keep it from growing. It also will lessen the temptation to simply withdraw all the funds and wipe out retirement savings in the process.

You May Like: How Do You Roll A 401k Into An Ira