Nondiscrimination Tests: How To Stay Compliant

Does your companys 401 plan benefit all your employees, or does it favor owners and executives who make more money? Thats what the two major 401 nondiscrimination tests try to assess each year.

What do you need to do to pass the tests? Well, our friends at the IRS have made that piece of the equation a little more complex, so lets take a closer look at what each nondiscrimination test measures, how to apply them, and what it means if your plan fails. As you read this, also keep in mind that its possible to set up a Safe Harbor 401 plan, that’s exempt from nondiscrimination testing.

What Is The Actual Deferral Percentage Test

The Actual Deferral Percentage test is a way to ensure employer 401 contributions are proportional and fair for all employees. Through this test, an employer can know if they meet the required actual deferral percentage of both nonhighly and highly compensated employees as stated by the IRS.

Another nondiscrimination test for 401 plans is the Actual Contribution Percentage test, which takes into account matching employer contributions and after-tax employee contributions.

For the purposes of the ADP and ACP tests, an HCE is considered to be an employee who:

-

Owned at least 5% of the company at any time during the year.

-

OR was paid more than $130,000 for the year 2020 or 2021 AND is elected by the employer to be in the top 20% of paid employees at the company.

Generally, companies must also pass one more test, the Top-Heavy test. This focuses on key employees rather than just highly compensated employees.

For the purposes of the Top-Heavy test, an employee is considered key if they:

-

Fulfill the above-mentioned considerations for HCE employees.

-

OR earned more than $150,000 during the year AND owned over 1% of the business.

All three of these tests compare plan benefits among the nonhighly and highly compensated employees.

The three benefits measured by these tests are:

Contributions: This measures matching company contributions and nonelective contributions to an employees 401.

How To Post A 401 Journal Expense Entry

A 401k is a retirement plan in which an employee contributes a portion of her wages. A company often contributes its own money toward an employees 401k plan to add to the employees contribution as a benefit to the employee. While the employees contribution is part of the companys wages expense, the additional amount the company contributes is a 401k expense for the company. As the employer, you can record a journal entry for 401k expense to reflect the amount your company will contribute for a payroll period.

Determine the last date of your payroll period, which is the date on which you record a 401k expense journal entry. For example, record the entry on January 31.

Determine the amount of money you will contribute to your employees 401k plans. For example, assume you will contribute $500.

Write the date on which you are recording the journal entry in the date column of your accounting journal to designate a new journal entry. For example, write 01-31 in the date column.

Write 401k Expense in the accounts column of the journal entry and the amount you will contribute toward your employees 401k plans in the debit column on the first line of the entry. Debit means an increase for expense accounts. For example, write 401k Expense in the accounts column and $500 in the debit column.

Tips

-

You can combine your 401k expense in a journal entry with other payroll expense items, such as worker’s compensation expense.

References

You May Like: Can I Keep My 401k After I Leave My Job

What Are Average Adp 401 Fees

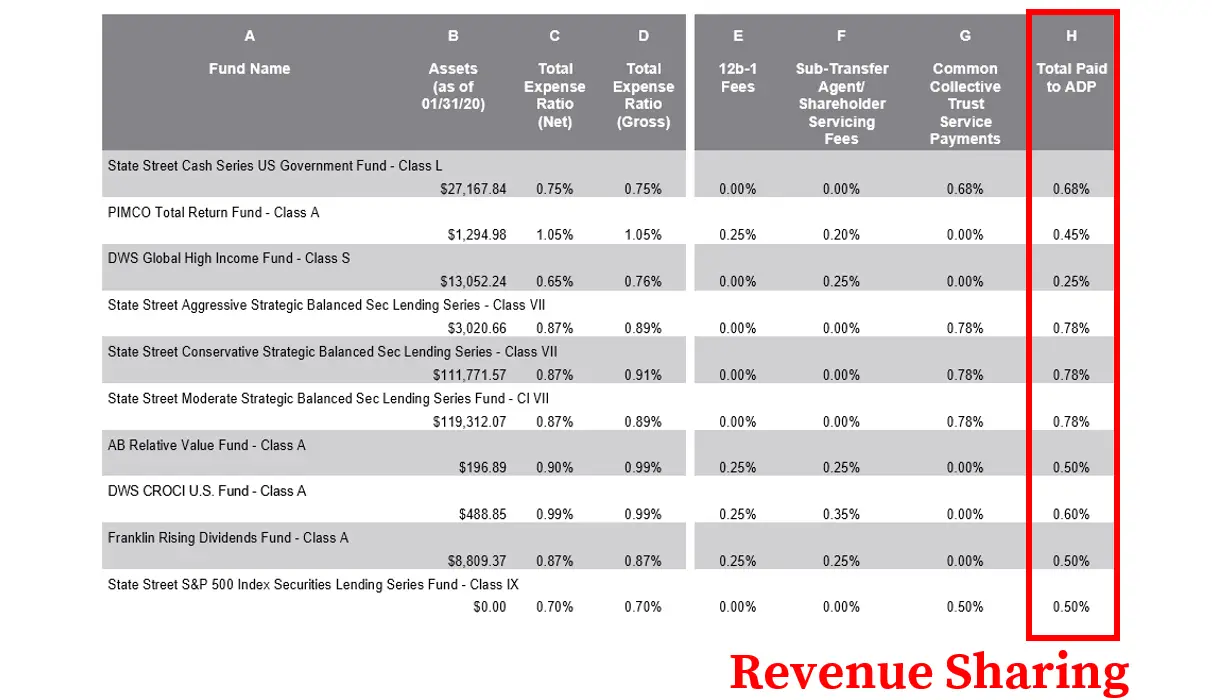

In our most recent Small Business 401 Fee Study, we found that ADP plans cost small businesses an average of 1.47% of plan assets each year, with their admin fees totaling about $314.08 per participant.

|

Average ADP 401 Fees |

|

|

All-In Fees |

1.47% |

While their per-capita admin fee is below the study average of $422.30, that number can easily grow much higher due to the way these fees are charged.

In our experience, about 60% of admin fees charged by ADP are paid by revenue sharing hidden 401 fees that lower the investment returns of plan participants. Not only are plan sponsors or participants often unaware that theyre paying them, but theyre always charged as a percentage of plan assets. That means plan participants will automatically pay ADP higher and higher administration fees for the same level of service as their account grows. Thats not fair!

When you factor in compound interest, these growing fees can make a huge dent in your retirement savings. As such, you want to do everything in your power to avoid paying them.

If youre currently using ADP for your 401, your first step to avoiding these fees is to find out whether or not youre paying them. Well show you how to do that later.

How Much Support Do They Provide

ADP provides fiduciary support by serving as both the plan administrator and record-keeper. Heres what that means:

A fiduciary is defined as a trustee. Fiduciary support can be defined as involving trust, especially with regard to the relationship between a trustee and a beneficiary. ADP provides this support in compliance with federal law. This ensures that the 401k plan is being managed properly and that beneficiaries are benefiting.

As the administrator and record-keeper, ADP provides documents related to the plan and prepares IRS Form 5500 for tax filings. They offer extra options for additional fees, such as fund performance monitoring and investment advice. These advisory services help employees enrolled in the plan to decide where and how to invest their money.

You May Like: Can You Merge 401k Accounts

Types Of Money That Might Vest

Examples of money types that are most likely to have a vesting schedule include:

- Employer matching: Any funds you receive as a result of your own contributions to the plan.

- Employer profit-sharing: Money you might get regardless of whether or not you contribute.

- Others, potentially

Examples of contributions that would generally not require any wait for vesting:

- Qualified non-elective contribution : An employer contribution thats typically used to fix mistakes or solve failed discrimination tests. For the contribution to work, it must be 100% immediately vested.

- Qualified matching contribution : Similar to a QNEC, above, but handled differently.

- Rollover: Funds that you roll into your plan from a previous employers 401, 403, your IRA, etc.

IRA-based accounts, including SEPs and SIMPLEs, do not have vesting schedules. Once the money goes into your account, its yours to do with as you please. However, its critical to learn about potential tax consequences of moving or withdrawing funds from any retirement account.

Important: Speak with your tax advisor and your plan administrator before making any decisions. The information here might not apply to your plan, it may be outdated, or there may be errors or omissions that you need to address with a professional.

What Is Actual Deferred Percentage

Actual deferral percentage is the percentage of wages deferred by employees under a 401 retirement plan.

An employers ADP helps to ensure that employee 401 benefits are compliant with IRS and ERISA rules that require such plans to be non-discriminatory against lower-paid employees or in favor of higher-earning employees.

The IRS states that traditional 401 plans must ensure that the contributions made by and for rank-and-file employees ) are proportional to contributions made for owners and managers ).

Recommended Reading: How To Withdraw My 401k

Adp Is Transforming The Way People Save For Retirement

Every employees vision for retirement is different. Each will have questions to answer and decisions to make. At ADP we provide resources to help them get started and take control of their plan.

From financial education to useful tools like the MyADP Retirement Snapshot®1, we help participants understand how to think about the future and design a path to get there.

We make enrollment easy and provide a dashboard that gives each participant a clear view of their plan. Add targeted messaging that provides important information and employees find themselves both more connected to their plan and able to see the benefits of having it.

What Is A 401 Rollover

A 401 rollover is the technical term for transferring the money in an old 401 account to another retirement account. Most people who roll over end up transferring their 401 savings into a new or existing IRA .

Let Capitalize handle your 401 rollover for you, for free! Weve made it our mission to make the 401-to-IRA rollover process easy for everyone. Learn more

Also Check: Can You Do A Partial 401k Rollover

How To Find The Mistake:

Complete an independent review to determine if you properly classified HCEs and NHCEs, including all employees eligible to make a deferral, even if they chose not to make one. Plan administrators should pay special attention to:

- Prior year compensation

- The rules related to ownership when identifying 5% owners.

- Plan administrators need access to ownership documents to identify 5% owners.

- Take care to identify family members of the owners, as many will have different last names.

Review the rules and definitions in your plan document for:

- Determining HCEs

- ACP testing

- Prior or current year testing

If incorrect data is used for the original testing, then you may have to rerun the tests. If the original or corrected test fails, then corrective action is required to keep the plan qualified.

How To Check An Adp Card Balance

The ADP Aline card, now known as the Wisely card, is a way for your employer to provide direct deposit services on payday. This specialized card is not a bank account or a credit card and it involves no credit check. Instead, it is a prepaid card that your employer reloads for you each payday. There are several ways to check your ADP Aline or Wisely card balance by phone, online and more.

Don’t Miss: Can I Transfer My 401k To Another Company

The Adp 401k Doesnt Have Set Pricing

Price is also a drawback for many employers considering the ADP 401k plan. It is not the cheapest solution available especially for physicians with small practices that have only a few employees. ADP fees tend to be a bit higher than those of their competitors.

Unfortunately, there is no pricing on the ADP website. Youll need to take the time to contact them to receive a quote. This is because the plans are customized. There is no one set price for every business different businesses get different quotes.

If you need advisory and management services, ADP will charge you even more. Those additional fees can add up quickly, so make sure youre well aware of them before deciding to go with an ADP plan.

How To Check Your 401 Balance

If you already have a 401 and want to check the balance, it’s pretty easy. You should receive statements on your account either on paper or electronically. If not, talk to the Human Resources department at your job and ask who the provider is and how to access your account. Companies dont traditionally handle pensions and retirement accounts themselves. They are outsourced to investment managers.

Some of the largest 401 investment managers include Fidelity Investments, Bank of America – Get Bank of America Corp Report, T. Rowe Price – Get T. Rowe Price Group Report, Vanguard, Charles Schwab – Get Charles Schwab Corporation Report, Edward Jones, and others.

Once you know who the plan sponsor or investment manager is, you can go to their website and log in, or restore your log-in, to see your account balance. Expect to go through some security measures if you do not have a user name and password for the account.

Much of this should be covered when you initiate the 401 when you are hired or when the retirement account option becomes available to you. Details like contributions, company matching, and information on how to check your balance history and current holdings should be provided.

Finding a 401 from a job you are no longer with is a little different.

Read more on TheStreet about how to find an old 401 account.

Read Also: Is It Good To Invest In 401k

Cant I Just Write A Check

For most workers, the answer is no. Your regular contributions to your 401 account typically only happen through salary deferral. In other words, the Payroll department needs to send money, and you cant just write a personal check if youre hoping to invest a large chunk or reach the maximum contribution limit by the end of the year.

Why not? For starters, the law does not allow you to defer funds that you already received. If the money is in your checking account, you received it. Also, your 401 plan might have specific rules saying you cant make your own payments into the plan.

Catch-up contributions: Those over age 50 can make additional catch-up contributions to retirement accounts. But 401 catch-up contributions, like other employee contributions, generally must go in through payroll deduction.

Applying The Adp/acp Tests

To pass the ADP and ACP tests, HCE deferral rates and employer contributions need to fall below these thresholds:

- If the ADP or ACP for NHCEs is 0%-2%, the ADP/ACP for HCEs must not be more than 2 times the NHCE rate.

- If the ADP or ACP for NHCEs is 2%-8%, the ADP/ACP for HCEs must not exceed the NHCE rate .

- If the ADP or ACP for NHCEs is greater than 8%, the ADP/ACP for HCEs must not be more than 1.25 times the NHCE rate.

Note that the formula the IRS uses looks a little different from this. We find their language pretty hard to understand, so we reworked it to make it clearer. You can see their original testing formula in the IRS 401 Plan Fix-It Guide.

Both the ADP and the ACP tests only look at the most recent full plan year. To apply these tests to the employees of Winterfell Consulting, lets review the Winterfell NHCEs ADP and ACP test results:

The ADP Test: The NHCEs had an average ADP of 3%. That means the ADP of HCEs cant be more than 5% . Winterfells HCE defers 10%, so this plan fails the ADP test.

The ACP Test: The Winterfell NHCEs received an average contribution that was 1.5% of their W-2 income. To pass the test, HCEs cant receive more than double the NHCE average a maximum of 3% in this case. It turns out that the HCE receives 3%, so this plan passes the ACP test by the narrowest of margins.

Read Also: How To Start My Own 401k

Can I Withdraw That Money

Access to funds in your retirement account depends on your situation.

After You Leave Your Job

Once you quit, retire, or get fired, you should have access to your vested balance. You can withdraw those funds and reinvest in a retirement accountor cash out, although there may be tax consequences and other reasons to avoid doing so.

While Still Employed

While youre still employed, you typically have limited access to money in a retirement planeven your fully vested balance. Rules may require that you meet specific criteria and that your plan allows you to access your money. There are several potential ways to withdraw money before you leave your employer:

Other Situations

You might become fully vested in all of your balances if your employer terminates or shuts down the retirement plan, enabling you to transfer the funds elsewhere. Likewise, death or disability can trigger 100% vesting. Check with your employers plan administrator to learn about all of the plans rules.

How Much Does It Cost

ADP is rather transparent about its direct fees.It is easy to understand their:

- Base record-keeping fee

- 5500 preparation fee

- Trustee fee

These fees are all reported clearly in their 404a-5 participant fee disclosure forms, plan statements, and 5500 forms.

However, when it comes to revenue sharing fees, they are not as upfront.

Why does this matter? Because revenue sharing fees can be the same as the direct fees, meaning that the total of your fees for having the plan may be double what you may think.

Revenue sharing payments are based on a percentage of the plans assets. As assets grow, so do the revenue sharing fees. And they can grow quickly. The bigger your plan design grows, and the more assets you have, the more fees youll have to pay.

You May Like: What Is The Minimum Withdrawal From 401k At Age 70.5

Seamless Payroll Integration With Smartsync

For companies using ADP payroll and HR solutions like RUN Powered by ADP® and ADP Workforce Now®, SMARTSync is an efficient way to connect ADPs payroll and 401 plan record-keeping systems. In a recent survey, ADP customers reported real benefits:

- 86% saw time savings5 by greatly reducing manual data entry requirements

- A majority claimed reduced compliance concerns6 due to preset programming that manages tasks and checks for errors

Get started

Get pricing specific to your business.

How Long Do I Have To Deposit The Check

You should deposit the check you get right away. Even if the check is made out to your IRA provider , you should try to do it within 60 days of receiving it.

Get a prepaid envelope sent directly to your door with a tracking number! Start a rollover with Capitalize and well send you a prepaid priority mail envelope with detailed instructions to make sure your rollover is transferred successfully. Get started

Don’t Miss: How Much Can You Put Into A Solo 401k

Why Adp Is Best For Small Businesses

If your business has employees, it’s usually a good idea to use an independent payroll services provider. Whether you already use ADP or still need a payroll provider, it’s an easy way to streamline payroll, retirement and health benefits. The 401 Essential plan makes it easier to offer an employee retirement plan by simplifying employee account setup and maintenance, and ADP Run is a cost-efficient payroll option for businesses with fewer than 50 employees.