If You Default On Your 401 Loan You’ll Owe A Penalty

If you do not pay your 401 loan back as required, the defaulted loan is considered a withdrawal or distribution and thus is subject to a 10% penalty applicable to early withdrawals made before age 59 1/2. That’s potentially a huge cost, especially when you also consider the loss of the potential gains your money would have made had you left it invested.

How Long Does It Usually Take To Get Your 401k After You Quit

When you leave a job, you can decide to cash out your 401 money. Generally, when you request a payout, it can take a few days to two weeks to get your funds from your 401 plan. However, depending on the employer and the amount of funds in your account, the waiting period can be longer than two weeks.

Find The Mortgage Option Thats Right For You

Your 401 account may seem tempting as an untapped source of cash, especially if youre struggling to come up with the money for a down payment on your new home. While this is a viable option, and there are ways to mitigate the penalties, it should only be used as a last resort. Consider applying for a low down-payment loan like an FHA or VA loan, or, if you have one, making a withdrawal from your IRA.

Whatever you decide, make sure you consult with a mortgage specialist before committing to an option. Rocket Mortgage® has experts waiting to help you navigate the tricky waters of home loans. If youre ready to take that next step toward a mortgage, then get started with our experts today.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

Don’t Miss: What 401k Funds Should I Invest In

What Happens If You Default On A 401 Loan

When you default on a 401 loan, it’s usually treated as an early withdrawal. Each plan can set its own rules, so you should check with your 401 company to see whether it handles the situation differently. When the remaining loan balance is reclassified as a “deemed distribution,” you will owe all the penalty and income taxes you would owe on any early 401 withdrawal.

Can I Take An Additional Loan From My 401

Most 401 plans allow one loan at a time, and this means you must pay back the first loan fully before you can be allowed to take another loan. However, if your plan allows multiple loans at a time, you can take an additional loan at any time within a rolling 12-month period as long as you have not exceeded the loan limit.

For example, if your 401 vested balance is $120,000, your loan limit is $50,000. If you borrowed $30,000 from your 401, you cannot borrow more than $20,000 as a second loan in a 12-month rolling period even if you paid the first loan early.

Read Also: What Time Does Fidelity Update 401k Accounts

How Long Do You Have To Wait Between 401k Loans

Borrowing limitations are placed on a 12-month period, even if you ve paid the amount back early. For example, if the vested balance of your account is $200,000 and you take a $30,000 loan out in February, you wont be permitted to take out more than $20,000 in additional funds again until the following February.

How Long Do You Have To Repay A 401 Loan

Generally, you have up to five years to repay a 401 loan, although the term may be longer if youre using the money to buy your principal residence. IRS guidance says that loans should be repaid in substantially equal payments that include principal and interest and that are paid at least quarterly. Your plan may also allow you to repay your loan through payroll deductions.

The CARES Act allows plan sponsors to provide qualified borrowers with up to an additional year to pay off their 401 loans.

The interest rate youll pay on the loan is typically determined by the plan administrator based on the current prime rate, but it and the repayment schedule should be similar to what you might expect to receive from a bank loan. Also, the interest isnt paid to a lender since youre borrowing your own money, the interest you pay is added to your own 401 account.

Recommended Reading: How Do I Cash Out My 401k After Being Fired

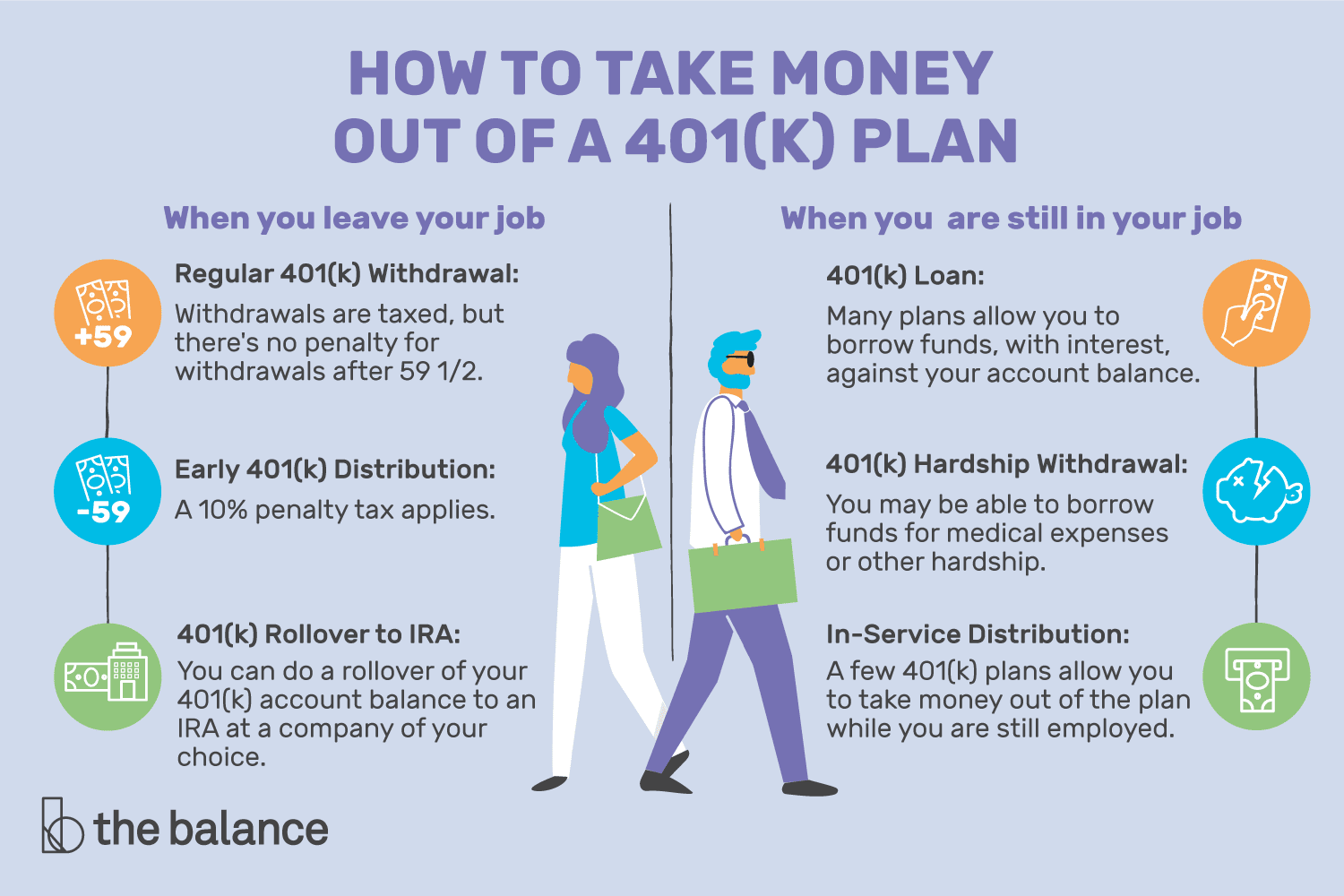

Can You Use Your 401 To Buy A House

Retirement accounts are just that: money thats being set aside for you to use in your golden years. And if youve been carefully saving, you might be wondering if its OK to tap those funds to use for something right now, like a home purchase, given that its an investment in its own right.

One of the most common types of retirement plans is the 401, which is often offered by companies to their workers. It provides an easy way to earmark some of your salary for retirement savings, along with the tax benefits that a 401 brings. Youll be setting aside money without paying taxes right now and then will pay the taxes when you withdraw it, which ideally will be when youre in a lower tax bracket than youre in now. In many cases, companies also match up to part of your personal savings, which is another reason that 401 accounts are so popular, since thats essentially free money.

But those funds have been set aside specifically for your retirement savings, which means that if your plan allows you to withdraw it earlier, youll pay a penalty, along with the taxes you owe given your current tax bracket. Theres usually the potential to borrow from it, though, which may be a better option.

So, while you can use your 401 for a first-time home purchase in most cases, the question is whether you should.

How Much Can You Expect To Earn With Your 401k If You Dont Borrow The Money

We still need another estimate to complete our analysis. We need to know how much we expect our money to earn in the 401k plan if we dont borrow the money. This isnt likely to be an easy or precise estimate to get, either. The earnings will depend on how the money is invested. And each plan has different investment options available. Some are very conservative and only offer guaranteed type investments with a lower rate of interest. Other plans are heavily invested in the stock of your employer. Depending on the performance of that stock, your return can be terrific or terrible. And dont expect your employer to give you an estimate of what the return will be. Way too much legal risk for that to happen.

Ultimately, youll probably have to take a look at whats happened in past years, take a guess about the future and go with your instincts. Lets suppose that you think that the earnings will be about 3% higher than the loan interest rate. So hows that important?

Well, that $900 will grow before you retire. Theres an easy way to estimate what it will be worth at retirement. If the money earns 9% it will double every eight years. So if youre eight years from retirement, you will have $1800 less . If youre 16 years from retirement, it will double again. We dont know how old Lucy is. But she can figure out how many years she has until retirement and then double the lost earnings for every eight year period until she reaches retirement.

About the Author

Read Also: What Is The Current Interest Rate For A 401k Loan

Understanding How 401 Loans Work

Financial advisors typically advise against 401 loans unless you have a financial emergency since the loan could impact the amount of money you have for retirement. However, there are several advantages to this type of loan. No credit check is required and the interest rate is usually low. Unlike a normal 401 distribution, money received from a 401 loan is not taxable. One of the main disadvantages is that employed workers cannot contribute to their retirement account until any outstanding loan is repaid, so they are missing out on both the contributions and any earnings from it due to the loan.

What Other Options Are There If You Need Cash

- If you have a Roth IRA for five years, you can withdraw your original contributions at any age, free of federal taxes and penalties.

- For education expenses, explore scholarships or student loans. You can borrow for school but not for retirement.

- You can borrow against the value of your home with a home equity loan or home equity line of credit.

Also Check: How To Tell If You Have A 401k

Risks Of Taking Out A 401 Loan

Before deciding to borrow money from your 401, keep in mind that doing so has its drawbacks.

You may not get one. Having the option to get a 401 loan depends on your employer and the plan they have set up. A 2020 study from retirement data firm BrightScope and the Investment Company Institute says that 78 percent of plans gave participants the option to borrow based on 2017 data. So you may need to seek funds elsewhere.

You have limits. You might not be able to access as much cash as you need. The maximum loan amount is $50,000 or 50 percent of your vested account balance, whichever is less.

Old 401s dont count. If youre planning on tapping into a 401 from a company you no longer work for, youre out of luck. Unless youve rolled that money into your current 401 plan, you wont be able to use it.

You could pay taxes and penalties on it. If you dont repay your loan on time, the loan could turn into a distribution, which means you may end up paying taxes and bonus penalties on it.

Youll have to pay it back more quickly if you leave your job. If you change jobs, quit or get fired by your current employer, youll have to repay your outstanding 401 balance sooner than five years. Under the new tax law, 401 borrowers have until the due date of their federal income tax return to repay in such circumstances.

You Probably Can’t Take Out A Loan Directly From Your Old 401 But There Are Alternatives

Photo: www.TaxCredits.net.

A 401 is the most common type of retirement plan offered by private-sector employers, and many of these plans offer the ability to take out a loan against the assets in your plan. However, this can be challenging to do once you no longer work for the employer sponsoring the plan. Here’s what you need to know about post-employment 401 loans, and other options that may be available.

The short answerMost, if not all, 401 plans do not allow former employees to take out loans from their accounts, and actually require that any previously outstanding loans be paid back within a short period of time after leaving employment.

It’s easy to understand why — after all, while you’re receiving paychecks, the “lender” is guaranteed that you’ll repay your 401 loan as agreed. Once you’re no longer receiving those paychecks, you become much more of a credit risk. In fact, about 10% of borrowers default on 401 loans, primarily because of a job change.

While you’re technically borrowing the money from yourself, there are still legal reasons why you need to pay it back. Specifically, the tax benefits you get with a 401 are based on the assumption that you’ll leave the money alone until you retire. If you fail to pay back a 401 loan, it’s considered to be a distribution, and you’ll face the same taxes and penalties as if you simply withdrew money.

In short — 401 loans are generally made exclusively to current employees.

Don’t Miss: How Do You Max Out Your 401k

Is Borrowing Money From 401s Penalized

If you’re pressed for cash, your 401 plan can provide a loan in your time of need. If you’ve already taken out a loan, you may be able to take out an additional loan even though you haven’t finished repaying the first one. Just make sure you can keep up with the required payments on both.

TL DR

As long as you don’t exceed the maximum loan limits set by the IRS, you can take out another 401 loan if your employer permits it. Be sure to make both required payments, though.

Making A 401 Withdrawal For A Home

Compared to a loan, a withdrawal seems like a much more straightforward way to get the money you need to buy a home. The money doesn’t have to be repaid and you’re not limited in the amount you can withdraw, which is the case with a 401 loan. Withdrawing from a 401 isn’t as easy as it seems, though.

The first thing to understand is that your employer may not even allow withdrawals from your 401 plan due to age. If they do allow employees to tap 401 funds early, you may have to prove that you’re experiencing a financial hardship before they’ll allow a withdrawal. Under the IRS rules, consumer purchases generally don’t fit the hardship guidelines.

You may be able to withdraw funds from a 401 plan that you’ve left behind at a previous employer and haven’t rolled over to your new 401. This, however, is where things can get tricky.

If you’re under age 59 1/2 and decide to cash out an old 401, you’ll owe both a 10% early withdrawal penalty on the amount withdrawn and ordinary income tax. Your plan custodian will withhold 20% of the amount withdrawn for taxes. If you withdraw $40,000, $8,000 would be set aside for taxes upfront, and you’d still owe another $4,000 as an early-withdrawal penalty.

Don’t Miss: Should I Cash Out My 401k To Start A Business

Reasons To Borrow From Your 401

Although general financial wisdom tells us we shouldnt borrow against our future, there are some benefits to borrowing from your 401.

- With a loan from a commercial lender such as a bank, the interest on the loan is the price you pay to borrow the banks money. With a 401 loan, you pay the interest on the loan out of your own pocket and into your own 401 account.

- The interest rate on a 401 loan may be lower than what you could obtain through a commercial lender, a line of credit, or a credit card, making the loan payments more affordable.

- There are generally no qualifying requirements for taking a 401 loan, which can help employees who may not qualify for a commercial loan based on their credit history or current financial status.

- The 401 loan application process is generally easier and faster than going through a commercial lender and does not go on your credit report.

- If you are taking a loan to buy a home, you can have up to 30 years to repay the loan with interest.

- Loan payments are generally deducted from your paycheck, making repayment easy and consistent.

- If you are in the armed forces, your loan repayments may be suspended while you are on active duty and your loan term may be extended.

Late Repayment Is Potentially Costly

When you take a 401 loan, you pay no taxes on the amount received. However, if you dont repay the loan on time, taxes and penalties may be due. Specifically, if the loan is not repaid according to the specific repayment terms, then any remaining outstanding loan balance can be considered a distribution. In that case, it becomes taxable income to you, and if you are not yet 59 1/2 years old, a 10% early withdrawal penalty tax will also apply.

If you leave employment while you have an outstanding 401 loan, your remaining loan balance is considered a distribution at that time, unless you repay it. However, you can avoid taking the tax hit by rolling over the outstanding balance into an IRA or another eligible retirement plan by the due date for filing your federal income tax return for the year in which the loan was characterized as a distribution.

Read Also: How To Open A Solo 401k

Read Also: Where Can I Find My 401k

Can You Borrow From Your 401k

While you cannot withdraw from a 401 without paying interest and penalties, most 401 plans offer loans. To get a firm answer to this question about your 401 plan, you’ll need to speak with your company’s human resources or plan administrator. You can also log into your 401 account online to verify if this is an option for you.

Unlike a traditional loan from a bank or other lender, there are no credit requirements to borrow from a 401. As long as this feature is available and you have a large enough balance, you can qualify for a 401 loan. Additionally, 401 loans are not reported to the credit bureaus. Because of this, they will not build your credit, nor should they affect your ability to qualify for other loans.

In some states, your spouse may have to sign off on the 401 loan due to community property rules. This ensures that one spouse doesn’t spend money that they may have a claim to in case of a divorce.

Those Who Can Stomach The Loss In Stock Value

Because a 401 is an investment account, you should also consider the trade-off of missing the market rebound if you withdraw funds right now. Any money that you borrow from your 401 now wont be there when the market turns around, Renfro says. This would compound the adverse effects of an early 401 withdrawal if you dont truly need one.

Echoing that, Levine says many 401 balances have been hit hard, and taking a loan while theyre down essentially locks in the losses.

Taking an early withdrawal from your 401 can have long-term adverse effects on your financial health. However, so can the ramifications of COVID-19, especially if youve been particularly affected by the disease. The CARES Act gives options to those who need it most. Theres no right answer, but in times of uncertainty and struggle, those options can be a life raft.

Don’t Miss: Can You Get 401k If You Quit