You Expect To Earn More Money In The Future

If you plan to earn lots of money in the future or earn a high income now you should consider rolling your funds into a Roth IRA instead of a traditional IRA. For single filers in 2016, the maximum income allowable for contributions to a Roth IRA starts at $117,000 and ends at $133,000. Learn more about Roth IRA rules and contribution limits here. For married filers, on the other hand, the ability to contribute to a Roth IRA begins phasing out at $184,000 and halts completely at $194,000 for 2016. The more you earn in the future, the harder it will become to contribute to a Roth IRA and secure the benefits that come with it.

You Want To Increase Your Tax Diversification

Contributions to traditional IRAs are tax-advantaged, meaning you wont pay taxes on your invested funds until you begin taking withdrawals at retirement. Roth IRAs, on the other hand, are taxed up front but offer tax-free withdrawals after age 59 ½. If youre unsure how your tax and income situation might pan out in the future, having both types of accounts a traditional IRA and a Roth IRA is a smart move in terms of diversifying your future tax exposure.

How Do I Rollover If I Receive The Check

If you receive a distribution check from your 401 rollover to a Roth IRA, then chances are good they will hold around 20% for taxes. If you want a direct 401 rollover to a Roth IRA, you may want to send that check back to your employer 401 provider and ask to be sent all of your eligible retirement distribution directly to your new Rollover IRA account .

You have 60 days upon receiving the check to get the money into the Roth IRA- no exceptions! So dont procrastinate on this one.

Read Also: Where Do I Go To Withdraw My 401k

Tips For Managing Your Retirement Accounts

- Taking care of your retirement plans on your own is harder than it might seem. Luckily, finding the right financial advisor that fits your needs doesnt have to be hard. SmartAssets free tool matches you with financial advisors in your area in 5 minutes. If youre ready to be matched with local advisors that will help you achieve your financial goals, get started now.

- Check your 401 contributions each year to make sure youre taking full advantage of your employers plan when it comes to matching contributions. Run the numbers through our 401 calculator annually to make sure youre contributing enough to reach your target retirement savings goal.

Is There Any Portion Of A Distribution Thats Tax

Yes, if the distribution includes after-tax contributions or Roth contributions. Non-Roth after-tax contributions can be distributed tax-free, but earnings are taxable. Qualified distributions from Roth 401 or Roth 403 accounts are tax-free. However, the earnings portion of nonqualified Roth distributions is taxable.

Recommended Reading: How To Cash In Your 401k Early

What Happens If A Check From My Former Employer Plan Is Made To Me

The distribution will be subject to mandatory tax withholding of 20%, even if you intend to roll it over later. This withholding can be credited to your income tax liability when you file your federal tax return if you roll over the full amount of any eligible distribution you receive within 60 days.

If you are not able to make up for the 20% withheld, the IRS will consider the 20% a taxable distribution it will be subject to regular income tax and, if you are under age 59½, an additional 10% early-withdrawal penalty.

What To Consider When Choosing A Broker

If youre planning to roll over your 401 into an IRA, youll likely be most concerned with a broker that can do the following things best. Most brokers do offer an IRA, but some popular ones do not, but the brokers below all offer IRAs. We also considered the following factors when selecting the top places for your 401 rollover.

- Price: Trading commissions for stocks and ETFs have fallen to $0 at most online brokers, and thats great for investors. But there are other costs, too, perhaps most notably account fees, such as fees for transferring out of your account.

- No-transaction-fee mutual funds: The brokers in the list below offer thousands of mutual funds without a transaction fee. If youre rolling over your 401 and you like the mutual funds you have already, these brokers may allow you to buy and sell the same one without a fee.

- Investing strategy: While a 401 may limit your investing options to a pre-selected group of mutual funds, an IRA gives you the ability to invest in almost anything trading in the market. So we considered how each broker might fit an investors needs.

Recommended Reading: How Much Should I Have In 401k

Can I Roll My Account Balance From An Employers Plan Into My Current American Funds Plan

Only if your current plan accepts rollovers. Check your plans Summary Plan Description or talk to your plans financial professional to see whether your plan accepts rollovers.

If it does, youll need to contact your former employer to obtain and complete a distribution request form. On the form, indicate you want a direct rollover to your current employers plan. Youll also have to provide your former employer with the new plans name and account number and the name of the trustee. Youll find the plan name and name of the trustee in your SPD. Ask your plans financial professional for the plans account number.

What About The Roth 401k

If your employer offers a Roth 401k and you were savvy enough to take part, the path to a rollover will be much easier. When youre converting one Roth product to another, there is simply no need for a conversion. You would simply roll the Roth 401 directly into the Roth IRA with the help of your plan provider.

Roll Your 401 by Following These Steps

You May Like: How Do I Find My Old 401k

Need To Open A Roth Ira

My favorite online broker is Ally Invest but you can check out our recap on the best places to open a Roth IRA and the best online stock broker sign up bonuses. There are many good options out there, but I have had the best overall experience with Ally Invest. No matter which option you choose the most important thing with any investing is to get started.

How To Roll Over A Roth 401 To A Roth Ira

Saving through a Roth 401 can help you grow a nest egg that you can then tap into in retirement without having to pay taxes. If you leave your job or youre ready to retire, you may be wondering what to do with the funds in your 401. Rolling your Roth 401 over to a Roth IRA is just one possibility. But make sure you know how this process works to avoid triggering an IRS tax penalty. A financial advisor can walk you through a rollover if youre new to it.

Also Check: How Do You Rollover Your 401k To A New Employer

Why Should I Roll My Retirement Plan Money Into An American Funds Ira

American Funds is one of the most experienced investment managers in the United States. Weve been managing investors assets since 1931. We take a conservative, long-term approach thats consistent with the needs of most people saving for the future. Thats why most of our shareholders investments are intended for retirement.

Signs It Makes Sense To Roll Your 401 Into A Roth Ira

If youre thinking of rolling your 401 into a Roth IRA instead of a traditional IRA, you have plenty of reasons to do so. Not only do Roth IRAs let you invest your dollars in the same investments as traditional IRAs, but they offer additional perks that can help you save money down the line. Here are four signs that a Roth IRA might actually be your best bet.

Read Also: How To See How Much 401k You Have

Automatically Linking Your 401k Or Employer Sponsored Plan

How Do I Transfer Shares Held By A Transfer Agent

Contact your transfer agent and obtain a current account statement, then submit your account statement to TD Ameritrade along with a completed TD Ameritrade Transfer Form. Be sure to indicate how you would like your shares transferred by making a selection in Section 3-D of the form.

Please note: The registration on your account with the transfer agent must match the registration on your TD Ameritrade account.

Read Also: Is An Ira Better Than 401k

Are There Exceptions To The 10% Early Withdrawal Penalty

If you’re under 59½ when you cash out of your plan, you may also be subject to a 10% early withdrawal penalty. Certain exceptions include:

- If youre 55 or older when you leave your job.

- Distributions due to death, disability and certain medical expenses.

- You take the distribution as part of substantially equal payments over your lifetime.

Ask your financial professional for more information about these and other exceptions.

Ira Rollover Vs Transfer

Although both rollovers and transfers allow you to move your retirement savings from one financial institution to another, the process for each is different, and each have different rules.

A 401 rollover occurs when you move retirement funds from an employer-sponsored plan to an IRA this is why it’s also called a Rollover IRA. This option is typically chosen when an employee leaves a job and is no longer contributing to the employer-sponsored retirement plan.

A Transfer is when you move your IRA to another IRA at a different institution. In the case of a transfer, funds or assets are sent between institutions, from the previous custodian or trust company to the new one. This is not only the quickest, but also the best method of moving your IRA to a self-directed IRA.

You May Like: What Happens To My 401k If I Retire Early

Why You May Not Want To Roll Over Your 401

Rollovers arent for everyone. Consider the following:

You Need Money Access to Your Money Earlier

If you retire early, you can start making withdrawals from your 401 account penalty-free starting at age 55. Under most circumstances, you may not begin making withdrawals from an IRA until age 59 ½.

You Have a Large Number of Assets You Need to Protect

401 assets are protected in the event that you need to declare bankruptcy or you have creditors coming after you. IRA protection status varies by state, so you may not be covered.

If you live in California, Georgia, Maine, Mississippi, or West Virginia, your IRA has the potential to be seized if you are found to be at fault for a costly lawsuit. Even in states that protect IRAs, bankruptcy protection is typically limited to $1.28 million in assets.

You Want to Hold Onto Your Money a Little Longer Before Dipping In

401 accounts and IRAs both require that payouts start to be received no later than when the owner of the account turns 70 ½ years old. However, 401 accounts have a loophole that allows owners to defer these payments until after they actually retire IRAs offer no such loophole.

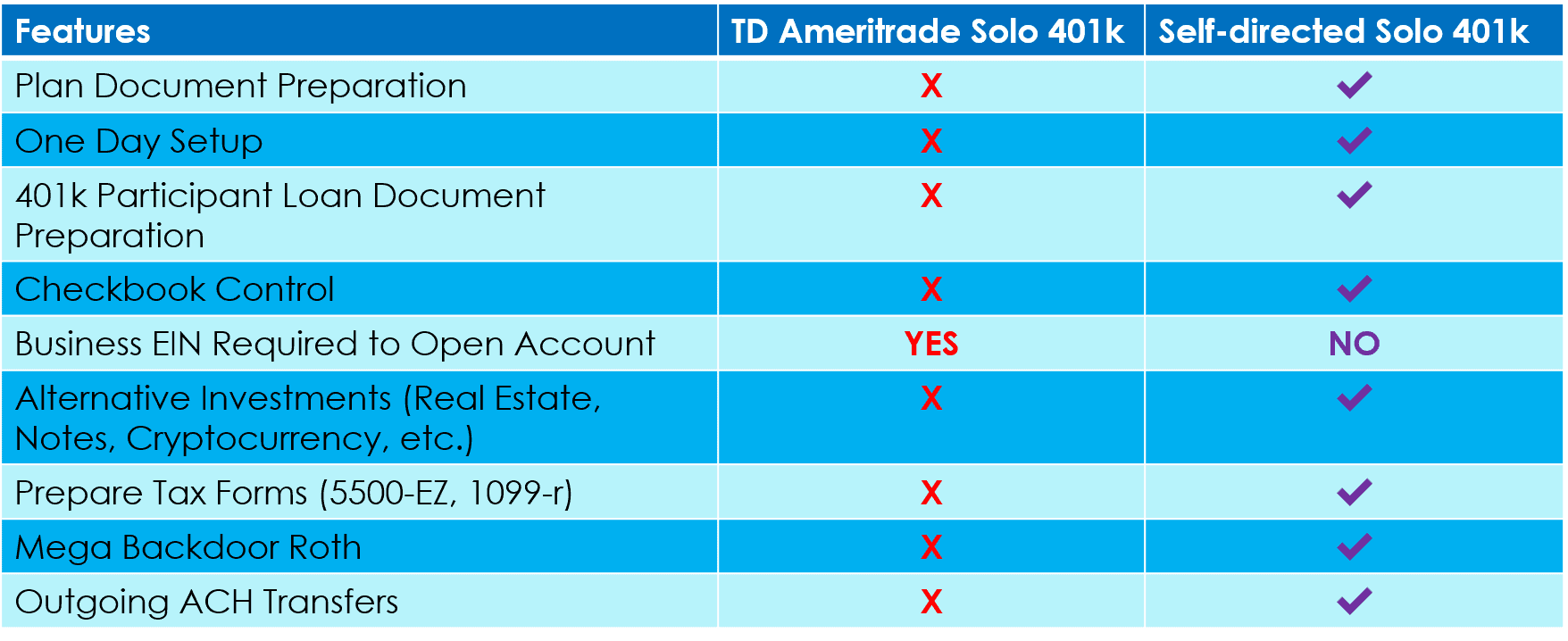

How To Change Plan Providers: Td Ameritrade To Self

- Process:

- New Solo 401k Plan Documents

- List the original plan effective date

- Additional Considerations:

- Have you been filing Form 5500-EZ?

- If not, need to file under the IRS Correction Program

Don’t Miss: Can I Invest In 401k And Ira

Can I Roll My Retirement Assets Directly Into A Roth Ira

Yes. After-tax or Roth contributions from an employers plan can be rolled over directly into a Roth IRA tax free. If you roll over non-Roth assets to a Roth IRA, while you may not be required to withhold taxes, the amount rolled over will be included in your gross income for federal and/or state income tax purposes.

Talk to your financial professional about your options.

Why Open A Td Ameritrade Traditional Ira

- Breadth of Investment Choices – Including commission-free ETFs, no-transaction-fee mutual funds1, fixed income products, and much more.

- Empowering Education – We offer exclusive videos, useful tools, and webcasts to help you create a personalized retirement plan.

- Smart Tools Plan and evaluate your retirement strategy with helpful tools like the IRA Selection Tool and Retirement Calculator.

- Fair and Objective Research – Take control with objective third-party research provided by Morningstar Investment Management, CFRA , and Market Edge

Don’t Miss: How To Find Old Employer 401k

How Much Will It Cost To Transfer My Account To Td Ameritrade

We do not charge clients a fee to transfer an account to TD Ameritrade. However, there are sometimes fees attached to holding certain types of assets in your TD Ameritrade account. For example, non-standard assets – such as limited partnerships and private placements – can only be held in TD Ameritrade IRAs and will be charged additional fees.

Delivering firms will usually charge fees to transfer the account out, which may result in a debit balance once your transfer is completed. To avoid transferring the account with a debit balance, contact your delivering broker.

What Are The Contribution Levels And Limits Of A Solo 401

To take full advantage of contributions to a Solo 401 plan you must understand your limits as an employee and employer, as well as contributions allowed on behalf of a spouse if applicable.

When contributing as the employee, you are allowed up to $19,500 or 100% of compensation in salary deferrals for tax years 2020 and 2021. If you are over 50, an additional $6,500 catch-up contribution is allowed for tax years 2020 and 2021. This is the type of contribution that can be made as pre-tax/tax-deferred or Roth deferral or a combination of both. Additionally, as the employer, you can make a profit-sharing contribution up to 25% of your compensation from the business up to $57,000 for tax year 2020 and $58,000 for tax year 2021. When adding the employee and employer contributions together for the year the maximum 2020 Solo 401 contribution limit is $57,000 and the maximum 2021 solo 401 contribution is $58,000. If you are age 50 and older and make catch-up contributions, the limit is increased by these catch-ups to be $63,500 for 2020 and $64,500 for 2021.

Compensation from your business can be a bit tricky. This is calculated as your business net profit minus half of your self-employment tax and the employer plan contributions you made for yourself plan). The limit on compensation that can be factored into your tax year contribution is $285,000 for 2020 and $290,000 for 2021.

You May Like: Can You Transfer An Ira Into A 401k

Pros Of Roth 401 To Roth Ira Rollovers

A unique fact that only applies to Roth 401s is that, beginning at age 70.5, you must take required minimum distributions from your account. This is similar to a traditional 401 or IRA. So if you would rather let your retirement funds grow tax-free until you need them, rolling them into a Roth IRA might be the best move for you.

In fact, you can leave rollover funds in a Roth IRA indefinitely if need be. That may be something of interest to you, particularly if youre looking to maximize the assets you leave for your beneficiaries.

After Tax Non Roth Money

After tax non Roth money rolled to a TIRA just adds basis to the TIRA and Form 8606 must be filed to report that basis. However, funds that are already in a Roth account such as a Roth 401k or Roth IRA are not eligible for rollover to a TIRA at all, and therefore such a rollover creates an excess contribution subject to an annual 6% excise tax. Therefore, such an ineligible rollover must be removed from the TIRA.

Read Also: When Changing Jobs What To Do With 401k

Solo 401 Withdrawals And Details

As with all qualified retirement plans, there are rules to when you can and must start taking withdrawals from your Solo 401 plan. You must begin taking the minimum required distribution no later than age 72 . There is a 10% early withdrawal penalty for distributions take before age 59 1/2, but exceptions may apply.

Please refer to the IRS page on individual 401s and review our Solo 401 Guide for additional details.

Transfer Funds From Your Old Qrp

Contact the plan administrator of the QRP you are rolling , and request a direct rollover distribution payable to Wells Fargo. Make sure to:

- Ask to roll over the funds directly to Wells Fargo for benefit of your name.

- Reference both your name and the account number of the new IRA you set up.

They will either send the funds directly to Wells Fargo, or you will receive a check in the mail made payable to your IRA to deposit into your Wells Fargo IRA.

Recommended Reading: How To View My 401k