How To Make Contribution And Investment Changes

Fidelity is the Master Administrator for the Plan this means that you have the streamlined ability to enroll in the Plan and make contribution changes, whether you contribute to Fidelity, TIAA, or both. In order to contribute to TIAA, you need to have an RIT TIAA account. By offering one consolidated plan, RIT is able to avoid unnecessary fees and keep costs to employees as low as possible.

- View and/or change your contribution percentage

- View and/or change the split between your pre-tax and Roth contribution percentage

- Join the annual increase program to automatically increase your contribution each September 1

- Change your record keeper election between Fidelity and TIAA

Log in at . You can set up a login if you do not have one by clicking on Register Now at the top of the page and follow the prompts.

Step 1:Once logged in, click on the drop down arrow to the right of Quick Links and choose Contribution Amount. If you are already logged in, click on the Contributions tab.

Step 2:There are three choices:

- Contribution Amount to view and change your contribution percentage and/or the split between pre-tax and after-tax Roth contributions

- Annual Increase Program to enroll or change participation in the program to automatically increase your contribution effective each September 1

- Retirement Providers to view and change the allocation for your future contributions between the two record keepers, Fidelity and TIAA

You May Like: Should I Rollover 401k To New Employer

Fidelity 401 Hardship Withdrawal Rules

You’ve been saving diligently in your 401, but what happens when you need access to the money for emergencies? Financial institutions have rules about this, and if you have a Fidelity 401, you need to understand the Fidelity 401k terms of withdrawal for hardships. It is possible to get money out, but there may be fees for doing so.

Uw Voluntary Investment Program

Save beyond your mandatory UW retirement plan by enrolling in the UW Voluntary Investment Program , a tax-advantaged 403 retirement plan that offers an array of mutual funds and annuities.

You choose your funds and how much you want to contribute. While contributions arent matched by UW, they are tax advantaged. And because the VIP is optional, you can start or stop contributions at any time.

Plus, get help when you need it from Fidelity Investments, the VIP administrator and the nations largest investment management firm.

If youre looking for even more ways to maximize your retirement savings, you can also enroll in the Washington state Deferred Compensation Programs.

Enroll in VIP

Enrolling in the VIP is optional. Its another way for you to save in addition to your primary UW retirement plan. Even if you arent participating in another UW plan, you can still enroll in the VIP.

All UW employees are eligible to participate .

Once you enroll, your contributions are automatically deducted from your paycheck. You can contribute up to 75 percent of your salary or as little as $15 per paycheck. You can change your contribution amount at any time.

To choose your funds and start making contributions, enroll through Fidelity Investments.

Investment and tax options

Whats your approach to investing for retirement? Would you rather avoid taxes now and pay later, during retirement? Or would you prefer to pay taxes now so you dont have to later?

IRS contribution limits

Read Also: Can You Rollover A 401k Into A Traditional Ira

What’s The Maximum I Can Request To Withdraw From My Account

The maximum you can request to withdraw from your account online or by telephone is $100,000 per account. To request a withdrawal greater than $100,000, you must complete a paper form. You can obtain a copy of that form by going to Customer Service > Find a Form, or by contacting a Fidelity representative at 800-544-6666. If you’ve changed your mailing address within the past 15 days, the most you can request to withdraw by check online or by telephone is $10,000.

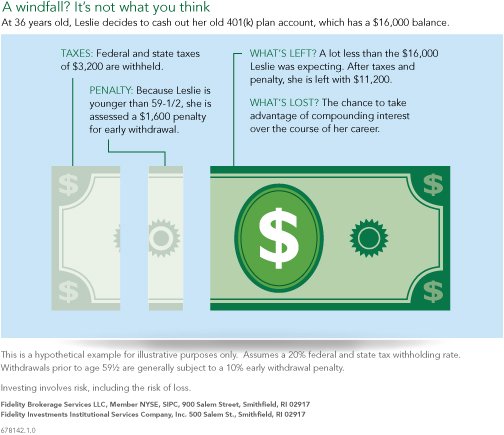

What Are The Risks Of Withdrawing 401k Money

If you’re using the Covid rules to withdraw cash from a 401k, keep in mind that you’ll need to pay tax on it or repay the withdrawal.

You also face a shortfall of cash in retirement, unless you already have enough money saved elsewhere.

In November, Fidelity said the average amount withdrawn of those who took advantage of the rule was $10,000.

It may seem small but it could eventually grow to be a significant amount if left untouched due to the benefits of compound interest.

For example, if youre 35, a $10,000 nest egg could grow to more than $100,000 by the time youre 70, assuming a 7% annual return.

Carrie Schwab-Pomerantz, a certified financial planner and president of the Charles Schwab Foundation, said: “Even if its possible to borrow from your 401k or take a distribution, consider this a last resort.

“While present circumstances may be difficult, Id counsel anyone to avoid jeopardizing their future retirement unless absolutely necessary.

“You may not appreciate the full consequences until much later.”

Recommended Reading: Can I Borrow From My 401k To Start A Business

How To Request A Withdrawal Or Loan From The Plan

You may request a withdrawal from your 403 retirement plan by contacting your investment carrier directly. Loans and hardship distributions are only available through Fidelity and can only be taken from the contributions that you put into the plan at Fidelity. Contact Fidelity to request a loan or hardship distribution.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

Don’t Miss: How To Check My 401k Plan

Convert To An Ira And Keep Contributing

You cannot contribute to a 401 after you leave your job, so if you want to continue adding money to your retirement funds, youll need to roll over your account into an IRA. Previously, you could contribute to a Roth IRA indefinitely but could not contribute to a traditional IRA after age 70½. However, under the new Setting Every Community Up for Retirement Enhancement Act, you can now contribute to a traditional IRA for as long as you like.

Keep in mind that you can only contribute earned income, not gross income, to either type of IRA, so this strategy will only work if you have not retired completely and still earn taxable compensation, such as wages, salaries, commissions, tips, bonuses, or net income from self-employment, as the IRS puts it. You cant contribute money earned from either investments or your Social Security check, though certain types of alimony payments may qualify.

To execute a rollover of your 401, you can ask your plan administrator to distribute your savings directly to a new or existing IRA. Alternatively, you can elect to take the distribution yourself. However, in this case, you must deposit the funds into your IRA within 60 days to avoid paying taxes on the income.

Traditional 401 accounts can be rolled over into either a traditional IRA or a Roth IRA, whereas designated Roth 401 accounts must be rolled over into a Roth IRA.

Where Fidelity Go Falls Short

Tax strategy: The company does not offer tax-loss harvesting, one of the features that makes robo-advisors stand out for taxable accounts.

No human advisor guidance: Although Fidelity Go has investment advisors managing and rebalancing portfolios, these advisors do not give financial planning guidance or answer other investment questions.

Read Also: Should I Move My 401k To Bonds 2020

Making A Fidelity 401k Withdrawal

Your 401k is your money, and making a withdrawal is as simple as contacting Fidelity to let them know you want it. The easiest way is to simply visit Fidelitys website and request a check there. However, you can also reach out via phone if you prefer: Call 800-343-3543 with any questions about the process.

From there, you can download the appropriate withdrawal request form and then mail it to the address listed on the form. Fidelity will have your check for you in five to seven business days after receiving your request. There are no fees for requesting a check, but if you liquidate any holdings, there could be commissions or mutual fund fees associated with that.

Borrowing From Your 401k: What You Need to Know

Why Are There So Many Vanguard Mutual Funds Available As Investments In The New Plan

Vanguard is well known for their low cost funds. Morningstar did a study called Fees Matter. They found that expenses are a much better predictor of future returns than past performance. As an investor, there are three elements that you can control in the 401 plan: the amount of risk you can afford to take, the amount you save, and the fees of the funds you select. The passively managed S& P 500 Index has outperformed 80% of actively managed funds over a 20-year period primarily because of the low fees charged. For example, the SSgA S& P 500 Index fund in the typical Slavic401k plan costs only 0.05% to own. The Trustee of the plan elected to include many low cost funds as options for you to invest in.

Recommended Reading: Is There A Maximum You Can Contribute To A 401k

Are You Investing Enough For Retirement

Periodically, you may decide to invest more for retirement. This can be easily done using the following steps:

What Type Of Ira Should I Open

During the process of opening your new account, you may get asked which type of IRA youd like to open. You might see the following options: Rollover IRA, Traditional IRA, or Roth IRA. Heres how to pick the right one:

- If you had a Traditional 401 pick a Rollover IRA or, if thats not available, Traditional IRA or, if thats not available, just IRA. The only exception would be if youre considering a Roth conversion, but this is an advanced tax planning strategy that most people dont need to worry about.

- If you had a Roth 401 pick a Roth IRA. Youll need to match the Roth 401 to a Roth IRA for tax reasons.

- If your 401 has mixed assets youll need to open two IRAs, one Roth and one Traditional to for their respective assets.

Also Check: How Do I Use My 401k To Start A Business

Don’t Miss: How To Find Out If Someone Has A 401k

Drawbacks To Using Your 401 To Buy A House

Even if it’s doable, tapping your retirement account for a house is problematic, no matter how you proceed. You diminish your retirement savingsnot only in terms of the immediate drop in the balance but in its future potential for growth.

For example, if you have $20,000 in your account and take out $10,000 for a home, that remaining $10,000 could potentially grow to $54,000 in 25 years with a 7% annualized return. But if you leave $20,000 in your 401 instead of using it for a home purchase, that $20,000 could grow to $108,000 in 25 years, earning the same 7% return.

What Is The Covid

You’ll generally have to pay a 10% early withdrawal penalty if you take the cash out before you reach 59 1/2 years old.

You also have to pay normal income taxes on the withdrawn funds.

However, last March, former President Donald Trump signed an emergency stimulus bill that lets those affected by Covid withdraw up to $100,000 without the penalty, even if they’re younger than 59 1/2.

Account owners also have three years to pay the tax owed on withdrawals, instead of owing it in the current year.

Alternatively, you can repay the withdrawal to a 401k and avoid owing any tax.

To qualify for the exemption, you, your spouse or a dependent must’ve been diagnosed with Covid-19.

Alternatively, you must have experienced “adverse financial consequences” due to Covid, which could include a lay-off or reduced income.

There are also other exceptions to the penalty, such as using the funds to pay for your medical insurance premium after a job loss.

Plus, you can take penalty-free withdrawals if you either retire, quit, or get fired anytime during or after the year of your 55th birthday.

This is known as the IRS Rule of 55.

Recommended Reading: How To Set Up A Solo 401k Account

Taking 401 Distributions In Retirement

The 401 withdrawal rules require you to begin depleting your 401 savings when you reach age 72.

At this point, you must take a required minimum distribution each year until your account is depleted. If you are still working for the employer beyond age 72, you may be able to delay required minimum distribution until you stop working if your plan allows this delay. The delay option is not available to you if you own 5% or more of the business.

You have until April 1 of the year after you turn 72 to take your first required minimum distribution. After that, you must take a minimum amount by December 31 each year. Your 401 plan administrator will tell you how much you are required to take each year.

The amount is based on your life expectancy and your account balance. If you dont take your required minimum distribution each year, you will have to pay a tax of 50% of the amount that should have been taken but was not. If you participate in more than one employer plan, you must take a required minimum distribution from each plan.

Confirm A Few Key Details About Your 401 Plan

First, get together any information you have on your old 401. Its okay if you dont have a ton, but any details like an old account statement or an offboarding e-mail from your former HR team can help. 401 paperwork can be confusing, so just focus on identifying the following three items:

Read Also: How Much Should I Put In My 401k

When To Cash Out Your 401k To Pay Off Debt

The decision to withdraw 401k will depend on your financial situation. If debts are stressful on a daily basis, you should consider serious debt payment plans. Withdrawing the 401k plan early can cost money. The decision to withdraw 401k will depend on your financial situation. If debts are stressful on a daily basis, you should consider serious debt payment plans.

Hardships Early Withdrawals And Loans

Generally, a retirement plan can distribute benefits only when certain events occur. Your summary plan description should clearly state when a distribution can be made. The plan document and summary description must also state whether the plan allows hardship distributions, early withdrawals or loans from your plan account.

Also Check: Can Anyone Open A 401k

Automatic Enrollment Or Making Changes

Enrollment is Automatic for All Employees

Participation in the Supplemental Retirement and Savings Plan is automatic for all employees. You will automatically be enrolled to contribute 3% of your eligible compensation, as defined under the BU Retirement Plan, on a tax-deferred basis and your contribution will be invested in a Vanguard Target Date Fund closest to the year in which you will turn age 65. Your first contribution to the plan will commence in the month following your hire date.

You may change or stop your contribution at any time. You may also change the investment allocation of your contributions at any time.

Automatic Enrollment and BU Matching Contribution After Two Years of Service

Once you have completed two years of service with at least a nine-month assignment at 50% or more of a full-time schedule, you will be eligible to receive the University matching contributions to the Boston University Retirement Plan.

In addition, you will automatically be enrolled in the Supplemental Retirement and Savings Plan to contribute 3% of your eligible compensation as defined under the BU Retirement Plan on a tax-deferred basis if you are not already doing so when you complete two years of service. BU matches your contribution dollar-for-dollar up to 3% of your eligible compensation as defined under the BU Retirement Plan.

You may make the following changes at any time: