Can I Choose Individual Stocks In My 401k

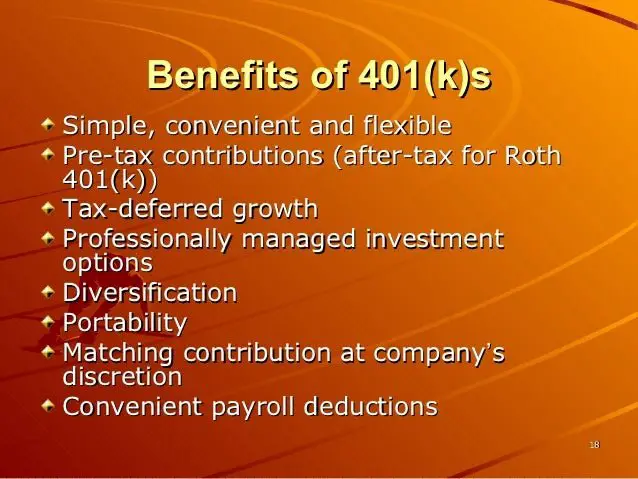

The average 401 plan, according to the Financial Industry Regulatory Authority, offers at least eight to 12 investment options. Your alternatives may come in the form of mutual funds, company stock, guaranteed investment funds, annuities or stable value accounts. You might find that sometimes your investments perform satisfactorily and sometimes they dont. In the latter case, you may need to change them. How often you can shift your investments depends on your companys policy.

Setting Up Recurring Contributions

When it comes to setting up a 401, the process varies by workplace. Some companies offer automatic enrollment to employees, automatically reducing the employees wages by a certain amount and diverting that money to the employees 401 plan, unless the employee chooses not to have their wages contributed.

Or, an employee can choose to enroll, but to contribute a custom amount. This type of contribution is referred to as an elective deferral.

In companies that dont offer automatic enrollment as an option, employees will need to work with their HR department and retirement plan provider to get their 401 set up.

Participants need to decide how much they want to contribute, may need to choose their investments, can opt to take advantage of autopilot settings, and can roll over a 401 from a past job into their new one.

Can You Change 401 Contributions At Any Time

Most employers allow employees to change their 401 contributions at any time. However, some employers only let their employees change the amount of 401 contributions once a year.

Changing the contribution amount is a straightforward process, and you should contact your plan provider to obtain the correct procedure. If allowed, you may be able to change your contribution online on the plan sponsorâs website.

According to the Department of Labor guidelines, employers are required to allow plan participants to change their investment allocation at least quarterly. This period can change to âmore oftenâ where the plan offers volatile investment options like stocks to plan participants.

If you donât know how often your plan lets employees change contributions, you should contact the plan provider to get the correct information. If you donât know who your plan provider is, you should ask the companyâs human resource department to point you in the right direction. You can then call or email the plan provider to know when you can change your 401 contributions.

Recommended Reading: How To Access My Fidelity 401k Account

Which Is Simpler Reducing Or Suspending Discretionary Employer Contributions

Reducing or suspending discretionary employer contributions is far simpler than reducing or suspending nonelective or matching employer contributions because such contributions are by their nature optional. Therefore, the employer is free to exercise its discretion to make or not make such contributions.

Everything You Need To Know About A 401

Weve all heard of a 401, but how much do you really know? A recent CNBC survey reported that 63% of Americans are confused by 401 plans and its hard to blame them.1

After all, between contribution amounts, fund allocations, employer matching2, tax implications, and rollovers, participating in a 401 can sound more like a headache and less like a helpful path towards a successful retirement. Thankfully, it doesnt have to be.

To help get you started and alleviate any stress we spoke with John Hancocks Head of Financial Planning, Misty Lynch, CFP®, to get the 411 on 401s.

Also Check: How To Get A Loan From My 401k

Contributing To Your 401

Your employer determines how often you can change your 401 contribution. Some employers may let you change it only once per year, while others may let you change it as often as you like. Your companys 401 plan provider can let you know how often you can change your contribution. If you arent sure of who your plan provider is, contact your companys human resources department to obtain their contact information. You may be able to change your contribution through your plan providers website.

Your company may have a minimum or maximum contribution amount. The IRS also has a maximum contribution amount that increases annually. As of 2019, the maximum you can contribute to a 401 is $19,000 per year or your annual salary, whichever is less. If you are going to be age 50 or older this calendar year, you may be able to exceed the IRS maximum and make catch-up contributions if your employer allows it. You can make up to $6,000 per year in catch-up contributions as of 2019.

How Much Money Will Be Deducted From My Paycheck

Everyone has a unique situation when it comes to the amount of money they’ll need for retirement savings, and how much they can contribute. Employees may increase or decrease the amount in order to meet their comfort level.

One way to determine how much an employee should plan to save is by using a retirement calculator.

Because approximately 30 percent of eligible workers do not participate in their employer’s 401 plan, some organizations set up auto-enrollment to encourage participation. Qualified automatic contribution arrangements must set an auto-enrollment percentage of at least three percent of total annual compensation , and increase by one percent each following year.

Also Check: How Do I Put My 401k Into An Ira

Consider Hsa Contribution Limits

If you do decide to change your level of HSA contributions mid-year, you need to ensure that the change does not put you over the yearly contribution limit. For 2021, you can contribute up to $3,600 if you have an HSA that covers only yourself. If you have a family HSA, you can contribute up to $7,200. Special rules also allow those 55 and older to contribute an extra $1,000 to their HSA plans, for a total contribution limit of $4,600 and $8,200, respectively.

If you go over the annual health savings account contribution allowed by the IRS, you could be subject to taxes and penalties. First, you won’t get any tax deduction for that extra money contributed to the HSA. Second, the IRS will usually make you pay a six percent tax penalty on the amount over the annual HSA limit. The IRS suggests either withdrawing the extra HSA funds as one way to not have to pay the tax penalty, but keep in mind the withdrawn money will be subject to income taxes.

Effective Dates For 403 Sra And 457

There are limitations regarding when your elections for the 403 SRA and 457 will become effective due to the differences in plan effective dates. In addition, the ability to change 403 SRA and 457 elections for bi-weekly paid staff are limited because processing times are much shorter for the bi-weekly payroll cycle than for the monthly payroll cycle. Note the following:

You may make elections for the 457 Deferred Compensation Plan in Wolverine Access throughout the year. The 457 is not part of the new hire enrollment choices you must create a separate election to enroll in this program.

Please note that you may use Wolverine Access only once per calendar month to either enroll in the 457 or change an existing election. You have until 7:00 p.m. EST on the day you create an event to finalize and submit your election or it will expire and you will not be able to use create another election until the following month.

Read Also: How To Find Out If I Have Old 401k

Why Are 401ks Bad

Theres more than a few reasons that I think 401s are a bad idea, including that you give up control of your money, have extremely limited investment options, cant access your funds until youre 59.5 or older, are not paid income distributions on your investments, and dont benefit from them during the most.

How Much Should I Invest

If you are many years from retirement and struggling with the here-and-now, you may think a 401 plan just isn’t a priority. But the combination of an employer match and a tax benefit make it irresistible.

When starting out, the achievable goal might be a minimum contribution to your 401 plan. That minimum should be the amount that qualifies you for the full match from your employer. To get the full tax savings, you need to contribute the maximum yearly contribution.

Also Check: Can I Move My 401k From One Company To Another

Pros And Cons: 401 Vs Ira

401 Pros |

|

|---|---|

|

|

|

|

How Do I Contribute To My 401k Outside Of Paycheck

When you find yourself between jobs or if your employer doesnt offer a 401k retirement account, you might wonder, Can I add money to my 401k? Unfortunately, employers dont allow you to contribute to your 401k outside of payroll, which means you cant add extra cash to your account unless its funneled from your Nov 9, 2017.

You May Like: What 401k Funds Should I Invest In

Roll Over Your Old Accounts

Have you switched jobs every few years? Then youve probably collected much more than a bunch of LinkedIn connections. Youve likely ended up with quite a few retirement accounts that you may want to consider combining in the name of efficiency. Im a big believer in simplicity, says Schaefer. Every time you switch jobs, you want to reassess whether you should consolidate. Some things to consider: whether a better investment vehicle option is only available via an old jobs plan, or if one employer has agreed to pay fees on behalf of account holders. These factors will help you weigh whether it makes fiscal sense to roll over your existing accounts into one.

Planning Ahead With Your 401k

When saving for retirement, start as early as possible, but know that its never too late to begin. Although you cant boost your account by making a lump sum 401k contribution whenever you like, you might be able to increase your paycheck contributions, make catch-up contributions or use other methods to increase your balance. If you cant use one of these methods to boost your balance or you dont have access to a 401k account, IRA accounts or bonds should be your next choices.

Ashley Eneriz contributed to the reporting for this article.

Don’t Miss: Can You Transfer 401k To 403b

Examples Of Permissible Mid

If they satisfy the notice rules, if applicable, safe harbor 401 plans sponsors may mid-year:

What Happens To Your 401 If You Leave Your Job

Its entirely dependent on your circumstances. If your 401 balance is less than $5,000, your company may remove you from their plan and send you a check, unless you elect otherwise to roll this money into an IRA or your new employers 401 plan both of these options are not taxed. If you receive and cash a distribution check and are younger than 59½, youll pay both federal and state taxes, as well as a 10% penalty imposed by the IRS.

You May Like: Who Does Amazon Use For 401k

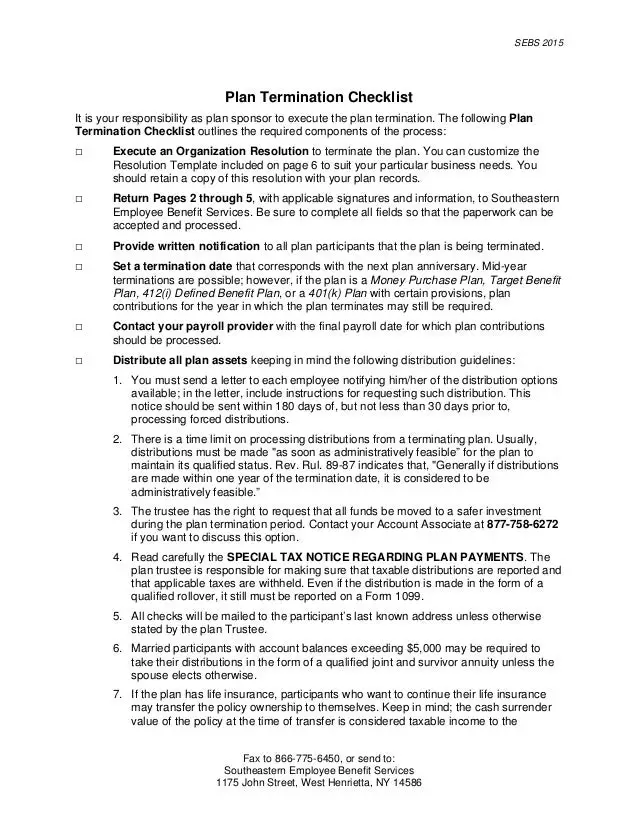

Can A Company Suspend Contributions To A Safe Harbor Plan

Thus, before amending a safe harbor plan, an employer should ensure that the plan can meet its testing goals for the year. Contributions can only be suspended prospectively and can only be effective after providing the eligible employees with 30 days notice and an opportunity to stop their own contributions.

Setting Up Automatic Increases

Some plans offer participants the option of automatically increasing their contribution rate every year, typically up to a certain percentage , and not to exceed the maximum contribution levels. While some plans have different rules, the basic contribution limit for 401 plans for 2022 is $20,500 for participants under age 50. For those 50 and older, you can save an extra $6,500 in catch-up contributions, for a total of $27,000.

Setting up automatic increases allows you to save more each year without having to think about it this can be beneficial for overcoming the inertia common among many savers.

You May Like: How To Transfer 401k From Charles Schwab To Fidelity

Extra Benefits For Lower

The federal government offers another benefit to lower-income people. Called the Saver’s Tax Credit, it can raise your refund or reduce the taxes owed by offsetting a percentage of the first $2,000 that you contribute to your 401, IRA, or similar tax-advantaged retirement plan.

This offset is in addition to the usual tax benefits of these plans. The size of the percentage depends on the taxpayer’s adjusted gross income for the year and tax-filing status. The income limits to qualify for the minimum percentage offset under the Saver’s Tax Credit are as follows:

- For single taxpayers , the income limit is $33,000 in 2021 and $34,000 in 2022.

- For married couples filing jointly, it’s $66,000 in 2021 and $68,000 in 2022.

- For heads of household, it maxes out at $49,500 in 2021 and $51,000 in 2022.

Can I Contribute To 401k Without Employer

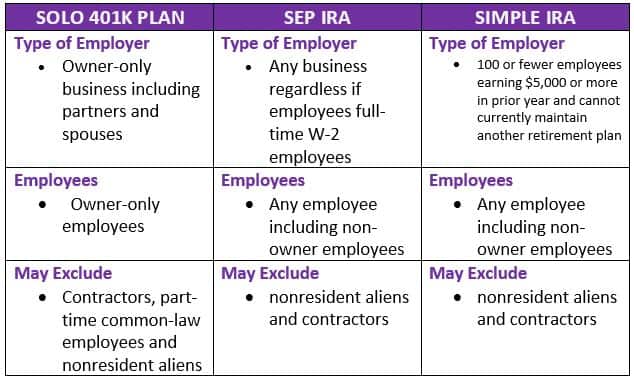

If you qualify, a Solo 401 can be a great choice for your retirement savings. The contribution limits are high since youre both the employer and the employee, you can contribute for both. Its also important to note that you can qualify for a Solo 401 even if self-employment isnt your only source of income.

Read Also: How To Start My Own 401k

Think About How Much You’ll Need In Retirement

Contributing the maximum to your 401 requires a lot of money especially as an ongoing, year-after-year commitment. It may or may not be enough to fund your retirement, or it could be even more than you need. Your 401 contribution amount should be guided by your retirement savings goal.

How much money you’ll need in retirement depends on when you plan to retire, how much of your current income youd like to replace and how much you want to rely on Social Security.

Most experts recommend saving 10% to 15% of your income, but our suggestion is to get a more detailed goal from a retirement calculator.

If you need to start at a lower contribution and work your way up, that’s fine. Aim to contribute at least enough to grab the match, then bump up the percent you contribute by 1% or 2% each year.

How Does An Employer Contribute To A 401k Plan

With employer-sponsored defined contribution retirement plans like 401 accounts, employees contribute from their salary, usually on a pre-income tax basis.

These are found in the Employee Retired Income Security Act and also in your plan documents ie the information given to you about the 401K plan and how it works. You also need to check with the 401K holder. The issue is that your employer changed the withholding without your consent.

Don’t Miss: How Much Do I Put In My 401k

Your 401 Plan If Your Company Was Acquired

If your company was acquired by Adobe, youll have approximately 1224 months to access your old 401 account and allocate investments, but you wont be able to roll over assets or request an account distribution until a plan audit with a favorable determination has been completed by the IRS, which typically takes 1218 months.

Following the plan audit and receipt of a favorable determination from the IRS, you can do one of the following:

- Roll over your account assets into Adobes 401 plan at Vanguard.

- Roll over your account assets to an individual retirement account .

- Request an account distribution, which may be subject to taxes and early-withdrawal penalties.

If your employment ends, you can immediately initiate a rollover or account distribution by contacting the plans provider.

Be sure your contact information is up to date so you receive notifications about your account and actions you have to take. See below for address-update directions for your plan.

Heres the status of the 401 plans for recently acquired companies.

What Are The Limits For The Savers Credit

Here are the Adjusted Gross Income limits for claiming the Savers Credit in for filing your taxes in 2021: 50% credit, or up to $1,000 for individuals or $2,000 for married couples filing jointly AGI below $19,750 for individuals, $29,625 for heads of household or $39,500 for married couples filing jointly.

Read Also: How Much Do I Need To Contribute To My 401k