Best Retirement Plans For Small Businesses & The Self

Self-employment is increasingly popular in the United States. According to the Pew Research Center, in 2019 16 million Americans were self-employed, and 29.4 million people worked for self-employed individuals, accounting for 30% of the nations workforce.

Being a small business owner or a solo entrepreneur means youre on your own when it comes to saving for retirement. But that doesnt mean you cant get at least some of the benefits available to people with employer-sponsored retirement plans.

Whether you employ several workers or are a solo freelancer, here are the best retirement plans for you.

| Who Is It Best For? | Eligibility |

|---|---|

|

Self-employed business owners with no employees . |

Higher contribution limits than IRAs. Contributions are tax-deductible as a business expense. |

How To Fund A Retirement Account

So you know how much you need to save for retirement and which accounts you can open. Now you have to fund those accounts without your employers help. The first step you can take is to set up direct deposit. You can set it so that a portion of your paycheck automatically deposits into your IRA or other account. You may also set up automatic transfers from a bank account to your retirement savings account. That way, you can set it and forget it.

You may also want to set aside any tax refunds, windfalls or bonuses you get. Its easy to deposit those funds into an account right away. That way, you can pretend that you never had access to that money anyways.

Its important to know that putting money into your IRAs or solo 401 isnt all you need to do. Youll also need to choose your investments. Luckily, you wont be limited to the funds your employer has selected to provide. A good place to start is with an S& P 500 index ETF and an intermediate term bond index fund. Youll need to make sure your investments are well-diversified and optimized. You dont need to do this all on your own, though. If you need help, there are a ton of financial advisors or robo-advisors out there who can help you manage your accounts.

Contribute To A Roth Ira If You’re Eligible

Roth IRA contributions cannot be deducted from your taxes in the current year, but earnings from Roth IRAs are tax-deferred and withdrawals after the age of 59 1/2 are not taxed. The tax deferral on your Roth IRA’s earnings is valuable because it expedites your savings growth.

Without any recurring tax implications, you don’t have to pull money out of the account each year to pay Uncle Sam. And the ability to withdraw money tax-free in retirement could save you thousands if you are in a high tax bracket when you leave the workforce.

There’s one other advantage of the Roth IRA. Since you contribute to your Roth IRA with after-tax money, you can withdraw your contributions at any time without paying a penalty. You are only penalized for withdrawing earnings, until you reach the age of 59 1/2 and at least five years have passed since your first Roth IRA contribution.

The Roth IRA does have two drawbacks. One, the annual contribution limits are fairly low. In 2021, you can contribute up to $6,000 annually, or $7,000 if you’re 50 or older. That limit applies to your combined deposits to Roth and traditional IRA accounts. And two, eligibility for contributing to a Roth IRA is based on your income and tax filing status. As the table below shows, you can’t put money in a Roth IRA if you have a high income, unless you use a backdoor Roth IRA strategy.

Also Check: Can You Borrow Money Against Your 401k

What About A Traditional Ira

If your income is too high to contribute to a Roth IRA, you can go with a traditional IRA. Like a Roth IRA, you can contribute up to $6,000 a year$7,000 if youre 50 or olderand you and your spouse can both have an account.4

Thats where the similarities end. Unlike a Roth IRA, there are no annual income limits. But youre required to begin withdrawing once you turn 72, and even though contributions to a traditional IRA are tax-deductible, youll have to pay taxes on the money you take from it in retirement.5

Still with us? Now, lets look at some other options you can explore if youre self-employed.

Option : Roll Over Your Old 401 Into An Individual Retirement Account

Still another option is to roll over your old 401 into an IRA. The primary benefit of an IRA rollover is having access to a wider range of investment options, since youll be in control of your retirement savings rather than a participant in an employers plan. Depending on what you invest in, a rollover can also save you money from management and administrative fees, costs that can eat into investment returns over time. If you decide to roll over an old 401 into an IRA, you will have several options, each of which has different tax implications.

You May Like: What Is The Tax Penalty For Early 401k Withdrawal

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Recently enacted legislation made a number of changes to the rules regarding defined contribution, defined benefit and/or individual retirement plans and 529 plans. Information herein may refer to or be based on certain rules in effect prior to this legislation and current rules may differ. As always, before making any decisions about your retirement planning or withdrawals, you should consult with your personal tax advisor.

Fidelity does not provide legal or tax advice. The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Consult an attorney or tax professional regarding your specific situation.

With respect to federal taxation only. Contributions, investment earnings, and distributions may or may not be subject to state taxation.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

How To Open A 401k Without An Employer

How do you open a 401 account without an employer plan? Many companies donât offer a 401. But there are many alternatives to save for retirement.

The 401 retirement plan is the most common way in which Americans save for retirement. However, according to a study by the US Census Bureau, only 14% of US employers offer a 401 through their company. That still results in over 70% of Americans contributing to a 401 plan. But if you find yourself working for a company that doesn’t offer a 401 plan, you might not know how to open a 401 without an employer plan.

If your company doesnât offer a 401 plan or you are self-employed, youâll need to join a separate financial institution. There youâll be able to open a 401, IRA, or any other retirement plan you choose.

In addition to these alternatives to 401s, you’ll want to rollover your old 401s to these accounts. Consolidating your 401s will help keep your retirement properly managed and accounted for.

Read Also: How Much Can You Save In 401k Per Year

How Much Should I Save To Reach My Retirement Goals

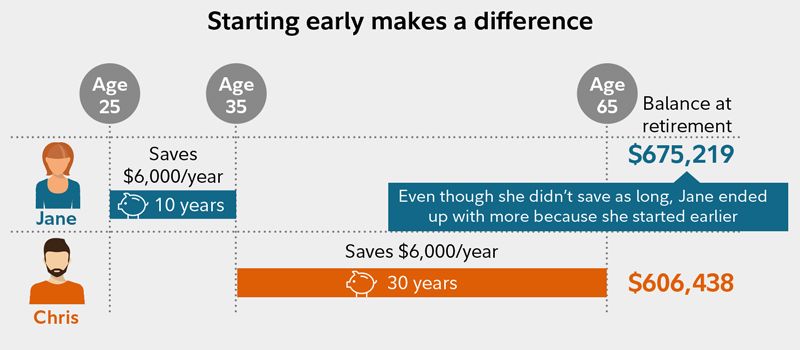

Thats a great question and it really all depends on when youre planning to retire. All things considered equal, the sooner you start saving for retirement, the less money youll need to save. Similarly, the sooner you plan to retire, the more aggressively youll need to save. Unfortunately, theres no magic number for everyone. Fortunately, doing the math isnt too tough.

Start by figuring out when your ideal retirement date is. Once you have a goal in terms of when youd like to retire, figure out the lifestyle youd like in retirement. For example, are you okay with playing bridge on your front porch or do you want to go on cruises and travel the world?

Once you have your dream retirement in mind, try to put a price tag on it. Figure out how much you expect to spend in retirement. It can help to create a mock budget. Once you have your mock budget in hand, you can figure out how much youd need to save from each paycheck in order to achieve your desired retirement date. Its that easy.

Keep In Mind That You Can Set Up Multiple Types Of Retirement Accounts

You don’t have to pick one retirement accounts. You can open several.

For example, Eweka says her favorite IRA mix is “the SEP and using a regular Roth or traditional IRA” because, she says, “If you can do more than the $6,000 a year that youre limited to with IRA, then with an SEP you can contribute up to 25% of your income with some calculations.”

And, of course, people who have a 401 through their work can still open an IRA on their own separately.

Don’t Miss: How Much Should I Have In 401k

Option : Keep Your Savings With Your Previous Employers Plan

If your previous employers 401 allows you to maintain your account and you are happy with the plans investment options, you can leave it. This might be the most convenient choice, but you should still evaluate your options. Each year, American workers manage to lose track of billions of dollars in old retirement savings accounts, so you should make sure to track your account regularly, review your investments as part of your overall portfolio and keep the beneficiaries up to date.

Some things to think about if youre considering keeping your money in your previous employers plan:

If You Can Contribute More Than $6000 A Year And You’re Self

If you’re a business owner or self-employed person with no employees and you want to set aside more than $6,000 a year, you might want to consider a Solo 401 ).

With this retirement plan, you play the role of both the employer and the employee, which allows you to contribute to the plan in both capacities outlined in #1). In total, you can contribute up to $58,000 for 2021.

Like the employer-sponsored 401 and the traditional IRA, you’re not taxed upfront for the money you put in, but you are charged when you withdraw money in retirement.

Don’t Miss: Will Walmart Cash A 401k Check

How Can I Save For Retirement Without One

There are lots of people who are looking for ways to save for retirement without relying on a 401, but they might be worried about their 401 losing value or they might not have it available to them at their job. One of the most common retirement vehicles that someone will use is called an IRA. An IRA is an individual retirement account. Two of the most common types of IRAs are traditional IRAs and Roth IRAs. Some people who are self-employed also use something called a SEP-IRA. One of the advantages of using an IRA is that the contributions are tax-deductible. In some cases, people claimed this deduction when they contribute to the IRA. In other cases, people claimed this deduction when they pull money out of their IRA. If people decide to make contributions to an IRA, they might be able to save money on their taxes.

On the other hand, there are some people who are simply worried that they are going to lose money if they invest in the stock market. They may not be comfortable with their knowledge base or they might not have time to track the market that closely. The good news is that there are other resources available to individuals who would like to save for retirement without having to rely on the stock market.

Pick A Plan And Start Saving

Time is one of the most important factors when it comes to building up your retirement fund. While you’re young, time is on your side. Don’t let the absence of a workplace retirement plan like a 401 stand in your way. There are plenty of other retirement savings optionspick a plan and start saving and investing.

Also Check: How Does Retirement Work With 401k

Take Advantage Of Catch

Once you turn 50, you are allowed to contribute an additional $1,000 to your IRA accounts each year. While this small contribution increase may not seem to make much of a difference, you still have close to 20 years until retirement when you turn 50. With the power of compound interest, that additional $1,000 contribution each year could be worth close to $50,000 by the time you turn 70.

Challenges With A 401 Plan

Some challenges make this plan unsuitable for some, including:

-

The limit placed on the maximum amount a person can contribute

-

The tax and regulations or rules set for the withdrawal of money

The plan is not accessible to employers, and some self-employed people do not know how else to save for retirement. There are risks of not learning and implementing other saving ways for retirement.

Some risks include:

-

Working past the retirement age to sustain your needs – Once you cannot save up for your retirement, it will force you to work longer when you should rest and enjoy what you have worked for over the years.

-

Risk of falling into debt – Different times come with different economic waves. After retirement, the streams of income become dry, and some expenses are recurrent while others come as emergencies. Failure to save up for retirement may force you to borrow money to meet some of these needs.

Also Check: Can You Use Your 401k To Buy Real Estate

Crank Up The Investments Available

- Contribute more Put a higher percentage of your income into your existing retirement plan. Since it lowers your taxable income, it may be cheaper than you think.

- Try other tax-deferred options Consider opening an individual retirement account if youve reached the maximum contribution level in your employer-sponsored plan.

- Consider getting taxed up front Money placed in a Roth IRA is taxed now, but qualified Roth earnings are never taxed. This can save you more money in the long run.

Smart Tips On How To Save For Retirement Without A 401k

Are you about starting a retirement portfolio but dont want to invest in a 401K? If YES, here are 13 smart tips on how to save for retirement without a 401K. Since it was established in the 1970s, 401k plans have been by far the most popular type of employer-sponsored retirement plan in the U.S., but even with its popularity, millions of Americans do not access these plans for one reason or the other.

In fact, according to a study that was done in March 2016 by the united states Bureau of Labor Statistics , 67 percent of full-time American workers have access to employer-sponsored defined contribution plans and only 48 percent actively participate in these plans. What this means is that a large amount of Americans still do not have access to a 401k plan and as such, they need to find an alternative retirement plan for themselves.

It is not difficult to see why 401k plans are so popular. This savings channel is tax-deferredand it is an easily accessible way for employees to accumulate wealth over time for retirement. Any contribution you make to your 401k plan is task free and this means that they are deducted from your taxable income for that year. The savings in a 401k thus have freedom to grow untaxed until they are ripe for withdrawal .

Here are some ways you can save for your retirement without a traditional 401k.

Recommended Reading: How Do You Move Your 401k When You Change Jobs

Launch A Profitable Side Hustle And Open A Solo 401 Or Sep Ira

If you really don’t want to save for retirement without a 401, then you could open your own. You’d have to start a side hustle and establish a solo 401 orSimplified Employee Pension IRA. What’s nice about these accounts is that they have very high contribution limits. In 2021, you can contribute up to $58,000 to a SEP IRA or solo 401. If you’re 50 or older, then you can add an additional $6,500 to the solo 401 limit. There are caveats, though:

- contributions cannot exceed 25% of your income from the business.

- With a solo 401, you can contribute as both the employee and employer. This distinction is important because the contribution rules for each role are different. As an employee of the business, you can contribute up to $19,500 of your compensation. As the employer, you can contribute up to 25% of earned income. Earned income equals your net earnings from self-employment less one-half of the sum of your self-employment tax and contributions to yourself. The contribution cap for a solo 401 applies to the total of the combined employee and employer contributions.

The broader takeaway is that your business must be profitable to make contributions to these accounts. You can’t, for example, get a business license for a hobby, open a solo 401, and then contribute money from your day job.

Consider A Health Savings Account

Another option to consider is a health savings account . If you have an HSA-eligible health plan, these accounts offer a number of benefits, including a tax deduction, tax-free growth potential, and tax-free withdrawals to pay for qualified medical expenseseither now or in retirement.*

After age 65, if you dont need the money for health care costs, you can take withdrawals from the account penalty-free. But, similar to a traditional IRA, taxes on contributions and earnings will be due.

- For more information, read on Fidelity.com: How can an HSA benefit you?

Don’t Miss: Where To Move Your 401k Money