What Is Better Than A 401k

In many cases, a Roth IRA can be a better choice than a 401 retirement plan, as it offers a flexible investment vehicle with greater tax benefitsespecially if you think youll be in a higher tax bracket later on. Invest in your 401 up to the matching limit, then fund a Roth up to the contribution limit.

Summary Roth 401 Or Pre

Thats all I have for you today on what is better for you? Pre-tax contributions to your 401 or after-tax Roth contributions?

Its not an easy decision. When in doubt, always go 50/50. And also remember, your employer contributions will always be taxable when you withdraw them. That should change the way you think as well, because those taxable distributions if everything is going to be taxable, that could easily put you into that 22% bracket when you are pulling money out later. So put more into the Roth now.

Just keep that in mind. 50/50 is a great place to start. If you can afford it, do the full Roth contribution and put more money in. Instead of that $320 that we talked about if you can put more money in, do it. Put more money in and do it in the Roth. Because, even though youre not saving the taxes now, you get those big benefits later.

There are also some other big benefits after you pass with how the Roth and the IRA are distributed to your beneficiaries and heirs. And again, having both types is good in that direction as well, thinking longer-term.

So, thats all I have for you today. Once again, my name is Greg Phelps with Redrock Wealth Management here in Las Vegas. The blog and podcast host and webinar host to retirewire.com. Thank you so much for your time. I hope you found this helpful. And if you have any questions, feel free to reach out through retirewire.com or redrockwealth.com.

How Do Roth 401 And Pre

How do these tax implications affect you? Lets look at a working life here.

What I did is I took just a sample scenario where, lets just say, youre 40 years old, and now you decide youre going to start saving for retirement. Thats great. And then you retire over here, right about age 62. Its just not on the chart there.

So you retire at age 62. And then you end up dying over here at age 84. This is a very common scenario that a lot of people have experienced throughout their life.

So, as you can see here, weve got a chart here with the pink, which is effectively your Roth contribution. And what youll notice there is, again, you have less money because you paid your taxes upfront. Less money in your account. So it may feel worse when in actuality its really not.

And then you can see right here, the red chart is your traditional or your pre-tax 401 contribution because you basically did not pay those taxes upfront. Youve got more money than youre using that you would have paid in taxes to grow for you. You can see here, you have more money when you retire at age 62 versus here with the Roth. Thats not necessarily a bad thing though.

Lets go ahead and follow through with the mathematical concepts here. If your salary is $4,000 a month, all things being equal, youre saving 10%. Your pre-tax savings is going to be $400, just like we just talked about. Your taxable income is now $3,600 because you saved that $400 into your pre-tax 401 at a tax rate of 20%.

You May Like: Can I Change My 401k Contribution At Any Time

Why We Recommend The Roth 401

If youre investing consistently every monthwhether its in a Roth 401, a traditional 401 or even a Roth IRAyoure already on the right track! The most important part of wealth building is consistent saving every month, no matter what the market is doing.

But if choosing between a traditional 401 and a Roth 401, we’d go with the Roth every time! Weve already talked through the differences between these two types of accounts, so youre probably already seeing the benefits. But just to be clear, here are the biggest reasons the Roth comes out on top.

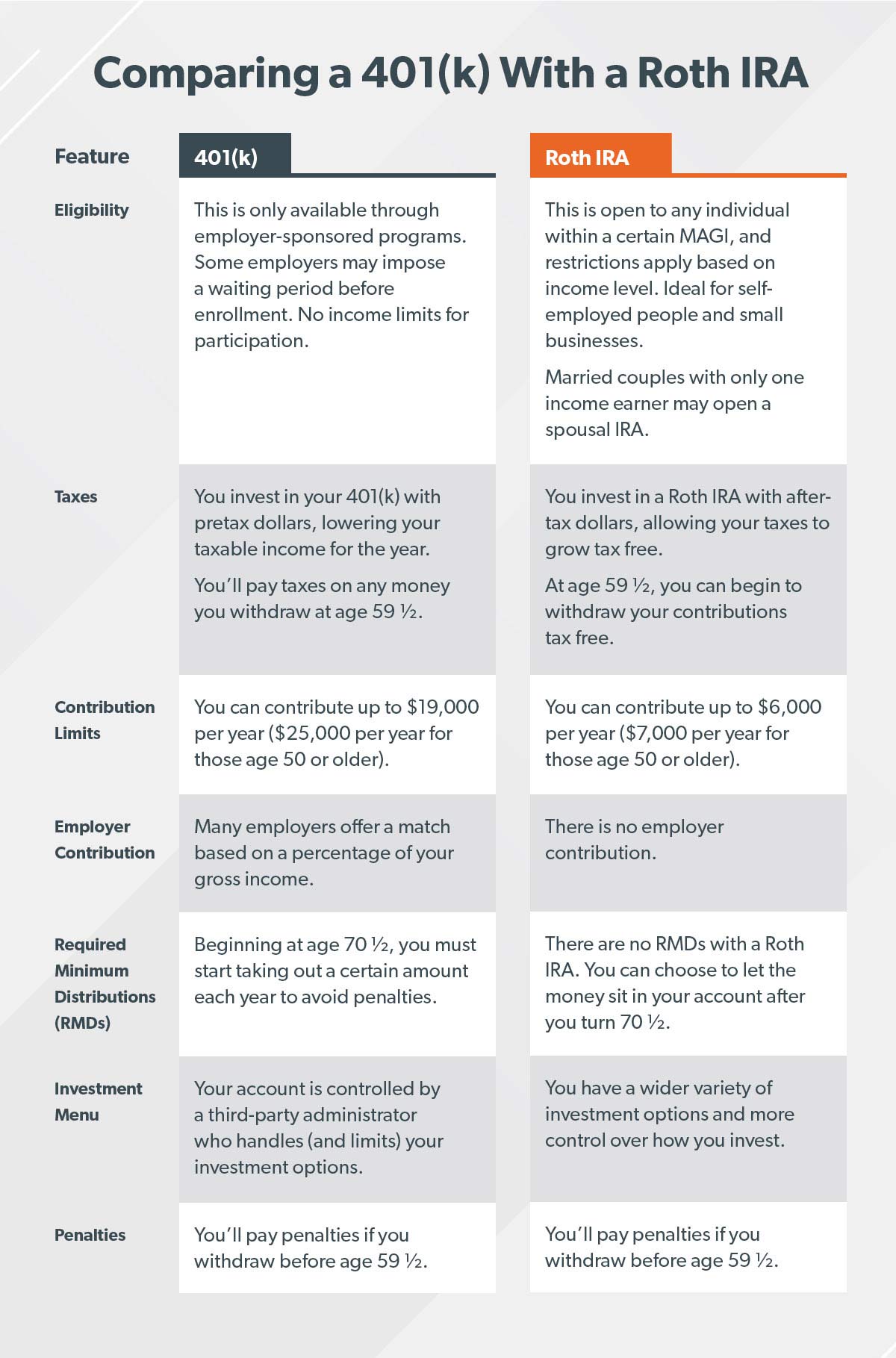

Types Of Retirement Accounts: Iras And 401s

We can help. By learning about your options, you can choose the type of savings account thats right for your life, now and in the future.

Lets start with the two most common ways to saveIndividual Retirement Accounts and 401 accounts. Well break down the similarities and differences between traditional 401s and traditional IRAs, then share details around Roth IRAs and Roth 401s, giving you a basic understanding of each.

Recommended Reading: How Do I Roll Over My 401k To An Ira

Vs Roth : How Are They Different

The biggest difference between a traditional 401 and a Roth 401 is how the money you contribute is taxed. Taxes can be kind of confusing , so lets start with a simple definition and then well dive into the details.

A Roth 401 is a post-tax retirement savings account. That means your contributions have already been taxed before they enter your Roth account.

On the other hand, a traditional 401 is a pretax savings account. When you invest in a traditional 401, your contributions go in before theyre taxed, which makes your taxable income lower.

Roth 401 vs. Traditional 401: Pros and Cons

| Contributions | Contributions are made with after-tax dollars . | Contributions are made with pre-tax dollars . |

| Withdrawals | The money you put in and its growth are not taxed. However, your employer match is subject to taxes. | All withdrawals will be taxed at your ordinary income tax rate. Most state income taxes apply too. |

| Access | If youve held the account for at least five years, you can start taking money out once you are age 59 1/2. You or your beneficiaries can also receive distributions due to disability or death. | You can start receiving distributions at age 59 1/2, no matter how long youve had your 401. You or your beneficiaries can also receive distributions due to disability or death. |

Vs Roth : Which One Is Better

11 Minute Read | November 12, 2021

If youve heard of a Roth 401, you may be wondering how different it really is from a traditional 401. We get it, 401s can be confusing! While these two types of 401 accounts have some similarities, they also have some pretty huge differences.

Access to a Roth option is becoming more and more common, so youre in the majority if you have this option at work. Just over the last five years, the number of plans offering a Roth 401 option has increased by 32%. As of 2021, about 3 out of 4 workplace retirement plans now offer a Roth optionwhich is great news for you!1

And guess what? Younger savers are starting to take advantage of this new option. Millennials are the most likely group to contribute to their Roth 401 at work.2

If you can contribute to a Roth and traditional 401 at work, which one should you choose? Lets dig into some of the differences between these options so you can make the best decision.

Read Also: Do You Pay Taxes On 401k Withdrawals

S Are Great But They Can’t Match These Other Accounts In Terms Of Flexibility

A 401 is the go-to retirement account for most workers who have access to one, but it’s not the best choice in every situation. There are other places you can stash your savings that offer greater flexibility and control over your investments. Here are three you should consider adding to your retirement plan.

Advantages Of A Roth Ira

Here are some advantages a Roth IRA has over a 401:

- Tax-free growth. The biggest benefit is the tax break. Since you invest in your Roth IRA with money thats already been taxed, the growth isnt taxed, and you wont pay any taxes when you withdraw your money at retirement.

- More investing options. With a Roth IRA, you dont have a third-party administrator deciding which funds you can invest in, so you can choose any mutual fund you like. But be careful: Always seek good advice when choosing mutual funds, and make sure you fully understand how they work before you invest any money.

- Set up apart from an employer. Unlike a workplace retirement plan, you can open a Roth IRA at any time as long as you deposit the minimum amount. The amount will vary based on who you open your account with.

- No required minimum distributions . With a Roth IRA, you wont be penalized if you leave your money in your account after age 72 as long as you hold the Roth IRA for at least five years. But like the 401, youll be penalized for taking money out of a Roth IRA before age 59 1/2 unless you meet specific requirements.

- The spousal IRA. If youre married but only one of you earns money, you can still open an IRA for the non-working spouse. The spouse who earns money can invest in accounts for both spousesup to the full amount! A 401, on the other hand, can only be opened by someone earning an income.

Recommended Reading: How To Choose 401k Investment Options

Why Is A 401 Better Than An Ira In Terms Of Retirement

Whats right for you really comes down to your unique circumstances, so its important to consider both 401s and IRAs as potential retirement savings tools.

401s definitely have their advantages. One of the biggest is employer contribution matches. So if your employer offers one, be sure to take advantage of it. Otherwise youll be leaving that free money on the table. Another advantage of 401s are their contribution limits, which are about three to four times higher than those of IRAs.

But dont count out IRAs just because you have a 401. Traditional IRAs offer an additional, pretax investment option. And, if you expect to be in a higher tax bracket when you reach retirement age, Roth IRAs withdrawals are tax-free.

Making the right decision can sometimes feel overwhelming. If youre unsure of what to choose, talk to a retirement planner. A professional can help you map out the best strategy for your financial situation.

Learn The Differences And Similarities Between A 401 And 457 Retirement Savings Plan

If your workplace offers both a 401 plan and a 457 plan to help you save for retirement, you may be wondering which one to invest in. The two retirement plans look very similar, and the super-creative numerical names based on IRS tax codes don’t distinguish them much.

457s are savings plans primarily offered to government employees, including state and local government officials, public school teachers, county and city employees, and first responders. By contrast, 401 retirement plans are usually offered by private enterprises. But some big government employees might offer both. Here’s how to decide which is the best choice for you.

Don’t Miss: How To Collect Your 401k From Previous Employer

Plans May Offer An Employer Match

While they might be harder to obtain, 401 plans make up for it with the potential for free money. That is, many employers will match your contributions up to some level.

401s sometimes will have a match depending on the employers generosity and financial position, says Michael Lackwood, founding principal of New York City-based Spring Delta Asset Management. If your employer does offer a match, it makes most sense to contribute to the 401 at least up to the maximum percentage match.

For example, if you contribute 4 percent of your salary, your employer may offer 2, 3 or 4 percent, as an inducement to help you save. Thats free money and an immediate return on your investment.

In contrast, youre on your own with an IRA, and your funds will consist only of what you contribute and any earnings on those contributions.

How To Invest In Both Roth Ira & 401

When managed properly, having both a Roth IRA and 401 can be an excellent way to prepare for retirement. Get started by learning more about your 401 eligibility at work do you have to wait a year to open an account? Does your employer match, and how much? Which mutual funds are available to you? If you do receive employer contributions, many financial planners might tell you to start by opening and contributing to this account. After you have a 401 you can set up and contribute to a Roth IRA at the same time.

Also Check: What Age Can I Start Withdrawing From My 401k

Whats Better Roth 401 Or Pre

Then the question is, well whats better for you? Should it be pre-tax or should it be Roth?

So lets take a look at those things. And again, just to drive home the foundation here, your contributions with the Roth are made with after-tax dollars. With the pre-tax 401, it is pre-tax.

Now your limits here, your contribution limits, this is currently 2020, very end of 2020. This may change. But your limits right now are $19,500, if youre 49 years of age or younger and contributing. And if youre age 50 or older, you get that catch-up contribution which is super-cool. The IRS allows you to put an additional $6,500 into your 401 retirement plan. So those are your contribution limits.

I get asked an awful lot, Well, how much should I put into my 401? And the number one thing I tell people is, you should put in at least 10%. I know its very hard for a lot of people to do that, but when we talk about retirement and shaping what your future golden years are going to look like, the 10% today is going to be a lot better off than waiting. The longer you go, it takes longer to catch up, the less youll have in retirement and so on and so forth.

The other thing to think about here is growth. And the growth in that account, once you get the money in there, whether its pre-tax or whether its Roth, that growth is going to be tax-deferred. And eventually, when you pull the money out of a pre-tax account, thats going to be taxable at your ordinary income rates.

Understanding Your Investment Account Options

Now that youve made the right choice in deciding to save for retirement, make sure you are investing that money wisely.

The lineup of retirement accounts is a giant bowl of alphabet soup: 401s, 403s, 457s, I.R.A.s, Roth I.R.A.s, Solo 401s and all the rest. They came into existence over the decades for specific reasons, designed to help people who couldnt get all the benefits of the other accounts. But the result is a system that leaves many confused.

The first thing you need to know is that your account options will depend in large part on where and how you work.

Also Check: Is It Better To Have A 401k Or Ira

Which Is Better For You

There are more commonalities than differences between a 401 and a 457.

- They both offer the same tax advantages. Employees can deduct their contributions from their taxes in the current year. Investments grow tax-free. And retirees pay regular income tax on withdrawals.

- They can both offer Roth options, which allow people to pay income tax now in exchange for tax-free withdrawals in retirement.

- They have the same standard contribution limits of $19,500 in 2021 and $20,500 in 2022 with an additional $6,500 catch-up contribution limit for those 50 and older.

- They both allow for loan provisions if you need to temporarily access funds early.

- They both typically offer a selection of mutual funds to invest in, and they charge fees for managing the plans.

The big differences are the penalty on early withdrawals and the potential employer match.

If your employer offers a match on the 401, it behooves you to contribute at least up until the match. Even if you expect to retire early, paying a 10% early withdrawal penalty on a 100% free match is still a good deal. Otherwise, those with plans for an early retirement ought to favor the 457.

All else being equal, investors should consider the investment options and fees for each plan. If one plan offers the ETFs or mutual funds you like or it has considerably lower fees, opt for that one. Fees can be a major drag on your investment returns over 30 or 40 years, so it pays to keep them low.

Iras Offer A Better Investment Selection

If you want the best possible selection of investments, then an IRA especially at an online brokerage will offer you the most options. Youll have the full suite of assets on offer at the institution: stocks, bonds, CDs, mutual funds, ETFs and more.

Generally, for investment selection and overall management of your funds, I would say IRAs have a clear advantage, says Lackwood.

In contrast, 401 plans usually offer only a relatively small selection of investments, even if it does offer the key fundamental types, such as a money market fund and a Standard & Poors 500 index fund.

Usually, employers restrict the 401 the choice of investments to 15-20 positions whereas an IRA allows thousands of different choices, says Lackwood.

IRAs tend to allow significantly more investment options than the average 401 plan does and can therefore be better tailored to each individual, says Burke.

Recommended Reading: How Much Can We Contribute To 401k

The Roth 401 & Roth Ira Rules Work Together

Okay. Moving on. Theres one thing you need to be very well aware of as a Roth 401 investor, and thats the Roth IRA five-year rule. And what this basically says is that, when you put money into a Roth IRA, you can always pull out the amount that you put in completely tax-free and penalty-free, because that was your money, it was after-tax.

Now, lets say you put $1,000 into a Roth IRA and it grows to $1,500 over the next few years. If you pull that $1,500 out, the $1,000, your contribution, is going to be tax-free. The $500 may or may not be taxable. And heres the rule. You must be at least age 59 and a half and have the account open for five years for that $500 to not have any tax consequences or implications at all.

The tricky part about the Roth 401 is, the Roth 401 is a designated Roth account per IRS rules. So it doesnt follow, it doesnt play by the same rules that your Roth IRA does.

The tricky thing about the Roth 401, if you have no other Roth IRAs, you retire and you roll over that Roth 401 into a new Roth IRA that you set up, you have a new five-year rule. That five-year clock now starts. So while you can pull out your contributions and so forth, there is possibly taxes and penalties on the growth, depending on your circumstances, your situation.

However, its just smart. Get the seasoning done. Dont even have to worry about it.