How Do I Know The Right Amount Of My Rmd

The amount of your RMD is determined by tables created by the IRS based on your life expectancy, and the age of your spouse, if youre married. If your spouse is more than 10 years younger than you, or less than 10 years younger, the calculation is slightly different .

Youre not limited to the amount of your RMD, by the way. You can withdraw more than the RMD amount at any point. These rules are simply to insure minimum withdrawals are met.

If you withdraw more than the RMD one year, it does not change the RMD requirement for the next year.

Required Minimum Distribution Calculator

SECURE Act Raises Age for RMDs from 70½ to 72: The Setting Every Community Up for Retirement Enhancement Act of 2019 raised the age when you must begin taking RMDs from a traditional 401 or IRA from 70½ to 72. If you turned 70½ years old on or after January 1, 2020, this laws changes apply to you and you do not have to begin taking RMDs until April 1 of the year following the year that you turn age 72. If you turned 70½ years old in 2019, the law’s changes do not apply to you.

Note: If your spouse is more than ten years younger than you, please reviewIRS Publication 590-Bto calculate your required minimum distribution.

Date For Receiving Subsequent Required Minimum Distributions

For each year after your required beginning date, you must withdraw your RMD by December 31.

For the first year following the year you reach age 70½ , you will generally have two required distribution dates: an April 1 withdrawal ) and an additional withdrawal by December 31 ). You can make your first withdrawal by December 31 of the year you turn 70½ instead of waiting until April 1 of the following year which would allow the distributions to be included in your income in separate tax years.

Example: John reached age 70½ on August 20, 2019. He must receive his 2019 required minimum distribution by April 1, 2020, based on his 2019 year-end balance. John must receive his 2020 required minimum distribution by December 31, 2020, based on his 2020 year-end balance.

If John receives his initial required minimum distribution for 2019 on December 31, 2019, then he will take the first RMD in 2019 and the second in 2020. However, if John waits to take his first RMD until April 1, 2020, then both his 2019 and 2020 distributions will be included in income on his 2020 income tax return.

Example: Paul reached age 70½ on January 28, 2020. Since Paul had not reached age 70½ before 2020, his first RMD is due for 2021, the year he turns 72. Pauls first RMD is due by April 1, 2022, based on his 2020 year-end balance. Paul must receive his 2022 required minimum distribution by December 31, 2022, based on his 2021 year-end balance.

Recommended Reading: How To Roll Over 401k To New Company

Strategies For Postponing Or Minimizing Rmds

There are some things you can do to mitigate RMDs. But lets start with what you cant do.

You may not put the money you withdraw into another IRA or Roth IRA. After paying taxes, you may invest the money in a non-retirement account.

While you may withdraw more than the minimum amount required, you cant apply the excess withdrawal to your RMD in a subsequent year.

On the other hand, to lessen the tax impact, you can take your first RMD in two different calendar years. However, that means the second RMD will be added for tax purposes to the amount of the first RMD you took that year.

If youre still employed when you turn 72 and are participating in an employer-sponsored 401, you dont have to take RMDs from that account as long as you continue to work for that employer and you dont own more than 5 percent of the company you are employed with.

For those who are self-employed and have a , you still must take an annual RMD from that account once you reach 72 , but you can offset the RMD by making contributions to the account.

You can also roll over the amount withdrawn directly into a charitable donation, with no taxes required on the donated amount up to $100,000 a year.

You can purchase a qualified longevity annuity contract, or QLAC, which is a deferred annuity funded with assets from a qualified retirement plan. Federal rules allow you to spend the lesser of 25 percent of your retirement savings or $125,000 to purchase a QLAC.

Ira 705 Irs Withdrawal Rules

An IRA can be a useful retirement planning tool.

When you own a traditional IRA you benefit from a number of tax advantages. Your contributions may qualify for a tax deduction , and investment earnings in the plan accumulate tax free. You only pay tax when you begin taking withdrawals.

One major restriction is that you are forced to take distributions once you reach age 70.5. Failure to do so can result in a hefty 50 percent penalty from the IRS.

Also Check: How Do I Rollover My 401k To My New Job

Don’t Miss: When Can You Use Your 401k

Why Do Rmds Exist

You may find yourself wondering why there is a required minimum distribution for your IRA. After all, its your money, so why cant you take it out of your account at your own pace? The answer to this question is the same as the answer to many questions when it comes to financial matters: taxes.

You dont pay taxes on the money in your IRA when you put it in. Instead, you pay taxes when you withdraw the funds in retirement. The money will be taxed according to your current tax bracket. This is beneficial if you are in a lower tax bracket in retirement than you were when you first earned the money and were probably earning a much higher total income.

If you were to leave all of your money in your IRA, it would eventually become eligible to be passed on as inheritance and perhaps end up un-taxed. The required minimum distribution forces you to take out some money while it can still be taxed.

Planning With The New Rmd Starting Age

While any delay in the forced distribution of funds from IRAs and other retirement accounts will, no doubt, be welcome news for many individuals particularly the clients of financial advisors who tend to have sizable retirement account balances the reality is that the majority of retirement owners will see little to no benefit from this change.

As its important to remember that an RMD is a required minimum distribution, it doesnt prevent people from taking more than the required amount, or from taking distributions from their retirement accounts before they are mandated to do so. Which in practice is what many people do, simply because they need the money .

To that end, earlier this year, as part of Proposed Regulations to update the Life Expectancy Tables that individuals use to calculate RMDs, the IRS indicated that according to its own numbers, only about 20% of people take just the required minimum amount. And if someone is already taking more than the minimum, theyll likely continue to do so regardless of whether the RMD age is age 70 ½ or age 72. Its unlikely that theyll suddenly find enough other money to be able to delay taking distributions.

For such individuals, pushing back the RMD starting age from 70 ½, all the way to 72 may seem like only a minor change, but whenever Congress cracks open a planning window, its best to make the most of it, no matter how small that crack may be.

Read Also: How To Roll 401k Into New Job

Read Also: How To Cash Out Your 401k Fidelity

Rollover Traditional Ira To Roth Ira

Transferring money from a traditional IRA to a Roth IRA early in retirement can also help you avoid future RMDs. Be aware that you will still owe taxes on the transferred amount from your traditional IRA to a Roth IRA. These taxes are due in the year when the conversion is made.

Once the transfer is completed and all taxes paid, the retirement money will grow tax-free. Even better, it will not be subject to RMDs.

Simple Ira Definition And Rules

SIMPLE IRA stands for Savings Incentive Match Plan for Employees Individual Retirement Account. A SIMPLE IRA is similar to a traditional IRA, but it has higher contribution limits.

Heres how it works: A small business owner with fewer than 100 employees, along with the sole proprietor or partner in a business, can set up a SIMPLE IRA for herself and her employees. Per IRS rules, all employees who, in the previous two calendar years, received at least $5,000 in compensation from the employer and who are expected to receive at least as much during the present calendar year are eligible.

Eligible employees can decide to make elective deferrals, just like with a 401. That means that employees can choose to save a certain percentage of their pre-tax income. The employer then contributes to the SIMPLE IRA on behalf of each eligible employee.

Employer contributions can be either matching or non-elective. Non-elective means that the employer makes a unilateral decision to contribute to an employees savings plan, regardless of whether the employee contributes in a given year. Non-elective matches have a lower limit of 2%.

IRS rules prohibit employees from opting out of a SIMPLE IRA. They can choose not to make elective deferrals , but they cannot opt out of receiving non-elective contributions from their employers. This shouldnt ever be an issue however, because it would be against the employees interest to turn down more money from their employer.

Recommended Reading: Can You Pull Out Your 401k To Buy A House

How Do You Calculate A 401k Withdrawal At Age 70

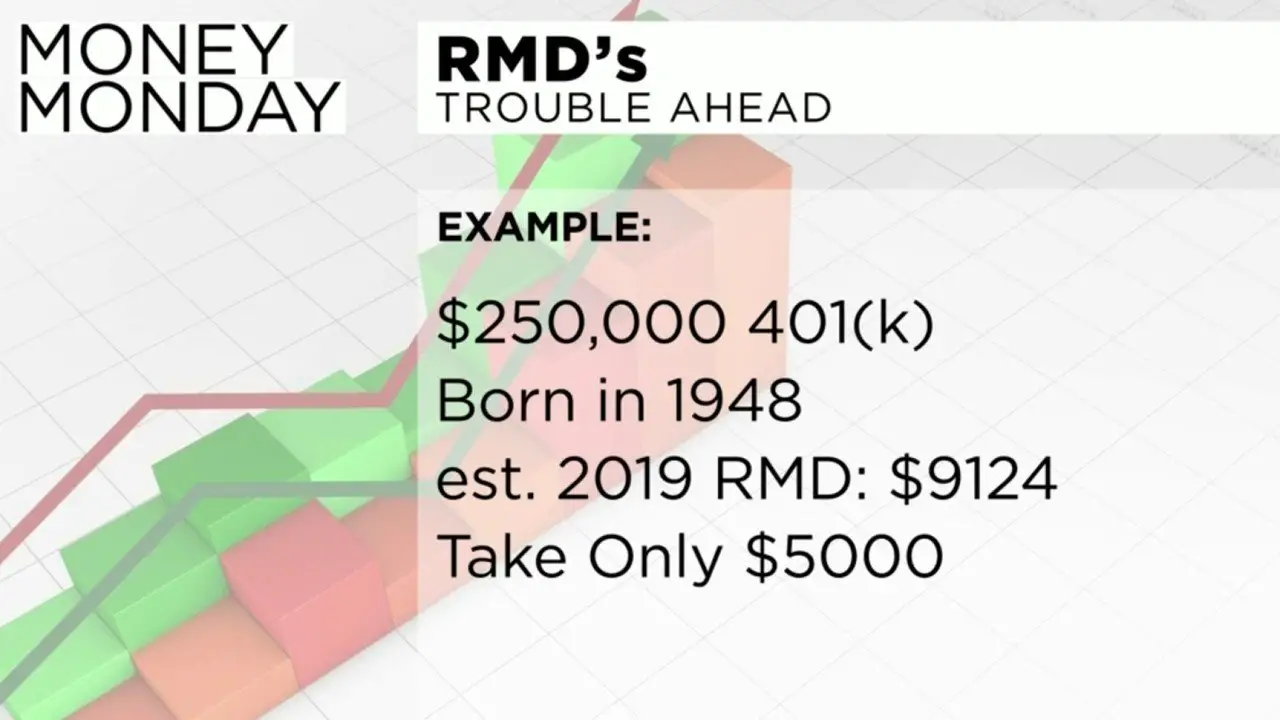

Mandatory 401 withdrawals at age 70 1/2, known as required minimum distributions, are calculated by dividing the balance in the 401 account on December 31 of the previous year by the life expectancy of the account holder, reports Bankrate. Life expectancy is determined using the appropriate IRS uniform lifetime table.

401 account holders can withdraw more than the minimum distribution at any time after age 59 1/2, but required minimum distributions must begin at age 70 1/2, or account holders are subject to a 50 percent penalty tax on the amount that should have been distributed, according to the IRS. Account holders may withdraw larger amounts than the minimum, but the excess does not count towards the following years required minimum distribution. Although 401 administrators may help calculate the required minimum distribution, responsibility for calculating and withdrawing the correct amount lies with the 401 account holder.

There are three uniform lifetime tables, as reported by the IRS. The standard uniform lifetime table is used by a 401 owner whose wife is not more than 10 years younger. The Joint and Last Survivor table is used by an account holder whose only beneficiary is his wife who is more than 10 years younger. The Single Life Expectancy table is used by other beneficiaries of a 401 account.

Why Do Required Minimum Distributions Exist

Investment gains within a retirement account aren’t taxed until they’re withdrawn. If you have other sources of income, and if RMDs didn’t exist, you could hypothetically live off your other sources of income and never pay taxes on the retirement account gains they could potentially be passed onto family or friends as an inheritance without creating a taxable scenario.

Enforcing RMDs is the government’s way of making sure the IRS receives taxes on the gains held within a retirement account.

Account holders are required to withdraw a minimum amount from their retirement fundsand pay tax on that moneyeach year after they reach a certain age. You must do so by April 1 of the year following the year in which you reach age 72. After the first RMD, you must continue taking RMDs annually by December 31.

Recommended Reading: Should I Move 401k To Ira

Are There Penalties For Not Taking My Rmd

The penalty for not taking a required minimum distribution is a tax of 50% on any amounts not withdrawn in time. The penalty can be waived, however, if you can establish that you failed to take the RMD due to reasonable error and you’ve taken steps to correct the situation. You can file Form 5329 with the IRS to request a waiver from the penalty, along with a letter explaining what went wrong.

Calculating Required Minimum Distributions For Designated Beneficiaries

Generally, for individuals or employees with accounts who die prior to January 1, 2020, designated beneficiaries of retirement accounts and IRAs calculate RMDs using the Single Life Table ). The table provides a life expectancy factor based on the beneficiarys age. The account balance is divided by this life expectancy factor to determine the first RMD. The life expectancy is reduced by one for each subsequent year.

If the distribution is from a qualified retirement plan, the plan document will establish the RMD rules, and the plan administrator should provide the beneficiary with his or her options. The options for the RMD pay-out period may be as short as 5 years, or as long as the life expectancy of the beneficiary. Therefore, if the distribution is from a qualified plan, the beneficiary should contact the plan administrator. For IRA distributions, see Publication 590-B, Distribution from Individual Retirement Arrangements , or this chart of required minimum distributions to help calculate the required minimum distributions.

Don’t Miss: Should I Rollover My Old 401k To An Ira

Tax On A 401k Withdrawal After 65 Varies

Whatever you take out of your 401k account is taxable income, just as a regular paycheck would be when you contributed to the 401k, your contributions were pre-tax, and so you are taxed on withdrawals. On your Form 1040, you combine your 401k withdrawal income with all your other taxable income. Your tax depends on how much you withdraw and how much other income you have. If you have a $200,000 account, you could legally withdraw it all the year you turn 70. The amount of a 401k or IRA distribution tax will depend on your marginal tax rate for the tax year, as set forth below the tax rate on a 401k at age 65 or any other age above 59 1/2 is the same as your regular income tax rate.

Ask The Hammer: What Are The New Rmd Tables For 2022

- Publish date: Jan 14, 2022

Jeffrey Levine of Buckingham Wealth Partners explains what the new life expectancy tables for required minimum distributions mean for IRA account owners.

Jeffrey Levine of Buckingham Wealth Partners explains what the new life expectancy tables for required minimum distributions mean for IRA account owners.

Read Also: Where Can I Cash A 401k Check

What If You Dont Hit The Required Minimum Distribution Amount

You will have to pay a fairly significant tax penalty if you do not take the minimum distribution. Youll pay a 50% tax rate on required money that was not withdrawn.

However, there are steps you can take to fix a missed RMD deadline. The first step is to correct your mistake by taking the RMD amount that you previously failed to take. Next, you need to notify the IRS of your mistake by filing IRS Form 5329 and attaching a letter explaining why you failed to take the required withdrawal. The IRS will consider waiving the penalty tax due to a reasonable error, which may include illness, a change in address or faulty advice on your distribution.

How Much Am I Required To Withdraw

Your RMD is based on the value of your account on December 31 of the previous year.1 An RMD for 2021, for example, is based on your account value as of December 31, 2020.

The withdrawal amount is calculated by dividing your account value by a number based on your age. In IRS terms, thats called the life expectancy factor which can be found in the IRSs Uniform Lifetime table.3, 4 Because the factor decreases as you age, the amount of your RMD will grow as you get older.

Heres an example of how the life expectancy factor works:

- If your IRA balance at year-end is $1 million and youre 72 years old, your life expectancy factor is 25.6 , according to the IRS.

- Divide your balance by 25.6 , and that equals $39,062.50, which is your RMD amount.

An 80-year-old with an identical balance would use the life expectancy factor of 18.7, which would result in a $53,475.90 RMD. For a 90-year-old, the RMD on a $1 million balance would be $87,719.20.

Exception alert: If your spouse is the sole beneficiary of your retirement account and is 10 or more years younger than you, the life expectancy factor should be obtained from the IRS Joint Life Expectancy table.4

You can always withdraw more than the RMD amount, but any additional withdrawal wont count toward future RMDs.

You May Like: How To Borrow Money From Your 401k Plan

How Fidelity Can Help You Plan

If you are taking RMDs, we can help you:

- Use our Planning & Guidance Center to get a holistic view of your retirement income plan and see how long your money may last.

- Adjust your portfolio as your life changes. Schedule an appointment with one of our experienced advisors to create a customized path forward.

Rmds And Other Retirement Accounts

If you have multiple retirement accounts, such as a 401 and an Individual Retirement Account , you may be thinking about taking out one RMD from a specific account rather than taking distributions from each account. When it comes to IRAs, you must calculate the RMD separately for each one, if you have multiple accounts. You can then withdraw the total amount from one or more of your IRAs. However, your RMD from your 401 must be taken separately from the RMD you take out of your IRAs.

Also Check: How Does 401k Work If You Quit