Using This Simple 401 Calculator

Our 401 Growth Calculator is a simple and easy way to estimate the long-term growth of your 401 retirement account by the time you want to retire. Knowing how much your current 401 account may accumulate in the future can help you determine if you should adjust your annual 401 contributions to help reach your retirement goals. After answering a brief series of questions, you will get your results, including your estimated accumulated plan balance at retirement, total out-of-pocket costs, and a summary table and bar graph illustrating your retirement plan accumulation over time.

Contact Your 401s Administrators

Your human resources department or administrator will be able to help you check your 401 balance.

You have most likely been mailed statements of your 401 accounts yearly or quarterly unless there is a different address on file.

Speak with your representative to verify that your contact information and address are up to date to prevent future lapses in correspondences.

If your 401 plan’s administrator uses an online portal, similar to your online banking platform, they can help you get set up.

Online access to your 401 is excellent in checking your 401 balance and how your funds are performing. Some 401 platforms allow you to research the various funds, as well as reallocate your investments right on the platform.

Next Steps: Strategic Investments

Let’s say you have also maxed out your IRA optionsor have decided you’d rather invest your extra savings in a different way.

Although there is no magic formula that is guaranteed to achieve both goals, careful planning can come close. “Look at the options in terms of investment products and investment strategies,” says Keith Klein, CFP and principal at Turning Pointe Wealth Management in Tempe, Arizona. Here are some non-IRA options to consider as well.

Recommended Reading: How Do I Look At My 401k

Think About Opening A Roth 401

If youre looking ahead a few years, you may also want to consider opening a specific type of 401 called a Roth 401. With the Roth version, you fund with after-tax money, but youre able to enjoy tax-free withdrawals at retirement. .)

Tax rates are relatively low, so now could be a good time to fund a Roth 401 rather than a traditional 401.

With the Trump tax law due to sunset in 2025, we are facing higher rates in the future, says Kinder. It could be an excellent time to utilize the Roth 401 option and take advantage of the lower rates now. This is especially true for folks under 40 or folks in the 10 percent or 12 percent tax bracket.

Lower tax rates mean that the cost to take advantage of the Roth plan is lower, since you fund it with after-tax money. Taxpayers in higher brackets may find their break on current taxes is more advantageous, however, and stick to the traditional 401 plan.

This Bankrate calculator can help you decide whether the traditional 401 or Roth 401 is better for you.

Why Employers Offer 401s

In 1978, when the law authorizing the creation of the 401 was passed, employers commonly attracted and retained talent by offering a secure retirement through a pension . The 401 created an entirely new system, with more flexibility for both employer and employee. One of the ways it did so was by giving employers the option to match employee contributions.

Matching is a very transparent process: for every dollar you put into your 401, your employer also puts in a dollar, up to a certain amount or percentage of your income. Theres no mystery here. If your employer promises to match all 401 contributions up to 5% of your income, and you contribute that amount every month, your employer will match you dollar for dollar, every month. Its a win-win situation. You are doubling your money, and your employer is building a happy workforce.

You May Like: When You Leave A Job Do You Get Your 401k

How Long Do You Have To Wait Between 401k Loans

Borrowing limitations are placed on a 12-month period, even if you ve paid the amount back early. For example, if the vested balance of your account is $200,000 and you take a $30,000 loan out in February, you wont be permitted to take out more than $20,000 in additional funds again until the following February.

How To Find An Old 401 And What To Do With It

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

There are billions of dollars sitting unclaimed in ghosted workplace retirement plans. And some of it might be yours if youve ever left a job and forgotten to take your vested retirement savings with you.

But no matter how long the cobwebs have been forming on your old 401, that money is still yours. All you have to do is find it.

Also Check: How To Take A Loan From 401k

You Have More Access To Your 401 Than You Think And Thats Not Always A Good Thing

When policy makers consider leakages from 401 plans, they must balance two conflicting goals: 1) keeping tax-favored savings in the plan so that funds are available at retirement and allowing access to participants who need their money, which can encourage greater participation and larger contributions.

Video: Money Matters: Contributing to 401s and IRAs

Read:Here is some provocative news about retirement, Social Security and mortgages

That said, the current setup seems a little crazy. Participants can take their money out in three ways.

- Hardship withdrawals: Participants can withdraw funds for an immediate and heavy financial need, which includes medical care postsecondary education and buying, repairing, or avoiding foreclosure on a house. Hardship withdrawals generally are subject to income tax, a 10% penalty tax, and 20% withholding for income taxes.

- Cash-outs upon job separation: An employee can take a lump sum distribution, or preserve the balance by leaving it in the prior employers plan , rolling over the plan balance into an IRA, or transferring it to the new employers 401. Distributions are subject to the 10% penalty tax and the 20% withholding requirement.

Read:401 and IRA leakages may be more severe than previously believed

Dont miss more retirement news and advice in

My preference would be to prohibit cashing out at job changes entirely. At the same time, the Department of Labor needs to push plan sponsors to make 401 balances truly portable.

Disadvantages Of Closing Your 401k

Whether you should cash out your 401k before turning 59 ½ is another story. The biggest disadvantage is the penalty the IRS applies on early withdrawals.

First, you must pay an immediate 10% penalty on the amount withdrawn. Later, you must include the amount withdrawn as income when you file taxes. Even further down the road, there is severe damage on the long-term earning potential of your 401k account.

So, lets say at age 40, you have $50,000 in your 401k and decide you want to cash out $25,000 of it. For starters, the 10% early withdrawal penalty of $2,500 means you only get $22,500.

Later, the $25,000 is added to your taxable income for that year. If you were single and making $75,000, you would be in the 22% tax bracket. Add $25,000 to that and now youre being taxed on $100,000 income, which means youre in the 24% tax bracket. That means youre paying an extra $6,000 in taxes.

So, youre net for early withdrawal is just $16,500. In other words, it cost you $8,500 to withdraw $25,000.

Beyond that, you reduced the earning potential of your 401k account by $25,000. Measured over 25 years, the cost to your bottom line would be around $100,000. That is an even bigger disadvantage.

Also Check: What Is Qualified Domestic Relations Order 401k

Picking The Best Option

Figuring out what to do can be difficult, as there may be complex tax and investment return implications for each decision.

In many cases, unless youre ready to retire, moving the funds into a new retirement account is often a good option. If your funds are in an IRA that was opened in your name, the IRA provider may be charging high fees. And, unless the old employer offers a much better plan than your current options, consolidating your money within a few accounts can make it easier to track your investments and help you qualify for discounts or benefits from plan administrators.

The easiest way to do this is with a direct transfer, where the money never touches your hands. Otherwise, 20 percent of the money has to be withheld for taxes, and you only have 60 days to deposit the funds into the new retirement account or the withdrawal will be treated as a cash out.

Fair warning, there can still be a lot of paperwork involved with a direct transfer. However, the company that youre sending the money to will often be able to help you with the process.

No matter what option you choose, if youve got old retirement accounts floating out there its in your best interests to track that money down sooner than later. The more you know about your retirement funds, the more options you may have the next time youre faced with a major financial setback. At the very least, youll understand where you stand as you prepare for retirement.

Working While Receiving The Cpp Retirement Pension

Youll qualify for the CPP Post-retirement benefit if you work while receiving your CPP retirement pension while under age 70 and decide to keep making contributions.

Each year you contribute to the CPP will result in an additional post retirement benefit and increase your retirement income. We will automatically pay you this benefit the following year. Youll receive it for the rest of your life.

You can choose to stop your post-retirement contributions when you reach age 65. Your contributions will stop when you reach age 70, even if youre still working. We will contact you if we need more information for you to qualify.

Contributions after age 65

If you work after you turn 65 and don’t yet receive the CPP retirement pension, periods of low earnings before age 65 will be automatically replaced with periods of higher earnings after age 65. This will increase your pension amount.

Read Also: How Much You Should Contribute To 401k

Now What What Can You Do About Fees

Unfortunately when you have high fees in your retirement plan, theres not much you can immediately do about it. But just the knowledge of your fees will help you answer questions like:

- Should I consider investing in different funds within my plan?

- What should I do with investment dollars after I reach my company 401K match?

- Should I leave my companys 401K plan because of the absurdly high fees?

- Should I divert funds to a discount online stock brokers?

- What should I do with those funds once I leave my job?

Luckily, the tide is turning, and we are seeing new pressure from U.S. lawmakers to make this fee information more apparent. Sites like BrightScope are also doing a good job of exposing the truth about the company 401K plan.

This guest post is from PT Money: Personal Finance. Follow along as PT discusses things like the best places to store your short-term cash, how to spend your money wisely, and the best cash back credit cards to earn more money on your spending.

Vs Roth : How Do They Differ

The key difference between a 401 and a Roth 401 is the tax treatment of contributions and distributions.

A 401 is a type of retirement savings account that is funded with pretax dollars. When you contribute to a 401 account, the contribution is deducted from the employee’s taxable income. When you take a distribution from a traditional 401 account, the amount withdrawn will be subject to income taxes. For example, if you have accumulated $1 million in your 401, and you are in the 32% tax bracket, it means you will pay $320,000 in income taxes to the IRS.

In comparison, a Roth 401 is a post-tax retirement account that is funded with post-tax dollars. This means that the taxes are already taken out, and you remain with reduced pay. Since you paid income taxes when contributing to the Roth 401 account, you wonât pay any taxes if you withdraw money in retirement. However, if your employer contributed a match to your retirement account, you will be required to pay taxes on the employerâs match. For example, assume that you have $1 million in your Roth 401, out of which $100,000 represents the employerâs match. When you take a distribution, you wonât owe any income taxes on the $900,000 you contributed from your paycheck. However, if you are in the 22% tax bracket, you will owe $22,000 in taxes on the employerâs match.

Tags

Also Check: What Do I Do With My Old 401k

Look For Contact Information

If you don’t know how to contact your former employer perhaps the company no longer exists or it was acquired or merged with another company see if you have any old 401 statements. These should have contact information to help put you in touch with the plan administrator.

If you don’t have an old 401 statement handy or yours doesn’t tell you what you need to know, visit the U.S. Department of Labor website and look up your employer. There you should find your old retirement account’s tax return, known as Form 5500. That will most likely have contact information for your 401’s plan administrator.

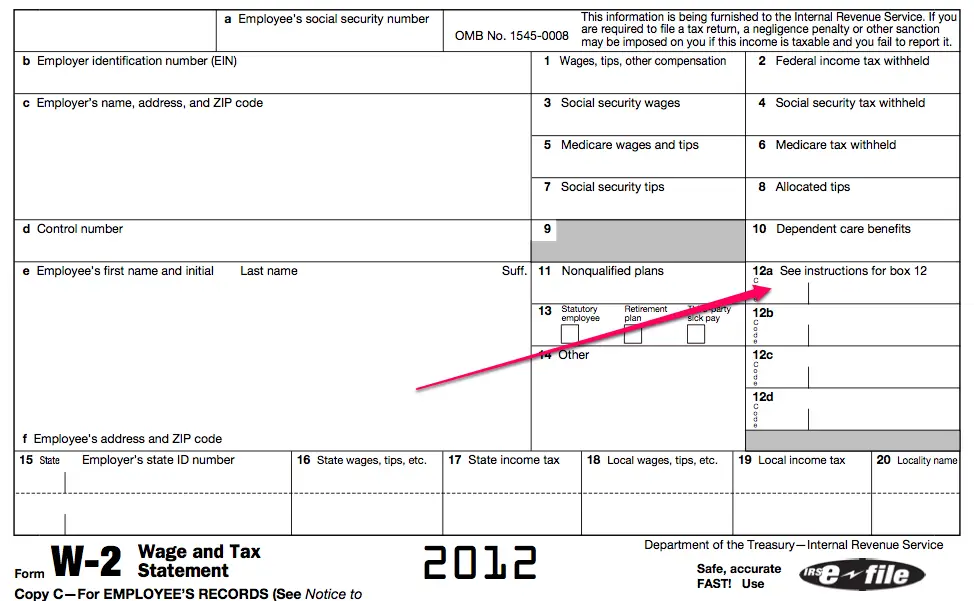

Find 401s With Your Social Security Number

All your 401s are linkedin to your social security number when you enrolled. Theoretically you should be able to find all your 401s with your SSN. However, in practice it’s pretty hard for one to do so. As far as we know, Beagle is the only company that simplifies this process and can conduct a comprehensive 401 search using your SSN. Once they find your 401s, they also help you with the tedious rollover process.

Read Also: How To Find Out If You Have A 401k Account

The Average 401k Balance By Age

401k plans are one of the most common investment vehicles that Americans use to save for retirement.

To help you maximize your retirement dollars, the 401k is an employer-sponsored plan that allows you to save for retirement in a tax-sheltered way. You can contribute up to $19,500 in 2021 and $20,500 in 2022.

If your employer offers a 401k and you are not utilizing it, you may be leaving money on the table especially if your employer matches your contributions.

While the 401k is one of the best available retirement saving options for many people, only 32% of Americans are investing in one, according to the U.S. Census Bureau. That is staggering given the number of employees who have access to one: 59% of employed Americans.

So how much do people actually have saved in their 401k plans? And how does this stack up against what they could have saved if they were maxing out their 401k every year?

What Is A Defined Contribution Plan

A defined contribution plan is any retirement plan to which an employee or employer regularly contributes some amount. Often, the employee chooses to send a fixed percentage of monthly income to the account, and these contributions are automatically withdrawn, directly from her paycheck – no effort required. The money that doesn’t go to the employee’s take-home pay gradually accumulates, the balance earns interest from investments, and by the time retirement rolls around, its grown into a substantial nest egg for the retiree. Thats the idea.

In a defined contribution plan , there are no guarantees about the income youll receive in retirement. That doesnt mean such plans cant be just as effective, however, and employers often sweeten the deal by making contributions of their own, straight into your account.

Recommended Reading: Can You Roll Over 403b To 401k

What Is A 401

A 401 is an employer-sponsored retirement plan enabling workers to save money in a tax-deferred way. Often employers will match contributions up to a percentage of salary. Its just like any other retirement plan in the sense that youre trying to save money and reduce taxes as you do it. Like an IRA, you will pay taxes once you start taking withdrawals in retirement.

If you opted for it when you were hired, every paycheck a percentage of your salary is taken out and put into a 401 retirement account. Your employer may add some more money, maybe even the same amount, on top of that. That money is usually invested, and has been accumulating. How much is in there?

There are different types of 401s. A Roth 401 operates much in the same fashion as a Roth IRA. While still employer-sponsored, it uses after-tax income to fund itself, so you pay the taxes now, and not later in retirement. While one can deliberate the merits of which to use, the general consensus is that a Roth format is useful if one believes they will be in an higher tax bracket later in life when withdrawing from their retirement accounts.

Conversely, a traditional 401 advocate might argue that the ability to put more money into an account in the beginning and through time, allows the saver to make the most of compound interest.

Read more about how a 401 works in this article from TheStreet.