Cashing Out A 401 Due To Covid

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

Editor’s note: Many of the provisions of the CARES Act outlined below expired in 2020. Current information about 401 withdrawal rules can be found here.

Typically, the penalty for withdrawing from a 401 before the age of 59½ is 10% of the distribution, plus an automatic withholding of at least 20% for taxes. But with the passage of the CARES Act, that all changes in 2020.

The Coronavirus Aid, Relief and Economic Security Act, which allocates $2 trillion toward economic stimulus and relief in the wake of the coronavirus pandemic, includes several provisions that make it easier for those affected by the outbreak to access retirement funds.

The $300 billion earmarked for direct payments is getting considerable attention, but the CARES Acts language on early withdrawals from retirement accounts is remarkable in itself. Heres a broad overview:

See If You Qualify For An Exception To The 10% Tax Penalty

Generally, the IRS will waive it if any of these situations apply to you:

-

You choose to receive substantially equal periodic payments. Basically, you agree to take a series of equal payments from your account. They begin after you stop working, continue for life and generally have to stay the same for at least five years or until you hit 59½ . A lot of rules apply to this option, so be sure to check with a qualified financial advisor first.

-

You leave your job. This works only if it happens in the year you turn 55 or later .

-

You have to divvy up a 401 in a divorce. If the courts qualified domestic relations order in your divorce requires cashing out a 401 to split with your ex, the withdrawal to do that might be penalty-free.

Other exceptions might get you out of the 10% penalty if you’re cashing out a 401 or making a 401 early withdrawal:

-

You become or are disabled.

-

You rolled the account over to another retirement plan .

-

Payments were made to your beneficiary or estate after you died.

-

You gave birth to a child or adopted a child during the year .

-

The money paid an IRS levy.

-

You were a victim of a disaster for which the IRS granted relief.

-

You overcontributed or were auto-enrolled in a 401 and want out .

-

You were a military reservist called to active duty.

Withdrawals Before Age 59 1/2

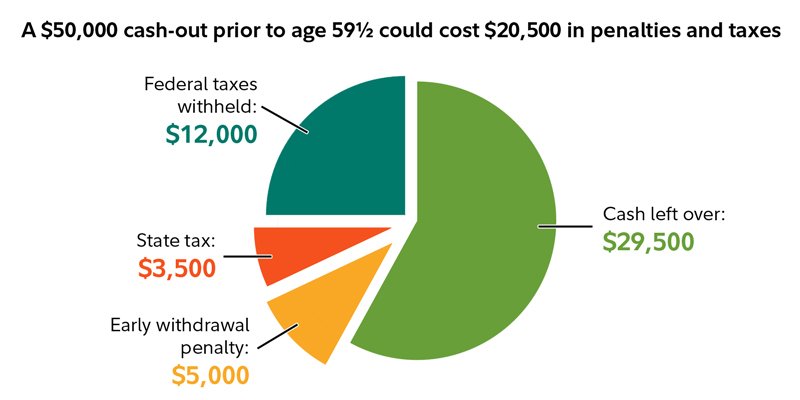

Any withdrawal made from your 401 will be treated as taxable income and subject to income taxes in the year in which you made it, before or after retirement. But you’ll also be subject to a 10% early distribution penalty if you’re younger than age 59 1/2 at the time you take the withdrawal.

These taxes and penalties can add up and can nearly cut the value of your original withdrawal in half in some cases.

You can avoid these taxes and the penalty with a trustee-to-trustee transfer. This involves rolling over some or all of your 401 assets into another qualified account. You might consider a 401 loan if you want to access your account’s assets because of financial hardship.

You can take a penalty-free withdrawal from your 401 before reaching age 59 1/2 for a few reasons, however:

- You pass away, and the account’s balance is withdrawn by your beneficiary.

- You become disabled.

- Your unreimbursed medical expenses are more than 7.5% of your adjusted gross income for the year.

- You begin “substantially equal periodic” withdrawals.

- Your withdrawal is the result of a Qualified Domestic Relations Order after a divorce.

- You’re at least 55 years old and have been laid off, fired, or quit your job, otherwise known as the “Rule of 55.”

Your distributions will still be taxed if you take the money for any of these reasons, but at least you’ll dodge the extra 10% penalty.

You May Like: How To View My 401k

What Is A Good Amount Of Money To Retire With At 65

THE 4-PERCENT RULE MAY BE THE FIRST THING So, if you find yourself wanting to make up to $ 120,000 a year on withdrawal from your savings, according to a 4-percent rule you would need up to $ 3 million in retirement savings to support that lifestyle. for thirty years. Of course, the 4-percent rule is not far from perfect.

How much should a 65-year-old retire before retirement? Retirement experts have set various rules about how much you want to save: somewhere around $ 1 million, 80% to 90% of your annual income before you retire, twelve times your salary before you retire.

Understanding Early Withdrawal From A 401

Withdrawing money early from your 401 can carry serious financial penalties, so the decision should not be made lightly. It really should be a last resort.

Not every employer allows early 401 withdrawals, so the first thing you need to do is check with your human resources department to see if the option is available to you.

As of 2021, if you are under the age of 59½, a withdrawal from a 401 is subject to a 10% early withdrawal penalty. You will also be required to pay regular income taxes on the withdrawn funds.

For a $10,000 withdrawal, when all taxes and penalties are paid, you will only receive approximately $6,300.

You May Like: What To Do With 401k When You Retire

Key Considerations With 401 Loans

- Some plans permit up to two loans at a time, but most plans allow only one and require it be paid off before requesting another one.

- Your plan may also require that you obtain consent from your spouse/domestic partner.

- You will be required to make regularly scheduled repayments consisting of both principal and interest, typically through payroll deduction.

- Loans must be paid back within five years .

- If you leave your job and have an outstanding 401 balance, youll have to pay the loan back within a certain amount of time or be subject to tax and early withdrawal penalties.

- The money you use to pay yourself back is done with after-tax dollars.

Although getting a loan from your 401 is relatively quick and easy, the benefit of paying yourself back with interest will likely not make up for the return on investment you could have earned if your funds had remained invested.

Another risk: If your financial situation does not improve and you fail to pay the loan back, it will likely result in penalties and interest.

What To Do Before Withdrawing From Your 401

Even if you qualify for an early distribution, you should be wary of withdrawing from your 401.

So before borrowing from your 401, where should you look for money? The first and obvious place to look is liquid, cash savings, Levine says. Ideally, everyone would have an emergency fund for situations like this.

If you dont have enough saved up, then take a look at your current spending you may find areas where you can scale back to save money while times are tough.

Do you have a car payment or lease that you could reasonably get rid of by buying a cheaper or used car? Are you living in a rental that you could move out of and into something cheaper? Those are obviously serious steps, and just examples, but withdrawing from a 401 will permanently reduce your savings, says Renfro.

If you cant cut anything out of your budget, you could try to get discounts. Levine suggests calling providers, like your cable and insurance companies, and explaining that you need to cut back due to coronavirus-related cash flow issues. Theyll almost definitely offer a discount, he says.

You could also consider taking out a small loan, but be careful not to get yourself further behind with a high-interest debt payment, Renfro says.

Recommended Reading: How Do I Take Out My 401k

What You Need To Know To Avoid Costly Mistakes

Andy Smith is a Certified Financial Planner , licensed realtor and educator with over 35 years of diverse financial management experience. He is an expert on personal finance, corporate finance and real estate and has assisted thousands of clients in meeting their financial goals over his career.

In an ideal world, everybody would leave their 401 funds alone until they need the money for retirement. That might mean rolling your account over to an Individual Retirement Account , but it also means not cashing out the funds prior to reaching retirement age, to allow the money to grow to its maximum potential amount. In investing, time truly is your best asset. At some point though, you will begin taking distributions, and here’s what you need to know.

The best way to take money out of your 401 plan depends on three things:

When A 401 Loan Makes Sense

When you mustfind the cash for a serious short-term liquidity need, a loan from your 401 plan probably is one of the first places you should look. Let’s define short-term as being roughly a year or less. Let’s define “serious liquidity need” as a serious one-time demand for funds or a lump-sum cash payment.

Kathryn B. Hauer, MBA, CFP®, a financial planner with Wilson David Investment Advisors and author of Financial Advice for Blue Collar America put it this way: “Lets face it, in the real world, sometimes people need money. Borrowing from your 401 can be financially smarter than taking out a cripplingly high-interest title loan, pawn, or payday loanor even a more reasonable personal loan. It will cost you less in the long run.”

Why is your 401 an attractive source for short-term loans? Because it can be the quickest, simplest, lowest-cost way to get the cash you need. Receiving a loan from your 401 is not a taxable event unless the loan limits and repayment rules are violated, and it has no impact on your .

Assuming you pay back a short-term loan on schedule, it usually will have little effect on your retirement savings progress. In fact, in some cases, it can even have a positive impact. Let’s dig a little deeper to explain why.

You May Like: When I Leave My Job What Happens To 401k

You Must Follow The Five

On the list above, you’ll notice the IRS allows tax-free withdrawals only if you made the first contribution to your account at least five years earlier. This is called the five-year rule.

Many Roth 401 account holders are confused about this because they assume they can start withdrawals without penalty after 59 1/2, as with a traditional 401. However, the five-year rule supersedes that rule. If you open your account in the tax year you turn 58, you must wait until you are 63 to take a penalty-free withdrawal.

The five-year rule can also cause problems if you roll over your Roth 401 into a Roth IRA. If you move your money into a newly opened Roth IRA, you will have to wait five years from the first Roth IRA contribution regardless of how long ago you first contributed to the 401.

Those Who Truly Need It

It really comes down to need. If you need to withdraw your money, then withdraw your money. Thats really the essence of the CARES Act. It simply makes a need-based withdrawal less harmful. If you dont need to, then dont, says Brandon Renfro, a financial advisor and assistant professor of finance at East Texas Baptist University.

Its important to consider what things will be like after you take a withdrawal and once things are back to a new normal. Under the CARES Act, you have to repay your withdrawal within three years. If you just need a withdrawal to get you through the next few months before you start earning regular paychecks again, it could be a good option.

Read Also: How To Maximize Your 401k

Youre Rolling Over Funds

If you leave, quit, or get fired from the company at age 55 or older, you can cash out that account in a lump sum withdrawal without incurring a penalty.

If youre under 55 years of age , you have up to 60 days to rollover your funds to a new 401 or IRA without triggering a taxable event. The best way to accomplish the rollover is to transfer the money directly from the old custodian to the new custodian to avoid having 20% automatically withheld for income tax.

If you fail to put the entire amount into a new retirement account within two months, it will be considered a distribution that is not only taxed but penalized if youre under 59 ½.

Make A 401 Withdrawal

Your second option would be to make a direct withdrawal from your 401 account. As mentioned above, this is the less desirable of the two options.

An early withdrawal would be classified as a hardship withdrawal. The IRS considers any emergency removal of funds from a 401 to cover an immediate and heavy financial need as a hardship withdrawal. Whether or not the purchase of a home using your 401 counts as a hardship withdrawal is a determination that falls to your employer, and you will need to present evidence of hardship before the withdrawal can be approved.

Regardless, you will still likely incur the 10% early withdrawal penalty. There are exemptions in place for specific circumstances, including home buying expenses for a principal residence. Qualifying for such exemptions is difficult by design, however. If you possess other assets that could be used for your home purchase, then you likely wont qualify for an exemption. Even if you do, your withdrawal will still be taxed as income.

Also Check: How To Find Out 401k Balance

How Many Times Can You Consolidate Student Loans

Category: Loans 1. Consolidating your federal education loans Federal Student Generally, you cannot consolidate an existing consolidation loan unless you include an additional eligible loan in the consolidation. Under certain How long will it take? The entire Loan Consolidation process must be completed in a single session. Most

What Proof Do You Need For A Hardship Withdrawal

Documentation of the hardship application or request including your review and/or approval of the request. Financial information or documentation that substantiates the employees immediate and heavy financial need. This may include insurance bills, escrow paperwork, funeral expenses, bank statements, etc.

Recommended Reading: Can I Move My 401k To A Different Company

Learn About The Changes To Iras 401s Rmds And More

The Setting Every Community Up for Retirement Enhancement Act of 2019, better known as the SECURE Act, which originally passed the House in July 2019, was approved by the Senate on Dec.19, 2019, as part of an end-of-year appropriations act and accompanying tax measure, and signed into law on Dec. 20, 2019, by President Donald Trump. The far-reaching bill includes significant provisions aimed at increasing access to tax-advantaged accounts and preventing older Americans from outliving their assets.

And Ira Withdrawals For Covid Reasons

The CARES Act had many provisions that received attention, especially the Paycheck Protection Plan loans and the individual relief checks that went to a majority of Americans. One less-noticed part of the bill, though, changes the way that pre-retirement withdrawals from retirement plans work.

Section 2022 of the CARES Act allows people to take up to $100,000 out of a retirement plan without incurring the 10% penalty. This includes both workplace plans, like a 401 or 403, and individual plans, like an IRA. This provision is contingent on the withdrawal being for COVID-related issues. The following reasons are permitted for making these special withdrawals:

- You have been diagnosed with COVID-19

- Your spouse or a dependent has been diagnosed with COVID-19

- You have financial issues because of being quarantined, furloughed or laid off due to COVID-19

- You have financial issues because you cant work due to a lack of childcare caused by COVID-19

- Youre experiencing financial hardship because the business you own or operate had to close or reduce hours

This is obviously a fairly broad set of circumstances. Essentially, if youre having a hard time financially because of circumstances caused by the pandemic, youre likely to qualify for these early withdrawals.

Recommended Reading: How Do You Pull Out Your 401k

Withdrawals After Age 59 1/2

Age 59 1/2 is the magic number when it comes to avoiding the penalties associated with early 401 withdrawals. You can take penalty-free withdrawals from 401 assets that have been rolled over into a traditional IRA when you’ve reached this age. You can also take a penalty-free withdrawal if your funds are still in the 401 plan, and you’ve retired.

You can take a withdrawal penalty-free if you’re still working after you reach age 59 1/2, but the rules change a bit. Check with the plan administrator about its specific rules if you’re still working at the company with which you have your 401 assets.

Your plan might offer an “in-service” withdrawal that allows you to access your 401 assets penalty-free, but not all plans offer this option. And remember, the withdrawal will still be subject to income taxes, even if it’s not penalized.