Breaking It Down: Where Do You Fit In

There are many reasons you might think this chart seems totally reasonable, or, conversely, totally unreasonable. And thats understandable. Life presents us all with different challenges. We have unexpected medical expenses, decide to go back to school, or have kids and want to pay their college tuitions. These are all perfectly valid excuses as to why you might be falling behind where this chart says you should, or could, be.

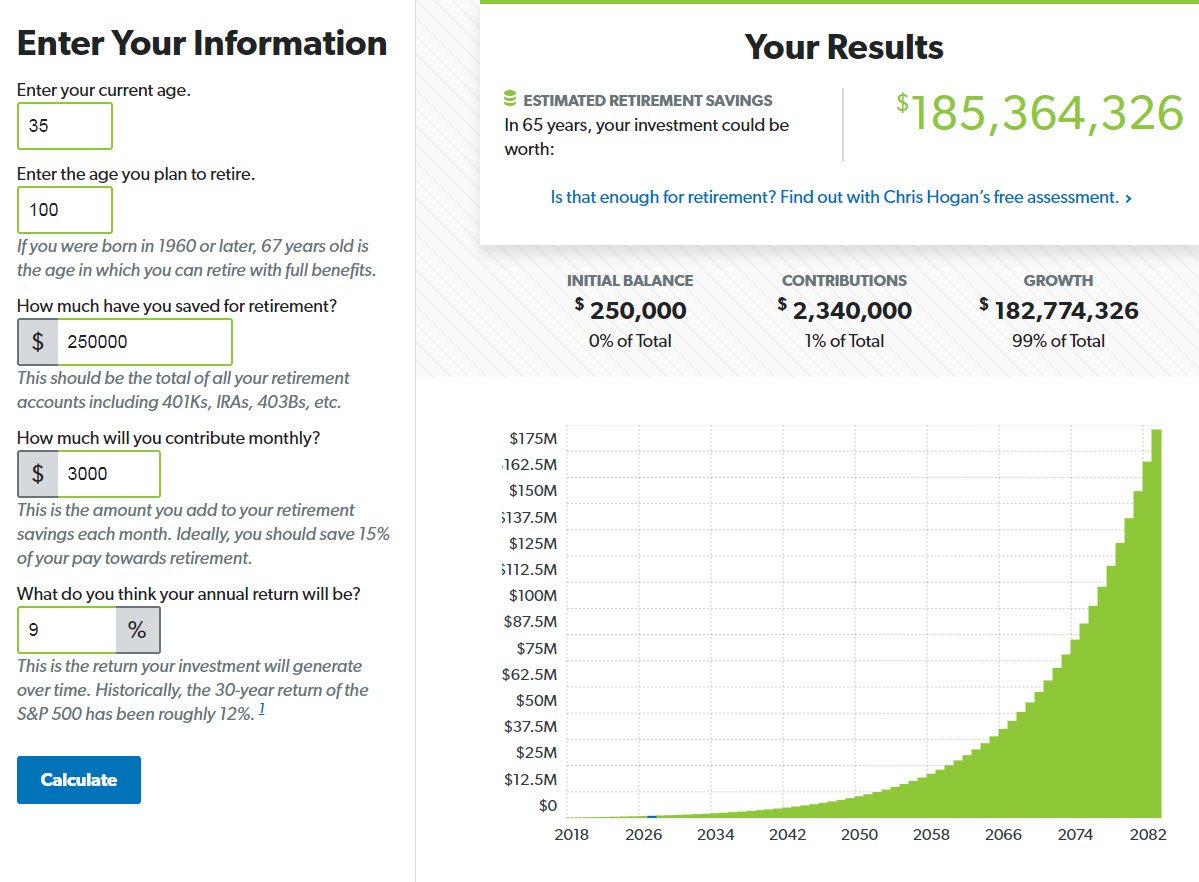

Based on this chart, you would think that most Americans should be retiring as multi-millionaires at age 65. This probably seems way off-base, and in reality, it is most people retire with very little in the way of savings and investments. The point is that this chart shows what is possible if you are disciplined and strategic about your 401k savings.

If you are on the younger end of the ages shown on the chart, you may be daunted at the prospect of contributing $8,000 per year to your 401k, not to mention $19,500. Where you live, what your first-year salary is, or what loans you may be paying can make it difficult for this contribution to seem realistic. Its crucial, however, to recognize the importance of saving as much as you can for retirement as early as you can.

So, lets determine, based on the two scenarios in the potential savings chart, whether these figures would be sufficient to support your lifestyle for the rest of your retirement.The average life expectancy for men is around 84 years old, and 86.5 years old for women.

A $10000 Withdrawal As 30 Year Old Could Cost You Over $280000 By The Time You Retire

We always work with our clients to establish a solid foundation of personal finance fundamentals. Saving early and often, even a small amount, is crucial to long term success. When working with clients and taking them through the Dream Financial Planning Process , we work to optimize their budget and establish an emergency fund so they can handle unexpected expenses. We never recommend withdrawing money from a 401k unless it’s a last resort or to possibly buy a home.

For example, let’s say you’re a 30-year-old that is contemplating withdrawing $10,000 from your 401k or IRA . If you don’t qualify for an exemption that $10,000 is going to be approximately $7,000 after taxes and penalties depending on your tax rate.

You plan to retire at 65 years old, so you have a 35-year time horizon. $10,000 invested for 35 years, earning 10% per year, which happens to be the long-term return of the stock market as defined by the S& P 500 index, comes out to approximately $281,000.

Increase Your Income If Need Be

Sometimes a lack of retirement savings is caused by mismanaged income. Its common to get caught up in everyday frivolous spending that seems harmless but causes major savings deficits over the years.

Other times there is a real lack of income that has caused a persons inability to save for retirement.

If youre managing your money well and minimizing waste but dont make enough to save what you need to save for retirement you may need to increase your income.

Luckily, there are several options for boosting your income:

- Get a part-time job

- Sell unwanted items

Then take that cash and use it to fund your 401k or other retirement accounts.

However, its important to remember that as you increase your income, you need to be sure to take that extra money and target it all toward retirement savings.

It might be tempting to use it for fun stuff like vacations and new and shiny things especially if youve been living on a tight budget for a long period of time.

Dont make that mistake. Instead, commit to funneling all extra income into your 401k or other retirement accounts, even if its only for a specified period like five years or ten years.

After that time is up, youll likely see a significant increase in your retirement savings. That increase will help ensure you wont be struggling to live in your later years.

Recommended Reading: How To Pull Out Of 401k

What Happens If You Exceed 401 Contribution Limits

The IRS simply does not allow an individual to exceed the contribution limits they have set, which is why its important that you evaluate your estimated contributions at the beginning of the year and then analyze your actual contributions at the end of the year.

If you discover that you have exceeded the contribution limits for a given year, you need to notify the IRS by March 1. They will return excess deferrals to you by April 15. If you fail to notify the IRS, whether intentionally or accidentally, your excess contributions will be taxed at six percent each year from the time they were deposited until the time you withdraw them.

Your 401k Asset Allocation

How you allocate your 401k should depend on your age, but also your tolerance for risk. If a big stock market crash like we had in 2008 were to wipe out a third or your portfolios value, would you?

- A: Sell your stocks as fast as you could.

- B: Do nothing.

- C: Buy more stocks at a discount.

If you answered A, you should probably stick with a conservative portfolio of more bonds and fewer foreign stocks.

If you answered B, the above guidelines are good for you.

If you answered C, you may want a more aggressive approach and hold even more stocks even as you age.

As an example, right now, my allocation is 80% stocks, 12% bonds, and 8% alternatives . Im staying a little bit on the aggressive side because:

- I dont have a ton of money invested yet.

- Im optimistic about economic growth over my lifetime.

- I still have got a long way before I retire.

You May Like: How Is 401k Paid Out

Are Roth Iras Worth It

Contents

A Roth IRA or 401 makes the most sense if youre confident youll have a higher income in retirement than you do now. If you expect your income to be lower in retirement than it is now, a traditional IRA or 401 is probably the better bet.

Are ROTH IRAs Still a Good Idea? If you have earned income and meet income limits, a Roth IRA can be an excellent retirement savings tool. But keep in mind that its only part of an overall retirement strategy. If possible, its a good idea to contribute to other retirement accounts as well.

And 403 Contribution Limits

In 2017, savers age 49 and under can legally contribute $18,500. Savers who are 50 years or older can make an additional $6,000 catch up contribution, for a total annual 401 contribution of $24,500 a year.

| Another $6,000 | Another $6,000 |

Okay, done laughing? If the idea of contributing $18,500 a year doesnt make you laugh, well, great! The rest of us need to find a contribution amount thats going to accelerate our retirement savings but not cause us to start bouncing checks or going into debt.

The first questions to ask are:

- Does your employer match contributions?

- If so, up to what percentage?

Many employers will kick in a little extra towards your retirement plan. If this is the case, then you want to AT LEAST contribute the maximum amount theyll match. If you dont, its like turning down part of your salary.

Here are some guidelines:

Don’t Miss: What To Do With 401k When You Quit Your Job

Can A 70 Year Old Invest In A Roth Ira

There is no age limit for contributions to Roth IRAs. Thanks to the SECURE Act, you can now contribute to traditional IRAs beyond the previous age limit of 70½.

Should a 70 year old open a Roth IRA?

You are never too old to fund a Roth IRA. Opening a Roth IRA later in life means you dont have to worry about the early payout penalty if youre 59½. Roth IRAs are ideal if you want to avoid required minimum distributions and/or leave tax-free funds to your heirs.

Can seniors contribute to Roth IRA?

Retirees can continue to contribute their earned money to a Roth IRA indefinitely. You cannot contribute any amount that exceeds your earnings, and you can only contribute to the annual IRS contribution limits. People with traditional IRAs should start taking the required minimum distributions when they reach 72.

Other Important Financial Goals To Consider

You should keep a few other things in mind as you decide how much to contribute to your 401 based on your own unique financial situation.

- Do you have a formal estate plan with a will and other critical papers ?

- Can you cover health care expenses? Make sure you’re putting enough into your health savings account , both now and in the future, to cover medical expenses if you have a high-deductible health plan with an HSA combo.

- Do you have proper disability insurance coverage to protect you and your family if you miss work for six months or more due to illness or injury?

- Do you have long-term care plans in place if you’re nearing retirement?

You May Like: How To Find Missing 401k Accounts

What Happens If I Contribute To A Roth Ira But Make Too Much Money

If you contribute more than is allowed to the IRA, you have contributed ineligible or in excess. See the article : Daniel Calugar outlines 7 benefits of starting to invest at a young age DU Clarion. You will pay an additional 10% early withdrawal penalty on earnings if you cannot take a qualified distribution from your IRA to correct the error.

What to do if you made too much for a Roth IRA?

I Do Too Much To Contribute To A Roth IRA â What I Do.

- Withdraw excess contributions plus any workable income.

- Proposed return corrected.

- Apply the excess to next years contribution.

- Transfer excess contributions to a Traditional IRA through a recharacterization, including your earnings.

Can you have a Roth IRA if you make too much money?

Roth IRA Income limits You can contribute to a traditional IRA regardless of how much money you earn. But you dont have the right to open or contribute to a Roth IRA if you make too much money.

What happens if you contribute to a Roth IRA and your income is too high?

The IRS will charge you a 6% penalty tax on the excess amount for each year where you do not take action to correct the error. For example, if you donate $ 1,000 more than is allowed, you should owe $ 60 each year until you correct the mistake.

The Power Of Compound Returns

The earlier you start saving for retirement, the less youll need to save each month. You can thank compounding, which is basically the returns you make on returns. Once youre making money on your earnings, your returns compound at an accelerated rate.

Suppose you want to retire at age 60 with $2 million and that you get average returns of 10%. Thats slightly less than what the S& P 500 index has delivered before inflation over the past 60 years with dividends reinvested.

Heres what youd need to invest, between your own contributions and your employers match, if you have a $50,000 annual salary.

- If you started investing at 20: Youd need to invest $316.25 per month, or 7.6% of your salary.

- If you started investing at 30: Youd need to invest $884.76 per month, or 21.2% of your salary.

- If you started investing at 40: Youd need to invest $2,633.76 per month, or 63.2% of your salary.

The examples above show not only how much more youll have to contribute to your 401 each month if you start saving later, but also how much more youll have to save overall. In the first example, youd invest just under $152,000 total by starting at 20. But if you didnt get started until 40, youd wind up investing more than $632,000 to reach your goal.

Keep in mind that 10% is an average, not the 401 rate of return you should expect every year. Your returns will vary, based on how your investments perform, along with the risk tolerance you indicate when you choose your investments.

Recommended Reading: What Happens When You Roll Over 401k To Ira

So How Much Should You Invest In Your 401k

Okay. So, while investing is highly personal and financial goals should be personalized, you are here so we can teach you to be rich. We have some advice to get you started.

How much you should actually be investing each month depends on a system we call the Ladder of Personal Finance. Check out this video, or read about the Ladder below:

1. Your employers 401k match. Each month you should be contributing as much as you need to in order to get the most out of your companys 401k match. That means if your company offers a 5% match, you should be contributing AT LEAST 5% of your monthly income to your 401k each month.

Weve already discussed the importance of this dont throw away free money and the returns from that free money.

2. Whether youre in debt. Once youve committed yourself to contributing at least the employer match for your 401k, you need to make sure you dont have any debt. Remember, if you have employee matching, you are effectively earning a 100% return on every penny you invest in your 401k that is significantly more than the interest you would save by paying down your debt.

If you dont, great! If you do, thats okay. You can check out my system on eliminating debt fast to help you.

What Is An After

Saving money for retirement is always a wise decision. If you contribute to a 401, youre already making great strides to protect and grow your money for the future. However, even after you reach your annual contribution limits, you may find yourself with extra cash that you arent sure what to do with.

Theres good news. Your standard 401 contribution limits dont have to stop you from getting even more tax-advantaged savings, allowing you to responsibly save even more for retirement. In fact, if youve maxed out your annual contribution limit, you can still take advantage of an after-tax 401 contribution.

You May Like: Can I Use My 401k To Invest In A Business

Withdraw Your Money If Your Plan Allows In

Once youve saved the $19,500, you can save into after-tax 401 bucket all the way up to that $58,000 limit and then either convert to the Roth 401 if your plan allows it, or eventually, withdraw the money and convert to a Roth IRA once distributions are allowed in your plan. Under normal circumstances, this happens after you are 59 ½ years old and the account is at least five years old. However, each plan document is unique and has a unique set of rules covering what is and isnt allowed in that particular plan.. Consult your plan administrator for a complete set of rules on what might be allowed in your particular plan.

It is important to note that with all the strategies mentioned above, there are always potential limits or rules allowing or prohibiting certain strategies. Before converting any funds to other accounts, consult your workplace retirement investment plan to determine whats possible for your specific situation. Also, always reference the IRS to determine whats allowed with your plan.

If you earn a high income and are planning for retirement, there are few places you can protect your money from being lost to taxes. Continuing to contribute to your 401 after youve reached your contribution limit is a great strategy to do just that. By following our advice with after-tax 401 options and subsequent Roth conversions, youll save a lot more for retirement without being subject to income limits.

Basics Of 401 Allocation

When you allocate your 401, you can decide where the money you contribute to the account will go by directing it into investments of your choice.

At a minimum, consider investments for your 401 that contain the mix of assets you want to hold in your portfolio in the percentages that meet your retirement goals and suit your tolerance for risk.

Recommended Reading: How Does A 401k Work When You Change Jobs

At What Age Must You Stop Contributing To A Roth Ira

You can contribute to your Roth IRA after you reach age 70 . You can leave amounts in your Roth IRA as long as you live.

Can a 75 year old contribute to a Roth IRA?

You are never too old to fund a Roth IRA. Opening a Roth IRA later in life means you dont have to worry about the early payout penalty if youre 59½. It doesnt matter when you open a Roth IRA, you have to wait five years to withdraw the income tax-free.

Can a 73 year old contribute to a Roth IRA?

Who Can Contribute to a Roth IRA? Roth IRA contributions are allowed with no age limit as long as an older person has income from employment and does not exceed the income limit.

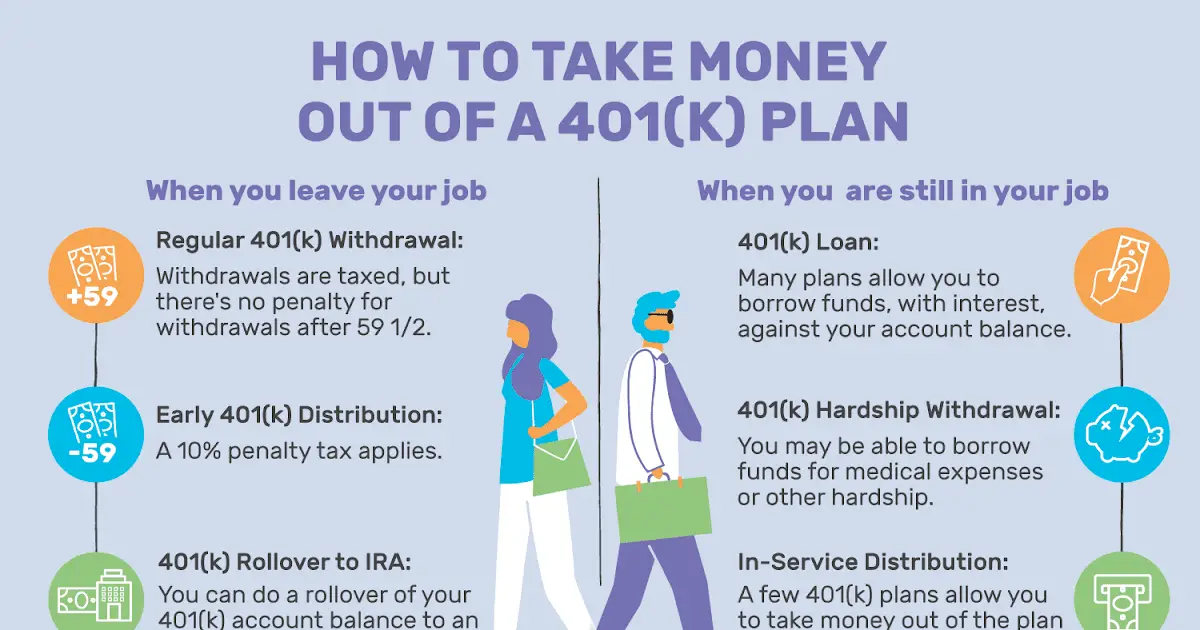

Dont Cash Out Your 401 Early

Another lesson: Whatever you do, dont cash out your 401 savings. If you leave your job, you are allowed to spend your 401 funds if you pay taxes on the amount, including a 10% penalty tax assessed on most withdrawals made before age 59 ½. You may be tempted to take the cash and spend it on a vacation before you start your next job, but thats not a very good idea.

Roll over that retirement money, sign up for the retirement plan with your new employer and take a nice and affordable staycation instead. Your retired self will be very grateful to your working self for making a small sacrifice that could have a big impact down the line.

Don’t Miss: Where Can I Find My 401k