Use Resources To Discover Unclaimed Assets

Once you use these resources to locate your funds, you can use the following resources to get access to your unclaimed assets.

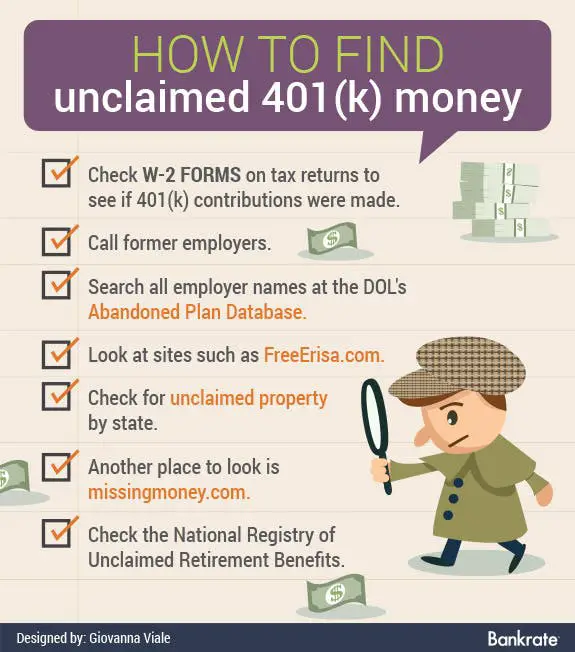

How To Find Lost 401 Account Funds

If you suspect youve lost track of some old 401 funds, or if your old company has gone out of business, you may still be able to find that money.

If Congress passes the legislation, the proposed SECURE Act 2.0 intends to create a national, online lost and found for orphaned retirement plans. In the meantime, your best option is to work through the options below.

Usei Releases An Interview On Its Metaverse Plans

Your best bet is to visit FreeERISA.com, which can help you track down your old 401 using the following website tools:

- Code search: Find employee benefit and retirement plan filings by location.

- Dynamic name search: Find 5500s even if the plan sponsor’s name changed.

- Instant View: See benefit filings right in your browser instantly.

Read Also: Can A Small Business Owner Have A 401k

Search For Money From A Former Employer

You have at least a couple ways to track down money from a former employer:

- If you think youre owed back wages, you can turn to the Department of Labors database and see if its holding your cash. The department holds unpaid wages for up to three years.

- If youre searching for unclaimed pensions because a company went out of business or ended a defined benefit plan, you can turn to the Pension Benefit Guaranty Corp.s website. More than 80,000 people have earned a pension but havent claimed it, the organization says.

Track Down Previous Employer Via The Department Of Labor

If you cant find an old statement, you may still be able to track down contact information for the plan administrator via the plans tax return. Many plans are required to file an annual tax return, Form 5500, with the Internal Revenue Service and the Department of Labor . You can search for these 5500s by the name of your former employer at www.efast.dol.gov. If you can find a Form 5500 for an old plan, it should have contact information on it.

Once you locate contact information for the plan administrator, call them to check on your account. Again, youll need to have your personal information available.

Also Check: How To Open A Personal 401k

Is It Ok To Just Send The Entire Balance To The Irs As Tax Withholding And Let Them Sort It Out

A few years ago, it became popular practice to simply pay the entire amount of the distribution to the IRS as income tax withholding. Although very clean and efficient from the plan sponsors perspective, the IRS issued guidance indicating such practice was not acceptable. Therefore, sponsors should no longer pursue 100% withholding as an option.

Call Your Old Employer

If you suspect you have missing 401 funds or even if you’re not sure, it’s still a good idea to contact old employers and ask them to check if they’re holding your old account. Your former company will have records of you actually participating in a 401 plan.

You’ll either need to provide or confirm your Social Security number and the dates of your employment, but if you can, you’ll have found the fastest way to dig up a missing 401.

Read Also: What Does It Mean To Roll Over Your 401k

Find Accounts From Failed Banks

You have a couple options if your bank failed and you have yet to claim your money:

- You can find unclaimed money from banks that have failed at this Federal Deposit Insurance Corp. website.

- If your unclaimed money was held at a failed credit union, you can track it down at this National Credit Union Administration website.

What Other Sites Can I Visit To Check For Lost Money

As I mentioned earlier, lost retirement accounts are just one type of unclaimed money. Here are some other resources that can help you find missing money:

- MissingMoney.com: a government database of unclaimed property.

- HUD.gov: If youve ever gotten a Federal Housing Administration loan, you may be due a refund.

- FDIC.gov: Search for unclaimed funds from failed banks and other financial institutions on this site.

- USA.gov: This site is full of resources to search for unclaimed money, including federal money such as tax refunds and bonds.

- FindMyFunds.com: links to the official website of at least 25 states including some not covered by MissingMoney.com.

You May Like: How To Start My 401k

How To Find Your Lost 401 And Other Retirement Accounts

Video: Why You Should Track Down Your Old 401s Now

Between job changes, growing families, maybe even cross-country moves, losing access or forgetting about a retirement account is completely plausible.

Retirement Tip of the Week: If you think you have money floating around in a 401 or pension somewhere, try and find it with a few helpful resources.

For those of us who have been in the workforce for some time, it is easier than one might think to lose track of retirement assets, said Larry Harris, a certified financial planner at Parsec Financial Wealth Management.

Lost retirement money could be held in an abandoned 401 plan or a pension, or in the form of stock shares granted by the employer.

The first step is to check your states treasury site, as states will take custody of these assets after a certain number of years . Many states have an option to perform a search for unclaimed property, said Christopher Lyman, certified financial planner at Allied Financial Advisors. Be careful as to what site youre actually on a state government website will end in .gov, for example. Claiming the property from there is a fairly straightforward process laid out by the state, he said.

Try running the search using any name ever used, said Sarah Carlson, a certified financial planner and founder of Fulcrum Financial Group.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our investing reporters and editors focus on the points consumers care about most how to get started, the best brokers, types of investment accounts, how to choose investments and more so you can feel confident when investing your money.

Investing disclosure:

The investment information provided in this table is for informational and general educational purposes only and should not be construed as investment or financial advice. Bankrate does not offer advisory or brokerage services, nor does it provide individualized recommendations or personalized investment advice. Investment decisions should be based on an evaluation of your own personal financial situation, needs, risk tolerance and investment objectives. Investing involves risk including the potential loss of principal.

Recommended Reading: Can I Transfer Rollover Ira To 401k

Tracking Down Transferred Or Missing Small 401 Plan Assets

The search for old 401 assets gets extra tricky if your accounts had less than $5,000 in them. It turns out you may no longer be searching for an old 401, but rather an Individual Retirement Account. Federal law allows retirement plans to transfer balances up to $5,000 to IRA- without additional consent from the participant. While there is no paperwork on the forced rollover, many firms require additional paperwork to update or change your account in any way.

If your old 401 was automatically rolled over to an IRA there is a place to look online. Abandoned Plan Seach, is a database of companies that accept transfers of small balances from 401 plans. However, the best place to start your search is the investment company that held the 401. If your old 401 was at Fidelity or Vanguard, your IRA is still likely at the same company.

Look Into Your States Unclaimed Property Database

If your former company goes bankrupt, youre still OK. The law protects your 401 funds from its creditors.

Often, the brokerage firm that held the funds for your former companys 401 plan will retain the funds for you. However, that firm can eventually turn over the money to the states unclaimed property fund.

Depending on the state, if your account becomes inactive or dormant for as few as three years, the administrator can mail the funds to your last known address. If those funds are returned to sender or if you cant be reached, your assets get relinquished to the state.

A number of websites allow you to search for unclaimed money using databases in various states. Many states have their own sites, but these may be a good place to start:

You May Like: How To Avoid Taxes On 401k

How Can I Find My Old 401k Account

The good news is that its relatively painless to locate lost funds in unclaimed 401k accounts. Online resources such as missingmoney.com and unclaimed.org allow you to search for assets in any states in which youve lived or worked. And if you do find money from an old 401k thats owed to you, its often as easy as filling out a simple online form to get it back.

Darin Bostic, a Schwab financial planner, points out that the best way to keep track of your funds is not to lose them in the first place. Consolidating similar accounts, such as old and new 401s, can help you keep track of your savings, says Darin.

Whats more, consolidation helps ensure your assets are working in harmony toward your long-term goals. Its difficult to follow a comprehensive investment strategy when your money is spread out all over the place.

Use Additional Government Document Recovery Tools

Lots of folks say the federal government is beholden to excessive paperwork and, in many ways, those people are right. But your hunt for an old 401 isn’t a good example of that mindset.

Exhibit “A” is the U.S. Department of Labor’s Abandoned Plan Database. The database can tell you if your company’s old 401 plan is still up and running, has been deep-sixed, or is being held by an outside administrator who can steer you to your old 401 account.

When using the website, the more information you can provide, the better. Your best bets include using the plan’s name, the name of your old employer, the city and state where the company resided, and the appropriate zip code.

Also Check: How To Cash Out 401k While Still Employed

Where To Find Unclaimed Money

The type of unclaimed money can affect the type of database you need to search or the state agency you need to contact.

Unfortunately, this is a state-by-state problem, says Warren Ward, CFP, founder of WWA Planning and Investments in Columbus, Indiana. I dont know of any national database.

So, for many types of money or unclaimed property, you will need to research your states records.

In Indiana, you can visit indianaunclaimed.gov, a site maintained by the attorney generals office, says Ward. Its actually something that we do every year for our clients, but its very easy for an individual to do if they care.

Ward warns of treasure hunters who contact you out of the blue and offer to find the lost money for you.

The claims process is now automated, but we still hear about people scanning the database for large sums of money and trying to get people to pay them to locate the funds, says -he.

So if someone contacts you to find unclaimed money, it may indicate that you have funds somewhere. This means that you have to search for it yourself. You can search any of the states websites for free, and you dont need to pay anyone to find the money for you.

Follow The Paper Trail

If you think you may have money in a company-sponsored retirement plan floating around somewhere, you should take all necessary measures to track it down. You worked hard for those dollars, and you want to make sure theyre working as hard as possible for you and your future.

The Find a Financial Advisor links contained in this article will direct you to webpages devoted to MagnifyMoney Advisor . After completing a brief questionnaire, you will be matched with certain financial advisers who participate in MMAs referral program, which may or may not include the investment advisers discussed.

Don’t Miss: How To Save Without 401k

How To Search For Unclaimed Retirement Benefits: 401

You can take a few steps to search for your unclaimed 401 retirement benefits. The first step is to gather as much information as you can about your former employer. If your employer is still in regular operation, there is a chance that your 401 is still in the account that you had when you were with the company.

If you need to do a bit more digging, here are some steps you can take.

How To Track Down That Lost 401 Or Pension

Tweet This

Can’t Find your old 401 or that old pension? Here is how to track your money down. Shutterstock

At least once every few months a long-term client brings in a retirement account statement and says, I forgot I had this retirement account. Can you help me with it? Sometimes these accounts are tiny but other times they hold a substantial amount of money. All of them are old, and havent been looked at in years. If you find yourself in this position, follow these steps to locating your 401 or other retirement accounts from previous employers.

Do you ever feel like you know you saved more for retirement than your statements indicate? Are you certain you must have forgotten about an old retirement account or pension with a previous employer? You likely arent crazy, and youre definitely not alone.

Americans lost track of more than $7.7 billion worth of retirement savings in 2015 alone by accidentally and unknowingly abandoning their 401.– USA Today, February 25, 2018

The days of graduating college, getting a corporate job and staying with the same employer until the retirement age of 65 are long gone. Today, people are jumping from job to job which often leaves a trail of old retirement accounts and even a few pensions. Because of this, a surprising number of people lose track of these old accounts. Forgetting about these accounts can really hurt your overall retirement security when you factor in compounding interest.

What happens when a 401 plan is terminated?

Also Check: Can You Get 401k If You Quit

Find Lost 401k: How To Find Out If You Have Lost Or Forgotten Retirement Accounts

Here is a guide for how to find lost money a lost 401k or other unclaimed retirement benefits.

Finding a lost 401k or other retirement account is more tedious than metal detector treasure hunting,but perhaps more rewarding.

A few years ago, I received a strange notice in the mail: a former employer was discontinuing their retirement plan and I had 30 days to either roll my balance into a different account or receive a distribution from the plan. This sort of thing happens quite often when people change jobs and leave their retirement account in the old employers plan. The strange thing about this notice was, I had no idea Id been participating in the plan while I worked there!

Could the same thing have happened to you? If youre looking for ways to increase your retirement savings, you just may want to look for lost or forgotten retirement accounts.

Search For Unclaimed Retirement Benefits

When all else fails, search for yourself in the National Registry of Unclaimed Retirement Benefits. Not all employers participate in this service, but many do because it provides benefits that help them meet their legal requirements. It’s a free service, and it only requires your Social Security number.

You May Like: How To Use Your 401k To Invest In Real Estate

What Should I Do With My Lost Retirement Account

Once youve tracked down your lost retirement funds, you have some decisions you need to make. You can, of course, withdraw the funds and spend them, but there are a few reasons that might be a bad idea. If youre withdrawing funds from a forgotten 401 or other savings plan, take some time to research the taxes or penalties youll have to pay on any money you take out. Unless you put after-tax funds in, youll be taxed on the funds as you would with any type of income.

If youre 72 years old, though, youll need to pay attention to the Required Minimum Distributions to avoid a penalty. The amount youre required to take each year is based on a calculation that divides your account balance by your life expectancy factor. You can use the IRS Required Minimum Distribution Worksheet to help with that.

For the remainder of the amount, you may choose to leave it alone, withdraw it, or roll it into an IRA. You may find you can save on fees by rolling the amount over, but after retirement, the fees involved in doing that may eat into any cost savings. Weigh your options, including calculating the income taxes youll owe on any amount you withdraw, before making any decisions.