My Accountant Doesn’t Believe You

Obviously, having access to multiple 401s is an unusual situation among Americans in general, even if it is quite common among doctors. As such, an unbelievable number of accountants have a misunderstanding of the rules noted above, particularly the one about having a separate $57K limit for each unrelated employer. However, taking a look at this article on IRS.Gov written in layman’s language, you can see this is true:

Anything Else I Should Know

Yep. A few things, actually.

Once you contribute to a 401, you should consider that money locked up for retirement. In general, distributions prior to age 59½ will be hit with a 10% penalty and income taxes.

If you leave a job, you can roll your 401 into a new 401 or an IRA at an online brokerage or robo-advisor. The IRA can give you more control over your account and allow you to access a larger investment selection.

401s typically force you to begin taking distributions called required minimum distributions, or RMDs at age 72 or when you retire, whichever is later. You may be able to roll a Roth 401 into a Roth IRA to avoid RMDs.

Other Reasons To Use A Roth Ira

One of the biggest advantages of a Roth IRA over other retirement savings accounts is the ability to access contributions at any time. Thus a Roth IRA can be a good vehicle to save for preretirement goals if you otherwise wouldn’t contribute to an IRA.

Assuming you’re eligible for Roth IRA contributions, let’s say you deposit $9,000 over three years. You invest those contributions in low-cost mutual funds, and your balance grows to about $13,000 in six years. At that point you decide to buy a car. You can withdraw up to $9,000 from the account without explanation and without penalties. You can’t touch $4,000 in earnings unless you want to pay income taxes plus a 10% penalty.

There’s also a way to access your Roth IRA earnings early, without paying penalties or taxes. You can withdraw up to $10,000 in earnings if you use the money for a home purchase. These are the requirements:

- It’s been at least five years since your first Roth IRA contribution

- You and your spouse haven’t owned a primary home in the past two years

- You use the funds within 120 days of withdrawal

The $10,000 earnings withdrawal exception is a lifetime cap, so you can’t repeat this move in the future.

Read Also: How To Rollover Old 401k To New 401k

Benefits Of Contributing To Your 401 Plan

401 account contributions provide a double tax advantage for taxpayers. Individuals are able to direct pre-tax funds from their paycheck into their 401, reducing the amount of their income subject to income taxes the following year. In addition, any earnings from 401 account contributions are also tax-exempt.

Individuals will need to pay income taxes on funds taken out of 401 accounts during retirement. However, many find their income is lower during retirement than it was while working, placing them in a lower tax bracket.

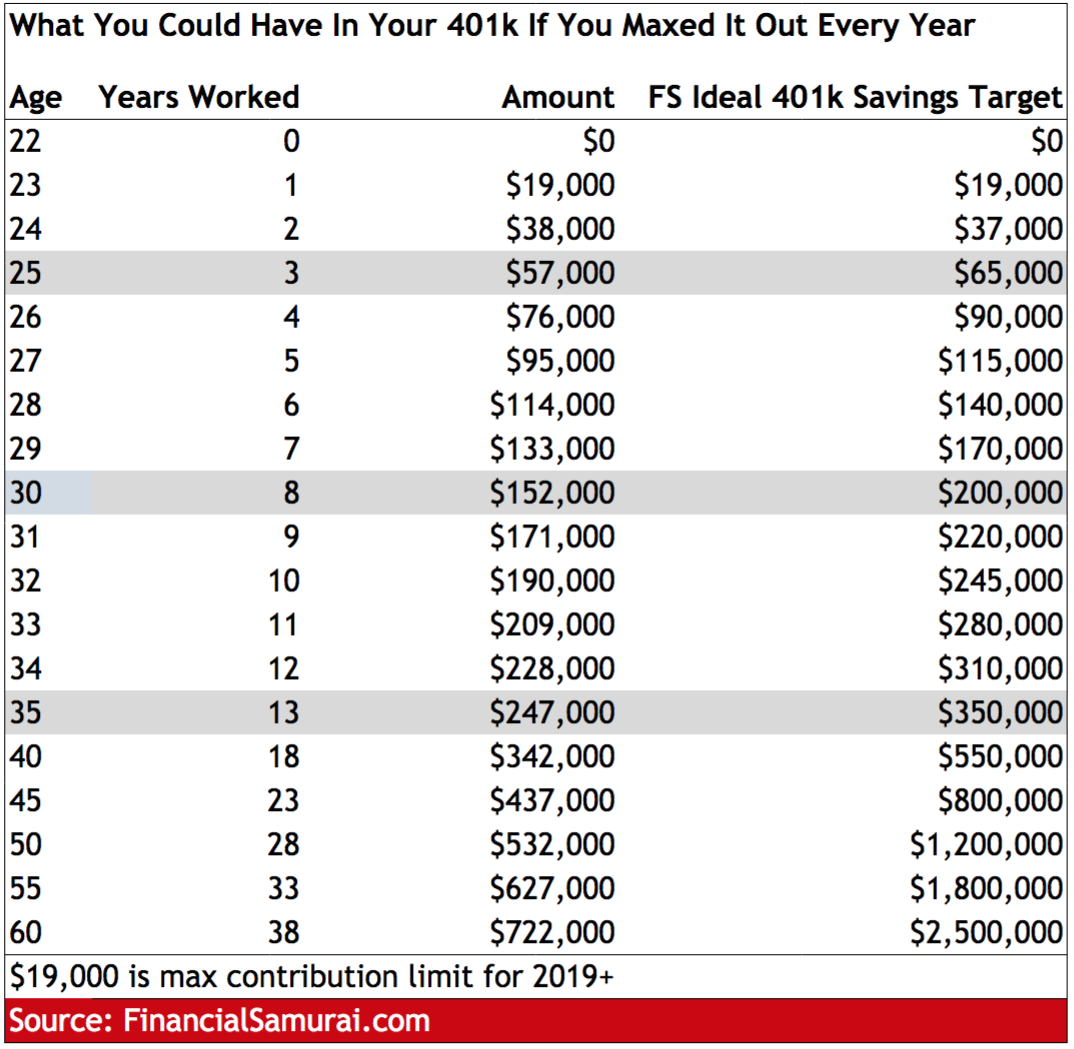

How To Contribute Far More Than $19500 To Your 401

Adding a cash balance plan to your 401 can allow you to make significantly larger retirement plan contributions and save on taxes

A cash balance plan is like a 401 on steroids. Most 401 investors understand that wealth creation is based on your ability to save and the return on your investments. But there is a third factor which is often overlooked: the minimization of taxes. Fortunately, a lesser-known but extremely valuable solution, known as the cash balance retirement plan, allows profitable business owners to accelerate savings and pay significantly less in taxes.

In the current tax laws, the benefit of a cash balance plan is that it allows far higher contributions than a 401, which are limited to $19,500 per year . Depending on your age, cash balance plan contribution limits are as high as $288,000 each year. These contributions bring down your taxable income on a dollar by dollar level. That means that any income you put into a cash balance plan will not be taxed in that year.

The example below shows how much tax you could save by using a cash balance plan strategy. After making the maximum 401 and profit sharing retirement plan contribution, by adding a cash balance plan you could increase your total annual retirement savings to $315,000. This equals $116,550 less in taxes paid, assuming a 37% tax rate.

Don’t Miss: How To Check Your 401k Balance

Contribution Limits For Roth Iras

For most households, the Roth IRA contribution limits in 2021 and 2022 will be the smaller of $6,000 or your taxable income. If you’re age 50 or older, you can make an additional $1,000 catch-up contribution.

Some may see a reduced contribution limit based on their modified AGI. If you make within $10,000 or $15,000 of the maximum modified AGI, you’ll have to do a little math.

- Take the maximum limit for your filing status and subtract your modified AGI.

- If you’re married filing jointly or separately and you lived with your spouse, take that number and divide by $10,000.

- Otherwise divide by $15,000.

- Multiply the resulting percentage by $6,000 . That’s your contribution limit for a Roth IRA.

For example, if you’re a married couple and you have a combined AGI of $200,000 in 2021, you’d:

- Subtract that amount from $206,000, the maximum AGI allowed to make any contribution. The result is $8,000.

- That number divided by $10,000 is 80%.

- 80% multiplied by $6,000 is $4,800. That’s the maximum amount you and your partner can each contribute to your Roth IRAs.

Importantly, the $6,000 contribution limit applies to all IRAs. The income limits for the Roth IRA apply only to Roth IRA contributions, so you could still contribute to a traditional IRA up to the $6,000 limit. Those contributions won’t be tax deductible, though, if your Roth contributions are limited by your income and you have a 401 at work.

Don’t Forget The Match

Of course, every person’s answer to this question depends on individual retirement goals, existing resources, lifestyle, and family decisions, but a common rule of thumb is to set aside at least 10% of your gross earnings as a start.

In any case, if your company offers a 401 matching contribution, you should put in at least enough to get the maximum amount. A typical match might be 3% of salary or 50% of the first 6% of the employee contribution.

It’s free money, so be sure to check if your plan has a match and contribute at least enough to get all of it. You can always ramp up or scale back your contribution later.

“There is no ideal contribution to a 401 plan unless there is a company match. You should always take full advantage of a company match because it is essentially free money that the company gives you,” notes Arie Korving, a financial advisor with Koving & Company in Suffolk, Va.

Many plans require a 6% deferral to get the full match, and many savers stop there. That may be enough for those who expect to have other resources, but for most, it probably won’t be.

If you start early enough, given the time your money has to grow, 10% may add up to a very nice nest egg, especially as your salary increases over time.

Don’t Miss: Who Do I Call About My 401k

Working With Your Financial And Tax Professionals

A 401 plan can become the cornerstone of a personal retirement savings program, providing the foundation for future financial security. Consult your financial and tax professionals to help you determine how your employer’s 401 and other savings and investment plans could help make your financial future more secure.

Important NoteEquitable believes that education is a key step toward addressing your financial goals, and we’ve designed this material to serve simply as an informational and educational resource. Accordingly, this article does not offer or constitute investment advice and makes no direct or indirect recommendation of any particular product or of the appropriateness of any particular investment-related option. Your needs, goals and circumstances are unique, and they require the individualized attention of your financial professional. But for now, take some time just to learn more.

Please be advised that this material is not intended as legal or tax advice. Accordingly, any tax information provided in this material is not intended or written to be used, and cannot be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer. The tax information was written to support the promotion or marketing of the transactions or matter addressed and you should seek advice based on your particular circumstances from an independent advisor.

What’s the next step for you?

A financial professional can help you decide. Let’s talk.

Other Irs Retirement Account Changes For 2022

In addition to contribution increases to 457, 403, and 401 plans, the IRS has additional 2022 updates:

-

Traditional and Roth IRA contribution limits remain the same at $6,000, with traditional and Roth IRA catch-up contribution limits staying at $1,000.

-

Income ranges for determining eligibility to make deductible contributions to traditional IRAs, to contribute to Roth IRAs, and to claim the Saver’s Credit all were raised for 2022.

Recommended Reading: Can I Transfer My 403b To A 401k

Cash Balance Plans And The New Tax Law

As we understand it right now, the new tax law passed in 2017 provides a small reduction in marginal rates, including a drop in the top tax bracket from 39.6% to 37%. More significant for partners and business owners is a new 20% deduction for pass-through businesses . In practice, this means that many small businesses will now be taxed on only 80% of their qualified business income , providing significant tax savings.

The new 20% deduction looks attractive, but it isnt distributed equally. If you are a professional in a specified service business, which includes industries of health care, law, finance, and accounting, the 20% deduction is phased out and eventually eliminated once certain income levels are met . Simply put, if you own a specified service business and are a high earner you likely do not qualify for the new 20% pass-through deduction.

The good news is that strategic planning with a cash balance plan can cause physicians or lawyers who dont qualify for the 20% deduction to become re-eligible. Because retirement plan contributions reduce your taxable income, additional plan contributions can help you fall below the $315,000 phase-out limit. This means that plan contributions not only reduce your tax dollar for dollar, but can trigger an added 20% deduction on your income. Seen in the example below, a $185,000 contribution creates a $208,000 reduction in taxable income.

Think About How Much You’ll Need In Retirement

Contributing the maximum to your 401 requires a lot of money especially as an ongoing, year-after-year commitment. It may or may not be enough to fund your retirement, or it could be even more than you need. Your 401 contribution amount should be guided by your retirement savings goal.

How much money you’ll need in retirement depends on when you plan to retire, how much of your current income youd like to replace and how much you want to rely on Social Security.

Most experts recommend saving 10% to 15% of your income, but our suggestion is to get a more detailed goal from a retirement calculator.

If you need to start at a lower contribution and work your way up, that’s fine. Aim to contribute at least enough to grab the match, then bump up the percent you contribute by 1% or 2% each year.

Don’t Miss: How Much Can I Take From 401k For Home Purchase

Retirement Contribution Limits At A Glance

First, the IRS increased the max contribution for 401s and other plans you may have through your employer. Meaning your 401 can hold more money. IRA contribution limits didnt increase, but you can still make good progress toward retirement.

If youre 50 or older, you can continue to set aside more money in your employers plan to help reach your retirement goal. Learn how these catch-up contributions work.

| Account | Catch-up limit |

|---|---|

| Employer-sponsored plans: |

Not ready to max out your accounts? Learn how to gradually increase your contributions.

When A Withdrawal Penalty Applies

While you can take money out of your 401 without penalty for a few reasons, you’ll typically still pay income taxes on it. What if you just want to take the money out to do some shopping before you’ve reached age 59 1/2, or before age 55 if the Rule of 55 applies to you? Well, the IRS will hit you with a 10% penalty on top of taxes. That means that expenses such as a new car or a vacation don’t count as reasons to take out your 401 savings.

Recommended Reading: Can I Borrow Against 401k

Is There An Income Limit For Contributing To A 401

Not exactly. If you have access to a 401 plan at work, you can put money into it no matter how high or how low your salary is. But listen up, high-income earners: The IRS does limit how much of your salary and compensation is eligible for a 401 match.

For 2021, the compensation limit contributions and matches) is limited to $290,000. So keep that in mind! In 2022, the compensation limit increases to $305,000.7

Heres how it works. Lets say you make $500,000 in 2022 and your company offers a 4% match on your 401 contributions. You contribute $20,500the maximum amount youre allowed to put into your 401 in 2022. But instead of matching that $20,500 , your employer only contributes $12,200. Why? Because your employer is only allowed to apply your match on up to $305,000 of your compensation, and 4% of $305,000 is $12,200.

Noit doesnt really make sense. But dont let that stop you from using all the tools you have to build wealth for the future!

Limits For Highly Compensated Employees

All 401s are subject to annual nondiscrimination tests to ensure the plans don’t provide unfair advantages to HCEs and key employees that lower-earning employees don’t get. These tests ensure HCEs aren’t contributing substantially more of their earnings or receiving more in employer contributions compared to non-HCEs. They also place limitations on how much of a 401 plan’s assets can be in the hands of HCEs. Failing a nondiscrimination test could result in the 401 plan losing its tax benefits, so companies want to avoid this at all costs.

Companies that fail can remedy the situation in a few ways. First, they can provide additional nonelective contributions to lower-earning employees to bring the plan into compliance, or they can place additional limits on HCE contributions, refunding them in some cases if employees have already contributed too much for the year. They can also do a combination of the two.

If a company has to limit HCE contributions, they may not be able to contribute the full sums listed in the table above. Their maximum contribution limits depend in part on how much lower-earning employees are contributing to their 401s. HCEs should talk to their company’s HR department to learn about how much they’re eligible to contribute annually.

You May Like: Will Walmart Cash A 401k Check

Considerations When Contributing To An Ira & A 401

One benefit of contributing to both an IRA and 401 plan is to maximize the power of tax deferral. While every personal financial situation is unique, there are a few general rules to follow for contributing to both an IRA and a 401:

- Maximize the 401 match: If your employer offers a match in your 401 plan, you should likely aim to contribute at least enough to receive the match. For example, if the match is dollar-for-dollar up to 5% of compensation, you may want to contribute at least 5%.

- Maximize IRA contributions: If you’ve already maximized your employer’s 401 match, try to make the maximum allowed IRA contribution, which is $6,000 per year .

- Roth vs traditional contributions: Like IRAs, many 401 plans allow for Roth or traditional contributions. It’s generally wise to make Roth contributions if you expect to be in a higher income tax bracket than you are now when you retire. And if you think you’ll be in a lower tax bracket when making withdrawals from your IRA in retirement, traditional contributions may be better.

Now that you know how you can contribute to a 401 and an IRA, you can rest assured that the IRS won’t penalize you for maintaining both types of retirement accounts, as long as you adhere to the rules and regulations. Ultimately, retirement planning strategies for contributing to a 401 and a IRA will depend on your personal financial situation. For this reason, it can help to consult a financial professional to get specific advice for your retirement goals.

Why Does The Irs Impose Contribution Limits

Contributions to 401 plans are made using pretax dollars, which provides significant tax benefits. This means you dont have to pay federal income tax for contributions up to the $20,500 limit , which lowers your taxable income. And because earnings in a 401 account are on a tax-deferred basis, dividends and capital gains arent subject to tax until you withdraw your funds.

However, because of the substantial tax benefits offered by 401 retirement plans, the IRS works to ensure that plans do not unfairly benefit company owners and highly compensated employees over non-highly compensated employees. Thats where contribution limits and cost-of-living adjustments come into play. To ensure a 401 plan is structured fairly and not favoring specific employees, all 401 plans must pass a set of annual compliance tests.

Don’t Miss: Can 401k Be Transferred To Roth Ira