Ira Contributions After Age 70

For 2020 and later, there is no age limit on making regular contributions to traditional or Roth IRAs.

For 2019, if youre 70 ½ or older, you can’t make a regular contribution to a traditional IRA. However, you can still contribute to a Roth IRA and make rollover contributions to a Roth or traditional IRA regardless of your age.

What About Employer Contributions

Employers are not obligated to match your Roth contributions, but if they do, the match is a pre-tax contribution. The funds will go into a separate pre-tax account, and funds from it will be subject to tax when distributions are made at retirement.

Your employers contribution does not count towards your individual maximum permitted contribution, but they do count towards the overall limit. Currently, the maximum amount that you can put into all your 401 plans, Roth or traditional and including employer contribution, is $57,000 for individuals under 50 or $63,500 for those aged 50 and over.

You Should Max Out 401 Contributions Right Not So Fast

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

Just because you can do something doesnt mean you should. Like entering a hot dog eating contest, getting a tattoo on your face or even deciding to max out 401 contributions.

The last one may seem incongruous after all, numerous studies show Americans feel they arent saving enough for retirement. And if youve read any personal finance advice, you probably believe the best bet is to save, save, save.

The maximum 401 contribution is $19,500 in 2021 and $20,500 for 2022 . But depending on your financial situation, putting that much into an employer-sponsored retirement account each year may not make sense. Rather, you may want to fund other accounts first. Here are three things to consider before you max out 401 contributions.

Also Check: Can Anyone Have A 401k

Can I Max Out A 401k And An Ira In The Same Year

The limits for 401 plan contributions and IRA contributions do not overlap. As a result, you can fully contribute to both types of plans in the same year as long as you meet the different eligibility requirements.

How much can I contribute to an IRA if I also have a 401k?

If you participate in an employers retirement plan, such as a 401, and your adjusted gross income is equal to or less than the number in the first column for your tax return status, you can claim a traditional IRA contribution. up to the maximum of $6,000, or $7,000 if you are 50 years of age or older, in

How much can I contribute to my 401k and IRA in 2021?

16 For 2021, the combined 401 contribution limits between you and the employer-matched funds are as follows: $58,000 if you are under 50 $64,500 if you are 50 years of age or older

There Are Other Ways To Save For Retirement

A Tea Reader: Living Life One Cup at a Time

A 401 is a powerful retirement savings tool. If you have access to such a program through work, it’s shrewd to take advantage of any employer match. If you still have money left over, there are other ways to save for retirement. Retirement planning ensures individuals will live out their golden years in comfort, so it’s vitally important to understand the ins and outs of this practice. This article outlines some of the other options you have available to make the most out of your retirement savings strategy and to help you lower your tax liability.

Read Also: How To Do A Direct 401k Rollover

How To Choose Between An Ira And A 401

If you have a 401 at work, you may be trying to figure out if it makes sense to open up an IRA. First, understand the annual contribution limits for both accounts:

-

401: You can contribute up to $19,500 in 2021 and $20,500 for 2022 .

-

IRA: You can contribute up to $6,000 in 2021 and 2022 . You can contribute that amount to a traditional IRA or a Roth IRA, or you can divvy up your money into each type of plan.

Heres a good way to approach deciding between a 401 and an IRA, assuming you cant max out both:

If your employer offers a 401 match, contribute enough to get all of that free money.

Once youre set up to get the full match in your 401, next consider contributing to an IRA. If youre eligible for the tax deduction, a traditional IRA can offer a lot of benefits beyond that tax break, including access to low-cost investments and low or zero administrative fees. A Roth IRA is another great option.

If youre not eligible to claim the traditional IRA tax deduction or a Roth isnt right for you, then sticking with your 401 might make the most sense.

» Still not sure? Read our road map for choosing between an IRA vs. 401

» Ready to decide? Check out all of our picks for the best IRA accounts

About the author:Andrea Coombes is a former NerdWallet authority on retirement and investing. Her work has appeared in The Wall Street Journal and MarketWatch.Read more

Should You Max Out Your 401 Or Ira At The Beginning Of The Year

Ask any expert investor, and they’ll tell you that trying to time the market is a fool’s errand. For long term investments, like retirement savings, it’s time in the market that matters most, not the perfect entry point.

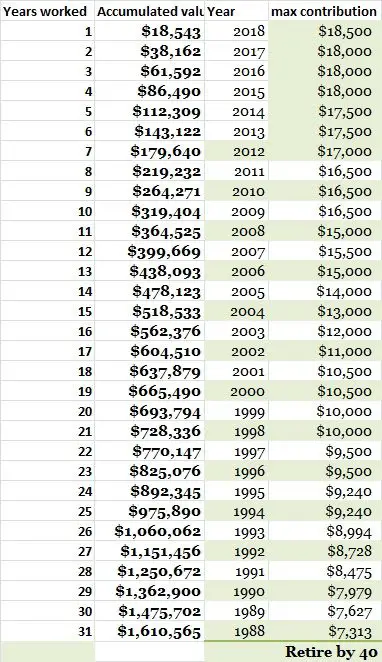

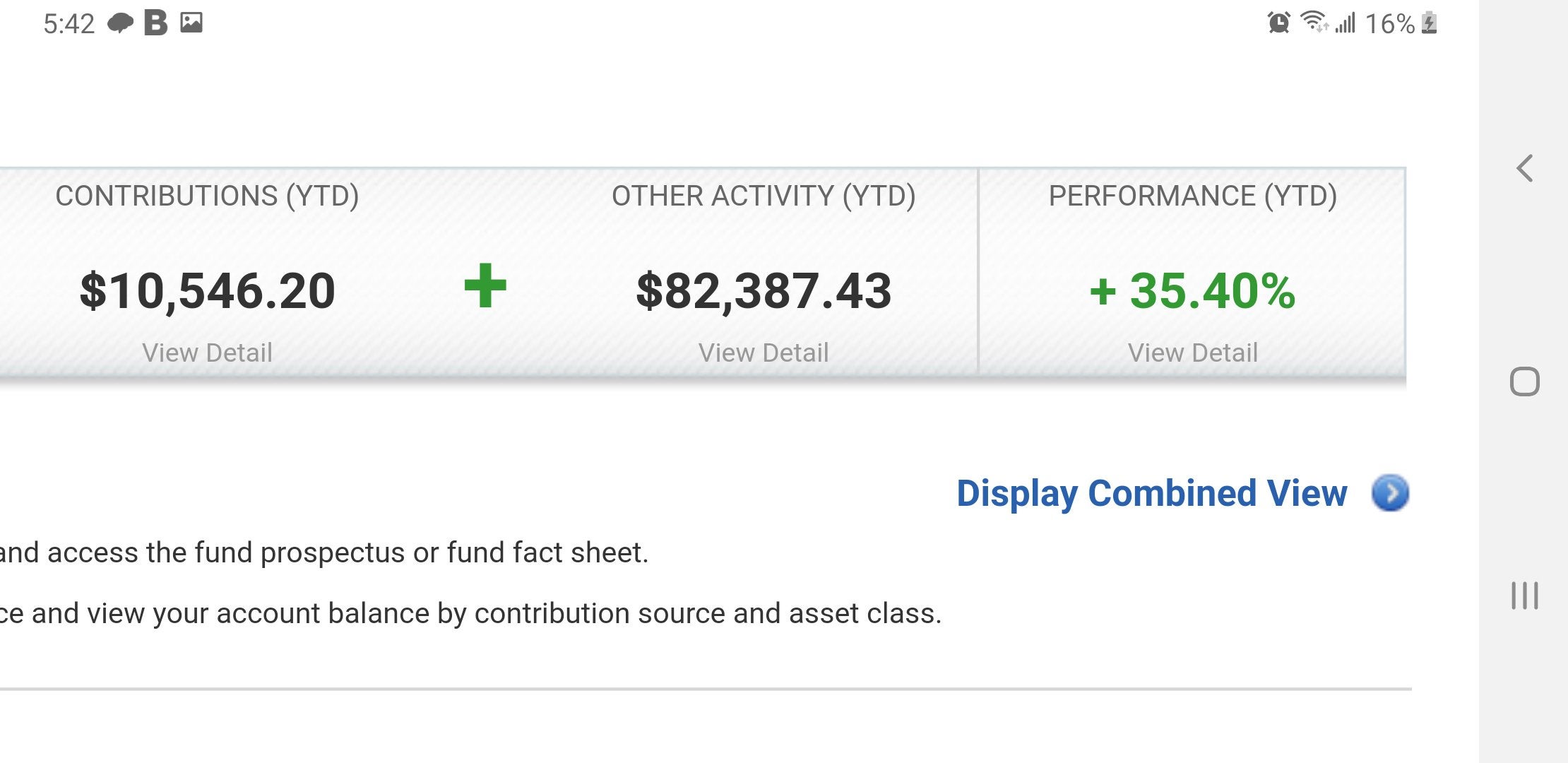

Which is why it might make sense to try to max out retirement contributions as early in the year is possible, assuming you have the means to do so. In 2019, the 401 contribution limit is $19,000 and the IRA limit is $6,000 for those under 50.

The idea is that more time in the market can potentially lead to higher returns over time. If the market goes up throughout the year, as it has historically done, contributing in January as opposed to November or December can give you almost a year’s worth of growth. This is especially true for a Roth IRA, an investment account that is funded with money that has already been taxed, because its main benefit to investors is tax-free growth.

“If you can make that contribution earlier in the year, why not? You’re getting the growth in a tax-free shelter,” Chantel Bonneau, wealth management advisor at Northwestern Mutual, tells CNBC Make It about Roth IRAs. “It could participate in the market longer.”

That extra time compounds the Roth’s tax benefit, whereas you are getting the same tax benefit with a traditional IRA no matter when you contribute.

Don’t Miss: How To Get Your Money Out Of 401k

This Years Contributions Are A Long

Between worries about inflation and concerns about the stock markets ability to continue on its recent tear, you might be concerned about buying too high. However, maxing out your contributions is not a one-and-done strategy.

Ideally, you will contribute to your Roth IRA this year, next year and many years to come. And when you begin to withdraw funds, youll likely draw it down over an extended period of time. So, dont worry about what the market does today or tomorrow spend time thinking about how your investments will look much further down the road.

What Is A 401

In simple terms, a 401 plan is a retirement savings account offered by your employer, with contributions set as a consistent monthly amount, typically as a percentage of your salary.

The main advantage of a traditional 401 is that you can make contributions straight from your paycheck pre-taxsaving you 10% to 37% on your contributions, depending on your income tax rate.

Investment growth in your 401 is also tax-deferred meaning you dont need to pay annual taxes on interest earned. All of this adds up to a big upside for long-term, tax-deferred growth. However, with a traditional 401 you will need to pay income tax on all your earnings when you withdraw from the account.

Another benefit of a 401 is that many employers will match up to a certain contribution amount, effectively doubling your savings. Every company differs in their contribution matching limit, but a common amount is a 50 cents match for every dollar, up to 6% of an employees pay. matching here.)

However, with all the benefits come a few restrictions. The most significant is the contribution limit of $19,500 for employees in 2020. There is also a 10% early distribution penalty tax if you access your funds before age 59½, but the CARES Act may let you waive that penalty if you made an early withdrawal for reasons related to the pandemic, including financial hardship.

Recommended Reading: How Do I Know If I Have Money In 401k

Should You Max Out Your 401k

Retirement is important and many financial experts would suggest maxing out any employer match contributions.

But while you may want to take full advantage of any tax and employer benefits that come with your 401, you also want to consider other financial goals and obligations you have before maxing out your 401, including:

Is all high-interest debt paid off? High-interest debt like credit card debt should be paid off first, so it doesnt accrue additional interest and fees. Do you have an emergency fund? Life can throw curveballsits smart to be prepared for job loss or other emergency expenses. Is there enough money in your budget for other expenses? You should have plenty of funds to ensure you can pay for additional bills, like student loans, health insurance, and rent. Are there other big-ticket expenses to save for? If youre saving for a large purchase such as a home or a kids college fund, you may want to put extra money into this saving goal, at least for the time being.

Once youre comfortable with other savings strategies, it might be time to explore maxing out your 401. There are many reasons to do soits a way to take advantage of tax-deferred savings, employer matching , and its a convenient way to save, since the money gets deducted from your paycheck automatically, once you set up your contribution amount.

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Don’t Miss: How Much Can You Contribute To 401k Per Year

Compound Interest For Retirement Accounts

Let’s look at an example using $12,000 in annual contributions . If your $12,000 deposit earns 8%, the simple interest for that year would be $960. Your accounts would collectively end the year at $12,960. The next year, the combined balance would be $25,920.

Let’s say your Roth IRA accounts earn interest at an 8% compounded rate. At the end of the first year, you would have the same balance as if you earned simple interest: $12,960. But at the end of the second year, you would have $26,957 instead of $25,920 because of the extra interest you’ve earned on the first year’s interest. It may not be a huge difference yet, but still more than the simple interest would earn.

Of course, the more years that pass, the greater the effect of compounding. Here’s what happens to your earnings over the next five years:

- Year 1: $960

- Year 5: $16,031

Put Money Into Taxable Investments

Lots of people think that they cant invest in mutual funds if they participate in their companys retirement plan. Thats not true. You can open a taxable account with an investment management company or brokerage firm. Youre investing after tax dollars, so youre not getting any sort of break with the IRS. Thats why its not the first and best option. But its better than putting your money under the mattress!

What are the advantages of taxable investments? Good question. Heres the answer:

The disadvantage of a taxable account is, well, the taxes. Youll pay the IRS on the growth of those investments, because the government is, well, the government. Uncle Sam wants his share.

In addition to investing in the stock market, some people choose to invest in real estate. This is an option, but only if you have cash to pay for it. Dont ever go into debt to invest! Also, make sure you have an emergency fund specifically for your real estate so you can cash flow any taxes, repairs or other emergencies.

Recommended Reading: Who Are The Top 401k Providers

Which Celebrity Investor Are You Take Our Quiz To Find Out

3. Open a brokerage account

If your emergency savings is up to snuff and you’ve looked into an HSA as another pre-tax savings option, consider opening a taxable brokerage account.

Brokerage accounts provide investors with another way to invest money in the stock market similar to a traditional 401k, except you’re investing after-tax dollars. Any capital gains are taxed upon withdrawal.

Investors pay a fee to the brokerage house with each transaction.

My wife and I have a brokerage account with Vanguard with holdings in stocks, bonds as well as mutual funds. Less experienced investors who wish to invest their money in something without needing a lot of knowledge might consider the Vanguard LifeStrategy Growth Fund, which is a broadly diversified 80/20 stocks to bonds collection of funds.

A wide variety of companies offer brokerage accounts, like Vanguard, Fidelity, Charles Schwab, T.Rowe Price, Scottrade and many others.

What say you? What would you do with your extra cash after maxing out your 401k and Roth IRA?

Note: This article was originally written in November of 2015 but has been updated in May 2019.

Other Reasons To Use A Roth Ira

One of the biggest advantages of a Roth IRA over other retirement savings accounts is the ability to access contributions at any time. Thus a Roth IRA can be a good vehicle to save for preretirement goals if you otherwise wouldn’t contribute to an IRA.

Assuming you’re eligible for Roth IRA contributions, let’s say you deposit $9,000 over three years. You invest those contributions in low-cost mutual funds, and your balance grows to about $13,000 in six years. At that point you decide to buy a car. You can withdraw up to $9,000 from the account without explanation and without penalties. You can’t touch $4,000 in earnings unless you want to pay income taxes plus a 10% penalty.

There’s also a way to access your Roth IRA earnings early, without paying penalties or taxes. You can withdraw up to $10,000 in earnings if you use the money for a home purchase. These are the requirements:

- It’s been at least five years since your first Roth IRA contribution

- You and your spouse haven’t owned a primary home in the past two years

- You use the funds within 120 days of withdrawal

The $10,000 earnings withdrawal exception is a lifetime cap, so you can’t repeat this move in the future.

Recommended Reading: How Much Should You Put In Your 401k

What Is The Downside Of A Roth Ira

One major drawback: Roth IRA contributions are made with after-tax money, meaning there are no tax deductions in the year of the contribution. Another drawback is that the withdrawal of account income should not be made until at least five years have passed since the first deposit.

Is a Roth IRA good or bad?

Roth IRA withdrawals can help your taxes in retirement. When you decide to dive into your Roth IRA funds, withdrawals are tax-free. These tax-free withdrawals can help you defer the need to withdraw money from other accounts, which could increase your AGI, income tax or other costs.

What Is The 5 Year Rule For Roth Conversions

The first five-year rule states that you must wait five years after making your first contribution to a Roth IRA to withdraw your income tax-free. The five-year period begins on the first day of the tax year for which you contributed to a Roth IRA, not necessarily the one from which you withdraw.

How do I avoid a tax penalty on Roth conversion? Salary withholding. Paying the conversion tax with deductions is the surest way to pay the full tax and avoid any underpayment fees and penalties.

Don’t Miss: Can A Small Business Owner Have A 401k