Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

Dont Miss: Does A 401k Rollover Count As A Contribution

Consequences Of A 401 Early Withdrawal

- IRS Penalty. If you took an early withdrawal of $10,000 from your 401 account, the IRS could assess a 10% penalty on the withdrawal if its not covered by any of the exceptions outlined below.

- Withdrawals are taxed. Even if it were covered by an exception, all early withdrawals from your 401 are taxed as ordinary income. The IRS typically withholds 20% of an early withdrawal to cover taxes. So if you withdrew $10,000, you might only receive $7,000 after the 20% IRS tax withholding and a 10% penalty.

- Less money for retirement. Perhaps the biggest consequence of an early 401 withdrawal is missing out on long-term returns in the market. The stock markets average returns have been around 9.6% a year since the end of the Great Depression. If you withdrew $10,000 from your 401 and were about 30 years away from retirement, you could be giving up more than $117,000 in total returns.

Tax On Early Distributions

If a distribution is made to you under the plan before you reach age 59½, you may have to pay a 10% additional tax on the distribution. This tax applies to the amount received that you must include in income.

Exceptions. The 10% tax will not apply if distributions before age 59 ½ are made in any of the following circumstances:

- Made to a beneficiary on or after the death of the participant,

- Made because the participant has a qualifying disability,

- Made as part of a series of substantially equal periodic payments beginning after separation from service and made at least annually for the life or life expectancy of the participant or the joint lives or life expectancies of the participant and his or her designated beneficiary. ,

- Made to a participant after separation from service if the separation occurred during or after the calendar year in which the participant reached age 55,

- Made to an alternate payee under a qualified domestic relations order ,

- Made to a participant for medical care up to the amount allowable as a medical expense deduction ,

- Timely made to reduce excess contributions,

- Timely made to reduce excess employee or matching employer contributions,

- Timely made to reduce excess elective deferrals, or

- Made because of an IRS levy on the plan.

- Made on account of certain disasters for which IRS relief has been granted.

Also Check: How Is A 401k Different From An Ira

How To Take Money Out Of Your 401

There are many different ways to take money out of a 401, including:

- Withdrawing money when you retire: These are withdrawals made after age 59 1/2.

- Making an early withdrawal: These are withdrawals made prior to age 59 1/2. You may be subject to a 10% penalty unless your situation qualifies as an exception.

- Making a hardship withdrawal: These are early withdrawals made because of immediate financial need. You may be still be penalized for them.

- Taking out a 401 loan: You can borrow against your 401 and will not incur penalties as long as you repay the loan on schedule.

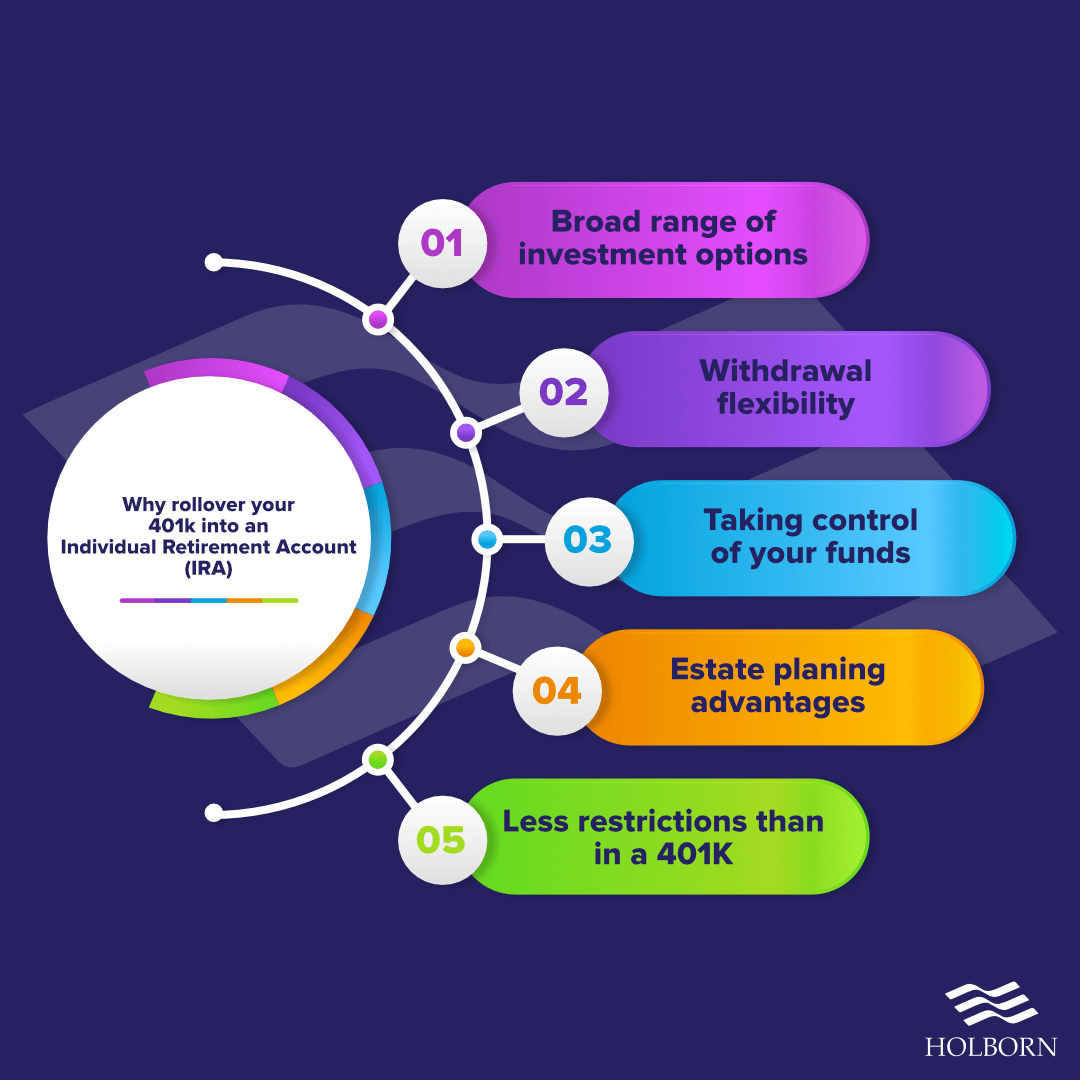

- Rolling over a 401: If you leave your job, you can move your 401 into another 401 or IRA without penalty as long as the funds are moved over within 60 days of your distribution.

Taxes On A Traditional 401

For the tax year 2021, for example, payable on April 18, 2022, a married couple who files jointly and earns $90,000 together would pay $9,328 plus 22% of the amount over $81,050. . If the couple’s income rose enough that it entered the next tax bracket, some of the additional income could be taxed at the next highest incremental rate of 24%.

That upward creep in the tax rate makes it important to consider how 401 withdrawals, which are required after you turn 72, may affect your tax bill once they’re added to other income. “Taxes on your 401 distributions are important,” says Curtis Sheldon, CFP®, president of C.L. Sheldon & Company LLC in Alexandria, Va. “But what is more important is, ‘What will your 401 distributions do to your other taxes and fees?'”

Sheldon cites the taxation of Social Security benefits as an example. Normally, Social Security retirement benefits aren’t subject to income tax unless the recipient’s overall annual income exceeds a certain amount. A sizable 401 distribution could push someone’s income over that limit, causing a large chunk of Social Security benefits to become taxable when they would have been untaxed without the distribution being made. If your annual income exceeds $34,000 , 85% of Social Security benefits may be taxed.

Such an example underlines the importance of paying close attention to when and how you withdraw money from your 401.

Also Check: Do I Need Ein For Solo 401k

It Depends On Whether Your Funds Are In A Traditional Or Roth 401

A Tea Reader: Living Life One Cup at a Time

When you withdraw funds from your 401or “take distributions,” in IRS lingoyou begin to enjoy the income from this retirement mainstay and face its tax consequences. For most people, and with most 401s, distributions are taxed as ordinary income. However, the tax burden youll incur varies by the type of account you have: traditional or Roth 401, and by how and when you withdraw funds from it.

What Is A 401 Early Withdrawal

Generally, anyone can make an early withdrawal from 401 plans at any time and for any reason. However, these distributions typically count as taxable income. If you’re under the age of 59½, you typically have to pay a 10% penalty on the amount withdrawn. The IRS does allow some exceptions to the penalty, including:

- Total and permanent disability.

- Unreimbursed medical expenses .

- Employee separated from service at age 55 or older but only from the plan at the job you are leaving.

Some 401 plans allow participants to take hardship distributions while you are still participating in the plan. Each plan sets its own criteria for what constitutes a hardship, but they usually include things like:

- Medical or funeral expenses

- Avoiding eviction or foreclosure

- The cost of repairing damage to the employee’s home

Hardship withdrawals don’t qualify for an exception to the 10% early withdrawal penalty unless the employee is age 59½ or older or qualifies for one of the exceptions listed above.

Recommended Reading: Can I Contribute To Traditional Ira And 401k

Have Diverse Retirement Income Sources

To be truly efficient with your taxes in retirement, itâs best to have a diverse mix of assets to work with â which means saving for retirement using more than just a 401. This allows you to make strategic withdrawals in retirement that can help you lower your tax burden overall because different assets like Roth accounts, whole life insurance and even annuities have different attributes, including their tax treatment.

Exceptions To 10% Penalty For Iras Only

The exceptions to the penalty for traditional IRAs are the ones most people have heard of, but they often assume they apply to any type of plan, which isnt necessarily the case. The following exceptions are strictly limited to traditional IRAs. These exceptions dont apply to 401s, 403s or other tax-deferred retirement plans:

Also Check: Where Can I Get 401k Plan

Don’t Miss: How To Change 401k Investments

How Much State Tax Do I Pay On 401k Withdrawal

Because payments received from your 401 account are considered income and taxed at the federal level, you must also pay state income taxes on the funds. The only exception occurs in states without an income tax. Your 401 plan may offer you the opportunity to have taxes automatically withheld from a withdrawal.

The Basics Of 401 Withdrawal Taxes

If you are wondering whether your 401 withdrawals are taxed, the short answer is yes your 401 distributions are likely taxable.

This may come as a surprise, because there is some confusion around how retirement accounts work. People often refer to retirement accounts like 401s as tax-advantaged, or tax-deferred. This means investments within your 401 or IRA grow tax-free. Unlike taxable investment accounts, you wont be charged income tax or capital gains tax as your 401 account grows each year.

As an example, if you earn $1,500 before taxes per paycheck, and you contribute $300 of that money to your 401, then you will only be taxed on $1,200. For reference, 401 account holders can contribute up to $19,500 in 2021 , and $26,000 for those 50 and older. For 2022 the limit is $20,500, and $27,000 for those 50 and older.

This tax advantage, however, changes once an account holder starts receiving distributions from the 401. As you pull money out, youll owe income taxes on the funds. Some 401 plans will automatically withhold 20% or so of your account to pay for taxes. Youll want to check with your plan provider to see how your particular 401 works.

The exception is if you have a Roth 401. Like with a Roth IRA, money is put into these accounts after taxes, so the distributions are generally untaxed.

You May Like: How To Withdraw From 401k Fidelity

How To Avoid The Early Withdrawal Penalty

There are a few exceptions to the age 59½ minimum. The IRS offers penalty-free withdrawals under special circumstances related to death, disability, medical expenses, child support, spousal support and military active duty, says Bryan Stiger, CFP, a financial advisor at Betterments 401.

If you dont meet any of those qualifications, you arent entirely out of luck, though. Youve got a couple of options that may let you make penalty-free withdrawals, if youre slightly younger than retirement age or plan your withdrawals methodically.

If youre between age 55 and 59 ½ and you lose your job, the IRS will allow you to withdraw from your 401 plan penalty-free. This is called the Rule of 55, and it applies to everyone within this age group who loses a job, no matter whether youre fired, laid off or voluntarily quit. Stiger says. To qualify for the Rule of 55, the 401 you hope to take withdrawals from must be at the company youve just parted ways with. Note that the Rule of 55 does not apply to IRAs.

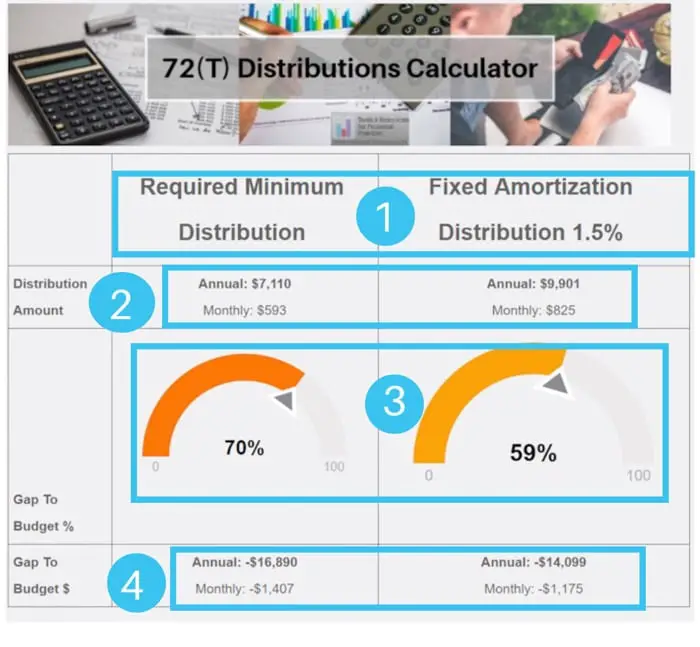

There is also the Substantially Equal Periodic Payment exemption, or an IRS Section 72 distribution, say Stiger. With SEPP you can take substantially equal payments from your 401 based on life expectancy. Unlike the Rule of 55, you may use SEPPs to tap an IRA early.

What Information Do I Need To Give To My Employees

Before the beginning of each annual election period, you must notify each employee of:

If you havent timely given your employees the notice, find out how you can correct this mistake.

The election period is generally the 60-day period immediately preceding January 1 of a calendar year . However, the dates of this period are modified if you set up a SIMPLE IRA plan in mid-year or if the 60-day period falls before the first day an employee becomes eligible to participate in the SIMPLE IRA plan.

If you set up your SIMPLE IRA plan using either Form 5304-SIMPLE or Form 5305-SIMPLE, you can give each employee a copy of the signed forms to satisfy the notification requirement.

If the deferral limitations arent released timely and you normally include the deferral amount for the upcoming year in your notice, you can mention the current limit and advise participants to check the COLA Increase table for next years amount. The notice isnt required to include the salary deferral limitation for the upcoming year.

Read Also: How Does 401k Retirement Work

You May Like: How To Take Out 401k Money For House

Taxes If You Withdraw Money In Retirement

When you withdraw money from a 401 in retirement, you will owe taxes in the year when you take the distribution. The withdrawals will be taxed as your other sources of income at your tax bracket rate. At the minimum, you will pay federal income taxes on the distribution. If you are a resident of a state that imposes state income taxes on retirement distributions, you will pay extra taxes. However, certain states don’t tax 401 distributions, and you wonât pay additional taxes.

For Roth 401 withdrawals, you wonât pay income taxes when you withdraw money in retirement, since you had already paid income taxes at the onset. You must have reached 59 ½ and have held the account for five years or more to qualify for tax-free withdrawals from your Roth 401.

If you are already 72, you must start taking the required minimum distributions from a traditional 401 and Roth 401. If you do not take the mandatory distributions, you will incur a 10% penalty on the distribution not taken.

How A 401 Loan Works

Given all the drawbacks of early withdrawals, you might consider borrowing from your 401 instead.

In general, you can borrow up to $50,000 or 50% of your vested account on a tax-free basis if you repay the loan within five years. That said, if you leave your job, you may be expected to pay off the loan in a short period of time. A 401 loan can be a better option than an early withdrawal for a couple of reasons:

- You won’t owe taxes or a penalty on the amount you borrow unless you violate the loan limits and repayment rules.

- If you repay the loan on time, you won’t miss out on years of growth like you would with a withdrawal.

- The interest you pay on a 401 loan can go back into your 401.

That said, some 401 loan plans don’t let you contribute to retirement while you have an outstanding balance. Additionally, the money you use to pay back the loan is already after-tax income. This money will be taxed again once you take it out after you’ve retired.

Note: Not all companies offer 401 loans. Don’t assume you can take one before checking with your plan’s administrator.

Read Also: Where Can I Find My 401k Statement

Beware The Early Withdrawal Penalty

If you are younger than 59½, not disabled, and choose to cash out the funds from your 401, youll be subject to a 10% early withdrawal penalty. So, if your 401 is worth $15,000 and you decide to liquidate the account, youll be required to pay an additional $1,500 in taxes. That means your withdrawal is essentially slashed to $13,500.

To top it off, your entire 401 withdrawal will be taxed as income by the U.S. even if youre back in your home country when you withdraw the funds. Because contributions to traditional 401 accounts are made with pretax dollars, this means any withdrawn funds are included in your gross income for the year the distribution is taken.

Lets say your income tax rate is 20% in the year you liquidate your 401. This drives the total tax impact up to 30% for that withdrawal .

Therefore, when you withdraw $15,000 from your 401, youll have to pay a total of $4,500 in taxes, which whittles down the grand total of your take-home amount to $10,500. This is precisely why many financial advisors tell U.S. residents that cashing out their 401 before they hit 59½ isnt the smartest option.

Taxes On Roth 401 Plans

Some employers offer another type of 401 plan called a Roth 401. These savings plans take the opposite approach when it comes to taxation: Theyre funded by post-tax income. This means your contributions wont lower your AGI ahead of tax-filing season.

The biggest benefit of a Roth 401 is that because youre paying taxes on your contributions now, you can withdraw the money tax-free later. A few other important notes:

-

You can begin withdrawing money from your Roth 401 without penalty once youve held the account for at least five years and youre at least 59½.

-

You can withdraw money from a Roth 401 early if youve held the account for at least five years and need the money due to disability or death.

-

Roth 401s also require taking RMDs.

Recommended Reading: How To Find Out What You Have In Your 401k

Do You Pay State Taxes On 401k Withdrawals

Because payments received from your 401 account are considered income and taxed at the federal level, you must also pay state income taxes on the funds. The only exception occurs in states without an income tax. Your 401 plan may offer you the opportunity to have taxes automatically withheld from a withdrawal.

Dont Miss: How To Check My Walmart 401k