Solo 401k: The 401k For The Self Employed

Flying solo does give you a lot of options. At the top of the list of retirement plans for the self employed is the Solo 401k which comes with more benefits and fewer restrictions than what major employers offer in a 401k. The Solo 401k is tailored to the business owner or self employed person with no employees . Leading the list of benefits is the maximum tax-deferred contribution allowed. Along with being the maximum allowed, the annual contribution limit increases based on inflation.

For 2022, the maximum is $61,000, plus a $6,500 catch-up contribution or 100% of earned income, whichever is less. Adding to the list of benefits making this the best among the retirement plans for the self employed is that you get to decide how much your annual contribution will be. As your own employer, you can contribute up to 25% of your compensation as the employer match. That is five times more generous than the average 401K match for company employees at around 5% of salary up to only $3,000. The limit on compensation that can be used to factor your contribution is $305,000 in 2022.

If you make the maximum contribution of $61,000 plus a $6,500 catch-up contribution your total possible contribution limit is $67,500. If a spouse is also making maximum contributions, the combined annual contribution can be as high as $135,000. And there are many more benefits that come with the Solo 401k

The 6 Best Solo 401 Companies Of 2022

- Best for Account Features: E*TRADE

- Best for Mutual Funds: Vanguard

- Best for Real Estate: Rocket Dollar

Fidelitys self-employed 401 plan is our pick for best overall due to a combination of very low fees, a wide range of investment choices, and the companys emphasis on retirement savings.

-

No regular account fees and no commissions for stock or ETF trades

-

10,000+ no-transaction-fee mutual funds including four Fidelity funds with no fund expenses

-

Retirement resources including calculators, apps, and education resources to help you improve your retirement savings and investment strategy

-

Some active traders may want more powerful active trading tools

-

No electronic deposit for contributions

Fidelity self-employed 401 accounts are a great choice for fee-conscious investors, earning our top overall pick. The Fidelity solo 401 charges no opening or closing costs and no annual maintenance fees. Customers can invest in stocks, ETFs, and over 3,400 mutual funds with no trading commissions. That means many small business owners could use this account without ever paying any fees to Fidelity. If you need help to place orders, however, the $32.95 broker-assisted trade fee may be an impediment.

Read our full Fidelity review.

How A Health Savings Account Works

HSAs are funded with pretax dollars, and the money within them grows tax-deferred as with an IRA or a 401. While the funds are meant to be withdrawn for out-of-pocket medical costs, they dont have to be, so you can let them accumulate year after year. Once you reach age 65, you can withdraw them for any reason. If its a medical one , its still tax-free. If its a non-medical expense, you are taxed at your current rate.

To open an HSA, you have to be covered by a high-deductible health insurance plan . For 2021 and 2022, the Internal Revenue Service defines a high deductible as $1,400 per individual and $2,800 per family.

Also, the annual out-of-pocket expenses, including deductibles, co-payments, but not premiums, must not exceed $7,000 for self-only coverage or $14,000 for family coverage for 2021, but for 2022, not exceed $7,050 for self-only coverage or $14,100 for family coverage.

The annual contribution limit for 2021 is $3,600 for individuals and $7,200 for families the 2022 contribution limit is $3,650 for individuals and $7,300 for families. People age 55 and older are allowed a $1,000 catch-up contribution.

You May Like: How To Convert Your 401k To A Roth Ira

Read Also: What Happens To Your 401k If You Get Fired

Account Options For Your Self

There are a number of different options available when you open an IRA. First, you will need to choose between a traditional IRA and Roth IRA. Both accounts have tax benefits, but they are different. The traditional IRA allows your contributions to be made tax free, which means you can deduct them on your taxes. However, you will be taxed on your withdrawals. The Roth IRA requires you to pay taxes on your contributions, but you will not pay taxes on your withdrawals. This option saves you money over the long term. You also have the option of choosing where you open your IRA, which can affect the types of investments you make.

- Self-Directed IRA: You can open this at an investment firm that specializes in self-directed IRAs. This option gives you more investing options like the ability to invest in property or gold.

- Investment Firm: You can open an IRA at a traditional investment firm that specializes in mutual funds and stocks. You will be able to choose a mutual fund but have little control over the investments other than that.

- Banks or Credit Unions: A bank or credit union will put your money into a Certificate of Deposit . The money is guaranteed by the FDIC for up to $250,000. CDs are widely heralded as âsafeâ investments, but they tend to have the lowest standardized rate of return among retirement account investments and may not be able to keep pace with inflation.

To Roll Over Other Plan Assets

If you already have a retirement savings plan for your business, you may be able to roll over or transfer existing plan assets to a Self-Employed 401. Consult with your tax advisor or benefits consultant prior to making a change to your retirement plan.

Assets from the following plans may be eligible to be rolled over into a Self-Employed 401:

- Profit Sharing, Money Purchase, and 401 plans

Read Also: How Much Can You Put In Your 401k A Year

Also Check: Where Can I Find My 401k

Do You Qualify For A Self

Are you a self-employed professional planning for your retirement? A self-employed 401 is an excellent plan to build out your retirement nest egg. Whether you are a freelancer, shop owner, or small business owner without employees, a solo 401 retirement plan can help you live your dream life when you retire. Here well discuss an overview of a self-employed 401, setting one up, how to withdraw from the account and other vital information.

Important Facts About The Solo 401k

The Solo 401 plan documents dictate the type of options you will have in your plan. For example, you can establish a plan with a bank or financial institution, but will only be able to invest in traditional investments. Traditional investments include stocks and bonds. Additionally, you will have no loan feature or ability to make Roth or after-tax contributions.

But if you establish a self-directed Solo 401 plan with IRA Financial, you can take advantage of all available options. This includes Solo 401 features such as Roth and after-tax contributions, the $50,000 loan feature, and the ability to make traditional as well as alternative asset investments, such as real estate. You can do all of this tax-free.

Best of all, you can serve as trustee of the Solo 401 plan and gain checkbook control over your funds.

Read Also: Can I Pull Money From My 401k

How Does The Money Grow In A Self

Bergman says thatdepending on the provider you choose to house your plan, you can invest in almost anything. However, if you select a financial institution to oversee your plan, you must invest in their products. Otherwise, opportunities remain limitless. Go the traditional route with stocks or mutual funds, or turn to alternative investments like real estate, gold or cryptocurrencies.

What Are The Benefits Of A Solo 401

Unlike other options, a Solo 401 account holder can choose between a traditional option and a Roth option. The traditional option allows you to deduct the amount you pay in from your income for that year, giving you an immediate tax break. With the Roth option, the income taxes on that money is paid immediately and you owe no taxes when you withdraw the funds.

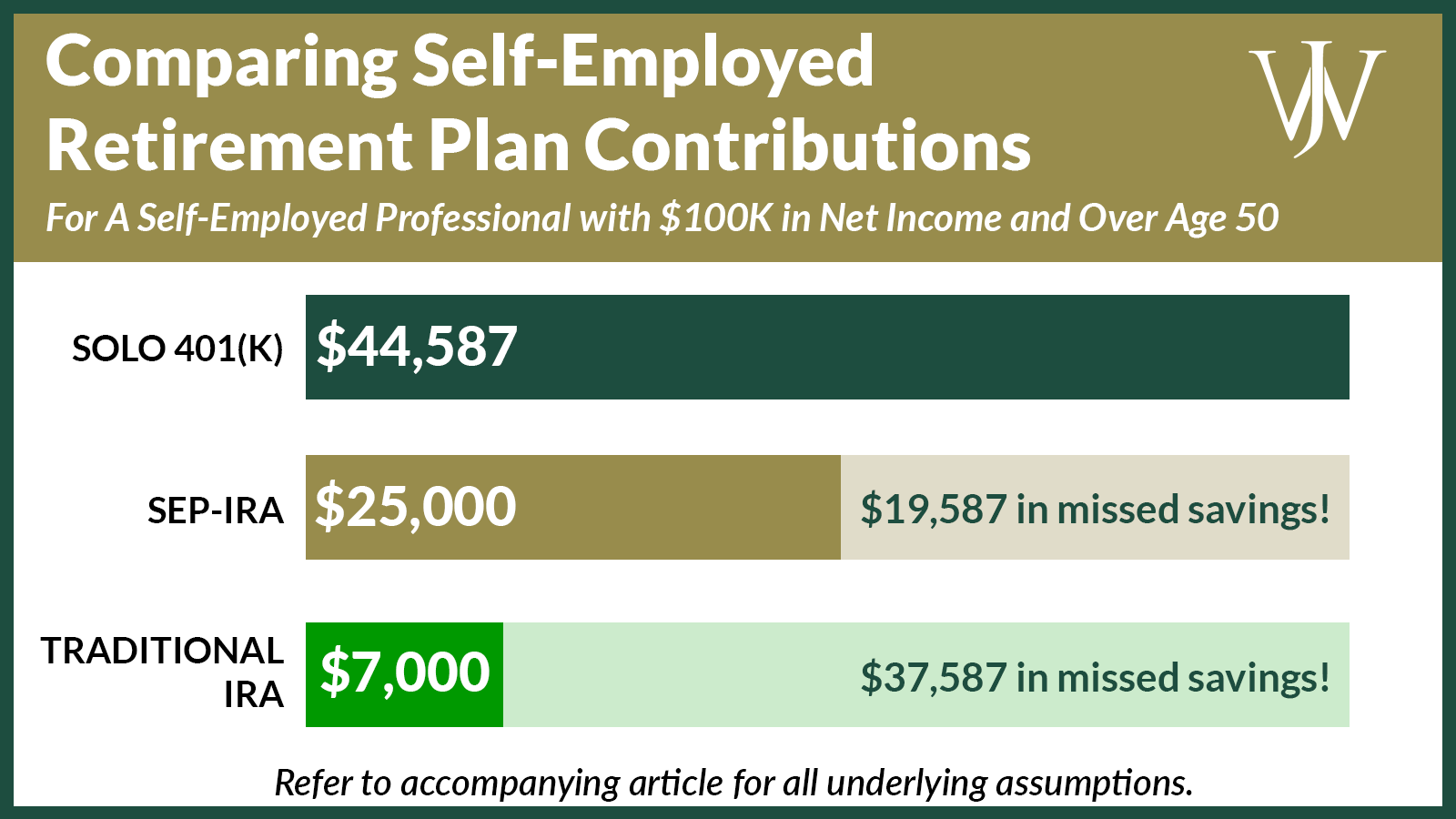

The Solo 401 has far higher annual contribution limits than a plain-vanilla IRA, although that is also true for the SEP IRA and the Keogh plan.

The Solo 401 allows you to take loans from your account before you retire. This is not an option with many other retirement plans.

Finally, the Solo 401 is relatively straightforward in terms of paperwork, as it is designed for one-person shops, not corporations.

Don’t Miss: Is A 401k A Defined Contribution Plan

Considerations When Choosing A Plan

Before you select a retirement plan, think about the qualities that the plan should have to meet your needs. Here are some questions to ask about the plans you are considering:

What are the tax benefits? Some plans allow you to make larger contributions than other plans. Generally, the larger the contribution, the bigger the tax break.

What are the costs of the plan? Some plans require a lot of administrative work. For some, you will need to hire an actuary to calculate contributions. Some plans require you to make reports to the government. All of these things cost money and time only you can decide if the plan’s benefits outweigh the administrative costs.

Does the plan require you to make contributions every year? This is an important consideration if the income from your business varies from year to year. During leaner years, you may want the option of making a small contribution or no contribution at all. Not all plans will give you this flexibility.

What is the deadline for establishing the plan? Some types of plans must be established by December 31 of the year you want to make contributions. Others may be established as late as the extended due date of your income tax return.

Solo 401k Rules For The Self

There are important Solo 401k rules to follow in order to remain IRS compliant. Failure to follow the rules can result in steep penalties and potentially the disqualification of your retirement plan. However, if you make sure to follow the rules, you can experience all the benefits the Solo 401k plan has to offer, which we will detail in this article.

Recommended Reading: How Do I Look At My 401k

Who Should Use This Type Of Plan

This type of plan is ideally suited for self-employed men and women who either own a small business with no employees, do a lot of freelance work, generate income from consulting, or otherwise engage in activity that results in earned income. Unlike its nearest competitor, the , the “self-employed 401” makes it possible to put aside quite a bit more money every year due to the way the contribution limits and matching are calculated.

Sole Proprietor / Independent Contractor:

In the case of a sole proprietor or independent contractor , you have earned income from performing personal services and report the income to the IRS on Schedule C, line 31, or Schedule F in the case of farmers and ranchers. Each of these schedules are attachments to IRS Form 1040. An owner of a sole proprietorship is the eligible participant under the employer solo 401k plan. The employer of these individuals is the sole proprietorship . See IRC 401 and IRC 401.

You May Like: How To Do A Direct 401k Rollover

Best Retirement Accounts For The Self

When you set out on your own to start your own business or gig, you give up structure and job benefits in favor of freedom and flexibility.

And its no different with your retirement plans. People who own their own businesses have far more options, both among tax-advantaged plans and investments within them.

Consider these retirement accounts and plans as a self-employed worker, along with a few recommended service providers for each.

Drawbacks To The Solo 401

The solo 401 has the same drawbacks of typical 401 plans, plus a couple others that are specific to itself. Like other 401 plans, the solo 401 will hit you with taxes and penalties if you withdraw the money before retirement age, currently set at 59½. Yes, you can take out a loan or may be able to access a hardship withdrawal, if needed, but those are last resorts.

In addition, it can take more paperwork to open a solo 401, but its not especially onerous. You usually wont be able to open the account completely online in 15 minutes, as you would a typical brokerage account. Plus, youll need to get a tax ID from the IRS, which you can do online quickly. On top of this, youll have to manage the plan, choose investments and ensure that you dont exceed annual contribution limits.

Another wrinkle: Once you exceed $250,000 in assets in the plan at the end of the year, youll need to start filing a special form with the IRS each year.

These drawbacks arent especially burdensome, but you should be aware of them.

Recommended Reading: Is Having A 401k Worth It

What Else Do Small Business Owners Need To Know About 401 Plans

Small business owners who offer retirement savings plans may be able to take advantage of tax incentives. Matching employee contributions, for instance, is generally tax deductible as a business expense. For the first three years of the plan, employers may also be eligible for tax credits up to 50% of the start-up and administration costs or $5,000 , as well as a $500 automatic enrollment credit per year.

Starting A 401 Without A Job

If you dont currently have a job, you may have some challenges. 401 plans are employer-sponsored plans, meaning only an employer can establish one. If you dont have your own organization and you dont have a job, you may want to evaluate contributing to an IRA instead. However, those accounts may require earned income during the year to contribute, so its not as simple as you might hope. That said, a spousal IRA may allow certain couples to contribute to a retirement account with no job.

Also Check: When You Leave A Job Where Does Your 401k Go

How To Set Up A 401 Plan

Now that you know the landscape, youre ready to set up a plan as an employer or self-employed individual. Whether youre establishing a plan for a large enterprise or or on your own the next steps are:

- If youre self employed, decide if you want a SoloK, SEP, or SIMPLE providers).

- Decide which plan provisions you want , Safe Harbor, matching, vesting schedules?).

- Choose a vendor .

- Complete the adoption agreement along with other agreements and submit to your vendor.

- Communicate and educate: Inform employees of the plans existence and features.

- Set up individual participant accounts.

- Fund the plan through payroll or any employer contributions.

- Review the plan regularly to ensure its meeting the needs of plan participants.

- Monitor and adjust the plan as regulations change and your needs evolve.

- Provide required information to participants on an ongoing basis.

What Is A Self

This plan goes by many names, including solo, individual and single-k, but they all refer to a 401 retirement savings plan for a self-employed person. You can contribute a large amount of money to this plan every year and then start taking distributions from the account after you turn 59.5 years of age.

Key takeaway: A self-employed 401 plan is a retirement savings plan started and contributed to by a self-employed person.

Don’t Miss: Can I Access My 401k If I Lose My Job

How To Save For Retirement When You’re Self Employed: The Solo 401k

Have you ever heard of the Solo 401k plan? The Solo 401k is the most tax efficient way for small business owners, consultants and contractors to save money for their retirement.The Solo 401k plan is an IRS approved retirement plan which is suited for business owners who do not have any employees, other than themselves or their spouse. Learn more about the Solo 401k and its benefits below.

Contribution Limits In A One

The business owner wears two hats in a 401 plan: employee and employer. Contributions can be made to the plan in both capacities. The owner can contribute both:

- Elective deferrals up to 100% of compensation up to the annual contribution limit:

- $20,500 in 2022 , or $27,000 in 2022 if age 50 or over plus

If youve exceeded the limit for elective deferrals in your 401 plan, find out how to correct this mistake.

Total contributions to a participants account, not counting catch-up contributions for those age 50 and over, cannot exceed $61,000 for 2022 .

Example: Ben, age 51, earned $50,000 in W-2 wages from his S Corporation in 2020. He deferred $19,500 in regular elective deferrals plus $6,500 in catch-up contributions to the 401 plan. His business contributed 25% of his compensation to the plan, $12,500. Total contributions to the plan for 2020 were $38,500. This is the maximum that can be contributed to the plan for Ben for 2019.

A business owner who is also employed by a second company and participating in its 401 plan should bear in mind that his limits on elective deferrals are by person, not by plan. He must consider the limit for all elective deferrals he makes during a year.

Read Also: How To Borrow From 401k For Home Purchase

Do I Need An Ein To Set Up A Solo 401 And Payroll

Yes. Before establishing payroll and contributing to a solo 401, a self-employed individual must obtain an EIN from the IRS. Paychex Solo includes incorporation services that can help you establish an EIN to take advantage of our solo 401 and payroll services.