What To Look For In A Solo 401k

Going through the process of shopping around for a solo 401k provider, I’ve learned a lot about what to look for. There are a lot of options and nuances that you should look for when shopping for a 401k. Many of the “free” providers offer simple generic plans, and if those don’t work for you, you can have a third party provider create a custom 401k plan for your business, which you can then take to a brokerage.

Whoa, that sounds confusing, and it can be. So let’s look at the major options that you need to consider when selecting a solo 401k provider.

- Does the 401k provider offer both Roth and Traditional contributions?

- Does the 401k provider offer after-tax contributions to do a mega backdoor Roth IRA.

- Does the 401k provider offer loans from the plan?

- What types of investment options are allowed in the plan?

- Does the provider allow rollovers into the plan and rollovers out of the plan?

- The costs to maintain the plan

- The costs to invest within the plan

Based on your wants and needs, there are a lot of things to compare when shopping for a solo 401k provider. Let’s compare some of the main firms that offer solo 401ks. We’re going to start with the 5 major firms that provide Prototype Plans. These are the “free” plans that the companies advertise.

Placing Real Estate Investment Question:

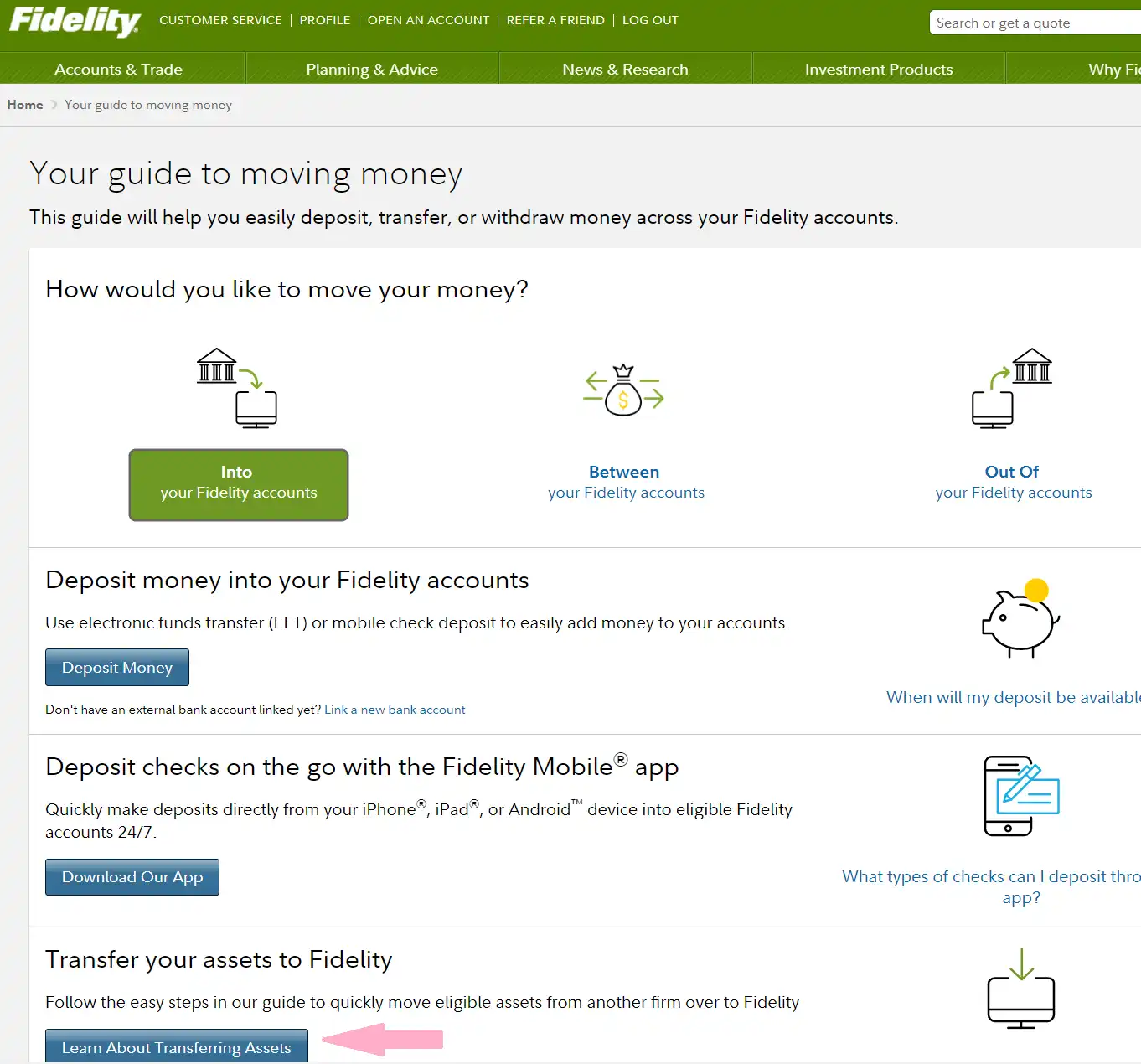

That is good news, and it sounds like the Fidelity brokerage account set up up process went smoothly and now you can start placing investments in alternative investments such as real estate. You can either place the investments by writing a check or by filling out the Fidelity outgoing wire directive, which we can fill out for you. for more information regarding investing in real estate.

Open Fidelity Investment Account: No Rollovers

If you’re simply opening the new investment-only account with Fidelity to get into traditional equities, then your work is done! Fund your Fidelity account with new contributions, calculated from your business income and you’re ready to go!

Complete the non-prototype plan application:

Include your full Adoption Agreement and your full trust document. These documents can be found in your 401k documents, located on your 401k dashboard.

Note: It is not required you fund the account when submitting the non-prototype retirement account application.

Mail your application along with your full Adoption Agreement and full Trust Agreement to Fidelity at:Fidelity Investments, P.O. Box 770001, Cincinnati, OH 45277-0036.

If you’re opening the new investment-only account with Fidelity so you can transfer funds from a pre-existing Fidelity IRA or Fidelity 401k account, the please follow the transfer/rollover tips below.

There are different procedures for rolling in IRA funds or 401k funds. Let’s cover rolling in IRA funds first.

Read Also: Can You Borrow Money Against Your 401k

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

Timing Of The Brokerage Account Setup

After submitting the Fidelity brokerage forms to Fidelity Investments, between 5-7 business days , you should receive an email from Fidelity Investments that their system has updated your email address. This indicates the application is in processing.

When you start receiving emails from Fidelity, you can check if the account has been fully setup without having to wait on the Fidelity Welcome Letter in the mail which includes your new account number. Please try to log in using one of the following methods:

- If you have an existing Fidelity login , you should see the new Non-Prototype account appear under your portfolio with an account number that starts with the letter Z.

- If you do not have an existing Fidelity login, you can try to register to Fidelity.com at the following link: You will need to create a username and password.

Read Also: How Much Is 401k Taxed

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Why A Solo 401k

You might be asking why I’m considering a solo 401k versus a SEP IRA or other self employed retirement savings options. Well, it all comes down to circumstance and how much you can save.

Let’s look at two scenarios that are similar to mine. First, in the past, I only saved in a because my income was lower and I was still maxing out my 401k at work, so I didn’t need any additional employee contributions.

With both a SEP and Solo 401k, on $30,000 of income, the employer contribution is $5,576.11. Since I was already doing the $18,000 at my primary employer, that amount didn’t make a difference.

However, fast forward to today, the business makes much more income, and my wife is now working for the business. As such, it can make a huge difference in savings and lowering our taxes. Let’s assume that the business is going to make $100,000 this year. That means that the business can contribute $18,587.05 to both my 401k and my wife’s 401k. Plus, my wife can contribute $18,000 of her salary to the 401k as well .

As such, the solo 401k provides much more savings options, and lower taxes today as a result.

Read Also: Can You Transfer Money From 401k To Roth Ira

Who Has The Best Solo 401k

All of the providers on this list are worth checking out if you are self-employed and want to invest for retirement. That being said, heres a quick overview:

- Best for low fees: Fidelity

- Best for mutual funds: Vanguard

- Best robo advisor feature: Charles Schwab

- Best for active investors: TD Ameritrade

- Best for features: E-Trade

Personally, fees and the overall cost is one of the biggest factors I would consider. Fees can quickly add up if you are not paying attention. This can drastically eat into your retirement savings.

Lower fees = more to invest. Its that simple.

From there, Id look at who has the most investment options, followed by being able to make both traditional and Roth contributions, then being able to take out a 401k loan last of all.

Really consider your priorities, and you can make the right choice from there.

What Happens If You Hire Employees

A solo 401k is an appropriate plan for a person who works for himself or who has a spouse or business partner involved in the company. It is not suitable for a company with employees.

If you have a solo 401k and hire workers, you will be required to switch your solo 401k to a traditional 401k plan. Doing this can come with hefty administrative costs and rules.

You may want to explore a SEP-IRA if you think youll hire workers in the future. A SIMPLE IRA, which allows for employee contributions, is also an option.

You May Like: Where To Put My 401k

Drawbacks To The Solo 401

The solo 401 has the same drawbacks of typical 401 plans, plus a couple others that are specific to itself. Like other 401 plans, the solo 401 will hit you with taxes and penalties if you withdraw the money before retirement age, currently set at 59½. Yes, you can take out a loan or may be able to access a hardship withdrawal, if needed, but those are last resorts.

In addition, it can take more paperwork to open a solo 401, but its not especially onerous. You usually wont be able to open the account completely online in 15 minutes, as you would a typical brokerage account. Plus, youll need to get a tax ID from the IRS, which you can do online quickly. On top of this, youll have to manage the plan, choose investments and ensure that you dont exceed annual contribution limits.

Another wrinkle: Once you exceed $250,000 in assets in the plan at the end of the year, youll need to start filing a special form with the IRS each year.

These drawbacks arent especially burdensome, but you should be aware of them.

Help With Rmd Concerns

Required minimum distributions apply to Roth 401s in the same way they do to tax-deferred 401s, meaning you’d have to start taking out a specified amount once you turn 72 if you are no longer working. However, once you are retired, you can roll over your plan into a Roth IRA, and then it would no longer be subject to the RMD rules , and you could withdraw the money on your own timetable.

Read Also: Can The Irs Take My 401k If I Owe Taxes

How To Open A Traditional And Roth Solo 401k

There are thousands of financial products and services out there, and we believe in helping you understand which is best for you, how it works, and will it actually help you achieve your financial goals. We’re proud of our content and guidance, and the information we provide is objective, independent, and free.

But we do have to make money to pay our team and keep this website running! Our partners compensate us. TheCollegeInvestor.com has an advertising relationship with some or all of the offers included on this page, which may impact how, where, and in what order products and services may appear. The College Investor does not include all companies or offers available in the marketplace. And our partners can never pay us to guarantee favorable reviews .

For more information and a complete list of our advertising partners, please check out our full Advertising Disclosure. TheCollegeInvestor.com strives to keep its information accurate and up to date. The information in our reviews could be different from what you find when visiting a financial institution, service provider or a specific product’s website. All products and services are presented without warranty.

Ongoing Considerations For Your Solo 401k

One of the great things about a solo 401k is that they are relatively easy to maintain, for the most part. Since you are technically the administrator of your own plan, you are personally required to submit required filings for the plan.

There are two ongoing paperwork requirements that you will need to stay on top of. First, if your plan has over $250,000 in assets on the last day of the plan year, you have to file a form 5500. This can be a bit complicated, but if you can fill out all of that paperwork above, you can likely handle it yourself.

You can submit the IRS Form 5500 for free, electronically here: EFAST2 Filing From The IRS.

If you don’t want to do it yourself, you’ll need your CPA to handle this for you, and they’ll likely charge a fee to do it. However, if you’re using a non-prototype plan, most of the plan providers will help you prepare the Form 5500 each year as part of your annual fee.

The second form you need to keep in mind is a 1099-R, but that form is only required if you take distributions from your 401k plan or if you roll it over, withdraw money of any kind, or change providers. This form is also relatively easy to fill out, but there is no free electronic filing for this form. You either have to pay a service to file it, or mail it in yourself.

Don’t Miss: Can You Roll A Traditional 401k Into A Roth Ira

Things To Consider When Opening A Solo 401k

If you’re considering opening a solo 401k, there are a few things to consider when it comes to plan features.

There are five key areas that you need to decide before you open your solo 401k:

Everyone who opens a solo 401k will have different requirements. However, I would recommend you open a solo 401k plan with the most options and flexibility. While you can always amend your plan documents, it can be a hassle and can cost you money . As such, it makes sense to create a solo 401k plan with the most options up front.

Fidelity Solo 401k Brokerage Account From My Solo 401k Financial

A Fidelity Investments Solo 401k brokerage account with checkbook control from My Solo 401k Financial is ideal for those looking to still have the option to invest in equities while also gaining checkbook control over their retirement funds for investing in alternative investments such as real estate, notes, tax liens, and private shares in addition to processing a solo 401k participant loan.

You May Like: Can I Borrow From My 401k

Expense Ratio Individual Fund Fees That Youll Deal With Regardless Of You 401k Provider

My Cost: 0.015%, or $15 of $100,000 portfolio

Most of us know that well pick from a list of several funds within our 401k plan to invest our money, and these funds come with a fee known as an expense ratio, ranging from .001% to a full 1.0%. Of course, Id recommend a low-cost fund such as one that tracks the S& P 500 index, often on the low end of the fee spectrum. Even a target date retirement fund, which will likely cost an extra tenth of a percent but will rebalance your investments automatically, is a great low-cost option. Actively managed mutual funds will cost you anywhere from half a percent to more than one percent, and you dont often get what you pay for. When I first began investing in my 401k, I assumed this was the only fee I had to concern myself with. Turns out, like usual, I was wrong.

Its important to keep expense ratios low, but even more so when your account is bleeding fees worth an additional percent of your account balance. In my case, I invested in the Fidelity S& P 500 fund, FXAIX, which carries a very low expense ratio of 0.015%, or less than two-hundredths of a percent. Control the fees you can control, I say.

Now, for the Fidelity administrative fees that I didnt know I was paying.A large portion of my net worth is tied up in index funds, including roughly $150,000 in my employer-sponsored 401k plan. But lets go with a $100,000 portfolio as an example to keep the math even simpler.

Why A Solo 401k Over A Sep Ira

Those accounts were really popular until legislation created the solo 401k, which gives business owners even more benefits. The biggest perk is that a solo 401k allows both employee and employer contributions.

So as the business owner, you can essentially contribute twice. SEP IRAs are funded through employer contributions alone.

Here are a few more reasons why more people are choosing a solo 401k over a SEP IRA:

- You can make catch-up contributions. SEP IRAs do not allow catch-up contributions for participants who are 50 and over. Catch-up contributions are an additional $6,500 for 2021.

- They allow employee deferrals. Like I was saying before, contributions can be made as an employee and as a profit-sharing contribution . This benefit allows the business owner to contribute up to $19,500 in 2021 even if the business loses money in that year.

- You can make both Roth and traditional contributions. Roth contributions are made with after-tax dollars and good if you expect to make more closer to your retirement date. Traditional contributions are taxed in retirement. SEP IRAs only allow traditional contributions.

- You can borrow from your 401k. Unlike a SEP IRA, participants can take out a loan thats equal to the lesser of 50% of your 401k balance or $50,000.

- Your spouse can make contributions. If your spouse pulls in income from your business, then they can also make contributions.

Recommended Reading: How Do I Get A Loan From My 401k

‘serious Concerns’ From Department Of Labor

In March 2022, the U.S. Department of Labor warned that cryptocurrencies were speculative and volatile investments with inflated valuation. The DOL expressed “serious concerns” about providers offering cryptocurrencies in retirement plans. The DOL also stressed that providers must offer adequate information to potential investors about the risks involved in cryptocurrency investing, including the volatile prices and the evolving regulatory environment.