What Is A Roth 401 Account

A Roth 401 is an employer-sponsored retirement saving account wherein you contribute after-tax dollars to be able to make tax-free withdrawals in retirement. However, in a Roth 401, there are no restrictions placed on you in terms of income to contribute to the account.

A Roth 401 differs from a traditional 401, wherein an investor contributes pre-tax dollars that are later taxed at the time of making withdrawals in retirement. It is a hybrid investment vehicle that combines the best features of traditional 401 and Roth IRA accounts. A Roth 401 is most suited for those investors that expect to be in a higher tax bracket in retirement.

Aarp And Social Security

For more than 60 years, AARP has fought to protect Americans hard-earned Social Security benefits, answer your questions about the program and make sure it continues to be financially strong for future generations. Heres what those efforts look like today.

Advocacy in Washington and beyond

In 2022, AARP will continue to urge members of Congress to shore up Social Securitys long-term finances and keep the promises made to all current and future beneficiaries. We have fought hard against arbitrary cuts to the cost of living adjustment and against bills like the Trust Act that target Social Security as a way to deal with budget deficits. And we fought hard to ensure that those on Social Security would be able to get economic stimulus payments without having to file separately.

Delivering better service: AARP plans to continue highlighting customer service challenges and solutions at the Social Security Administration , and advocating for Congress to approve adequate funding for the SSA to deliver benefits and services properly and promptly to its growing number of customers.

State taxation: Twelve U.S. states now tax Social Security benefits. In 2022, AARP will work at the state level to eliminate this tax burden for more retirees and their families.

Helping to answer your questions

Online seminars

A valuable eesource

Also of Interest

Choosing Investments In Your 401

You will usually have several investment options in your 401 plan. The plan administrator provides participants with a selection of different mutual funds, index funds and sometimes even exchange traded funds to choose from.

You get to decide how much of your 401 balance to invest in different funds. You could opt to invest 70 percent of your contributions in an equity index fund, 20 percent in a bond index fund and 10 percent in a money market mutual fund, for example.

Plans that automatically enroll workers almost always invest their contributions in what is known as a target-date fund. Thats a fund that holds a mix of stocks and bonds, with the mix determined by your current age and your target date for retirement. Generally, the younger you are, the higher the percentage of stocks. Even if you are automatically enrolled in a target-date fund, you are always free to change your investments.

Investing options available in 401 plans vary widely. You should consider consulting with a financial adviser to help you figure out the best investing strategy for you, based on your risk tolerance and long-term goals.

Recommended Reading: Can You Withdraw Your 401k When You Leave A Company

How Does A 401 Plan Work

Once the plan is established, a 401 goes through a period of tax-deferred growth before the employee reaches retirement. A 401 plans lifespan can be summed up in four steps:

Phases of a 401 Plan

- Step 1

- Your employer offers you a 401 plan in your benefits package. You enroll in the plan and select your underlying investment for growth, depending on your time horizon and risk tolerance. Self-employed workers also have the option to establish an independent, or solo 401 plan.

- Step 2

- You contribute pre-tax money from your paycheck directly to the 401 plan. Your employer may also match your contribution or pay an additional percentage. plans, which you contribute to on an after-tax basis.)

- Step 3

- Those funds are invested in your underlying portfolio, and earnings may ebb and flow with the investments performance over time. The qualified retirement plans contributions and earnings grow on a tax-deferred basis until the time of withdrawal.

- Step 4

- After reaching 59 ½ years old, you may begin withdrawing funds from the plan to use as retirement income. You may pay income taxes on your withdrawals at that time. Depending on the year you were born, you must begin taking required minimum distributions at either age 70 ½ or age 72.

When Can You Withdraw From Your 401k Without A Penalty

Wondering when can you withdraw from 401k? 59 and 1/2 is the current age when you can take money out of your 401k without incurring a penalty. However, the money you take out is still taxed as income. At the age of 70, you will be forced by the IRS to start taking distributions from your retirement accounts.

Don’t Miss: How To Withdraw 401k From Old Job

Rollovers As Business Start

ROBS is an arrangement in which prospective business owners use their 401 retirement funds to pay for new business start-up costs. ROBS is an acronym from the United States Internal Revenue Service for the IRS ROBS Rollovers as Business Start-Ups Compliance Project.

ROBS plans, while not considered an abusive tax avoidance transaction, are questionable because they may solely benefit one individual â the individual who rolls over his or her existing retirement 401 withdrawal funds to the ROBS plan in a tax-free transaction. The ROBS plan then uses the rollover assets to purchase the stock of the new business. A C corporation must be set up in order to roll the 401 withdrawal.

Should You Invest In A Roth 401 Or Pre

Many employees are faced with the decision about whether to invest a portion of their paycheck in a Roth 401 or traditional 401. What is the difference and what are the implications?

First, most plans now offer both options. If your plan does not, it may be as simple as asking the plan provider if both options can be offered. One major difference between the two is how they are taxed. The traditional 401 gives tax benefits now. The employee can deduct their contributions from their taxes now up to $20,500 if you are under age 50 and up to $27,000 if over. This can save thousands on your tax bill, depending upon what bracket you are in.

The Roth 401 does not offer tax benefits now. Contributions are made with after-tax money. Any growth on the funds is never taxed as long as the account has been held for at least five years, the distribution is qualified, and you take the distribution after age 59 ½. The investment choices are usually the same as the traditional 401 and many people contribute to both.

Barbara Trombley

If you are single and have taxable income over $215,951, incremental income is taxed at 35%. Your contributions to a traditional 401 plan could save you $350 on every $1000 contribution. The flipside of this strategy is that, in retirement, all withdrawals are taxed as ordinary income.

Don’t Miss: How To Find Old 401k Money

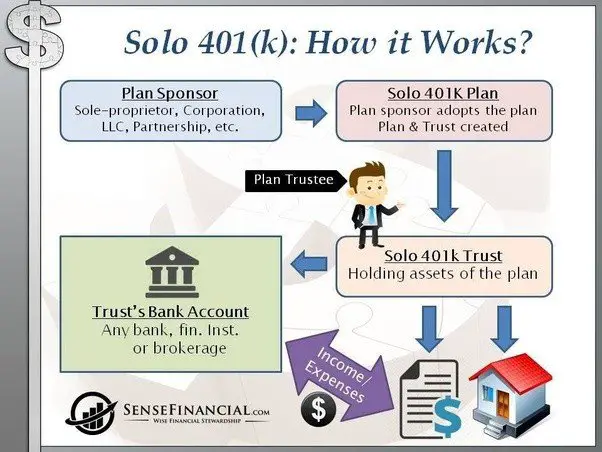

Getting Your Solo 401 Started

Once you have established the type of plan you want, you will need to create a trust that will hold the funds until you need them or you reach retirement age. You can select an investment firm, online brokerage, or insurance company to administer the plan for you.

You also need to establish a record-keeping system, so that your investments are accounted for properly.

What Are The Contribution Limits

The contribution limits for a traditional 401 apply to a Roth 401. For 2022, the maximum an individual can contribute to their 401 accounts is $20,500. In other words, your total contributions across different 401 accounts cannot exceed $20,500.

For people age 50 or older who are closer to retirement, they are eligible to make catch-up contributions of up to $6,500, for a maximum of $27,000 per year.

Also Check: How To Find Where Your 401k Is

Pros And Cons Of 401 Plans

401 plans have a myriad of benefits and potential disadvantages within the retirement savings realm. As you prepare for retirement, understanding pros and cons of available plans can help with your financial decision-making.

Pros of 401 Plans

- Federal protection under ERISA:

- The Employee Retirement Income Security Act of 1974 is a federal law that protects retirement plan money through standards set for employers. According to the U.S. Department of Labor, The law also establishes detailed funding rules that require plan sponsors to provide adequate funding for your plan.

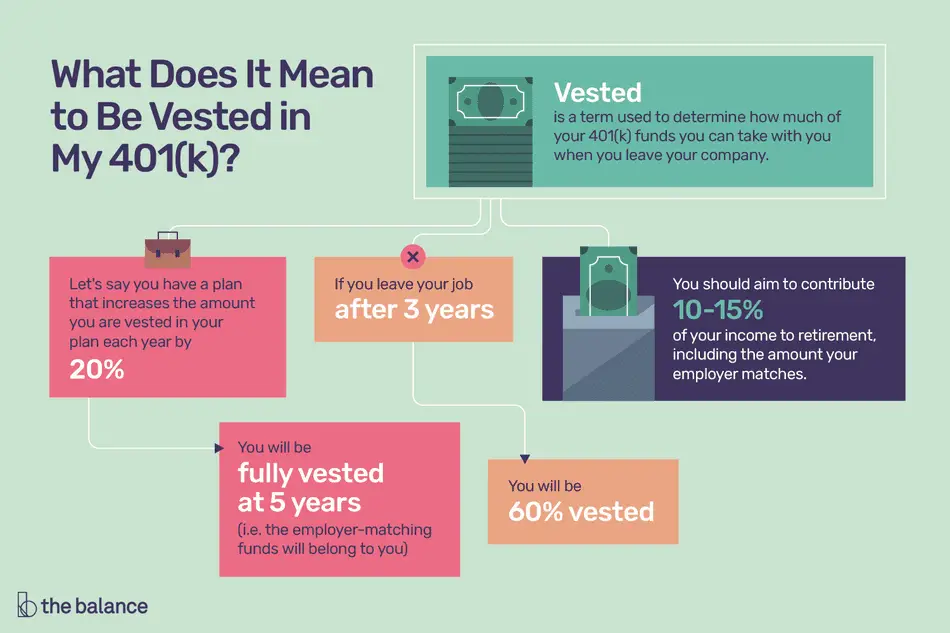

- Employer matching:

- Employers can match your contribution to the plan, essentially adding free money. For example, if you contribute 6 percent of your income, they may match the full 6 percent. Some employers may contribute up to a certain percentage, or they may not offer matching at all. Employers may also delay the matching until the employee is vested in the company, remaining with the organization for a determined amount of time.

- High contribution limits:

- The 401 plan contribution limit for 2021 is $19,500 with an additional $6,500 for employees aged 50 and over. The higher your contributions, the lower your federal income tax for the tax year.

Although their benefits almost always outweigh any drawbacks, 401 plans may pose some challenges for some investors.

Cons of 401 Plans

Resist The Temptation To Tap Your 401

When youre contributing funds to your 401 account month after month, there will be times when the market flags and you see the value of your investments steadily decline. You may face the urge to withdraw money from the market during downturns, its essential that you resist the temptation.

Especially for young investors, its important to remind people to stay the course even when the market is volatile, said Taylor. People who are younger have time to ride out market swings.

Also Check: Can I Roll My 401k To A Roth Ira

Then There Are The More Radical Ideas

Some have suggested scrapping the entire program and converting it to individual account plans similar to a 401 retirement program, in which you contribute some or all of your current payroll taxes to a self-managed retirement account invested in stocks, bonds and other securities you would bear the risks and rewards of your choices.

President George W. Bush proposed such a plan in 2005, but it was widely rejected by the American public. Experts also note that such a program would mean the trust funds would be depleted sooner, putting current benefits at even greater risk.

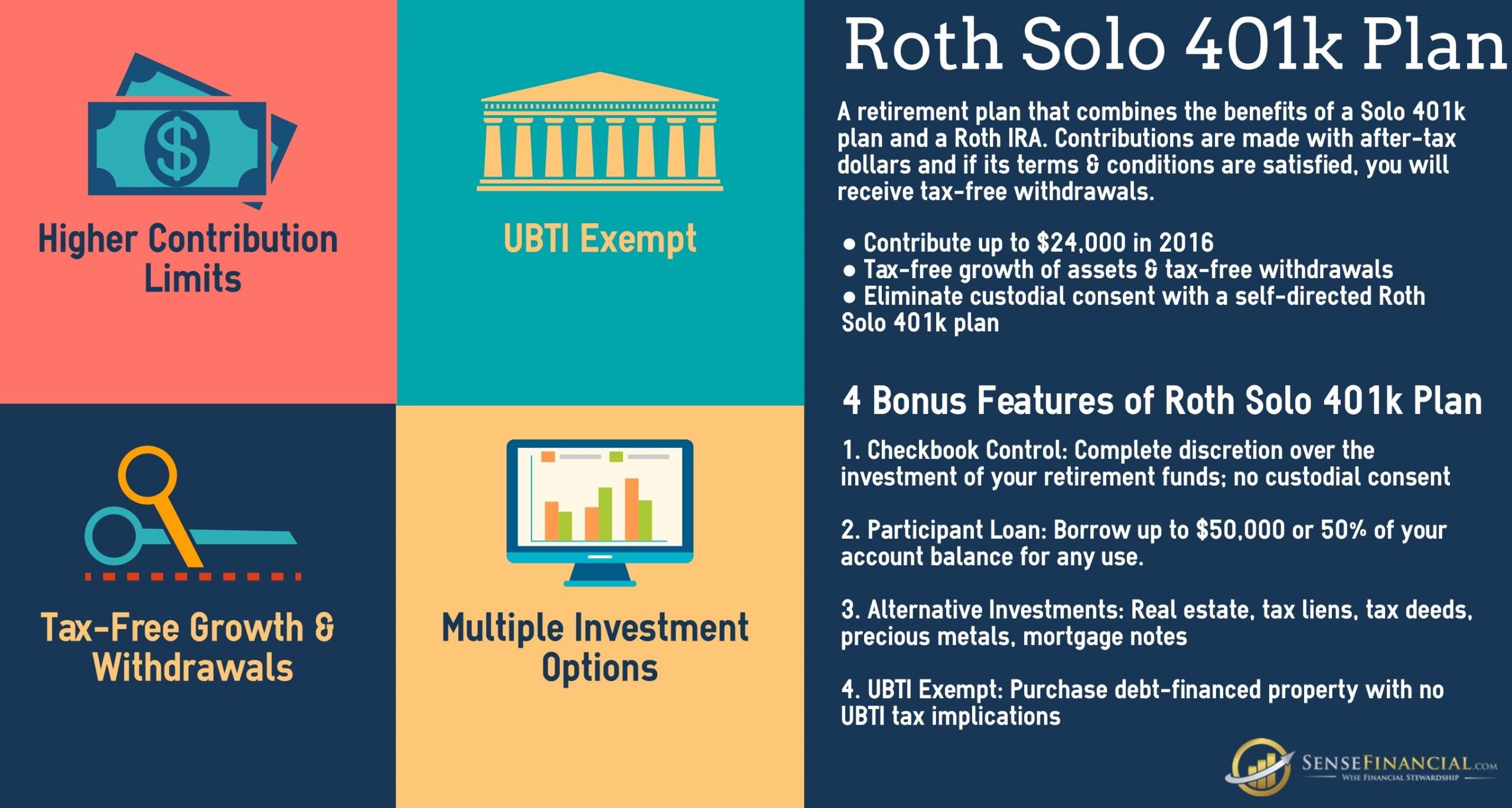

What Are The Benefits Of A Solo 401

Unlike other options, a Solo 401 account holder can choose between a traditional option and a Roth option. The traditional option allows you to deduct the amount you pay in from your income for that year, giving you an immediate tax break. With the Roth option, the income taxes on that money is paid immediately and you owe no taxes when you withdraw the funds.

The Solo 401 has far higher annual contribution limits than a plain-vanilla IRA, although that is also true for the SEP IRA and the Keogh plan.

The Solo 401 allows you to take loans from your account before you retire. This is not an option with many other retirement plans.

Finally, the Solo 401 is relatively straightforward in terms of paperwork, as it is designed for one-person shops, not corporations.

Recommended Reading: How To Use Your 401k

Sign Up For Automatic 401 Contributions

Enroll in automatic payroll deductions, so contributions are deposited in your 401 each pay period without any further action by you.

One of the advantages of these plans is the power of payroll deduction, said Young. You pay yourself first, automatically, every paycheck, making retirement savings easy.

Use Vanguards plan savings calculator to find out how a given level of contributions will impact your paycheck, and how much you could be earning for your retirement with an employers match.

How 401 Plans Work

With 401 plans, workers are squarely in the driver’s seat in making decisions on key issues, like contribution rates, investment choices, and 401 plan withdrawals. The plan participant decides how much of their paycheck should be steered towards a 401 plan, dependent on IRS contribution limits.

Operationally, 401 plans are managed by the employer, also known as the plan sponsor. The employer decides the type of 401 workers use, what investments workers can choose for their plan, and what investment management firm will run the investment side of a 401 plan.

All an employee has to do is sign up for a 401 plan with their company , choose their contribution levels and their investment vehicles, and the employer takes care of the rest. It’s a good idea to talk to a financial advisor first, before making any 401 plan investment selections.

Also Check: Is It Worth Rolling Over A 401k

How Does A 401k Work

A 401k plan is a benefit commonly offered by employers to ensure employees have dedicated retirement funds. A set percentage the employee chooses is automatically taken out of each paycheck and invested in a 401k account. They are made up of investments that the employee can pick themselves.

Depending on the details of the plan, the money invested may be tax-free and matching contributions may be made by the employer. If either of those benefits are included in your 401k plan, financial experts recommend contributing the maximum amount each year, or as close to it as you can manage.

Rules For Withdrawing Money

The distribution rules for 401 plans differ from those that apply to individual retirement accounts . In either case, an early withdrawal of assets from either type of plan will mean income taxes are due, and, with few exceptions, a 10% tax penalty will be levied on those younger than 59½.

But while an IRA withdrawal doesn’t require a rationale, a triggering event must be satisfied to receive a payout from a 401 plan. The following are the usual triggering events:

- The employee retires from or leaves the job.

- The employee dies or is disabled.

- The employee reaches age 59½.

- The employee experiences a specific hardship as defined under the plan.

- The plan is terminated.

Recommended Reading: How To Transfer 401k From Old Employer

How To Avoid 401 Early Withdrawal Penalties

There are certain exceptions that allow you to take early withdrawals from your 401 and avoid the 10% early withdrawal tax penalty if you arent yet age 59 ½. Some of these include:

Medical expenses that exceed 10% of your adjusted gross income

Permanent disability

If you leave your employer at age 55 or older

A Qualified Domestic Retirement Order issued as part of a divorce or court-approved separation.

Even if you can escape the additional 10% tax penalty, you still have to pay taxes on your withdrawal from a traditional 401. owner owes no income tax and the recipient can defer taxes by rolling the distribution into an IRA.)

How Much Should You Invest In Your 401

If your employer offers a match, you should at least invest enough to take full advantage of that perk. Dont say no to free money!

The good news is the vast majority of companies with a 401 plan provide a match on employee contributions.2 And the average employer match is around 4.5% of your salary.3 Even if your employer match is less than that, that extra money can make a big difference in your nest egg over time.

After you take advantage of the match, then what? Overall, we recommend that you save 15% of your income toward retirement. But does all of that need to be in your 401? Not necessarily. Here are a couple options:

- Option #1: You have a Roth 401 with great mutual fund choices. Good news! You can invest your whole 15% in your Roth 401 if you like your plans investment options.

- Option #2: You have a traditional 401. Invest up to the match, then contribute whats left of your 15% to a Roth IRA. Your financial advisor can help you get one started! If you contribute the maximum to your Roth IRA and still have money left over, you can go back to your traditional 401.

The most important factor in having a secure retirement is contributing consistently into your 401 over the long haul.

Recommended Reading: How Much Can You Contribute 401k

How Much Does It Cost To Open A Solo 401

There is no cost to open a 401 account but watch out for those fees later on. While you’re researching your options, check for account maintenance fees, transaction fees and commissions, mutual fund expense ratios, and sales loads.

A fractionally higher fee can mean a big hit to a retirement portfolio. If you make the right choices you can minimize the fees you pay.

How Does A 401 Work

A 401 is available in many workplaces as a benefit to employees. If your employer offers it, it’s worth considering it’s one of the easiest ways to start saving for retirement. Upon starting a new job, some employees are automatically enrolled in a 401 plan. Others may have to wait until a certain length of time is over to enroll in the plan.

When you enroll, you can specify what fixed percentage or amount of each paycheck you want to set aside in your employee 401 account. You can also choose which investments you want to put that money in and what portion of the money you want to go toward each investment. The spread of your money across different types of investments is known as your “asset allocation.”

HR departments often take care of the management of the plan. If you’re traditionally employed, your employer will deduct your contributions from your paycheck then, they will funnel them into the investments you chose, in your desired asset allocation. You’ll never even have to handle the money.

With a traditional 401, any contributions you make are excluded from your taxable income in the contribution year. In other words, they are eligible for a tax deduction that year. Also, contributions and earnings grow tax-deferred. This means you won’t pay taxes until you take distributions from the account.

Don’t Miss: How Old To Start A 401k