Why A Sep In The First Place

A SEP is a plan that basically acts like a profit sharing plan. The contributions are made based on one of the two following structures:

A model traditional SEP-IRA that is executed on an IRS form. This is often referred to as a model SEP or

A master or prototype traditional SEP-IRA that has received a favorable IRS opinion letter. This is commonly referred to as a non-model SEP.

We will discuss what these distinctions are shortly. But at the end of the day, #1 above does not allow for the combining of plans, while #2 does.

Many people set up SEPs years back when their business was smaller and they werent looking for large tax deductible contributions. In addition, SEPs seem to be very popular with CPAs and financial advisors.

I think this is mostly because you could set them up and fund them before the date the company filed its tax return. So it made it easy to get in a contribution before the filing tax deadline.

In reality though, SEPs are really not the best plans for most business owners. Since it really just operates like a profit sharing plan, you can get the same profit sharing allocation that a 401 plan can get.

Are you looking to get over $100,000 into retirement? Get a FREE Illustration showing your contribution and tax savings today. See for yourself why our plans are one of the best tax deferrals!

The table below outlines some of the contribution and other requirements associated with SEPs and defined benefit plans.

Tips For Getting Ready For Retirement

- Employer-sponsored defined contribution or defined benefit plans are a great way to get ready for retirement. However, you can always save beyond employer programs and Social Security benefits. Every American should also consider getting an IRA to help them reach their retirement goals. You dont need an employer to open an IRA and it can be a good complement to an employer-sponsored return. Just dont forget that youll owe taxes when you withdraw money.

- To make sure youre on track with your retirement planning, consider working with a financial advisor. SmartAssets financial advisor matching tool can help you find a person to work with who meets your needs. After you answer questions about your goals and situation, the program will pair you with up to three advisors in your area based on your responses. You can then read the advisors profiles and interview them to decide who you want to work with in the future.

- Figure out how much youll need to save to ensure you get the retirement youre dreaming of. SmartAssets retirement calculator can help you determine if youre on track or not.

What Is The Difference Between A 401k And A Defined Contribution Plan

What is the difference between a 401k and a defined contribution plan? Pension Plan: An Overview. A 401 plan and pension are both employer-sponsored retirement plans. A defined-contribution plan allows employees and employers to contribute and invest funds to save for retirement, while a defined-benefit plan provides a specified payment amount in retirement.8 Sept 2021

Is a defined benefit plan better than a 401k? Pensions offer greater stability than 401 plans. With your pension, you are guaranteed a fixed monthly payment every month when you retire. Because its a fixed amount, youll be able to budget based on steady payments from your pension and Social Security benefits. A 401 is less stable.

Which is better defined benefit or contribution? In short, if you would like to make a tax deductible contribution of at least $60,000 per year, a Defined Benefit Plan is likely a better fit. Otherwise, with some exceptions, a Defined Contribution Plan will be a better option.

Can I contribute to 401k and defined benefit plan? You can have a pension and still contribute to a 401and an IRAto take charge of your retirement. If you have a defined benefit pension plan at work, you have nothing to worry about, right? Maybe not.

Don’t Miss: How Does 401k Work When You Quit

Who Is Eligible For A Defined Benefit Plan

To be eligible for benefits, an employee must have worked a set amount of time for the company offering the plan. In most cases, an employee receives a fixed benefit every month until death, when the payments either stop or are assigned in a reduced amount to the employees spouse, depending on the plan.

Understanding Workplace Retirement Plans

A defined contribution plan is a common workplace retirement plan in which an employee contributes money and the employer typically makes a matching contribution. Two popular types of these plans are 401 and 403 plans. Defined contribution plans are the most widely used type of employer-sponsored benefit plans in the United States. The plan may require that you enroll yourself to take advantage.

Defined contribution plans and defined benefit plans have a number of notable differences. In a defined contribution plan, both you and your employer can contribute to your individual account. For some plans, you may be required to wait up to one year before enrolling. There may also be a waiting period before any contributions your employer makes to the account become yours to keep.

In a defined benefit plan, generally only your employer contributes and you get a monthly payout in retirement. There are two types of defined benefit plans: traditional pensions and cash-balance plans. Both plans automatically enroll participants. However, for some defined benefit plans, you must wait some period of time before you are enrolled and/or the benefits become yours to keep.

Recommended Reading: How To Roll Your 401k From Previous Employer

What Must I Do To Receive A Pension

You must have worked for the same employer or within the same union for a specified number of years for your benefits to become vested . Once you are vested, you are entitled to your pension benefits, although you may have to wait to receive them until you reach the retirement age specified in your pension plan. If you die before your retirement age, your spouse and children under age 18 receive your benefits , unless your spouse has given up this right.

Defined Contribution Plans Limits And Restrictions

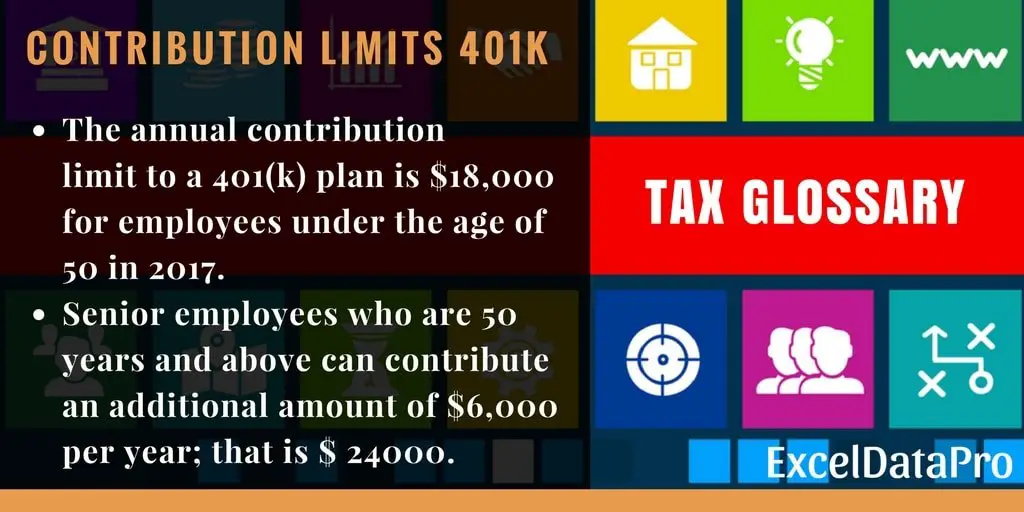

Employees dont have to contribute to a defined contribution plan. However, theyd be silly to miss out on the retirement savings opportunity. Defined contribution plans are tax-advantaged, which means that balances can grow larger over time when compared to taxable accounts. However, there are limits on how much you can contribute, which may change each year. In 2019, employees under 50 could contribute up to $19,000. The limit for 2020 will be $19,500. Employees over the age of 50 can make catch-up contributions, raising their maximum contribution limit to $26,000. While many experts recommend contributing the maximum amount allowed, employees should contribute at least the amount needed to qualify for their employers match program.

There are also restrictions on when and how much each employee withdraw from their defined contribution plans without facing penalties. Typically, employees face a penalty if they withdraw funds before reaching the age of 59 1/2.

Read Also: How Much Do I Need To Contribute To My 401k

Required Distributions For Some Former Employees

A 401 plan may have a provision in its plan documents to close the account of former employees who have low account balances. Almost 90% of 401 plans have such a provision. As of March 2005, a 401 plan may require the closing of a former employee’s account if and only if the former employee’s account has less than $1,000 of vested assets.

When a former employee’s account is closed, the former employee can either roll over the funds to an individual retirement account, roll over the funds to another 401 plan, or receive a cash distribution, less required income taxes and possibly a penalty for a cash withdrawal before the age of 59+1â2.

Types Of Defined Benefit Plans

There are many types of defined benefit plans. They include:

- Pensions: These provide retirement income based on a pre-defined formula. Generally, the formula factors in your years of service with the employer, as well as total earnings. Once an employee reaches a certain age specified by the plan, they begin receiving payouts that typically continue until their death. Some pensions also allow for benefits to transfer to a spouse or other beneficiary once the employee dies.

- Cash balance plans: These guarantee employees a set amount of money upon leaving the employer rather than a guaranteed monthly income. Years of work with the employer typically determine the amount an employee will receive.

Employers take on the investment risk with defined benefit plans, as well as the responsibility for making and managing employee contributions. These plans substantially differ from defined contribution plans such as 401s, which do not guarantee employees will receive any set amount of funds upon retirement. A lifetime income guarantee makes defined benefit plans desirable for employees but risky for employers.

Read Also: Can I Invest My 401k

Defined Benefit Retirement Plans

A defined benefit plan is one set up to provide a predetermined retirement benefit to employees or their beneficiaries, either in the form of a certain dollar amount or a specific percentage of compensation.Employer contributions to a defined benefit plan are very complex to determine and require the work of an actuary. The assets of the plan are held in a pool, rather than individual accounts for each employee, and as a result, the employees have no voice in investment decisions. Once established, the employer must continue to fund the plan, even if the company has no profits in a given year. Since the employer makes a specific promise to pay a certain sum in the future, it is the employer who assumes the risk of fluctuations in the value of the investment pool.Types of defined benefit plans. There are three basic types of defined benefit plans:

- Flat benefit plan. All participants receive a flat dollar amount as long as a predetermined minimum years requirement has been met.

- Unit benefit plan. Provides a benefit that is either a percentage of compensation or a fixed dollar amount multiplied by the number of qualifying years of service.

- Variable benefit plan. Benefits are based on allocating units, rather than dollars, to the contributions to the plan. At retirement, the value of the units allocated to the retiring employee would be the proportionate value of all units in the fund.

The Importance Of The 401 Match

Most 401 providers offer an employer match, meaning the company will contribute an annual percentage of eligible employees compensation to their 401 account. One popular matching formula is 100% of the first 6%where employers contribute as much as employees contribute, up to 6% of their salary if employees contribute 3%, employers match 3% and if employees contribute 8%, employers contribute 6%. With the match, employers provide a generous incentive to save for retirement.

Read Also: What Can I Move My 401k Into

Defined Benefit Pension Plans

In a defined benefit pension plan, your employer promises to pay you a regular income after you retire.

Usually both you and your employer contribute to the plan. Your contributions are pooled into a fund. Your employer or a pension plan administrator invests and manages the fund. You dont have to make any investment choices.

The income you get when you retire is usually calculated based on your salary and the number of years you contributed to the plan. It’s a set amount that does not depend on how well the investments perform.

The amount you get may be increased on a regular basis to help you cover your living expenses while the overall cost of living increases. This is often called an indexed pension. Speak with a human resources advisor or your pension plan administrator to figure out if you will receive an indexed pension when you retire.

Us Safe Harbor 401 Versus Uk Defined Contribution Pension Scheme

Rebekah RossSenior Account Executive, Benefits

Our multi-national clients often ask us about the differences between US 401 plans and UK Defined Contribution schemes.

In the US, Defined Contribution plans are governed by Section 125 of the Internal Revenue Code. While there are many types of employer-sponsored retirement plans, this article will focus only on Safe Harbor plans, as Safe Harbor plans share many similarities with Occupational Pension Plans. Likewise, Master Trust Plans, which are also prevalent in the UK, will not be part of this article. We will provide an overview of the comparisons between the two plans.

Don’t Miss: How To Invest In 401k Without Employer

Who Can Set Up A Defined Benefit Plan

Any small or large business can set up a defined benefit plan. Even a self-employed individual can set it up as long as there is significant money to contribute to the plan. Typical examples of businesses that set up a defined benefit plan are:

- Individual consultants who are self-employed

- People who have a small business and a full time job

- Small business with only independent contractors

- A medical practice with a few full time employees

- Real estate agents with their own agency

Who Bears Fiduciary Responsibilities

Fiduciaries are responsible for selecting and monitoring plan service providers and selecting and monitoring the plans investment options.

Fiduciaries of 401 plans take on the added burden of potentially being held personally liable if they dont always act in the best interest of the participants and monitor all providers or if the investments perform poorly. Plan members can file a complaint with the IRS and DOL if there is a perception the plan is not being administered according to the Summary Plan Description . Examples of complaints could include:

- incorrect contributions

- contributions made in an untimely manner.

The Pensions Regulator in the UK squarely places the burden of being the plan fiduciary on the pension administrator rather than the employer. The fiduciary is independent of the employer and is responsible for selecting investment options, monitoring investment performance, and ensuring the scheme is compliant with all regulations.

Employers are not required to perform internal audits or form an investment committee. However, it is recommended to perform payroll audits regularly and after the first payroll. Scheme members who have reason to believe the plan administrator or employer has been negligent in administering the scheme may file a complaint with the Pensions Ombudsman.

If you have further questions about your retirement plan, we are here to help. Please contact your Woodruff Sawyer representative.

Also Check: How Do I Start A Solo 401k

Considerations For Investing In A Workplace Retirement Plan

- Consider making regular contributions to your individual account, up to the plan limit.

- Determine whether you want to make your contributions on a pre-tax basis or after taxes using a Roth account.

- Look into whether your employer provides matching contributions and consider taking advantage of your employers matching contribution to the fullest.

- Youll be given different choices regarding how your money will be invested. If you have any questions about which investment option might be best for you, consult a financial advisor.

Defined Contribution Retirement Plans: Who Has Them And What Do They Cost

In 1988, when defined contribution retirement plans were a fairly new concept in the workplace, Bureau of Labor Statistics Commissioner, Janet L. Norwood wrote, It is unclear whether the more rapid growth in defined contribution plans compared to defined benefit plans is a movement towards variable rather than fixed payments. But some plan sponsors have adopted defined contribution plans as a way of gaining more control, or at least predictability, over costs.1 Norwood further explained that the payments employers make to defined contribution plans often are tied to profitability and give employers flexibility to adapt to changing economic conditions. In todays economy, defined contribution retirement plans are the most prevalent type of employer-sponsored retirement benefit plans in private industry in the United States. In 2016, 44 percent of private industry workers participated in these plans.2

Read Also: Where To Move 401k Money

What Is A Defined

A defined-contribution plan is a retirement plan that’s typically tax-deferred, like a 401 or a 403, in which employees contribute a fixed amount or a percentage of their paychecks to an account that is intended to fund their retirements. The sponsor company will, at times, match a portion of employee contributions as an added benefit. These plans place restrictions that control when and how each employee can withdraw from these accounts without penalties.

Plans Vs Pension Plans

Defined benefit plans are becoming increasingly rare, especially in todays low interest rate environment.

More and more of these plans are being replaced with defined contribution plans, which are far cheaper for employers to establish, administrate and fund.

It is possible for an employee to work for more than one employer that offers a 401 plan.

The employee can participate in both plans, but the contribution limits are absolute.

The total contributions cannot exceed the contribution limits prescribed by the IRS in a given year.

For example, the employee described above could not contribute $19,500 to both plans in 2020.

He could only contribute amounts that add up to that amount between the two plans.

The contribution limits for 401 plans are indexed for inflation and thus usually increase by a small amount every year, or at least every other year in some cases.

Also Check: What To Do With Your 401k

Employer Pension Plan Basics

An employer pension plan is a registered plan that provides you with a source of income during your retirement. Under these plans, you and your employer regularly contribute money to the plan. When you retire, youll receive an income from the plan.

There are two main types of employer pension plans:

- defined contribution plans

- defined benefit plans

Speak to a human resources adviser or pension plan manager to find out how your employer-sponsored pension plan works.

If you switched jobs during your career, you may have two or more pensions from different employers. You may be able to transfer your old pension to your new plan. Talk to a financial planner or representative at your financial institution or your human resources representative to understand what choices you have.