Are There Income Limits For 401s

While there’s not a universal income limit on 401 contributions, in some cases the IRS does impose contribution limits on “highly compensated employees” when a company encounters disproportionate contribution levels among its workers. The IRS has a test that helps employers who sponsor 401 plans assess whether employees are participating in their plan at levels proportionate to their compensation.

If the test determines that people across compensation levels aren’t participating in a manner the IRS deems proportionate, employee contribution levels for highly compensated employees can be lowered. In these cases, your employer may need to return some of your excess contributions.

The IRS defines a highly compensated employee in one of two ways:

An individual who either owned more than 5% of the interest in a business at any time during the year or the preceding year, no matter how much they were paid.

An individual who received over $130,000 from the business in the preceding year in 2021 and, if the employer ranks employees by compensation, was in the top 20%.

What Does Your Plan Say

Although not common, a plan can specifically require that salary deferrals cease once a participants compensation reaches the annual limit.

If your plan specifies that salary deferrals be based on a participants first $280,000 of compensation, then you must stop allowing Mary to make salary deferrals when her year-to-date compensation reaches $280,000, even though she hasnt reached the annual $19,000 limit on salary deferrals, and must base the employer match on her actual deferrals.

Open A Taxable Account

You should still consider directing some money into taxable investments. Regardless of income, you can always open a brokerage account or invest in securities like mutual funds. You also wont run into any contribution limits regardless of how much you earn. In addition, youd have access to your investments as you need it.

Read Also: Should I Roll Over My 401k To A Roth Ira

Your Own Contributions Plus Your Company Match

The $19,500 contribution limit for workers is separate from the cap on employers’ contributions, which take the form of a company match or a profit-sharing contribution.

In 2020, the combined cap on contributions by plan members and employers is 100% of the worker’s compensation or $57,000, whichever is lower, or $63,500 for workers who are 50 or older.

Suggested Next Steps For You

The content contained in this blog post is intended for general informational purposes only and is not meant to constitute legal, tax, accounting or investment advice. You should consult a qualified legal or tax professional regarding your specific situation. Keep in mind that investing involves risk. The value of your investment will fluctuate over time and you may gain or lose money.

Any reference to the advisory services refers to Personal Capital Advisors Corporation, a subsidiary of Personal Capital. Personal Capital Advisors Corporation is an investment adviser registered with the Securities and Exchange Commission . Registration does not imply a certain level of skill or training nor does it imply endorsement by the SEC.

Also Check: How Do I Cash Out My 401k With Fidelity

Maximum 401k Contribution Limits

This article has been updated for 2022. The IRS has announced the 2022 maximum 401K contribution limit for employees, which is the max that workers can legally contribute to a 401K in a given calendar year. The 2022 maximum 401K contribution limit will be $20,500, which means an increase of $1,000 versus the 2021 maximum 401K contribution limit of $19,500. Read on for expanded details on the update, including catch-up contributions, employer maximum contributions, historical limits, and more..

The IRS adjusts maximum retirement account contribution limits according to changes in the consumer price index , and the CPI has recently seen large increases, year-over-year. Hence, the increase between 2021 and 2022.

The maximum 401K limit is set annually by the IRS and it applies to your personal employee contributions to both traditional 401Ks and Roth 401Ks . It is a component of the maximum employer 401K contribution . If you have self-employment income, this maximum also applies for the employee contribution portion of Solo 401Ks.

Change In Business Name Affect On Contributions Question:

You can still setup the solo 401k in 2021 under your sole proprietor business. Next year in 2022, we can update the plan to list the new self-employed business. All else would remain the same . The 2022 annual solo 401k contributions would be based on your new self-employment income and you would have until 2023 to make those contributions.

Also Check: How To Transfer 401k To Another Job

How To Maximize Your 401 Retirement Savings

A workplace 401 account can be a powerful tool to help build your retirement savings. To maximize your 401 benefits, follow these tips:

1. Set your contribution level to take full advantage of your employers 401 match. If your company matches a certain percentage of your contributions, set your contribution level to take maximum advantage of the match. Otherwise, youre leaving money on the table.

2. Start contributing to your 401 immediately.

3. Take advantage of target-date funds. If youre overwhelmed by the investment options offered by your 401 plan, choose a target-date fund aligned with your anticipated year of retirement. Target date funds are optimized for your retirement timeline, making them great options for beginners or more hands-off investors.

4. Increase your 401 contribution percentage regularly. Each year, increase your 401 contribution rate by at least one additional percentage point. Gradual small increases have a minor impact on your take-home pay and a major impact on your retirement nest egg over time. In addition, if you receive any raises or bonuses, dedicate at least a portion of them to your savings.

When A Withdrawal Penalty Applies

While you can take money out of your 401 without penalty for a few reasons, you’ll typically still pay income taxes on it. What if you just want to take the money out to do some shopping before you’ve reached age 59 1/2, or before age 55 if the Rule of 55 applies to you? Well, the IRS will hit you with a 10% penalty on top of taxes. That means that expenses such as a new car or a vacation don’t count as reasons to take out your 401 savings.

Recommended Reading: How Does 401k Work In Divorce

K Contribution Limit History

READ: Social Security Leveling Option

This means that in 2020, for those over age 50, the maximum allowable employee 401K contribution is $26,000. This amount includes the $19,500 regular 401K contribution, plus the $6,500 over-50 catch-up.

In addition to total allowable employee 401K contributions, there is a maximum total contribution allowed into your 401K . For 2020, the maximum allowed to be contributed into your 401K has increased from $56,000 to $57,000 with minimum $1,000 increases thereafter. Therefore, with employee standard contributions, potential over-50 catch-up contributions, plus employer contributions, the maximum overall contributions are $63,500 in 2020.

Maximum 401 Company Match Limits

The employee and employer match limits for 401s fluctuate each year to account for inflation. Since inflation is projected to rise, the 401 max contribution is increasing as well.

According to the IRS, the employee contribution amount 401 limits per year include:

- 2020: $57,000

- 2021: $58,000

Therefore, in 2021, an employee can contribute up to $19,500 toward their 401. The employer can match the employee contribution, as long as it doesnt exceed the separate $58,000 employer-employee matching limit.

Since matching $19,500 in full would only total $39,000, most employees dont have to worry about this dilemma. This problem typically arises for individuals who are contributing to more than one employer-matched 401 plan or have switched or are switching to a new employer within the year. Employers should continue to communicate limits with employees each year to avoid misunderstandings.

If you have employees who are aged 50 or older, they may be eligible for additional contributions to their 401 accounts, also known as catch-up contributions. Catch-up contributions remained the same in both 2020 and 2021.

- 2020: $285,000

- 2021: $290,000

The key employees compensation threshold didnt change from 2020 to 2021, remaining steady at $185,000. Known as the nondiscrimination testingthreshold, these limits apply to specific individuals within a company to ensure they remain within specific 401 contribution limits.

Key employees are defined as any employee who:

Read Also: Is It Good To Invest In 401k

Taking Your Retirement Contributions Further

Not everyone will be able to contribute the maximum 401K contribution. If you can, however, it is one of the best things you can do for your financial future, particularly when a possible employer 401K match is at stake. Matching funds are free money and can quickly boost your retirement outlook.

If you do contribute the maximum and want to add even more to your retirement, you can also create a Traditional or Roth IRA .

Additionally, if your employer allows it you may be able to make after-tax contributions and complete a mega backdoor Roth conversion. This really can boost your retirement savings.

If you have changed employers and have old 401Ks sitting around, you may want to consider a 401K rollover to an IRA or your current 401K, in order to consolidate your 401Ks. You may be able to save money on fees in an IRA versus your 401K.

A Solo 401k Works For The Young The Old And The Independent

The young or older business owner could be driving for Uber or any one of the many possibilities out there. A more traditional woman could be running her own Avon business. And entrepreneurs have every reason to open a Solo 401k. Almost every independently operated business qualifies. The key qualification is being self-employed. It has nothing to do with running a multimillion-dollar business. And who doesnt dream of being self-employed?

Today, tens of millions of Americans rely solely on an employer sponsored 401k as the source for their retirement income. Your money is in their account and limited to what they allow you to invest in . The employer decides how much they contribute to your future financial security. The employer makes the rules.

By starting a small side gig, you can take full control of your retirement account to invest it any way you see fit. You no longer have to financially depend on big business for your retirement years. Nor do you have to depend on Wall Street to leave you a few crumbs after the big guys first take all they want. Anyone can take control of their financial future by investing in real estate, or the modern cryptocurrency economy, or green technologies, or anything else. Employers and Wall Street have no say in how you invest your Solo 401k.

You May Like: Can You Leave Money In 401k At Your Old Job

Other Options For High Earners To Maximize Retirement Savings

That $6,000 in catch-up contributions for those over-50 has no earning limit, so HCEs can at least maximize there. HCEs can also contribute up to $3,550 into an individual health savings account or up to $7,100 for a family, plus $1,000 a year if youre over 55.

Highly compensated employees are ineligible for a tax-deductible Traditional IRA which phases out once modified adjusted gross income reaches $65,000 single-file or $104,000 joint-file in 2020 however, they can save $6,000 or $7,000 in after-tax contributions to enjoy tax-free earnings and growth.

A non-deductible IRA may also be converted into a Roth IRA a strategy known as the backdoor Roth IRA which allows HCEs to avoid paying tax on the conversion.

Many companies offer a deferred compensation plan, which allows a percentage of salary and taxes to be deferred to retirement. Many HCEs also put money into a low-cost deferred variable annuity, which functions like a non-deductible IRA without the contribution limits.

Spouses of HCEs can also max out their 401 contributions if they are not designated HCEs.

How Much Do Companies Typically Match On 401 In 2020

Dylan Telerski / 4 Aug 2020 / Business

Getting insight into how much companies are matching on 401s in 2020 will help you know how well your employer stacks up and whether youre in the right ballpark with your contributions.

Long gone are the days where a full pension or government stipend will guarantee you a secure future. These sources of income typically comprise less than half of what you would need to live comfortably in retirement. A 401 investment account is one of the best strategies to bridge the gap and save enough money for your post-retirement years.

In addition to the contribution deducted from your paycheck, about 51% of employers offering a 401 agree to match a certain amount of employee contributions. This generous bonus is literally FREE MONEY that employers add to your retirement savings that will gain interest and compound over time to help you reach your goals faster. There is, however, one caveat to the employer match in most cases , how much you receive depends on how much you put in.

You May Like: How Often Can I Change My 401k Contribution Fidelity

Traditional Vs Roth 401

Some employers offer both a traditional 401 and a Roth 401. With a traditional 401 plan, you can defer paying income tax on the amount you contribute. In other words, if you earn $80,000 a year and contribute the maximum $20,500, your taxable earnings for the 2022 tax year would be $59,500.

With a Roth 401 plan, you dont get an upfront tax break, but when its time to withdraw that money in retirement, you wont owe any tax on it. All your accumulated contributions and earnings come out tax free.

Investing in both types of plans provides you with tax diversification, which can come in handy during retirement.

If you have access to both a Roth and a traditional 401 plan, you can contribute to both, as long as your total contribution to both as an employee doesnt exceed $20,500.

In addition to the Roth and traditional 401, some employers also offer an after-tax plan, allowing you to save up to the total annual limit of $61,000. With this account you can put away money after-tax and it can grow tax-deferred in your 401 account until withdrawal, at which point any withdrawn earnings become taxable.

How Much Do Companies Typically Match

More commonly, companies follow a formula to determine their matching contribution. A 50% match means that for every dollar an employee puts in, the employer adds 50 cents. A 100% match means the employer puts in a dollar for every dollar the employee contributes. On average, companies donate an extra 4.3% of a persons pay into their retirement accounts as a bonus.

A 2019 Vanguard study identified the most common 401 match scenarios:

- About 71% of companies choose: 50% match, up to 6% of the employees pay

- Another 21% of companies prefer: 100% match on the first 3%, 50% match on the next 2%

- 6% of companies selected: A single or multi-tiered formula, capped at a certain amount

- 2% of companies opted for: A variable formula based on age, tenure, and other variables.

Recommended Reading: Can You Use Your 401k To Buy Real Estate

Why Do 401 Limits Change Some Years And Remain Unchanged In Others

The 401 contribution limits are adjusted annually in accordance with changes in inflation. The effects of inflation are measured by the consumer price index for urban wage earners and clerical workers. If inflation increases significantly, 401 matching limits are increased by increments of $500 or $1,000. However, if the increase in inflation isnt significant enough, the limits remain unchanged.

Treatment Of Excess Deferrals

You have an excess deferral if the total of your elective deferrals to all plans is more than the deferral limit for the year. Notify your plan administrator before April 15 of the following year that you would like the excess deferral amount, adjusted for earnings, to be distributed to you from the plan. The April 15 date is not tied to the due date for your return.

Excess withdrawn by April 15. If you exceed the deferral limit for 2020, you must distribute the excess deferrals by April 15, 2021.

- Excess deferrals for 2020 that are withdrawn by April 15, 2021, are includable in your gross income for 2020.

- Earnings on the excess deferrals are taxed in the year distributed.

The distribution is not subject to the additional 10% tax on early distributions.

Excess not withdrawn by April 15. If you don’t take out the excess deferral by April 15, 2021, the excess, though taxable in 2020, is not included in your cost basis in figuring the taxable amount of any eventual distributions from the plan. In effect, an excess deferral left in the plan is taxed twice, once when contributed and again when distributed. Also, if the entire deferral is allowed to stay in the plan, the plan may not be a qualified plan.

Reporting corrective distributions on Form 1099-R. Corrective distributions of excess deferrals are reported to you by the plan on Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.

Read Also: Should I Roll My 401k Over To An Ira

The Short And Simple Answer Is No But

The short and simple answer is no. Employer matching contributions do not count toward your maximum contribution limit as set by the Internal Revenue Service . Nevertheless, the IRS does place a limit on the total contribution to a 401 from both the employer and the employee.

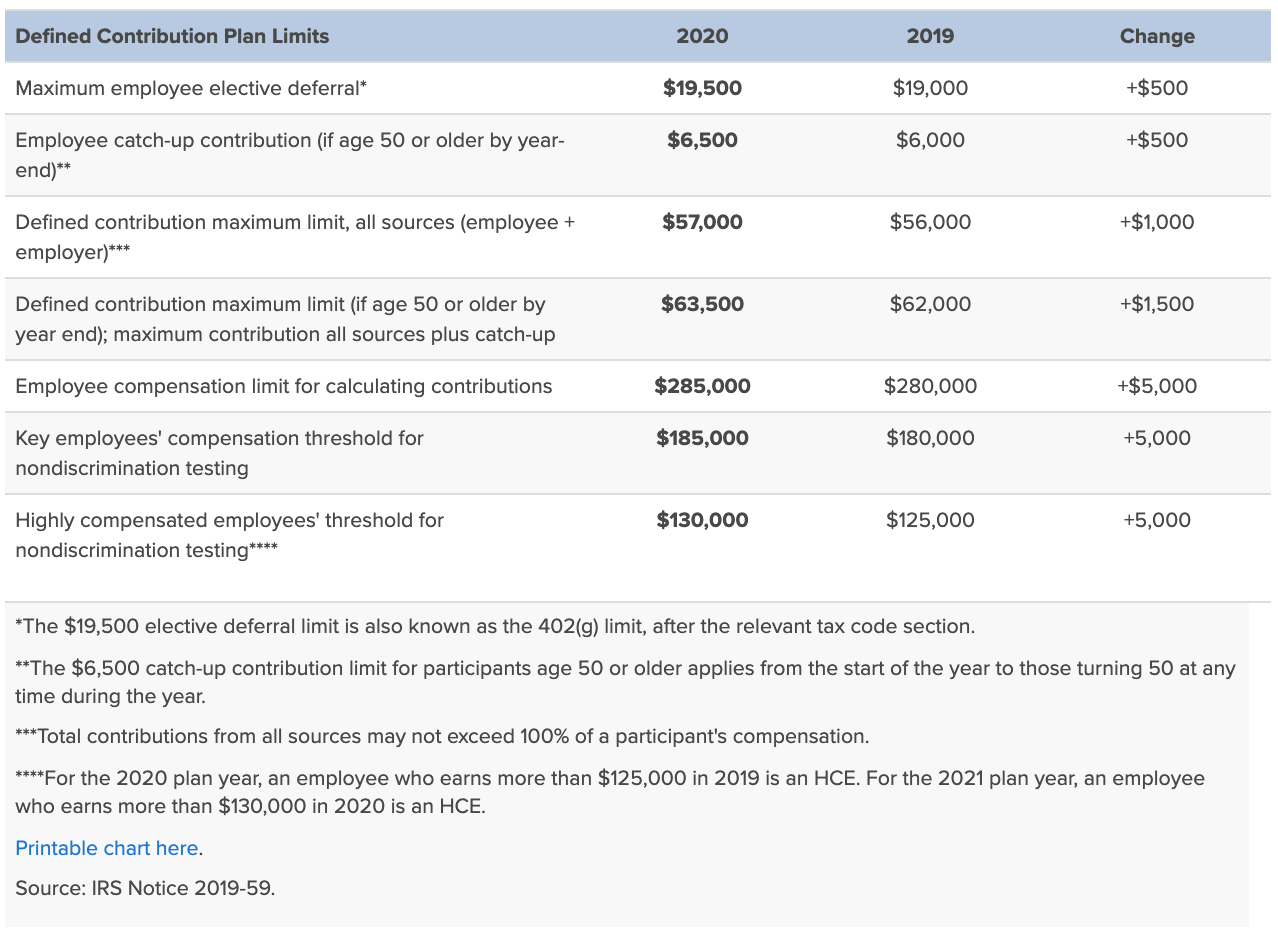

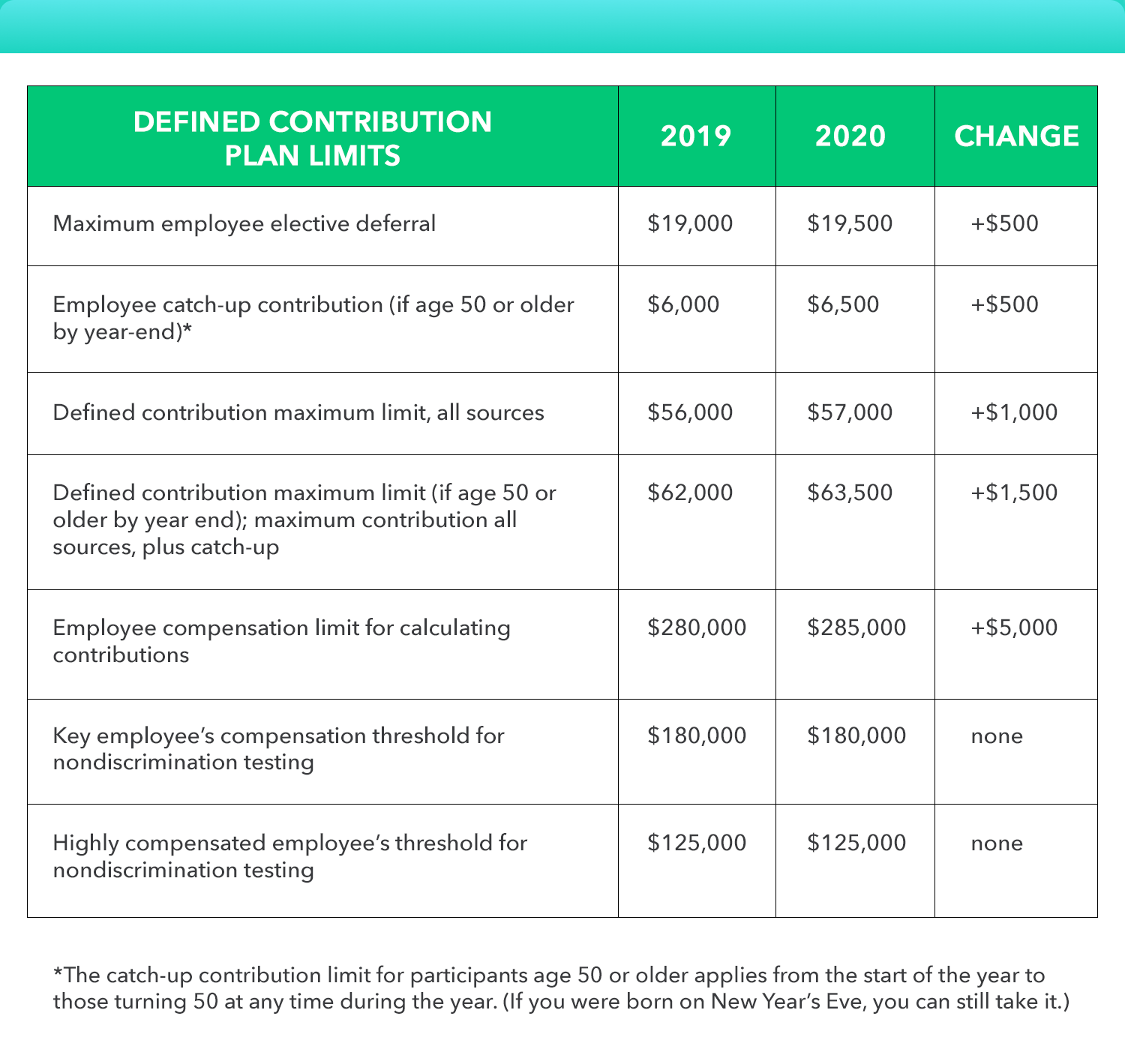

Highlights Of Changes For 2020

The contribution limit for employees who participate in 401, 403, most 457 plans, and the federal government’s Thrift Savings Plan is increased from $19,000 to $19,500.

The catch-up contribution limit for employees aged 50 and over who participate in these plans is increased from $6,000 to $6,500.

The limitation regarding SIMPLE retirement accounts for 2020 is increased to $13,500, up from $13,000 for 2019.

The income ranges for determining eligibility to make deductible contributions to traditional Individual Retirement Arrangements , to contribute to Roth IRAs and to claim the Saver’s Credit all increased for 2020.

Taxpayers can deduct contributions to a traditional IRA if they meet certain conditions. If during the year either the taxpayer or his or her spouse was covered by a retirement plan at work, the deduction may be reduced, or phased out, until it is eliminated, depending on filing status and income. Here are the phase-out ranges for 2020:

Also Check: How To Avoid Penalty On 401k Withdrawal