Special Rules Resulting From The Coronavirus Pandemic

It should be noted that the CARES Act of 2020 gave employers the option to amend their 401 plans only if they so choose to allow investors who are impacted by the coronavirus to gain access to of their retirement savings without being subject to early withdrawal penalties and with an expanded window for paying the income tax they owe on the amounts they withdraw per The Security and Exchange Commissions Office of Investor Education and Advocacy .

An employer could amend their plan by allowing coronavirus-related distributions but not increasing the 401 loan limit, according to Porretta.

The SECs OIEA guidance on the CARES Act allowed qualified individuals impacted by the coronavirus pandemic to pay back funds withdrawn over a three-year period , and without having the amount recognized as income for tax purposes.

For income taxes already filed for 2020, an amended return can be filed. The 10 percent early withdrawal penalty was also waived for withdrawals made between Jan. 1 and Dec. 31, 2020. It also waived the mandatory 20 percent withholding that typically applied.

The Act also allowed plan participants with outstanding loans taken before the Act was passed but with repayment due dates between March 27 and Dec. 31, 2020 to delay loan repayments for up to one year. .

Impact Of A 401 Loan Vs Hardship Withdrawal

A 401participant with a $38,000 account balance who borrows $15,000 will have $23,000 left in their account. If that same participant takes a hardship withdrawal for $15,000 instead, they would have to take out $23,810 to cover taxes and penalties, leaving only $14,190 in their account, according to a scenario developed by 401 plan sponsor Fidelity. Also, due to the time value of money and the loss of compounding opportunities, taking out $23,810 now could result in tens of thousands less at retirement, maybe even hundreds of thousands, depending on how long you could let the money compound.

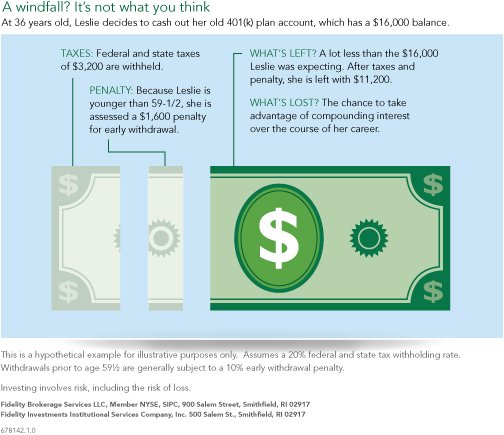

If You Have A 401 From A Past Job You May Be Tempted To Cash It Out But Just Because You Can Doesnt Necessarily Mean You Should

You may consider cashing out an old 401 for a number of reasons to cover an unexpected expense, fund a big purchase or just to make a clean break from a past employer.

But the tax impact of withdrawing money from a 401 can be significant, especially if youll be subject to early withdrawal penalties in addition to federal income taxes. Plus, when you take money out of a 401, those funds are no longer helping you grow your retirement savings.

Lets look at some details about cashing out a 401, including reasons why it should only be considered as a last resort.

Don’t Miss: How To Take Your 401k With You

How To Build Wealth With Compound Interest

First, we need to explain what compound interest is. With compound interest, unlike simple interest, you invest your money, earn money, and then invest that new money you made along with the sum you started out with, and that adds up year after year. Especially with considerable sums in your 401.

This is called compounding. Wealth is something that you create and compounding is a great way to do so. You can make money from both guaranteed and non-guaranteed investments while using compound interest. You can even take care of your retirement money this way.

Every year you can invest your money to make more money next year and save up for your future. These are the secrets of building wealth with compound interest. There are a lot of investment options out there that you can take and compound interest is closely related to retirement topics.

For example, if you invest $1,000 now in a guaranteed investment, years down the line your annual compound could go up to a couple of thousand dollars.

Before you start, you need to have a good foundation. Getting rid of consumer debt is your first step. If you dont pay off your credit card balance, you will be charged interest on your entire owning balance, including the interest added to your account the previous month. This will just make your credit card debt bigger.

After all, avoiding debt is one of the habits of millionaires.

What Age Can You Take Your 401k Without Paying Taxes

Once you are 59 years old, you can withdraw your money without having to pay an early withdrawal penalty. You can choose the traditional or Roth 401 plan. Traditional 401s offer deferred tax savings, but you still have to pay taxes when you collect the money.

Do I have to pay taxes on my 401k after age 65?

Tax on 401k Withdrawal after 65 Varies Anything you take out of your 401k account is taxable income, just like regular salary when you contribute to a 401k, your contribution is pre-tax, so you are taxed on withdrawals.

How can I get my 401k money without paying taxes?

You can roll your 401 into a new employers IRA or 401 without paying income tax on your 401 money. If you had $1000 to $5000 or more when you left your job, you can transfer those funds into a new retirement plan without paying taxes.

Do I pay taxes on 401k withdrawal after age 60?

Traditional 401 withdrawals are taxed at current individual income tax rates. In general, Roth 401 withdrawals are not taxed as long as the account was opened at least five years ago and the account holder is 59½ or older. Employer contributions that match a Roth 401 are subject to income tax.

Don’t Miss: Can I Use My 401k To Purchase A Home

Should You Take A 401 Loan Or 401 Withdrawal

Some plans allow loans from 401 plans as an option to get access to the fund for virtually any purpose. Maybe you want to travel, pay your childs college tuition, put a down-payment on a new house, or cover the cost of a divorce. There are many personal reasons to consider a loan.

Generally, you can take up to 50% of the balance to a maximum of $50,000. The good news is that there is no age restriction, and there are no taxes due when you take out a loan. However, the loan must be repaid over a five-year period, with interest owed back to your account.

There is risk involved in taking out a loan. Some plans allow you to roll over a 401 when changing employers. However, in other cases, you may have to pay your outstanding loan balance in full within 60 days of leaving an employer otherwise, it will be considered a 401 withdrawal, taxed as ordinary income and subject to the 10% withdrawal penalty.

Compared to a loan, an early 401 withdrawal:

- Must have an option that allows for in-service withdrawals, which may be restricted by age or hardship.

- Will be taxed as ordinary income .

- Can be subject to a 10% penalty if youre under 59.5 .

- Will not require repayment loan).

How To Cash Out A 401 From A Former Employer

Cashing out a 401k from a former employer is not a difficult task. In most cases, you contact the plan administrator for the appropriate paper work, fill it out, send it to the financial institution that manages the 401k, and wait for the check to come in the mail or for the electronic transfer.

Tips

-

In order to cash out a 401 from a former employer, you will likely have to contact the plan administrator at your former place of employment and request access to the paperwork needed to withdraw your funds.

You May Like: How Much Does A 401k Cost A Small Business

Consequences Of A 401 Early Withdrawal

- IRS Penalty. If you took an early withdrawal of $10,000 from your 401 account, the IRS could assess a 10% penalty on the withdrawal if its not covered by any of the exceptions outlined below.

- Withdrawals are taxed. Even if it were covered by an exception, all early withdrawals from your 401 are taxed as ordinary income. The IRS typically withholds 20% of an early withdrawal to cover taxes. So if you withdrew $10,000, you might only receive $7,000 after the 20% IRS tax withholding and a 10% penalty.

- Less money for retirement. Perhaps the biggest consequence of an early 401 withdrawal is missing out on long-term returns in the market. The stock markets average returns have been around 9.6% a year since the end of the Great Depression. If you withdrew $10,000 from your 401 and were about 30 years away from retirement, you could be giving up more than $117,000 in total returns.

The 4% Withdrawal Rule

The 4% rule says that you can withdraw 4% of your savings in the first year, and calculate subsequent yearâs withdrawals on the rate of inflation. This rule is based on the idea that you should withdraw 4% annually, and maintain the financial security in retirement for 30 years. This strategy is preferred because it is simple to compute, and gives retirees a predictable amount of income every year.

For example, if you have $1 million in retirement savings, 4% equals $40,000 in the first year. If the inflation rises by 2.5% in the second year, you should take out an additional 2.5% of the first yearâs withdrawal i.e. $1000. Therefore, the withdrawal for the second year will be $41,000.

Don’t Miss: How To Find Out If I Have Any 401k

Penalties For Cashing Out Your 401 Early

Of course, the biggest consequence comes from the penalties youll pay. You already know youll likely have to pay taxes on your cash out. But if you take out the money before you reach 59.5 years of age, the IRS will charge a 10 percent early withdrawal penalty. The money will also be included with your gross income for the year and taxed at the rate that applies to your tax bracket. You could find that withdrawing the funds moves you into a higher tax bracket.

One way around this is to qualify for a 401 hardship withdrawal, which can exempt you from early withdrawal penalties. The following events can qualify you for a hardship exemption, depending on the rules laid out by your plan:

- Medical expenses

How To Make An Early Withdrawal From A 401

When you have determined your eligibility and the type of withdrawal you want to make, you will need to fill out the necessary paperwork and provide the requested documents. The paperwork and documents will vary depending on your employer and the reason for the withdrawal, but when all the paperwork has been submitted, you will receive a check for the requested funds, hopefully without having to pay the 10% penalty.

Don’t Miss: What Is The Safest 401k Investment Option

Why Does Gethuman Write How

GetHuman has been working for over 10 years on sourcing information about big organizations like Vanguard in order to help customers resolve customer service issues faster. We started with contact information and fastest ways to reach a human at big companies. Particularly ones with slow or complicated IVR or phone menu systems. Or companies that have self-serve help forums instead of a customer service department. From there, we realized that consumers still needed more detailed help solving the most common problems, so we expanded to this set of guides, which grows every day. And if you spot any issues with our How Do I Close My Vanguard Account? guide, please let us know by sending us feedback. We want to be as helpful as possible. If you appreciated this guide, please share it with your favorite people. Our free information and tools is powered by you, the customer. The more people that use it, the better it gets.

Vanguard

Your Retirement Money Is Safe From Creditors

Did you know that money saved in a retirement account is safe from creditors? If you are sued by debt collectors or declare bankruptcy, your 401k and IRAs cannot be liquidated by creditors to satisfy bills you owe. If youre having problems managing your debt, its better to seek alternatives other than an early withdrawal, which will also come with a high penalty.

Also Check: How Much To Max Out 401k

Can I Cash Out My 401k At Age 62

Normally, when you turn 59 59, you can start withdrawing money from 401 without paying 10% in advance tax. Still, if you decide to retire at age 55, you can take part in the distribution without being punished.

Can I lock 401k and get paid? Getting Out of Your 401k Still Working If you resign or are fired, you can withdraw money from your account, but again, there are penalties if you do so which could lead to a review. You will be penalized for 10% withdrawal early and the money will be taxed on normal income.

Using Life Insurance For Sustainable Wealth

Many people like to fund whole life insurance during their career instead of maxing out 401 contributions. High cash values in life insurance can be valuable when opportunities arise where 401 funds are off-limit.

For example, my brothers run a metal fabrication business and recently had an opportunity to buy a machine shop for only $50,000 on a special liquidation deal. This equipment would have run close to $250,000 if they had to buy it piecemeal at used prices.

They were able to get a policy loan against their whole life insurance policies and take advantage of this deal quickly.

Some people like to fund whole life insurance with money from a 401, so they have a permanent death benefit and accessible cash values going into their golden years.

If they need more money during retirement 10-15+ years later, they can withdraw more than they paid for the policy or roll a policy to an annuity to create guaranteed passive income for the rest of their life. A high percentage of this income is usually tax-free.

Owning life insurance can also help with estate planning needs or as a volatility buffer where a policy owner can take a loan or withdrawal to cover lifestyle expenses in times when volatile market investments are down. This can allow time for the market to recover instead of further drawing down assets in an invested account.

Read Also: What To Do With 401k When You Leave A Company

No More Creditor Protection

Once youve squared away how long it takes to cash out your 401, its time to think about consequences. The first is the loss of protection against creditors. If youre cashing out because creditors may come knocking, this is something you need to consider. Employer-sponsored 401 plans are often protected against creditors, bankruptcy proceedings, and civil lawsuits. Once youve cashed the funds out, theyll be subject to action along with your other assets.

But before you assume this could be a problem, check to make sure your plan isnt vulnerable for other reasons. If youre in the process of divorcing or are already divorced, the other party could be able to snag a portion of the funds under a qualified domestic relations order. Funds in a 401 can also be seized to pay tax debts and federal penalties.

Plan for a better future

Get an affordable, professionally prepared retirement plan today.

Consider The Pros And Cons

Early withdrawals from your hard-fought savings should be considered carefully. There are many factors to consider with long-term implications. Study the alternatives available and make decisions according to your ultimate goal.

Whether you decide to keep your 401k contributions intact with your old employer, move it to your new employer, roll it over to an IRA, or simply cash it out, the question of taxes and penalties loom.

Related:5 Financial Planning Mistakes That Cost You Big-Time Explained in 5 Free Video Lessons

There are pros and cons to taking a lump-sum distribution. Four important factors to consider include:

In summary, there are many conflicting issues you must balance. Lifestyle needs, taxes, and penalties today versus future savings tomorrow. It is a difficult decision.

Don’t Miss: How To Find Your 401k Account Number

Making A Hardship Withdrawal

Depending on the terms of your plan, however, you may be eligible to take early distributions from your 401 without incurring a penalty, as long as you meet certain criteria. This type of penalty-free withdrawal is called a hardship distribution, and it requires that you have an immediate and heavy financial burden that you otherwise couldn’t afford to pay.

The practical necessity of the expense is taken into account, as are your other assets, such as savings or investment account balances and cash-value insurance policies, as well as the possible availability of other financing sources.

What qualifies as “hardship”? Certainly not discretionary expenses like buying a new boat or getting a nose job. Instead, think along the lines of the following:

- Essential medical expenses for treatment and care

- Home-buying expenses for a principal residence

- Up to 12 months worth of educational tuition and fees

- Expenses to prevent being foreclosed on or evicted

- Burial or funeral expenses

- Certain expenses to repair casualty losses to a principal residence

The home-buying expenses part is a bit of a gray area. But generally, it qualifies if the money is for a down payment or for closing costs.

What If I Dont Need The Rmd Assets

RMDs are designed to spread out your retirement savings and related taxes over your lifetime. If you dont depend on the money to satisfy your spending needs, you may want to consider:

- Reinvesting your distributions in a taxable account to take advantage of continued growth. You can then add beneficiaries to that account without passing along future RMDs to them.

- Gifting up to $100,000 annually to a qualified charity. Generally, qualified charitable distributions, or QCDs, arent subject to ordinary federal income taxes. As a result, theyre excluded from your taxable income.

Read Also: Is There A Max Contribution To 401k