Related Materials Available From The Irs

- The IRS Retirement Plan Products Guide, Publication 4460, lists resources to help you choose and maintain the right retirement plan for your business/organization.

- Lots of Benefits, Publication 4118, discusses the benefits of sponsoring and participating in a retirement plan.

- Have you had your Check-up this year? for Retirement Plans, Publication 3066, encourages employers to perform a periodic check-up of their retirement plans through the use of a checklist, and how to initiate any necessary corrective action.

- 401 Plan Checklist, Publication 4531, a tool to help you keep your plan in compliance with many of the important tax rules.

- Designated Roth Accounts under a 401, 403, or governmental 457 plans, Publication 4530, discusses this popular feature found in many 401, 403, and governmental 457 plans.

- Retirement Plans for Small Business , Publication 560, describes types of plans, qualification rules, setting up a qualified plan, the minimum funding requirement, contributions, employer deduction, elective deferrals, the qualified Roth contribution program, distributions, prohibited transactions, and reporting requirements.

To view these related publications, go to the Retirement Plans Web page and click on Forms & Publications in the left pane.

How Does A 401 Plan Work

401 plans were created to help employees save for retirement while also enjoying tax benefits. If your employer offers a 401 plan, heres what you need to know about joining, choosing and contributing to it.

Eligibility. Some company policies allow employees to sign up for a 401 as soon as theyre hired, while others may require a waiting period. Talk to your human resources department to confirm your companys eligibility requirements.

Types of 401 plans. There are two main types of 401 plans traditional and Roth. If both plans are offered by your employer, you may have the option to contribute to one or the other, or split contributions between both. Each type offers tax advantages, but the primary difference is the way contributions and withdrawals are taxed.

Contributions to a traditional 401 are pre-tax but you pay taxes on withdrawals. With a Roth 401, you pay taxes now, but the money grows tax free, and withdrawals are tax free, says Chris Ward, Executive Vice President and Financial Advisor with Commerce Financial Advisors. When deciding which type to contribute to, he recommends considering your age, as well as your tax bracket now and what it might be when you want to retire.

Another option for new investors is a model portfolio that recommends options based on your responses to a questionnaire.

If youre eligible to participate in your companys 401, the most important thing is to be invested and be in it for the long term, adds Ward.

What Are The Tax Benefits To The Employer For Offering A 401 Matching Plan

Employers can use the contributions to employee 401 accounts as tax deductions on their federal corporate income tax returns. These contributions may also be exempt from state and payroll taxes. As a result, the employer keeps their employees happy, sees reduced turnover and benefits financially with tax deductions.

Also Check: Can You Start Your Own 401k

A Tax Savings Example

Assume you make $50,000 per year. You decide to put 5% of your pay, or $2,500 a year, into your 401 plan. You’ll have $104.17 taken out of each paycheck before taxes have been applied if you get paid twice a month. This money goes into your plan.

The earned income you report on your tax return at the end of the year will be $47,500 instead of $50,000, because you get to reduce your earned income by the amount you put into your plan. The $2,500 you put into the plan means $625 less in federal taxes paid if you’re in the 25% tax bracket. Saving $2,500 for retirement therefore only costs you $1,875.

How Much You And Your Employer Can Contribute For You In 2022

If your employer offers a 401 plan, it can be one of the easiest and most effective ways to save for your retirement. But while a major advantage of 401 plans is that they let you put a portion of your pay automatically into your account, there are some limits on how much you can contribute.

Each year, usually in October or November, the Internal Revenue Service reviews and sometimes adjusts the maximum contribution limits for 401 plans, individual retirement accounts , and other retirement savings vehicles. In November 2021, the IRS made updates for 2022.

Recommended Reading: How To Choose 401k Investment Options

Why Should You Offer A 401 Employer Match

Offering a 401 employer match as part of your employee retirement plan has three primary benefits for your company:

- Better recruiting. Not all companies offer a 401 employer match, so doing so can help your business stand out to top job candidates. Offering better benefits correlates with hiring better candidates.

- Stronger employee morale and retention. Just as offering 401 contribution matching can draw better recruits to your business, this benefit can also improve employee morale and retention at your company.

- Employer tax benefits. There are tax savings that businesses can take advantage of by offering 401 employer matching. Tax laws allow employers to claim their matching contributions as tax deductions.

Key takeaway: Offering a 401 employer match program can attract stronger new hires, reduce taxable business income, and boost employee morale and retention.

Does Matching Count Towards Contribution Limits

The short answer is no, says Winston. But theres a separate IRS rule that limits the amount of total contributions to a 401 from both the employee and employer combined.

In 2022, most people can divert up to $20,500 per year to a 401 account$1,000 higher than in 2021. If youre age 50 or older by year-end, you can add an additional $6,500 in catch-up contributions.

However, the overall limit from all sources is $61,000 in 2022. That means that no matter who contributes to your account, you cant exceed that amount for the year. If your employer offers a match in the above scenario, the maximum amount youd reach is $41,000. Its therefore unlikely that youll exceed the overall contribution limit.

If your companys 401 plan offers a match, try to contribute enough to capture the full amount. From there, you can assess whether you want to contribute above that amount toward your retirement fund.

Recommended Reading: How Much Can You Contribute To 401k Per Year

What If I Have A Roth 401

If you have a Roth 401, you pay income taxes on your contributions now, rather than when you take that money out during your retirement. But your employer isnt likely to pay the taxes on matching contributions , so if you have a Roth, their matching contributions usually go into a separate, traditional 401. Youll pay the taxes on the traditional when you withdraw the money.

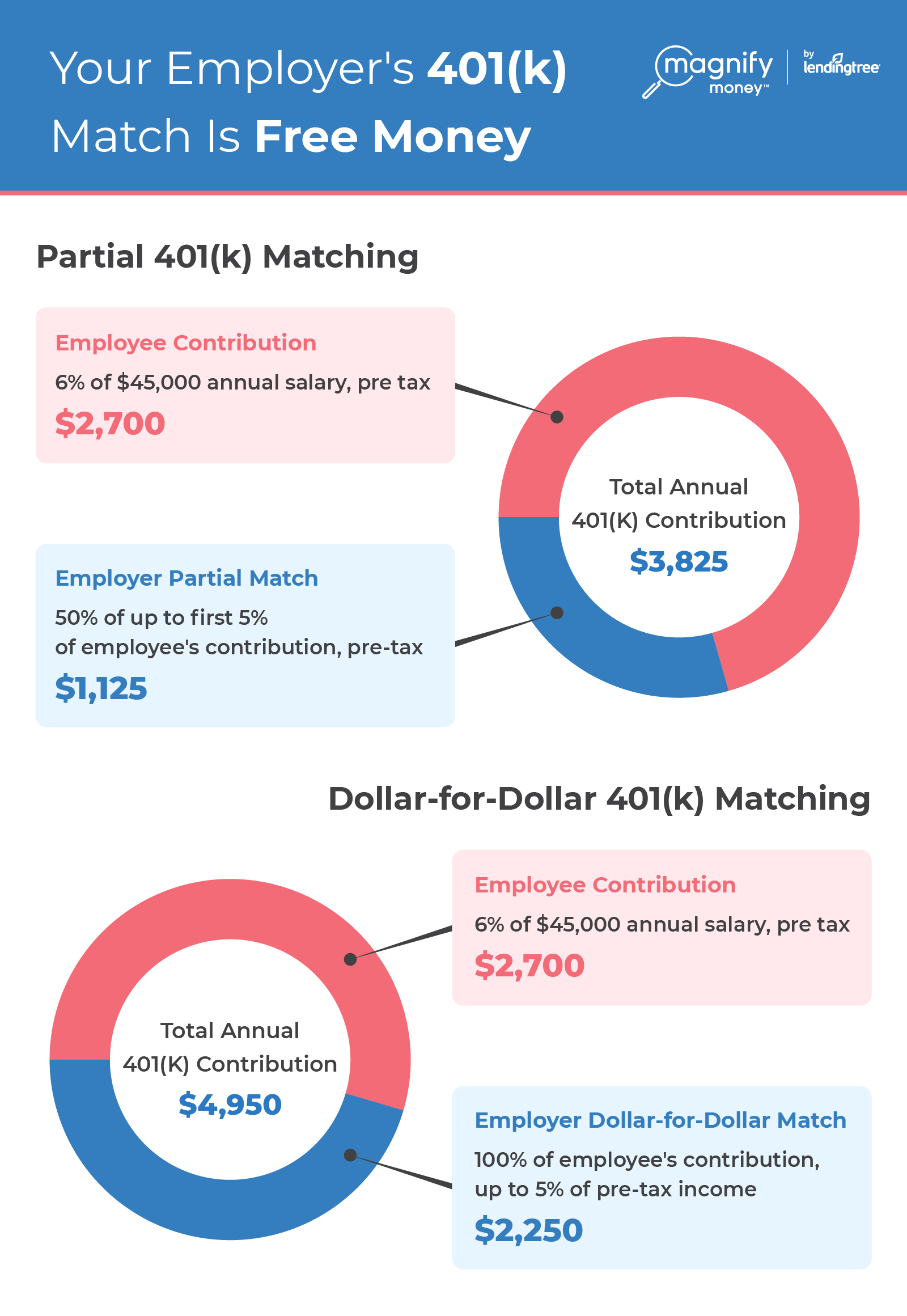

How Does An Employer Match Work

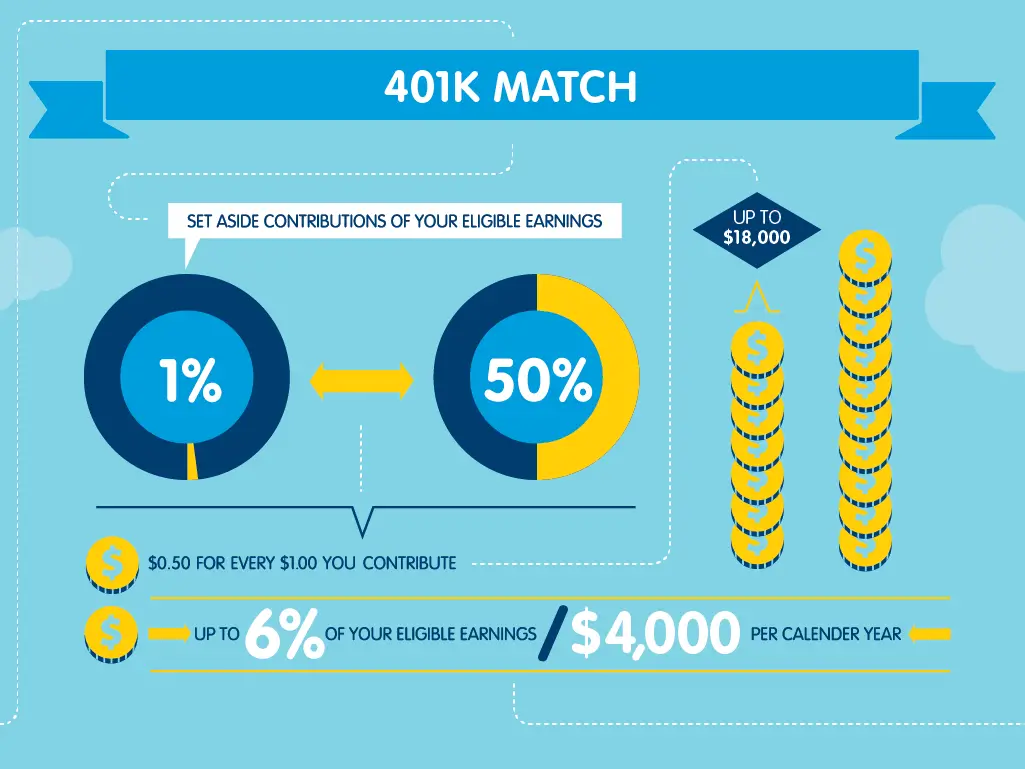

Some employers will match a portion of your retirement contributions, up to a certain limit. For example, they might put 50 cents into your account for every dollar you put in, up to 6% of your salary. If you contribute at least 6% of each paycheck, youll get the full match.

Some employers also set up a default contribution to help employees get the full match automatically.

Heres an example of how this could look over a year:

Recommended Reading: Why Roll 401k Into Ira

A Beginner’s Guide To Understanding 401k Plans

The word 401k is synonymous with retirement, but how many of us actually know all the rules around 401k accounts? We’ll walk you through all the finer details, but we also know you’re busy, so we’ve also whipped up this handy table of contents for you, too. Feel free to self-serve some of the most frequently asked questions about 401k plans, or binge it all, top to bottom.

Now, onto the good stuff:

When Is The Money Yours

Some types of matching employer contributions are subject to a vesting schedule. The money is there in your account, but you’ll only get to keep a portion of what the company put in for you if you leave your job before you’re 100% vested. You always get to keep any of the money that you personally put into the plan.

Also Check: How To Get Money Out Of 401k Without Paying Taxes

The Low Down On Contribution Matching

First things first: By law, employers do not have to match any part of an employees investment in a 401k plan. There is, however, required annual nondiscrimination testing plans are fair to all employees.Since Uncle Sam offers tax incentives for the contribution-friendly employer, many businesses do offer such contributions as part of an overall employee benefits package. Some advantages are the following:

- Attracting and retaining top talent

- 401k contributions are tax deductible and can be tax-deferred up to a limit established by the IRS

- A 401k plan puts the onus of retirement investing on the employee, cutting the employers workload.

What Are The Main Features Of A 401 Plan

You can expect the following features from a 401 plan:

-

Any business can set up 401 plans for their employees.

-

Employers create guidelines for employee eligibility.

-

If you have been with the company for less than a year, work part-time or are not a U.S. citizen, you may not qualify for your companys 401 plan.

-

Your employer may choose to contribute to your 401 account.

-

You may start and stop making contributions to the plan according to the rules of your company.

-

You can choose to contribute up to 100% of your salary as long as it does not exceed the limit set by the Internal Revenue Service.

-

If you are 50 years of age or older, you can make an additional contribution that is more than the ceiling amount set by the IRS. This additional contribution is commonly known as a catch-up contribution.

-

If you withdraw any money from your 401 account before you are 59.5 years old, you may have to pay a penalty amount of up to 10%. If you retire by the time you are 55 years old, you do not have to pay the penalty for withdrawing the money.

-

Some plans may allow you to take loans on your account accumulations. You must repay the loan within the specified period, which is usually a few years. If you leave your job, you will have to repay the loan within a few months.

Read Also: Can You Keep Your 401k In A Chapter 7

Whats A Typical Employer Match To A 401

Ever wondered how employers calculate matched contributions? In 2018, Vanguard administered more than 150 distinct match formulas . With 71% of plans using it, the most popular formula is the single-tier formula, such as $0.50 per dollar on up to 6% of pay. Under this single-tier formula, an employee making $60,000 per year could get up to $1,800 in employer-matched contributions.

Here are the most common employer matching formulas per the Vanguard survey:

| Match Type | |

|---|---|

| Variable formula, based on age, tenure or similar vehicles | 2% |

There are literally hundreds of matching formulas out there, so contact your 401 plan administrator regarding the rules and specifics of the matching formula used by your employer.

-

The most common matching formula among Vanguard plan holders was $0.50 per dollar on the first 6% of pay.

-

The second most popular formula for employer matching contributions is $1.00 per dollar on the first 3% of pay and $0.50 on the next 2% of pay. Under this multi-tier formula, the same worker in our previous example would receive up to $2,400 in matching contributions.

Dont Miss: How Much Can You Put In Your 401k A Year

Your 2021 Guide To Employer Match And 401 Contribution Limits

Offering a matching 401 plan to your team is a great way to attract high-quality employees to your company. An employer-matched 401 can also help reduce employee churn as individuals recognize the financial significance of this benefit.

Many companies now opt for a 401 employer match program, rather than the traditional pension plan. Employer-matched 401 contributions allow for tax deductions for the employer. For this reason, there are 401 matching limits for how much employers can contribute to their employees 401 savings plans.

Learn more about what a 401 plan is, how employer matching works and the max 401 contribution company match limits over the past few years, including 2021 limits.

Are you a job seeker? Find jobs.

Read Also: Can An Llc Have A Solo 401k

Can Employees Enroll In A 401 Employer Match Plan As Soon As They Are Hired

Employers are able to define their own specifications regarding when employees are eligible for 401 enrollment. Some companies choose to allow for registration immediately, while others require a certain amount of time to pass, such as the probation period, six months of employment and so on. Employers should make these regulations clear during the hiring process, so employees arent surprised if they need to wait.

Do I Qualify For 401 Employer Match

Your eligibility for employer 401 matching depends entirely on your employer. Not all employers offer a match program. According to statistics from the Bureau of Labor Statistics in 2015 around 51% of companies with a 401 offer some sort of match.

Its important not to assume your employer has automatically enrolled you for contribution matches. Be sure to ask when your matches will take effect. If youre unsure whether your employer offers a match program at all, dont be afraid to ask your boss or human resources representative about the company policy. Be sure to ask about the guaranteed match amount and what the match limits are.

Some firms may also have a vesting period for their contributions. This means that while the company may match 5% of your contributions, those contributions arent permanently yours until youve been at the company for a predetermined amount of time. If you leave before that time is up, you lose that money from your account.

Vesting schedules vary. Some companies have no vesting period, meaning all matching contributions are yours right away. Others have a vesting cliff at which point all of your matching contributions become permanently yours. Others have a schedule where a certain amount of your vested matches say 20% become permanently yours each year.

Also Check: How Much Can Be Put Into A 401k Per Year

How Does 401k Profit Sharing Work

When it comes to offering retirement benefits to your employees, you have more options than just offering a 401k. So, how does profit sharing work?

Profit sharing can be a great option for employers who want to give their employees a little extra towards retirement, help save more towards your own retirement, or would simply would rather give money to their employees than Uncle Sam.

Its a natural way to increase loyalty, retention, and morale, as workers directly benefit from the companys success.

Read on to learn more about what profit sharing is and how it can benefit you and your employees.

How To Decide Which Option Is Right For You

Steve Bogner, managing director at New York Citybased wealth management firm Treasury Partners, says choosing how to cash out on your 401 is a decision you should reevaluate each year.

Its very important to do a forensic on your retirement situation at least yearly and just plug in your numbers and use the models to figure out whats really the right solution for you, he says.

In other words, dont set your 401 on autopilot the day you leave the workforce and fail to check in. Each scenario for your distributions can change based on taxes and the state where you live, so be sure to keep a pulse on your unique situation.

Also Check: How Much Can We Contribute To 401k

Getting The Most From Your Employer 401 Match

Getting the most from your 401 plan is one of the best things you can do when planning your retirement. Thats because your employer may match the money you put into your account. If you work at a place that offers a 401 match benefit, when you put money from your paycheck into your 401, your employer puts money into the account, too.

If your company offers a match, you may have gotten a notice about it when you started your job. You can ask the 401 plan manager at work whether a 401 match is offered if you havent already heard about it. Companies want employees to contribute to their 401, so they match the funds as a way to spur on workers to save for their futures.

Think of matching funds as free money you receive from your job after you make pre-tax contributions to your 401 plan from your paycheck. If you fail to put money into your 401, you give up the chance to receive your employers matching amount.

Understanding The Solo 401 Plan Contribution Rules

Adam Bergman is the President of IRA Financial Group & IRA Financial Trust Company – a leading provider of self-directed retirement plans

getty

The Solo 401 plan offers small-business owners the ability to maximize their plan contributions more efficiently than almost any other retirement plan, including an individual retirement account , SEP IRA and SIMPLE IRA. And one of the best ways to maximize the benefits of your Solo 401 plan is to have a solid understanding of how the contribution rules work. These rules are the heart of the plan.

What Is A Solo 401 Plan?

A Solo 401 plan, which is also sometimes called an Individual 401, One Participant 401 or Self-Employed 401, is a retirement plan that covers just one individual. Anyone with self-employment income, including an owner-only business, can establish one.

One of the main reasons this type of account has grown in popularity is its high annual maximum contribution options. Gaining the ability to maximize your plan contributions is so important because of the concept of tax deferral, which holds that your money will grow faster when it is not subject to tax. Accordingly, the more money you can sock away, the greater the opportunity you will have to generate more retirement wealth. Further, a Solo 401 gives you more investment options than a regular workplace plan.

There are three types of contributions that can be made to a Solo 401 plan: employee deferrals, employer contributions and after-tax contributions.

You May Like: Can I Transfer Part Of My 401k To An Ira