Avoid Two Distributions In The Same Year

Your first required minimum distribution is due by April 1 of the year after you turn 70 1/2. Your second and all subsequent distributions must be taken by Dec. 31 each year. If you delay your first distribution until April, you will be required to take two distributions in the same year, which could result in an unusually high tax bill or even bump you into a higher tax bracket.

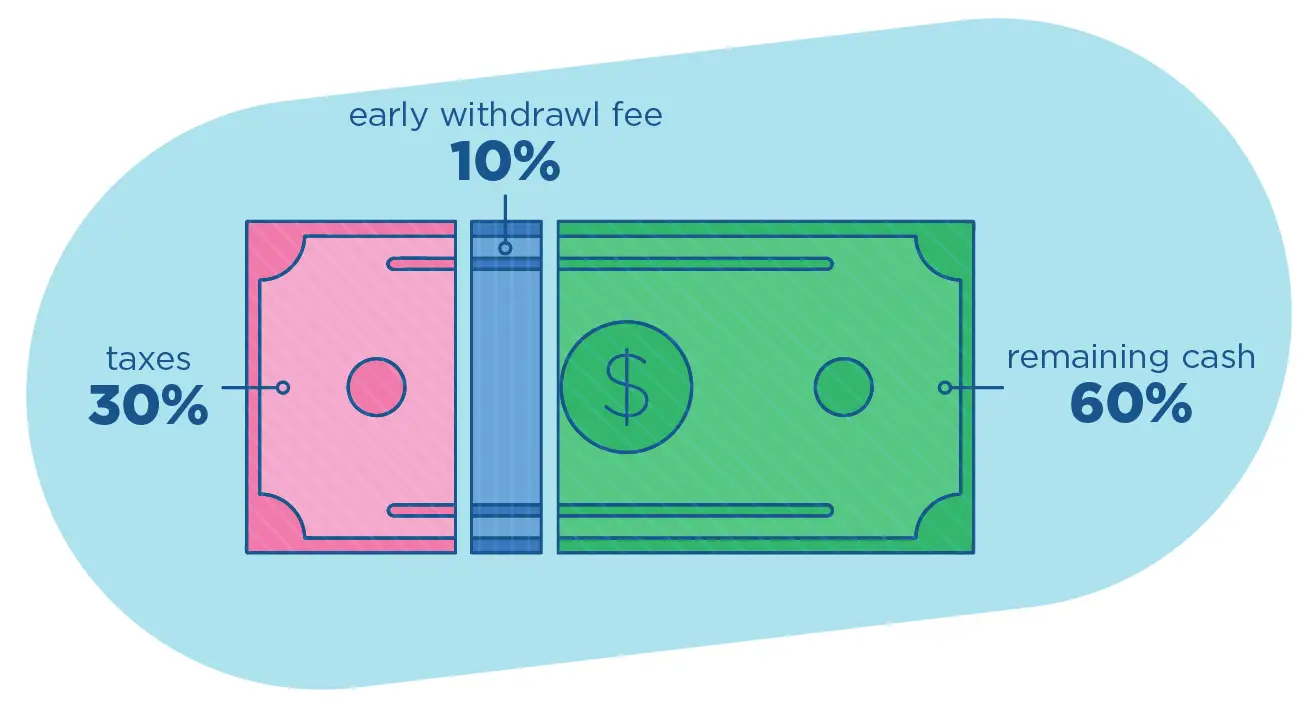

How Much Is Rrsp Withdrawal Tax

Early RRSP withdrawals are subject to taxes in two ways: RRSP withholding tax and income tax. How much RRSP withdrawal tax you pay depends on the amount you withdraw as well as your total income and tax bracket for that year.

RRSP withholding tax rate depends on the amount you withdraw.

- RRSP withdrawals in amounts up to $5,000 are subject to a 10% withholding tax,

- RRSP withdrawals of $5,001 to $15,000 are subject to a 20% withholding tax.

- RRSP withdrawals over $15,000 will be subject to an automatic 30% withholding tax.

However, you also need to be aware of your income tax bracket for the year. Because withdrawing from your RRSP counts as income, you will pay income taxes on it. If you owe more than the withholding tax, youll be taxed again when you file your taxes.

Tip 5 Give Up Citizenship

The final option, for citizens of countries like the US, that cannot escape the taxman in your home country no matter where you live, is to give up your passport and become an expatriate in another country.

Yes, we appreciate its a little drastic and not so easy to do. Thats why were sneaking it at the end of this article.

The catch with this option is you will have to qualify for citizenship in another country which typically involves you living there for at least 7 years or more, or marrying a native of that country and somedays you might wish youd just paid the tax!

Don’t Miss: How To Take Money Out Of 401k Without Penalty

Dividing Your 401 Assets

If you divorce, your former spouse may be entitled to some of the assets in your 401 account or to a portion of the actual account. That depends on where you live, as the laws governing marital property differ from state to state.

In community property states, you and your former spouse generally divide the value of your accounts equally. In the other states, assets are typically divided equitably rather than equally. That means that the division of your assets might not necessarily be a 50/50 split. In some cases, the partner who has the larger income will receive a larger share.

For your former spouse to get a share of your 401, his or her attorney will ask the court to issue a Qualified Domestic Relations Order . It instructs your plan administrator to create two subaccounts, one that you control and the other that your former spouse controls. In effect, that makes you both participants in the plan. Though your spouse cant make additional contributions, he or she may be able to change the way the assets are allocated.

Your plan administrator has 18 months to rule on the validity of the QDRO, and your spouses attorney may ask that you not be allowed to borrow from your plan, withdraw the assets or roll them into an IRA before that ruling is final. Once the division is final, your former spouse may choose to take the money in cash, roll it into an IRA or leave the assets in the plan.

Should You Take A Distribution From Your 401 Or Ira

Like the CARES Act, the Consolidated Appropriations Act allows you to withdraw funds from both a 401 and an IRA, as long as the amount is up to $100,000 across all accounts. If you are deciding whether to take a distribution from either your IRA or a 401, think about factors such as each of the account’s typical rules around penalties and taxes. F

Recommended Reading: How Can I Take Money Out Of My 401k

New & Outstanding Disaster Loans:

- Loan payment dates that are due between the disaster event date and ending 180 days after the disaster period may be delayed.

- Loan repayments may be delayed for one year , with the loans term extended by the period of the delay.

- Loan balances will continue to accrue interest during this delayed timeframe.

- The max 5-year loan term is disregarded for outstanding loans deferring payment for 1 year.

Consider Tax Loss Harvesting

Tax-loss harvesting helps investors minimize what they pay in capital gains taxes by offsetting the amount they must claim as income. Capital losses occur any time an asset diminishes in value and is sold for a price lower than the initial purchase price. Selling investments at a loss can lower or even eliminate the amount of taxes paid on gains that year.

Tax-loss harvesting only applies to taxable investment accounts not IRA or 401 accounts, which grow tax-deferred and are not subject to capital gains taxes. Married couples can claim up to $1,500 or up to $3,000 per year in realized losses to offset federal income tax.

Tax-loss harvesting wont help you avoid paying tax on a 401 withdrawal directly, but it can offset your overall tax obligations.

Don’t Miss: Which 401k Investment Option Is Best

The Basics Of 401 Withdrawal Taxes

If you are wondering whether your 401 withdrawals are taxed, the short answer is yes your 401 distributions are likely taxable.

This may come as a surprise, because there is some confusion around how retirement accounts work. People often refer to retirement accounts like 401s as tax-advantaged, or tax-deferred. This means investments within your 401 or IRA grow tax-free. Unlike taxable investment accounts, you wont be charged income tax or capital gains tax as your 401 account grows each year.

As an example, if you earn $1,500 before taxes per paycheck, and you contribute $300 of that money to your 401, then you will only be taxed on $1,200. For reference, 401 account holders can contribute up to $19,500 in 2021 , and $26,000 for those 50 and older.

This tax advantage, however, changes once an account holder starts receiving distributions from the 401. As you pull money out, youll owe income taxes on the funds. Some 401 plans will automatically withhold 20% or so of your account to pay for taxes. Youll want to check with your plan provider to see how your particular 401 works.

Wondering when you can start cashing out? Once you reach age 59.5 you can withdraw money from your 401. If you dont need the money yet, you can wait until you reach age 72 to withdraw funds. However, once you reach 72, its no longer a choice to withdraw from your 401, its mandatory. The IRS has defined required minimum distributions for certain retirement accounts, including 401s.

Cashing Out Your 401k While Still Employed

The first thing to know about cashing out a 401k account while still employed is that you cant do it, not if you are still employed at the company that sponsors the 401k.

You can take out a loan against it, but you cant simply withdraw the money.

If you resign or get fired, you can withdraw the money in your account, but again, there are penalties for doing so that should cause you to reconsider. You will be subject to 10% early withdrawal penalty and the money will be taxed as regular income. Also, your employer must withhold 20% of the amount you cash out for tax purposes.

There are some exceptions to the rule that eliminate penalties, but they are very specific:

- You are over 55

- You are permanently disabled

- The money is needed for medical expenses that exceed 10% of your adjusted gross income

- You intend to cash out via a series of substantially equal payments over the rest of your life

- You are a qualified military reservist called to active duty

Don’t Miss: How Do I Know Where My 401k Is

How To Take Money Out Of Your 401

There are many different ways to take money out of a 401, including:

- Withdrawing money when you retire: These are withdrawals made after age 59 1/2.

- Making an early withdrawal: These are withdrawals made prior to age 59 1/2. You may be subject to a 10% penalty unless your situation qualifies as an exception.

- Making a hardship withdrawal: These are early withdrawals made because of immediate financial need. You may be still be penalized for them.

- Taking out a 401 loan: You can borrow against your 401 and will not incur penalties as long as you repay the loan on schedule.

- Rolling over a 401: If you leave your job, you can move your 401 into another 401 or IRA without penalty as long as the funds are moved over within 60 days of your distribution.

- Taking a coronavirus-related withdrawal: There are special rules in place in 2020 allowing a penalty-free withdrawal of up to $100,000 if you’re experiencing hardships related to the coronavirus.

Employers Have Options Under Latest Law

Although the Consolidated Appropriations Act temporarily relaxes rules for eligible individuals to access their retirement funds, businesses don’t necessarily have to include these provisions in their plan provisions. Businesses that had to layoff workers due to business slowdowns also have more time to restore their workforce to at least 80 percent to avoid partial plan termination rules relating to their retirement plan. The partial retirement plan termination rule would be relaxed during a plan year that includes the period between March 13, 2020, and March 31, 2021, deferring assessments until March 2021.

Read Also: How To Transfer 401k From Old Job

Ways To Withdraw Money From Your 401k Without Penalty

This article was originally published on ETFTrends.com.

When hard times befall you, you may wonder if there is a way withdraw money from your 401k plan. In some cases you can get to the funds for a hardship withdrawal, but if youre under age 59½ you will likely owe the 10% early withdrawal penalty. The term 401k is used throughout this article, but these options apply to all qualified plans, including 403b, 457, etc.. These rules are not for IRA withdrawals see the article at this link for 19 Ways to Withdraw IRA Funds Without Penalty.

Generally its difficult to withdraw money from your 401k, thats part of the value of a 401k plan a sort of forced discipline that requires you to leave your savings alone until retirement or face some significant penalties. Many 401k plans have options available to get your hands on the money , but most have substantial qualifications that are tough to meet.

Your withdrawal of money from the 401k plan will result in taxation of the withdrawal, and if you do not meet one of the exceptions, a penalty as well. See the article Taxes and the 401k Withdrawal for more details about how the taxation works.

The list below is not all-inclusive, and each 401k plan administrator may have different restrictions or may not allow the option at all.

Well start with the obvious methods, all of which generally require the plan participant to leave employment:

1. Normal Begin after age 59½ after leaving employment at any age

Withdrawals With Low Or No Income

During years when you have little to no income from other sources, an RRSP withdrawal may result in a minimal or zero tax bill.

Heres how this works:

When you withdraw money from your RRSP, your financial institution withholds tax on behalf of the CRA regardless of your tax bracket or income level.

At tax time, you dont pay taxes on the federal/provincial basic personal amounts. For example, the maximum federal basic personal amount for 2021 is $13,808.

If your RRSP withdrawal is $13,808 or less , and you dont have any other income, you wont pay federal income taxes.

Given this scenario, you can expect a tax refund.

From the provincial side of things, lets use Ontario as an example.

Ontarios basic personal amount is $10,880 in 2021. Income below this amount will result in $0 provincial taxes for the 2021 tax year as well.

Check your provincial tax rates below:

| 15% |

Québécois also pay a provincial sales tax.

If you are a non-resident of Canada for tax purposes, a 25% withholding tax is applied.

Depending on your marginal tax rate at the end of the year, you may still owe federal and provincial taxes that are due by April 30th.

The other downsides for dipping into your RRSP before retirement are:

Loss of Contribution Room: When you take money out of your RRSP and it is not related to HBP or LLP, you lose the contribution room forever. You cant add it back at a later date.

You May Like: How To Protect Your 401k In A Divorce

Do You Need To Deduct 401 Contributions On Your Tax Return

You do not need to deduct 401 contributions on your tax return. In fact, there is no way for you to deduct that money.

When employers report your earnings at the end of the year, they account for the fact that you made 401 contributions. To give you an example, lets say you have a salary of $50,000 and you contribute $5,000 into a 401 account. Only $45,000 of your salary is taxable income. Your employer will report that $45,000 on your W-2. So if you try to deduct the $5,000 when you file your taxes, you will be double-counting your contributions, which is incorrect.

Watch Your Tax Bracket

Since all of your 401 distribution is based on your tax bracket at the time of distribution, only take distributions to the upper limit of your tax bracket.

“One of the best ways to keep taxes to a minimum is to do detailed tax planning each year to keep your taxable income to a minimum,” says Neil Dinndorf, CFP®, a wealth advisor at EnRich Financial Partners in Madison, Wis. Say, for example, you are . For 2020, you can stay in the 12% tax bracket by keeping taxable income under $80,250. For 2021, you can stay in the 12% tax bracket by keeping taxable income under $81,050.

You May Like: How To Move 401k To Cash

How To Minimize Taxes On 401 Withdrawals

Now that you’re finally taking withdrawals from that 401 you’ve been contributing to for decades, how are 401 withdrawals taxed? Withdrawalsdistributions, in retirement-plan speakrequire you to pay taxes on what you take out, in most cases, effectively reducing your nest egg. What do you do? Here are several ways to minimize taxes on withdrawals.

Withdraw Before You Need It

Some of the methods that allow you to save on taxes also require you to take out more from your 401 than you actually need. If you can trust yourself not to spend those fundsin other words, save or invest the extrathis can be an easy way to spread out the tax obligation.

If the person is under 59½ years of age, the IRS allows under Rule 72 to take substantially equal distributions over ones life from a qualified plan without incurring the 10% early withdrawal penalty, Sheehan says. However, the withdrawals need to last a minimum of five years. Therefore, someone who is 56 and starts the withdrawals must continue those withdrawals to at least age 61, even though they may not need the money.

CFP and certified public accountant Jamie Block of Mercer Advisors says that if you take out distributions earlier while youre in a lower tax bracket, you could save on taxes, versus waiting until youll have Social Security and possible income from other retirement vehicles. It could all add up to a sudden increase in how much youre bringing home, and if your spouse is receiving Social Security and has other retirement income too, your joint income might be even higher.

Due to the CARES Act, which the president signed into law on March 27, 2020, RMDs from all 401s and IRAs were suspended for 2020. So if 2020 was when your RMDs were set to begin, youve got a bit of a breather in which you may still be in a lower tax bracket.

You May Like: What’s My 401k Balance

What If You Are The Beneficiary Of A 401 Plan

If you are the beneficiary of a 401 plan, you’ll have a little bit different set of rules that apply to taking money out of the 401 plan. Your choices will depend on whether you were the spouse or non-spouse of the 401 plan participant and whether the 401 plan participant had reached age 70 1/2the age for required minimum distributions .

If you or your spouse turned 70 1/2 before Jan. 1, 2020, the age for RMDs is still 70 1/2. If you or your spouse turned 70 1/2 on or after Jan. 1, 2020, the age for RMDs is 72.

Better Options For Emergency Cash Than An Early 401 Withdrawal

We know it can be a struggle when suddenly you need emergency cash for medical expenses, student loans, or crushing consumer debt. The extreme impact of coronavirus on public health and the economy has only compounded some of the more routine challenges of consumer cash flow.

We get it. The money squeeze can be quick and traumatic, especially in a more volatile economy.

Thats why information about an early 401 withdrawal is among the most frequently searched items on principal.com. Understandably so, in a world keen on saddling us with debt.

But the sad reality is that if you do it, you could be missing out on crucial long-term growth, says Stanley Poorman, an advice and planning manager for Principal® Advised Services who helps clients on household money matters.

In short, he says, Youre harming your ability to reach retirement. More on that in a minute. First, lets cover your alternatives.

Don’t Miss: How Much Will My 401k Grow If I Stop Contributing