Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Company Matching Aka Free Money

Because many companies offer their employees a dollar-to-dollar match on 401 contributions up to a certain amount, many employees choose to max out their 401 contributions for the year first, then contribute to another retirement account, such as an IRA. At a minimum, you should aim to contribute enough to take full advantage of your employer match, if they offer one, says Jason DallAcqua, a CFP and president of Crest Wealth Advisors LLC. .

Total Annual 401 Contribution Limits

Total contribution limits for 2022 are the following:

- $61,000 total annual 401 if you are age 49 or younger

- $67,500 total annual 401 if you are age 50 or older

The dollar amounts listed above are the total maximum amount that can be contributed. This number is a combination of both your own and your employers contributions.

In some cases, you can contribute additional amounts to other types of plans these may include a 457 plan, Roth IRA, or traditional IRA. It all depends on your income and the types of plans available to you.

Don’t Miss: How Do You Know If You Have An Old 401k

Think About How Much You’ll Need In Retirement

Contributing the maximum to your 401 requires a lot of money especially as an ongoing, year-after-year commitment. It may or may not be enough to fund your retirement, or it could be even more than you need. Your 401 contribution amount should be guided by your retirement savings goal.

How much money you’ll need in retirement depends on when you plan to retire, how much of your current income youd like to replace and how much you want to rely on Social Security.

Most experts recommend saving 10% to 15% of your income, but our suggestion is to get a more detailed goal from a retirement calculator.

If you need to start at a lower contribution and work your way up, that’s fine. Aim to contribute at least enough to grab the match, then bump up the percent you contribute by 1% or 2% each year.

Tax Deductible Ira Contributions If I Have A Solo 401k Question:

My question: As my wife and I are *not* contributing to our solo401k plan, does that mean that we are not active participants and IRA contributions are tax deductible?

Good question. Yes, you are still considered covered by a retirement plan at work even if you are not making solo 401k contributions.

While you can still contribute to a traditional IRA, your traditional IRA contribution deductions will be reduced if your AGI is a certain amount.

For 2017, if you are covered by a retirement plan, your deduction for contributions to a traditional IRA is reduced if your AGI is:

- More than $99,000 but less than $119,000 for a married couple filing a joint return or a qualifying widow,

- More than $62,000 but less than $72,000 for a single individual or head of household, or

- Less than $10,000 for a married individual filing a separate return.

Dont Miss: How To Make 401k Grow Faster

You May Like: What Age Can You Start A 401k

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

An Ira Might Be A Better Option

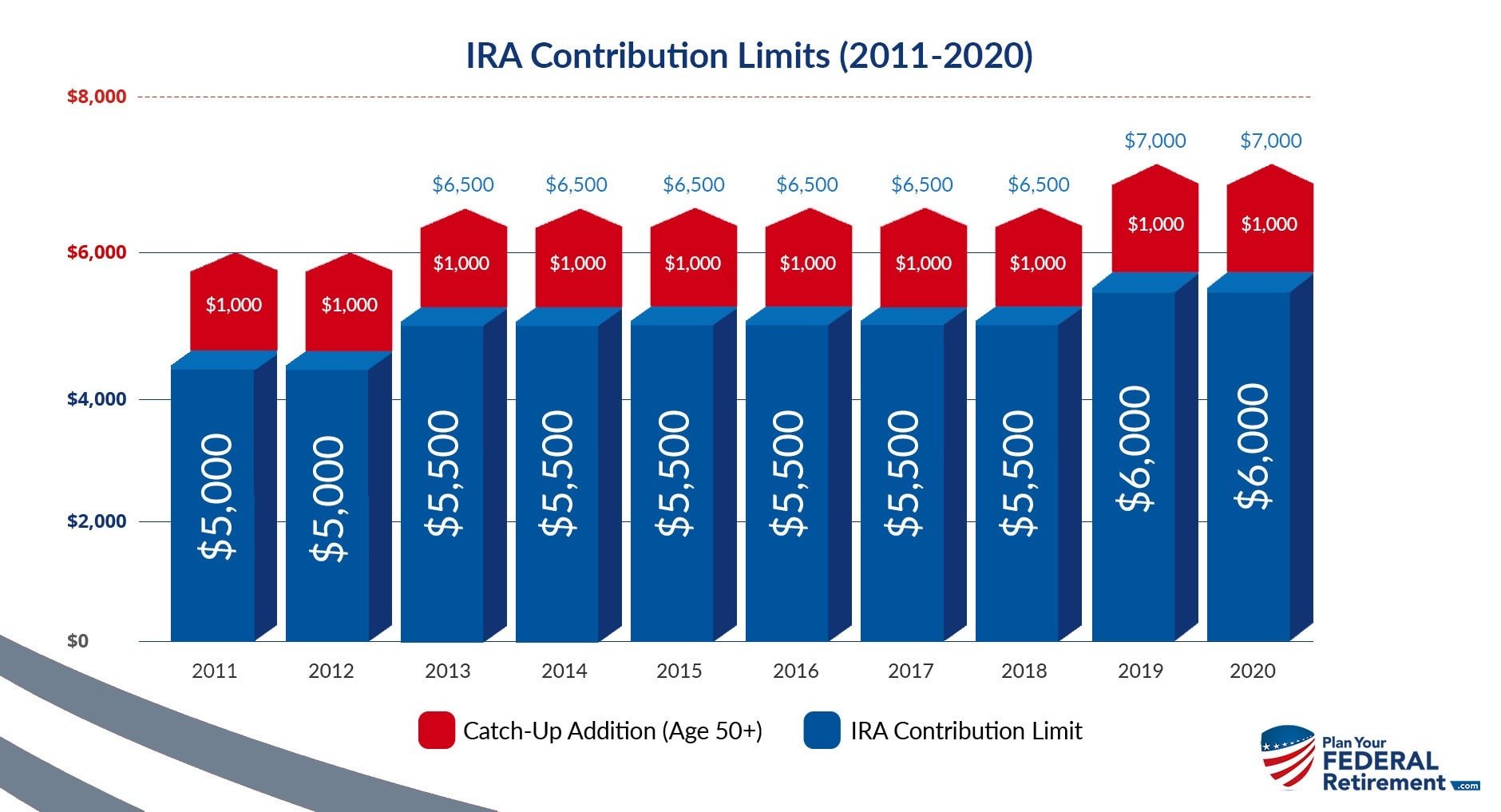

If you are already contributing up to your employer match, another way to invest additional cash is through a traditional or Roth individual retirement account. The IRA contribution limit is much lower $6,000 in 2021 and 2022 so if you max that out but want to continue saving, go back to your 401.

Some 401 plans, typically at large companies, have access to investments with very low expense ratios. That means youll pay less through your 401 than you might through an IRA for the very same investment. In other cases, the opposite is true small companies generally cant negotiate for low-fee funds the way large companies may be able to. And because 401 plans offer a small selection of investments, youre limited to what’s available.

Lets be clear: While fees are a bummer, matching dollars from your employer outweigh any fee you might be charged. But once youve contributed enough to earn the full match or if youre in a plan with no match at all the decision of whether to continue contributions to your 401 is all about those fees. fee analyzer.) If the fees are high, direct additional dollars over the match to a traditional or Roth IRA.

Don’t Miss: What Is A 401k Vs Roth Ira

Is There An Income Limit For Contributing To A 401

Not exactly. If you have access to a 401 plan at work, you can put money into it no matter how high or how low your salary is. But listen up, high-income earners: The IRS does limit how much of your salary and compensation is eligible for a 401 match.

For 2021, the compensation limit contributions and matches) is limited to $290,000.5 So keep that in mind!

Heres how it works. Lets say you make $500,000 this year and your company offers a 4% match on your 401 contributions. You contribute the maximum $19,500 amount that youre allowed to put into your 401 this year. But instead of matching that $19,500 , your employer only contributes $11,600. Why? Because your employer is only allowed to apply your match on up to $290,000 of your compensation, and 4% of $290,000 is $11,600.

Donât Miss: How Do I Start My Own 401k

Limits For Highly Compensated Employees

All 401s are subject to annual nondiscrimination tests to ensure the plans don’t provide unfair advantages to HCEs and key employees that lower-earning employees don’t get. These tests ensure HCEs aren’t contributing substantially more of their earnings or receiving more in employer contributions compared to non-HCEs. They also place limitations on how much of a 401 plan’s assets can be in the hands of HCEs. Failing a nondiscrimination test could result in the 401 plan losing its tax benefits, so companies want to avoid this at all costs.

Companies that fail can remedy the situation in a few ways. First, they can provide additional nonelective contributions to lower-earning employees to bring the plan into compliance, or they can place additional limits on HCE contributions, refunding them in some cases if employees have already contributed too much for the year. They can also do a combination of the two.

If a company has to limit HCE contributions, they may not be able to contribute the full sums listed in the table above. Their maximum contribution limits depend in part on how much lower-earning employees are contributing to their 401s. HCEs should talk to their company’s HR department to learn about how much they’re eligible to contribute annually.

Read Also: Can You Invest In 401k And Roth Ira

How Much Should You Contribute To Your 401

Most retirement experts recommend you contribute 10% to 15% of your income toward your 401 each year. The most you can contribute in 2019 is $19,000, and those age 50 or older can contribute an extra $6,000. In 2020, you can contribute a maximum of $19,500. Those age 50 or older will be able to contribute an additional $6,500. However, you can use our 401 calculator to figure out how much you can expect to earn based on any contribution amount you choose.

Also Check: How Do You Max Out Your 401k

How Much Should You Contribute To Your 401 Rule Of Thumb

As a rule of thumb, experts advise that you to save between 10% and 20% of your gross salary toward retirement. That could be in a 401 or in another kind of retirement account. No matter where you save it, you want to save as much for retirement as you can while still living comfortably.

Its important to say that this is just a general rule. The actual amount you should save depends on your individual situation. For example, if you are 50 years old and dont have any retirement savings, you should save more than 20% of your gross annual salary. If youre 30 years old and already have $100,000 in retirement savings, you could probably decrease your contributions for a bit in order to pay off a mortgage or loan. Its difficult to create a one-size-fits-all plan, because everyone is in a different place with his or her finances.

Saving 10% to 20% of your salary every year might sound like a lot. Luckily, you dont have to do it all at once. You can spread your contributions out throughout the year and you can contribute more or less some years. You also dont have to save all that money through your 401. Lets take a step back and talk about other factors you should consider when you think about how much to contribute to your 401.

Also Check: Should I Rollover My 401k When I Retire

Also Check: How To Get Money From My 401k Plan

Limitation On Elective Deferrals

The maximum amount you can defer into your 401 plan adjusts each year for inflation. As of 2012, the standard limit is $17,000. However, for people age 50 and older, the contribution limit increases by $5,500 because of what is known as a “catch-up” contribution. This extra $5,500 increases the total limit for someone older than 50 to $22,500. The catch-up contribution does not count toward the general 401 plan contribution limits.

Working With Your Financial And Tax Professionals

A 401 plan can become the cornerstone of a personal retirement savings program, providing the foundation for future financial security. Consult your financial and tax professionals to help you determine how your employerâs 401 and other savings and investment plans could help make your financial future more secure.

Important NoteEquitable believes that education is a key step toward addressing your financial goals, and weâve designed this material to serve simply as an informational and educational resource. Accordingly, this article does not offer or constitute investment advice and makes no direct or indirect recommendation of any particular product or of the appropriateness of any particular investment-related option. Your needs, goals and circumstances are unique, and they require the individualized attention of your financial professional. But for now, take some time just to learn more.

Please be advised that this material is not intended as legal or tax advice. Accordingly, any tax information provided in this material is not intended or written to be used, and cannot be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer. The tax information was written to support the promotion or marketing of the transactions or matter addressed and you should seek advice based on your particular circumstances from an independent advisor.

Whatâs the next step for you?

A financial professional can help you decide. Letâs talk.

Recommended Reading: How Soon Can I Get My 401k After I Quit

Knowing These Rules Can Save You A Lot Of Trouble With The Irs

A 401 is a tax-advantaged retirement account, so the government sets limits on how much you can contribute every year. But it also understands that inflation makes retirement more expensive over time, so it reevaluates its limits every year and sometimes raises them. Here’s an overview of all of the contribution limits the government imposes on 401s in 2020 and 2021.

Best Places For Employee Benefits

SmartAssets interactive map highlights the counties across the country that are best for employee benefits. Zoom between states and the national map to see data points for each region, or look specifically at one of four factors driving our analysis: unemployment rate, percentage of residents contributing to retirement accounts, cost of living and percentage of the population with health insurance.

Read Also: How Much Will 401k Pay Per Month

Why Employers Offer 401s

In 1978, when the law authorizing the creation of the 401 was passed, employers commonly attracted and retained talent by offering a secure retirement through a pension . The 401 created an entirely new system, with more flexibility for both employer and employee. One of the ways it did so was by giving employers the option to match employee contributions.

Matching is a very transparent process: for every dollar you put into your 401, your employer also puts in a dollar, up to a certain amount or percentage of your income. Theres no mystery here. If your employer promises to match all 401 contributions up to 5% of your income, and you contribute that amount every month, your employer will match you dollar for dollar, every month. Its a win-win situation. You are doubling your money, and your employer is building a happy workforce.

Breaking It Down: Where Do You Fit In

There are many reasons you might think this chart seems totally reasonable, or, conversely, totally unreasonable. And thats understandable. Life presents us all with different challenges. We have unexpected medical expenses, decide to go back to school, or have kids and want to pay their college tuitions. These are all perfectly valid excuses as to why you might be falling behind where this chart says you should, or could, be.

Based on this chart, you would think that most Americans should be retiring as multi-millionaires at age 65. This probably seems way off-base, and in reality, it is most people retire with very little in the way of savings and investments. The point is that this chart shows what is possible if you are disciplined and strategic about your 401k savings.

If you are on the younger end of the ages shown on the chart, you may be daunted at the prospect of contributing $8,000 per year to your 401k, not to mention $19,500. Where you live, what your first-year salary is, or what loans you may be paying can make it difficult for this contribution to seem realistic. Its crucial, however, to recognize the importance of saving as much as you can for retirement as early as you can.

So, lets determine, based on the two scenarios in the potential savings chart, whether these figures would be sufficient to support your lifestyle for the rest of your retirement.The average life expectancy for men is around 84 years old, and 86.5 years old for women.

You May Like: How To Cash Out 401k Without Penalty

Why Should I Use One

Matching dollars, for one thing. Over 90% of employers that offer a 401 plan also kick in a company match, which means as you contribute, your employer will, too. Commonly, that match will be worth 50% to 100% of your contributions, up to a limit that typically falls between 3% and 6% of your annual salary. If your employer offers up this free money, a good rule of thumb is to do everything you can to contribute enough to take advantage of it.

The other huge benefit of the 401 is that it allows you to put a lot of money away for retirement in a tax-advantaged way. The annual 401k contribution limit is $20,500 for tax year 2022, with an extra $6,500 allowed as a catch-up contribution every year for participants age 50 or older.

Is A Cash Balance Plan Right For Me

You can squeeze twenty years of savings into ten with a cash balance plan strategy. This is extremely valuable for many high-earners who have gotten a late start on retirement. If you have completed years of schooling or focused your early assets on building your business, a cash balance plan can help you catch up on retirement savings, while paying less tax every year while you do so.

Of course, this is not a no-strings attached benefit. A cash balance plan is a defined benefit plan, much like a company pension. Unlike a 401, which is based on how much money you can put into the plan every year, a cash balance plan is based on how much you can take out of the plan every year once you are retired. Using your age, expected investment return, and annual compensation, a professional can calculate how much youll need to contribute each year to reach your retirement goal.

These defined contribution requirements make a cash balance plan much less flexible than a 401. A cash balance strategy is therefore a good fit only if you can commit to making large contributions year after year. With that understanding, you might be a good candidate for a cash balance strategy if:

Don’t Miss: How Many Loans Can I Take From My 401k