Where Should I Invest After Maxing Out A Roth Ira And A 401

If you have access to a health savings account , this is a great and lesser-known third option for retirement investing. If you accumulate more money than you need for medical expenses in your HSA, you can withdraw this money for any reason with no penalty after age 65. You’ll just pay ordinary income tax on your withdrawals if you don’t use them for medical expenses. After that, you might want to look into standard, taxable investment accounts.

You Can Contribute To Both An Ira And A 401 But There Are Limitations You Need To Know

A work 401 is a nice perk to help you increase your retirement savings. If you’re also trying to save outside of your employer-sponsored retirement plan, however, you might run into some problems.

The good news is that you can contribute to an IRA even if you also contribute to a 401 at work. There are certain limitations you should consider, though.

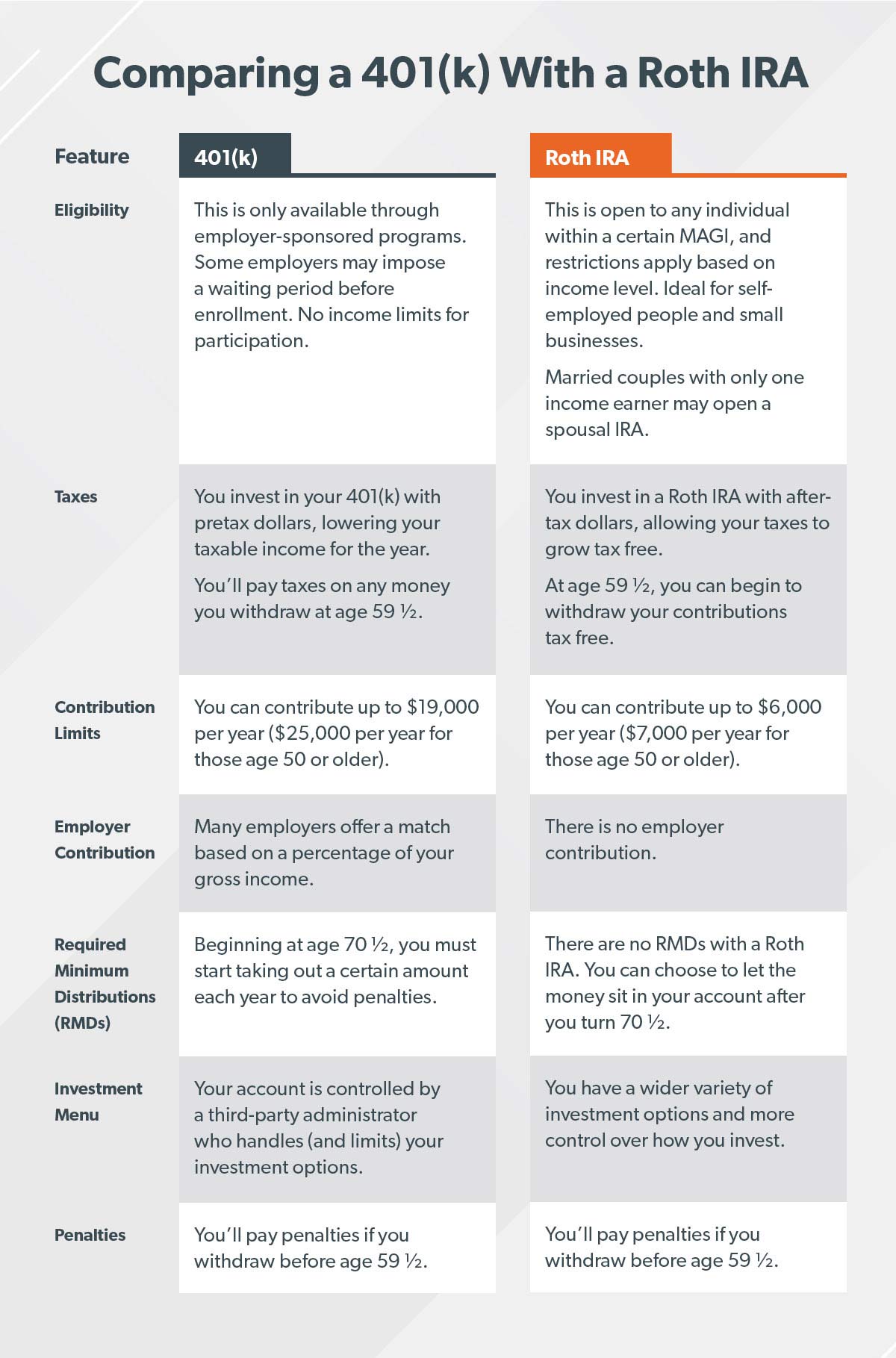

While a 401 and an IRA will both help you save for your retirement, there are a few important differences. A 401 is established by an employer an IRA is established by an individual. A 401 may have a company match contribution. And a 401 may have more limited investment options than an IRA.

How To Maximize Your 401 Retirement Savings

A workplace 401 account can be a powerful tool to help build your retirement savings. To maximize your 401 benefits, follow these tips:

1. Set your contribution level to take full advantage of your employers 401 match. If your company matches a certain percentage of your contributions, set your contribution level to take maximum advantage of the match. Otherwise, youre leaving money on the table.

2. Start contributing to your 401 immediately.

3. Take advantage of target-date funds. If youre overwhelmed by the investment options offered by your 401 plan, choose a target-date fund aligned with your anticipated year of retirement. Target date funds are optimized for your retirement timeline, making them great options for beginners or more hands-off investors.

4. Increase your 401 contribution percentage regularly. Each year, increase your 401 contribution rate by at least one additional percentage point. Gradual small increases have a minor impact on your take-home pay and a major impact on your retirement nest egg over time. In addition, if you receive any raises or bonuses, dedicate at least a portion of them to your savings.

Also Check: Can My Wife Take My 401k In A Divorce

Can I Add More Money To My 401k Account Whenever I Want

Find out how and when to make a 401k contribution. You and Your 401K

When you find yourself between jobs or if your employer doesnt offer a 401k retirement account, you might wonder, Can I add money to my 401k? Unfortunately, employers dont allow you to contribute to your 401k outside of payroll, which means you cant add extra cash to your account unless its funneled from your paycheck via automatic deposit. Heres what you can do to prepare for retirement by maximizing your 401k contributions.

Campaigns To Abolish The Code

The Tax Cuts and Jobs Act of 2017 enacted significant changes to the previous laws. However, there have also been ongoing campaigns to abolish the entire system. The two most recent bills:

In 2017, the House of Representatives Bill H.R. 29, The Tax Code Termination Act, was filed to abolish the Internal Revenue Code of 1986 by the end of 2021. The H.R. 29 bill would require Congress to approve a new federal tax system by July 4, 2021, prior to abolishing the current system.

Bill S.18, the Fair Tax Act of 2017, was introduced into Congress on January 3, 2017. The bill proposes imposing a national sales tax on the use or consumption of taxable property or services in the U.S. in place of personal and corporate income tax, employment and self-employment tax, and estate and gift taxes. The proposed sales tax rate would be 23% in 2019, with adjustments to the rate made in subsequent years. The bill includes exemptions for the tax for used and intangible property, property or services purchased for business, export or investment purposes and for state government functions. The Internal Revenue Service would be disbanded entirely, with no funding for operations authorized after 2021.

The Fair Tax Act has made little progress since its introduction. The passage of the TCJA, which made significant changes in the current tax system but reaffirmed its basic structure, makes the future of the Fair Tax Act uncertain to unlikely.

You May Like: What Is My Fidelity 401k Account Number

Solo 401 Establishment Deadline:

For 2021, in order to make employee contributions for 2021, the self-employed business owner had to establish the solo 401k plan by December 31, 2021. However, if the plan was established on January 1, 2022 or after by your business tax return due date including the business tax return extension, then you cam make employer profit sharing contributions for 2021 but cannot make employee contributions. For example, an employer operating the plan on a calendar-year basis had to complete the solo 401k plan documentation no later than .

For makin 2021 solo 401k plan contributions, the solo 401k has to be adopted by December 31, 2021 for self-employed businesses operating the plan on a calendar-year basis in order to preserve the right to make both employee and employer contributions in 2022 for 2021 by the business tax return including business tax return extensions. Otherwise, if the solo 401k plan is adopted on January 1, 2022 or after but by your business tax return due date including extensions, you will only be allowed to make employer contributions not employee contributions to the solo 401k plan. To learn more about the December 31, 2021 plan adoption/establishment deadline VISIT HERE.

Total Annual 401 Contribution Limits

Total contribution limits for 2022 are the following:

- $61,000 total annual 401 if you are age 49 or younger

- $67,500 total annual 401 if you are age 50 or older

The dollar amounts listed above are the total maximum amount that can be contributed. This number is a combination of both your own and your employers contributions.

In some cases, you can contribute additional amounts to other types of plans these may include a 457 plan, Roth IRA, or traditional IRA. It all depends on your income and the types of plans available to you.

Read Also: How Can I Get Money From My 401k

What Happens If I Exceed My 401 Limit By Mistake

If you contribute too much to your 401 and notice your mistake before the tax filing deadline, you can probably correct it with your employer. Youll need to notify your plan administrator. Theyll return the excess money to you, and youll get a new W-2 and pay taxes on your new total taxable wages.

If you dont catch the mistake before tax day, you may have to pay taxes twice on the amount you contributed over the limit. Thats because the excess contribution cant be deducted from your taxes in the year it was made, and because the IRS will still count that money as taxable when its distributed too.

About the author:Arielle O’Shea is a NerdWallet authority on retirement and investing, with appearances on the “Today” Show, “NBC Nightly News” and other national media. Read more

Solo 401 Withdrawals And Details

As with all qualified retirement plans, there are rules to when you can and must start taking withdrawals from your Solo 401 plan. You must begin taking the minimum required distribution no later than age 72 . There is a 10% early withdrawal penalty for distributions take before age 59 1/2, but exceptions may apply.

Please refer to the IRS page on individual 401s and review our Solo 401 Guide for additional details.

Read Also: Can I Take Out From My 401k

What Is A 401 Plan And How Does It Work

A 401 Plan is a retirement savings vehicle that allows employees to have a portion of each paycheck directly paid into a long-term investment account. The employer may contribute some money as well.

There are immediate tax advantages for the employee if the account is a traditional 401 and tax advantages after retiring if it is a Roth 401.

In either case, the money earned in the account will not be taxed until it is withdrawn during retirement if it is a traditional 401. If it is a Roth 401, no taxes will be due when the money is withdrawn.

Can You Open A Joint 401 As A Married Couple

While it is possible for married couples to open a joint bank account, you cannot open a joint 401 even if you are a couple. IRS rules require that retirement accounts such as 401s and IRAs be individually-owned, and you cannot co-own your spouseâs 401 account or move funds between the retirement accounts.

Spouses suffer no harm in maintaining their own retirement account. The two 401s can grow in tandem by choosing investments that meet their financial goals. The goal of the spouses should be to create a diversified portfolio comprising a mix of short-term and long-term assets.

However, it is possible to have joint taxable investment accounts as a couple. For example, you can open a joint brokerage account as a married couple to buy and sell securities such as stocks, bonds, and ETFs. A brokerage account has various pros such as no income limits, tax benefits, and no funding restrictions, which make it more flexible than a 401 account. On the downside, brokerage accounts may have higher fees and higher risks than a traditional retirement account.

Read Also: How To Transfer 401k From Vanguard To Fidelity

Reasons Not To Max Out Your 401

While maxing out 401 contributions is a lofty goal, there are reasons why you may decide to limit deferrals after receiving the full company match.

“This, of course, may vary depending on goals,” said Marianela Collado, a CFP and CPA at Tobias Financial Advisors in Plantation, Florida.

For example, if you’re saving a down payment for a home, you may decide to re-route funds until meeting your short-term goal, she said.

Likewise, if you’re sitting on high-interest credit card debt or don’t have an emergency fund, you may allocate money elsewhere before increasing 401 deferrals.

How Can Married Couples Max Out Their 401

If you and your spouse are both working and the employer provides a 401, you can contribute up to the IRS limits. For 2021, each spouse can contribute up to $19,500, which amounts to $39,000 annually for both spouses. If you and your spouse are already 50 years, each spouse can make an additional $6,500 in catch-up contributions to their account. This increases each spouseâs contribution to $26,000 or $52,000 between the two spouses annually.

If your income does not allow you to max out your 401, you can maximize any employerâs match that the employer provides. Usually, an employer may match your contribution up to a certain limit. For example, if your employer offers a 5% match, and your spouseâs employer offers an 8% match, you should try to collect all the matches, since it equates to getting free money for your retirement savings. You should also compare the 401 fees you incur and the investment options that the plan sponsor provides. If the fees are too high, you can rollover 401 to an IRA with lower fees and more investment options.

You May Like: How To Find 401k From Former Employer

Could You Increase Your 401 Contribution

How often you can adjust your 401 or 403 contribution is generally determined by your employer and your retirement planit may be once a year or as often as youd like.

If youre able, reducing non-essentials or allocating new income could allow you to bump up the amount youre saving.

A 1% increase only makes a small difference in your paycheckbut may make a big difference down the road. Consider the example below for a $35,000 annual income:1

| Additional contribution |

|---|

1 This example is for illustrative purposes only. It assumes $35,000 in annual income, 3.5% annual wage growth, 30 years to retirement, 7% annual rate of return and a 25% tax bracket. Estimated monthly retirement income calculations assume a 4.5% annual withdrawal in retirement. The assumed rate of return is hypothetical and does not guarantee any future returns nor represent the return of any particular investment option. Reduced take-home pay is accurate for the initial year and would change based on participants annual pay. Estimated savings amounts shown do not reflect the impact of taxes on pre-tax distributions. Individual taxpayer circumstances may vary.

2 Contributions are limited to the lesser of the annual plan or the IRS limit as indexed annually.

3 Some plans may not allow catch-up contributions to the plan.

This document is intended to be educational in nature and is not intended to be taken as a recommendation.

Ira Eligibility And Contribution Limits

The contribution limits for both traditional and Roth IRAs are $6,000 per year, plus a $1,000 catch-up contribution for those 50 and older, for both tax years 2020 and 2021. You can split your contributions between the two types, but your total contribution is still limited to $6,000 or $7,000. Traditional and Roth IRAs also have some different rules regarding your contributions

Don’t Miss: Where To Put My 401k

How Do Small Business Owners Choose The Best 401 For Their Needs

To find the right 401 for their small business, employers generally look for plan providers that:

- Charge reasonable plan and investment fees and have no hidden costs

- Provide real-time integration between the 401 recordkeeping and payroll systems to eliminate manual data entry and reduce errors

- Offer a simplified compliance process

- Make administrative fiduciary oversight available

- Offer ERISA bond and corporate trustee services

- Help with investment fiduciary services and plan investment responsibilities

- Make investment advisory services available for employees

Why It’s Worth Meeting The Higher 401 Contribution Limit

If you can already afford to max out your 401 account, you should take advantage of the increased contribution limit in the new year and plan on saving an additional $1,000 to make your total contribution for the year $20,500.

It’s sort of a no-brainer option, thanks to these tax breaks that come with 401 contributions:

Don’t Miss: How Can I Get Access To My 401k

Filing Status And Income

As for contribution limits, not everyone can contribute to a Roth IRA because of phase-outs due to income caps. In contrast, there are no income caps on contributions to a traditional tax-deferred IRA.

The most P.H.s daughter can contribute will depend on her modified adjusted gross income . Assuming she is single, she can contribute up to the limit for a Roth IRA if her MAGI is less than $129,000 in 2022. If her MAGI is higher than that but less than $144,000, she can still contribute, but the amount is reduced.

When MAGI is $144,000 and above, no Roth IRA contribution is permissible. However, there is no comparable MAGI limit for traditional IRAs. That is, someone who cannot contribute to a Roth IRAdue to earnings limits can contribute to a traditional IRA. Further, there is no MAGI limit on who can convert from a traditional IRA to a Roth IRA. If you decide to contribute to a traditional IRA and convertto a Roth IRA, be sure to review your plan with your tax adviser before taking action.

As to IRS resources, the Roth IRA chart for 2022 on IRS.gov covers limits for other filings statuses, including couples. There also are details about how to calculate a reduced Roth IRA contribution amount if your MAGI is higher than permitted under current limits.

Contribute To Solo 401k And Day

Your wifes ability to contribute to a solo 401 depends on the self employment income that she receives from the partnership. Specifically, in order to determine how much she could contribute to the solo 401 she would take the amount reported on line 14 of her K-1 and reduce it by one half of the self-employment tax. Of that number, she could contribute for 2021: up to $26,000 as an employee contribution plan sponsored by her daytime employer) and a profit-sharing contribution to the solo 401 equal to 20% of that same number provided that her overall contribution to the solo 401 cannot exceed $64,500 for 2021. For 2022, the overall limit is $67,500.

Don’t Miss: Do I Need Ein For Solo 401k

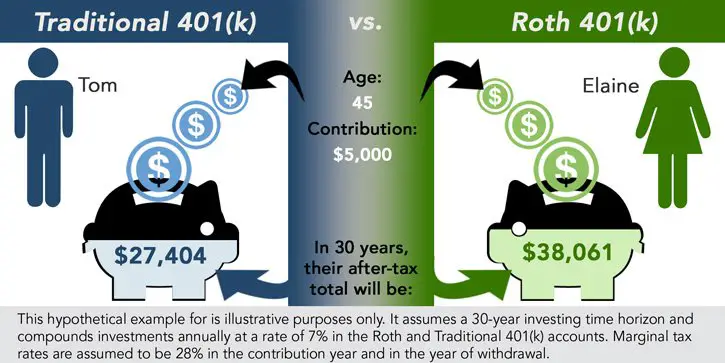

Traditional 401 Vs Roth 401

When 401 plans became available in 1978, companies and their employees had just one choice: the traditional 401. Then, in 2006, Roth 401s arrived. Roths are named for former U.S. Senator William Roth of Delaware, the primary sponsor of the 1997 legislation that made the Roth IRA possible.

While Roth 401s were a little slow to catch on, many employers now offer them. So the first decision employees often have to make is between Roth and traditional.

As a general rule, employees who expect to be in a lower after they retire might want to opt for a traditional 401 and take advantage of the immediate tax break.

On the other hand, employees who expect to be in a higher bracket after retiring might opt for the Roth so that they can avoid taxes on their savings later. Also importantespecially if the Roth has years to growis that there is no tax on withdrawals, which means that all the money the contributions earn over decades of being in the account is tax-free.

As a practical matter, the Roth reduces your immediate spending power more than a traditional 401 plan. That matters if your budget is tight.

Since no one can predict what tax rates will be decades from now, neither type of 401 is a sure thing. For that reason, many financial advisors suggest that people hedge their bets, putting some of their money into each.