Do I Pay Taxes On Social Security

Most of you have to pay your social security benefits with Federal income tax.

You may be charged income tax of up to 50% of your benefits from $25,000 to $34,000. For more than $34,000, up to 85% of your benefits might be taxed.

We hope that these social security retirement calculators will be useful for you.

How Much Will My 401 Pay Per Month

I have written about retirement before, even arguing Dont save for retirement at times to make the point that saving for retirement is not about building a certain amount of net worth on which to retire. To reach your Point of Independence, it is much more important to focus on creating a recurring revenue model that generates a stable income for the rest of your life.

In the past, the company pension provided this income, and coupled with social security, retirees had confidence it would be there every month. The company hired professional investment managers to ensure they could meet the obligations. But in the last decade, pensions have been replaced by 401 plans and this change has put the retirement of millions of Americans at risk.

Today the modern version of the 401 shifts the burden to the employee a task most are not qualified to handle. But more tragically, the move shifts people away from focusing on creating a retirement income to focusing on growing their account balance. The question, How much income will I be able to generate at retirement? has been by replaced by How do I invest my account to maximize growth?

Contact me today at .

4151 Ashford Dunwoody Road, Suite 165Atlanta, GA 30319

Read our Customer Relationship Summary for more information on how we work with our clients and conduct our business.

How Does The $1000

The $1,000-a-month rule states that for every $1,000 per month you want to have in income during retirement, you need to have at least $240,000 saved. Each year, you withdraw 5% of $240,000, which is $12,000. That gives you $1,000 per month for that year.

Depending on your income from Social Security, pensions, or part-time work, the number of $240,000 multiples will vary. For example, if you want $2,000 per month, you’d need to save at least $480,000 before retirement.

When interest rates are low and the stock market is volatile, the 5% withdrawal aspect of the rule becomes even more critical. The market can go months or even years without a gain, and the discipline surrounding the 5% withdrawal rate can help your savings last through those tough times.

Recommended Reading: How To Get My 401k From A Previous Employer

How To Calculate Your Monthly 401 Contribution

In 2021, the 401 contribution limit is $19,500 for those under age 50 this increases to $20,500 for 2022. Workers age 50 or older can make an additional catch-up contribution of $6,500 in both 2021 and 2022. You and your employers combined contributions cant exceed $58,000 in 2021 or $61,000 in 2022, excluding catch-up contributions.

However, few people actually contribute these amounts. Only 12% of plan participants made the maximum contribution in 2020, when the limit was $19,500, according to Vanguard’s 2021 How America Saves report.

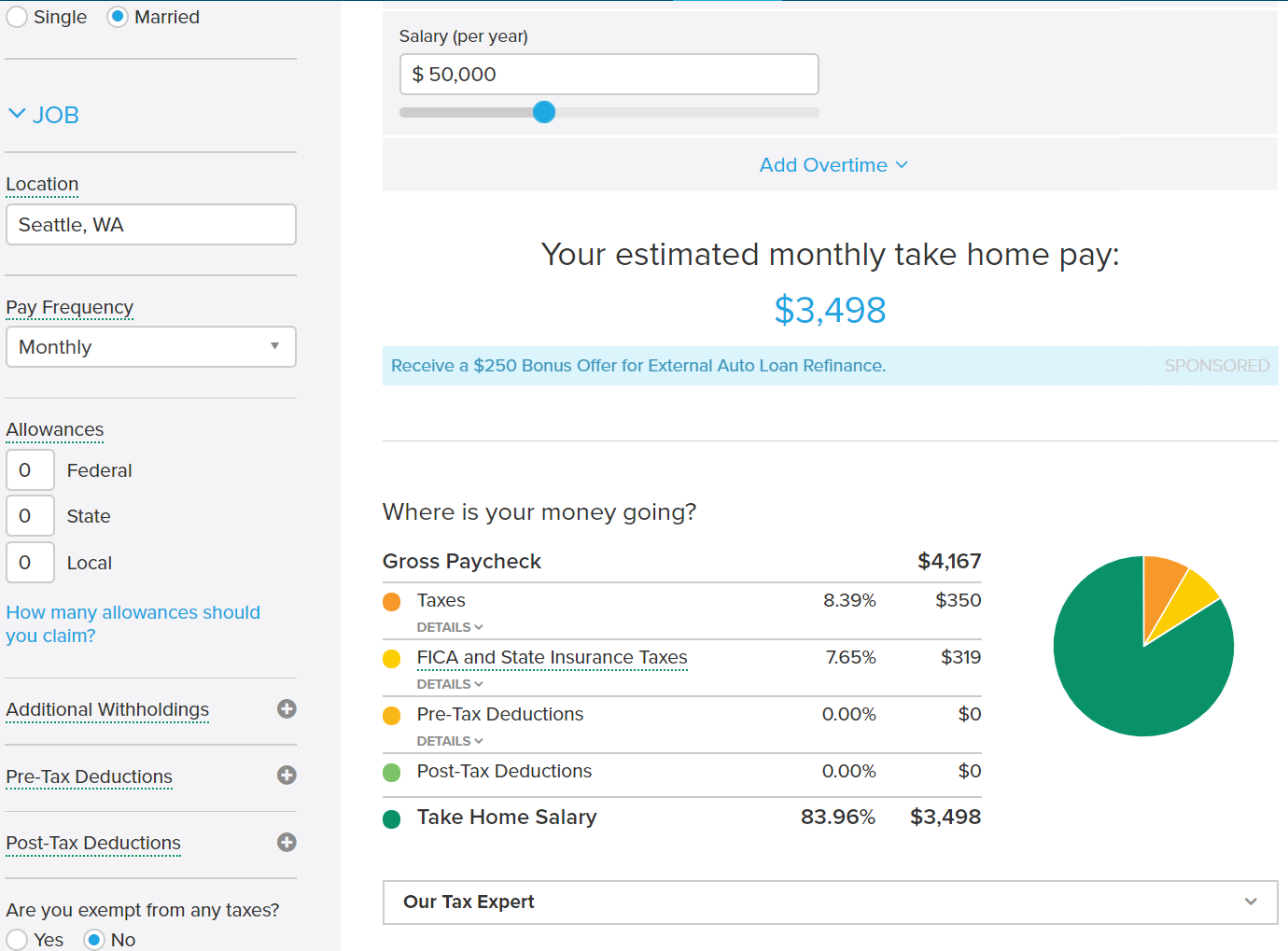

To determine how much you should be saving, you can use Social Securitys retirement estimator and see what monthly benefit you can expect from that fund. You also can use a retirement calculator to estimate how much youll need each month on top of Social Security. Choose a calculator that allows you to personalize as many factors as possible, including your current age and account balance, anticipated contributions, other sources of income, and expected rates of return.

Can I Retire At 50 With $3 Million

If you have three million dollars saved up, you can retire at 50. An annuity will begin paying out $118,800 a year to the insured at the age of 50, and it will continue to do so for the remainder of the insureds life. The amount of money you make will never go up or go down.

If the annuitant chooses the growing income option, they will get an annual income of $106,200, which will rise over time to keep pace with the rate of price increases.

Also Check: Can You Withdraw Your 401k When You Leave A Company

How To Calculate Interest Earned On A Savings Account

- The amount of your deposit or the amount you borrow with the variable “p” for principal.

- How often interest is calculated and paid , using “n” for the number of times per year.

- Interest rate, where “r” is used for the interest rate in decimal format.

- How long you earn interest, with the letter “t” for the maturity in years

How Much Do You Get For Retirement Benefits

Other circumstances, mainly the age at which you claim assistance, change the amount that you have the right to. The Social Security retirement pension average expected to be $1,543 per month in 2021.

Since each countrys pension is different, we cannot give a clear example of this wage. To find out your own pension, you must first know your retirement age in your country. Using the Retirement age calculator, you can find out your retirement age in seconds without research. Then you can find out your pension in your country by using the social security calculator by age.

Also Check: How To Open 401k For Individuals

A 401 Is A Defined Contribution Plan

Unlike a defined benefit plan , also known as a pension plan, which is based on formulas for determining retirement withdrawals, defined contribution plans allow their participants to choose from a variety of investment options. DCPs, 401s in particular, have been gaining in popularity as compared to DBPs. Today, the 401 defined contribution pension plan is the most popular private-market retirement plan. The shift in the choice between DBPs and DCP can be attributed to a number of reasons, one of which is the projected length of time a person is likely to stay with a company. In the past, it was more common for a person to stay with a company for several decades, which made DBPs ideal since deriving the most value out of a DBP required a person to stay with their company for 25 years or more. However, this is no longer the case today, as the workforce turnover rate is much higher. DCPs are highly mobile in comparison to DBPs, and their values do not drop when a person switches companies. When an employee with a 401 plan changes employers, they generally have the option to:

What Is A Good Retirement Income Per Month

According to the 2016 Bureau of Labor Statistics, the average household of 65 and over spends $ 48,885 a year, which is about $ 4,000 a month.

What is a good retirement income?

With that in mind, you should expect to need about 80% of your pre-retirement income to cover the cost of living in retirement. In other words, if you earn $ 100,000 now, you will need about $ 80,000 a year after you retire, according to this principle.

What is the average monthly retirement income?

KEY RELATIONS. The median retirement income for the elderly is about $ 24,000 however, average incomes can be much higher. On average, seniors earn between $ 2,000 and $ 6,000 a month. Older retirees usually earn less than younger retirees.

Also Check: Should I Roll My 401k Into An Annuity

How Much Should I Save If I Want To Retire Early

If you want to retire early, you need to save more than 20% of your income every year. The more you save, the less you need to live comfortably. Check out the chart below, which also assumes you get a minimum of 3% risk-free return on your money while maintaining a stable cost of living.

What is recyclingWhat are the bad things about recycling? Food scraps and particles are absorbed by recycled paper and can damage large amounts of recyclable materials. Textiles such as old clothing and video tapes, chains, hoses and electrical cables can enter sorting machines, crushing equipment and injure workers. at the processing plant.Is recycling worth it, or a waste of time?Recycling is not a waste of time. In fact, retraining is so rewarding that th

Preferred Stocks For $10000 Of Monthly Income

Preferred stocks are another popular income investment among financial advisors and more proactive investors.

Preferred stocks are like a combination of stocks and bonds. They are like stocks because they can increase in value but they are like bonds because they pay out fixed dividends.

One good thing about preferred stocks is that they are a little less risky In the event of a company needing to cut the dividend, the common shareholders get cut, if needed, before preferred shareholders.

Plus, in the rare and unfortunate event of liquidation, preferred shareholders get their equity out before common stock investors .

Preferred stocks typically yield more than most common stocks.

Don’t Miss: Where To Put My 401k

How Much Should You Have Saved In Your Hsa

So, for example, if you make $100,000 and save $10,000 a year in your 401, put $1,000 into your HSA each year, and raise your Roth IRA to $6,000, your total savings would be $17,000 — or the 17% of your income. Once you have your current savings rate, you can start a three step process to increase it to 30-40%.

What Percentage Of My Income Should I Invest And Save

- Build a pillow. Even if you make a lot of money, losing your job or a medical disaster can overwhelm you.

- Saving for retirement. You will live better after retirement if you can count on more than just social security.

- BigTicket purchases. Avoiding major purchases, such as new cars and equipment, can save you money.

- Balance your budget.

Recommended Reading: How To Check My 401k Balance

How To Increase Your Chances Of Success With A 5% Withdrawal Rate

There are other factors to consider for the 5% withdrawal rate to be successful. For example, retirement often lasts for more than 20 years. You want to be able to withdraw 5% of your savings each year and not run out of money.

One way to do this is through income investing. With this investment strategy, you invest your funds in ways that will produce income. This might include buying stocks that pay dividends and investing in real estate investment trusts and master limited partnerships . MLPs are publicly traded and tend to pay higher dividends to investors.

Investing can help ensure your funds last through a lengthy retirement. If you withdraw 5% while earning no interest on your money, your funds will last 20 years. For many, however, retirement can last much longer, and exhausting your funds doesn’t allow you to leave funds to family or charity.

If you have a portfolio yield of 3% to 4%, you may be able to withdraw 5% or more. For example, if your portfolio is earning a 4% yield from dividends and the markets rise by 3%, withdrawing 5% would be well below your annual gain of 7%. Any gains in the markets can help boost your portfolio and increase the chances of being able to withdraw 5% per year.

Using This Simple 401 Calculator

Our 401 Growth Calculator is a simple and easy way to estimate the long-term growth of your 401 retirement account by the time you want to retire. Knowing how much your current 401 account may accumulate in the future can help you determine if you should adjust your annual 401 contributions to help reach your retirement goals. After answering a brief series of questions, you will get your results, including your estimated accumulated plan balance at retirement, total out-of-pocket costs, and a summary table and bar graph illustrating your retirement plan accumulation over time.

Don’t Miss: How To Change A 401k To A Roth Ira

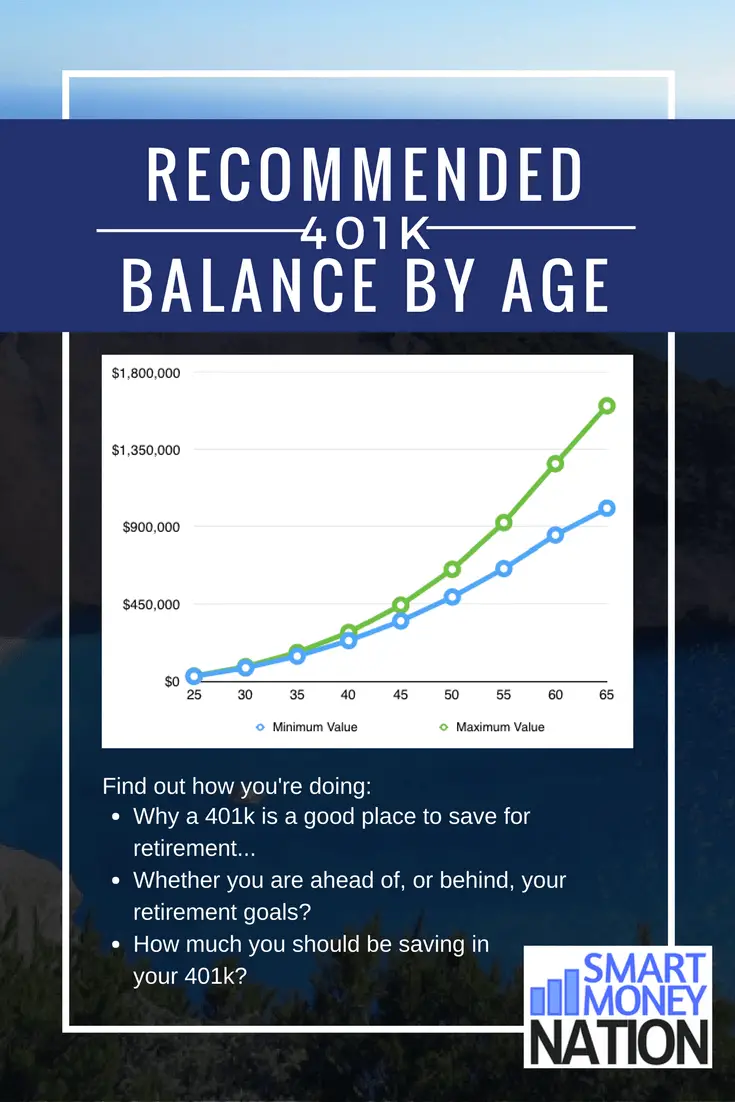

How Much Should I Have Saved By Age 65

While saving for retirement, it is helpful to know how much you need to save and whether you are on the right track. We estimated that most people who want to retire around age 65 should aspire to assets totaling between seven and a half and 14 times their gross pre-retirement income.

How much should you have in the bank to retire at 65?

Retirement experts have offered different rules about how much you need to save: somewhere close to a million dollars, 80% to 90% of your annual pre-retirement income, 12 times your pre-retirement salary.

How much money should I have at 65?

At age 65, you should have an amount of savings / net worth equal to 20X -25X your annual expenses. In other words, if you spend $ 50,000 a year, you should have about $ 1,000,000 $ 1,250,000 in savings or net worth to live a comfortable retirement lifestyle.

How Do I Use A Savings Goal Calculator

Use this savings goal calculator to find out how many reports you run more than you need to save each month to meet your financial goals. Simply enter your savings goal, your current savings balance and the number of years you will reach your savings goal. The calculator determines how much you need to save each month to reach your goal.

Recommended Reading: Can I Move Money From 401k To Ira

Why Employers Offer 401s

In 1978, when the law authorizing the creation of the 401 was passed, employers commonly attracted and retained talent by offering a secure retirement through a pension . The 401 created an entirely new system, with more flexibility for both employer and employee. One of the ways it did so was by giving employers the option to match employee contributions.

Matching is a very transparent process: for every dollar you put into your 401, your employer also puts in a dollar, up to a certain amount or percentage of your income. Theres no mystery here. If your employer promises to match all 401 contributions up to 5% of your income, and you contribute that amount every month, your employer will match you dollar for dollar, every month. Its a win-win situation. You are doubling your money, and your employer is building a happy workforce.

Reits For Investment Income Of $10000 A Month

Through REITs investors can invest in commercial real estate. Much like MLPs, REITs have gone through a major transition.

The increase in remote workers and the online sales explosion have significantly hurt much of this sector.

A well chosen, decent quality REIT portfolio yields in the 5% range or more nowadays. A more conservative REIT portfolio yields 3% to 4%, and a riskier REIT portfolio yields 6% or more.

There are also REIT ETFs and mutual funds.

Covered calls can also be sold on many REIT ETFs.

Now you have several ways to calculate how much you need to invest for $10,000 a month income based on various potential yields.

Don’t Miss: How Can I Use My 401k To Buy A House

Maximize Employer 401 Match Calculator

Contribution percentages that are too low or too high may not take full advantage of employer matches. If the percentage is too high, contributions may reach the IRS limit before the end of the year. As a result, employers will not match for the rest of the year. This calculation can show the contribution percentage window in order to take full advantage of the employer’s matching contributions.

How Much Of Your Income Should You Spend On A Mortgage

The 28% rule The 28% rule states that you must spend 28% or less of your gross monthly income on your mortgage payments . To determine how much you can afford under this rule, multiply your gross monthly income by 28%.

How much should i have saved by 30How much money should millennials have saved by age 30? Millennials should aim to earn 25% of their total gross salary by age 20. It can be a combination of savings, investment and retirement accounts. This number can be lower if you pay off your huge student debt. Save at least one annual salary for up to 30 years.How much savings should a 30 year old have?As practice shows, income is saved once at

You May Like: How To Find Out If Deceased Had 401k

How Much Would A $250000 Annuity Pay

If you acquired a $250,000 annuity at the age of 60 and immediately began receiving payments, you would receive around $1,094 every month for the rest of your life. A $250,000 annuity would pay you $1,198 a month for the rest of your life if you bought it at 65 and started receiving payments right away, assuming you bought it. If you acquired a $250,000 annuity at the age of 70 and immediately began receiving payments, you would receive around $1,302 every month for the rest of your life.

What Is Investment Return

The third equation related to investment income is called investment return. Investment return is commonly used for measuring investment performance. Many investors, however, get investment return confused with yield. Investment return is also known as ROI, or return on investment.

Investment returns include any amount an investment has increased in value plus dividends or plus compounding of both dividends and capital gains when they are reinvested.

INVESTMENT RETURN = GAIN + DIVIDENDS + COMPOUNDING

To clarify this important point, in this post, we are looking at ways to get income from investments of $10,000 a month. This does not include capital gains from investing.

When considering investment return, note that taxes and fees are not factored into the numbers in this post since they vary greatly but they will likely offset investment income and should be considered in your income planning.

where I address how to handle extraordinary expenses such as taxes and fees.

Now that we have clarified investment income vs capital gains vs investment return, and addressed investment risk, lets look more at how much investors need to invest to make $10,000 a monthin income alone.

You May Like: How To Use 401k To Start A Business