What Are The Penalties For Withdrawing From My 401 Before Age 59

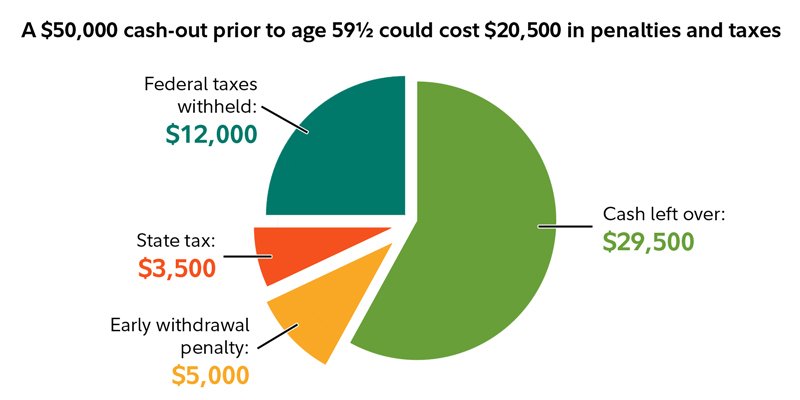

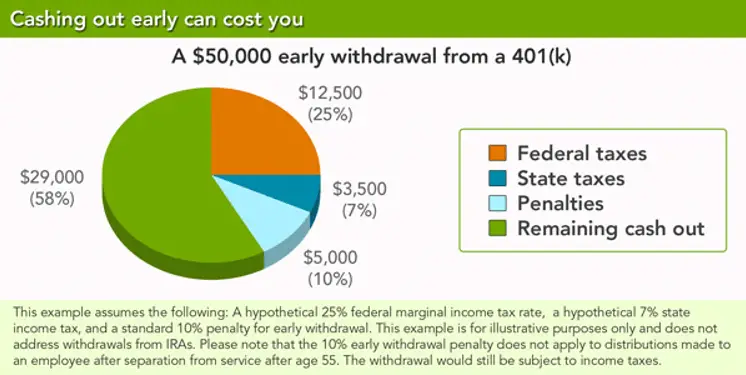

Unless you fall into one of the special exemption categories, you will pay a penalty of 10% of the amount of funds you withdraw. This can get quite pricey and really cut into your retirement savings. If you must make a withdrawal before reaching retirement age, then make sure you check the list of exemptions to the penalty. If you can qualify under one of the exemptions, then you will not be forced to pay this extra penalty.

What Percent Is Taken Out Of 401k Early Withdrawls

- Tax withheld. The IRS generally requires an automatic withholding of 20% of the amount of the early 401 withdrawal to pay taxes.

- The IRS will punish you. If you withdraw money from your 401 at 59, the IRS generally imposes a 10% penalty when you file your tax return.

- This can mean that you have less money for your future.

How To Take An Early Withdrawal From Your Ira

How to Withdraw Money From Your IRA Early Without Paying CARES and Retirement Fees. To help the millions of people whose finances have been affected by the pandemic, the March 2020 CARES Act created special distribution options for beneficiaries. Reasons for early dismissal. Common exceptions to prepayment penalties. Alternatives to Using an IRA to Raise Funds.

You May Like: How Much Can You Take Out Of Your 401k

Can I Cash Out My 401k While Still Employed

One of the rules related to cashing out a 401 relates to the employment status of the account owner. You are allowed to cash out a 401 while you are employed, but you cannot cash it out if youre still employed at the company that sponsors the 401 that you wish to cash out.

Why You Should Consider A 401 Loan Instead Of Hardship Withdrawal

If youre in need of extra funds and have no other options outside of your 401 plan, consider taking a plan loan. First, check out your 401 plan document to see if it allows for plan loans. If allowed, you can borrow up to 50 percent of the vested portion of your 401 balance. Youll pay interest as youre paying the loan off, but it is credited back into your account. And as long as you pay the loan back, its not taxable. In addition, you can still contribute to the 401 plan and pay back the loan at the same time, although it may be wiser to put that additional money toward the principal to get it paid off in a shorter time saving on interest charges.

A loan is better than a hardship distribution because with a loan, you can restore your 401 balance by paying the loan back. But there are no payback provisions for hardships once the hardship distribution is made, its out your 401. You will need to make other arrangements to cover any shortage in your retirement savings objective due to the hardship distribution.

Also Check: Can You Move Money From One 401k To Another

What Are The Rules For 401k

One of the rules of 401k plans is that members must pay before their 70th birthday. This is called a mandatory minimum distribution , and any account holder who does not withdraw their RMD will be penalized by the IRS.

Standard retirementWhat type of retirement plan is tax-deferred?Important points to keep in mind. 401 and traditional IRAs are two common types of tax-advantaged savings plans. The money saved by the investor is not taxed as income until it is withdrawn, usually afterwards retirement … Since the money saved is deducted from the gross income, the investor immediately receives a tax benefit. What to consider in retirem

Those Who Can Stomach The Loss In Stock Value

Because a 401 is an investment account, you should also consider the trade-off of missing the market rebound if you withdraw funds right now. Any money that you borrow from your 401 now wont be there when the market turns around, Renfro says. This would compound the adverse effects of an early 401 withdrawal if you dont truly need one.

Echoing that, Levine says many 401 balances have been hit hard, and taking a loan while theyre down essentially locks in the losses.

Taking an early withdrawal from your 401 can have long-term adverse effects on your financial health. However, so can the ramifications of COVID-19, especially if youve been particularly affected by the disease. The CARES Act gives options to those who need it most. Theres no right answer, but in times of uncertainty and struggle, those options can be a life raft.

Recommended Reading: Can You Get A Loan Using Your 401k As Collateral

What To Do Before Withdrawing From Your 401

Even if you qualify for an early distribution, you should be wary of withdrawing from your 401.

So before borrowing from your 401, where should you look for money? The first and obvious place to look is liquid, cash savings, Levine says. Ideally, everyone would have an emergency fund for situations like this.

If you dont have enough saved up, then take a look at your current spending you may find areas where you can scale back to save money while times are tough.

Do you have a car payment or lease that you could reasonably get rid of by buying a cheaper or used car? Are you living in a rental that you could move out of and into something cheaper? Those are obviously serious steps, and just examples, but withdrawing from a 401 will permanently reduce your savings, says Renfro.

If you cant cut anything out of your budget, you could try to get discounts. Levine suggests calling providers, like your cable and insurance companies, and explaining that you need to cut back due to coronavirus-related cash flow issues. Theyll almost definitely offer a discount, he says.

You could also consider taking out a small loan, but be careful not to get yourself further behind with a high-interest debt payment, Renfro says.

How Much To Cash Out 401k Early

The IRS generally requires an automatic withholding of 20% of the amount of the early 401 withdrawal to pay taxes. So if you take $10,000 off your 401 before age 40, you can only get about $8,000. Keep in mind that you can get some of this back as a tax refund at the time of your tax return if your withholding tax is higher than your actual taxes.

Also Check: How To Set Up A Solo 401k Account

How Early Retirement Plan Withdrawals Work Under Normal Circumstances

When there isnt a global pandemic impacting the livelihoods of the entire nation, withdrawing money early from a retirement plan is a serious decision. Thats because it carries with it some pretty serious consequences: namely, a 10% penalty paid on all of the money you withdraw, in addition to paying normal taxes. This, of course, assumes it is not a Roth plan, where the money has already been taxed.

Even if youre willing to pay the penalty, you have get approval from your plan beforehand. This is typically known as a hardship withdrawal. Some plan sponsors may not be willing to grant them, so make sure you check with your HR department before you plan on making one. Acceptable reasons for a hardship withdrawal include:

- Paying certain medical bills for you or family members

- Avoiding foreclosure on or to buy a primary residence

- Covering educational expenses for you or family members

- Paying for family funeral expenses

- Paying for some home repairs, such as those necessary after a natural disaster

Note that these reasons still carry the 10% penalties, in addition to taxes. There are a few instances where the penalty is waived:

How To Withdraw Money From Your 401

The 401 has become a staple of retirement planning in the U.S. Millions of Americans contribute to their 401 plans with the goal of having enough money to retire comfortably when the time comes. Whether youve reached retirement age or need to tap your 401 early to pay for an unexpected expense, there are various ways to withdraw money from your employer-sponsored retirement account. A financial advisor can steer you through these decisions and help you manage your retirement savings.

Also Check: How To Make 401k Grow Faster

Read Also: Can I Use My 401k To Purchase A House

How Can I Get My 401k Money Without Paying Taxes

Heres how to minimize 401 and IRA withdrawal taxes in retirement:

Debt Relief Without Closing My 401k

Before borrowing money from your retirement account, consider other options like nonprofit credit counseling or a home equity loan. You may be able to access a nonprofit debt management plan where your payments are consolidated, without having to take out a new loan. A credit counselor can review your income and expenses and see if you qualify for debt consolidation without taking out a new loan.

Read Also: How To Invest My 401k Money

You May Like: Can You Set Up Your Own 401k

Who Should Withdraw From Their 401 Early

Just because you qualify for a hardship-related withdrawal doesnt mean you should take one without weighing all your other options.

The experts we spoke with were all in agreement that withdrawing from your 401 shouldnt be your first move. However, they also indicated that if youre truly in need, then you should take advantage of the CARES Acts allowances.

It should be a last resort option. People shouldnt get carried away and start using their 401 assets just because they can, Pfau says.

Read Also: What Percentage Should I Be Putting In My 401k

Employers Have Options Under Latest Law

Although the Consolidated Appropriations Act temporarily relaxes rules for eligible individuals to access their retirement funds, businesses don’t necessarily have to include these provisions in their plan provisions. Businesses that had to layoff workers due to business slowdowns also have more time to restore their workforce to at least 80 percent to avoid partial plan termination rules relating to their retirement plan. The partial retirement plan termination rule would be relaxed during a plan year that includes the period between March 13, 2020, and March 31, 2021, deferring assessments until March 2021.

Read Also: How To Self Manage Your 401k

Can I Take Money Out Of My 401k At Age 60 Without Penalty

in your 401 plan60canfrom withdrawingmoneynottaking money out

. Correspondingly, can I cash out my 401k at age 62?

The IRS allows penalty-free withdrawals from retirement accounts after age 59 1/2 and requires withdrawals after age 70 1/2 . Given these consequences, withdrawing from a 401k or IRA early is not ideal.

Beside above, what is the earliest age you can withdraw from a 401k without penalty? The age 59½ distribution rule says any 401k participant may begin to withdraw money from his or her plan after reaching the age of 59½ without having to pay a 10 percent early withdrawal penalty.

Similarly one may ask, how do I withdraw money from my 401k after 59 1 2?

Theres no limit for the number of withdrawals you can make. After you become 59 ½ years old, you can take your money out without needing to pay an early withdrawal penalty. You can choose a traditional or a Roth 401 plan.

How can I avoid paying taxes on my 401k withdrawal?

Avoid penalties and minimize taxes as you pull money out of your retirement accounts.

Hardship Withdrawals Can Be Used For One Of The Following Five Circumstances:

- Purchase of a primary home

- Tuition, room and board, and fees associated with higher education for the next twelve months for the purpose of you, your spouse, dependents, and non-dependent children.

- Prevention of primary residence foreclosure or eviction.

- As payment for tax-deductible, non-reimbursable medical expenses for you, your spouse, or your dependents.

- Several financial hardship you can prove.

Read Also: How Much Will My 401k Grow If I Stop Contributing

Those Who Can Pay Themselves Back

Its not free money. You have to pay it back or risk getting hit with a hefty tax bill, says Jeff Levine, of Nerds Eye View, an online news source that caters to financial planners.

Someone who may not be able to pay it back should think a little harder about whether they should tap into their retirement assets or not, Pfau says.

Another thing to keep in mind is how close you are to retirement. For many people, this could force them into an early retirement. Borrowing from their 401 may just be a way of actually starting to take distributions for retirement earlier, Pfau says. You just have to recognize the trade-offs, like not having as much money for retirement down the road.

Can I Withdraw From My 401 At 55 Without A Penalty

If you leave your job at age 55 or older and want to access your 401 funds, the Rule of 55 allows you to do so without penalty. Whether you’ve been laid off, fired or simply quit doesn’t matteronly the timing does. Per the IRS rule, you must leave your employer in the calendar year you turn 55 or later to get a penalty-free distribution. So, for example, if you lost your job before the eligible age, you would not be able to withdraw from that employer’s 401 early you’d need to wait until you turned 59½.

It’s also important to remember that while you can avoid the 10% penalty, the rule doesn’t free you from your IRS obligations. Distributions from your 401 are considered income and are subject to federal taxes.

You May Like: What Age Can I Withdraw From 401k

Early Withdrawal Penalties Dont Always Apply

The 10% penalty doesnt apply on an early distribution if:

- The participant has died and their beneficiary is collecting the balance

- The participant has a significant disability

- The person is separated from service during or after the year that the participant turned 55 according to IRS Publication 575

- Is being made to a payee under a qualified domestic relations order sometimes called a QDRO

- The participant needs it for medical care

- The participant accidentally made an excess contribution or the employer accidentally made an excess contribution, and the contribution is withdrawn in the year it was made

- The participant needs it because of a natural disaster that the IRS has specifically indicated as qualified for an early penalty-free withdrawal

Can You Use Your 401k While Youre Still Employed

Things happen in life that are out of our control and there might be times when you need to access the funds in your 401k even though youre still of working age.

This is entirely possible to do, but as discussed earlier, it comes with penalties including income tax and a 10 percent fee thats charged on the balance you take out.

Another way to withdraw money early is with a specific rule set in place by the IRS, rule 72, which lets people take a certain amount from their account each year depending on their age.

With the age for withdrawal being 59.5, youre able to take more each year the closer you get to that age.

However, you must make deductions for a minimum of five years and the entire amount will be taxed as income in addition to your regular salary.

There are some hardship provisions in place with most 401k plans, depending on your provider and employer.

These might include things like funeral costs, property damage, and medical bills, however, you will need to provide proof in order to qualify.

Even though this access is granted based on financial hardship, you will still be required to pay the regular tax as well as the standard penalty for early withdrawal.

Worse still, after you get the money youll have to wait another six months before you can start making contributions to your 401k again.

You may be able to access the money in your 401k is by taking out a loan while youre still working, but this will depend on the options your plan offers.

Don’t Miss: Can You Move Money From 401k To Ira

Series Of Substantially Equal Periodic Payments

This is the classic Section 72t ) method for early withdrawal exceptions to the penalty. Essentially you agree to continue taking the same amount from your plan for the greater of five years or until you reach age 59½. There are three methods of SOSEPP:

7. Required Minimum Distribution method uses the IRS RMD table to determine your Equal Payments.

8. Fixed Amortization method in this method, you calculate your Equal Payment based on one of three life expectancy tables published by the IRS.

9. Fixed Annuitization method this method uses an annuitization factor published by the IRS to determine your Equal Payments.

Section 72 provides additional methods for premature distribution exceptions which can occur before leaving employment :

10. High Unreimbursed Medical Expenses for yourself, your spouse, or your qualified dependent. If you face these expenses, you may be allowed to withdraw a limited amount without penalty.

11. Corrective Distributions of Excess Contributions under certain conditions, when excess contributions are made to an account these can be returned without penalty.

12. IRS Levy when the IRS levies an account for unpaid taxes and/or penalties, this distribution is generally not subject to penalty.

And lastly, here are a few additional ways that you can withdraw your 401k funds without penalty:

Originally by Financial Ducks In A Row, 1/20/20

POPULAR ARTICLES AND RESOURCES FROM ETFTRENDS.COM