Us Department Of Labor

Even if your former employer abandoned its retirement plan, your money isnt lost forever. The U.S. Department of Labor maintains records for plans that have been abandoned or are in the process of being terminated. Search their database to find the Qualified Termination Administrator responsible for directing the shutdown of the plan.

How To Find An Old 401 And What To Do With It

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

There are billions of dollars sitting unclaimed in ghosted workplace retirement plans. And some of it might be yours if youve ever left a job and forgotten to take your vested retirement savings with you.

But no matter how long the cobwebs have been forming on your old 401, that money is still yours. All you have to do is find it.

Option : Roll It Into An Ira

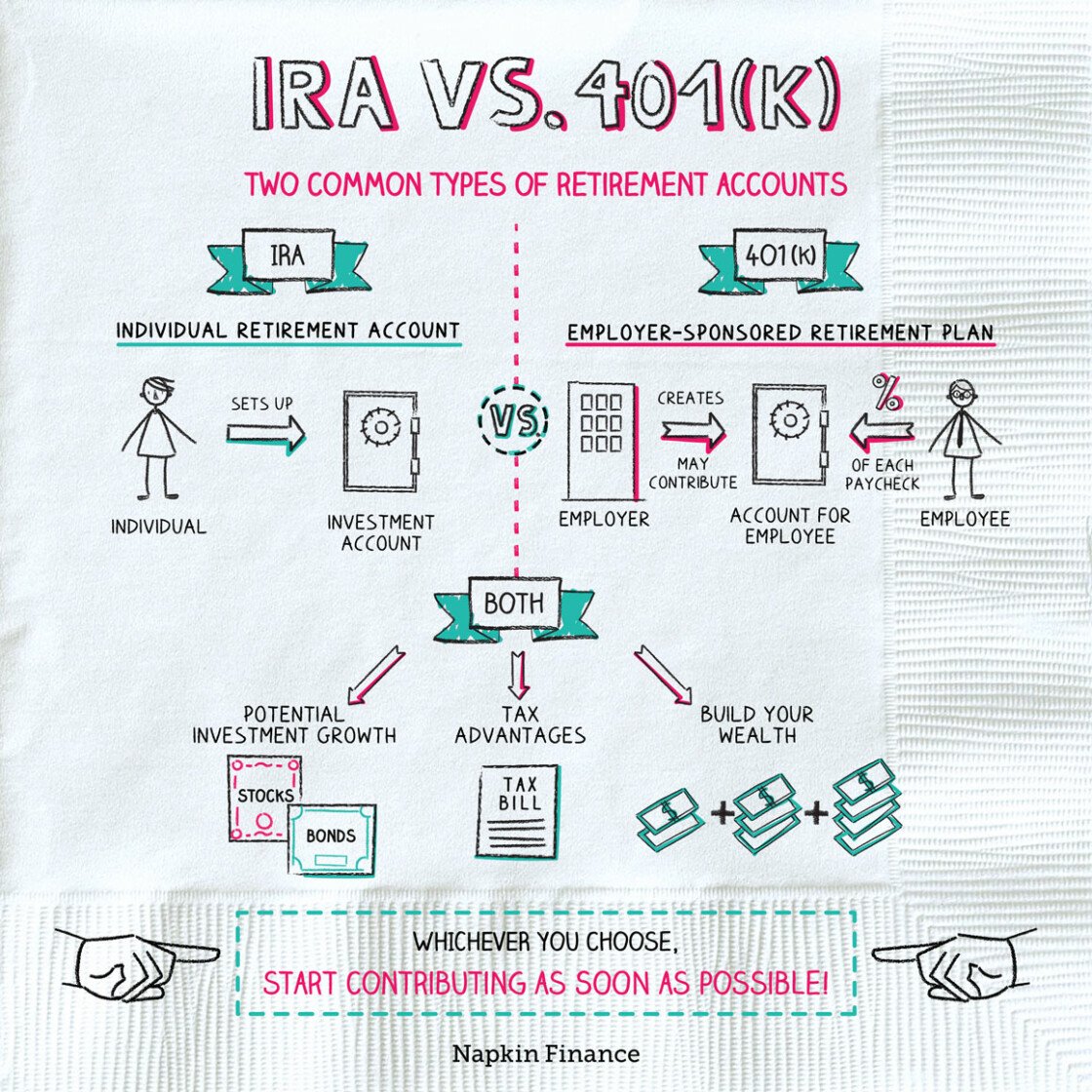

If your new employer doesnt offer a 401 or you dont like their option, you can roll your 401 into an IRA.

Rolling over accounts is easier than it sounds. You may need to open an IRA at a brokerage company and sign a few papers that allow the brokerage to transfer the money into your new account. This option will help keep your balance growing tax deferred and you can continue to make tax-deferred contributions.

Don’t Miss: When Changing Jobs What To Do With 401k

You Can Take It With You

If you leave your job someday for another, you can take your 401 with you. This won’t go into a box with your other belongings rather, you’ll need to roll over that account into a new one and for many people, converting that 401 to an IRA is a great idea. You’ll want to consult our guide for 401 rollovers when that time comes.

About the author:Dayana Yochim is a former NerdWallet authority on retirement and investing. Her work has been featured by Forbes, Real Simple, USA Today, Woman’s Day and The Associated Press.Read more

What Are My 401 Options After Retirement

Generally speaking, retirees with a 401 are left with the following choices: Leave your money in the plan until you reach the age of required minimum distributions convert the account into an individual retirement account or start cashing out via a lump-sum distribution, installment payments, or purchasing an annuity through a recommended insurer.

Also Check: What Percent To Put In 401k

What Is A 401 And How Do They Work

A 401 is a retirement savings plan sponsored by employers. You fund the account with money from your paycheck, you can invest that money in the stock market, and you earn some tax perks for participating.

That’s the basic definition of a 401. The more interesting angle is what a 401 can do for you. The 401 is a powerful resource for achieving financial independence, especially when you start using it early in your career. Said another way, if you like money and wish to have more of it in the future, you can use a 401 to make that happen.

Read on for a closer look at how the 401 works, when you can withdraw funds from a 401, and what happens to your 401 if you change jobs.

Keeping Your Money In A 401

You are not required to take distributions from your account as soon as you retire. While you cannot continue to contribute to a 401 held by a previous employer, your plan administrator is required to maintain your plan if you have more than $5,000 invested. Anything less than $5,000 will trigger a lump-sum distribution, but most people nearing retirement will have more substantial savings accrued.

If you have no need for your savings immediately after retirement, then theres no reason not to let your savings continue to earn investment income. As long as you do not take any distributions from your 401, you are not subject to any taxation.

If your account has $1,000 to $5,000, your company is required to roll over the funds into an IRA if it forces you out of the planunless you opt to receive a lump-sum payment or roll over the funds into an IRA of your choice.

Read Also: How To Do A Direct 401k Rollover

Withdrawing Funds Between Ages 55 And 59 1/2

Most 401 plans allow for penalty-free withdrawals starting at age 55. You must have left your job no earlier than the year in which you turn age 55 to use this option. You must leave your funds in the 401 plan to access them penalty-free. But there are a few exceptions to this rule. This option makes funds accessible as early as age 50 for many police officers, firefighters, and EMTs.

Make sure to understand the rules around the age requirement for penalty-free withdrawals. For example, the age 55 rule won’t apply if you retire in the year before you reach age 55, and your withdrawal would be subject to a 10% early withdrawal penalty tax in this case.

The age 55 and up retirement rule won’t apply if you roll your 401 plan over to an IRA. The earliest age to withdraw funds from a traditional IRA account without a penalty tax is 59. 1/2.

You might retire at age 54, thinking that you can access funds penalty-free in one year. It doesn’t work that way. You must wait one more year to retire for this age rule to take effect.

How Does A 401k Work

A 401k plan is a benefit commonly offered by employers to ensure employees have dedicated retirement funds. A set percentage the employee chooses is automatically taken out of each paycheck and invested in a 401k account. They are made up of investments that the employee can pick themselves.

Depending on the details of the plan, the money invested may be tax-free and matching contributions may be made by the employer. If either of those benefits are included in your 401k plan, financial experts recommend contributing the maximum amount each year, or as close to it as you can manage.

Also Check: How To Manage 401k In Retirement

Defined Benefit Vs Defined Contribution Plans

During the 1970s, the government created several defined contribution plans, including 401s and IRAs. These get their name because they are funded by employee contributions. The amount you receive at retirement depends on how much you contribute to the planand how well your investments perform.

While defined contribution plans were welcome creations for the self-employed, few realized at the time that they would eventually replace the cherished traditional pensions that employees had grown accustomed to.

Defined contribution plans are cheaper for employers to maintain and fund. They also shift the burden of retirement planningand the longevity riskto the employee.

For these reasons, traditional pensions are no longer part of the retirement equation for most workers.

How To Get Retirement Ready

Open a retirement account. If you have access to a GRSP, you should at the very least contribute the amount of money your employer is willing to match. You should also open a RRSP if you don’t already have one. A RRSP is one of the most popular ways to save for retirement in Canada and it comes with nice tax benefits. Learn more about RRSPs and GRSPs.

Avoid paying high fees. Fees are like savings termites they’ll chew right through your savings. When you invest with Wealthsimple, we charge a 0.5% management fees when you invest up to $100,000 and 0.4% when you deposit more than $100,000. That’s significantly less than the 2% fees paid by traditional mutual fund investors in Canada.

Make smart moves. Begin saving for retirement as early as you can and take advantage of the power of compounding. Create a budget that includes retirement savings, learn how investing works, discover smart retirement strategies and understand what it takes to retire early.

Read Also: How To Transfer Roth 401k To Roth Ira

Do You Need To Deduct 401 Contributions On Your Tax Return

You do not need to deduct 401 contributions on your tax return. In fact, there is no way for you to deduct that money.

When employers report your earnings at the end of the year, they account for the fact that you made 401 contributions. To give you an example, lets say you have a salary of $50,000 and you contribute $5,000 into a 401 account. Only $45,000 of your salary is taxable income. Your employer will report that $45,000 on your W-2. So if you try to deduct the $5,000 when you file your taxes, you will be double-counting your contributions, which is incorrect.

Want To Boost Your Score Here’s How

Here are some ways to boost your retirement readiness whether youre behind on your goals or are on track but maybe want to retire a little earlier.

“My score needs attention.”

An individual retirement account is one of the most popular ways to save for retirement given its large tax advantages. You can put in up to $6,000 a year. And if you’re 50 or older, you can contribute an additional $1,000 a year. » Learn more about IRAs

“On my way, but I could close the gap.”

The annual limit for 401 contributions is $19,500 . Its wise to at least contribute up to the point where youre getting all of the matching dollars your employer might offer. » See about increasing your 401 contributions

“I’m on track, but I want to do more.”

A good advisor can help you understand complex issues, diagnose potential problems and take steps to plan for the future. And theyre not as expensive as you might think. » Learn how to choose a financial advisor

Recommended Reading: How To Check Your 401k Balance Online

Tracking Down A Lost 401

Its easy to understand why some workers might lose track of an old 401: Those born between 1957 and 1964 held an average of 12.4 jobs before the age of 54, according to the Bureau of Labor Statistics. The more accounts you acquire, the more challenging it is to keep track of them all.

Perhaps this is why there are some 24 million forgotten 401s holding assets in excess of $1.3 trillion.1 Left unattended too long, old accounts can be converted to cashand even transferred to the state as unclaimed propertyforgoing their future growth potential.

If youre among those with misplaced savings, heres how to locate and retrieve them:

What Are The Rules For A Roth Ira

Roth IRAs are only available to people making less than $129,000 a year as an individual, or $191,000 for married couples. They have contribution limits of $5,500 a year, or $6,500 for those over 50. Unlike 401ks and traditional IRAs though, there’s no penalty for withdrawing part of your contribution early.

Don’t Miss: How To Use Your 401k Money

But Why Would I Max Out My Roth Ira Before My 401k If Its So Good

Theres a lot of nerdy debate in the personal finance sphere about this very question, but our position is based on taxes and policy.

Assuming your career goes well, youll be in a higher tax bracket when you retire, meaning that youd have to pay more taxes with a 401k. Also, tax rates will likely increase in the future.

The Ladder of Personal Finance is pretty handy when considering what to prioritize when it comes to your investments, but it is just a tool. For more about the Ladder of Personal Finance and how to make it work for you, check out THIS video where I explain it.

PRO TIP: The video is less than three minutes long. It is worth your time.

The Average 401k Balance By Age

401k plans are one of the most common investment vehicles that Americans use to save for retirement.

To help you maximize your retirement dollars, the 401k is an employer-sponsored plan that allows you to save for retirement in a tax-sheltered way. You can contribute up to $19,500 in 2021 and $20,500 in 2022.

If your employer offers a 401k and you are not utilizing it, you may be leaving money on the table especially if your employer matches your contributions.

While the 401k is one of the best available retirement saving options for many people, only 32% of Americans are investing in one, according to the U.S. Census Bureau. That is staggering given the number of employees who have access to one: 59% of employed Americans.

So how much do people actually have saved in their 401k plans? And how does this stack up against what they could have saved if they were maxing out their 401k every year?

Also Check: How Do I Get Access To My 401k

Taxes On Rolling Over A 401 Account

There are a few instances where you may want to transfer funds from an employers 401 into another account. The most common situation is when you leave an employer and want to transfer funds from your previous employer into your new employers 401, or into your own individual retirement account .

Whenever you withdraw money from a 401, you have 60 days to put the money into another tax-deferred retirement plan. If you transfer the money within 60 days, you will not have to pay any taxes or penalties on your withdrawals. You will need to say on your tax return that you made a transfer, but you wont pay anything. If you dont make the transfer within 60 days, the money you withdrew will add to your gross income and you will have to pay income tax on it. You will also pay any applicable penalties if you withdraw before age 59.5.

If you dont want to worry about missing the 60-day deadline, you can make a direct 401 rollover. This means the money goes directly from one custodian provider) to another without ever being in your hands.

Finally, note that if youre rolling over a 401 into a Roth IRA, youll need to pay the full income tax on the rolled-over amount. However, theres no 10% penalty for doing this before age 59.5.

Using This Retirement Calculator

-

First, enter your current age, income, savings balance and how much you save toward retirement each month. Thats enough to get a snapshot of where you stand. The calculator assumes increases in salary and inflation.

-

Want to customize your results? Expanding the Optional settings lets you add what you expect to receive from Social Security, adjust your spending level in retirement, change your expected retirement age and more.

-

Hover over or tap on the color bars in your results panel to get further insight into where you stand.

-

You can adjust your inputs to see how various actions, like saving more or planning to retire later, might affect your retirement picture.

Read Also: Is It A Good Idea To Borrow From Your 401k

How Much Should I Be Putting Into My 401k

Aim to save between 10% and 15% of your income toward retirement. Another piece of general advice is to put all of those funds into your 401k up until your employer’s matching contribution amount. Once that has been reached, maxed out your Roth IRA contribution. If there are funds leftover then consider putting those funds into your 401k.

Another way to determine how much you will need to save is to look at what income amount you will need in retirement. Fortunately, there are a lot of calculators out there that will help you figure out your magic number. Here are two of our favorites.

-

Nerdwallet provides a great basic calculator that lets you play with different contributions and matching amounts.

-

CalcXL makes a recommendation on how much you should be saving based on projected inflation. Tip: You should aim for a retirement income of roughly 80% of your current salary.

How Do You Get A 401

You get a 401 from your employer. Unfortunately, not all employers offer access to a 401 plan. Don’t despair if you fall into that camp. You can still reap the same tax benefits from the other big retirement savings vehicle, an individual retirement account.

All that may raise the inevitable question: What is an IRA? These accounts offer some attractive benefits , albeit with a few downsides . Heres how a 401 differs from an IRA and, if applicable, how to take advantage of both at the same time.

Interested in an IRA? Here’s a comparison of some of our top-rated IRA accounts. We have a full guide to opening an account here.

You May Like: How To Sell 401k Investments

Your Retirement Money Is Safe From Creditors

Did you know that money saved in a retirement account is safe from creditors? If you are sued by debt collectors or declare bankruptcy, your 401k and IRAs cannot be liquidated by creditors to satisfy bills you owe. If youre having problems managing your debt, its better to seek alternatives other than an early withdrawal, which will also come with a high penalty.