Do I Have To Pay Taxes When Rolling Over A 401

Whether you owe taxes on a rollover depends on whether youre changing account types . Generally, if you move a traditional 401 account to a Roth IRA, you could create a tax liability. Here are a few scenarios:

- If youre rolling over money from a traditional 401 to another traditional 401 or traditional IRA, you wont create a tax liability.

- If youre rolling over a Roth 401 to another Roth 401 or Roth IRA, you wont create a tax liability.

- However, if youre rolling a traditional 401 into a Roth IRA, you could create a tax liability.

Its also important to know that if you have a Roth 401 that has any employer matching funds in it, those matching funds are categorized as a traditional 401 contribution. So if you transfer a Roth 401 with matching funds into an IRA, youll need to create two IRA accounts a traditional IRA and a Roth IRA to avoid any tax issues during the rollover.

Of course, youll still need to abide by the 60-day rule on rollovers. That is, you have 60 days from the date you receive a retirement plan distribution to roll it over into another plan, according to the IRS. Taxes generally arent withheld from the transfer amount, and this may be processed with a check made payable to your new qualified plan or IRA account.

Sign up for Bankrates myMoney today to track your finances in one place.

Disadvantages Of An Ira Rollover

A rollover is not for everyone. A few cons to rolling over your accounts include:

- . You may have credit and bankruptcy protections by leaving funds in a 401k as protection from creditors vary by state under IRA rules.

- Loan options are not available. The funds may be less accessible. You may be able to get a loan from an employer-sponsored 401k account, but never from an IRA.

- Minimum distribution requirements. You can generally withdraw funds without a 10% early withdrawal penalty from a 401k if you leave your employer at age 55 or older. With an IRA you generally have to wait until you are age 59 1/2 to withdraw funds in order to avoid a 10% early withdrawal penalty. The Internal Revenue Service offers more information on tax scenarios as well as a rollover chart.

- More fees. You may be responsible for higher account fees as compared to a 401k which has access to lower-cost institutional investment funds because of group buying power.

- Tax rules on withdrawals. You may be eligible for favorable tax treatment on withdrawals if your 401K is invested in company stock.

Neither State Farm nor its agents provide tax or legal advice.

How Many Roth Ira Rollovers Per Year

You can only rollover a Roth IRA to another Roth IRA once per year. The once-per-year Roth IRA rollover only applies to the 60-day rollover, and it applies across all separate Roth IRAs. Direct trustee-to-trustee rollovers are excluded from this rule.

Although Roth IRA rollovers are limited to one rollover per year, this rule does not apply to qualified plan rollovers such as 401, IRA, or Solo 401 to a Roth IRA. The rule also excludes Roth IRA rollovers to traditional IRA or 401.

Don’t Miss: How To Move 401k To Vanguard

Roll It Into Your New 401 Plan

Some plans allow you to roll-in your previous employers plan. This can be an easy way to consolidate if you want to have everything in one place assuming the tax status of the two accounts is the same. For example, rolling a traditional, pre-tax 401 into a traditional pre-tax IRA would trigger no tax consequences.

Reasons To Roll Your Money Into An Ira

When you have a lot of retirement accounts in a lot of different places, its hard to a) wrap your mind around where you actually stand and b) make sure that everything you own is properly diversified. If you have all your retirement accounts in an IRA, on the other hand, balancing your investments and forecasting whether youre on track to hit your goals, like we do for you at Ellevest is a lot easier.

Another big reason why many people choose to roll an old 401 into an IRA is to have more choice. When you can decide for yourself which company youll open your IRA with , you often have greater control over things like how much you pay in fees and the types of businesses your money is supporting. With a 401, youre stuck with whatever investment provider and investment options your employer picks for you .

Also, if youre trying to make certain special purchases, the government lets you take money out of an IRA before retirement without facing the 10% early withdrawal penalty. These include things like college costs and your first home. Not so with a 401.

You May Like: How Much Can You Put Into 401k Per Year

Rolling Over Your 401 Is Annoying

Modified date: May. 17, 2021

Rolling over your 401 when you leave your job is essential. Some employers wont allow former employees to keep money stashed in their plans, and, after a certain amount of time, may just cash out your investments, sending you a check with taxes and the 10% early withdrawal fee taken out. And, even if they dont, you may be able to get lower fees and better fund options elsewhere.

Now, the benefits of rolling your 401 are obvious and undeniable. The actual process of rolling over your 401 into a new plan, Im sorry to tell you, is exceptionally tedious.

Ive recently gone through the excruciating experience of rolling over not one, not two, but three different accounts into a single IRA at Vanguard. I dont wish the process on my worst enemy.

Every broker and plan is different, but here are some guidelines to make rolling over your 401 a little easier. And we should warn you, its a very manual process that almost always involves phone calls and snail mail. to Betterment is an exception. They claim to be the only financial institution to offer a completely paperless rollover process.)

Whats Ahead:

How Long Do I Have To Rollover Really Old 401s

Itâs easy to lose track of 401s youâve held at former employers. At the rate Americans change jobs, itâs possible to have 401s outstanding at multiple employers.

Human resource departments and plan administrators can lose track of 401 accounts of former employers, causing them to sit in the plan untouched for years.

There are no specific time constraints with these plans. However, if the plan were to cash out your old 401, youâll have 60 days from the time they terminated the plan to roll it over to another retirement account.

Recommended Reading: Who Offers Roth Solo 401k

What Is A 401 Rollover

There are many ways to save for retirement, and an employer-sponsored plan like a 401 is one of the most common. But when you leave the employer that sponsored the 401, youll likely choose to roll over the funds from that account. You might choose to roll it into your new employers 401 plan, if one exists. You might also choose to put it into an individual retirement account , which can provide more control and flexibility.

Just like IRAs, 401 plans come in two forms: traditional and Roth. In most cases, someone directing a 401 rollover will transfer their funds to a new account that features the same tax benefits. So if you have a traditional 401, youll likely roll its assets over to a traditional IRA or 401. The same is generally true for Roth accounts.

But nothing in the IRS rules says you have to go with the same type of account. Instead, you could roll over money from a traditional 401 to a Roth IRA. However, you would then owe taxes on that money for the current tax year, as Roth accounts are funded with post-tax dollars. Because of this, you cannot do the reverse and roll over money from a Roth 401 to a traditional IRA.

You could also complete a 60-day rollover. This involves the custodian of your 401 making a check out to you in the amount of your account balance But since the money will technically pass through your hands, there are some unfavorable tax implications, including a 20% tax withholding by your employer.

Distributions From Your Rolled

Although it is typically not advisable to tap retirement funds before you leave the workforce, in tight times, the undesirable option may become the only option. If you must withdraw money from your Roth at the time of the rollover, or soon after that, be aware that the timing rules for such withdrawals differ from those of traditional IRAs and 401s. Some of these requirements may also apply to Roths that are rolled over when you are at or close to retirement age.

Specifically, to make distributions from these accounts without incurring any taxes or penalties, the distribution must be qualified, which requires that it meets what is known as the five-year rule. Also applied to inherited retirement accounts, this rule requires that funds had remained intact in the account for a five-year period to avoid or at least minimize taxes and penalties.

Read Also: How To Find 401k Account Number

How To Transfer A 401 To Ira

There are three steps to a rollover IRA.

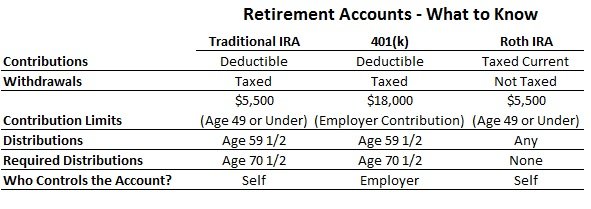

If you have an existing IRA, you can transfer your balance into the IRA you have later consider opening a new account if that’s a concern for you). Traditional IRAs and Roth IRAs are the most popular types of individual retirement accounts. The main difference between them is their tax treatment:

-

Traditional IRAs can net you a tax deduction on contributions in the year they are made, but withdrawals in retirement are taxed. If you go this route, you won’t pay taxes on the rolled-over amount until retirement.

-

Roth IRAs dont offer an immediate tax deduction for contributions. Rolling into a Roth means youll pay taxes on the rolled amount, unless youre rolling over a Roth 401. The upside is that withdrawals in retirement are tax-free after age 59½.

Here are three things to consider:

If you want to keep things simple and preserve the tax treatment of a 401, a traditional IRA is an easy choice.

A Roth IRA may be good if you wish to minimize your tax bill in retirement. The caveat is that you’ll likely face a big tax bill today if you go with a Roth unless your old account was a Roth 401.

If you need cash from the rollover to foot the tax bill today, a Roth IRA could open you up to even more tax complications.

The choice often boils down to two options: an online broker or a robo-advisor.

Option : Roll It Into An Ira

If your new employer doesnt offer a 401 or you dont like their option, you can roll your 401 into an IRA.

Rolling over accounts is easier than it sounds. You may need to open an IRA at a brokerage company and sign a few papers that allow the brokerage to transfer the money into your new account. This option will help keep your balance growing tax deferred and you can continue to make tax-deferred contributions.

Don’t Miss: Can You Roll Over A 403b Into A 401k

Rollover To A Life Insurance Policy

Technically, you cant roll over your 401 account into an insurance policy however, if you have a life insurance needs, you can withdraw funds from the account and redirect them to pay for a life insurance policy. You can avoid early withdrawal penalties under IRS Rule 72t,2 which allows you to take equal payments from your accounts. However, you must agree to take consistent withdrawals from your account each year for life.

Rollover Of 401 To Traditional Ira And Later To Roth Ira

The 401 plan is tax-deferred, so you dont have to pay any taxes upfront. As a result, your company or hiring organization will withdraw funds from your paycheck to fund your retirement. So, while paying federal taxes, youll be able to choose a deductible amount, striving for a low tax rate.

A Traditional IRA is comparable to a 401. However, anyone with legal and taxable income can start an account with pre-tax contributions. The distinction between Traditional IRA and Roth IRA is that individuals will report grants rather than an organization with many employees. A typical IRA is tax-deferred, and the 401k transfer rules are also pretty similar.

When you retire, you will be required to pay taxes. However, because your annual income is limited at that point, the amount of income taxes owed is equally low.

A Roth IRA is typically referred to as tax-free withdrawals or retirement savings. Unlike standard IRAs and 401s, the Roth IRA must pay tax bills before the assets in its retirement account may be accessed. Because you will pay the income taxes beforehand, the gains on withdrawal will be tax-free. In fact, RMDs are not required in a Roth IRA as there is no unpredictable tax hit on the after-tax dollars.

Switching from Traditional IRA and Roth IRA will lead to some taxable penalties with a Roth IRA. People frequently choose these programs when they merely want a fraction of a particular number to be rolled over to avoid unnecessary taxation.

You May Like: Can You Convert Your 401k To A Roth Ira

Advantages To Performing An Indirect Rollover

If you think the 401 rollover rules sound brutal, well, it’s deliberate. The IRS wants to make sure that your retirement funds stay exactly where they belong in a retirement account. If the path to performing an indirect rollover was not fraught with peril, people could use their retirement account like an ATM.

It is possible that, for the right investor, an indirect rollover can serve as a valuable short-term loan. If you have a credit card debt, for example, you could use the 401 funds to pay off the debt and stop the interest charges from racking up. If you have a Christmas bonus or an inheritance coming in, you could then use that money to fund your IRA.

For most people though, a direct rollover is the safest from a tax standpoint and therefore the preferred way to move retirement money.

Rollover To A Roth Ira

Rollovers are a great time to alter the tax treatment offered by your retirement account, such as rolling your 401 funds over into a Roth IRA. Its a beneficial choice for many retirement savers, but it may be especially appealing for people with high incomes who may not be able to otherwise save in a Roth IRA.

This type of rollover can also help you avoid required minimum distributions that come even with a Roth 401.

However, there will most likely be tax consequences. Because traditional 401 contributions are made with pre-tax dollars, you will owe income taxes on the funds you convert to a Roth IRA, which holds after-tax contributions.

You May Like: Where To Put My 401k

Where Should You Transfer Your 401

You have several options on what to do with your 401 savings after retirement or when you change jobs. For example, you can:

The right choice depends on your needs, and thats a choice everybody needs to make after evaluating all of the options.

Want help finding the right place for your retirement savings? Thats exactly what I do. As a fee-only fidicuary advisor, I can provide advice whether you prefer to pay a flat fee or youd like me to handle investment management for you, and I dont earn any commissions. To help with that decision, learn more about me or take a look at the Pricing page to see if it makes sense to talk. Theres no obligation to chat.

Important:The different rules that apply to 401 and IRA accounts are confusing. Discuss any transfers with a professional advisor before you make any decisions. This article is not tax advice, and you need to verify details with a CPA and your employers plan administrator. Likewise, only an attorney authorized to work in your state can provide guidance on legal matters. Approach Financial, Inc. does not provide tax or legal services. This information might not be applicable to your situation, it may be out of date, and it may contain errors and omissions.

What Happens If You Cash Out Your 401

If you withdraw 401 money before age 59 ½, you could face a 10% penalty from the IRS on top of paying applicable income taxes. There are some exceptions, such as if you leave your job at age 55 or later or if you make a hardship or other eligible withdrawal, but its a good idea to consult a tax professional before cashing out your 401.

No matter when you cash out your 401, though, you may owe income tax on what you withdraw if its a traditional account or investment earnings in a Roth account that you didnt start contributing to at least five years before.

Recommended Reading: How To Retrieve 401k Money

Know The Rules For Roth 401 Rollovers

Eric is currently a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance. He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer. His background in tax accounting has served as a solid base supporting his current book of business.

If you have moved jobs while holding a traditional 401, you are probably familiar with the rollover options for these ubiquitous retirement accounts. You may be less sure, though, of your options when you leave an employer with whom you hold a Roth 401, the newer and less prevalent cousin of the traditional 401.

The main difference between the traditional 401 and the Roth 401 is that the former is funded with pretax dollars while Roth contributions are in post-tax dollars so there is no tax hit from a qualified withdrawal made in the future.

If your job is at stake, or you are considering a career move, here are your options regarding your Roth 401 account when changing employers.